Professional Documents

Culture Documents

Chapter 1 PDF

Chapter 1 PDF

Uploaded by

Fely Maata0 ratings0% found this document useful (0 votes)

116 views23 pagesOriginal Title

chapter 1.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

116 views23 pagesChapter 1 PDF

Chapter 1 PDF

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 23

INCOME TAXATION

2019 EDITION

OVERVIEW OF CONTENTS

Introductory concepts to taxation

The concept of tax, tax laws and tax administration

The concept of gross income under taxation

Taxation schemes, accounting period, methods and income reporting

Final income taxes

Capital gains taxes

Overview of the regular income tax

Exclusions and exempt income

Income subject to regular income tax

Compensation income

Fringe benefits and the fringe benefits tax

Dealings in properties subject to regular tax

‘Allowable deductions from gross income

Specific regular tax rules applicable individuals

Specific regular tax rules applicable to corporations

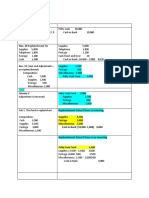

‘THE CONCEPT MAP OF INCOME TAXATION

‘TABLE OF CONTENTS

PARTI

INTRODUCTORY CONCEPTS

Regular Income

Taxation ‘Taxation

Fringe benefits rape

>| Gross income P XXX

Less:

== Deductions XXX

Personal exemptions _XXX

‘Taxable income Eu

L

Individual Taxpayers Corporate income Taxpayers Saat

{Progressive Income Tax)

PARTIC

i INCOME RECOGNITION, MEASUREMENT

| ‘TAXPAYER, CLASSIFICATIONS ORTING, AND

‘Special ndividwal tax rules: Special corporate tax rules:

tates Gross income tox

Mcit

last

Branch profit remittan

Te / ce

station

CHAPTER 6 Ct on amare” robes

‘i properties

167-220

167

individual taxpayers

‘Taxable estates and trusts =

Corporate taxpayers

‘The genera rules in income taxation

Situs of income

Exercise Drills

CHAPTER 4 Tax Schemes, Periods and Methods and Reporting

schemes

income tax returns

‘Taxpayers mandated to use the eFPS

mento the 6

Groupings of eFPS taxpayers is

mentary stamp tox onthe sal of capital assets

Payment oo -

Penalies for lingo returns and late payment of taxes

Exercise Drills —

PART OT

‘SPECIAL INCOME TAXATION

We annual income tax retuens

ry

UNIT 1 - GENERAL RULES ON GROSS INCOME

264275

26316

The effect of tus 209

val

‘The transier pricing regu sion 295

Beereise Drills 300316

UNIT 2 - SPECIAL RULES ON GROSS INCOME

CHAPTER 10 Compensation income

Emphoyer-empioyee relationship

Elements of at employer employee relationship 318

Types af employees as to funetion and taxablty

cuaprer 12

employ

meet ae compensatonsneoM=

feta sompen

fetcrapeeaion tems

i compensation

ymmonth pay and other benef

a Prot taal compensation income

‘wage earners:

imam wage status

Fringe Benefits Taxation

‘Tureament offing beets

‘Srope ofthe fnge benef tax

es \ge benefits to the fringe benefits tax

‘The tnge benefits tax and

Dealings in Properties

Dealingsin properties subject to regular income tax

Determination and treatment of gain or loss

Inia acqistton ef cotrot

Exchanges not pany for socks

Washes

Transacons considered exchanges

Exercise Drills ve

348-361

362-392

362

363

365

366

367

368

369

377

377

378

379

382-392

393-432

393

394

395

396

398,

399

401

408

408

406

407

413

47

419.432

‘UNIT 3 - DEDUCTIONS ON GROSS INCOME

CHAPTER 13 Principles or Deductions

iesiness

Pens vs personal expense

Alcaton a common cxpenaes

Business expense rs cpl expenditures

Releson deducting capital expeotres

Deprecation methods

ing Rule

‘The Related Party Rule

CHAPTER 13-4 Regular Allowable Itemized Deductions

remized deductions

Interest expense

Taxes

Foreign income tax credit

Depreciation expense

‘Amortization expense on intangible assets

Depletion expense

lopment and general expenses

nt and amusement expenses

Freraise Drills

CHAPTER 13-8 Special Allowable Itemized Deductions and

Net Operating Loss Carry-over

‘special deductions

Special expenses under the NIRC and special laws

jon incentives under special laws

rating Loss Carry-over

NOL vs. NOLCO

Requisites for te deductibility of NOLCO

476517

476

476

480

482

38

487

506.517

519.582

518

519

sar

KoLco 343

raxpav"

ger and cons

548

Rulesin carry-over of|

mio 545/552

553.578

3st

$53

358

356

nds 358

sr

50

Ses

ding parners 585

ae 370-578

dard Dedcton

rs ndard Deduction (OSD)

red to use ntemized deductions

Cost of services

(OSD for general professional partnership incl

Exercise Drills

UNIT ~ SPECIFIC REGULAR TAX RULES PER TAXPAYER CLASS

‘Sub-Unit 1

Special Regular Tax Rules for Individual taxpayers

879.617

579

580

580

581

54

506

587

593

‘Tarable estates and trusts 596

Consolidation oftwo oF more trusts 598

599

red taxpayers 600

fh PERA accounts 601

come Tax Returns 602

meot payment of regular income tax 603

come tax return 605

606-617

‘Sub-Unit 2

Special Regular Tax Rules for Corporate taxpayers

(CHAPTER 15-A Corporate Income Taxation - Special Corporations 618-660

General classification and tax rules for corporations: 618

Sub:classification of corporate taxpayers. 619

Exempt corporations 6

‘The casieaton rue a

Requisites of

erption of monprocorporatns

Exception to the classifi ul "porate

tion rule S22

Tati of cooperatives a

“cation of common expenses of exer ‘corporations :

Reporting requirements tor exemprecreenert Po

Special domestic, ‘corporations ee

The Pre-dominance test a

Taxation of FCDUs bid

‘Tax on PEZA or Bc oa

tore me &

Taxation of RHQs: &

ees &

Taxon special non-resident foreign corporations a

Exercise oor.ee0

eer ear eon, Seer Copeiton tak

tn

teers s

Te a

Tene 3

Feat kai citi 7

nae 7

a lecia &

wn

Appendices

x1 Table summary for final income tax rates

iM2 Withholding tax tables on compensation

Appendix 3 Income tax table for

Appendix 4

‘Chapter 1 = Introduction to Taxation

CHAPTER 1

INTRODUCTION TO TAXATION

‘Chapter Overview and Objectives

‘This chapter discusses the fundamental principles of taxation.

ise ch .

iopter, readers must be able to comprehend and demonstrate mastery

After this

core

waiaation and is necessity for every government

2 bid ds onto taxation

i

:

:

é

,

é

s Incipes surrounding tration

10, Various escapes from taxation

11, Concept of tax amnesty and condonation

(WAT IS TAXATION?

