Professional Documents

Culture Documents

Attempt All The Questions. All Questions Carry Equal Marks

Uploaded by

NagendraSinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Attempt All The Questions. All Questions Carry Equal Marks

Uploaded by

NagendraSinghCopyright:

Available Formats

खंड: अ / PART-A

Code: CI-601

Name of examination: B.Com. VI semester main exam. 2020

Subject: Commerce

Paper: H-XI Goods and Service Tax

Maximum marks: 150

Attempt all the questions. All questions carry equal marks.

Q 1. भारतममालऔरसेवाकरप रषदकाढांचाएवंकायसमझाइए।

Explain the structure and function of GST council in India.

Q 2. जीएसटीके अंतगतमालएवंसव

े ा क पू तके समयिनधारणसंबध

ं ी ावधानसमझाइए।

Discuss the provisions of GST relating to determination of time of goods and services

Supplied.

Q 3. जीएसटीनेटवकके दूरदृि एवं य कोसमझाइए

Explain the Vision and Mission of GST network.

खंड: B / PART-B

Code: CI-602

Name of examination: B.Com. VI semester main exam. 2020

Subject: Commerce

Paper: H-XII Auditing

Maximum marks: 150

Attempt all the questions. All questions carry equal marks.

Q 1.आंत रकअंके णसेआप यासमझतेह? आंत रकअंके णतथा वतं अंके णमअंतर प

क िजए।

What do you mean by internal audit? Explain the difference between Internal Audit

and independent audit .

Q 2. संपि य के स यापनका याउ े यहै? उनके मू यांकनके संबंधमअंके ककहांतकउ रदाईहै

What is the object of verification of assets? How far is the auditor responsible as

regard to their valuation?

Q 3.ब कगकं पिनय काअंके णकरनेक या और यानरखनेवालीआव यकबात कोसमझाइए

तथाबक के िलएअंके कक रपोटकानमूनाबताइए।

Explain the process and important points keeping in view while audit of account of a

banking company.Give a sample of auditor’s report for banking company.

You might also like

- New Format Exam Aud610 - Dec 2014Document6 pagesNew Format Exam Aud610 - Dec 2014pastelinaaNo ratings yet

- May 2020 AA1 QuestionsDocument6 pagesMay 2020 AA1 QuestionsSarah RanduNo ratings yet

- Financial Auditing - Example Exam 22-23 (1)Document12 pagesFinancial Auditing - Example Exam 22-23 (1)Teodora SirbulescuNo ratings yet

- BCOE-108 Company Law Assignment GuideDocument3 pagesBCOE-108 Company Law Assignment GuideTulasiram PatraNo ratings yet

- Bachelor of Commerce: Bcoc - 138: Cost AccountingDocument4 pagesBachelor of Commerce: Bcoc - 138: Cost Accountingsubhaa DasNo ratings yet

- BCHCR610 Evening PDFDocument3 pagesBCHCR610 Evening PDFRalfNo ratings yet

- Auditing Terminal Exam - SP2020Document2 pagesAuditing Terminal Exam - SP2020Daim AslamNo ratings yet

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- ACC302 THEFinal A 2021 SpringDocument5 pagesACC302 THEFinal A 2021 Springayushi kNo ratings yet

- Mba DEC 2022 Exam - MergedDocument13 pagesMba DEC 2022 Exam - MergedAman SharmaNo ratings yet

- Subject Code: 101 Subject: Management Concepts and Application Attempt Any TWO Questions From The FollowingDocument12 pagesSubject Code: 101 Subject: Management Concepts and Application Attempt Any TWO Questions From The FollowingVishalKhuranaNo ratings yet

- Bcoe-143 DoneDocument4 pagesBcoe-143 Donevaishnav v kunnathNo ratings yet

- BBA END SEMESTER 3 PAPERSDocument6 pagesBBA END SEMESTER 3 PAPERSDivyanshuNo ratings yet

- Bcoe 142 PDFDocument4 pagesBcoe 142 PDFShiv KumarNo ratings yet

- Terminal SP21 AuditingDocument5 pagesTerminal SP21 AuditingMariam AfzalNo ratings yet

- AssignmentsDocument7 pagesAssignmentspratikshakurhade04No ratings yet

- Auditing Ethics Full Test 1 May 2024 Test Paper 1703329935Document22 pagesAuditing Ethics Full Test 1 May 2024 Test Paper 1703329935hersheyys4No ratings yet

- CSS Past Papers Auditing OverallDocument3 pagesCSS Past Papers Auditing OverallMasood Ahmad AadamNo ratings yet

- Celibacy and Spiritual LifeDocument12 pagesCelibacy and Spiritual LifeDebi Prasad SahooNo ratings yet

- Ldce Questions 2001Document73 pagesLdce Questions 2001Anurag KumarNo ratings yet

- Auditing Ethics Full Test 1 May 2024 Solution 1703329941Document40 pagesAuditing Ethics Full Test 1 May 2024 Solution 1703329941hersheyys4No ratings yet

- 5 - (S2) Aa MP PDFDocument3 pages5 - (S2) Aa MP PDFFlow RiyaNo ratings yet

- Jan 2020 AA1 QuestionsDocument7 pagesJan 2020 AA1 QuestionsSarah RanduNo ratings yet

- Financial Management 210621Document1 pageFinancial Management 210621Nikeeta PawarNo ratings yet

- Assignments MADocument4 pagesAssignments MAYashi SinghNo ratings yet

- BPAG 172 EM 2023 24 AergouDocument11 pagesBPAG 172 EM 2023 24 AergouNandini SolankiNo ratings yet

- POIM P 1Document2 pagesPOIM P 1nidhi malikNo ratings yet

- ExaminationBooks 0635a718e2b6372 80446100Document60 pagesExaminationBooks 0635a718e2b6372 80446100alex raNo ratings yet

- Mid Term PaperDocument9 pagesMid Term Paperthorat82No ratings yet

- CC 403 ASS M. Com. Sem-IV Exam-2021 (02.08.2021)Document3 pagesCC 403 ASS M. Com. Sem-IV Exam-2021 (02.08.2021)sejal AgarwalNo ratings yet

- Exam - 2021: Syllabus and Course Scheme Academic Year 2020-21Document21 pagesExam - 2021: Syllabus and Course Scheme Academic Year 2020-21PanduNo ratings yet

- Commerce Ias - Main 2004Document3 pagesCommerce Ias - Main 2004Nija KumarNo ratings yet

- B.Com Ordinances and SyllabusDocument30 pagesB.Com Ordinances and Syllabusmayank guptaNo ratings yet

- SME IIT Jodhpur ExamDocument15 pagesSME IIT Jodhpur ExamJatin yadavNo ratings yet

- Bcoc - 137 PDFDocument3 pagesBcoc - 137 PDFShiv KumarNo ratings yet

- Exam. - 2017: Syllabus and Course Scheme Academic Year 2016-17Document21 pagesExam. - 2017: Syllabus and Course Scheme Academic Year 2016-17DonNo ratings yet

- GE Comm - Invt in Stock Markets - CBCS 2021 (OBE)Document4 pagesGE Comm - Invt in Stock Markets - CBCS 2021 (OBE)Jeva AroraNo ratings yet

- Mefa PDFDocument4 pagesMefa PDFpadmajasivaNo ratings yet

- Faculty of Business Management BAC 215: Auditing: TH THDocument2 pagesFaculty of Business Management BAC 215: Auditing: TH THMichael AronNo ratings yet

- Research Methodology Exam QuestionsDocument5 pagesResearch Methodology Exam QuestionsJyoti SinghNo ratings yet

- Question Paper MBADocument39 pagesQuestion Paper MBAVishal ChitkaraNo ratings yet

- 2-F8 MCQ's Questions and AnswersDocument19 pages2-F8 MCQ's Questions and AnswersMansoor SharifNo ratings yet

- 21937mtp Cptvolu2 Part1Document114 pages21937mtp Cptvolu2 Part1rnaganirmitaNo ratings yet

- Tutorial On AuditingDocument6 pagesTutorial On AuditingSyazliana KasimNo ratings yet

- 120 - ECO-1 - ENG D18 - CompressedDocument2 pages120 - ECO-1 - ENG D18 - CompressedJdjdj JsjdjdNo ratings yet

