Professional Documents

Culture Documents

Reports in Accounting: Balance Sheet

Uploaded by

Nikolajay MarrenoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reports in Accounting: Balance Sheet

Uploaded by

Nikolajay MarrenoCopyright:

Available Formats

Reports in accounting

Three reports are typically generated in financial accounting and cover a specific,

predetermined accounting period:

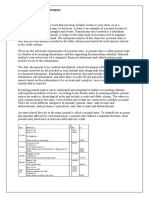

1. Balance sheet: summarises the firm’s assets and liabilities at a given point in time

- usually at the end of an accounting period. This report provides a clear idea of the

company’s financial standing.

2. Income statement: reports the firm’s gross proceeds, expenses, and profit or loss.

This report addresses the income and expenses that are produced both by regular

operating activities, or by ‘non-operating’ activities - income or expenses that are not

directly produced by the business. This is probably the most important of the three types

of accounting reports, as it is commonly used by management to help determine financial

standing and decision-making.

3. Statement of cash flows: analyses the flow of cash into and out of the business.

This report deals only with the cash that moves in and out of the company through

various business activities. It also includes income and loss from any investments made

in the company name. Keep in mind that ‘cash’ also includes credit payments after the

payment is completed.

The creation of these reports typically occurs monthly and is used for internal

planning and decision-making. This is known as 'management accounting'.

The aim is to provide managers with reliable information regarding the costs of

operations and on standards with which those costs can be compared in order to

assist with budgeting.

You might also like

- Lecture 1-Introduction To Applied Office AccountingDocument15 pagesLecture 1-Introduction To Applied Office AccountingMary De JesusNo ratings yet

- Accounting and Financial StatementsDocument14 pagesAccounting and Financial StatementsMitha LarasNo ratings yet

- Muzzamil Janjua SAP ID 42618Document9 pagesMuzzamil Janjua SAP ID 42618Muzzamil JanjuaNo ratings yet

- What Is Financial Accounting?Document3 pagesWhat Is Financial Accounting?Meenakshi SeerviNo ratings yet

- Muzzamil Janjua SAP ID 42618Document9 pagesMuzzamil Janjua SAP ID 42618Muzzamil JanjuaNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentFarooq HaiderNo ratings yet

- CHAPTER - 3 Conceptual FrameworkDocument14 pagesCHAPTER - 3 Conceptual FrameworkSarva ShivaNo ratings yet

- Financial Statements, Mis and Financial KpisDocument2 pagesFinancial Statements, Mis and Financial KpisSidhi SoodNo ratings yet

- FABMDocument6 pagesFABMShane CayyongNo ratings yet

- Financial Statement Sivaswathi TEXTILESDocument103 pagesFinancial Statement Sivaswathi TEXTILESSakhamuri Ram'sNo ratings yet

- Understanding Financial StatementsDocument5 pagesUnderstanding Financial StatementsMark Russel Sean LealNo ratings yet

- Equation Becomes: Assets A Liabilities L + Stockholders' Equity SEDocument2 pagesEquation Becomes: Assets A Liabilities L + Stockholders' Equity SEJorge L CastelarNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingHaseebNo ratings yet

- Accounting DefinitionsDocument5 pagesAccounting DefinitionsAli GoharNo ratings yet

- Accounting NotesDocument66 pagesAccounting NotesSreenivas KuppachiNo ratings yet

- Chapter 9 - Financial AnalysisDocument13 pagesChapter 9 - Financial AnalysisNicole Feliz InfanteNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chapter 02 Final AccountsDocument69 pagesChapter 02 Final AccountsAuthor Jyoti Prakash rathNo ratings yet

- INTRODUCTIONDocument80 pagesINTRODUCTIONparth100% (1)

- GAURAVDocument12 pagesGAURAVSaurabh MishraNo ratings yet

- Fsa Assignment 1 PDFDocument19 pagesFsa Assignment 1 PDFMUHAMMAD UMARNo ratings yet

- FM TermpaoerDocument34 pagesFM TermpaoerFilmona YonasNo ratings yet

- Financial Accounting Reporting: Time. in Accounting, We Measure Profitability For A Period, Such As A Month or YearDocument2 pagesFinancial Accounting Reporting: Time. in Accounting, We Measure Profitability For A Period, Such As A Month or YearMuneebAhmedNo ratings yet

- Week 002-003-Module Review of Financial Statement Preparation, Analysis and InterpretationDocument12 pagesWeek 002-003-Module Review of Financial Statement Preparation, Analysis and InterpretationWenzel ManaigNo ratings yet

- Activity05 - Lfca133e022 - Lique GinoDocument4 pagesActivity05 - Lfca133e022 - Lique GinoGino LiqueNo ratings yet

- Introduction To Financial Accountin1Document27 pagesIntroduction To Financial Accountin1yug.rokadia100% (1)

- Weekly Discussion 1Document3 pagesWeekly Discussion 1Vivek SharmaNo ratings yet

- Accounting CycleDocument3 pagesAccounting CycleMohiuddin GaalibNo ratings yet

- Introduction To Financial AccountingDocument3 pagesIntroduction To Financial AccountingnidayousafzaiNo ratings yet

- Safari - 7 Jul 2022 at 3:41 PMDocument1 pageSafari - 7 Jul 2022 at 3:41 PMKristy Veyna BautistaNo ratings yet

- BUSINESS FINANCE Week 5Document8 pagesBUSINESS FINANCE Week 5Ace San GabrielNo ratings yet

- What Is AccountingDocument49 pagesWhat Is AccountingMay Myoe KhinNo ratings yet

- Accounting ExerciseDocument14 pagesAccounting ExerciseDima Abboud100% (2)

- Prepare Financial Report IbexDocument13 pagesPrepare Financial Report Ibexfentahun enyewNo ratings yet

- Faa U2Document10 pagesFaa U2kztrmfbc8wNo ratings yet

- LECTURE 1: Accounting ReportsDocument8 pagesLECTURE 1: Accounting ReportscheskaNo ratings yet

- BBA Accounting For Business 01Document11 pagesBBA Accounting For Business 01naldo nestoNo ratings yet

- Analysis of Trial Balance-: Solution 2Document3 pagesAnalysis of Trial Balance-: Solution 2BUNTY GUPTANo ratings yet

- Financial Accounting BBA MUDocument19 pagesFinancial Accounting BBA MUbhimNo ratings yet

- D196 Study Guide Answers & NotesDocument21 pagesD196 Study Guide Answers & NotesAsril DoankNo ratings yet

- Balance Sheet: AccountingDocument5 pagesBalance Sheet: AccountingPrathameshChoudhury100% (1)

- Financial Accounting and Cost AccountingDocument6 pagesFinancial Accounting and Cost AccountingdranilshindeNo ratings yet

- Financial Accounting WORDDocument18 pagesFinancial Accounting WORDramakrishnanNo ratings yet

- Act07 - Lfca133e022 - Lique GinoDocument4 pagesAct07 - Lfca133e022 - Lique GinoGino LiqueNo ratings yet

- Unit - 1 NotesDocument11 pagesUnit - 1 NotesIshan SharmaNo ratings yet

- Meaning of Financial StatementsDocument44 pagesMeaning of Financial Statementsparth100% (1)

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- 5 Financial StatementsDocument8 pages5 Financial StatementsMuhammad Muzammil100% (2)

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- 03 BSAIS 2 Financial Management Week 5 6Document8 pages03 BSAIS 2 Financial Management Week 5 6Ace San GabrielNo ratings yet

- Accounting and Finance For Managers Assignment Assignment OneDocument6 pagesAccounting and Finance For Managers Assignment Assignment OneBirukee ManNo ratings yet

- Accounting TheoryDocument5 pagesAccounting TheoryMis LailaNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAeilin AgotoNo ratings yet

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Assign 1 Audit AssuranceDocument5 pagesAssign 1 Audit AssuranceAyesha HamidNo ratings yet

- FABMDocument8 pagesFABMMary Grace DegamoNo ratings yet

- The Propaganda MovementDocument60 pagesThe Propaganda MovementNikolajay MarrenoNo ratings yet

- The Propaganda Movement 1Document16 pagesThe Propaganda Movement 1Nikolajay MarrenoNo ratings yet

- Moral LessonDocument1 pageMoral LessonNikolajay MarrenoNo ratings yet

- G. ExpositionDocument1 pageG. ExpositionNikolajay MarrenoNo ratings yet

- The Two BroDocument1 pageThe Two BroNikolajay MarrenoNo ratings yet

- H. Rising Action: G.ExpositionDocument1 pageH. Rising Action: G.ExpositionNikolajay MarrenoNo ratings yet

- Singapore Traditions What Is The Traditional Clothiong in Singapore?Document1 pageSingapore Traditions What Is The Traditional Clothiong in Singapore?Nikolajay MarrenoNo ratings yet

- Story of Two BrothersDocument1 pageStory of Two BrothersNikolajay MarrenoNo ratings yet

- Attitudes of Student Toward His Parents - Loyalty For Family - HonestyDocument1 pageAttitudes of Student Toward His Parents - Loyalty For Family - HonestyNikolajay MarrenoNo ratings yet

- Plot of Two BDocument1 pagePlot of Two BNikolajay MarrenoNo ratings yet

- Malaysia TraditionsDocument1 pageMalaysia TraditionsNikolajay MarrenoNo ratings yet

- 2 Brothers ResolutionDocument1 page2 Brothers ResolutionNikolajay MarrenoNo ratings yet

- Outwitting A CrocodileDocument2 pagesOutwitting A CrocodileNikolajay MarrenoNo ratings yet

- Alibaba and The Frty ThievesDocument2 pagesAlibaba and The Frty ThievesNikolajay MarrenoNo ratings yet

- 2 Brothers ClimaxDocument1 page2 Brothers ClimaxNikolajay MarrenoNo ratings yet

- Once There Were Two Brothers - Anpu Was The Name of The Elder and Bata Was The of The YoungerDocument1 pageOnce There Were Two Brothers - Anpu Was The Name of The Elder and Bata Was The of The YoungerNikolajay MarrenoNo ratings yet

- Calao West, Santiago City Second Semester, AY 2019-2020Document1 pageCalao West, Santiago City Second Semester, AY 2019-2020Nikolajay MarrenoNo ratings yet

- The Nature of Strategic ManagementDocument14 pagesThe Nature of Strategic ManagementRuel Lopez Mabasa Jr.100% (1)

- Study Questions Pg. 20-21: Daniel Otero AP Economics 08/21/2014Document10 pagesStudy Questions Pg. 20-21: Daniel Otero AP Economics 08/21/2014Nikolajay MarrenoNo ratings yet

- Ms Teams: For Students Online LearningDocument31 pagesMs Teams: For Students Online LearningNikolajay MarrenoNo ratings yet

- Income Taxation Solution Manual 2019 Ed PDFDocument40 pagesIncome Taxation Solution Manual 2019 Ed PDFAilene QuintoNo ratings yet

- Auditing Theory Overview of The Audit Process With AnswersDocument44 pagesAuditing Theory Overview of The Audit Process With AnswersNikolajay MarrenoNo ratings yet

- TaxationDocument188 pagesTaxationNikolajay MarrenoNo ratings yet

- What Is International AccountingDocument2 pagesWhat Is International AccountingNikolajay MarrenoNo ratings yet