Taxation may be defined as a State power, a legislative process, and a mode of

government cost distribution

4. Asastate power

Toxation is an inherent power of the State to enforce a proportional

contribution from its subjects for public purpose.

2 Asaprocess

's a process of levying taxes by the legislature of the State to enforce

ional contributions from its subjects for public purpose.

3. Asamode of cost distribution

Taxation 1s a mode hy which the State allocates its costs or burden to its

Subjects who ae benefited by its spending

‘The Theory of Taxation

Every government provides a vast arra

public order and safety, health, education,

'y Of pubite services including defense,

‘and social protection among others.

(Chapter 1 - Introduction to Taxation

: sy. However

forfunding iste hea The governments ech

The Basisof Taxation

‘The government provides benef tothe people nthe

ole inthe form of publ se

the people provice the finds that fnanee the gaveneee te

Support berween the people andthe government Ie refered tse

1y of

bast of

‘This mutuality is illustrated as:

Public services

et

[creme

t___ tas

Receipt of benefits is conclusively presumed

Every citizen and resident of the State directly or indit

public services rendered by the government, These bene

daily free usage of public infrastructures, access to public health or educational

services, the protection and security of person and property, or simply the

comfort of living in a civilized and peaceful society which is maintained by the

‘government.

tion by every

fof these benefits bythe

5 cannot avoid payment of taxes

lunder the defense of absence of benefit received. The direct receipt or actual

availment of government services is not a precondition to taxation,

the people. In

wing general

1. Benefit received theory

2 Ability to pay theory

nto Taxation

chapter 1 -tniroductor

eer)

ee nl ea

iit

receives from

poses that the more benefit one FES

a oe

ep

Parr tatve capacity to sacrifice For the

apposes that tra

bol be reqs

netlovort tthe government

they benefit less from

hey receive

ave more should be taxed more even if they Be

Inshort. hase wha tate Te have lest shal contribute less even if

bate ‘benefits from the government.

more ofthe

Aspects ofthe Ability to Pay Theory

Se ae that the extent of one’s ability to pay is directly

Vertical equity propeses

proportional to the level of is fax base.

or example. A has F200000 income while 8

rent should tax B more than A because B hi

has P400,000. tn taxing income, the

as greater mcome; hence, a greater

Horizontal equity

Horizontal equity requires consideration of the particular circumstance of the

taxpayer.

the lifeblood of the government, and thelr prompt and certain

are an imperious need. Upon taxation depends the government's

Fernandes) Peuple for whose benefit taxes are collected. (Vera vs,

hapten econ

ter 1 = ntodcon to Tava

Implication ofthe iteblood doctrine in taxation: comparison ote tee Pers =

1 _ Comparison oo

A Font fe | Taxation

3 [_oiperence | ited

‘ awe | om

5. Inivcome nation [set aan apo

2 Income received in advance i taxable upon receipt, pose | Fine government — a

1. Deduction for capital expenditures and prepayments is not allowed as noe

Me cilection af income tax wedsk aoe | propery

of deductions preferred whe a caimable exp

“ pretrred when a caimabe expenseiw | ated Te aout

‘base is preferred when the tax object has multiple tax bases, Frank of imposed.

‘pton

INHERENT POWERS OF THESTATE commpensati

Tempera

rocnchas ha banc nents and igh which co-exist with itscreaton has [orice _ important

io sustenance, protection, and properties. The government sustains is ene Superior to th

to sustenance roe gua andthe wen of people by pole | wih the

ee aS properis tery ot Hs pic series Oye | Eastaton

ower of eminent domain Constston

Taaven—} Consctavonal

‘These rights, dubbed 25 “powers” ae natura ineparl, and abe Cornet | and due proces

sain of eee operte mien

government. No government can su

powers. Therefore, the exercise of thes

Bhderstood and acknowledged by the people from the very mom

their government. These powers are naturally exercisable

‘even in the absence ofan express grant of power in the Const

se powers by the government is presumed

they establish Similarities ofthe three powers of the State

the government 1. They are all necessary attributes of sovereignty.

‘The Inherent Powers of the State

‘Taxation power isthe powar ofthe State to enforce proportional contribution rays in which the State interferes with private rights and

from ts subjects to sustain self

Police power i the general power of the State to enact laws to protec he

1

of the Constitution and are exercisable by the

rent even without Constitutional grant, However, the Constitution

2

rettnnget the pest. 4. elinor censor for thet exe

“Eminent domain s the power ofthe State to tke private property fr psbte + ‘They all presuppose an equivalent form of compensation

3 ee ing je corners 1, Mista by te exert ofthe power. pensation received by the

ie national egsanye, 7 Fst Government units may be himited by

J) chose -itotictntoTecaten

SCOPE OF THE TAXATION

v0

The scope of taxation ts widely Fe

anasupreme

regarded as com

#atded as comprehensive, plenary unin

mites

However, despite the seemingly

unlimited. Taxation has its 0

the Constitution,

‘THE LIMITATIONS OF THE TAXATION POWER

2. International comity

3. Public purpose

4 Exemption of the government

5. Non-delegation of the taxing power

B. Constitutional Limitations

1

ressive system of taxation

1 non-payment of debt or poll tax

Non-impairment of obligation and contract

Free worship rul

Exemption of religious or charitable entities, non-profit cemetene,

churches and mosque from property taxes

9. Non-appropriation of public funds or property for the benefit of any

church, sect or system of religion

wxes of the revenues and assets of non-profit, non-stock

ions

11. Concurrence of a majority of all

Taw granting tax exemption

jon of tax collections

‘of the power of taxation

risdiction of the Supreme Court to review 3s

ils shal

It members of Congress for the passage of*

13. Non-deley

14. Non-impairment of the ju

15, The requirement

originate exclusivel

16, The delegation of taxing power

that appropriations, revenue, of tari

sy m the House of Representatives

to local government units

—=—

peor 1 Irvoducion © Taxaer

.T10N OF TAXATION

‘char

INHERENT LIMITA

jon its 5h

‘only demand (2% pons eign Sublets

jurisdiction: Phe government. Furthermore,

we gerive benefits (rom oUF

re ene eroachent of foreign SOverelENY-

-qworfold obligations of taxpayers

Figen coeemerinet

be demanded and enforet

id residents. It cannot entor

eine!

1 and its remittance

fed by the Philippine

‘ree these upon subjects

‘these obligations can only

ineroachment of foreign

tener upon ts ins a

severe orial urisicton as this would Fest

sovereignty.