- Bcos-185 Entrepreneurship eDocument3 pagesBcos-185 Entrepreneurship eAmit YadavNo ratings yet

- Jntuworld: R09 Set No. 2Document4 pagesJntuworld: R09 Set No. 2adi05320% (1)

- FE Unand Midterm Exam TipsDocument2 pagesFE Unand Midterm Exam TipsZakyaNo ratings yet

- B.Com Part I Syllabus and Course Scheme for University of KotaDocument21 pagesB.Com Part I Syllabus and Course Scheme for University of KotaGeeta AhlawatNo ratings yet

- Financial Management For Agri. Business - Sum-2010Document1 pageFinancial Management For Agri. Business - Sum-2010THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’No ratings yet

- Business Economics & Financial Analysis 3Document2 pagesBusiness Economics & Financial Analysis 3LIwaiNo ratings yet

- FAA Sem (1) 2020Document2 pagesFAA Sem (1) 2020daskarinakiranNo ratings yet

- Bcoc 132 Solved AssignmentsDocument15 pagesBcoc 132 Solved AssignmentsKajal Bindal50% (2)

- Time: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarryDocument2 pagesTime: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarrySohamsNo ratings yet

- PradhiCA Nov23 CA Inter SubjectwiseTestSeries - DirectDocument16 pagesPradhiCA Nov23 CA Inter SubjectwiseTestSeries - DirectSrinishaNo ratings yet

- 306 A Stretegic Financial ManagementDocument2 pages306 A Stretegic Financial ManagementSwapnil SonjeNo ratings yet

- Time Allowed: Three Hours Maximum Marks: 300Document3 pagesTime Allowed: Three Hours Maximum Marks: 300Asim JavedNo ratings yet

- FMDocument18 pagesFMPriyanka DashNo ratings yet

- F. HAUD230-1-Jan-Jun2024-FA1-MK-V2-09112023Document10 pagesF. HAUD230-1-Jan-Jun2024-FA1-MK-V2-09112023ICT ASSIGNMENTS MZANSINo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Rajeev Gandhi Proudyogiki Vishwavidyalaya Office Complex, A/4 Gautam Nagar, Bhopal (M.P.)Document2 pagesRajeev Gandhi Proudyogiki Vishwavidyalaya Office Complex, A/4 Gautam Nagar, Bhopal (M.P.)NagendraSinghNo ratings yet

- Registration Blank Form Class-11 (2020-21) - Science PDFDocument1 pageRegistration Blank Form Class-11 (2020-21) - Science PDFNagendraSinghNo ratings yet

- UPSEE2018 AdmitCardDocument1 pageUPSEE2018 AdmitCardNagendraSinghNo ratings yet

- Attempt All The Questions. All Questions Carry Equal MarksDocument1 pageAttempt All The Questions. All Questions Carry Equal MarksNagendraSinghNo ratings yet

- Q 1. Describe search engines with examples. सचइंजन का उदहारण सिहत वणन कर. Q 2. Describe the steps to create new slide. नयी लाइडबनाने के िविभ चरण का वणन करDocument1 pageQ 1. Describe search engines with examples. सचइंजन का उदहारण सिहत वणन कर. Q 2. Describe the steps to create new slide. नयी लाइडबनाने के िविभ चरण का वणन करNagendraSinghNo ratings yet

- Railway Recruitment Board - Online Registration: Payment DetailsDocument2 pagesRailway Recruitment Board - Online Registration: Payment DetailsNagendraSinghNo ratings yet

- Acknowledgement: Thank YouDocument3 pagesAcknowledgement: Thank YouNagendraSinghNo ratings yet

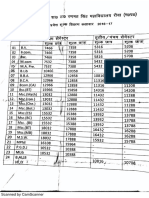

- Fees List 2016Document1 pageFees List 2016NagendraSinghNo ratings yet

- KālidāsaDocument2 pagesKālidāsaNagendraSinghNo ratings yet

- Career Objective: Personal DetailsDocument1 pageCareer Objective: Personal DetailsNagendraSinghNo ratings yet

- KālidāsaDocument2 pagesKālidāsaNagendraSinghNo ratings yet

- JGJGJGHJGHDocument1 pageJGJGJGHJGHNagendraSinghNo ratings yet