Professional Documents

Culture Documents

Chapter 7

Chapter 7

Uploaded by

Fely Maata0 ratings0% found this document useful (0 votes)

3K views15 pagesOriginal Title

chapter 7

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views15 pagesChapter 7

Chapter 7

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

Chapter 7 - Introduction to Regular income Tax

CHAPTER 7

INTRODUCTION TO REGULAR INCOME TAX

chapter Overview and Objectives:

This chapter provides an overview of the regular income tax intended to acquaint

readers with the nature and tax structures of the regular income tax. It also

discusses regular tax reporting and income tax determination. Subsequent

chapters deal with specific aspects of the regular income tax.

After this chapter, readers are expected to demonstrate knowledge on the

following:

The scope of regular income and its tax model

The features of the regular income tax

‘The concept of inclusion and exclusions from gross income

‘The types of gross income subject to regular tax

‘The concept of deduction and personal exemption

‘The concept of deductions compared to personal exemptions

Measurement of gross income from employment and business and the

treatment of other income

8 The concept of operating income or revenue and the difference in tax

presentation of individuals and corporate taxpayers

9. The procedural computation of taxable income of corporations and different

individual taxpayers

10. The computation of the regular tax for individuals and corporations

11, The deadline of the regular tax returns

12. Applicability of the quarterly filing and its deadlines

None ene

CHARACTERISTICS OF THE REGULAR INCOME TAX

4. General in coverage

2. Anetincome tax

3. Anannual tax

4. Creditable withholding tax

5. Progressive or proportional tax

General coverage

The regular income tax applies to all items of income except those that are subject to

final tax, capital gains tax, and special tax regimes.

Net income taxation

‘The regular tax is an imposition on residual profits or gains after deductions for

expenses and personal exemptions allowable by law.

221

Chapter 7 - Introduction to Regular Income T=

oo

incor ‘applies on yearly profits or galt

The reel come tao ge cong method doped by pe

el ee a men Fe

seep:

redabe withholding tne

State cont re bie to ced

a age are vances

croton a deh oer

shholding tax (CWT). The

be deducted against repct

rrogesiveor prope

imposes fat oF proporuonal tax of 30% upon the taxable income of corpor

rape har he revigion ofthe corporate income tax inthe second package ofthe TRAIN

Law proposes a 25% corporate income tax,

‘THE REGULAR INCOME TAX MODEL

Pou

2x

Pos

Gross income consists ofthe major topics:

Exclusions of gross income - list of income exempt to regular income tax

Inclusions in gross income lst of income subject to regular income tax

‘Special topics ~ covers income that are either exclusion or inclusion depending

fon certain circumstances, such as:

Gross income - inclusions

Less: Allowable deductions

‘Taxable income

Dealings in properties

GROSS INCOME

Gross income constitutes all items of income that are neither excluded in gross

income nor subjected to final tax or capital gains tax. The items of gross income

subject to the regular income tax will be extensively discussed in Chapter 9.

Exclusions fr

These pertain

income tax. These

Gross income

ms of income that are excluded: hence. exempt from regular

Ibe discussed in detail in Chapter 8,

Excluded income vs. exemptincome

Excluded income is also exempt income. Excluded income are those listed by the

NIRC as exempt income from regular tax The term exempt income includes alt

income exempt from income tax whether final tax, capital gains tax or regular

m2

chapter 7 - Introducton to Regular income Tax

income tax. Exclusions from gross income are listed in the nption

income may be provided by the NRCor spec laws. NN Examen fom

ALLOWABLE DEDUCTIONS

Alone dedictions, oF simaly “deductions” are expenses of the conduct of

usiness oF exercise of profession. They are commonly known as. business

expenses » “

“The book sub-divided the vast topic of deductions as follows:

‘of Deductions - Chapter 13

able Itemized Deductions - Chapter 13-8

rable Remized Deductions & Net Operating Loss Carry-over -

4. The Standard Optional Deductions (OSD) - Chapter 13-C

For individual taxpayers there is a need to note the diference between business

‘expenses and personal expenses. Personal expenses or those that an individual

‘pends that are not connected to furtherance, maintenance or development of his

trade, business or profession are non-deductible against gross income.

