Professional Documents

Culture Documents

Proposed Ordinance Prescribing The Standard Payments and Regulatory

Uploaded by

Chester CaroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proposed Ordinance Prescribing The Standard Payments and Regulatory

Uploaded by

Chester CaroCopyright:

Available Formats

PROPOSED ORDINANCE NO.

___-18: PRESCRIBING THE STANDARD PAYMENTS AND REGULATORY

REQUIREMENTS FOR ISSUANCE OF BUSINESS PERMITS TO ALL DULY-REGISTERED AND LEGITIMATE

PRIMARY COOPERATIVES, COOPERATIVE BRANCHES AND COOPERATIVE SATELLITE OFFICES

OPERATING WITHIN THE CITY OF MASBATE

EXPLANATORY NOTE

The 1987 Constitution provides in Article X Section 5 that: "Sec. 5. Each local government unit shall

have the power to create its own sources of revenues and to levy taxes, fees and charges subject to such

guidelines and limitations as the Congress may provide, consistent with the basic policy of local autonomy. Such

taxes, fees and charges shall accrue exclusively to the local government."

Section 129, Title I, Chapter I of Book II of the Local Government Code of 1991 or (LGC of 1991)

provides that each local government unit shall exercise its power to create its own sources of revenue and to levy

taxes, fees, and charges subject to the provisions herein, consistent with the basic policy of local autonomy.

Republic Act 9520 (RA 9520) or otherwise known as the, “Philippine Cooperative Code of 2208”

provides that it is the declared policy of the State to foster the creation and growth of cooperatives as a practical

vehicle for promoting self-reliance and harnessing people power towards the attainment of economic

development and social justice. The State shall encourage the private sector to undertake the actual formation

and organization of cooperatives and shall create an atmosphere that is conducive to the growth and

development of these cooperatives.

The basis for exemption from local taxes, fees and charges of qualified cooperatives is RA 9520, a

special law on cooperatives. While it is true that local government units enjoy fiscal autonomy, this is not absolute

since this is subject to the limitations imposed by law.

RA 9520 emphasized the exemption of duly registered cooperatives from payment of applicable fees,

taxes and charges.

The Department of the Interior and Local Government (DILG) Memorandum Circular No. 2010-120

dated October 20, 2010 emphasized the exemption of duly registered cooperatives from payment of applicable

fees, taxes and charges BUT subject to compliance with the Bureau of Local Government Finance of the

Department of Finance (BLGF) Memorandum Circular No. 31-2009 dated October 7, 2009, which prescribes

that all cooperatives transacting business with both members and non-members are still required to:

a) Obtain or secure a Mayor's Permit and pay the commensurate cost of regulation, inspection and

surveillance of the operation of its business in amount not exceeding One Thousand Pesos (₱1,000.00);

b) Secure a Community Tax Certificate as a juridical entity and pay the basic tax of Five Hundred Pesos

(₱500.00); and

c) Pay service charges or rentals for the use of property and equipment or public utilities owned by the

local government such as charges for actual water consumption, electric power, toll fees for the use of public

roads and bridges, and the like.

The proposed measure seeks to further enhance the general welfare of the City and its constituents

pursuant to the general welfare clause of the Local Government Code of 1991.

It is for this reason that the enactment of this Proposed Ordinance is earnestly sought.

You might also like

- Crim Law CasesDocument16 pagesCrim Law CasesMarjo PachecoNo ratings yet

- Itinerary Fun Zumba Walk at Night 2019Document1 pageItinerary Fun Zumba Walk at Night 2019Chester CaroNo ratings yet

- Deductions From Gross Income, Lifeblood Doctrine, Benefits-Protection Theory (Symbiotic Relationship Doctrine)Document12 pagesDeductions From Gross Income, Lifeblood Doctrine, Benefits-Protection Theory (Symbiotic Relationship Doctrine)Chester CaroNo ratings yet

- Working COmmittees 2021 Womens Month - Mco - 022421Document4 pagesWorking COmmittees 2021 Womens Month - Mco - 022421Chester CaroNo ratings yet