‘Exception to the territoriality prin

1 tmincome taxation, resident c

income derived within and outside the Phil

2. in transfer taxation, residents or citizens such as resident Azer, Te

resident citizens and resi ng are taxable on transfers of properties

Tocated within or outside

jorations are taxable on

International comity

In the UN Convention, countries of the world agreed to one fundamental concept

Ureoequal sovereignty wherein all nations are deemed equal with one another

regardless of ace, religion, culture, economic conditien or military power.

No county is power than the othe. es by this principle that each coum

Ss mail ome a rey or eaprost besn ‘he

1 Goverment donot tae he nce ap

ve and properties other governments

E: ovenments ge primacy tothe ren ob

Serene pe pinay theta pts over how domestic

Embassies or consular ofces

bess of cnr of orein goverment the Phin ncaing

erat irnon-Pipino staff are not subject to ict

wees o ner = Under the Neon ternal Revenue Code (NII the

ent and foreign government

Carperaons remot sabecttoicometax, Snnenwownes. and con

7

I>

(Chapter 1 - Introduction to Taxation

When a state ent

agreements as a

same conflicts wit

te

Public purpose

tended forthe

common good, Taxation

public purpose. It cannot be exercised to furth elute fo

Exemption ofthe government

road. The government can exercise the po

"EF Upon

does not

this will not aise additional funds but wil only impute adivonatconys SAE

Under the NIRC, government properties and income from ess

functions are not subject to taxation. However, income te

properties and activities conducted fo pro

‘owned and controlled corporations is subject to tax

abi

government fom is

from government

Non-delegation ofthe taxing power

The eiative taxing power vested exclusively in Congres ands non del

pursuant to the dotine of separation of the branches of te green

‘ensure a system of checks and balances. .

‘The power of lawmaking including taxation, i delegated by he people tte

legislature. So as not to spoil the purpose of delegat held dente has

been delegated cannot be further deepsed

Exceptions to the rule of non-delegation

local government units are allowed to exercse the

watonomy.

‘empowered to fi the

power to taxto.

2. Under the Tariff and C

amount of tariffs to be fe

3. Other cases that req

{implementation of asse

CONSTITUTIONAL LIMITATIONS OF TAXATION

Observance of due process of law

No one should be deprived of his lif, liberty, or proper

law. Tax laws should neither be harsh nor oppressive.

ty without due proces

caper 1 Inonon 19 Tera?

cour

nee no

by the taxing Trement of due Process:

ah le peas the egureme

taxes, and the

hearing. The law

4 seessments and if

rocess rent and collection of

race ness in assessment and collec

2. Procedural due

There should be m0

overnment shall 0

yvoiished procedures which mus

‘Equal protection ofthe law

Io person shall be denied the equal protection

oth in terms of rights conferred

of the law. Taxpayers should be

‘and obligations imposed.

trested equal

ani

‘this rule applies where taxpayers are under the same sitcumstanse®

‘his rule appl rcement would mean Congress cannot exempt sellers of

bala” while ers of “penoy” to tax since they are essentially the

same goods.

Uniformity rule in taxation

‘The rule of taxation shall be uniform and equitable. Taxpayers under dissimilar

Grvumstanaes should not be taxed the same. Taxpayers should be classified

‘ccording to commonality in attybutes, and the tax classification to be adopted

Should be based on substantial distncuon, Each class is taxed differently, but

taxpayers falling under the same class are taxed the same, Hence, uniformity is

Congress shall evolve a progressive system of taxation. Under the progressive

rhe Constitution favors

to pay. Moreover, the

le distribution of wealth ta society by taxing

Chapter 1 - Introduction to Taxation

Non-imprisonment for non-payment of debt or poll tax

‘Asa policy no one shall be imprisoned because of his poverty, and

imprisoned for mere pay debt POVEEY, An D0 one shan

However, this Constitutional guarantee applies only when the debt i

the debtor in good faith Debt acqured in bad ath constaes ge ey

offense punishable by imprisonment. " @ Criminal

‘except poll tax. om

Poll tax has two components:

a. Basic community tax

b. Additional community tax

The consttutional guarante of non-imprsonment for non-payment of

apples only to the basie community tx Nor-payment of he tea

omnuity tax ta act of tax evasion punishable by imprisonment

Non-impairment of obligation and contract.

‘The State should set an example of good faith among its constituents, It should not

set aside its obligations from contracts by the exercise ofits taxation power. Tar

‘exemptions granted under contract should be honored and should aot be

cancelled by a unilateral government action.

Free worship rule

1¢ government adc pts free exercise of religion and does not subject.

(0 taxation. Consequently, the properties and revenues of religious

utions such as tithes or offerings are not subject to tax, This exemption

however, does not extend to income from properties or activities of reliposs

institutions that are proprietary or commercial in nature

Exemption of religious, charitable oF educational

‘cemeteries, churches and mosques, tands, buildings,

from property taxes

‘The Constitutional exemption from property tx applies for properties eee

directly, and exclusively (ie. primarily) used for charitable

educational purposes.

fentides, non-profit

‘and Improvements

10

—

_ntoaueiono Texan

Chapter + Inrocucto rows the doctrine of

haritable, oF

—

eS

por

: yrties of religious, charitable, oF

rs i

benefit of any church,

ine of omnerip, We Br

te wr oF not used

oun sno ap

Unde

educational entities whether

secret reper ton TH

on-appropraion of publ funds oF property for the

we

mended to hight the separation of eligion

vom ane government should RO V9"

on pub ands or PreDETY 18

‘To support

any particular system of religion by appro

support thereof,

pensation to priests, imams, or religious

ry, penal institutions, orphanages, oF

ligious appropriation.

It should be noted, however, that

‘ministers working with the

leprosarium isnot considered

Exemption from taxes of the revenues and assets of non-profit, non-stock

‘educational institutions including grants, endowments, donations, or

contributions for educational purposes

‘The Constitution recognizes the necessity of education in state building by

ting tax exemption on revenues and assets of non-profit educational

institutions. This exemption, however, applies only on revenues and assets that

are actualy. directly. and exclusively devoted for educational purposes.

Consistr

NIRC also exempts. govert

ssubjeces private educational

ation as a necessity, the

ns from income tax and

1% income tax.

Concurrence of a majority of all members of Congress for the passage of a

remption must proceed only

A requires the vote of the

grant oftax exemption.

members of Congress

In the approval of an exe

ave. an absolute majority or the majority of all

ve majority or quorum majority, is required.

‘exemption, only a relative majority is required,

Non-liversification of tax collections :

ax collections should be used only fo

Ahvesied or sed or priate non fOF PUbUC purpose. it should never be

However, in the withdrawal

a

Chapter 1 - Introduction to Taxation

Non-delegation of the power of taxation

ee, Principle of checks and balances ina republican state requires that taxa

ion

Power as partof lawmaking be vested exclusively in Congress.

the expedient ang

id collection of taxes

slative in character ae

Hence, implementing adminstrative agencies such as the Department of Fina

and the Bureau of internal Revenue (I issues revenue regulations, isa

orders o circulars to interpret and clan the ap

their functions are merel

law. They are not

lative authority

serrate rane

scoaae ee entons ae ease

Non-tmpairment ofthe jurisdiction of the Supreme Court to review tax cases

Notwithstanding the existence of the Court of Tax Appeals, which is a special

court, all cases iavolving taxes can be raised to and be finally decided by the

Supreme Court ofthe Philippines,

Appropriations, revenue, or tariff bills shall originate exclusively in the

House of Representatives, but the Senate may propose or concur with

amendments.

Laws that add income to the nat

therein must originate from the

concur with amendments. The

the House

il treasury and those that allows spending

of Repres

Each local government unit shall exercise the power to create its own

sources of revenue and shall have a just share in the national taxes,

This is a constitutional recognition ofthe local autonomy of local governments and

an express delegation ofthe taxing power

‘STAGES OF THE EXERCISE OF TAXATICN POWER

1. Levy or imposition

2. Assessment and collection

ae

Intreducton to Taxation

oe act

dis called ip:

Levy orlmpostto a cunent ofa tax law by Congress and is

Ee scforreatoas the legislative actin taxa

oftoxntion re!

ore mgt

a

neh ttn

aces Cort

Refer is approved by both bodes, but tx

vera dn ne ner icon

se Crea coy

‘

Parken ten rl eet

Je of

ust originate from the Hous

us, orravons of proposed aM

a orgiate exclusively #FO™

ed

ich must be public use

1

2

3

4

bi

6

1

Assessment and Collection ‘men

‘the tax law is implemented by the administrative branch of the government.

shaptites of

Mejeentaton votes osesenet or the determination of he 2

tenet esta stage referred wo a nedence of fonction oF the

samira tf tran,

SITUS OF TAXATION

‘Situs isthe place of taxation, It is the tax jurisdiction that has the power to levy

taxes upon the tax object. Situs rules serve as frames of reference in gat

the tax object is within or outside the tax jurisdiction of the taxing

Examples of Situs Rules:

1, Business tax situs: Businesses are subject to tax in the place where the business

is conducted.

‘payer is involved in car dealership abroad and restaurant operation in the

pines,

estaurant business will be subject to business tax in the Phil

ess tax in the Philippines since the

ess is conducted herein, but the car dealing business is exempt because the

B

(Chapter 1 - introduction to Taxation

2.

Income tax situs on services:

Service fees are subject to tox where

rendered. fee hey ore

istration

A foreign cor

reign corporation leases a residenta space to a non-reskdent Fp

‘The rent income willbe exempt from Philipine taxation as the lasing se

rendered abroad. etree

o

Income tax situs on sale of goods: The gain on sale is subject to tax in the

place of sale

ant OFW citizen agreed witha Chinese friend to sell hig

‘They stipulated that the delivery of the item and

bbe made a week later in the Philippines. ‘The sale wes

‘consummated as agreed

is consensual and is perfected by the meeting of the minds of

the contracting parties. The perfection of the contract of China. The sits

The gain on the sale ofthe necklace wll be taxable abroad and

Property tax situs: Properties are taxable in their location.

Mlustration

‘An overseas Filipino worker has a residential lot in the Philippines.

pay real property tax despite his absence in the Philippines because

his property is located herein.

Personal tax situs: Persons are taxable in their place of residence.

Mlustration

‘Ahmed Loft isa Sudanese studying medicine in the Philippines.

‘Ahmed will pay personal tax in the Philippines even ifhe isan alien beceuse he is

residing in the Philippines.

OTHER FUNDAMENTAL DOCTRINES IN TAXATION.

1. Marshall Doctrine -"The power to tax involves the power to destroy.” Taxation

power van be used as an instrument of police power. It can be used t0

discourage or prohibit undesirable acuvsties or occupation. As such, taxation

power carries with it the power to destroy.

However, the taxation power does not include the power to destroy

used solely for the purpose of raising revenue. (Roras vs. CTA)

4

‘Chapter 1 - Introduction to Taxation

2. Holme’s Doctrine

4

while he

ation power 1s mot the power to destroy

caine power may be used to uid or encourage bene

opie rtf on incenves.

dict

e's Dectine appear to contra

peal practice. A good manifestation ofthe

a Peeccnve ax on c4aretes while

She te erento ot Ecoranes with a

sation ncentves such asthe Omimbus investment Code

tnd ne barangay co Dusen nterprie(OMBE) Law.

ion. An ex post facto law or a law

Dn

cvely if so intended by

Exceptionally, income tax laws may operate retrospectively

Congress under certain justifiable conditions. For example, Congress can levy

tax on income earned during periods of foreign occupation even after the war.

Non-compensation or set-off

Taxes are not subje comatic set-off or compensation. The taxpayer

cannot delay payme to wait for the resolution of a lawsuit involving

his pending claim against the government. Tax is not a debt; hence, its not

subject to set-off. This rule is important to allow the government sufficient

period to evaluate the validity of the claim. (See Philex Mining Corporation vs.

GIR, GR. 125704)

Except

‘8. Where the taxpayer's claim has already become due and demandable such

as when the goverment already eecognized the same and an

appropriation for refund was made

'. Cases of obvious overpayment of taxes

© Local taxes

igned or transferred to another entity by

the taxpayer to such effect shall not prejudice

of the government to collect.

Imprescriptibi

Prescription

in taxation

apsing of a night due to the passage of time. When on

en one

over an unreasonable period of time, he is presumed to be

The government it to collect tae da

the self provide for such prescription, es “ORS NOt Prescribe

15

—

‘chapter 1 -Introducton to Taxation

[Chapter 1 -Inroducton to Taxation

Under the NIRC, tax prescribes if not collected within § years from the

ies assessment in the absence ofan assessment, ax prescribes ifnot gee

by judicial action within 3 years from the date the return is requ

filed. However, taxes due from taxpayers who did not flea returm or

who fled fraudulent returns do not prescribe

lected

tobe

hoe

7. Doctrine of estoppel

‘against that person who made the misreprest

Fhe semeonenis ss scalpel The tO 6 SG

Ee Span fue opp, There yeoman

See ee eae arate

eee gee ee

8. Judicial Non-interference

Generally, courts are not allowed to issue injunction against the governments

pursuit to collect tax as this would unnecessarily defer tax collection. This rule

isanchored on the Lifeblood Doctrine,

9. Strict Construction of Tax Laws

‘When the law clearly provides for taxat

there isa clear exemption. Hence the maxi

the exception”

‘When the language of the law is clear and categorical, there is no room fer

interpretation. There is only room for application. However, when taxation

laws are vague, the doctrine of strict legal construction is observed.

taxation is the general rule unless

“Taxation isthe rule, exemptions

Vague tax laws

Vague tax laws are construed against the government and in favor of the

taxpayers. A vague tax law means no tax law. Obligation arising from law is

‘ot presumed, The Constitutional requirement of due process requires laws

be sufficiently clear and expressed in their provisions.

Vague exemption laws

Vague tax exemption laws are construed against the taxpayer and in favor of

the government. A vague tax exemption law means no exemption law. Tht

claim for exemption is construed strictly against the taxpayer in accordance

with the lifeblood doctrine.

16

DOUBLE TAXATION

aprer eta

te inherent to te State Isa prerogative assent) Te

int of organ oF statute Ia

SOR ‘No. 167260. February 27,

te must be shown indubuably (0 exist AE the

Oc st A welfounded doubt is fatal tothe

re opestaon can be supported. (82)

‘When exemp

‘every presumption is agains

any other construction hat

4 fom vague ference Tax exemption must be

Scpoverelaming a tax exempsion must point

confer fe taRDaver, in clear and ‘terms,

eubt wheter a tox exertion exists

al Telecommunications, ne Vs C1

‘Tax exemption cannot ans

‘Sfeec provision of law conferng. on

‘rempuon om a common burden Anya

{feived agains the taxpayer (see Dig

Government of Baangos etl)

Double taxation occurs when the same taxpayer 1s taxed twice by the same tax

jurisdiction for the same thing.

Elements of double taxation

1, Primary element: Same object

2. Secondary elements:

a, Same type of tax

, Same purpose of tax

Same taxing jurisdiction

dd. Same tax period

‘Types of Double Taxation

1. Direct double taxation

‘This occurs when all the element of double taxation exists for both

impositions.

Earmples:

2 An income tax of 10% on monthly sales and a 2% income tax on the ann

‘sales (total of monthly sales) m the annual

Ate taxon bank reserve deiiency and another 19% penalty per day as a

consequence of such reserve deficiency, penalty ”

2. Indirect double taxation

This occurs when atleast one ofthe secondary elemen "

‘not common for both impositions. Ny elements of double taxation is

"7

NE!

(Chapter 1 - Introduction to Taxation

Examples:

‘4 The national government levies busines tax on the sas oF gross recep

business while the local government levies business tax upon the same sac,

or receipts.

%

Wvernment collects community tax upon the same income,

Se erate

ne gre es te opt

{international double taxation).

Nothing in our law expressly prohibits double taxation. In fact, indirect double

taxation is prevalent in practice. However, direct double taxation 1s discouraged

because it is oppressive and burdensome to taxpayers. It is also believed to

‘counter the rule of equal protection and uniformity in the Constitution.

Mow can double taxation be mintmized?

‘The impact of double taxation can be minimized by any one oF a combination of

the following:

14 Provision of tax exemption - only one tax aw is allowed to apply to the tax

‘object while the other tax law exempts the same tax object

Bb. Alfowing foreign tax credit ~ both tax laws of the domestic country and +

foreign country tax the tax abject but the tax payments made inthe foreign ux

law s deductible against the tax due of the domestic tax law

Allowing reciprocal tax ereotment - provisions in tax laws imposing a reduced

tax rates or even exertion if te country of the foreign taxpayer also give the

same treatment to Filipino non-residents therein

4. neering ino trevees or bilateral agreements ~ countries may stipulate fora

lower tax rates for their residents if they engage in transactions that 2

taxable by both of them

ESCAPES FROM TAXATION

Escapes from taxation are the means available to the taxpayer to limit or even

avoid the impact of taxation,

Categories of Escapes from Taxation

A. Those that result to loss of government revenue

1. Tax evasion, also known as tax dodging, refers to any act or tick that

tends to illegally reduce or avoid tie payment of tax.

18

—

Chapter 1 - Invoducton to Taxation

Examples

a Th

és

b. Misrepresent

advantage of lower taxes.

“can be achieved by gross understatement of income, nom

ration of income, overstatement of expenses or tax credit.

‘he nature or amount of transaction to take

2. Tox avoidance iso wxown a8 or minimisation refers to ay acto ek

Fer guteae ay csapes tae any eal permissible means

Bane:

aon and executon of transaction that would expose taxpayer

tower une

b.Nisimang options tx cary-overs ort reais

cota pnning

2. Tar exemption, so known a tax holay, refers tothe immunity

rantege se teedom rom ing subject toa tx which eters ae subject

2 ateempsns mayb granted he Cnsonton aw, or contact

Ai forms of exemptons can be ceveked by Congress except those

Gray the Consain aad hove rated er cna

Tose that donot resut tos of goverment revenue

sning This Is the proves of transtersng tax burden to other

copays

Forms of siting

2 Pooward shifting Tiss the shiing fox which follows the normal

and services such as food and fuel.

°

Backward shifting - This is the reverse of forward shifting. Backward

shifting is common with non-essential commodities where buyers

have considerable market power and commodities with numerous

substitute products.

'© any tax shifting in the distribution

iftng or backward shifting.

Shiting \s common with business taxes where taxes imposed on busines

Tevenue can be shifted or passed-on to customers, aa .

2 Capitalization ~ This pertains tothe adjustment of the v

caused by changes tn tax rates. es

19

chapter {= Introduction to Taxation

For instance the value of a mining property will correspondingly decrease

Fer mining output is subjected to higher taxes. This is a form of

backward shifting of tax

44. Transformation ~ This pertains tothe elimination of wastes or losses by

the taxpayer to form savings to compensate for the tax imposition o¢

sncrease in taxes.

Tax Amnesty

‘Amnesty is 2 general pardon granted by the government for erring taxpayers to

fave them a chance to reform and enable them to have afresh start to be part of

Sooty with a clean slate. It 15 an absolute forgiveness or waiver by the

{government on its right to collect and is retrospective in application.

‘Tax Condonation

‘Tax condonation is forgiveness of the tax obligation of a certain taxpayer under

certain justifiable grounds. This is also referred to as tax remission.

Because they deprive the government of revenues, tax exemption, tax refund, tax

amnesty and tax condonation are construed against the taxpayer and in favor of

the government.

‘Tax Amnesty vs. Tax Condonation

‘Amnesty covers both civil and crimi

civ habllites of the taxpayer.

ss, but condonation covers only

Amnesty epertes reirospecovely by forging past vol

Zope rospectvel to any unpaid balance of theta en

aldby the taxpayer note ended

“Amnesty isto conditions upon the taxpayer paying the government a portion

thetnwherasunfonaoorequresrepemene ements poruen of

6. Condonation

portion already

‘Chapter 1 = Introduction to Taxation

CHAPTER 1: SELF-TEST EXERCISES

Discussion Questions

4. Define taxation,

2 the theory and the basis of taxation.

3 ‘the theories of government location? Explain each.

4 fate vertical and horizontal equity:

5.

6

zi

8 scope of the power of taxation.

9 substantive due process from procedural due process

10. of equality from the concept of uniformity i

TL Distinguish non-payment of debt versus non-payment of tax in

from real property tax in the Const

ins are also classified as inherent limitations?

taxation power,

15, Explain the concept of situs.

16. Distinguish the Marshall Doctrine from the tfolme's Doctrine.

Explain double taxati ype:

19. What are the categories of escapes from taxation? Enumerate and explain each

means of escape under each category.

20, Distinguish tax amnesty from tax condonation.

Exercise Drills

‘Exemption of the revenues and assets of nomspr

stock educational institutions Pomene

igious purpose a

8 ne requireme ak in

eemmpiane Sonn T#RNY Te peemge ors | 1

(Bon: inpnonment Torani fora |

rae

a

(Chapter 1 - Introduction to Taxation

=

To, | Taxpayers under 0 matance should be

treated equal both in terms of privileges and obligations.

TE | Exemption from property taxes of religious, educational

and chat

Ti | Government ineome and properties are not objects of

axation,

5." | Each local government shall have the power to create its

‘own sources of revenue.

i

15, |

16. _| Guarantee of proportional system of taxation.

17. {Imernational courtesy

8. | Non-impairment ofthe jurisdiction ofthe Supreme Court

toreviewtaxcases.

T3_| The governments Hot subject to estoppel.

20. Imprisonment for non-payment of poll tx.

False 1

inent domain involves confiscation of prohibited commodities to protect the

ingof the people.

2 inal equity requires consideration ofthe circumstance ofthe taxpayer,

3 Taxes are the lifeblood of the government.

4

5.

‘Taxation isa mode of apportionment of government costs to the peopl

‘There should be direct receipt of benefit before one could be compelled to pay

taxes.

6. ‘The exercise of taxation power requires Constitutional grant.

7. Taxation is inherent in sovereignty.

8 Police power is the most superior power of the government. Its exercise needs

\ctoned by the Constitution.

erent powers presuppose an equivalent form of compensation.

10, The reciprocal duty of support between the government and the people

underscores the bass of taxation.

True or False 2

1. The Constitutional exemption of ri

churches and mosques refers to income tax and real property tax.

‘Taxpayers under the same circumstance should be taxed differenti.

‘Taxation 1s subject ¢9 herent and Constitutional limitations.

International comity connotes courtesy between nations.

Colleciun af taxes in the absence of a law is violative of the Constitution’!

requirement for:

6. The scope of taxation is regarded as comprehensive, plenary, unl

supreme.

7. Noone shall be imprisoned for non-payment of tax.

jous, charitable, and non-profit cemeteries,

2

ood doctrine requires the government to override tts obligations and

‘when necessary.

Trembers of Congress is required to pass atax exemption law.

samen should tax itself

‘Multiple Choice - Theory: Part 1

which tax is levied

i:

2 legislative function

inherent and constitutional limitation

@. Generally for public purpose

3, Which is correct?

3. Tax condonation {s ageneral pardon granted by the government.

b. The BIRhas five deputy

The government can

because taxes arethe

4. The Presid

necessity of

pines can change tariff or imposts

Congress to pass alaw for that purpose.

4. A The power to tax in

B. The power tolicens

the power to exempt.

cludes the power to tax

Which is true?

a Aonly.

b. Bonly,

©. AandB

4.Neither A nor B

5, International double taxation can be mitigated by any ofthe following except

‘2. Providing allowance for tax credit

Provision of reciprocity provisions in tax laws

Provision of tax exemptions

Entering into treaties to form regional trade blockage against the rest of the

world

6. Which is not an object of taxation?

a. Persons Transactions

Business 4 Public properties

Tat courts cannot issue injunction agains the governments

Patou governments etfort to collect taxes

2 theliebood doctrine. —_c.the bility to pay theory.

3 Imprescripbity of taxes. the doctrine estoppel

2B

(Chapter 1 - Introduction to Taxation

8. The power to enforce proportional contribution from the peo

of the government is

a. Taxation

b. Police power

PI oF the spp

¢ Eminent domain

Exploitation

9. This theory underscores that taxes areindlspensabetothe ex

a Doctrine of equitable recoupment me sence ofthe ae

b. The ifebioed Doctrine

The benefit received theory

4. The Holmes Docrine

10. A Taxation isthe rule, exception isthe exemption.

B. Vague taxation laws are interpreted liberally in favor ofthe government,

Which is false?

a Aonly

b. Bonly

11, Select the incorrect statement.

a ‘The power to tax includes the power to exempt

Exemption is construed against the taxpayer and in favor ofthe government

¢ Taxstatutes are construed against the government in case of doubt.

d._ Taxes should be collected only for public improvements.

Both A and B

Neither Annor B

a Publiceducation

National defense

None of these

113, Which does not properly describe the scope of taxation?

a Comprehensive «Discretionary

b Supreme Unlimited

14, Allof these are secondary purposes of taxation except

4. To reduce social inequality

1b. To protect local industries

To raise revenue for the support ofthe government

. Toencourage growth of local industries

15, Whatis the theory of taxation?

‘a. Reciprocal duties of support and protection

b. Necessity

e Constitutionality

d Public purpose

16. A.Taxes should not operate retrospectively.

B.Tax is generally for public purpose.

2

=

“chapter 1 Introducton to Taxation

eAand8

4 Neither Anor B

17, Which provision of te Const is double taation believed to violate?

2. Equal protection gua

usive scheme of taxation

4. Bither Aor

oftweation isthe concept of “sus of taxation” based?

‘International comity

‘Exemption of the government

19, which ax exemption is irevocable?

Wr Sdempton based on cnerat

fee Sktmpton tase on the Conssation

Tet etempron based on

G pomames

Isincorrec? scans

ater ut coerbue his sharein goverament os

a Every person torment isexpeted to mprove the lives of te POP e

Threaten of sides protcron and other benefits wile the people

rovide support

a ade PRT able to pay taxcan enjoy the piles and protection of

the govern

2, whichis the mostincortet statement egarding taxes?

We eesary for the conn existence ofthe government.

aoe eet py tan does net ces upon the privilege enjoyed by or the

aan aon the cien ofthe government but upon the neces of

Money for he support ofthe State.

TREE alte personal bene enjoyed from the government before one is

rete to pay te

4. Tater should be col

rote aie th

20, Which statem

without unnecessary delay but its collection should

ofthe objects of taxation, the cours have no power to

catty motive expediency, or mecesityof ax law

be both tax and a regulation, Taxes nay be levied

SSprivide means for ehbitaion and stabilaation of threatened Industry.

Which sconrest

2 Statement 1 only

Statement 2 nly

¢ Both statements

Neither statement

2s

(Chapter 1 - introduction to Taxation

i: Fata, anette amount to be imposed. bi naaes?

fearon ® MSHS Me Oe

4. Satonmg eae apy rte

col thetarto impose

24. This reles to the priviege

Ths brilege oF munity om a tx barden whieh tes ay

2 Excsion Taxi

B. Deduction Reciproy

je benef ecived

Dresupposes that some taxpayers withis

nes wl be een

hey donot receive Denes from te gverement nn PE Ee

Statement 2: The

ity to pay theory suggests that some taxpayers

‘exempted from tax eae Bhat some taxpayers may be

vided they do not have the ability to pay the same,

Which statement is true?

Only statement 1

b. Only statement 2

€ Both statements 1 and 2

4. Neither statement I nor 2

26. Which is nota legislative act?

Determination of the subject of the tax

bb. Setting the amount ofthe tax

©. Assessment ofthe tax

d._ Determining the purpose of the tax

27. Statement 1: Taxation is the rule; exemption is the exception.

‘Statement 2: Taxation may be used to implement the police power ofthe state.

a listrue Land llare true

b, Mistrue

28. Which of the following powers ofthe Commissioner of Internal Revenue cannot =

delegated?

ee Fhe examination of tax return and the determination of tax due thereon

3. Torrefund or crecit tax abilities in certain cases

The power to compromise or abate any tax lability Involving basle defile

tax of P500,000 and minor criminal violations

a. The power to reverse aruling oft e Bureau of Interna Revenue

4 Land I are not rue

29, When exemption from a tax imposition islet or not cleaty stated, wAeN#

Ceci ie enn te

Singers cgnnt coda

26

chapter 1 -Invoduction to Taxation scout

sigation arising from law cannot Be P

government.

eaemption pies

a ‘hence construed #Rai

whatisthe basis of

on 1 duties

a. Necessity

of an iter, which is

+31, when the provisions of ax laws are sent 350

2 Taxation applies since:

& Exemption applies since ¥

anation the eae exempion ste exception.

atom sabe es are construed, agtinst the

1e.o the Lifeblood doctrine

1 on gation arising from law is presumed: ignorance

excuse

statements does not support the principle that tax is not

32, Which ofthe fo

subject to compe

2. The government and the taxpayer are not

the nature of contract Bi

jtors and debtors of each other.

rows out of a duty wherein

the personal consent of the

taxpayer

Taser arise from law, nt from contracts.

Both tax and debt partake the nature ofan obligation,

tenable in refusing to pay tx?

© Preserl

4. Allofthese

34, Whats the primary purpose of taxation?

1. To.enforce contribution frem its subjects for public purpose

b. Toraiserevenue

economic and social stably

jeory: Part 2

cemption of religious or charitable institutions refers only to

«. Property tax and incom

4.Business tax ss

b. Income tax

7

(Chapter 1 = Introduction to Taxation

‘The agreement among nations o lessen ax burden of thee respective su

called " petra bts,

S Reciprocity

i Inremational comity

‘Av educational insttution operated by 2 religious organization wat beng

4. No, with respect to properties not actually devoted to educational purposes

Which is nota Constitutional limitation?

No tax law shall be passed without the concurrence of a majri

members of Congress, ver oft

4. Exemption of government agencies and instrumentalitis.

‘The following are inherent limitations to the power of taxation except one Chose

the exception.

a. Territoriality of taxes

b.Legislative in character

For public purpose

4. Non-appropriation for religious purpose

‘That all taxable articles or properties ofthe same class shall be taxed atthe sim

rate underscores

| Equality ncaxation —_¢ Uniformity m taxation

None of these

Non-impairmentof contracts

B.

Taxation is for public purpose.

D.

£.Non-delegation ofthe power totax

28

chapter 1 - Introduction to Taxation

ese are classified as both constitutional ana ia

Cand E

d.DandE

erent limitations?

Which ofthe

a AandB

b Bande

in the Constitution regarding taxation are

§ Gtteonsapainec double taxation

ronal exemption of nonstock, non-profit educational IASHRuROns

10, The Const

«¢ Property tax and income tax

b. Ineome tax Business tax

11, Which ofthe following

a leg

iolative of the principle of non-delegation?

rcement must exclusively pertain to Congress:

te fix the amount of impost on imported and

Allowing the Secretary of

‘which go beyond the scope ofa tax law

12, Which of the fllowing violates Constitutional provisions?

to priests of religious ministers employed by the Armed.

Forces of the Philippines

Imposing tax on properties of religious institutions which are not directly and

Authoria

Imposts

hase-out a huge devit, che President of the Philippines passed a law

rs with previous tax delinquency to

rom a aiesment inthe period of delinquency. s his vaid

‘aus the measure adopted is grounded upon necessity.

'b Yes: because the President is merely exercising his presidential discretion,

No, because the power of taxation s non delegated "

4: No. because only the Department of Finance ean issue such ruling

14 Concerned with increasing une

‘the Pt ~

loyment rates in the country, the President of

enate to pase lar romting

‘tablish businesses in the um

‘Passed to Congress for approval. ia

afted the bill and

23

Ram is the only practicing lung transplant

Ram isthe oly 1g lung transplant special

transplant to 2% tax based on re

dent to adopt any me

necessary to alleviate poor co athe coun iy

Yes. Any means beneficial to the public

ae able interest should Be gen optima

ee. The President's proposs will have be ally approve

the logetature The ruleonnondlegation of taxation would ot bene

is shall originate from the House of Represem viet

in Baguio Cty, The

nance subjecting the race of

Ram objected claiming thet oth

Baguio passed a local

transplant specialists in other regions ofthe country are not subjected to tax,

Is Ram's contention valid?

b.

4

‘With the country ur

enacted a law provid

|. No, because there is na uniformi

Yes, because te rule of taxation should be uniform and

should be uniform and equitably eno

Yer because Ram ithe only one subject Other protiones who woudl

practice would not be covered by the ordinance. er

the ordinance would cover all transplant sped

practice in Baguio ity. The uniformity rule would not be vi

Ro. because subjecting the new industry taxation would hamper economie

growth

incessant shortage of sugar. the

x exemptions and incentives to can

exemptions to rice farmers who produce the

the new law valid? a

atid clasication of the taxpayers who woud be

‘exempted from tax.

Yes, since sugar is more important than rice.

Nov since the grant of exemption is construed in favor of taxpayers.

inthe grant of tax exemption.

Congress passed alaw subjecting governmentowned and controlled corporations

a

Which of the following

b.

Yer, because GOCCs are not government agencies and ar

No, because govern:

income tax. s the aw valid?”

Jeo necouse all government agencies and instrumentals are sublet 9

essential

commercial in nature

‘are exempt. This would pose a violation of

the equality clause in the constitution.

se ony GOCCs ae constitutionally exempted fom Paying es

ytation ofthe power to tax?

'Non-impairment

Due process and equal

Non appropriation for re

caper t-tovouclon 12 TaN

of police power

«4, Non-deleation

acted alae requiring foreign Banke op with ese

enacted 3 country and to Femi one #2

sof cara gil anisicon of the

opine Cones

eal elipno.e

ea vali exer

ind government

Pog ce Treg banks are wh

nthe Cercitor

pects of foreign

mn enforce tax requirements €0

re outside the county.

ey ment of foregn sover ete

‘he Constitution:

ly pays real property (ax?

oft charitable institution.

oe eligi institution

7 yprietary ‘educational institution

sperty development company

Which ofthe following 90

eM pantay Bata, a non-pre

i jesus Crusade mover

é

20.

seswersity of Pangasinan a private Pro

vor property Holdings a registered PFC

21, Taxexemption bills are approved by

Tax ony of all members of COnBEESS

the President of the Republic

bers of Congress

resentatives constituting 2 QUOFuIM

© 2/3ot

Majority of the rr

1 The lapanese government invested P'100,000,000 in 2 Phitirping tocal bank and

‘Tamed P10,000,000 interest. Which is correct?

The income is exempt on grounds

The income is exempt due to intern

P The income is subject co tax on the basis wt sovereignty.

F TMe MRtome i subject to tax because the income is earned within the

Philippines.

‘Multiple Chotce ~ Theory: Part3

1. when a legislative body taxes persons and property, rights and privileges under

the came taxable category at the same rate, this is referred to as compliance with

‘the conshtutional imitation of

«Due process

4. qual protection clause

«Determination of the subject ofthe tax

1b. Sectingtheamount of the tax d, Determining the purpose of the tax

an

(Chapter 1 - Introduction fo Taxation

b. They areexercisable

¢Allare not exercised by pr

1. Which is mandatorily observed in Implementing police power?

Public use

6. The general power to enact laws to protect the well-being ofthe people

a Police power ¢. Taxation a PeoPleiscaes

% Eminentdomain Alot these

7. Which of the following entities wil

domain?

a. Electric cooperatives

b. Water cooperatives

ast likely exercise the power of eminent

© Telecommunication business

4. Transportation operators,

8 In exercising taxation, the government need not consider

‘a. Inherent limitations, Due process of

BL Justcompensation —_. Constitution

9. Licensing of business or profession isan exercise of

a Police power Eminent domain

b, Taxation 4.Allof these

10, Select the correct statement.

a. Eminent domain refers to the power to take public property for private ust

‘paying just compensation.

‘ower being the mest superior power of the State is not subject any

Taxation power shall be exercised by Congress even without an expres

Consticutional grant

lected even in the absence of a law since obligation arising

sys presumed.

14, Which is principally limited by the requirement of due process?

a. Eminent domain ¢ Taxation

' Police power All of these

‘chapter 4 - Introdvenon to Taxation

mnt 1. Congress can exercise the power of taxation

ome oF to tax.

12, Seartutiona) delegation of the power

Sgotement 2: only the legislature can exercise the power o

domain, and police power.

Which statement is correct?

a. Statement 1

b Statement 2

13, Which power of the State affects the least number of

2 pole power Taxation

roles rrfomain Taxation and police power

wen without

f taxation, eminent

¢ Statements 1 and 2

4 Neither statement 1 n0F 2

people?

lect the correct statement

14. See or eed teary explains tat the government is oblige to serve

the people since itis benefiting from the tax collection from its subjects:

‘The hfeblood theory underscores that taxation is the most superior power of

the State,

‘The police power of the State is superior to the non-impairment clause of the

Constitution.

4. ‘The power of taxation is superior to the non-impairment clause of the

Constitution.

following isnot exercised by the government?

‘¢.Eminent domain

4. Exploitation

16, Select che incorrect statement.

a Since there is compensation, eminent domain raises money for the

government,

>. Once a government is established, taxation is exercisable.

& Themes important ofthe powers taxation,

wer fs more superior than the non-impairment

poe pss che wpairment clause of the

17. The following statements reflect the dif

pe fect the diferences among the inherent powers

2 Te properey taken under eminent domai i

that of police power is destroyed. sed ation ery preterit bit

1% Eminent domain and

& Taxation, police power, and

fovernment interferes with private right and peg

ate right and property,

3

Chapter 1 - Introduction to Taxation

18. Statement 1: The Taxation power can be used to destroy ifthe law is valid,

Siotement 2: A tax law which destroys things business, oF enters

Purpose of raising revenue is an invalid tax law. Sere or he

Which is incorrect?

a Statement 1

€ Both statements

Statement 2

4. Neither statement

19. Select the correct statement.

3 The provisions on taxation in the Philippine Constitution are grants ofthe

powerts

{ax includes the power to destroy

is used asa too! for general and economic welfare, ths is called

fiscal purpose,

‘The sumptuary purpose of taxation isto raise funds for the government

20. Which of the following powers is inherent or co-existent with the creation ofthe

government?

a Police power

b._ Eminent domain

21, Which of the follo

Taxation

GLAlLofthese

taxpayer and in Favor of the government.

st the government in case of doubt.

‘d,_ Taxes should be collected only for public improvement

b. Police power; Taxation

© Eminent domain; Police power

L_Allthe powers are equally superior and important

4

rminvstration

cnapter 2 Taxos, Tax Laws and Tax Admini

CHAPTER 2

TAXES, TAX LAWS, AND. TAX ADMINISTRATION

“Thus Chapter discusses tax laws, taxes, and their distinction from sim!

and the administration of the tax system.

jaws, revenue regulations, and rulings

Jements, and classifications

ction of tax from similar items

he Bureau of Internal Revenue (BIR) and the Commissioner of

Internal Revenue (CIR) and the non-delegated powers of the CIR

“The critena for selection of large taxpayers

TAXATION LAW

Taxation law cefers to any law that arises from the exercise of the taxation power

ofthe State

‘Types of taxation laws

4. Tax laws - These are laws that provide for the assessment and collection of

taxes,

Examples

. The Tariff and Customs Code ?

© TheLocalTarcnce

The Re Property Tax Code

2 Tax exemption lows ~ These are

eames = These ate laws shat grat certain immunity from

Ranges

2 The Moimim Wage aw

2 Be Oa nese Code o 1987 (60226)

gay Micro Busnes Enter he

4 Cooperatis evelopment Act mee (BSE) Lave

35

You might also like

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)