Individuals that are not engage in business cannot claim deductions from gross

income. Consequently, individuals are classified as follows:

1. Pure compensation income earner

2. Pure business or professional income earner

3. Mixed income earner - an individual earning both compensation and business

oF professional income

Note on Person:

Previously, the

taxpayers. The amount of personal exemption depends on the number of

dependents who are supported by the taxpayer. Personal exemption is in lieu of

the personal, living, and family expenses of an individual taxpayer. Personal

exemption Is repealed effective January 1,2018.

In an effort the simply the tax system, the TRAIN law simply exernpts P250,000

annual income of the individual income taxpayer from regular income tax. This

‘Sxemption fs embedded in the income tax table for individual taxpayers. As such,

there is no need to separately deduct personal exemption.

xemption

provides for personal exemption of income of individual

[DETERMINATION OF TAXABLE INCOME

‘The taxable income of individuals taxpayers 1s computed using the Classification

{and Globalization rule.

23

‘chapter 7 -noducbon to Regular income T=

‘Classification Rule

Gross income is first classified into:

‘2. Compensation income

'b. Business or professional income

m Business income

Corea me arses, orn an_employer employee

Telatnship ts characterized by 2 power to retench giving the

Service 9 terminate he arrangement when he is losing n business. B

Sere a ertong of goods or rendering of services f0r a profit. Im seryet

siagemeres where the purchaser af the service BAS NO POWET to retrench te

income realized thereon isa busines Income.

‘Treatment of other income

Income that are nether compensation income nor business income such as those

possive income are simply classified as “other taxable income” and are added ty

gross income from business and profession.

Allowable deductions

Business expenses are deducted against gross income from business or

profession. No deduction is allowed against compensation income since personal

expenses of individuals for cost of living are deemed to be included in the

250,000 blanket exemption inthe income tax table

Other income which is neither compensation nor business or professional income

1s simply added to total gross income from business ot pro

‘operating income” If the taxpayer has no business or profes

‘same shall be added to taxable compensation income as “other

‘Taxable income of pure compensation income earner

‘The taxable compensation income of employees is computed as follows:

Gross compensation income

less: Non-taxable compensation

‘Taxable compensation income

Non-toxable compensation includes legalh

* legally mandated salary deductions and items

of compensation income that are exempted by law, contracts, or treaty from

{income taxation. The

in chapter 1g. he dae tax rules on compensation income wil be discussed

24

‘Chapter 7 - Introduction to Regular Income Tax.

‘Taxable income of pure business or professional income earner

‘The taxable net mcome of businessmen or professionals 1s computed as follows:

Dusiness/profession P

200,00

—— mms

Pome x

as

Eos

rome earner from both sources is simply globalized or

\come oF net loss when deductions exceeds gross income

from business or profession shall not be offset against taxable compensation

income because deductions are expenses of business or profession and are

properly deductible only against gross income thereto whereas no expense is

deductible against taxable compensation income,

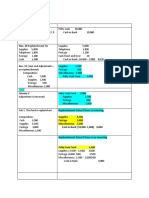

dividual tacome taxpayer

Case | Case2 | Case3 | Cased |

|? 300 008) 300,000 | P 300000

30,000 30,000 | 30.000

| #.400,000 | 400.000 | 200,000

"250.000 | 250,000 [250,000 |

20900. — 20,000 [— 20,000 {20,000

‘Taxable income shall be determined in each ofthe above case as follows:

Case 1: A compensation earner with other income

Gross compensation income

Less: Non-taxable compensation

‘Taxable compensation income

‘Add: Other gross income

Taxable income

P 300,000

30.000

P 270,000

70.090

‘B290.000

Case 2:A business income earner with other income

Gross business income

‘Add: Other gross income

‘Total gross income

Less: Allowable deductions

Net income

P 400,000

20.000

420,000

250.000

E120.000

2S

Chapter 7 -nreducton to Regular Income T=

ith ocher Income

‘P 300,000

30.000

P 270000

Case 3: Amixed income earner wit

Gross compensation income

Less: Non-taxable compensation

‘Taxable compensation income

P 400,000

20.000

P 420,000

250.000

Gross business income

Other gross income

Tota gross income

Less: Deductions

‘Taxable net income

‘Taxable Income

120.009

B.s40.000

Case 4: Mixed income earner - with net loss on business or profession

Gross compensation income P 300,000

Less: Non-taxable compensation

‘Taxable compensation income

P 270,000

Gross business income

‘Add: Other gross income

Total gross income

Less: Deductions

not clearly

bbe made in accordance with such

er, clearly reflects the income,

26

‘chapler 7-Introducton to Regular income Tax

Inshort.

Determination of Gross Income from Business or Profession

Business selling goods

‘rom business on the sale of goods is computed as:

Po xxx

— as

Peas

he acquisition cost of the goods sold for merchandising or

f the goods sold mn the case of manufacturing.

Cost of sale of a trading business

or by the

Under the perpetual system, the cost of goods sold is determined through bar

Cost of sales of a manufacturing business

‘The cost of goods sold of a manufacturing business is computed in almost the

same way with those of a trading

inventories of a manufacturing bust

discussed in Chapter 13.

“Chapter 7 = Introduction to Reguar income Tex ‘Chapter 7 - Introduction to Regular income Tax

Mtustration

on

towing data during the yea": ing auditor had the’

‘Ataxpayer had the following, pissin i auditor had the following come and expenses during the year

Sonics 100,000 om

ales discounts 100,000

Sales etre 200.000 1400,000

Beginning inventory 2.500.000 20.000

0

‘returns and allowances ope 250,000

‘ 420,000

—_ 800,000 0,000

. RODS issued to audit staff 50,000

les shall be computed as follows: on office properties 20.000

Beginning inventory oye 400,000

Net purchases (P2.5M ~ P1SOK) : 50,000

fre ‘odors ? 3.150000 100,000

‘Total goods avilable for sale 3

lace bate evesnory 800.000 ‘The cost of services shall include only those directly incurred or related gross revenue

Costof sales B-2350.000 from the rendition of services such as

“The business gross income shall be computed a fellows: P 1,400,000

12,000

Sales (P4M ~ PLOOK - P200K) P 3,700,000 anon

Less: Cost of sales —2Ascon0 280.000

Gross income 24330,000 50.000

Eauz000

Business selling services

‘The gross income from sale of services or exercise of a profession is measured as “The gross income shall be computed as follows:

follows:

Revenue P 4,500,000,

Less: Cost of services 2112000

Grossincome Ete.o00

INCOME TAX REPORTING FORMAT

Service provers using the accrual

basis shall eport ther gross receipts.

5s These two are separately presented under the deduction category

“Regular allowable itemized deductions”

28

‘Chapter 7 nroducton to Reguiar Income TaX

distinguished is

sansreemeareipaarde ttl, yee oy

Reve 3 gener ot the business. Sales pertains

fee ang rm he panacea of He OER, Se rei

ee ee

reer om a of os acon em tesa 88 Fever

are commonly used to denote the income

ing rerenen

‘The terms ste or fes or simply revenes Er tra recepts is used to denote the

OT taxpayer xing te acon as

Income a expayers ing the cash bass

fevenue vs. gross income

Revenue vs gross move pearing to the ttl return ina tansaction which

includes the return of capital and the return on capital, Gross income is a net

‘concept pertaining tthe return on capital in a transaction Gross income is net of

the cost of sales or cost of services.

Other taxable income from operations

Other tarable income from operations includes revenues or receipts from

incidental or secondary operations aside from the primary operations,

a

wien pi vs bone ob i

Acoli tt Soran pecrorioe

ener etree

Se alee Ae ae

reer

LT ail he pn oi iy ci iti.

Tebelattiies

Se cin

has the receipts from passengers and baggage as

‘primary revenue, but may earn income from bus stop restaurants and washrooms

as other operating revenues.

Non-operating income

‘Non-operating income includes all other tems of gross income such as:

4. Gains from dealings in properties

Being net of costs, these are gross income items rather than revenue. They are

not part of “Sole/Kevenues/Receipts/Fees" but of “Non-operating income”

individual taxpayers

Dealings in properties pertain tothe sale, exchange and other disposition of

Properties bythe taxpayer The rules on gains in dealing in properties nat

230

‘chapter 7 - Introduction to Regular Income Tax

covered by the capital gains tax willbe discussed in Chapter 12 under regular

{income taxation.

2, Income distribution from a gen

trust or estate, or from an exemp

Income dist

income, hence

3. Casual active income

‘This includes acuve income from isolated or one-time transactions such 35

casual carpentry income of a person nat engaged in carpentry business. Any

expense on casual transactions is set off with the casual income. The net gain

‘oF income is a non-operating income.

Passive income not subject to final tax

‘income not connected with the business ofthe taxpayer

final tax such ‘onadvances to employees and

from foreign corporations. Similar to casual income, these do not

from the regular business operations, hence, classified as non-operating

income,

Professional partnership, taxable

‘venture

are not revenue, but stems of gross

-operating income of individuals

tMustration

{An individual taxpayer who is using the accrual

wn his manufacturing business

ling year:

Sales, net of returns, and discounts P 4.000.000

Cost of sales 100,000,

Dividend income, net of fina tax 36,000

Business expenses 1,600,000

Gain on sale of old equipment 100,000

Sale of scrap metals 200,000

Interest income on employee advances 435,000

Gain on sale of domestic stocks directly toa buyer 10,000

‘The business income of the individual will be presented in the income tax return as

4,000,000

200.000

P 4200000

—Lag0.000

Gross income trom Business/Profession P 2,400,000

‘Add: Non-operating income

Gain on sale of equipment P 100,000

Interest income on employee advances 45000 __14s.000

Total Gross Income 2545.00

231

chapter 7 -Inoducton to Regular income Tax

‘Total Gross income P 2,545,000

otal Gross .

Total oss ble deductions (Busines Pen )

Netincome

like the dividends and capi

neorne subject t0 FRU

[Motes income items subject te final

merSccuded in the computznon of the Bross

Renorting Format or Cormarate TAXPAvErS

P somxer

cevenves/Receipts/Fees

net saesevees/ ee

Gross income from Pwo

‘ad ter enable neon me

‘Total gross income roo

Lass Alowable deductions a

Pas

ote For corporate taxpayers revenues of ects fom secondary OF Iniden

ny Revenses/Recipes/ees”

‘operations wil be included under the cl

Other taxable income not subject to fal

ms o sme whether or not arising from the

from dealings in properties, income

and other passive income not subject to

Mlustration

Assuming the same data in

corporation, the business incor

the previous illustration except that the taxpayer is

be reported as follows:

Wet Sates/Revenues/Receipts/Fees (P4M + PO.2M) P 4,200,000

Less: Cost of sales —{g00.000

P 2,400,000

Total — Ast ene

oat P 2,545,000

Less: Allowable deductions (Business expenses) 800.000

245.000

Netincome

fence in. presentation between individuals and corporations is

i Stndar ection (05D) The bass ote OSD OF

(otal revenues or receipts from operations while the

ns 1s on total gross income subject to regular

from the regular business operations.

fncome tax whether or not they a

232

chapter 7 -Introducton to Regular Income Tax

pparate bookkeeping for business and professional practice

Individual taxpa} ged yess or exercise of a

wsactions from business

‘of the individual taxpayer must not be

5 or professional practice.

‘this is important in the tax treatmer

cannot be deducted again:

allowable perso’

the actual personal, family and cost

[TYPES OF REGULAR INCOME TAX

1. Individual income tax

7300.00

ve P2,000,000

‘Above P8,000,000

Noe: Eumineesarenaereured tomar isa tole for Board Exam purposes

sep ecogressive (ax covers all individuals inctudingtarable estates and trusts

‘except NRA NETB which is subject to 25% final taxon gross income

Illustration 1: Income Tax Computation

‘A resident cauzen with has 2 compensation Income of 1,250,000 within she

Philippines and P150,000 from abroad

“The income tax due shall be computed 25 follows:

233

‘cnaptet 7 - Introduction to Regular income Tax

‘The 8% income

for two taxes whi

‘of tis tax system wil be exter

e-tume compliance

Wg and payments. Details

4

fly by bracket marginal rate

ea income ax v6

10% on taxable income, The

foreign corporation and FCDU

Mustration

Mlustration 2: Income Tax Computation ‘A corporation has a net income of P1,200,000 in the Philippines and P800,000 from

‘Arresdent alien has a net business net Income of P2,200,000 in the Philippines ang abroad, " ene

1,250,000 from abroad

corporation Is 2 domestic corporation, the income tax due shall be

‘The income tax due shall be computed as follows: computed as follows:

Tatu ‘Taxable income (world) P 2,000,000

‘Taxable compensation income P 2,200,000

Less: Lower lim ofthe income bracket Income tax due Ecos

& wherethe table income qualifies. — _2,000000 P 490,000

Fewcess P 200,000 [Assuming the corporation is a resident foreign corporation, the income tax due shall

P 1,200,000

ite

2 Sano09

3 x wxable on glbal income while resident foreign

Corporation is taxable on Philippine ncome.

Note: Rec thata resident sin is tacable only on Phlipioe income

‘The Optional 8% Income Tax

computed as 2% of total

i ced an optional income tax for self-employed and or tae orp os CN OE

losing in business, they are

1S-B,

Spectal Corporations

‘The 896 income tax shal bein lieu of the:

a. Progressive income tax, computed under individual tax table; and

'b. 3% percentage busines: tax on sales or receipts.

re those enjoying fower tax rates but not 096, such as such

wn-proRt hospials and PEZA or TIEZA-repstered enterprises.

corporations will be discussed thoroughly in Chapter 15-A.

2S

238

chapter 7 -voducton to Regu income TA

Exempt Corporations enjoying 0% tax rate with no tax dues 5

Exempt corporations are th uch

fempt corporations sions with no taxable int ®

5, non-profit organizat le in

government agencies, non raft ie Board of Investments (BOI) eng

‘cooperatives, and those reg! sion

income tax holiday or TH.

INCOME TAX RETURNS

Inaivduat income TaxRetuNs

(iasiteturmForm | Tndildval taxpayers ~~

Form 1700 Purely employ

Form 17014 Purely in business or profess!

opting to the 89609

Form TOL — [Mid income

[— ‘Corporate inc

Corporations siyec nk

It should be noted that exempt corporations are required to report thei

they do not have taxat

1B compliance of exempt

corporanon tax obligations and to provide for 3

‘mechanism to identify income earned by third parties.

Exempt corporations with gross income subject to the regular corporate income

tax or special rate shall file BIR Form 1702-MX,

of filing the income tax return

me tax return s due for filing on the 15% day of the fourth month

taxable year ofthe taxpayer. The income tax due shall be paid upon

Hence, an aunt for P10049 shall be entered inthe

An amount of P100.50 shall be rounded to P101, income tax return 35 FOR

236

“chapter 7 - Introduction to Regular income Tax

Required Attachment in the Annual Income Tax Return

Independent CPA - if annual sales, earnings, receipts or output

for taxpayers wit es per tax r

egime

form and financial statements (FS) showing:

services

1Rand other taxable income

ons (i taxpayer did not avail of OSD)

formation prescribed to be

of management responsi

tax payment and the return previously fled

celef/Enuitlement issued by the concerned Investment,

INCOME TAX RETURN

juals engaged in business and those engaged in the

pract e required to file three quarterly returns aside from the

Annual consolidated income tax return

Individual taxpayers engaged in business or practice of profession shall file thei

quarterly income tax returns using BIR Form 1701Q Corporations shall file thear

quarterly income tax returns using BIR Form 17020

12x payments, These quarterly tax payments

Taxpayers make est

‘to the annual consolidated income tax due

are claimed as tax creé

of the taxpayer.

Deadline of Quarterly Income Tax Returns

‘Quarterly Income

Tax Returns

chapter 7-Invoducton to Regular I9com Tex

ssofindwiduals engaged in business or profes,

ion

=

arter tax recurs

atte er first three quarter whereas the quarter

due 45 days from the end of the ve

due 45 ye Feaporaeaspayesare due 60 Gays from the end ofthe guano

requency of Reporting Per Taxpayer TYPE

ee ————"] ocqueney of Wan Babs

Taxpayer _____| Freaueney of Tax Reporting

Tndiviuals

Pure compensation income earner.

in business or profession

‘Arawal

Purely engage:

Mixed income carne

‘Corporations “Quarterly & Annual

‘The substituted fling system for employees

aan erpensidon income earners may be relieved from the obligation tg

they have no taxable income from other sour,

ee ener

‘other from their lone employer.

i withhold the income tax of the employer,

_gstem wherein the employer shall

‘compensation.

aro required ithe employee bas other taxable income or has more

employer, either concurrent or successive, during the year. ‘omen

238

chapter 7-Inroducbon to Regular Income Tax

(HAPTER 7: SELF-TEST EXERCISES

piscussion Questions

Diserrecuss the scope of the regular income tax especially on passive income and

acteristics ofthe regular income tax.

in gross income?

ble deductions from personal exemption.

Pommonstrate the computation of the gross income from employment and the

igross income from business or exercise of profession ne

Frow is cost of goods sold determined?

‘What are included in cost of services?

iat arsmposes the compensation income of a rank and file employee and 2

igerial and supervisory employee?

ion of the ¢

uals and corporate taxpayers?

"from non-operating income.

exe

9, How does the tax pr

revenue from sales, fees, and receipt.

how the taxable income ofthe Following is determined:

jonal income earner

business or prot

‘imcome earner

tment of net loss from business or exercise of profession.

idlines of the quarterly regular income tax for individu

b. Purely compensation ea

©

é

13, Disc

14, What are the dea

corporations?

als and

‘True or False 1

1. There are two types of regular inco

corporations and progressive co

2, NRA-NETBs and NRFCs are also su

3. All taxpayers are subject to final

‘4. Taxable income is synonymous to net income,

S._ For all taxpayers, table income means the

Subject to capital garns tax and final tac essa

gular income tas

‘expenses from their employment as deductions

‘inal tax and capital gains tax are excluded in

oportional income tax for

als

ygome tk,

items of gross income not

fable deductions.

‘compens

: gross income subject

ross income subject to regular

150,000 income tax exemp!

ersonal and business expen:

10. Non-taxable compensation are items of compensa

gross income.

ax,

Yor individuals is designed to be in lieu of

sion that are excluded against

239

‘chapia 7 Inoducton to Regular Income T=

‘True or False 2

1

come is computed 25 8F9S5 COMPensation Igy

me. .

the quarterly income tax return

43, Business expenses can be deducted against all types of

by multiplying their gross income,

come tax return of corporations using the cal

ixed for individual taxpayers. il

10. Every 3 taxpay from income tax on compensation up

250,000 annually but the same exemption does not apply to business income,

‘Multiple Choice - Theory: Part 1

regular income taxation.

fringe benefit taxation.

2, Active income is subject to

a regular tax.

b. capital gains tax.

Question 3 and 4 are based on the following:

A Regulartax —B.Finaltax —_C.Capitalgains tax

Which ofthe foregoing are passive incomes are subject to?

a Aonly Both Aand B

final tax,

4.any of these

b Bony 4. Either AorB

‘4. Which ofthe foregoing are capital gains

a Acnly c

‘Chapter 7 - Introducton to Regular income Tax

¢ corporate taxpayers only.

4 taxpayers engaged in business.

«corporate taxpayers only

4 taxpayers engaged in business.

ture of the regular income tax?

Annual tax

4.Creditable withholding tax

business only,

‘oportional regular income tax

corporations only. engaged in business.

‘compensation earners only. d.both individuals and corporations.

Fh of the following individual taxpayers is not subject to tax on taxable

¢.NRA.NETB

b Residentalien Non-resident alien engaged in business

16, Which of the following corporate taxpayers is not subject to tax on taxable

income?

‘2. Domestic corporation _«. Non

b. Business parmership Resi

mi

wwe escent one

enonemecorane mt

i ign don rt

erm ae

—

vm nen

* ‘a Interest income from bank deposits

eo

i

© inning rom he Philipines

Feet Nenet income of general pefessional partnership

income but is nevertheless subject to

final income taxation? i

0c Merchandising income

4 Dividends from domestic corporations

Deductions from gross income

D._ Personal exemption

‘Which isnot considered in the determination of taxable income?

a AandB cDonly

%. CandD 4.BandD only

of employees maybe sujet final

al ring benefit?

yes e Ranken le employee

loyees dAand B —

Yoon n prog ne?

onincome by etal sore

B Fatstomdberendenngotsernea

22

‘chapter 7 -Introduchon to Regular Income Tax.

Interest income from advances to employees

@. Sale of serap

©.Gate recelpts of cockpits

4.Gate receipts of cinemas

9, The reporting classification of gross income into operating and non-operating 1s.

unnecessary for

‘a Corporate taxpayers

._ Individual taxpayers

Both Aand B

Neither Anor B

‘oF supervisory employees

and file employees

ired to Me quarterly declaration of 2ome?

is engaged in business

jons and individuals engaged in business

CChapler7- Invocton to Regular income TAF

13, Me Jones wishes to le his 2019 income Ax FeCuT. Toateldvenly hema gy

greta on or bere, August 15,2020.

