Professional Documents

Culture Documents

Venture Financing and Angel Investors Guide

Uploaded by

Jennifer Lee0 ratings0% found this document useful (0 votes)

42 views2 pagesThis document provides an overview of venture financing options for startups and growing companies. It discusses the roles of angel investors and venture capitalists in providing different types of funding, including seed/startup funding, first-round funding, later-stage funding, mezzanine funding, and funding for mergers and acquisitions. The key points are that angel investors provide early funding and advisory support, while venture capitalists primarily seek a return on their investment and expect regular updates but not direct management involvement. Maintaining open communication and making the venture capitalists' job easy are important for a productive relationship.

Original Description:

This proposed summary of the terms for the purchase of shares of Series A Convertible Preferred Stock of THE HOUND IS LOOSE.COM, INC. (the “Company”) does not constitute a binding contract or commitment but is solely for the purpose of outlining those terms that may be incorporated into a definitive stock purchase agreement, which must be prepared and executed by all necessary parties.

Original Title

Venture_Financing_Business_Coach_Sample_term_sheet_Series_A_convertible

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of venture financing options for startups and growing companies. It discusses the roles of angel investors and venture capitalists in providing different types of funding, including seed/startup funding, first-round funding, later-stage funding, mezzanine funding, and funding for mergers and acquisitions. The key points are that angel investors provide early funding and advisory support, while venture capitalists primarily seek a return on their investment and expect regular updates but not direct management involvement. Maintaining open communication and making the venture capitalists' job easy are important for a productive relationship.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views2 pagesVenture Financing and Angel Investors Guide

Uploaded by

Jennifer LeeThis document provides an overview of venture financing options for startups and growing companies. It discusses the roles of angel investors and venture capitalists in providing different types of funding, including seed/startup funding, first-round funding, later-stage funding, mezzanine funding, and funding for mergers and acquisitions. The key points are that angel investors provide early funding and advisory support, while venture capitalists primarily seek a return on their investment and expect regular updates but not direct management involvement. Maintaining open communication and making the venture capitalists' job easy are important for a productive relationship.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

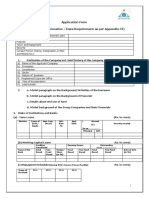

Venture Financing Business Coach

Sample term sheet

Series A convertible preferred stock financing

Indiaco, www.indiaco.com

This proposed summary of the terms for the purchase of shares of Series A Convertible Preferred Stock of THE HOUND IS

LOOSE.COM, INC. (the “Company”) does not constitute a binding contract or commitment but is solely for the purpose of

outlining those terms that may be incorporated into a definitive stock purchase agreement, which must be prepared and

executed by all necessary parties.

Amount of investment Automatic conversion

$1,500,000 The Series A stock will automatically convert into common stock

Securities upon the earlier of (i) the closing of a public offering of the

1,500,000 shares of Series A convertible preferred stock Company’s common stock but only if the gross proceeds of the

(the “Series A Stock”) offering equal or exceed $ 5,000,000, (ii) the vote in favour of

conversion of the holders of at least a majority of the outstand-

Price of series A stock ing Series A stock, or (iii) the Company first becoming subject to

$1.00 per share the SEC reporting requirements.

Shares outstanding, pre-financing

Liquidation preference

10,000,000 shares of common stock

The Series A stock will have a liquidation preference of $ 1.00

Option pool per share, plus all declared but unpaid dividends, that is senior

Stock Option Plan with 3,500,000 shares reserved for issuance to the common stock. After this liquidation preference is satis-

under the plan. fied, all remaining assets to be distributed to shareholders will

Use of proceeds be distributed to all holders of common stock on a pro rata

Proceeds will be used for research and development and other basis. For this purpose, a liquidation will not include a merger,

working capital. consolidation, reorganization, recapitalization, sale of substan-

tially all of the assets or other similar transaction pursuant to

Resulting capitalization which control of the Company is transferred.

The resulting capitalization (assuming the grant and exercise

of all options and the conversion of all Series A stock): Dividends

Shares The holders of the Series A stock will be entitled to receive a

Common Stock 10,000,000 non-cumulative, eight per cent (8%) dividend per annum prior

Series A Stock 1,500,000 to any payment of dividends on common stock, but only when

Option Pool 3,500,000 and if declared by the Board of Directors.

Total 15,000,000

Voting rights

Conversion price

Each share of Series A stock is convertible at any time at the The Series A stock will vote on an equal basis with the common

option of the holders of Series A stock into one share of com- stock on an “as if converted” basis. In addition, the Series A

mon stock, subject to anti-dilution protections. stock will be entitled to vote as a separate class by a majority in

interest to the extent required by law.

Anti-dilution protection

Anti-dilution protection for the Series A stock for changes in Registration rights

capitalization (stock splits, stock dividends, etc.) and mergers, The holders of Series A stock will have “piggy back” registration

consolidations, recapitalizations or other exchanges or substi- rights (i.e., the right to include shares in a registered public

tutions of securities. offering of the Company). Such rights will contain a typical un-

Optional conversion derwriters’ cutback provisions (i.e., a provision requiring a pro-

Each Series A stock may at any time convert part or all of such rata cutback of non-Company shares in the event that the pub-

holder’s shares of Series A stock into shares of common stock lic offering would be adversely affected) as well as other cus-

at the then applicable conversion rate. tomary terms. r

For more information, visit: http://www.Business-asia.net

or buy the Business Coach on CD-ROM at US$ 120/Indian Rs. 5,000.

44 TECH MONITOR l Sep-Oct 2003

Business Coach Venture Financing

Finance for start-ups

Business angels and venture capitalists

Rahul Patwardan, Indiaco

What is an angel investor? Later-Stage Funding

Most angel investors are successful business leaders or pro- Mature company where funds are needed to support major

fessionals who make significant investments in other compa- expansion or new product development. Company is profitable

nies, usually early-stage startups. They typically invest in busi- or break-even.

nesses within their particular area of experience and exper- Merger and Acquisition

tise.

The combination of two companies. If one company survives it

The most important role of an angel investor is to infuse your is a merger; if both survive it is an acquisition.

startup with cash. But unlike other types of financing — such

Mezzanine Funding

as bank loans — angel investors can do more than keep your

company’s coffers full. Angels often take a hands-on advisory Company’s progress makes positioning for an initial public of-

or consulting role in the company, especially when it’s just fering viable. Venture funds are used to support the IPO.

starting out.

Seed/Startup Funding

Angels can be invaluable resources who help you connect

with future rounds of financing, build your executive team, Earliest stage of business; typically no operating history. Invest-

choose advisory board members and meet potential business ment is based on a business plan, the management group

partners. backgrounds and market and financial projections.

Keep in mind, however, that an angel investor is just that — an While I’m looking forward to the capital I might receive and how

investor. They expect to turn a profit by owning a part of your my company could grow because of it, I’m also wondering how

company. Therefore, not only should you have a plan for provid- much control venture capitalists usually expect over their in-

ing them with a reasonable return on their money, but you also vestments? What are the keys to working effectively with ven-

need to agree on the details of the plan. Typically, a cash return ture capitalists?

within five to seven years is considered reasonable and is Venture capitalists are investors. I know that seems obvious, but

often achieved by selling the company or taking it public. it’s important to remember what VCs are — and what they are

not. Venture capitalists are not business managers; they are not

Step 1 business operators.

Select the type of venture capital that best suits your compa- In the best of all worlds for venture capitalists, they attend board

ny’s needs. meetings periodically, are presented with outstanding reports

and go on to their next deal. The less time they are required to

spend on their investments, the closer they come to meeting

Equity Loan

their own personal objectives.

Offer of an ownership position to induce the loan, or can be a

note that has an option to convert from debt to equity. So how do you work effectively with venture capitalists? Make

their life easy. Schedule regular board meetings. Venture capi-

First-Round Funding talists will undoubtedly either have a seat on the board or ob-

servation rights. Give them timely information. Avoid surprises

Typically funding that accommodates growth. Company may and keep them well informed. Invite their input on a regular

have finished R&D. Funding is often in the form of convertible

basis when preparing for board meetings. Always hand out a

bond.

packet of information about the agenda of the next board meet-

ing a week in advance. And make sure they’re totally aware of

Intermediate/Second-Round Funding your developments and capital requirements. Venture inves-

Maturing company where a future leveraged buyout, merger or tors who already are invested can be your best advocates in

acquisition and/or initial public offering is a viable option. helping you raise additional money when the time comes. r

For more information, visit: http://www.Business-asia.net

or buy the Business Coach on CD-ROM at US$ 120/Indian Rs. 5,000.

TECH MONITOR l Sep-Oct 2003 45

You might also like

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- All 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchDocument50 pagesAll 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchAnonymous f9Zj4lNo ratings yet

- Bylaws of CorporationDocument9 pagesBylaws of CorporationAboromo LimotoNo ratings yet

- Fraud 101: Techniques and Strategies for Understanding FraudFrom EverandFraud 101: Techniques and Strategies for Understanding FraudNo ratings yet

- Pro Forma COP - Open Pit - 0Document101 pagesPro Forma COP - Open Pit - 0Gurinder ParmarNo ratings yet

- How to Get Your Share of the $30-Plus Billion Being Offered by the U.S. Foundations: A Complete Guide for Locating, Preparing, and Presenting Your ProposalFrom EverandHow to Get Your Share of the $30-Plus Billion Being Offered by the U.S. Foundations: A Complete Guide for Locating, Preparing, and Presenting Your ProposalRating: 5 out of 5 stars5/5 (1)

- Splitting The Roles of CEO and ChairmanDocument2 pagesSplitting The Roles of CEO and Chairmanmelrandal7No ratings yet

- Sweat EquityDocument3 pagesSweat EquityparulshinyNo ratings yet

- Make money with AI Artificial Intelligence A Beginner's Guide to Private Investing in the Stock Market (Stocks, ETFs and Funds) and the Blockchain (Cryptocurrencies and Other Cryptoassets)From EverandMake money with AI Artificial Intelligence A Beginner's Guide to Private Investing in the Stock Market (Stocks, ETFs and Funds) and the Blockchain (Cryptocurrencies and Other Cryptoassets)No ratings yet

- Business Tax Credit For Research And Development A Complete Guide - 2020 EditionFrom EverandBusiness Tax Credit For Research And Development A Complete Guide - 2020 EditionNo ratings yet

- Beyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3From EverandBeyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3No ratings yet

- Currency Stability and a Country’s Prosperity: "Does a Mandatory Currency Stability Law Determine the Stability and or Prosperity of a Country?"From EverandCurrency Stability and a Country’s Prosperity: "Does a Mandatory Currency Stability Law Determine the Stability and or Prosperity of a Country?"No ratings yet

- Converted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)From EverandConverted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)No ratings yet

- Crowdfunding in 2014 (Understanding a New Asset Class)From EverandCrowdfunding in 2014 (Understanding a New Asset Class)No ratings yet

- The Ultimate Financing Guide: The Complete Array of all Available Options - The Way it Works in the Real WorldFrom EverandThe Ultimate Financing Guide: The Complete Array of all Available Options - The Way it Works in the Real WorldNo ratings yet

- TRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSFrom EverandTRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSNo ratings yet

- IC Pro Forma Balance Sheets Template 10510Document4 pagesIC Pro Forma Balance Sheets Template 10510Royd BeñasNo ratings yet

- The Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationFrom EverandThe Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationNo ratings yet

- The Investment Handbook: A one-stop guide to investment, capital and business: The Essential Funding Guide for EntrepreneursFrom EverandThe Investment Handbook: A one-stop guide to investment, capital and business: The Essential Funding Guide for EntrepreneursNo ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckFirst Round CapitalNo ratings yet

- What Are RTO's (Reverse Takeovers) PrimerDocument6 pagesWhat Are RTO's (Reverse Takeovers) PrimerPropertywizzNo ratings yet

- Sponsorship Programme 3 Month AgreementDocument3 pagesSponsorship Programme 3 Month AgreementEthan GonzagaNo ratings yet

- DocSend Fundraising ResearchDocument19 pagesDocSend Fundraising ResearchGimme DunlodsNo ratings yet

- Report On Regulation A+ PrimerDocument13 pagesReport On Regulation A+ PrimerCrowdFunding BeatNo ratings yet

- Investment Banking & Public Issue GuideDocument55 pagesInvestment Banking & Public Issue GuideShafiq SumonNo ratings yet

- BitShares White PaperDocument18 pagesBitShares White PaperMichael WebbNo ratings yet

- Direct Listings - A More Certain Path To NasdaqDocument16 pagesDirect Listings - A More Certain Path To NasdaqkeatingcapitalNo ratings yet

- Weibo and WeChat KOL Marketing Costs - PARKLUDocument21 pagesWeibo and WeChat KOL Marketing Costs - PARKLUSieleen FernandezNo ratings yet

- Series Seed Term Sheet (v2)Document2 pagesSeries Seed Term Sheet (v2)zazenNo ratings yet

- Cedi Sika Investment Club ProspectusDocument16 pagesCedi Sika Investment Club ProspectusIsaac Dwimoh-OpokuNo ratings yet

- IP & VC: A Framework For Funding Disruption of The Intellectual Property MarketsDocument10 pagesIP & VC: A Framework For Funding Disruption of The Intellectual Property MarketsJorge M TorresNo ratings yet

- Estafa 3Document1 pageEstafa 3Ojo-publico.comNo ratings yet

- Passion Capital Plain English Term SheetDocument3 pagesPassion Capital Plain English Term SheetPassion Capital100% (3)

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckJessi Craige ShikmanNo ratings yet

- SSP Templates: Business Name: Last Completed Fiscal YearDocument23 pagesSSP Templates: Business Name: Last Completed Fiscal YearMee TootNo ratings yet

- Event Ticket SalesDocument15 pagesEvent Ticket SalesAnakinNo ratings yet

- VC Investment Thesis Template-VCLABDocument1 pageVC Investment Thesis Template-VCLABRodolfo ValentinoNo ratings yet

- Bus IessDocument45 pagesBus IessBernadette Mausisa100% (1)

- Post Money SAFE Dilution Analysis: Y Combinator Example From "SAFE Quickstart Guide" GreenDocument1 pagePost Money SAFE Dilution Analysis: Y Combinator Example From "SAFE Quickstart Guide" GreenDaniel Porras ReyesNo ratings yet

- Broker Success Issue 5Document20 pagesBroker Success Issue 5Graham ReibeltNo ratings yet

- Some Basics of Venture Capital: Michael Kearns Chief Technology Officer Syntek CapitalDocument21 pagesSome Basics of Venture Capital: Michael Kearns Chief Technology Officer Syntek CapitaldippuneNo ratings yet

- Legal Formalities For Starting A BusinessDocument4 pagesLegal Formalities For Starting A BusinessVareen voraNo ratings yet

- Pro Forma StatementDocument14 pagesPro Forma StatementEse Peace100% (1)

- Sample California Limited Partnership AgreementDocument6 pagesSample California Limited Partnership AgreementStan Burman50% (2)

- Local Law 15 of 2020 - Bird SafetyDocument3 pagesLocal Law 15 of 2020 - Bird SafetyJennifer LeeNo ratings yet

- NYCECC How-To Demonstrate Energy Code ComplianceDocument1 pageNYCECC How-To Demonstrate Energy Code ComplianceJennifer LeeNo ratings yet

- Brownsville Learn Phase ReportDocument28 pagesBrownsville Learn Phase ReportJennifer LeeNo ratings yet

- Building Energy Exchange: Ambassador ProgramDocument1 pageBuilding Energy Exchange: Ambassador ProgramJennifer LeeNo ratings yet

- Mit Commercial Real Estate Analysis and Investment Online Short Program BrochureDocument9 pagesMit Commercial Real Estate Analysis and Investment Online Short Program BrochureJennifer LeeNo ratings yet

- Pop Cad Bmi StndrdsDocument106 pagesPop Cad Bmi StndrdskuraimundNo ratings yet

- Series B Preferred - Sample Term SheetDocument3 pagesSeries B Preferred - Sample Term SheetJennifer LeeNo ratings yet

- Anatomy Term SheetDocument16 pagesAnatomy Term SheetidownloadbooksforstuNo ratings yet

- Letter of Intent Joint VentureDocument10 pagesLetter of Intent Joint VentureJennifer LeeNo ratings yet

- Draft Term Sheet SampleDocument8 pagesDraft Term Sheet SampleJennifer LeeNo ratings yet

- ABC Term SheetDocument10 pagesABC Term SheetJennifer LeeNo ratings yet

- Anatomy Term SheetDocument16 pagesAnatomy Term SheetidownloadbooksforstuNo ratings yet

- Design Professionals ManualDocument114 pagesDesign Professionals ManualJennifer LeeNo ratings yet

- Management 12th Edition Griffin Solutions ManualDocument14 pagesManagement 12th Edition Griffin Solutions Manualcaiharoldf84w2b100% (24)

- Guide To The Nigerian Power SectorDocument27 pagesGuide To The Nigerian Power SectorOgunranti RasaqNo ratings yet

- Chapter 6 MCDocument4 pagesChapter 6 MCapi-3749577No ratings yet

- ASR01 Assurance Engagements Other ServicesDocument16 pagesASR01 Assurance Engagements Other ServicesRouise GagalacNo ratings yet

- En General CV Andreea StancuDocument2 pagesEn General CV Andreea StancucititoruNo ratings yet

- Robert T. Futrell, Donald F. Shafer, Linda Isabell Shafer - Quality Software Project Management (2002)Document1,893 pagesRobert T. Futrell, Donald F. Shafer, Linda Isabell Shafer - Quality Software Project Management (2002)Sai Charan0% (1)

- Our Promoters: Mr. Binnybansal Flipkart India Private Limited and Navi Financial Services Private LimitedDocument2 pagesOur Promoters: Mr. Binnybansal Flipkart India Private Limited and Navi Financial Services Private LimitedAnubhav KushwahaNo ratings yet

- Week 2 - Accrual Accounting and The Income Statement PDFDocument50 pagesWeek 2 - Accrual Accounting and The Income Statement PDFHisham ShihabNo ratings yet

- EDPDocument19 pagesEDPShaista AslamNo ratings yet

- Acpa Application FormDocument3 pagesAcpa Application FormGrand OverallNo ratings yet

- Financial Leasing RegulationsDocument30 pagesFinancial Leasing RegulationsZaminNo ratings yet

- Clothing Retailing - UK - 2022 - BrochureDocument4 pagesClothing Retailing - UK - 2022 - BrochureMainak PaulNo ratings yet

- Industrial MachineryDocument8 pagesIndustrial MachineryGalma GalmaNo ratings yet

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- Barclays India 2021 - MBA GradDocument3 pagesBarclays India 2021 - MBA GradHARSH MATHURNo ratings yet

- Financial Accounting Information For Decisions Wild 7th Edition Solutions ManualDocument36 pagesFinancial Accounting Information For Decisions Wild 7th Edition Solutions Manualwalerfluster9egfh3100% (34)

- System Analysis and DesignDocument3 pagesSystem Analysis and DesignhemantsajwanNo ratings yet

- Tesco's Motivational Theories in PracticeDocument7 pagesTesco's Motivational Theories in PracticeArindam RayNo ratings yet

- Working Capital Management: Kiran ThapaDocument18 pagesWorking Capital Management: Kiran ThapaRajesh ShresthaNo ratings yet

- Loss Prevention Cover Letter TemplateDocument9 pagesLoss Prevention Cover Letter Templateafiwgbuua100% (2)

- SIPL - HR ManualDocument32 pagesSIPL - HR ManualFaihatul AkmaNo ratings yet

- Human Resource Accounting-FinalDocument20 pagesHuman Resource Accounting-FinalLikitha T AppajiNo ratings yet

- ASM1 - 1ST - Planning A Computing Projec - Nguyen Chi Thanh - BH00887Document21 pagesASM1 - 1ST - Planning A Computing Projec - Nguyen Chi Thanh - BH00887Nguyễn Chí ThanhNo ratings yet

- Sample Balance Sheet PDFDocument1 pageSample Balance Sheet PDFEshan MishraNo ratings yet

- Datawarehouse PPTDocument39 pagesDatawarehouse PPTLakshmiNarasaiah_MNo ratings yet

- 242-Siwar, C & Harizan, SDocument16 pages242-Siwar, C & Harizan, SSelam HulgizeNo ratings yet

- Liabilities 2010 2011 Assets 2010 2011Document27 pagesLiabilities 2010 2011 Assets 2010 2011afreen affuNo ratings yet

- Accounts Test No. 1Document3 pagesAccounts Test No. 1AMIN BUHARI ABDUL KHADERNo ratings yet

- Remax India - External Case StudyDocument1 pageRemax India - External Case StudyremaxyoungaceleadsNo ratings yet

- Social Responsibility, Business Strategy and Development: The Case of Grameen-Danone Foods LimitedDocument16 pagesSocial Responsibility, Business Strategy and Development: The Case of Grameen-Danone Foods LimitedstefanNo ratings yet