- Office of The City Vice Mayor: Activity DesignDocument3 pagesOffice of The City Vice Mayor: Activity DesignChester CaroNo ratings yet

- 2017 CALENDAR OF ACTIVITIES IN THE PHILIPPINES - Mco - 032417Document31 pages2017 CALENDAR OF ACTIVITIES IN THE PHILIPPINES - Mco - 032417Chester CaroNo ratings yet

- Consti Cases For ResearchDocument1 pageConsti Cases For ResearchChester CaroNo ratings yet

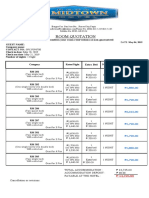

- Midtown Hotel Room RatesDocument2 pagesMidtown Hotel Room RatesChester CaroNo ratings yet

- Huang et al. vs. Tamayo: Buyer may suspend payments if developer fails obligationsDocument45 pagesHuang et al. vs. Tamayo: Buyer may suspend payments if developer fails obligationsChester CaroNo ratings yet

- Human Rights Cases 8 9Document20 pagesHuman Rights Cases 8 9Chester CaroNo ratings yet

- Human Rights Cases 8 9Document20 pagesHuman Rights Cases 8 9Chester CaroNo ratings yet

- Masbate Brgy Ordinance ReviewDocument3 pagesMasbate Brgy Ordinance ReviewChester CaroNo ratings yet

- Agrarian NotesDocument30 pagesAgrarian NotesChester CaroNo ratings yet

- Masbate City Public Market Rental RatesDocument2 pagesMasbate City Public Market Rental RatesChester CaroNo ratings yet

- Human Rights Cases 8 9Document20 pagesHuman Rights Cases 8 9Chester CaroNo ratings yet

- CR Mangrovetum Mco 102119Document3 pagesCR Mangrovetum Mco 102119Chester CaroNo ratings yet

- CR - TRAFFIC CODE AMENDMENT - Mco - 112918Document5 pagesCR - TRAFFIC CODE AMENDMENT - Mco - 112918Chester CaroNo ratings yet

- CR - Online Betting Games Cockfighting - Mco - 121917Document2 pagesCR - Online Betting Games Cockfighting - Mco - 121917Chester CaroNo ratings yet

- CR - Anti Spitting Ordinance - Kap - Mco - 060820Document3 pagesCR - Anti Spitting Ordinance - Kap - Mco - 060820Chester CaroNo ratings yet

- Committee Report: Office of The Sangguniang PanlungsodDocument2 pagesCommittee Report: Office of The Sangguniang PanlungsodChester CaroNo ratings yet

- CR - Nutrition Council - Mco - 031219Document3 pagesCR - Nutrition Council - Mco - 031219Chester CaroNo ratings yet

- Use of Firecrackers CR - Mco - 042318Document2 pagesUse of Firecrackers CR - Mco - 042318Chester CaroNo ratings yet

- CR - Amendment On The City Traffic Code - 060517Document4 pagesCR - Amendment On The City Traffic Code - 060517Chester CaroNo ratings yet

- CR - PO Amendment Physical Distancing - McoDocument2 pagesCR - PO Amendment Physical Distancing - McoChester CaroNo ratings yet

- Psmoc Membership GuidelinesDocument1 pagePsmoc Membership GuidelinesChester CaroNo ratings yet

- Criminal Law 1 Finals Reviewer Under 40 CharactersDocument287 pagesCriminal Law 1 Finals Reviewer Under 40 CharactersalfiedeckNo ratings yet

- Masbate City Council Committee ReportDocument2 pagesMasbate City Council Committee ReportChester Caro100% (1)

- CR - PrivilegeSpeech - Montenegro & PPA - Kap - Mco - 090219Document2 pagesCR - PrivilegeSpeech - Montenegro & PPA - Kap - Mco - 090219Chester CaroNo ratings yet

- Concrete or Otherwise: IRR of Presidential Decree 1096Document9 pagesConcrete or Otherwise: IRR of Presidential Decree 1096Chester CaroNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LTFRB Operator Data SheetDocument3 pagesLTFRB Operator Data SheetHaultech TrucksNo ratings yet

- RCL West India - Export Schedule Nov 2023Document3 pagesRCL West India - Export Schedule Nov 2023Rishi DhimanNo ratings yet

- Spa For PRC Id AuthorizationDocument2 pagesSpa For PRC Id AuthorizationJULEBIE LARIDE100% (1)

- Guidelines On Company NamesDocument15 pagesGuidelines On Company NamesEik Ren OngNo ratings yet

- AminaDocument2 pagesAminaKendrick Edwardo100% (1)

- Management Accountant Dec-2016Document124 pagesManagement Accountant Dec-2016ABC 123No ratings yet

- Pad104 Group Assignment - Introduction To Malaysian Public PolicyDocument19 pagesPad104 Group Assignment - Introduction To Malaysian Public PolicyHwang Ae Ri100% (1)

- Rajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.Document2 pagesRajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.arjun guptaNo ratings yet

- No suit between family members unless compromise efforts failDocument1 pageNo suit between family members unless compromise efforts failVicente Del Castillo IVNo ratings yet

- Extrajudicial Settelement Format - BAUTISTA VIRGILIODocument2 pagesExtrajudicial Settelement Format - BAUTISTA VIRGILIOvirgilio jr capilitan bautistaNo ratings yet

- CBUAE Annual Report Highlights Resilience and ProgressDocument46 pagesCBUAE Annual Report Highlights Resilience and ProgressahmedNo ratings yet

- Iso 377-2017Document27 pagesIso 377-2017EleanorNo ratings yet

- Miguel Ernesto Arias Garcia: Transaction CodeDocument2 pagesMiguel Ernesto Arias Garcia: Transaction CodeNUBIA CARDENAL JOVENNo ratings yet

- Electrical Electronic and Communications Contracting Award Ma000025 Pay GuideDocument17 pagesElectrical Electronic and Communications Contracting Award Ma000025 Pay GuideaidenNo ratings yet

- Chapter 5 - Accounting For Inventory PPEDocument12 pagesChapter 5 - Accounting For Inventory PPESuzanne SenadreNo ratings yet

- Measuring The Cost of Regulation: A Text Based ApproachDocument2 pagesMeasuring The Cost of Regulation: A Text Based ApproachCato InstituteNo ratings yet

- Letter Reply To PCC Request For Info - 01122021 v1.5Document2 pagesLetter Reply To PCC Request For Info - 01122021 v1.5Reginaldo BucuNo ratings yet

- Annual Report of the National Tender BoardDocument42 pagesAnnual Report of the National Tender BoardNothando NgwenyaNo ratings yet

- PU degree verification procedureDocument10 pagesPU degree verification procedureHasnain KhanNo ratings yet

- Contract Engagement Notice Walk in Selection Process For Assistant Level 2 FitterDocument1 pageContract Engagement Notice Walk in Selection Process For Assistant Level 2 FitterJaksonNo ratings yet

- GSTIN CertificateDocument3 pagesGSTIN CertificateAvijit GhoshNo ratings yet

- The Little Book of PMODocument83 pagesThe Little Book of PMOpnorbertoNo ratings yet

- Fundamentals of Energy Efficiency Sec3Document31 pagesFundamentals of Energy Efficiency Sec3Steven AdamsNo ratings yet

- MoF Interactive Annual Report 2022 English v11Document50 pagesMoF Interactive Annual Report 2022 English v11Ang SHNo ratings yet

- CN 5890053 GRP1 83-1Document2 pagesCN 5890053 GRP1 83-1Jeman KumarNo ratings yet

- คาบที่ 2 intro to PA1Document33 pagesคาบที่ 2 intro to PA1Seangnakkarach BoomNo ratings yet

- Trans1 2020 05Document166 pagesTrans1 2020 05AmbujNo ratings yet

- Grant Usage Report (2022)Document2 pagesGrant Usage Report (2022)Armando RiojasNo ratings yet

- Code of DisciplineDocument43 pagesCode of DisciplinevamsibuNo ratings yet

- Insurance Conference Tackles Legal ChallengesDocument9 pagesInsurance Conference Tackles Legal ChallengesAnandhNo ratings yet