Professional Documents

Culture Documents

Banggawan Chapter 2

Banggawan Chapter 2

Uploaded by

Fely Maata0 ratings0% found this document useful (0 votes)

79 views14 pagesOriginal Title

Banggawan chapter 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

79 views14 pagesBanggawan Chapter 2

Banggawan Chapter 2

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

Chapier 2 - Taxes, Tax Laws and Tax Administraton

‘Sources of Taxation Laws

1. Constitution

2. Statutes and Presidential Decrees

3. Judicial Decisions or case laws

4. Executive Orders and Batas Pambansa

5S. Administrative issuances

& Local Ordinances

7. Tax Treaties and conventions with foreign countries

8 Revenue Regulations

‘Types of Administrative Issuances

Revenue regulatons

2. Revenue memorandum orders

3. Revenue memorandum rulings

4. Revenue memorandum orculars

5. Revenue bulletins

6 BIR rulings

Revenue Regulations are issuances

recommendation of the Commi

prescribe, or define rules and

‘Memorandum Orders (RMOs) are ssuances that provide directives «

ns; prescribe guidelines, and outline processes, operations, activities

s, methods, and procedures necessary in the implementation of stated

policies, goals, objectives, plans, and programs ofthe Bureau inal areas of operatans

except auditing,

ings, opinions and interpretatonsafiie

Code and other tax laws as applied +

specific set of facts, wi ed precedents, and which the CIRM

issue from time to time for the purpose of providing taxpayers guidance onthe

ns. BIR Rulings, therefore, cannot contravene di

Revenue Memorandum Ri

consequence:

Issued RMRs,

Revenue Memoranduay Circulars (RMCS) ave sssuances Ul

applicable portions as well as amplifications of laws, rules regul

issued by the BIR and other agenc'es/offices.

ts

publish pertinent

Jations, and precede

36

chapter 2 - Taxes, Tax Laws and Tax Administration

we Ballets (8) reer wo period asvances, not

sition on certain specific sues of jaw or a

ferent Cae cet aa te BSN

Repub

rons of the Bureau to queries raised by taxpayers and

Tarification and interpretation of tax laws.

sort of information service to the taxpayer such that

the addressee and may be reversed by the BIR at

posit

skeholders relative 0

ly advisory

is binding except to

‘Types of rulings

1, Value Added Tax (VAT) rulings

2. International Tax Affais

3, BIR rulings

4. Delegated Authority (DA) rulings

1 (TAD) rulings

erally accepted accounting principles (GAAP) vs, Tax Laws

SERETIN cepted acountng prineples oF GAAP are no laws, but are mere

Traporting They ae benchmarks forthe fir and relevant

jes and equity of 8

accountng epors

‘umber of user in the general

‘conventions of finan

valuation and recognition of income, expense, asset

for general purpose financial repo

eet the common needs of a v

ings prescribe the criteria for tax

form of financial reporting which 1s intended to meet specific

needs oftax authorities

‘Taxpayers normally follow GAAP in recording transactions in their books.

However, in the preparation and filing of tax retums, taxpayers are mandated to

follow the tax law in cases of conflict with GAAP.

‘They are effective even

lemy occupation. They are laws of the occupied territory and.

tnemy. Tax payments made during occupations of fora

‘enemies are valid. me ations of foreiga

Cur tnternal revenue laws are not penal in nature because they do not define

énme. Their penalty provisions are merely int

se merely intended to secure taxpayers’

37

eT

Chapter 2 - Taxes, Tax Laws and Tax Administration

TAK

aes an enored proportonal et

Sutetoraerevnteforpbeprpse, ns” EMMMANINE ty

Blements ofa Valid Tax

‘Tax must be levied by the taxing power havi

Ee y 1 po ig jurisdiction over the object

po

‘Taxis generally payable in money.

Gassification of Taxes

‘A Asto purpose

1, Fiscal or revenue tax ~ 2 tax imposed for general purpose

2. Regulatory ~ a tax imposed to regulate business, conduct, acts or

transactions

3. Sumpruary~ a tax levied to achieve some socal or economic objectives

B. Asto subject matter

1. Personal, poll or capitation ~ a tax on persons who are residents of a

particular territory

2. Property tax ~ a tax on properties, real or personal

3. Excise or privilege tax - a tax imposed upon the performance of an a,

‘enjoyment ofa privilege ar engagement in an occupation

© Astoincidence

1. Direct cax ~ When both the impact and incidence of taxation rest upon the

same taxpayer, the taxis said to be direct. The tax iscolected from the

person who 1s intended to pay the same. The statutory taxpayer is the

‘economic taxpayer.

2. Indirect tox ~ When the taxis pa

fs intended to pay the same, the ta

the case of business taxes where

‘economic taxpayer.

‘The statutory taxpayer isthe person named by law to pay the ax At

economic taxpayer isthe one who actually pays the tax.

D. Astoamount

1. Specific ax ~ a tax ofa fixed amount imposed on a per uni bass such a

per kilo, ter or meter, te

ay person other than the one whe

be indirect. This occurs in

tory taxpayer Is not the

8

apter2- Tasos, Tax Laws and Tax Adminisiaton

4. Ad valorem -atax of 2 fixed proportion imposed

object

£ Astorate

4) Proportional tax ~ 7

tax emphasizes €9

eon eon Ttestx whch imposesneremn a

re eee The tse of Pomrssive rae, TANG

3 at ease because i ges more tanto those who are

cana ung he ga between the ch andthe POT

4 foprne tot This tan pes decreasing 2x rates a6 the tx base

re Te at reverse of progressive tax, Regressive (aX (

an ra lirectly violates the Constitutional guarantee of

pon the value of the tax

tax, The use of proportional

payers with the same rate

manifest tax rates which is2 combination of any of the

above types of tax.

B, Astoimposing authority

1 Nanana var tax imposed by the national government

Examples

2 Income ex tax on annual income. gains or profits

i Eoete or tx on gratuitous transfer of properties by a decedent

upon death

Donor’ tx taxon gratutous transfer of properties by ving donor

Value Added Tox = consumption tax collected by VAT business

taxpayers

© Other percentage tax ~ consumption tax collected by non-VAT

usiness taxpayers

ssential commodities such

inerals. This should be

} tax on documents

agreements an papers evidencing the accep

transfer of an obli _ m

2 Lect a-axis by the municipal ea government

amp

39

(Chapter 2 - Taxes, Tax Laws and Tax Adminstration

4. Community tax

© Tax on banks and other financial institutions

DISTINCTION OF TAXES WITH SIMILAR ITEMS

Taxvs Revenue

Tax refers tothe amount

amount imposed by the goverament for public purpose

refers to all income collections ef the government whith ince aa weet

licenses, toll, penalties and others. The amount

leases, lies and others. The amount imposed ts tax but the amount

Tax v5 License fee

Tax has a broader subject than license. Tax emanates from taxa

imposed upon at ject such as persons, proy piles ae

Imposed upon any objet such a persons properties, or prilges to ase

License fee emanates from peice power and is imposed to regulate the exercise of

2 privilege sucha the commencement ofa business oa provesaon

Taxes are imposed after the commencement ofa business or profession where

hens fe s imposed before engagement In those activites. In other words tax

a post-actvy imposizon whereas license preactiiyimpositon

Taxvs. Toll

‘Tax is a levy of government; hence,

isa demand of sveregay. Tl isa cha

for the use of other's property; hence, 2 =

isa demand of ownership.

‘The amount of tax depends upon the needs of the government, but the amount ef

toll is dependent upon the value of the property leased.

Both the government and private entities impose tol, but private entities cannot

impose taxes.

Tax vs. Debt

“Tax arises from law while debt arises from private contracts. Non-payment of tx

Jeads to imprisonment, but non-payment of debt does not lead to imprisonment.

Debt can be subject to set-off but tax is not. Debt can be paid in kind (dacion en

pogo) but tax is generally payable in money.

‘Tax draws interest only when the taxpayer is delinquent. Debt draws interest

'ss0 stipulated by the contracting parties or when the debtor incurs a

lay

‘chapter 2- Taxes, Tax Laws and Tax Administrator

Speci sessment a

exw spect Assesment eran, properties, ar privilege. Special

ee lands adjacent to a public

ont ened by the. government. on poli

assesment ee posed on land only and vs intended to compensate th

eroment he cost of the mprowerent.

of spec sessment i the benefit in urms of he appreciation

ee ee rrovemet Ont oer hd (as vied without

ln ofadretproximatebeneft

sessment attaches tothe land, It will nat become a personal

ssessment

land

ass

ind owner Therefore, the non-payment of speci

Imprisonment ofthe owner (ualike in non-paymer

Taxvs. Tacit

‘Tax i broader than tariff. Tax is an amount imposed upon persons, privilege,

transactions, o properties. Tariffs the amount imposed on imported or exported

commodities

‘Taxvs. Penalty

Tar is an amount imposed for the support of the government. Pen:

mount imposed to discourage an act Penalty may be imposed by bo

{government and private individuals. It may arise both from law or contract

‘whereas tax arises from law.

‘TAX SYSTEM

‘The eax stem refers to the methods or schemes of imposing, assessing, and

collecting taxes, Ie includes a laws and regi

and the government offices. bureau

rament in ta ‘The Philippine tax

ax system and the local tax system,

‘Types of Tax Systems According to Imposition

1 Progressive ~ em jon of income of individuals, and transfers

3. Regressive ~ not emp

i

fone that emphasizes di

encourages economic

1 to be efficient. This ty

‘tx system impacts,

‘more upon the rich

a

stration

cnaptor2 Teves, Taxtaws end Tax Admini

sone that emphasizes indirect t2Xe8, Indie.

A repress pucnenses to consumers hence the iMPACT Of tation pt

see rere ante sone ce

that despite the Constitutional guarantee ofa p

res has a dominantly regressive tax system

Teg

te ty

pexcousenon SEs

‘The creditable withholding tax is intended to support the self-assessment

method to lessen the burden of lump sum tax payment of taxpayer and

also provides for a possible third-party check for the BIR of non-compliat

taxpayers.

2. Final withholding tax - a system of tax collection wherein payors ax

required to deduct the full ax on certain income payments

‘The final withholding tax is intended for the collection of taxes fem

income with high risk of non-compliance.

‘Similarities of Onl tax and creditable withholding tax

‘ rncome payor withholds a fraction ofthe income and rem

the government.

1 By collecting at the moment cash 1s aval

flow problems tothe taxpayer and ccl

both serve to minimize =

Jems to the government.

Chapter 2 - Taxes, Tax Laws and Tax Administration

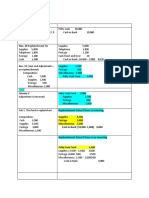

Differences between FWT and CWT

inal with taing [Grea

“income tax withheld | 4

Coverage of Geran passive income |

Gunning fn

Who remis the actual” | —Tnvomne payor | Taeome payor for the CWT and

ax cs eT _| the anpayer for tne balance

‘ecessig/of income tax | Wot required Required

return fortaspayer | .

B. Withholding system on business tax - when the national government

agencies and instrumentalities including government-owned and controlled

corporations (GOCCs) purchase goods oF services from private suppliers, the

Jaw requires withholding of the relevant business tax (Le. VAT or percentage

tax) Business taxation is discussed under Business and Transfer Toxation by

‘the same author.

Voluntary compliance system - Under this collection system, the taxpayer

himself determines bis income, reports the same through income tax returns

‘and pays the tax to the government. This system is also referred to as the

*Self-assessment method”

‘The tax due determined under this system will be reduced by:

a, Withholding tax on compensation withheld by employers

. Expanded withholding taxes withheld by suppliers of goods or services

‘The taxpayer shall pay to the government any tax balance after such credit or

claim refund or tax eredit for excessive tax withheld.

D. Assessment or enforcement system ~ Under this ci

jovernment identifies non-compliant taxpayers, assesses their tax dues

penalties, demands for taxpayer's voluntary compliance or enforces

lections by coercive means such as summary proceeding or judicial

proceedings when necessary.

jon system, the

PRINCIPLES OF A SOUND TAX SYSTEM

According to Adam Smith, governments should adhere to the following principles

ns to evolve a sound tax system:

3. Administrative feastbility

2

Chapter 2 - Taxes, Tax Laws and Tax Administration

Fiscal ade

TTY guices that the sources of government funds must be s

al adequacy Fea)

to cover government costs The government must Ot INEUF & deft A hye

defen paralyzes the government's abit to deliver the essential pubic serve

the people. Hence, taxes should increase in response f0 increase in goverpgs

spending,

Theoretical justice

Theorvtcel justice or equity suggests that taxation should consider the taxpayer

Prone et ease tht he everaef 20U0N shold ae

‘oppressive, unjust, or confiscatory.

Administrative feasibility

‘Administrovve feasibility suggests that tax laws should be capable of efficient ang

effective administration to encourage compliance. Government should make i,

easy for the taxpayer to comply by avoiding administrative bottlenecks ang

reducing compliance costs

ving are applications of the principle of administrative feasibility

ind e-payment of taxes

ing system for employees

holding tax on non-resident aliens or corporations

4. Accreditation of authorized agent banks inthe filing and payment of taxes

TAX ADMINISTRATION

Tax administration refers to the management of the tax system, Tar

administration of the national tax system in the Philippines is entrusted to the

Bureau of Internal Revenue which is under the supervision and administration of

‘the Department of Finance.

Chief oficials of the Bureau of Internal Revenue

4. 1 Commissioner

2. 4 Deputy Commissioners, each to be designated

a. Operations group

b. Legal Enforcement group

Systems Group

danagement Group

‘POWERS OF THE BUREAU OF INTERNAL REVENUE

1. Assessment and collection of taxes

2. Enforcement of al forfeitures, penalties and fines, and judgments in all cases

decided in its favor by the coures

he following:

“4

Chapter 2 - Taxes, Tax Laws and Tax Administration

the supervisory and pohee powers

ue officers and other employees to other dt

ution of forms, receipts, certificates, stamps, etc, (0

is and clearances

‘Submission of annual report, pertinent

‘the Congressional Oversight

POWERS OF THE COMMISSIONER OF INTERNAL REVENUE

the NIRC, subject to review by the Secretary of

sss and reports to

fe jurisdiction of the Court

bb, Refunds of internal revenue taxes, fees, or other charges

Penalties imposed

d. Other NIRC and special law matters administered by the BIR.

To obtatn information and to summon, examine, and take testimony of

persons to effect tax collection

Purpose: For the CIR to ascertain:

‘a, The correctness of any tax return or in making a return when none has

the taxpayer

ty of any person for any internal revenue tax or in correcting,

Authorized acts

a. Toexamine any book, paper, record or other data relevant to such inquiry

b. To obtain on a regular basis any infor ‘om any person other than

the person whose ty is subject to aud

«To summon the person lable for tax or required to file a return, his

employees, or any person having possession and custody of his books of

rds to produce such books, papers, records

yerson concerned, under oath, as may be

wiry

‘employees to make canvass of any revenue

distret

uke assessment and prescribe ade

jon and enforcement

ional requirement for tax

4s

‘Chapter 2 - Taxes, Tax Laws and Tax Administration

§. Toexamine tax returns and determine tax due thereon,

‘The CIR or his duly authorized represer

of any taxpayer and the assessment ofthe cor

‘a return shall not prevent the|

‘Tac or deficiency assessments are due upon notice and demand by the cg

his representatives. *

the examination,

panne sstenons of deratns shal tb

resis nels tend

Sty coo vn teuee Be at or

retbgen eae

When arts nat be frteomig within the greeted ded

west Sk mp nese pope sm th bro a

yom eon ey

fee mea

In case a person fails to file a required retum or other documents atthe tine

prescribed by law or willfully files a false or fraudulent return or other

documents, the CIR shall make or amend the return from his own knowledge

and from such information obtained from testimony. The return shall be

‘presumed prima facie correct and sufficient for all legal purposes.

‘To conduct inventory taking or surveillance

To prescribe presi

1 receipts for a taxpayer when:

ssue receipts: or

the books or other records of the taxpayer do net

gross sales 0 shall be derived from the performance

F business under similar circumstances adjusted for other relevant

tax period when the taxpayer is:

1g from business mye

property

The wemiston ofthe nal pened shal be commnicated trough tt

Serene eee rah rove le kamediee paseo: Tuan bab,

45

‘Chapter 2 - Taxes, Tax Laws and Tax Administration

9. To prescribe real property values

‘The CIR is authorized to

property values after consul

prescribed are referred to as zonal value.

For purposes of internal revenue taxes, fair value of real property shall mean

whichever is higher of

4. Zonal value prescribed by the Commissioner

. Faic-macket value 2 shown in the schedule of market values of the

Provincial and City Assessor’ Office

“The NIRC previously used the assessed vai

fair market value, Assessed value is th

taxation, The value to use now is the full fair

Philippines into zones and presenbe real

‘competent appraisers. The values

which is merely a fraction of the

‘of the real property tax in local

iue of the property

10. To compromise tax abilities of taxpayers

ying instances:

11, To inquire into bank deposits, only under the

ion of the gross estate of a det

. To substantiate the taxpayer's claim of financial incapacity to pay tax in an

application for tax compromise

inquiry can proceed only if the taxpayer

k Deposit Secrecy Act

12, To accredit and reg

‘The denial by the for accreditation is appealable to the

Department of Finance. The lailure of the Secretary of Finance to act on the

appeal within 60 days is deemed an approval

eral revenue taxes

13, To refund or credit

114, To abate or cancel tax abilities in certain cases

15. To prescribe additional procedures or documentary requirements

16, To delegate his powers to any subordinate officer with a rank equivalent to a

division chief of an ofice

Non-delegated power ofthe CIR

‘The fllowing powers ofthe Coromissioner shal nat be delegated:

1. The power to recommend the promtigaton of roles and regulations to the

Secretary of inane

2. The power to istue rulings of first mpression orto reverse, revoke or madly

any existing clings ofthe Bureau.

a

Chapter 2 - Taxes, Tax Laws and Tax Administration

3. The power to compromise or abate any tax tabihty

the Regional Evaluation Boards may compromise tax labiteg

wing

ts are issued by the regional offices involving basie defc

‘ax of P500,000 oF less, and ciency

mms discovered by regional and district officials,

Composition of che Regional Evaluation Board

a. Regional Director as chairman

b. Assistant Regional Director

Heads ofthe Legal, Assessment and Collection Divi

dd. Revenue District Officer having jurisdiction over the taxpayer

4. The power to assign and reassign internal revenue officers to establishments

where articles subject co excise tax are produced or kept.

Rules in assignments of revenue officers to other duties

1. Revenue officers assigned to an establishment where excisable articles are

kept shall m no case stay there for more than 2 years.

2. Revenue officers assigned to perform assessment and collection function shall

not remain in the same assignment for more than 3 years.

3. Assignment of internal revenue officers and employees of the Bureau to

special duties shall not exceed 1 year.

‘Agents and Deputies for Collection of National Internal Revenue Taxes

‘The following are constituted agents for the collection of internal revenue taxes:

|. The Commissioner of Customs and his subordinates with respect to collection

‘of national internal revenue taxes on imported goods.

2. ‘The head of appropriate government offices and his subordinates with respect

to the collection of energy tax.

3, Banks duly accredited by the Commissioner with respect to receipts of

payments of internal revenue taxes authorized to be made thru banks, These

are referred to as authorized government depositary banks (AGDB).

OTHER AGENCIES TASKED WITH TAX COLLECTIONS OR TAX INCENTIVES

RELATED FUNCTIONS

1. Bureau of Customs

2. Board of investments

3. Philippine Econonuc Zone Authonty

4. Local Government Tax Collecting Unit

48

(Chapter 2 - Taxes, Tax Laws and Tax Administraton

Bureau of Customs (BOC)

ions, the bureau of Customs is tasked to administer

tanfls on imported ‘and collection of the Value Added Tax on

on. Together with the BIR, the BOC is under the supervision of the

Department of Finance.

‘commissioner and is assisted by

The Bureau 1s 1s headed by the Cu:

five Deputy Commissioners and 34 District

ard of Investments (BOM)

tasked to lead the promotion of investments in the Philippines by

105 and foreign investors to venture and prosper in desirable areas

supervises the grant of ax mncentives under the Onintbus

Investment Code. The BOI is an attached agency of the Department of Trade and

Industry (DTH)

‘The BOI is composed of five ful jovernors, excluding the DTI secretary as tts

chairman. The President ‘a vice chairman of the

‘board who shall act as th

Philippine Economte Zone Authority (PEZA)

‘The PEZA 1s created to promote investments in export-oriented manufacturing

industries inthe Philippines and, among other mynads of functions, supervise the

grant of both fiscal and non-fiscal incentives.

PEZA registered enterprises enjoy tax holidays for certain years, exemption from

Import and export taxes including local taxes. The PEZA ts also an attached agency

of the DTI.

The PEZA is headed by a director general and is assisted by three deputy

directors.

Local Government Tax Collecting Units

Provinces, municipalities, cities and barangeys also imposed and collect various

taxes to rationalize thetr fiscal autonomy.

ax treatments of BOL-registered or PEZA-registered enterprises

1e local taxes imposed by ocal governments will be discussed under

Local & Preferential Taxation by the same author.

CChepter 2 - Taxes, Tax Laws and Tax Administration

‘TAXPAYER CLASSIFICATION FOR PURPOSES OF TAX ADMINISTRATION

For purposes of effective and efficent tax administration, taxpayers are classgeg

into:

1 Large taxpayers - under the supervision of the Large Taxpayer Service (ins

of the BIR National Office.

2. Non-lerge taxpayers ~ under the supervision of the respective Revenue

District Offices (RDOs) where the business, trade or profession of the taxpayer

is situated

Criteria for Large Taxpayers:

A. Asto payment

Value Added Tax - Atleast P200,000 per quarter forthe preceding year

2. Excise Tax - At Yeast 1,000,000 tax paid for the preceding year

3. Income Tax - At least P1.000,000 annwal income tax paid for the preceding

44. Withholding Tax - At least P1,000,000 annual withholding tax payment or

remittances from al types of withholding taxes

5, Percentage tax - At least P200,000 percentage tax paid or payable per

quarter for the preceding year

6. Documentary stamp tax At least P1,000,000 aggregate amount per year

B. Asto financial conditions and results of operations

1. Gross receipts or sales -P1,000,000,000 total annual gross sales or receipts

2. Net worth - 300,000,000 total net worth at the close of each calendar or

fiscal year

3. Gross purchases - P800,000,000 total annual purchases for the preceding

year

4. Top corporate taxpayer listed and published by the Securities and Exchange

Commission

‘Automatic classification of taxpayers as large taxpayers.

‘The foliowing taxpayers shall be automatically classified as large taxpayers upon

notice in writing by the CIR:

1, All branches of taxpayers under the Large Taxpayer's Service

2. Subsidiaries, affiliates, and entities of conglomerates or group of companies of &

large taxpayer

3. Surviving company in case of merger or “onsolidation of a large taxpayer

4. A corporation that absorbs the operation or business in case of spin-off of 20y

large taxpayer

5. Corporation with an authorized capitalization of at least P300,000,000 registered

swath the SEC

Chapter 2- Taxes, Tax Laws and Tax Admnistration

ital of

.es with an authorized capitalization oF assigned caps

ign banks (the reg

bbe considered one taxpayer

east P100.000,000 authored capital in banking.

yramunication, utilities, petroleum, tobacco, and alcohol industries

syers engaged in the production of metallic minerals

st

(Chapter 2 - Taxes, Tax Laws and Tax Administration

(CHAPTER 2: SELF-TEST EXERCISES

Discussion Questions

1, Distinguish taxlaw from

2. Enumerate the sources of

3. Discuss the nature of

4. Distinguish tax laws, revenue regul

5.

6

2

exemption law.

Define eax and identify ts elements.

What are the classifications of taxes? Enumerate and provide examples

dlassification. Pie Gre

Compare tax with revenue, license, toll, debt, special assessment, tai

penalty at

What tax system? What are ts types?

Enumerate the principles of a sound tx system. Explain each,

410. Enumerate the powers ofthe BIR.

44, Enumerate the non-delegated powers ofthe CIR

Chapter 2- Taxes, Tax Laws and Tax Administration

(0.3

teria fr the selection of large taxpayer foreach ofthe following:

‘Astopayment. | eriteria |

Exercise Drill No. CH, Value Added Tax —

Identify the typeof tax that s described by the following: 2. Excise Tax

a 3. Income Ta,

1A consumption tax collected by non-VAT busi : iding Tax :

2. Tax on gratuitous transfer of property by a 3. Percentage Tax ee

‘3. Tax that decreases in rates asthe amount or value a the Documentary Stamp Tae

sax objectincreases [Asto condi —

Tx

taxpayers

fed upon persons who are not the statutory

‘Tax that is imposed based on the vale of the tax objec

“Tax for general purpose

Tax imposed by the national government

‘Atax on sin products or non-essential commodities

imposed on the ransfer of property upon death

10, Tax on residents 0

residents 0 my

LL, Tax that remains at flat rate regardless ofthe value ofthe

52

‘Multiple Choice - Theory: Part 1

1. When taxis collected upon someone who is effectively reimbursed by another, the

taxis regarded as

«, personal

4 itegal.

ralorem taxes, except one. Select the exception.

«Real property tax

‘Capital gains tax on real property capital asset

3, Taxation power can be used to destroy

a asarevenue measure. c.as an implement of police power.

1. evenifthe tax sinvalid, d. when the State isin dire need of funds.

4. Which ts nota characteristic of tax?

4. tis an enforced contribution.

b._ Its generally payable in money.

53

chapter 2 - Taxes, Tax Laws and Tax Administration

c Itis subject to assignment.

§._ttislevied by the law-making body of the State having lurisdiction,

5. Which of the following {sa local tax?

a Value added tax vumentary stamp tax

Real property tax er percentage taxes

6. Which isnot a source of tax

a. CHED regulations, chal decisions

BIR Rulings Constitution

2, Taxas to purpose is classified as

a Fiscalor regul «National or local tax

b._Direct or indi 4 Specific or ad valorem tax

1. Taxasto incidence is classified as

a ‘regulatory ¢-National or local tax

9, Taxasto source is classified as

‘National oF local tax

4 Specific or ad valorem tax

10. Which isnot anature oftax?

‘4. Enforced proportional contribution

'b._ Enforced withia the teritoral jurisdiction ofthe taxing authority

_Levied by the lawmaking body

Generally payable n kind

1, Taxes that cannot be shifted by the statutory taxpayer are referred to as.

a direct taxes, c business taxes.

‘indirect taxes. 4 personal taxes.

12, Which is alocal tax?

a Donor's tax Documentary stamp tax

b. Professional tax Excise tax

13, Asto subject matter, taxes do not include

2. Property tax Poll tax

Regulatory tax d. Excise tax

14, A tax that is imposed upon the performance of an act, the enjoyment ofa privet

‘or the engagement ina profession s known as

2 incometax.

bi license.

‘Chapter 2 - Taxes, Tax Laws and Tax Administration

sonal tax

local tax

22, Which is not am excise tax?

2. Incometax

Community tax

18 from tax?

renders business illegal

wity sn applicanon

‘combination of an ad valorem tax and specific tax.

sxample of aregulatory tax.

¢ Bstate tax

Occupation tax

35

‘Taxes, Tax Laws and Tax Administration

indirect tax?

Income tax

4. Real property tax

Income tax

& Proportional tax «-Ad valorem tax

1B Specific tax 4 Progressive tax

26, Taxasto rates excludes

Specific tax Mixed x

4, Proportional tax

is obligations to B under the contract.

‘ean no longer run after Mr. A because he

the Philippine territory.

The government should wait until Mr. Becomes solvent again,

4. The government should force Mr. A to pay because taxes are non-assignable,

tax laws are, by nature,

al political and dvi

4. penal and civil.

29. Motor vehicles taxis an example of

a Property tax

b. Privilege tax

€ Income tax

Indirect tax

the constitution,

by the president

errors of public officials should bind the

abuse.

‘Chapter 2 - Taxes, Tax Laws and Tax Administration

Court of Tax Appeals

<4. Commissioner of internal Revenue

ced in application?

Tax treaties

6. BIR Ruling

of tax law?

‘¢ Opinions of tax experts

4. Tax treaties and ordinances

34, Which issues revenue regulations?

a. Department of Finance . Commissioner of internal Revenue

b. Congress <.Commissioner of Customs

35. Which is not an element of tax?

©

4. Itrwust be uniform and equitable.

36, Tax as to purpose does not int

a Revenue’

BL Sumptuary

37, When the impact and incidence of taxation are merged into the statutory

taxpayer, the tax is known as

a Personal tax

Direct tax

« Indirect ax

National wx

38, Tax as to objectincludes

a. Personal tax Excise tax

b. Property tax 4.Allofthese

39, Which is not an indirect tax?

a Dues Excise tax

b. Impost Personal tax

40. Atax that cannot be avoided is

a tax Specific tax

ct tax Personal tax

37

Chapter 2 - Taxes, Tax Laws and Tax Administration

b. Only statement 2 is correct.

€. Both statements are correct.

4d. Neither statement is correct.

42, Which isan indirect tax?

Other percentage tax _¢. Donor's tax

b. Income tax Estate tax

43, Income tax isnot a/an

a. Advalorem tax « Revenuetax

b. Direct tax 4. Property tax

44, Atransfer taxis not a/an

a Regressive tax «National tax

b. Advalorem tar d.Exeisetax

45, Which ofthe following levy is fiscal or revenue by nature?

fared to phase out a deficit balance of the government.

‘gambling in the Philippines.

€ Taxlaw intended to prot

4. Tax law supporting the development of a particular industry

Multiple Choice - Theory: Part

1, Which isnot an excise tax?

a. Income tax

b. Business tax

Personal tax

Transfer tax

4. Intended for public purpose

3, A levy from a property which derives some special benefit from putit

improvement is

a Specialassessment «Taxation

b. Eminent domain atoll

4. A.Government revenue may come From tax, license, toll and penalties.

B. Penalty may arise ether from law or contracts.

Which i false?

a Aonly cAandB

& Bonly .Neither A nor B

58

Chapter 2 - Taxes, Tax Laws and Tax Administration

5. What distinguishes tax from license?

a Taxisa regulatory measure.

G. Tacisa post acavity imposition

he following distinguishes license from tax?

7. Theamount imposed is based on the value of the property

a Eminentdomain Toll

License 4. Special assessment

18, Which is intended to regulate conduct?

a Penalty «Police power

b. License Toll

‘9, Toll exhibits all of the following characteristics, except one. Which is the

exception?

2 Demand of ownership

5. Compensation forthe use of another’ property

Maybe imposed by private individuals

44._Levied forthe supporto the government

10. Which ofthe following isincorrect?

2. The collected tax is referred to 25 revenue,

. Taxi the sole source of government revenue,

Tensei imposed before commencement of a business or profession.

42. Debt can be subject to compensation or set off

11, Debe as compared to tax

‘ademand of ownership.

imprisonment when not pald.

rayable in money.

‘ofthe persoa owning the property

on building and other real right attaching

Chapter 2 - Taxes, Tax Laws and Tax Administration

13, Tax asto subject matter does not include

a. Real propertytax «Excise tax

bb. Personal tax dd. Regulatory tax

14. What distinguishes debt from tax?

‘2 Atises from contract. c.Non-payment will lead to imprisons

BL Never draws interest d. Generally payable in money ™™

Multiple Choice - Theory: Part 3

1. The Commissioner of internal Revenue is not authorized to

a. interpret the provisions ofthe National Internal Revenue Code

promulgate Revenue Regulations.

terminate an accounting period.

4d. prescribe presumptive gross receipts.

2. Which is not a power of the Commissioner of Internal Revenue?

a. To change tax periods of taxpayers

. Torefund internal revenue taxes

¢ To prescribe assessed value of real properties

4. To inquire into bank deposits only under certain cases

3. Theprinciples ofa sound tax system exclude

a, Economic efficiency. Theoretical justice

b. Fiscal adequacy

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet