Professional Documents

Culture Documents

Impact of Global Financial Conditions

Uploaded by

thomas ardaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of Global Financial Conditions

Uploaded by

thomas ardaleCopyright:

Available Formats

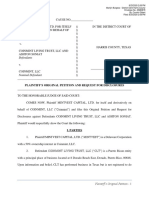

Platinum Outcomes Pty Ltd is a company with $2 of paid up capital.

Its shares are owned by

Francis Gaudet. Its directors are Glen Gaudet and Justin Broad. Glen Gaudet was instrumental in

the establishment and IPO of Greencross Limited (see above).

All vendors contemplating offers for their businesses should insist on 100% cash payment up front.

Given the recent state of the stock market it could be a long wait for IPO to occur. Vendors should

insist that contracts of sale are not dependent upon an IPO occurring.

If Platinum Outcomes wants a quick way into the dental laboratory business it could make a

takeover bid for Pearl Healthcare Ltd, which has negative equity.

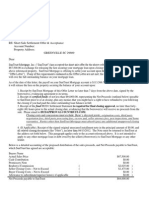

Impact of Global Financial Conditions

Events have moved rapidly. Hence any comment made in this article needs to be checked

carefully against the current state of the market. At time of writing, world stock markets have

suffered one of the most traumatic collapses in history, and the world is headed for recession.

World governments have handed effective control of the financial world to the governors of the

major reserve banks in Western economies. Politicians have been reading the lines given to them

by their reserve bankers and regulators. Regardless as to whether markets have stabilised or

remain volatile, it is unlikely that there will be any stomach for capital raisings to enable the float of

small professional consolidations. Even the largest companies are having difficulty in raising

capital on the stock market in current conditions. Stockbrokers will be reluctant to recommend

small floats to their clients.

The wave of consolidations and attempted consolidations was an attempt to cash in on buoyant

stock market conditions existing prior to this year. Often the types of businesses being

consolidated were unsuited to the model. The failure rate has been extraordinarily high and it

would be a very brave person who would put money into the float of a new dental company, dental

laboratory company, veterinary services company or medical services company in this

environment.

Raising Capital for Floats (Initial Public Offers)

After the longest period of economic growth in Australia’s history, our financial markets became

complacent about raising capital. During the past two or three years some bizarre businesses

have been able to raise capital via listing on the stock market. Bankers too have offered easy

credit, mobile mortgage brokers have been knocking on doors offering to procure loans. Low doc

and no doc loans (liars’ loans) found their way into the menu.

That has ceased. Australians are just beginning to understand that low doc loans have been

removed from the menu and Australia’s banks, which source about one third of their funds from

overseas, are now having difficulty raising those funds overseas. Home loan applications will

undergo a lot more scrutiny. Borrowers who can put up substantial deposits and have good

incomes will be preferred. Credit is now being rationed to worthy borrowers.

Banks who provided venture capital to throw at investment schemes will be a lot more discerning.

Bank senior management will ration the capital allocated to this type of activity. Investment

schemes will require rigorous assessment.

Investment Bank Margins Will Shrink

Stockbrokers have been charred by the experiences of the last year. They are wary of

recommending second tier stocks to their clients and afraid to associate with the float of third tier

mini stocks at IPO. These include professional consolidations when there have been so many

failures and disappointments. As Australia’s share market has sunk lower there have been many

larger companies with household names which appear safer yet which are now trading at much

You might also like

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- OGL LimitedDocument1 pageOGL Limitedthomas ardaleNo ratings yet

- FN323 - Corporate Credit LendingDocument10 pagesFN323 - Corporate Credit LendingNapat InseeyongNo ratings yet

- Paycheck Protection ProgramDocument1 pagePaycheck Protection ProgramAnthony NguyenNo ratings yet

- Robert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Document70 pagesRobert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Robert BoscaratoNo ratings yet

- Build Your Board of Directors for SuccessDocument1 pageBuild Your Board of Directors for Successthomas ardaleNo ratings yet

- Federal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesDocument29 pagesFederal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesMarketsWikiNo ratings yet

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- Private AcquisitionsDocument53 pagesPrivate AcquisitionsAleyna YılgınNo ratings yet

- Converted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)From EverandConverted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)No ratings yet

- Final Prospectus - ATRKE Equity Opportunity FundDocument54 pagesFinal Prospectus - ATRKE Equity Opportunity FundArjay Royales CarandangNo ratings yet

- Capital Raising Regulation D SEC Vladimir IvanovDocument11 pagesCapital Raising Regulation D SEC Vladimir IvanovCrowdfundInsiderNo ratings yet

- RewardsCardBooklet Feb2019Document18 pagesRewardsCardBooklet Feb2019Debbie Jamielyn Ong0% (1)

- And Schedule Calls As Soon As Possible. This Is A First-Come, First-Served Sales FunnelDocument1 pageAnd Schedule Calls As Soon As Possible. This Is A First-Come, First-Served Sales Funnelthomas ardaleNo ratings yet

- Wells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Document24 pagesWells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Frank GregoireNo ratings yet

- Other Dental Consolidation TrendsDocument1 pageOther Dental Consolidation Trendsthomas ardaleNo ratings yet

- Loan Modification: Contract & FormsDocument16 pagesLoan Modification: Contract & FormsjbarreroNo ratings yet

- DocuSign PDFDocument7 pagesDocuSign PDFLourdesNo ratings yet

- The Four Keys To Raising CapitalDocument6 pagesThe Four Keys To Raising CapitalMark OatesNo ratings yet

- CBA Full-Year ResultsDocument156 pagesCBA Full-Year ResultsTim MooreNo ratings yet

- Lead Schedule: Refer To The Attached Sample Bank Confirmation TemplateDocument4 pagesLead Schedule: Refer To The Attached Sample Bank Confirmation TemplateChristian Dela CruzNo ratings yet

- Andrea Orders PDFDocument2 pagesAndrea Orders PDFMoonlight SquadNo ratings yet

- Document Instructions: Tax RefundDocument8 pagesDocument Instructions: Tax RefundValentin PonochevniyNo ratings yet

- Forget You Are Conducting The InterviewDocument1 pageForget You Are Conducting The Interviewthomas ardaleNo ratings yet

- All 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchDocument50 pagesAll 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchAnonymous f9Zj4lNo ratings yet

- Maryland Withholding Form ExplainedDocument2 pagesMaryland Withholding Form ExplainedVenkatesh GorurNo ratings yet

- Cost of Equity and Capital for Over 7000 US CompaniesDocument15 pagesCost of Equity and Capital for Over 7000 US CompaniesPedro CooperNo ratings yet

- Tech, Sales & Customer Service Phone Support Central Region SupportDocument9 pagesTech, Sales & Customer Service Phone Support Central Region SupportペナアンソニーNo ratings yet

- Vba 26 1880 AreDocument2 pagesVba 26 1880 Areapi-269916574No ratings yet

- Fundbox Blog-WPS OfficeDocument7 pagesFundbox Blog-WPS OfficeChe DivineNo ratings yet

- Venture Financing and Angel Investors GuideDocument2 pagesVenture Financing and Angel Investors GuideJennifer LeeNo ratings yet

- Capital DirectoryDocument467 pagesCapital DirectoryWorla DewornuNo ratings yet

- FAQ in Day To Day BankingDocument17 pagesFAQ in Day To Day BankingKuwar WaliaNo ratings yet

- Off Shore CompaniesDocument9 pagesOff Shore Companieskainat safdarNo ratings yet

- Dgme Login: Access Employee Account atDocument6 pagesDgme Login: Access Employee Account atStacey L. TravisNo ratings yet

- TLD Auto Car Financing Barre VTDocument3 pagesTLD Auto Car Financing Barre VTBarre ATLNo ratings yet

- The Art of Deduction (WEB)Document7 pagesThe Art of Deduction (WEB)Derrie SuttonNo ratings yet

- Practitioners Guide Corporate LawDocument72 pagesPractitioners Guide Corporate LawoussNo ratings yet

- Coinmint vs. Ashton Soniat Fraud CaseDocument8 pagesCoinmint vs. Ashton Soniat Fraud CaseDon HewlettNo ratings yet

- PayU Technical Integration Document v1.3Document9 pagesPayU Technical Integration Document v1.3Abhishek ChakravartyNo ratings yet

- Sample Engagement Letter - PartnershipsDocument12 pagesSample Engagement Letter - PartnershipsSRIVASTAV17No ratings yet

- EziDebit - DDR Form - CompletePTDocument2 pagesEziDebit - DDR Form - CompletePTAndrewNeilYoungNo ratings yet

- Investment Banking & Public Issue GuideDocument55 pagesInvestment Banking & Public Issue GuideShafiq SumonNo ratings yet

- Veale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Document6 pagesVeale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- Loans and Advances 2016Document128 pagesLoans and Advances 2016Anonymous kyvLgSREMNo ratings yet

- Test 44Document1 pageTest 44thomas ardaleNo ratings yet

- Direct Deposit Authorization Form1Document1 pageDirect Deposit Authorization Form1utahlegalservicesNo ratings yet

- The Ultimate Financing Guide: The Complete Array of all Available Options - The Way it Works in the Real WorldFrom EverandThe Ultimate Financing Guide: The Complete Array of all Available Options - The Way it Works in the Real WorldNo ratings yet

- SBA Economic Injury Disaster Loans Available To Texas Small BusinessesDocument2 pagesSBA Economic Injury Disaster Loans Available To Texas Small BusinessesLauren MuntNo ratings yet

- PMT 8-K Acquires $140M Non-Performing Mortgage AssetsDocument2 pagesPMT 8-K Acquires $140M Non-Performing Mortgage Assetsank333No ratings yet

- Loan Modification Client Service AgreementDocument17 pagesLoan Modification Client Service AgreementDelicia33No ratings yet

- SunTrust Short Sale Approval (Fannie Mae)Document3 pagesSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Bank of America Group Experiments Innovations CustomersDocument26 pagesBank of America Group Experiments Innovations CustomersharshNo ratings yet

- Sweat EquityDocument3 pagesSweat EquityparulshinyNo ratings yet

- Business Credit Vetting FormDocument1 pageBusiness Credit Vetting FormJade Clarke-MackintoshNo ratings yet

- FinancialMarketsMeltdownOctober2008PDF Page 5Document1 pageFinancialMarketsMeltdownOctober2008PDF Page 5thomas ardaleNo ratings yet

- Other Dental Consolidation TrendsDocument1 pageOther Dental Consolidation Trendsthomas ardaleNo ratings yet

- Other Dental Consolidation TrendsDocument1 pageOther Dental Consolidation Trendsthomas ardaleNo ratings yet

- Building a Team, Securing Advisors, Finding Deals, and Financing AcquisitionsDocument1 pageBuilding a Team, Securing Advisors, Finding Deals, and Financing Acquisitionsthomas ardaleNo ratings yet

- Build Your Board of Directors for SuccessDocument1 pageBuild Your Board of Directors for Successthomas ardaleNo ratings yet

- 222221Document1 page222221thomas ardaleNo ratings yet

- Might 2Document1 pageMight 2thomas ardaleNo ratings yet

- Forget You Are Conducting The InterviewDocument1 pageForget You Are Conducting The Interviewthomas ardaleNo ratings yet

- How To Secure Top-Tier Directors For Your BoardDocument1 pageHow To Secure Top-Tier Directors For Your Boardthomas ardaleNo ratings yet

- Test 44Document1 pageTest 44thomas ardaleNo ratings yet

- And Schedule Calls As Soon As Possible. This Is A First-Come, First-Served Sales FunnelDocument1 pageAnd Schedule Calls As Soon As Possible. This Is A First-Come, First-Served Sales Funnelthomas ardaleNo ratings yet

- Building a Team, Securing Advisors, Finding Deals, and Financing AcquisitionsDocument1 pageBuilding a Team, Securing Advisors, Finding Deals, and Financing Acquisitionsthomas ardaleNo ratings yet

- Wick 22Document1 pageWick 22thomas ardaleNo ratings yet

- 323Document1 page323thomas ardaleNo ratings yet

- A Notification+message Each Time Someone AcceptsDocument1 pageA Notification+message Each Time Someone Acceptsthomas ardaleNo ratings yet

- Board of Directors in 30 Days: Financial Institutions Are Begging To Give You MoneyDocument1 pageBoard of Directors in 30 Days: Financial Institutions Are Begging To Give You Moneythomas ardaleNo ratings yet

- RFBT Quiz #2 - ContractsDocument9 pagesRFBT Quiz #2 - Contractsrandyblanza2014No ratings yet

- Yuson Vs Atty Vitan Dacion en PagsDocument2 pagesYuson Vs Atty Vitan Dacion en PagsVen BuenaobraNo ratings yet

- Novation RCBC Vs PlastDocument3 pagesNovation RCBC Vs PlastDeej JayNo ratings yet

- EDF PresentationDocument15 pagesEDF PresentationMohammad Mehedi Al-SumanNo ratings yet

- Sale Notice For Sale of Immovable Properties (Appendix - IV - A)Document2 pagesSale Notice For Sale of Immovable Properties (Appendix - IV - A)Sagar DesaiNo ratings yet

- Ang v. Ang 2013Document1 pageAng v. Ang 2013ALEXIR MENDOZANo ratings yet

- Lendingkart helps SMEs access loans via analyticsDocument4 pagesLendingkart helps SMEs access loans via analyticsWalidahmad AlamNo ratings yet

- WFRP 4ed - Banks of The EmpireDocument5 pagesWFRP 4ed - Banks of The Empiretempy23No ratings yet

- Certificate of Sale Foreclosure CaseDocument4 pagesCertificate of Sale Foreclosure CaseJuricoAlonzoNo ratings yet

- Dr. Rico Vargas Substituted by His Wife, Cecilia Vargas, v. Jose F. AcsayanDocument4 pagesDr. Rico Vargas Substituted by His Wife, Cecilia Vargas, v. Jose F. AcsayanRizza Angela MangallenoNo ratings yet

- Bbm221 Management AccountingDocument97 pagesBbm221 Management AccountingMAYENDE ALBERTNo ratings yet

- SSC Circular No 2010-004 (IRR of RA 9903)Document4 pagesSSC Circular No 2010-004 (IRR of RA 9903)louis adriano baguioNo ratings yet

- List of North Dakota Banks and Branch LocationsDocument2 pagesList of North Dakota Banks and Branch LocationsLisa KamlNo ratings yet

- K.L.E. Society's B.V. Bellad Law College, Belagavi Notice: ND RDDocument3 pagesK.L.E. Society's B.V. Bellad Law College, Belagavi Notice: ND RDRanjan BaradurNo ratings yet

- LitDocument11 pagesLitasefsdffNo ratings yet

- Date"), by and Between - , With An Address ofDocument2 pagesDate"), by and Between - , With An Address ofRhisia RaborNo ratings yet

- 39 Ridad V Filipinas Investment and Finance Corp., GR No. L - 39806, 27 January 1983Document1 page39 Ridad V Filipinas Investment and Finance Corp., GR No. L - 39806, 27 January 1983Johnny EnglishNo ratings yet

- SCF DissertationDocument26 pagesSCF DissertationSubham ChoudhuryNo ratings yet

- Republic of The Philippines Vs Sps Arturo and Laura SupanganDocument3 pagesRepublic of The Philippines Vs Sps Arturo and Laura SupanganJaimie Lyn TanNo ratings yet

- Bank mortgage rates and down payment requirementsDocument2 pagesBank mortgage rates and down payment requirementszavate_ciprianNo ratings yet

- 5 - The Economy of Growth and Impoverishment in The Marcos EraDocument8 pages5 - The Economy of Growth and Impoverishment in The Marcos EraanigygrhtNo ratings yet

- 2015 2 HKLRD 985Document44 pages2015 2 HKLRD 985sosadNo ratings yet

- Comm Rev ABELLA NOTESDocument65 pagesComm Rev ABELLA NOTESJevi RuiizNo ratings yet

- Credit Trans CasesDocument4 pagesCredit Trans CasesLuelle PacquingNo ratings yet

- 1st - LawDocument23 pages1st - LawPrankyJellyNo ratings yet

- Bitanga, Et Al., Plaintiffs-Appellees, Versus Philippine National Bank, Et Al.Document16 pagesBitanga, Et Al., Plaintiffs-Appellees, Versus Philippine National Bank, Et Al.Debroah Faith PajarilloNo ratings yet

- Provident Fund: Republic of The Philippines Department of EducationDocument4 pagesProvident Fund: Republic of The Philippines Department of EducationBen T OngNo ratings yet

- Contracts ReviewerDocument7 pagesContracts ReviewerMonina CabalagNo ratings yet

- Spouses Go Cinco vs. Ca, Ester ServacioDocument3 pagesSpouses Go Cinco vs. Ca, Ester ServacioQueenie SantosNo ratings yet

- Bakiza V Nafuna Bakiza (Divorce Cause No 22 of 2011) 2015 UGHCFD 26 (20 August 2015)Document8 pagesBakiza V Nafuna Bakiza (Divorce Cause No 22 of 2011) 2015 UGHCFD 26 (20 August 2015)Okello GerrardNo ratings yet