November 15, 2020.

1A: An dal eaxayer mst Re come tr Fe. OF Che third quar

019 onor before

a ap s,202, «.November 15,2020.

B pngust 15,2019, d.Novernber 15,2019.

ising ts income tax return for the quarter ending Februay

7019. The return must be fled on or before

‘2 April 18,2020 Apr 30,2019

Bb Angust 15,2019 d March 30,2019

116, Which ofthese taxpayers is required to file an income tax return?

2. Anemployee covered by the substituted filing system.

income st

. Ataxpayer deriving purely pas

fen with respect to his compensation

nt citzen who derives his entire incor

from sources outside the

17. The taxable income of corporate taxpayers isthe

a, netincone from business.

1b net income from business less personal exemption,

taxable compensation income.

taxable compensation income plus net income from business.

16, The taxable income ofa pure compensation income carner fs the

1a. net income from business less personal exemption.

taxable compensation income plusnet income from business.

taxable compensation income.

4. netincome from business.

19, Thetaxable income ofa

4 netincome from bus

b._netincome from bus

taxable compensation income.

d._ taxable compensation income plus net income from business.

sncome earners the

less personal exemption.

‘a netincome from business.

taxable compensation income

taxable compensation income plus net income from business.

net income from profession less personal exemption.

Bes

2s

Chapter 7 - Introduction to Regular Income Tax

tements is incorrect with respect to the determination

\dual taxpayers with other income?

eof pure compensation earersis simply incuded n taxable

me ofa professional Income earner fs included as part of non-

operating income and treet

The other income of

'd income earner is also treated as part of non

luded in net income.

ly ignored in the computation of taxable income.

22, Statement 1: Individuals with higher income are subject to higher tax rates.

‘Statement 2: Corporations with higher income are subject to higher tax rates.

Which is correct regarding the regular income tax?

4, Stotement tenly ——¢ Both statements { and 2

24, Which is incorrect in the determination of the taxable income of Individual

law. there is no instance where the compensation income of

taxpayers could become zero.

1b Anet operating loss is deductible against taxable compensation income.

¢._ The tanable compensation income ts added to the net income from business

4. Personal exemption isno longer deductible against compensation income.

‘24, Statement 1: Corporations with the same net income may not have the same tax

due.

Statement 2: Individuals with the same net income may not have the same tax due.

[Which statements incorrect regarding the rewslarincome tax?

a. Statement «Both statements 1 and 2

b. Statement 2 None

25. A purely engaged in business individual taxpayer shal use

a. BIRForm 17014 ¢.BIR Form 1700

b. BIR Form 1701 {BIR Form 1702,

26. BIR Form 1701 Is not intended for

a Estate ‘c Pure professional income earner

b. Trust Mixed income earner

27, BIR Form 1700 is intended for

a. Trust ‘Pure compensation lacome earner

b. Estate 4 Pure business or professional income earner

245,

rrtuctan Rogue no TAS

enacts shalt

2a horn bs Fr 170.MK

ie

4 Form 17014

tna wzable income shall use

‘e Form 1702-MK

4 Form 17014

preferential special axrate shall use

30 Asoo which eau 1702-MX

1702-RT

a fom a Farmi70IA

only toa 30% income tax rate shall use

:

3 ke efor UE MK

‘Mattiple Choice ~ Problems 1

45

Form 17014

irs Sancher Mira bad a gross taxable compensation income of P400,000 She

a ean addtional 2,000 by investing her money i time deposits plus P3 oy

sare nme from lending money toa frend. Compute her taxable income,

a 7303000 1 F300,000

302,000 4.403.000

Mz Caveria had a business net income of P300,000. She also earned PSo5p

semicon fom seling cellular cards and P12,000 dividends from a domes

corporation. Compute her taxable income.

2 P300,000 ‘.P30S,000

312000 4.P317,000

Hr, Pamplona earned total gross

Pamplona?

a 490,000 «P500000

». P460.000 4.P600,000

Mr. Monreal earned 2 gross compensation income of P200,00(

865 of P170,000 during

‘compensation income? a

2 30000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet