Professional Documents

Culture Documents

Chapter 8

Chapter 8

Uploaded by

Fely Maata100%(1)100% found this document useful (1 vote)

4K views14 pagesOriginal Title

chapter 8

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(1)100% found this document useful (1 vote)

4K views14 pagesChapter 8

Chapter 8

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

Chapter 8 - Regular Income Tax: Exclusion from Gross income

CHAPTER 8

REGULAR INCOME TAX:

EXCLUSIONS FROM GROSS INCOME

Chapter Overview and Objectives

This chapter discusses the items of income that are excluded from gross income,

hence not subject to income tax under the NIRC. It also includes discussions of.

other exempt income under special laws, treaties, or contracts.

After this chapter, readers must be able to demonstrate:

1, Mastery of the list of exclusions from gross income

2. Comprehension of exclusion conditions or limitations of certain items of

income

3. Knowledge of the list of entities exempt under the NIRC and special laws.

EXCLUSIONS FROM GROSS INCOME

Exclusions from gross income are income which will not be subject to income tax.

They are not included in gross income subject to regular tax, capital gains tax, or

final tax.

Under Sec. 32(B) of the NIRC, the following items shall not be included in gross

income and shall be exempt from taxation:

Proceeds of life insurance policy

Amount received by the insured as a return of premium

Gift, bequest, devise, or descent

Compensation for injuries or sickness

Income exempt under treaty

Retirement benefits, pensions, gratuities, etc.

;. Miscellaneous items

1. Income in the Philippines of foreign government or foreign government

owned and controlled corporations

Income of the government and its pulitical subdivisions

Prizes and awards in recognition of religious, charitable, scientific,

educational, artistic, literary, or civic achievements

Prizes and awards in athletic sports competitions

Contributions to GSIS, SSS, PhilHealth, Pag-Ibis, and union dues

Contributions to Personal Equity Retirement Account (PERA)

PERA investment income and PERA distributions

Pamoop>

oN

Mowe

249

sia ncome Tax Exiuson fom Gross Income

ts not exceeding P90,000

ures, or certificates of indebtedness wig

chapter 8 - Reg

benef

8, 13% month pay and other

9. Gains from sal often ee

maturity of more than .

net gen stares mua nd

EXCLUSION FROM GROSSINCOME

me. Life is

surance is a return of capital.

'B. Amount received by the insured as a return of premlum - The amount

Feceived by the insured asa return of premiuims paid by him under life insurance,

‘ndowment or annuity contracts either during the term or at the maturity ofthe

{erm mentioned in the contractor upon surrender ofthe contract,

‘The amount received by the in ium on any insurance

contracts a retur of capital; hence its excluded from gross income,

insurance policy with annual premium

payments of P20, berto outives the policy after the 10° year, he

‘willbe paid a PS00,

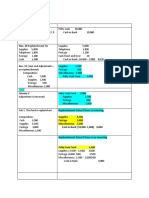

‘Scenario 1

Alberto died on the 8 year of coverage and his

proceeds. The entire insurance proceed: ofPI,000,000 is

lected the P1,000,000

ble.

nce company negotiated for an extension of the

insurance company shall pay P1,050,000 on the

The P',000,000 proceeds wil not be taxed upon callection, but the

50,000 excess representing interest is taxable item of ross income.

Scenario3

‘Alberto outlived the policy and collected the maturity value of P500,000,

‘The total proceeds shall be analyzed as:

Total proceeds

Return of premium (720,000 x10

Return on capita (item of gross

P 500,000

200.000

2 eo.009

chapter 8 - Regular income Tax: Exclusion from Gross Income

Scenarto+

‘ter 6 years of payment, Alberto assigned the policy to Gino who paid him P130,000.

Glino continued the premium payments for two more years afer which Alberto died.

tino 1,000,000 insurance proceeds.

‘The assignment oF sale of the policy by Alberto to Glino for P130,000 resulted énto

120,000 (P20,000x 6) return of premiums and P10,000 taxable return on copftal

‘The receipt of the insurance proceeds by Gtino resulted in P170,000 return of copital

{730,000 + (P20,000 x 2)] and P830.000 taxable return on capital There s lass of ife In

doe the purchaser ofthe life insurance policy. Hence,

resting to note that the entire proceeds

thin the purview of the NIRC exemption; he

Property insurance contracts

of property insurance contracts in excess of the tax basis of the

or destroyed isa taxable return on capital

sd by fire when the

0. Antec recovered the

The total proceeds shall be analyzed as follows:

Total proceeds

Less: Bass of property destroyed (return of capital)

Return on capita (tem of gross income)

P 2,000,000

1.200.000

B_200,000

Gifts, Bequests, and Devises or Descunt - The value of property acquired by

if, bequest, devise, or descent: Provided, however, that income from such

Property as well ax git, bequest, devise, or descent of income from any property,

in cases of transfers of divided interest, shall be included in gross income.

sd a restaurant business as a gift on A

ad total properties amounting to P400,000.

‘earned since January 1, 2020, The restaurant posted an additional P150,000 cash

Income from April i to December 31, 2020.

21

Gross income

crate 8 - Regu rca TO =

0.00 t Mark 1 3 sue

properties Wort 4,000 donated income shal be ncaa

net eg cee TRE PS0 00 Kone gg

i ct re nation eel of gy

fir the dome.

income inthe tax re"

‘indistinguished from exCR40E® .» ye evaluated in determining, whether

‘The transferor’ intention OF MORO eg are characterized BY ure liberality oy

cer gare en an el An exchange ala,

fmvivesa conser

Eplment aaet pee sans 6 Roy ee

ratutes given wnder

ae 2 ee rmplayes. Hence, they are subject 0 come ty,

managerial or supervisory employees ig

as ot major anniversary gifts granted by

efit subject to income tax

‘The cransfer of properties bythe employer (0

generally subject to fringe benefit tx Ci

Ere employer to employees are de mi

1. Compensation for injuries and sickness = amounts recewed through

acadent or health ins ‘Workmen's Compensation Acts as

Seaton fr personal injuries or sickness ps the amounts of any damages

cant whether by suitor agreement, on account of such injuries or sickness

‘by a jeepney He paid P100,000 for hospitalization expenses. He sued

aoa esos awarded by the court 2 total indemnity of P340,000

iows. P200,000 indemnity for his pain, anguish and sufferings, P40,000,

ies and P100,000 as rembursement for his hospital bi

‘The P200.000 indemity and the P100,000 relmbursement for hospitalization expenses

drenon-tarable returns of capital. Note that health isa capital iter with infinite value

However the 40.000 reimbursement for lost salary Isa recovery of lst profit: hence, an

tem of gross come

lustration2

Pogi's brand new car which he Bought for 1,200,000 was totally wrecked in a car

Mr. Pgi escaped unharmed. He was paid P1 300,000 forthe accident.

‘he 710000 exces ineniy santo of rs income Noe tha the ow pata

Pesala en mn oetnsorpopety nn ee

Income exempt under treaty

Income tems that are eile by

ine goverment

fe tat eayapeemens oversde p

{ase of oft nae the exemption dete of narrauna com

252

ich the

ational agreement to

luded from income tax. It

chapter 8- Regular Income Tax: Exclusion fom Gross Income

fF. Retirement Benefits, Pensions, Gratulies and others benefits

[Retirement benefit under RA. 7641 and those recelved by officals and

pyees of private firms in accordance with a reasonable private benefit plan

ed by the employer

mneumonics: 1-10-50-RPEP)

ent of retirement benefit exemption.

mmployee has been in the services of the same

crap 0) years.

‘The retiring employee is at least fifty (50) years of age at the time of

retirement.

4, The employer maintains a reasonable private benefit plan.

the officials or

ig co such offi employees the

‘and wherein itis provided in said

‘at no time shall any part of the corpus or income of the fund be used for, or

fed to, ay purpose other than for the exclusive benefit ofthe said officials and

employees.

‘To be exempt, the retirement benefit plan must be a “rusteed" plan where the fund is

Raid under the management of a trustee free from both emplayer and employee

control.

“The 10-year service period requirement pertains to cumulative yeors of employment

auth the same employer. It does not need to be continuous years of employment. A

Tequirement for continuous employment would be prejudicial to working women

Mlustration 1

nga was employed in 1990 when she was 25 years old. In 2020, she availed of the

early retirement program of her employer.

‘Angel satisfied the 10-year cumulative employment requirement but she is only 45 years

ld (ue. 25 + (2010-1990) at the time of her retirement. The retirement benefit is

taxable isan inclusion in gross income as compensation income.

Mustration 2

ipsounne that Angel joined another employer and worked therein for 7 more years ater

‘which she retired from her employment

‘Although Angel s 50 years old by then, she only 7 years under the employ of her second

employer, The second retirement benefit is aso taxable as compensation income since

she failed the residency requirement.

253

Cchapler 8 - Regular Income Tex: Exlusion ftom Gross Income

Mlustration 3

Assume instead

worked therein

another empl

efit from the second employer is tax

ee ra to rbot extn can be led fon once nang

2, Separation or Termination

Requisite of exemption:

1. The separation or termi

deaths, or other physica

2. The same must be due to any cause beyond the control of the employee op

official such as:

a. Redundancy

b. Retrenchment

Closure of employer's business

4

e

ion must be due to jobsthreatening sickneys,

Employee lay-off

Downsizing of employer's business

Sickness or death ofthe employee

‘The phrase “beyond the control of the employee” connotes involuntariness on the

part of the employee. In other words, the separation must not be of his own

making

‘Abandonment of office such as the registration and subsequent appointment to

another office is considered as a voluntary separation and does not fall within the

purview ase “for any cause beyond the control of such official or

ing 054-2001)

oF separation benefits does not extend to:

legal deductuons repaid by the employer upon termination

(BIR Ruling 003-2004

2. Terminal leave pay or the commutation of accumulated unused leave credits

(BIR Ruling No, 199-2

To avail ofthe tax exemy

or certificate of exemy

required documents shall be

Mlustration 1

‘Ywonne isan employee of Goldfish Company w'

‘Yvonne's last paycheck shows the following det

254

ie employee or his heirs shall request for a ruling

fom the BIR. The request for a CTE and other

at the RDO where the employer is registered.

losed its business during the year

‘chapter 8 - Regular Income Tax: Exclusion from Gross Income

Unpaid salary in the ast two months

P 30,000

corzeenh oly 15,000

Separation Pa

ore Bass.009

‘The current month salary and the P30,000 backwoges are subject to income tax. The

7104000 separation pay sam exlsion fom gross come: hence net tance

Mlustration 2

Henson's employer was downsizing

‘among others to be laid off. To avoid

filed a resignation letter to the compa

ss operations. Henson was identified

5 of inefficienctes on his part, Henson

received a separation pay of P120,000,

‘The separation pay is axable as compensation income since the underlying reason of the

severance of the employment (ce. resignation) is within the control of the employee.

Henson got terminated witho

employer decided to terminate his services but granted him P1,000,000 separation

‘The P1,000,000 separation pay is taxable as STD does not normally render the employee

incapable of working.

3. Social Security Benefits, Retirement Gratuities, and Other similar benefits

{rom foreign government agencies and other institutions, private or public,

received by resident or non-resident citizens or aliens who come to settle

permanently in the Philippines

Mustration

John was an OFW employed by Microsoft Corporation in the USA. John retired and

returned to permanently settle in the Philippines. He is paid a $2,000 monthly pension

from Microsofts pension fund and another $800 monthly benefit from the US social

security benefit.

Both the pension and the social securiy benefits are exempt. Note that these benefits

‘were carned abroad when the taxpayer was a non-resident Under situs rule, the foreign

Income of non-residents is not taxable in the Philippines. This holds true even if the

taxpayer subsequently recelves the Income as a resident of the Philippines

4. United States Veterans Administration (USVA) - administered benefits

tunder the laws of the United States received by any person residing In the

Philippines.

255

chapter 8 - Regular income Tax: Excuson fom Grose Income

‘Mustration ei

Mr, jackson is a retired US serviceman from ©

Filipina and setted sn the Phibppines. Hess rece!

the USVA.

The USVA beneficis excluded in

beneficiares of Flipino veterans wh

|S Social Security Systems(SS5) benefits under RA 6282

6 GSIS benefits under RA 6291 including retirement gratuity received py

government officials and employees

(war. He married a beg

2 $1,000 monthly benene a

ross income. The some rule applies £0 USVA benef

* fought under the American flag in World War

G. Miscellaneous items

1. Income derived on investments in the Philippines in loans, stocks, bonds,

or other domestic securitles, or from interest on deposits in banks in the

Philippines by:

a Foreign governments

‘Financing institutions owned, controlled, or enjoying refinancing from foreign

government

‘c. International or regional financial institutions established by foreign

‘governments

‘These are exempt under the exemption doctrine of international comity

2. Income derived by the government and its polltical subdivisions from:

‘a. Any publicunlity or

b, Exeraise of essential government function

Government agencies and instrument

The general rule with governm:

because of their public service nai

in income-producin

gencies and instrumentalities is exemption

. However, taxation applies when they engage

‘hare proprietary or commercial in nature.

This exemption does not extend to government-owned and con

corporations (GOCCS), GOCCs are generally taxable as regular corporations

because their operations are proprietary in nature.

3. Prizes and Awards made primarlly in recognition of religious, charitable

stent educational arte leary reve achlevements toy fe

‘a. The recipient was selected without any action on his part to enter the contest

or proceeding; and

ts not required to render substantial future services as 3

jing the prize or award.

256

‘chapler 8 - Reguar Income Tax Exelusion fom Gross Income

prizes of this kind partake the nature of a un:

from income tax. These transfers are also exer

rect certed effort for the grant of the prize such

reaiured to render service prize such as joining a contest or 1s

nan exchange: hence, taxable as income.

ransfer and hence, exempt

Examples of exempt prizes:

a. Nobel Prize award

4. Prizes and Awards In Sports Competitions granted to athletes:

‘a. In local or international competitions and tournaments:

b. Whether held in the Philippines or abroad; and

Sanctioned by their national sports associations.

5. Contributions for GSIS, $5S, Philealth, Pag-Ibig and Union dues of

individuals

‘These pertain to the employee share in the premium contributions to Gi

PhilHealth, Pag-Ibig and union dues, The portion of the salary thus contri

‘exempt from income tax.

Under RMC No. 21-2011, the exclusion pertains only to the mandatory or

compulsory monthly contributions. Voluntary contributions to Pag big I, GSIS er

[668 in excess of the mandatory monthly contribution are taxable. Note that Pag

bigs now called the Home Development Mutual Fund or HDMF.

ustration

‘An employee has a gross compensation income of P400,000 in 2016. His employer

deducted P5000 SSS, P4,000 PhilHealth, P3000 HOMF, P2,000 union dues and

180,000 creditable withholding tax

“Thus the gross income subject to regular tax shall be computed as follows:

Gross compensat me 400,000,

Less: Excluded compensation income or contributions:

P 5,000,

4,000

3000

—2000 14.000

Gross taxable compensation income Paseono

ote: The creiable withholding ass no an exclusion in gress income but ata cregt which

{deductible against the income tax due ofthe taxpaye

237

19 Regular Income Tax. Exclusion om Gross Income

philHealth, and HDMF contribution,

1m of deduction against grass inconr

‘Chapter

‘The employer's share in SSS, GSIS,

exclusion from gross income but a

6 Contributions to Personal Equity Retirement Account (

6 nan contributors voluntary retirement account estab

Par unons of the contnbutor and oF his employer for the

{nvested in qualified PERA investment products

om

Each OFW ts allowed to contribute up to P200.000 per year to a PERA

cae oes re allowed 100.000 contributions per Year. Husband and wig

tach contribute up to the maximum allowable contribution. cn

Gsis Moreover, PERA coninbutors are allowed to claim 5% of thelr pegs

17. PBRAinvestment income and PERA dis

ERA investment income are exempt from taxes

regular meome lax). The PERA account assets wil be distributed back to the

Contributor either in lump sum, ife pension or in upon reaching th

lage of 5S orto his heirs or beneficiaries upon his or her death. PERA distributong

are kewise exclusions m gross income of the contributor or his heirs of

ibeneicianies asthe case may be.

tions

final tax, capital gains tax and

8, 13% Month Pay and Other Benefits received by officials and empl

public or private entities nat exceeding P90,000 ren

13th month pay and other benefit will be discussed in detailin Chapter 10

9. Gains frm sal of bonds; debentures, rotor certificate of indbtedns

with a maturity of more than 5 sears alice “

WF wounded wpon the same assunption that

jon. that longterm

vee tote frnongof ng term projets which sewed a

jeceiprentt cnn

ins noneer. dots ot incide “terest” (Kippon Life Insure

Company of the Philippines vs. CIR, CTA Case No. 6142) eae

ber 1, 2020. an individual taxpayer sold a 6-year term bond investment for

nce bonds bea 8 nea

ret aytble tery Decenie

equred at ,000000 fev onfanoary 30200

258

Chapter 8 - Regular Income Tax. Exclusion rom Gross Income

P8000

‘me gain from the sale of the longterm bonds is exempt becouse the bonds have &

maturity perod of ore than 5 years However, the acrued interest income sa item of

ras ncome subject to regular income tx

40. Gains realized from redemption of shares in a mutual fund company

the investor tna fon ®

‘The term mutual fand company shall mean an open-end and close-end vesmnen

Te Fong az defined under the investment Company Ae "

Mutual funds poo! the money invested by different investors and invest the money £

‘earn investinent income which shall add up to the net assets of

partic res from the fund

asset Valu

tosses by hi

the fund.

Mlustration

‘A taxpayer bought 10,000 shares from Golden Dragon Mutual Fund at P120 NAV per

Share, The taxpayer redeemed his shares when the NAV per share was P180.

‘The 600,000 gain, computed as {(P180 ~ P120) x 10,000}, on redemption is excluded

{from gross incame; hence, exempt from ta

‘The exemption is app: ded to rmtugate double taxation, Most of the

items of income of mutual

distribution of these to th

income tax. On the other hand, the exemption may have been intended to promote

the growth of mutual funds which are widely regarded as key partctpants 1m

providing liquidity in most financial market

OTHER EXEMPT INCOME UNDER THE NIRC AND SPECIAL LAWS,

{L._ Minumum wage and certain benefits of Minimum wage earners

2. Income of Barangay Micro- Business Enterprises Act (RA 9178)

3. Income of cooperauves (RA 95:

4, Income of non-stock, non-p

5. Income of qualified employee trust fands

259

‘Chapter 8 - Regular Income Tax Exclusion ftom Gross income

6: Business or profesional ncome of selfemployed and oF Professionals,

opted tothe 8% income tax

men ies

ae

I Enterprise (BMBE)

Para ney Mecrzenc eng or enterprise engaged in the PrOdCON, Processing

ae assay produces or commodtes, Mmchding aRTe-PrOCessIng. trae

‘nd services whose total assets including those arising from loans but exclusive gf

Bre ay se anh the porclar business entty’s office, plant, and equipment ae

‘itused do nt exceed 3,000,000

‘The tem service excludes those rendered by licensed professionals ang

partnership and corporations engaged in consultancy, advisory and similar

Services which are essentially carried out through licensed professionals.

include any individi

-ooperative, corporati

‘and/organized and existing und

the treasurer of a city or municy

ich buses entity or enterprise,

n, OF other entity incorporated

ne laws and registered with the office of

To qualify asa BME, an enterprise must not be a branch or a subsidiary of a lage

scale enterprise and ts policies, and modus operandi must not be determined bya

large scale enterprise such as in the case of franchises.

Te f the benefits and privileges of a BMBE, an applicant must secure a

certificate iperate as a BMBE from the Office of the Treasurer of the

city or municipality that has jurisdiction,

Tax Exemption on Income from Operations

Aside from other incentives afforded by the law, the income of BMBE from th

return. However, thetr non-operating, passive, and capi

appropriate type of income tax.

‘Mlustration

hhas a bakery with total assets of P4,000,000 inclusive of a lot with a book

hue of P1,200,000.

260

‘chapter 8 - Regular Income Tax: Exclusion rom Gross income

Gross income from sales of bread

P 300.000

wmissory notes of retail store clients ¢

sale of recipe books . Seo

idend income from domestic stocks. cate

Dis 10,000

Note that 2,800,000. excluding the lot. Hence,

business btained a certificate of authori

as. BMBE, the following items of operating income are exempt from income tax,

Gross income from sales of bread

P 300,000

12.000

Raizgo

fered as a BMBE, the P312,000 cotal operational

icome tak

income wl be subject to the rep

fither way, the royal

{income subject to regul

tax

Income and dividend income are exclusions in the gross

{ax but are inclusions in the gross income subject to final

Another illustration

Charis Santana has

derived a total oper

counting and auditing firm with total assets of P2,500,000. He

¥ income of P1,000.000 mn 2014.

1,000,000 is taxable since Mr. Santana is a professional service provider

fo be a BMBE.

Revocation of BMBE Tax Exemptions

‘The income tax exemption of @ EMBE may be revoked for any of the following

reasons:

‘Transfer of place of business

of assets exceeds P3,

‘om business, or cessation suspension of operations for one year

‘or omitting required declarations or statements

261

puny wi eb Af SE

prey inset ons

faves and fees if their accumulated reserve =

cats {DIOM. Otherwise, the AMOUNE Of sung

per Neat

from non-related SOUrCeS is fully tara

However, the income of any cooperative

foregut

n-stockand Non prone nities

Mom atone tat oe no Ea

Bar tcome fram operations, HOWeve

table.

for profit are exempt from income tax gy

their income from unrelated sources,

aed Esper wnt fos pata pension, stock Dons ope

ease ian af an employe for the benefit of some o all his employees is exer

from any income tax under the NIRC.

Conditions for exemptions of employee trust funds

Contributions are made to the trust by such employer, oF employees, or both

for the purpose of distributing to such employees the earnings and principal

tthe fund accumulated by the trust in accordance with such plan,

tb. “The asst of the fund shal not be diverted for other purposes other than the

‘exclusive benefit ofthe employees.

(QUALIFICATION OF EXEMPTION OF EXEMPT ENTITIES

Tax mcenuve or exemption 1 highly disfavored in law. It is not automatic

‘Taxpayers with exempuons or tax incentives under any existing laws or contracts

must establish their entitlement by filing required documents with the BIR

BMBEs need fo secure a Certificate of Authority. Cooperatives need to secure a

Certificate of Tax Exempoon/Ruling (CTE). Once exemption is established, it only

operates prospecuvely.

INCOME OF SELF-EMPLOYED OR PROFESSIONALS WHO OPTED TO BE TAXED AT

8% INCOME TAX

‘The income of self-employed and or professionals who opted to be taxed to the 64

income tax shall be excluded in gross income subject to regular tax, The 8% income

‘axis meu ofthe 3% percentage tax and the progressive income tax.

chapter 8 - Regular Income Tax Exclusion om Gross Income

INCOME SUBJECT TO FINAL TAX OR CAPITAL GAINS TAX

ikems of come that are subject to final income tax or capital gatns tax are not

tems of gr0ss income subject to regular income tax. Also, mcome items that are

exempted in the coverage of flaal tax or capital gains tax are not taxable to the

regular income tax

EXCLUSIONS VS. DEDUCTIONS

from gross income are not included in the amo

income tax return, The amount of deduction:

103s income but is separately presented as dedi

sncome tax return

table gross

luded in

st ross,

Exclu

D) Note to readers

Exeluston in gross income represents one ofthe exceptions to the general scope

of the regular income tax Readers are advised to master or, at least

familirize themselves with the list ond their respective excluston criteria

before proceeding (0 the next chapters of the book This ts ‘mportont in

‘sisting readers in mastering the regular income tax.

263

chapter 8 - Regular Income Tax Exclusion from Grose Income

CHAPTER 8: SELF-TEST EXERCISES

Discussion Questions

\e exclusions from gr

What capital items are considered

Enumerate the excluston cond

ules on res.

Tre caatustne froin gross compensation income In the determination

& Eoumer

9, Whats a BMBE?

10. What are the exemption conditions of an employee trust fund?

True or False 1

Tr The proceeds of fe insurance received by the heirs ofthe Insured upon his death

Is excluded in gross income.

received in excess of the premium paid in an insurance contragt

an item ol gross income.

in the gross income of the donee.

yuries and sickness constitutes profit; hence, an inclusion in

ross income

rer stferen that the employee rendered more than 10 years of sevice for bi

‘benefit to be exempt.

in employee can secure retirement benefit exemption only once in a

7. leis must that the employer maintains a reasonable pension benefi

retirement benefitco be exempt.

8 An-employse must have rendered more than 10 years of service before claiming

‘exemption for his termination benefits.

‘9, The income of the Philippine government from essential public functions is

‘exempt from any income tax,

10. Prizes paid to corporations are an inclusion in gross income subject to final tax.

11 Only the mandatory poruon of GSIS, $55, PhilHealth, and union dues can be

‘excluded in gr035 compensation income.

12, Social security benefits. rebrement gratuities, and other benefits from foreign

governments are excluded in gross income.

13, Social secure ber ment gratuines, and other benefits from foreign

pr luded mn gross income,

414, The gain from redempnon of shares in mutwal fund 1s an exclusion in gross

income subject to regular tax because its an inclusion mn gross income subject to

capital gains tax

15. 13* month pay and other benefits are taxable only up to P 90,000.

264

exclusion in gross income.

12, Anon-stock, non-profit entity is subject to tax on income from unrelated activities

13. Ageneral professional partnership can be registered as a BMBE

Income subject to regul

15. ASMBE must havea net asset nat exceeding P3,000.000 to be exempt

Multiple Choice - Theory 1

1s of passive income from abroad are subject to regular income

to

ypines are generally subj

is generally correct?

a mel «Both statements

b. Statement 2 Neither statement

Fue with the regular income tax?

ins of incotne are subject co final withholding tax.

cervals,

6 Income tax returns are not required.

4d Allofthese

265

Chapter 8 - Reguiar Income Tax. Exclusion from Gross Income

income tax?

tems of gross income not subject to Final tax,

Accounting period

‘Both statements | and 2 are true.

Neither statement 1 nor 2is true.

1 Staterment 2 tue.

Deductions from gross income are

a Personalexpenses. Either Aor B

b. Business expenses d.Neither Anor B

ring statement best distinguishes deductions from exclusion,

from gross income’

Jedutions can be claimed by citizens while P250,000 income exemption

Bath deductions and exclusions are deducted from gross income.

4 Allofthese.

tax does not apply to

len. c.non-resident citizen.

resident citizen,

8. Proportional income tax does nut apply toa

2 Domestic corporation

b. Resident foreign corporation

¢ Business partnership

General professional partnership

tncluded under the term “corporation”?

partnership _¢. Non-profit charitable institution

bk Go-ownership 4. Joint venture

30, The highest marginal tax rate for individual income taxpayers is

a 25%

b. 30%

‘Chapter 8 - Regular Income Tax: Exclusion from Gross Income

me axpayer snot subject to reel tax?

engaged nade orbusnes en

cin trade or business

€_Nonsreasdent alin engaged wiradeorbacoese

GL Nomsreidenalien not engaged intr o bases

13, Which is correct with respect to exclusions from gross income?

income but are subsequently deducted.

income but are added to the taxable income.

the computation of taxable income.

4, They are synonymous with deductions.

44, Which 1s correct with respect to deductions from gross income?

a, They pertain to expenses of generating items of business ot professional

gross income,

bo, They are excluded from the determination of taxable income.

lade all expenses incurred in the generation of any income,

d._ They include P250,000 annual income exemption.

15, Which constitute a taxable item of gross income?

‘a. Compensation for personal injuries

resin mutual funds

trom sale of government bonds

4. Income exempt under treaty

Multiple Choice - Theory 2

1. The proceeds of an insurance policy received by the corporation as beneficiary on

the life insurance ofits officer is

a agit

b, ataxable income,

2. Mr. Buguey wi snsurance with his daughter, Ybon, as the

‘Yoon was paid the entire proceeds when Mr. Buguey died.

|. an exclusion from gross income.

A policy holder who outlived the policy and received a cash surrender value in

isexernpt upon

fa the amount representing a return of premiums.

b. theentire amount received.

‘c. the excess of the amount received over the premiums paid.

4. Noneot these

287

‘Chapter 8 - Regular Income Tax Exclusion from Gross Income

44 The assigament of an ncurance poly at an amount I €x2e35 OF the Premigg,

iy is subject to

‘estate ta

4 any of these

|S. Awidow who collected the lite insurance proceeds of her decease husband ig

‘a exempt to the entire amount of the proceeds.

fe excess of the proceeds over the premiums paid

b. income tax

b. taxable: the hus

{Siro nemanatie aren tremmega te

premium,

6. The policyholder ofa life insurance contract outlived his insurance policy He way

paid ?300 000 upon maturity ofthe policy. He paid P250,000 total premium, What

fs the inclusion in gross income?

a P300,000 «,P50.000

. P250,000 apo

7. Which of the following is subject to tax?

a Proceeds of crop insurance

b. Proceeds of livestock insurance

ty under patent infringement suit

iite of exemption ofa retirement benefit plan?

2 Lo years af employment

b. The employer maintains a reasonable pension benefit plan.

c. Theretiree must be a senior citizen

4. First me availment of retirement exemption

9, Termination benefits are exempt from income tax provided that the reason for

termination is

nd the employee’s control. _c within the employee's control.

b. within the employer's cortrol. d. beyond the employe

tem of exclusion from gross income?

its politcal subdivisions

and conirolled corporations

4. Income ot fore

11, Which of the

roincome

Development Corporation

€ Philippine Charity Sweepstakes Otfice

268

chapler 8 - Regular Income Tax: Exclusion from Gross income

4. Philippine Health Insurance Corporation

112. Which is not an acceptable ground for exemption of termi

a. Mass employee lay-off iption of termination pay?

‘of gross income for taxati

ion purposes?

a Unrealized income « Income earned between related parties

Gallof these

14, Which is sub

a. Gainon

b. Gainon

Interest income on long-term bonds with a maturity period exceeding five

years.

4. Interest income on long-term deposits by individual taxpayers.

15. Which ofthe following is not an exclusion from gross income?

4d. Social Security benefits

‘Multiple Choice - Problem: Part 1

1. Mr Bisligo collected the P1,000,000 insurance proceeds of Mr. Pantukan which he

‘ought from the latter for P400,000. Before the death of Mr. Pantukan, Mr. Bisligo

sms of P200,000. Determine respectively the exclusion in gross

income and the inclusion in gross income.

‘a P1,000,000: PO «,P400,000; P600.000

', PO; 1,000,000 <. P600,000; P400,000

srrendered his life insurance policy and received a cash surrender

100,000 =: Determine

respectively the total exc ross income,

a. 800,000; P0

PO; P800,000 4 P700,000, P100,000,

died. His heirs collected the P2,000,000 proceeds of his life

insurance policy, Mr. Tarragoza previously paid a total payment of PS00,000 in

Determine respectively the exclusion in gross income and the inclusion

{In gross income.

a 2,000,000: PO ..P2,000,000; PO

'b, 500,000; P1.500,000 4. PO; F2.000:000

269

‘chapter 8 - Reguar Income Tax. Exclusion fom Gross Income

insurance proceeds of his bu

4c Mr Malla colected the #5,000000 fe insurance ro iy

Me Mallat orepegre. The buikig had a tan basis of 1 ne ig

se eh gece gee

omin groseneome

e ‘c. P4,500,000; P500,000

4. 500,000; P4,500,000

«.P100,000

a.PO

Juding its accrued incom,

a

6. Ms. Sindangan received a condominium ind

, 2014. The following day

Inheritance from her deceased grandfather on At

relates tothe property:

Fair value of property P 125,000,000

Rent income earned before death of decedent 4,000,000

Rent income earned after death of decedent 6,000,000,

Interest on deposits of rentals

100,000

(40% accruing after death)

How much of the above income will be included in the gross income of He

‘Sindangan and in the gross income of the decedent? “

4. P6,040,000, P4,060.000 c P4,060,000; P6.040,000

. P6.000,000; P4,000.000 d.P4,000,000; 6,000,000

7. Me. Dimataling was hurt in a bus accident. He received a total indemnity of

800,000 from the insurer of the bus. Mr. Dimataling, paid P250,000 in hospral

bills due to the accident. Compute the total amount to be excluded in gross

«.P550,000

4. P800,000

‘of P2,000,000

oyer's retirement

Sindangan

was awarded a retirement gre

Compute the total exclusion in gross income.

a. 1,700.00

b. 1,300.00

.P800,000

46. P2,500,000

270

Income Tax Exclusion from Gross Income

2.200.000

.P1;809,000

1m collected a total sum of P100,000,000,

ted PS.000,000 from rentals of

in gross income?

Compute the tatal exclusions from gross income,

a. P3600 © P66,000

61.000 471,000

12. Mr Henares received the following during the year

Donated properties » 200,000

Income of donated property before donation 50.000,

Income of donated property after donation 20,000

Inherited properties 100,000

How much i taxable to Mr. Henares?

a. P380,000 6.7 30,000

>. 80,000 450.000

13, Me-Tacurong has the following data during the year:

Baste salary 1.200.000

Income tax withbeld 5.000

136 month 9

ma 2,000

‘{300

1700

m

Chapter 8 - Regular Income Ta Exclusion fom Gross Income

500

social fond 2000

exclusions from gross income:

1 P96,000

4.P88,000

compre olan

sPiscon

2 Pinna

the reas company tha

ang coed 720008000 .

A, Mang Antonia of PAOD DOD when he re Ocared. Dy

Irn wih ad sgn op urn Pesce pane

ae i ee Tete oe ONE

mm gieo anon

5 Fone ‘rsmo0n

Multiple Choice ~ Problems: Part 2

1. Wary ot his deteriorating health conditions. Mr. Benigno resigned from his job x

ge 10 ater working as a supervisor for 12 years. He was pard F2,00

he P2,000,000 separation pay subject to income t

for Mr. Benigno's termination was beyond his contra,

, Yes because Mr. Benigno resigned.

_Norbecause Mr. Benigno worked for the company for more than 10 years,

Yes, because Mr, Benigno isnot yet 50 years old.

on

1 25,2014, Mr. Reynon was terminated by his employer at age 60 due

He joined the company in February 2006 and has since thea

ofthe company. Is Mr. Reynon’s retirement pay exernpt rom,

worked a teas

Income tax?

Yes, because is termination was beyond his control.

. No, because he was employed for less than 10 years.

ces because he isover 50 years ol.

4. No, because the employee is already a senfor citizen,

3. Ms. Henson reured from her job after 25 years of service.

atthe age of 23 and was promoted from an accounting cl

‘was. paid P2,000,000 total retirement

pension plan which was duly

Ms Henson cor Ms. Henson's fest ret

employment. How much is excluded from gross income?

2 Pe0,000 «© 2,000,000

b. P1.400000 4P0

Assuming Me. Henson transferred another

years of sence. The second employer

pension lund a5 retirement pay to Ms

registered withthe aiR

100 out ofits non-contributory

pension fund was also duly

am

chapter 8 - Regular Income Tax Exclusion from Gross income

{sthe second retirement pay exempt from income tax?

2. Bo, because this s the seco

ie Ms, Henson retired from employment.

ty a senior eizen.

1@ Ms, Henson qualifies for renrement pay

1 an emphoyee must work under one employer until retirement ro

retirement exemption

chess competition that was sanctioned by 8

applying for accreditation from the national

‘gross income?

av

onal competion.

GL Yes because the organizer 1s not an accredited sports organization

covered teleport technol

seconds, Due t

t coveted Not

where people can be transported over

hhe was awarded by the scientific

‘award in 2015. The total award was

‘community

tatement regarding the taxation ofthe award?

on sn grass income subject to regular income tax since

iy abroad

on in grass income subject to final tax since it is more

to regular tax since itis an

Inclusion 1 items of gross income sub al tax

4. The award san exclusion in gross income.

lowing relates tothe compensation income of Ms, Lamitan in 2017:

P 2,400,000

125,000

150,000

12000

190,000

108,000

cc

Creditable withholding taxes

Employer's share in SSS, Philealth and HOMF

Whats the total exclusion In gross income?

a P225000 ©. P395,000

be, P230,000 <.P465.000

23

‘Chapler 8 - Reguiat

Income Tex. Exclusion from Gross Income

0,000 in the 10-year bonds of Co

Investment in 2016 fora total con

in 2014s ate ree FO

12ers She do me

se ne P4000

Cent ‘me and the exclusion in gross income?

yon0 710,000

<4.P0; 500,000

a. 500.000: PO

b. 100,000; P400,000

epost.

Which statement isincorrect?

Be 7'300,006 gain is an exclusion in gross income.

FTE 100,000 interest income is an exclusion in gross income subject

regular tax.

‘The 700,000 interest income is an inclusion in grass income subject to fig

.

‘The P300,000 is an inclusion in gross income subject to regular tax, butt

100,000 isan exclusion in gross ncome subject to Final tax.

i

‘The following income relates to a proprietorship registered as a BMBE;

Grose income from sales P 400,000

Dividend income - domestic ‘9,000

6800

Interest on deposits

‘Compute the total exclusion in grass income subject to regular tax.

2 "400000 (or15#00

B atso0 aro

in the immediately preceding problem, compute the total inclusions in grow

Income subject to final tax. ™

ro «-rogo0

bis a00 P9000

KKB, a multi-purpose credit cooperative, had the following income tn 2015:

Income from related acnvities P 400,000

20,000

18,000

60,000

274

‘chepter 8 - Regular Income Tax: Exctusion fom Gross Income

Compute the total exclusion from gros income sujet to regular tax ofthe

‘cooperative,

a PO

b. P3800

©. P438,000

.P400.000

13, In the Immediately preceding problem, compute the total inclusion in gross

inconte subject to regular tax.

a. 60,000

b. 99,000

© P460,000

4.P38,000

14. Anon-stock non-profit charitable entity received the following during 2015:

Contributions from the public 1,600,000

Income from the sale of merchandise '500,000

Gain on the sale of properties 300,000

‘Whats the total exclusion from gross income subject to regular tax?

a. P2,200,000 P1.400.000

b. P1,900,000 ¢.P1,300,000

ity for P100.000 which will pay him P10,000 a

Santiago is 12 years. Which ofthe following can

15, Mr, Santiago purchased a li

aP 000

b. P2000 4.P 100,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet