Professional Documents

Culture Documents

Chapter 9

Chapter 9

Uploaded by

Fely Maata100%(2)100% found this document useful (2 votes)

3K views21 pagesOriginal Title

chapter 9

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(2)100% found this document useful (2 votes)

3K views21 pagesChapter 9

Chapter 9

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 21

Chapter 9 - Reguter Income Tax inclusion in Gross Income

CHAPTER 9

REGULAR INCOME TAX:

INCLUSION IN. GROSS INCOME.

Chapter Overview and Objectives

me subjectto the regular income ay

“This chapter discusses inclusion in grO55

‘After this chapter, readers are expected to demonstrate:

se Mastery of the NIRC list of tems of gross income Subject to regular tax ang

their measurement rules

2, Knawledge of the boundary between income subject to final tax or capi

gains tax and those subjectto regular income tx

3, Rnowledge ofthe link between items of exernpt income and income subject ty

regular income tax

Conprehension of the effect of accounting methods and situs rules on the

reportable amount of gross income

5. Knowledge of the treatment of creditable withholding tax

& Understanding the treatment of income from pass-through entities

7. Mastery of the rules on recoveries of past deductions

8. Appreciation of the essence and purposes of transfer pricing regulation

ITEMS OF GROSS INCOME

‘The term items of gross income or inclusions in gross income is a broad category

pertaining to all items of mcome subject to taxation, namely:

1, Gross income subject to final tax

2. Gross income subject to capital gains tax

3. Grossancome subject to regular tax

items of gross income subject +o final tax and items of gross income subject to

capital gains tax are respecuvely discussed in Chapter 5 and Chapter 6. This

chapter focuses on the items of gross income subject to regular tax.

ITEMS OF GROSS INCOME SUBJECT TO REGULAR TAX

GGross income includes, but isnot imited to, the following items:

‘Compensation for servicesin whatever form paid

{Gross income from the conduct of trace, business, or exercise of a profession

Gains derivee from dealings in properties

Interest

Rents

Royalties

276

chapter 9- Regular Income Tax: Inclusion in Gross Income

eet hapa

iter sm

ize the complexity of this section, compen:

bie coe . compensation income is separately

Gros: 1e from the conduct of trade, business or exercise of a profession

‘This includes income from any trade or business, egal oF illegal, and whether

registered or unregistered,

Gross income from business or profession is determined as follows:

sales/Revenues/Recerpts/Fees

Less: Cost of sales or services

Gross income from operations

PB xxxe

as

Poa

‘The following business income shall not be included in gross income subject to

income exempt from income tax such as:

3¥ Micro: Rusiess Enterprise (BME) under RA 9178

‘enjoying tx holiday incentves under EO 226

come tax holiday ineentives

10 special tax regime such 2

‘Zone Authority (PEZA) registered enterprises subject ro 5%

terprse Zone Authority (TIEZA} registered

come tax

iiviuals (SE/P) who opted to be taxed under

the 8¥o income tax

3. Business income subject to final tax when not subjected to final tax by the payor

sof petroleum serece contractors subject 9.8% final tax

“currency deposit units (FCDUs) and offshore banking

residents subject to 10% fal tax

‘of business income shall report thelr gross income subject to

heparin the computation of tox per regime nthe Annas

a

Taxpayers wath multiple type

regular tax under the column

chapter 9 - Regular income T8x: Inclusion in Gross Income

seen ont fe me eat

ven cot eon nes pce wen

sn Ne ea Tem —

ins: lings in properties

Cain rom aig pr nny ase Fe SUBEL 0 eRe igang

Th Bs es cr tan dete ck od el propertes ae

Sate ayy

subject to regular income ta

Ordinary losses are

nom other capa

tem of gross income.

gross income. me

Ordinary gains are included as items of gross

deductions against gross income. The

after deducting 1s also

‘capital loss isnot an

To avoid complicating this section, the tax rules on measurement and recogn

Tere com desing in popertis ae discussed in detall in Chapter 12,"

iy refers to interest income other than passive interest income

tax A taxable interest income must have been actually paid out gt

an agreement to pay interest. It cannot be imputed. (IR vs. Flinvest Development

Corporation, QR 163653 and 167659)

Examples oferestincome subject to regular income tax

1 Taerest income from lending activities to individual and corporations by ba

finance companies and other lenders by tain,

2. Interet income from bonds and promissory notes

41 Interest income from bank depos abroad

Exempt interest income

‘The following are exempt from regular income taxation:

1. Interest income earned by landowners in disposing their lands to their

ts pursuant to the Comprehensive Agrarian Reform Law

terest income (the opportunity cost of money) does not constitute

an actual income; hence itis exempt from income tax.

‘The power of the Commissioner to

include the power to impute “theoretic

‘Mlustration

Sapphire Hank ashe following income in 2014

Interest income from loans etoomginan

income and deduction does not

terest. (Ibid)

>

Ineretncnefomdpststhatertnks —* 900609

Interest income from notes rediscour i

Inereincme om enum "Segoe

78

chaper 9- Regu Income Tax Inclusion in Gross income

‘nly the interest income from loans and notes rediscounting are items of gross income

sie regula income tn, The terest on depos ond easy note are wens of

gross x

Rents

ent income arises from leasing properties of any kind. Its a passive income but

{snot subject to final tax under the NIRC; hence, i is subject to regular income tax.

special considerations on rent

{L_ Obligations of the lessor that are assumed by the lessee are additional rental

income to the lessor.

2, Advance rentals are

‘a, Item of gross income upon receipt if

Unrestricted or

si Restricted to be applied in future years or upon the termination of the

lease

b._ Notan item of gross income if:

ii, It 1s a security deposit to guarantee payment or rent subject to

‘contingency which may or may not happen

Leasehold improvements made by the lessee on the leased property are

recognized by the lessor as income using the spread-out method or outright

method discussed in Chapter 4

Mustration

Under the tba Leasing Corporation’s standard lease contract, leases shall run for 3

able 12-month period for a monthly’ rental of P25,000. The lessee shall

rental im advance plus one month security deposit. The reat fo

e lease shall be taken from the advance while the security dey

ere are no damages sustained by the property during the I

is an item of income subject to regular tax The P25,000 security

deposit is not an income.

Royalties

Royalties earned from sources within the Phulippines are genera

Income tax except when they are active by nature. Active

royalties earned from sources outside the Philippines are subject to regular icome

tax.

279

‘Chapter 9- Regular income Te}

Mtustration 1

PorressoRtware is a distributor of a compu

licensed users. Computer programs are sPec!

‘continuing maintenance services are provides

total of PSO0.000 royalty payments.

“The entire 500000 1s subject to regular income tx since te royalty (5 aM active In

to Forressoftware

rogram and ears Foy:

red to cach

3 year.

‘Mlustration 2

‘Mang Damian has the following roys

P 550,000

200.000

300,000

400,000

from books

from franchise exercised abroad

ing properties and from books in the Phipines are subject

"fom sources abroad aggregating P700,000 ave ters of gross

lar income tax Remember that the final withholding tox does not

Dividends

‘These pertain to dividends declared by foreign corporations. It should be recalled

that dividends declared by domestic corporations are gener: lect to 10%

he recipient is an individual taxpayer and exem fea

‘or a resident foreign corporation. Cash, property, idends

ign corporations are items of gross income subject tax

snd declaration or when stocks dividends are subsequently redeemed such

amounts to payment of cash dividend, the fair market value of the stock

dividends received is taxable.

Liquidating dividends

tration

bao Company, a domestic corporation, received cash dividends from the following:

Domes corporations m4

Resident rag corporations 400000

Nomen rg oportns 5o.000

280

chapter 9 - Regular tneome Tax Inclusion in Gross income

ne Pt) merce tn tty tne too ge

Le an ne

“phe P500,000 total dividends from the resident and non-resident foreign corporations

he items of regular income subject to regular income tax and shall be reported a5

follows:

scenario 1: Assuming Cubao is a domestic corporation, the PS00,000 total dividends

from foreign corporations shall be included in gross income because domestic

forporations are taxable on world income,

‘scenario 2: Assuming Cubao 1s a resident foreign corporation, anly a portion of the

200,000 dividends from the resident foreign corporation determined as earned

vaitin by yminance test discussed in Chapter 3 shall be included in gross

fncome. The situs of dividends from the non-resident foreign corporation is abroad.

Annuities

‘The excess of annuity payments received by the recipient aver premium pad is

taxable income inthe year of receipt.

mMustration

“Andrew purchased an annuity contract for P100,000 which shall pay him P10,000

‘annually until he dies.

The receipt of the fist 10 annua? annuity payments isa return of capital Any further

receipt from year 11 onwards isan item of gross income subject to regular income tax.

Prizes and

Prizes and

income subject to regu

t are exempted from final tax are not items of gross

income tax.

Exempt prizes and winnings

1. Prizes received without effort to joi a contest

2. Prizes in athletic competitions sanctioned by their respective national sports

association

3. Winnings from PCSO or loto, not exceeding P20,000 in amount

Summary rales of prizes and winnings for mdividual taxpayers:

TYonin Abroad —

Regular tax. Regular tax

Finabtax Regular tax

0, exceeding P20.000 Finaltax N/A

PCSO and lotto, nocexcecding P20.000 Exempt N/A

‘Winnings from other sources Regular tax

281

CChepter 9 - Regular Income Tax inclusion in Gross Income

inal taxation of | izesrand winnings for corporations

Metta orn

ae

Plated

is

Ube,

Rlustration .

The City of Baguio held its Panagbenga flower festival. During the festivities, y,

Erorita, the proprietor of Mr. Sexy Body Gym, won the PS00.000 second prize in

flower foat competion. John Hay Corporation won the P600,000 frst prize

tte onthe wining of Mr Brora The

The if ag tl wil 206 fr 20 0

Tao eg al at be suiectd to 20% nl tax but to creda

withholding tax john Hay shall include the prize in its gross income subject to rug

rae

Pensions

‘These pertain to pensions and retirement benefits that fail to meet the excusoy

criteria and hence subject to regular tax.

Partner's distributable share from the net income of the genera

professional partnership

It should be recalled that general professional parmerships are not subject

Income tax (Le, final tax, capital gans tax or regular income tax) because they ar

merely viewed as pass-through entities. The partners are the ones subject

regular tax on their share in the net income of the general professiond

partnership.

For this purpose, the net income of the general professional partnership shal

include items of income which are exempted from final tax or capital gains tax to

{the general professional partnership,

Mlustration

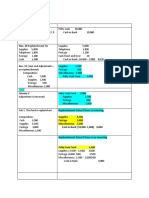

‘et and Siegiried practice their profession in a general professtonal partnership ané

share profits 60:40. Their firm reported the following:

Gross receipts

P 2,000,000

Less: Professional expenses 200.000

[Net income trom operations. P a00,000

Interest from bank deposits ——20.000

Distributive net income Eaz0.000

‘The share ofthe parmers in the net income of the partnership shall be computed 2:

‘Total distribution to Zef (60% x P620,000) P 492,000

ibution to Siegfried (40% xP820,000) _ 326,000

tive net income ECazo009

Di

282

chapter 9- Regular Income Tax Inctusion in Gross income

‘The partners shall include their respective shares i

heir gross income

regular income tax. ‘708s income subject to

Note that this rule applies to other pass-through entities such as:

1, Exempt joint ventures

2. Exempt co-ownership

venture or co-ownership

come tax. The distributive share of a

‘income of these entities, if organized.

tnholding tax

ted abroad, the share from

‘income tax for taxpayers taxable on global income.

the final income taxation is territorial and does not

apply to foreign income,

GENERAL CRITERIA FOR ITEMS OF GROSS INCOME

Items of gross income subject to regular income tax are not limited to the

provision for

1. not subject to final tax, capital gains tax, and special tax regime, and

2, notexcluded or exempted by law, treaty, or contract from taxation.

:ROSS INCOME SUBJECT TO REGULAR INCOME TAX

8 from taxable estates or trusts

income of other pass-through entities:

b. Exempt co-ownership

3. Farming income

4. Recovery of past deductions.

5. Reimbursement of expenses

6. Cancellation of indebtedness for a consideration

Income Distribution from taxable estates or trusts

‘Any income distribution received by an heir or beneficiary from a taxable estate

or trust shall be ject to regular tax, provided that

sch income must not have been subjected to final tax or capital gains tax.

IMlustration: Estates

Roman is one of several heirs

Judicial settlement. The admi

support of Roman:

estate of his father which is under

ed the following income for the

‘chapter 9- Reguar income Tax Inctusion Gross Income

P 22,500

Domestic dividends mano

Business income

a hs gros tacome subject to regular INCOME COX the py

clude m is gress nor Tote shal present the same amoung

Roman

disoibucion from business income

deduction against its gross income. The

Roman since tis was already subjected

0 dividend shalt not be neue

atsource.

Mlastration: Trusts

Havana received the following income distributions in his capacity as beneficiary yyy

Irrevocable trust designated by his grandmother:

Net capital gains on saleofdomesticstocks P9,500

Rental income 12,000

Horace shall report nly the P12,000 rental income in his grass income subject to regu

income tox. The net gain on the sole of stocks is subject o capital gains tax to the ruse,

Share from the net income of exe!

‘The same tax treatment on recog

professional partnership applies

ventures and co-ownerships.

int ventures and co-ownerships

of share in the net income of a gener

share from the acti

Farming income

Farming operations can be classified as:

1. Raise and sell operation

‘The proceeds on the sales of livestock or farm products is included in gross

‘income subject to regular income tax. Animal raising expenses are presented

as items of dedi ss income.

2 Purchase ai

operation

The gross profit rom the sale (sles less cos of purchase is included in poss

income.

Taxpayers

livestock or

used for reco,

yy follow accrual or cash basis in accounting for inventories of

m products. The crop year basis discussed in Chapter 4 may be

igincome for long-term crops,

It should be recalled that the proceeds of

ceeds of cop oF vestock

tmable tem of ross income because they are ecoery olen prof

‘RECOVERIES OF PAST DEDUCTIONS

When past year deductions from

(en pst yar deductions rom gross income ae subsequently recovered by it

expense Aeducted are subsequently paid a

am amount ess than the deducuon Ca

ot they resedntaxbenefit tothe taxpayers Nl De analyte whether

284

‘chapter 9 - Regula Income Tax. Inclusion in Grass income

xamples of recoveries of past deductions:

Fapecovery of previously claimed bad debt expense

J. Refund of local tax expense

& Getund of foreign tax previously caimed as deduction

+ Recommissioning of banwoned petroteum service contracts or mining tenements

£ Release of reserve funds of insurance companies

5 Inerest expense which were subsequently condoned bythe lender

past deductions that created tat benefit to the taxpayer must be reverted back to

Foss income in the year of recovery so thatthe government wall recover the tax

fost from the deduction.

‘Fax benefit

‘There are two ways a taxpayer may benefit from a deduction:

‘through reduction of taxable income in the year deduction 1s made

‘through redilction of future taxable income through carry-over of

Mote der outta laws the exces of deduoans over gos ncn i teal year i came ov

ade ehucon apunst the vet income of the next three years of operation This called net

23 dings carne NOLCD Because of th, amet al prior year deductions have tax

Demet ence, thelr recovery i

dhesend in Chapter

fis partly dscused hee Because oft elvan 10

Itustration 1: With Net income in the year of deduction

‘Rtaxpayer incurred P60,000 bad debt expense in 2018 out of which P35,000 was

recovered in 2020:

2g 202 2020

Ft00.000 F 80,000 P 120,000

(_s0.20) =. 35,000

19.000 E gogo £22

The entire P60,000 deduction in 2018 sa tax benefit othe taxpayer tence, the P35.000

Trvery from this deduction 6 0 fax Benefit which must be reverted hock to grass

Income in 2020. The taxable net income in 2020 shal be P155,000.

Net income before bad debt expense

(Bad debt expense)/Recoveries

Net income after bad debt expense

tgstraton 2: With operating loss & NOLCO carry-over before recovery

aaa er 0 bad deb expense in 2038 out of which PE0.000 was

recovered in 2020.

—2og_ 2012 _ 2020

P 70.000 100000 P 120.000

Pion om

eee zat

Neoncome EAD

Less: NOLCO application

285,

‘chapter 9 - Regular Income Tax Inclusion in Grass Income

tthe entre P90,000 deduction fsa tax Benefit The taxpayer benefited by the p

Fa ei cable income piste P20.000 cory-over of NOLCO. The pogo

rere fm the deduction in 2020 sa tox benef SUbfect 0 £0x. The repoeay

‘income in 2020 shall be P180,000. %

user expired NOLCO before recovery

Suypuce'a taxpayer ducted 2 P5O0 interest expense in 2016 but flled top

| dificult. The lender condoned the interest in 2020,

2016. 2017 _2018_ 2019 2020 _

Income beforeinterest P 100 (P 130) P80 (P 160) (P70)

Less Interest expense (_S00) pie = __ 500

Netincome (NOLCO) (400) (L130) P80 (P16 Paw

NOLCO application ———> (20) pow.

aay

‘The interest expense saved the 2016 P100 pre-tax income and the 2018 P8O net income

{from taxation, Note that NOLCO can be deducted only against net income in the net

tree ers The P30 emaning NOLCO ened n 2019 without tox Benefit The aa

interest deduction only benefited the taxpayer P180. Hence, only P180 of the

Mnepntiiadinnsaesctysckoc

bees one re mney bela aueyone ty

ayer incurved a ‘bad debt expense in 2019 out

a pens tt of which P45,000 was

—tm2_ _2020

[Net income/(loss) before bad debts/recovery P 70,000 (P 15,000)

(Bad debt expense} /Recovery (30,000) __45,900

[Net income after bad debt expense (20.000) & 2

‘An increases NOLCO which hasnt expired before h

te beginning of the taxable year in

whch che recovery takes plc sl be treated es tex Bena The the cnt S000

a tar beneficcothe Hence,

mbes aay: ence P4000 recovered cut of sax bereft whith

The 2020 net income shall be computed as follows:

‘Net ioss before reco

ha: Recovery” (15000)

iNet income saa

Less: NOLCO application ~ 2020 P3600

Taxable net mcome 20.000

caper 9- Regu Income Tax Incusionn Goss income

-Tuetax benefit ofthe P90,000 bad debt expense tothe corporation in this case shall be

‘otermined using the As-If Approach.

e-compute the

the subsequent dedi

jously reported to det

‘Assuring the future recovery is known,

Net income before bad debt expense

Less: Bad debt expense if recovery is known (P 90,000 - P60,000) __30.000

Eagoon

‘income that escaped taxation in 2019 computed as:

known

(recovery is unknown)

P 40,000

——2

e4o009

140,000 out of the 260,000 recovery in 2021 constitutes tax benefits which must be

included in the 2021 gross income. The 2021 net income shall be P160,000.

Illustration 6: Taxpayer fs exempt in the year of deduction

Kalinga Corporation is an exempt BMBE taxpayer in 2019 but became a taxable

oone taxpayer in 2020. it deducted P120,000 bad debt expense in 2019. In

recovered P40,000 out of the bad debts

2019 2020

F 70.000 F 100,000

(10.000) _40.000

(sog00) Bm

[Net income before bad debt expense

Jeb expense)/Recovery

comme after bad debt expense

Deductions have no tax benefit toa taxpayer who is exempt from fox. Future recoveries

rom dedurtions mode m the yeurof exemption are nan-taxable, The PAO.000 recovery is

‘ot income. The 2020 net income shal be P100,000.

287

‘Chapter 9 - Regular Income Tax. nciusion in Gross Income

Refund of non-deductible expenses

Expenses of payments which aren

‘computation of taxable net income w'

‘such, their recovery should not be

sdeacible ais £055 income ng

eet

ided in gross income

Hence, the refund of the following non-deductible items is not taxable:

1. Philippine income tax

2. Estate or donor's tax

3. income tax paid or incurred to a foreign country if the taxpayer claimed g

credit for such tax n the year it was paid oF incurred.

4. Stock transaction tax in disposing stocks through the Philippine stocy

Exchange

5. Special assessment

[REIMBURSEMENTS OF EXPENSES

Expenses of the taxpayer that are reimbursed or paid by the customer or cient

constitute additional income to the taxpayer.

Examples:

1. When the lessee pays the ownership costs of the lessor such as real property tax

and insurance on the property. the payment constitutes income to the lessor

2. When 2 chent reimburses the out-of-pocket expenses of a professional

practitioner, the reimbursements are income to the practitioner.

CANCELLATION OF INDEBTEDNESS

‘The cancellation of indebtedness may amount to gratuity or payment of income.

‘service or goods - treated as income

yratuny - treated as gift; not as income

transaction such as forfeiting the right to receive dividends m

exchange of the debt ~ treated as dividend income

‘SPECIAL CONSIDERATIONS IN REPORTING OF GROSS INCOME

|. Accounting methods

Situs rules

Erfect of value added tax

L Creditable withholding tax

Power of the CIR to redistribute Income and expenses

Paden

288

chapter 9 - Regular Income Tax Inclusion in Gross income:

ACCOUNTING METHOD

‘The accounting, met

teportable amount of er

sdopted by the taxpayer has a direct effect on the

income subject to regular mcome tax

Enllected and uncollected income as gross income,

Ir must be recalled also that regardiess ofthe accounting methods ofthe taxpayer,

Juvaneed income must be included in gross mcome in the period received.

SITUS RULES

‘on global income.

pine income, only their items of gross income

For taxpayers taxable only on Phi

‘wnthin the Philipp included in gross

subject to regular tax from sour

imcome.

For taxpayers taxable on \come, their items of gross income subject to

regular tax from sources within and without the Philippines are included in gross

income

Integrative illustration 1

Nomisma,a finance corporation, ends to various chents:

Interest income from loans to

Imerest nome fom bank ep

Required:

Requlreds al amount of goss income subject final tax and the reportable

oe te rogulrncme ta asoming the tanpayer

raygcorporston

srcorporeton

3. Domestic corporation

Solution:

‘An analysis ofthe situs ofthe above income is shown below.

wishin Without

Loan interest income P 490,000 P 500.000

Bank interest income 2000p 10.000

Total Paragon bsx0000

289

Chapter 9 - Regular income Tax Inclusion in Goss Income

sme fatowing ae the amounts subject to final tx andthe #OUnES 0 be repo,

gross income subject to regular sncome

———Subectto_

TBualtax. Regular tax

reigneorporaon §—«P420.000 Ps

1. Non-resident foreign corporat 20D 400,000

S Bomerecoerason 2.000 910.000

~~ final income tax on gross

“on esd oe copraons ese en

Ton ee gt shal wild 30% fia aon tei ETO come :

2. The mere nce om bake the Pippin ian tem of Bess Income seg y

ee eer Ine 2 ot Troe

2a acoso thove eared om sours thin. * fren,

ee evan oe ke ran hens

mega ea tom oc wihin a ee

3, Incame from sources abrox

Integrative Mlustration 2

‘A certain taxpayer had the following details of income during the year:

jents P 400,000

Service fees from for s 500,000

Gain on sale of dome directly to abuyer 150,000

Dividends from domestic corporations 5,000

Interest income on bank deposits abroad 30,000

2. Non-resident alien not engaged in trade or business (NRA-NETB)

‘engaged in trade or business (NRA-ETS), a resident aie

‘tizen (NRC}

(RA) oranon-resi

Resident citrzen (RC)

2 acorpors

2 Non-resident foreign corporation

b._ Resident foreign corporation

© Domestic corporation

chapter 9 - Regular Income Tax Inclusion in Gross Income

sotoion:

‘erbnlyis ofthe sks ofthe foregoing income sas falows:

jer iatons pitta, wathout

ain on sale of domestic stocks £00000 500,000

Domestic didends 008

Peter ooiirtoiont

Toul snow

‘The folowing are the amounts ob ineaded in gras ncome subject ina incom

tae (FT, capa gain a (COP, and rept ncone sa gr neo mane

ae Toor

individeals i

1. NRA-NETB P 405,000 P 150000 P

2. NRA-ETB, RA or NRC S000 150000 400.000

3 RC 5000 150,000 930,000

Corporations

4. REC P 405000 P 1s0000 P

s. RFC ~ 150000 400000

6 pe 10600 930.000,

note:

1. NRFCs and NRA-NETB are subjectto final tax on Philippine income.

2. The 5%-10% capital gains tax is the most universal rule im fenton that applies to all

taxpayers regardless of elasifcaton.

3. Inver-corporate dindends are exempt from fina tax, except when the recipient

resident foreign corporation

EFFECTS OF VALUE ADDED TAX ON REPORTABLE GROSS INCOME

Remember that business taxpayers are required to either register as:

a. VAT taxpayers ~ if their sales or receipts exceeds 3,000,000 in the last

consecutive 12-month period

b. Non-VAT taxpayers - if their sales or gross receipts is below the VAT threshold

cor are specifically designated by the law to pay percentage taxes

Every VAT taxpayer is mandatorily required to charge 12% output tax on their

sales or receipt. The regulations presume that the amount charged to customers is

‘nelusive of the 12% VAT, The output VAT will be raid to the government net of

the VAT paid by the taxpayer (input VAT) on his purchases. As such, the amount of

reportable gross income shall not include the output VAT.

291

chapter - Regular Income Tax Inctusionm Gross Income

imlustration 1: VAT taxpayers

RAT togstered taxpayer charged P78.00 toa client OF renal.

“The VAT taxpayer shall spt the billing 2s follows

70,000

Bo

Pa aDHA00

‘ny the renal incomes subject 0 income tax. The output VAT shall be recorded agg

Tabity, The collection ofthe rental is recorded in accounting as follows:

cosh 778.400

Rentincome 70000

‘urout VAT 3400

Rental income (P78,400/112%)

Plus: Output VAT (P78,400 x 12/122)

Invoice price

Wustration 2: Non-VAT taxpayers.

‘Aron VAT taxpayer charged P78,400 to a client for rental

Non-VAT caxpayers re not subject to VAT. The entire amount they charge for thee sly

of goods or service i gros income subject to income tax

WITHHOLDING TAK

holding taxes (CWT) dedueted by income payors against the gross

sare not exclusions in gross income. These should be added

reportable amount of gross income. CWTs are tax credits that are

deductible against the annual income tax due of the taxpayer.

Mlustration

Denzo Inc. anon-VAT domestic corporation, reported the following

P 475,000

360,000

40,000

10,000

500,000

the to le gross incom

wie irene aa ‘gross income and the income tax due and still due

‘The total reportable gross come shall be:

475K /95% oF (PATEK + P2SK))

HOK/O0% oF (PB6OK+PaOx) — gosgog

--40u.009

Bawuuog

292

chapter 9- Regu Income Tax Inclusion in Gross income

sox fo trimer dn Se cen cele

seers et em i tT ee

‘The income tax dve and still due shal be determined as:

come P 900,000

ole deductions (business expenses) _s00.009

income P 400,

Jy: Corporate tax rate 1.

Fiza

‘withholding tax angen

P 25,000

ional fees —-40.000 __65.090

Income tax still due

2. Thesinal axes shoul

Creditable withholding tax and VAT

VAT taxpayers shall revert back to grass income amounts of withholding tax but

texcludes therefrom the amount of VAT charged to customers o

Mustration 1

1,000

smpute his rent income subject to regular tax as follows:

Wve of 12% but net ofS% CWT] — P8560

107%

Bop0.000

Rent income (Gross income}

293

Chapt 9- Regular Income Tax etuson 1° Gross fncome

“The VAT and withholding tax are as follows:

Rent inco P 90,000

income 3600

‘lus Output VAT (PB0,000 x 12%)

iatholding tx (PB0,000 « 5%) 4000

Less: 8 Lbs600

‘Cash payments to th lessor

POWER OF THE CIR TO | REDISTRIBUTE INCOME. AND DEDUCTIONS

POWER OF THE On Tare oganzauons wades OF DUSIESSS (Whether o

qReorporated. and whether or not organized in the Philippines) owned

Incorporated a erty by the same Interests, the Commision

cond eyo rely patrons income or des

authored tee ongamatin, trade oF business, ihe determined tng

betwee Calon pporsenment or alcaton is neceSS2y in order to preva,

aoe eee ipery to reflec the income of any such Organtzabon, trade,

Brsiness (Se 50,NIRC)

‘The Problem of Unfair Pricing between Associated Enterprises

‘There is a risk that the pricing of the transfer of goods and services between,

associated enterprises will be con 9 such a way to further the interests of

the associated enterprises as a whole in disregard of their social responsibility on

taxes.

Examples:

1. Adomestc corporation which is subject to 30% corporate tax in the Phil

has a subsidiry that operates in a tax haven count

transfer pricing ba

recognized in the Phi

abroad where no taxis imposed.

A foreign corporation subject to 10% corporate tax in its home country has &

cost to his exempt

business thereby shifting the profits to the exempt business to save from income

tx

‘The transfer pricing guideline

Those enumerat

about

rw of the problems in taxation brought

these Unfair praties and to propery

Ccnapter @ - Regular Income Tax: Inclusion in Gross Income

reflect the income of associated enterprises, the BIR and the Department of

sehance promulgated Revenue Regulations No.2 series of 2013 (RR2-2013) 0°

transfer PreiOg,

whot are associated enterprises?

Under RR2-2013, two or more enterprises are associated if one participates

igrectly or indirectly in the management, control, or capital of the other; or ifthe

Gomme persons participate directly or indirectly m the management, control, oF

SShital ofthe enterprises. Associated enterprises are also called "related parties”

Examples of associated

1 parent corporation and its subsidiary corporation

1. Sister companies oF businesses owned by the same parent corporation

3. Allcorporations controlled under the same holding company

4 Businesses owned by the same person.

prises:

‘The arm's length principle

Tier RR2-2013, ransfer pricing between assoaated enterprises shall be made

Under comparable conditions and circumstances as those entered into between

unfependent parties where market forees drive the terms and conditions of the

‘Maneaction rather than being controlled solely by reason of special relaonship

between the associated enterprises.

ther words, an uncontrolled pricing method determined by free market forces,

also called arm's length pricing is preferred. The failure to comply may expose the

taxpayer to a transfer pi justment where the BIR re-computes the proper

income of the associated enterprises.

‘The arm’s length principle shall be applied to:

1. Cross-border transactions between associated enterprises

2. Domestic transactions between associated enterprises

When operations are conducted cross-border, the taxpayer may enter into an

“lavanced pricing agreement” with the BIR where a pricing rates pre-agreed to

apply fora period of time.

[Although this is not a mandatory requirement, this may serve as 2 safety net for

the taxpayer to avoid the risk of transfer pricing examination and adjustment and

the inconvenience it may possibly cause.

‘Transfer pricing methods

Whe 1e pricing methods between associated enterprises do not reflect arm's

Jength pricing, the DIR will adjust the controlled transactions to ther arm's length

295

chapter 9- Reguiar Income Tax Inclusion in Gross Income

valves using the most appropate of the following method considenng y

tarcumstance of the taxpayer: a

‘uncontrolied price (CUP) method - The transaction 1s va

2 cm et ne et

comparable circumstances

ie oa

ries en et

does not apply ¢@ products containing

patented products or those containing trade secrets.

~The transaction is valued based on the fu

2. Resale price method (RPM) - The transaction is val setae

pertormed by the reseling party to the product. This is used when produg,

purchased froma related party are resold to an independent party

3. Cost plus method (CPM) - The transaction is measured by valuing the functng

performed by the supplier of the property or services.

pit based ow

the dmsion of profits Would have

‘expected to realize from

Res:dual profit:

‘The residual profit after

based on an analysis of

independent parties.

anctions performed by each of thea

rolled transactions

5S. Transactional net margin method (TNMM) -

the resale price methods in the sense that sm appr

reference tothe operating profit earned in comparable uncontrolled transactions

‘When no comparatives can be derived within the industry of the subject taxpayer, the

Bik may

the transfer pricing methods using comparatives derived from

rr segmen

b. Use a combination ofthe transter pricing methods or other methods

296

chapter 9 - Regular Income Tax: Incluaon in Gross income

{ts forengn branch at cost;

) ith che BIR which

Crosby compiled the following costs and sales during the year

Philippines. Branch —

Sales through the branch (tatra-company sles)

P 7.000.000. 12,000,000

—Zan0.009 7.000.000

b___o 2 scango0

‘Sales to unassoctated domestic enterprises:

P 3,000,000

[Applying the APA, the gross income earned from within and outside the Philippines

shall be computed as:

Sales through the bronc!

Sales

‘Less: cost of sales

Gross income

Sales to unassociated domestic enterprises:

3.000.000 P © P 3,000,000

297

chapter 9 - Regular Income Tax Inclusion in Gross Income

eee omegen a ey NIE

sty shal rep cing rae only important the measurement

aoe a a yaaa soucesfor purposes ofthe computation ofthe foreign

income | pp sources

Prope

Raxcrei

Scenario 2: Crest sa domestic corporaion, andthe foelgn operation ny,

branch but a foreign subsidtary incorporated abroa

come The income ofthe Foreign subside

‘a non-resident foreign corporation. Note’®

in measuring the fair and proper amout

the Philippines 2

the transfer pr

weorable srofits on the sales of Crosby to the

rable gross income rom with. The pro :

Mates could hove escaped ataton without this rl

ie

foreig,

‘The same procedures in this scenario wil be applied if Crosby 5 a resident fore

corporation.

IMlustration 2: Without an advanced pricing agreement

Hot Corpo foreign corporation, sells cosmetics products in the Philippine,

theough i ‘The Philippine branch fled an income tax return reflecting te

following gross income:

Sales P 4,000,000

Less: Cost of goods sold 3.500.009

Gross income B_S00.900

‘Scenario 1: The BIR determined that Hot Corporation is billing its branch at 200%

of cost. Meanwhile, other competitors of Hot Corporation which offer simitor

Product lines are billing their Philippine independent distributors at an average

0f 150% of cost.

‘The gross income ofthe Hot Corporation for purposes of Philippine income tax shall

be restated by e-measuring the cost of goods sold as follows,

les t 200% billing rate (ie. 200% x Cost) P 3,500,000

selling party (P3,500,000/200%) 11,750,000

length price (150% x P1,750,000) 2,625,000

‘Thus, the gross income of Hot Corporation shall be restated as follows:

Sales

‘Les: Cost of goods so (orm engeh con)

P 4,000,000

2.625.000

BLg7s.009

Note: Hot Corporation wall be given an assessment

Dales tht ay be Gu rome ear etment by he BIR forthe incremental tax lt

298

chapter 9- Regular Income Tax, inclusion in Gross income

Scenario 2: Hot Corporation bills ts branch at established market prices

since te taste pics of Hot Corporation recs arm's length pricing no transfer

‘aujustment shall be made

pricing

selection of Transfer Pricing Method

To minimize the risks of transfer pricing adjustments, taxpayers may also

consider using the transfer pricing methods used by the BIR in pricing their

transactions with associated enterprises. The taxpayer must support the propriety

ofthe method adopted through proper documentation,

PERIOD IN WHICH ITEMS OF GROSS INCOME ARE INCLUDED

‘The amount sms of gross income shall be included in the gross income for

the taxable year in which received by the taxpayer, unless, under methods of

accounting permitted, any such amounts are to be property accounted for as of a

different penod.

‘chapter 9 - Regular Income Tax. Incision in Gross Income

curren, seueresrenenases

Discussion Questions

the NIRC ist of tems of gross income,

2, What are the broad categories of grass income?

3 Discnas in detail the taxation of interest tncome. Which is subject to final tay

Which is subject to regular income tx? 2

Discuss the treatment of gains from de properties. Which gaing

Which gains are subject to regular income tay?“

Discuss he taxation o i"

Compare actual distnbution andthe share in the net income of the parte

1e gross income of the partner? Partnershy,

9, Diseuss the taabiityof recoveries of past deductions.

10, Enumerate examples of pass-through entities. Are they taxable to final tay, apt

fins tax oF regular anceme tx?

11, Brumerate and discuss the transfer pricing methods.

come subjet to regular income tax and capital gans tax ae

government.

assvencorre buts no subject to ial a

The tere income rombonds sed by bak s subject to alae

ser ange nepal tt ace ee bec the Pepa coe

5. The gous income from operations enjoying stax hollay are included in

income subject to regular ax, uta presented ae deductions in he income tat

earn

he share ina busines partnership subject t0 final tax, bu the share 8

rehab

300

cpacter 9 - Regular Income Tax Inclusion n Gross income

property ta and Insurance on the propery if assumed by the lessee

‘winnings are exclusions in gross income; hence, they are exempt from

income tax

idends are never subject to mcome tax

's are inclusions in gross income subject to regular

due toany cause within his control

‘Trucor False 2

ributat

ta by the heir or beneficiary.

past deduction must be rverted back to gross income of

ye accrual basis,

rad debts need aot be reverted back to grass income of taxpayers

he debtor.

subsequent

ny tax benelit.

taxes shall not be reverted back £0 BrO35.

‘The lets of the partnership can be claimed by the partners as deduction in their

15, The accounting period of the taxpayer has a direct impact upon the amount of

{ross income to be reported.

301

‘chapter 9 - Regular Income Tax Inclusion in Gross Income

eesetmebemer ane eo Oe

Fine bee a pact on the ee of Ne FEPOMAbL oN ny

2 ot nnoling tensa ade back tothe AMUN of epoca

income

19, The ockput VAT must be included as part of grassincome of VAT taxpayers,

re tert bac to gros come fe aunt Of wie tag

Payee of NRA-NETB and NRFCS from the Philippines

me subject to final tax. ™

no an advanced pricing agreement the Bry

gt associate enterprises.

vaatenoeen ansocited enterprises mst be made at ars length,

Fe celanons apply only to cross-border transtes of goad ng

{envces between assornte enterprises

25. eeidone ander the dicet aed indirect contol of the same contoiy

fediidual or corporation are sesoclated enterprises.

26, Uns he accrual Sat of accounting, hems Of gos Income are reported in he

period they are received

“anster prem, adjustment is needed when the income reported te

Palippte train sunersated

‘Multiple Choice - Theory: Part 1

4. Gain from sale of shares in mutual funds by the investor

b. Prizes in recognition of civic, religious, and artistic achievements

€ PCSO and loito winnings, not exceeding P20.000

. Allofthese

Which isan item of gross income subject to regular tax?

a. Gain on sale of lot by a realty dealer

Interest income from bank deposits

© Passiveroyalty income

4. Capita gain on the sale of domestic stocks

3. Which is

tan item of gross income subject to final tax?

1s from a domestic corporation

B. Prizesin excess of PI

Peni yan

© Shareinte income ofa general profesional

d. Winnings ® —

4. Which oftesemployeebenefis sujet fal at

3 rings nets tori nde employees

Regular pay ot supervisory and managerial employees

302

chapter 9 - Regular Income Tax Inclusion in Gross Income

‘e_Pringe benefits to supervisory and managertal employees

._ Regular pay of rank and file employees "

5, Allof these are items of gross income subject to regular tax except one. Select the

exception.

‘2 Compensation income

’b._ Interest income from long-term bank deposits

Ordinary gain on sale of properties

4, Interest on notes receivables

6. Which isan income exempt from income tax?

‘a. Income of a general professional partnership,

B. Forcign divdends

Taxes collected by the government

4. Income of government-owned and controlled corporations,

7, Allofthese are subject to regular income tax, except

a. Professional fees

bb. Wages and commissions

¢, Businessincome

4. Capital gain from the sale of real property located inthe Philippines

|. Which is exempt from regular tax?

a. Income from construction

bb. income of qualified pension plans

‘e._ Income from merchandising or trading

4. Income from financing or leasing,

item of gross income is nor subject to regular tax?

ycome from foreign bank depo==>

in on the sale of bonds with more than S years maturity

1 sale of damestic stocks by a security dealer

gain on sale of patent

pases

10. Which is not part of compensation income subjectto regular tax?

2 or'sfees

Bonuses and fixed allowances

‘c. Portion of salary contributed to $SS

Portion of salary used to pay salary loans

11, Which is included in the gross income subject to regular tax of a resident alien?

Gross income from the sale of goods abroad

'b._ Interest income from promissory notes of resident clients

Interest income from relatives abroad

‘&._ Galn from the sale of domestic stocks directly toa buyer

303,

Chapter 9- Reguar Income Tax Inclusion i Gross Income

chapter 9 - Regular Income Tax Inclusion in Gross income

Me

20, The proceeds of life insurance received by the wife ofthe insured ts

a. exempt from income tax, © part of taxable income.

ee Wihhodingtax

au * subject to inal tax 4. pertly exempt and pardy taxable

cre te tn lng spats thane

cae bara 2 tncecenn

co regalar tax inudes

vidends - ¢. Both aandb

dens aiNethernorb

come of a foreign partnership

foreign sources

n from a taxable estate

15, Stotement 1: All prizes earned

Statement 2: Ali prizes inthe

generally correct?

«Both statements 1 and 2

are subject to regular tax, 2. Which isnot a reportable type of gross income?

ines are subject to final tax. wwe royalties

's trom a foreign corporation

ie Sate iahlies amtemece bee, Capital gains from the sale of domestic stocks through the PSE

16, Which isan item of ross income subject to regular tax? 3

Lottery winnings from abroad

b, Imputed interest income

Advanced rent representing security deposit for contingency which may o

may not happen

4. Leasehold improvements with useful life not extending beyond the lease term

117. Which ofthe following is not subject to regular tax of a domestic corporation or

resident citizen?

‘2 Deposit interest income from abroad

Prize not exceeding P10,000 fromthe Philippines s.

Income from abroad exempt under treaty

Royalties from abroad

4. all taxpayers.

income earned abroad are subject to regular tax to

poration only.

resident citizens and domestic corporations.

b

4 alltaxpayers.

28, Which is subject to regular tax to a non-resident foreign corporation or nos

resident alien not engaged in trade or business?

6. Which individual taxpayer is not subject to progressive tax?

'b, Capital gain from the sale of stocks directly to a buyer in the Philippines a NRAETB « Resident

‘Dividends from domestic corporations = nm b. Special aliens @-Reskdent cirzen

4 Noe ot these

2. Which corporat taxpayer snot able requla a?

reqs teres tgncoportent wit comere ener eae

ed 'b. Resident corporation d. Non-resident foreign corporatior

real property capital assets in the Philippines

je damiessc carpoe sxpayers shall report their income on

4. Gain from dealings in propernes abro: & aa ae

‘elther a fiscal or calendar year.

d.acrop year.

305,

304

‘Chapter @ - Regu Income Tax: Inclusion i Gross Income

chapter 9 - Regular income Tax inclusion in Gross incom

jons are allowed to report eon

9. Coren: a ether a fiscal year oF calendar year 150000

fever: d acropye 3 stocks through the PSE 400,000

lincome to bereported by Mr. Lelng in ross nome.

¢P1026,000 *

a Pazeato

b Git

e.Amounts received by the insured in excess of premiums paid

Compensation for perso

P40

11, wie ofthese sujet ther benefits 2000

and Pag-Ibig contributions 20,000

payments 50.000

Deductions for withholding tax 60,000

ompu smpensation it in the annual income

12. If not covered by the substituted fling system, employed individual taxpayers & 7 ste the compensation income to be reported in the annual tax

stare og ome we p40,000 .P380900

Abceon SEE snd ernest, ». ¥330,000 4.P390,000

resigned in 2015 after 12 years of service. S 3 falowing income

13, Corporations and individuals engaged in business or in the exercise of, * — Yeas cfserve. Ste athe

profession are required to repo ye year:

net of P80,000 withholding tax, P20,000 SSS,

000 Philhealth and P40,000 13 month pay P 40,000

Separation pay 1,000,000

Compute the gross income to progressive (regular) tax.

a. P1.480,000 560,000,

by the need to save from total income tax b P1'560,000 «480,000

‘may be restated by the BIR 4. niga Corporation is engaged in the sales of goods. it reported the following.

summarized financial statements during the eat:

an associated enterprise to the controling individual of a holding ‘sien 3,500,000

@ Anassociate of iary in the, Less: cost of sales 2.000.000

& Teparentconpany EP Pisoo 000

200.000

i 20,000

we aroup 10.000

Fr7e0000

ed the following income in 2015: lesa

sien Pzaocoa

4000 P 800,000

200,000

Gain from redemption ofsharesin amutual fund 10¢ 000

306

jor income Tax Incusion in Gross Income

crater 9 Rep

ol gossncome saeco regula

Compa eO ee Phe0O

& byro000 been

9 sa dmenicoperaton eared the olomng nomen 214

/

service ees PE oS

meres “I 40,000 1

te ne 80,000 30,000

Royalties ~ franchise

‘compute the total gross Income subject to regular Income tax

2 7970,000 .P800,000,

7860.00 44,700,000

st recy Ine isa resident foreign corporation, compute the gross income subjety

regular tax

a. 520,000 «.P400,000

. P480,000 4.440.000

“Andres leases a building toa cient. During the year. he received the folowing

remittance from the lessee

lewithholding tax P 1,900,000

Rental, net ofS

‘building $0,000

ed

200,000

P 30,000

70,000

Reimbursements for client expenses 40,000

Reimbursement for out-of-pocket expenses 10,000

How much wil be incuded in Crokts gots Income for regular inom tt

a P150,000

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet