Professional Documents

Culture Documents

This Study Resource Was Shared Via: Chapter 2 - Audit Strategy, Planning and Programming

Uploaded by

Navneet NandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Study Resource Was Shared Via: Chapter 2 - Audit Strategy, Planning and Programming

Uploaded by

Navneet NandaCopyright:

Available Formats

Chapter 2 - Audit Strategy, Planning and Programming

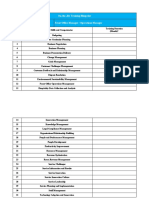

Audit Strategy Audit Planning Audit Programming

Meaning: Designing Audit Approaches to achieve necessary audit assurance Developing an overall plan for the Detailed plan of work

Meaning

Meaning

at the lowest cost. expected scope and conduct of the comprises of techniques and

1. Obtaining knowledge of business: audit and procedures,

It provides a frame of reference within which the auditor exercises Developing an audit programme

may also contain objectives for

his professional judgement to assess risk, to plan audit, to evaluate showing NTE of Audit procedures

each audit step.

audit evidence and providing quality services.

a

Acquiring knowledge of client Nature of business.

Aspects to be covered

2. Performing Analytical Procedures at Initial Stages: To assess accounting system, policies and Overall Plan

vi

Matters to be

the potential for material misstatement in the F.S. as a whole. internal control procedures. System of internal control and

considered

3. Evaluating Inherent Risk: Establishing the expected degree accounting procedures.

d

On the basis of prior audit experience, controls exercised by of reliance on internal control. Size and structure of

management, significant changes since last assessment.

re

Determining the NTE of audit organization.

Steps involved in Audit Strategy

Factors to be evaluated to assess inherent risk procedures. Information regarding the

ha

At the level of F.S. At the level of A/c Balance Coordinating the work to be organization.

Integrity of Management. Quality of Accounting System. performed. Accounting policies followed.

Management experience Susceptibility to Misstatement

s

To devote attention to important areas Draw a broad outline

Changes in management / Misappropriation of assets. Identify & resolve potential

First Time Audit

Filled up the details on a

Importance of

Development of Audit programme

as

Pressures on Management Complexity of transactions. problems. consideration of

planning

Nature of entity business. Degree of judgement involved. Organized and managed audit. deficiencies in internal

w

Factors affecting industry. Unusual transactions Selection of suitable ET. control.

4. Evaluating Internal Control System: Coordination of work done Determine the special

By documenting the extent of computerization, preparing/updating Direction and supervision of procedures needs to be

m e

flowcharts to record the transactions. engagement team. applied.

5. Formulating Audit Strategy: Requires consideration of:

Engagement objective

co rc

Terms of engagement

Nature & timing of reports

Review earlier programme and

modified on account of:

o. ou

Factors to be

Experience gained during the

Engagement

considered

Legal or statutory requirements.

Subsequent

Knowledge of clients business

Accounting policies & changes therein. previous audit.

Preliminary judgements as to materiality

Important changes in internal

er res

Effects of new accounting/auditing

Identified inherent risks control system, accounting

pronouncements.

Extent of compliance testing Identification of significant audit areas. procedures etc.

NTE of Substantive testing Setting of materiality levels. Evaluation of internal control

Points relating to planning and controlling the audit.

eH y

Degree of reliance on internal control. for current year.

1. Employment of Qualitative Resources. 1. Substantial increase in Volume of turnover.

rs ud

Relationship - Audit Strategy & Audit Planning

Circumstances

2. Significant changes in accounting procedures.

Benefits

2. Allocation of appropriate quantity of resources.

requiring

changes

Inter-related to each other because change in one would 3. Observation w.r.t. ineffective internal control.

3. Determining the timing of deployment of resources. result change in other. 4. Substantial increase in book debts or

t

4. Better management of resources in terms of direction, supervision, timing Audit strategy is prepared before the audit plan and provides inventory.

ss

of team meetings etc. the guidelines for developing the audit plan. 5. Suspicion as to misappropriation of assets.

Compiled by: Pankaj Garg Page 1

hi

https://www.coursehero.com/file/27267043/Chapter-2-Audit-Strategy-Planning-Programming-Filepdf/

Powered by TCPDF (www.tcpdf.org)

You might also like

- Introduction to Project Management: The Quick Reference HandbookFrom EverandIntroduction to Project Management: The Quick Reference HandbookNo ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- II - Audit Strategy, PlanningDocument8 pagesII - Audit Strategy, PlanningAlphy maria cherianNo ratings yet

- Pre0131 Midterm Reviewer - PDF PlanningDocument2 pagesPre0131 Midterm Reviewer - PDF PlanningEliny CruzNo ratings yet

- Operations Auditing Phases: Learning ObjectivesDocument20 pagesOperations Auditing Phases: Learning ObjectivesRamil SagubanNo ratings yet

- Audit PlanningDocument2 pagesAudit Planninglied27106No ratings yet

- DOH AG III - Accomplishment ReportDocument18 pagesDOH AG III - Accomplishment Reportshane natividadNo ratings yet

- Planning - Prelims Seatwork No. 1Document35 pagesPlanning - Prelims Seatwork No. 1Shiela Marie GadayosNo ratings yet

- Auditing and Assurance Speclized Industries - 18 Sep 2023Document29 pagesAuditing and Assurance Speclized Industries - 18 Sep 2023Renelyn FiloteoNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource Wasvenice cambryNo ratings yet

- Audit Plan Includes A Description ofDocument9 pagesAudit Plan Includes A Description of03LJNo ratings yet

- BPM - 3 - HalaDocument12 pagesBPM - 3 - HalaAsadulla KhanNo ratings yet

- Audit PlanningDocument2 pagesAudit PlanningChan Chan GamoNo ratings yet

- Lecture Notes: Auditing Theory AT.1808-Audit Planning-An Overview MAY 2015Document8 pagesLecture Notes: Auditing Theory AT.1808-Audit Planning-An Overview MAY 2015Misa AmaneNo ratings yet

- Audit Planning: Auditor's Main ObjectiveDocument7 pagesAudit Planning: Auditor's Main Objectivemarie aniceteNo ratings yet

- At Audit PlanningDocument7 pagesAt Audit PlanningRey Joyce AbuelNo ratings yet

- Chapter 2-Audit Stategy Audit Planing and Audit ProgrammeDocument34 pagesChapter 2-Audit Stategy Audit Planing and Audit Programmeabhichavan7722No ratings yet

- Audit Strategy, Audit Planning and Audit Programme: Learning OutcomesDocument31 pagesAudit Strategy, Audit Planning and Audit Programme: Learning OutcomesMayank JainNo ratings yet

- Section 2 Comparative AnalysisDocument35 pagesSection 2 Comparative AnalysisShiela Marie GadayosNo ratings yet

- Section 2 Comparative AnalysisDocument34 pagesSection 2 Comparative AnalysisShiela Marie GadayosNo ratings yet

- Project On Audit Plan and Programme & Special AuditDocument11 pagesProject On Audit Plan and Programme & Special AuditPriyank SolankiNo ratings yet

- Cost Project ManagementDocument30 pagesCost Project ManagementZu RazNo ratings yet

- Audit Planning (Unit 2)Document12 pagesAudit Planning (Unit 2)ShradhaNo ratings yet

- Detailed Audit PlanDocument3 pagesDetailed Audit PlanPhrexilyn PajarilloNo ratings yet

- Chapter 2 Audit Strategy, Planning and Programme - ScannerDocument44 pagesChapter 2 Audit Strategy, Planning and Programme - ScannerRanjisi chimbanguNo ratings yet

- Unit 3: Basic Concepts of AuditingDocument12 pagesUnit 3: Basic Concepts of Auditingembiale ayaluNo ratings yet

- Audit PlanningDocument4 pagesAudit PlanningLoo Bee YeokNo ratings yet

- Statement of Auditing StandardsDocument2 pagesStatement of Auditing StandardsMikaela SalvadorNo ratings yet

- Study Notes On Auditing: Planning An Audit of Financial Statements (ISA-300)Document11 pagesStudy Notes On Auditing: Planning An Audit of Financial Statements (ISA-300)sajedulNo ratings yet

- Day 2 - IAI-Effective - Technique - For - Internal - AuditDocument65 pagesDay 2 - IAI-Effective - Technique - For - Internal - AuditArdiFarazNo ratings yet

- Iau Manual Section I1Document30 pagesIau Manual Section I1Herbert NgwaraiNo ratings yet

- Planning An Audit of Financial Statements8888888Document11 pagesPlanning An Audit of Financial Statements8888888sajedulNo ratings yet

- Audit Liquid Measurement (Class 7050)Document4 pagesAudit Liquid Measurement (Class 7050)yoyokpurwantoNo ratings yet

- Auditing Notes by Rehan Farhat ISA 300Document21 pagesAuditing Notes by Rehan Farhat ISA 300Omar SiddiquiNo ratings yet

- CHAPTER 5 - AudTheoDocument4 pagesCHAPTER 5 - AudTheoVicente, Liza Mae C.No ratings yet

- ACCO 30043 Assignment No.4 RevisedDocument9 pagesACCO 30043 Assignment No.4 RevisedRoseanneNo ratings yet

- Pmbok5thexecutingprocessgroup 160914033833 PDFDocument53 pagesPmbok5thexecutingprocessgroup 160914033833 PDFLightning LamboNo ratings yet

- P7 - Planning PartDocument15 pagesP7 - Planning PartArab AhmedNo ratings yet

- Engagement Value Enabler 3: Audit Objective: Step 1: Why To Audit?Document10 pagesEngagement Value Enabler 3: Audit Objective: Step 1: Why To Audit?Jonnabel SulascoNo ratings yet

- Scope Management Processes: This Chapter Covers Key Concepts Related To Project Scope ManagementDocument24 pagesScope Management Processes: This Chapter Covers Key Concepts Related To Project Scope ManagementBhattt ANo ratings yet

- Stages of An AuditDocument4 pagesStages of An AuditDerrick KimaniNo ratings yet

- Unit 3: Basic Concepts of AuditingDocument13 pagesUnit 3: Basic Concepts of AuditingYonasNo ratings yet

- The Risk-Based Audit Process - Phase 1-BDocument15 pagesThe Risk-Based Audit Process - Phase 1-BJoseph LomboyNo ratings yet

- On-the-Job Training Blueprint - Front Office Manager - Operations ManagerDocument44 pagesOn-the-Job Training Blueprint - Front Office Manager - Operations ManagerRHTi BDNo ratings yet

- Competency Name: Broad Definition: Criteria I Criteria For DefiningDocument5 pagesCompetency Name: Broad Definition: Criteria I Criteria For DefiningRahul KumarNo ratings yet

- AT.3610 - Overall Audit Strategy and Audit ProgramDocument12 pagesAT.3610 - Overall Audit Strategy and Audit Programrichshielanghag627No ratings yet

- ICTSAD609 Student Assessment Tasks Project Portfolio V2.0Document47 pagesICTSAD609 Student Assessment Tasks Project Portfolio V2.0akashpandet6No ratings yet

- Audit UNIT 3Document11 pagesAudit UNIT 3Nigussie BerhanuNo ratings yet

- The Procedure of Audit Planning: Russian ExperienceDocument17 pagesThe Procedure of Audit Planning: Russian ExperienceSyedur RahmanNo ratings yet

- Strategic Management: Prof. Amol AnkushDocument252 pagesStrategic Management: Prof. Amol AnkushhimanshuNo ratings yet

- PezzeYoung Ch20 PlanningDocument16 pagesPezzeYoung Ch20 PlanningSinchana SatishNo ratings yet

- BSM 401 Chapter 1 - IntroductionDocument28 pagesBSM 401 Chapter 1 - Introductionoduor wanenoNo ratings yet

- At.1609 - Audit Planning - An OverviewDocument6 pagesAt.1609 - Audit Planning - An Overviewnaztig_017No ratings yet

- SAMPLE Auditing PDFDocument74 pagesSAMPLE Auditing PDFMiku LendioNo ratings yet

- At.3206-Planning An Audit of Financial StatementsDocument6 pagesAt.3206-Planning An Audit of Financial StatementsDenny June CraususNo ratings yet

- External Audit ScopeDocument2 pagesExternal Audit ScopeBennice 8No ratings yet

- Ch-2 Audit Strategy Audit Planning and Audit ProgrammeDocument24 pagesCh-2 Audit Strategy Audit Planning and Audit Programmesubasha1a1No ratings yet

- At 05 - Auditor PlanningDocument8 pagesAt 05 - Auditor PlanningRei-Anne ReaNo ratings yet

- Chap 4 - Audit Planning P2Document14 pagesChap 4 - Audit Planning P2hangNo ratings yet

- 62549studentjournal-Jan2021a (1) - RemovedDocument15 pages62549studentjournal-Jan2021a (1) - RemovedTimepass MungfuliNo ratings yet

- Scm-Case Study-BscDocument5 pagesScm-Case Study-BscNavneet NandaNo ratings yet

- HDFC AMC, Adani Gas Among Candidates For Inclusion in F&O SegmentDocument2 pagesHDFC AMC, Adani Gas Among Candidates For Inclusion in F&O SegmentNavneet NandaNo ratings yet

- TQM in Ford Motor Company: Serial No. Name IDDocument17 pagesTQM in Ford Motor Company: Serial No. Name IDIrahq Yarte TorrejosNo ratings yet

- Uber Unicorn AJMC CaseDocument10 pagesUber Unicorn AJMC CaseNavneet NandaNo ratings yet

- Ifrs in Practice 2016Document60 pagesIfrs in Practice 2016Navneet NandaNo ratings yet

- AFTERNOON SESSION II Design Patent Lessons From Apple v. Samsung Christopher v. Carani. Managing IPDocument4 pagesAFTERNOON SESSION II Design Patent Lessons From Apple v. Samsung Christopher v. Carani. Managing IPPutu DenyNo ratings yet

- Process of Deal Structuring Process of Deal Structuring: Presented ToDocument26 pagesProcess of Deal Structuring Process of Deal Structuring: Presented ToNavneet NandaNo ratings yet

- Auditing NBFCDocument205 pagesAuditing NBFCNavneet NandaNo ratings yet

- Banking Sectors in IndiaDocument12 pagesBanking Sectors in Indiabookhunter01No ratings yet

- Compare Perfmnce BankDocument10 pagesCompare Perfmnce BankshobhikatyagiNo ratings yet

- ABC - 07,13,17,28 NewDocument85 pagesABC - 07,13,17,28 NewNavneet NandaNo ratings yet

- Master Direction: Monitoring of Frauds in NBFC (Reserve Bank) Directions, 2016Document14 pagesMaster Direction: Monitoring of Frauds in NBFC (Reserve Bank) Directions, 2016Navneet NandaNo ratings yet

- A Critical Review of NPA in Indian Banking IndustryDocument12 pagesA Critical Review of NPA in Indian Banking IndustryNavneet NandaNo ratings yet

- A Study On Analysis of Non - Performing Assets and Its Impact On ProfitabilityDocument10 pagesA Study On Analysis of Non - Performing Assets and Its Impact On ProfitabilityNavneet NandaNo ratings yet

- Corporate Restructuring - A Financial Strategy: Vikas Srivastava Ms. Ghausia MushtaqDocument9 pagesCorporate Restructuring - A Financial Strategy: Vikas Srivastava Ms. Ghausia MushtaqDharmesh MistryNo ratings yet

- Sciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaDocument8 pagesSciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaNavneet NandaNo ratings yet

- Paper 4 Case StudyDocument10 pagesPaper 4 Case StudyNavneet NandaNo ratings yet

- STUDY OF CUSTOMERS' PERCEPTION AND SATISFACTION OF SERVICE QUALITY - RepairedDocument50 pagesSTUDY OF CUSTOMERS' PERCEPTION AND SATISFACTION OF SERVICE QUALITY - RepairedNavneet NandaNo ratings yet

- Advanced AuditingDocument10 pagesAdvanced AuditingNavneet NandaNo ratings yet

- Sciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaDocument8 pagesSciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaNavneet NandaNo ratings yet

- Paper 15 New PDFDocument364 pagesPaper 15 New PDFAnwesha SinghNo ratings yet

- Notes of Activity Based CostingDocument32 pagesNotes of Activity Based Costingaparna bingi100% (1)

- Carasid CaseDocument7 pagesCarasid CaseNavneet NandaNo ratings yet

- Corporate Restructuring - A Financial Strategy: Vikas Srivastava Ms. Ghausia MushtaqDocument9 pagesCorporate Restructuring - A Financial Strategy: Vikas Srivastava Ms. Ghausia MushtaqDharmesh MistryNo ratings yet

- MMM 140429165008 Phpapp02Document56 pagesMMM 140429165008 Phpapp02Navneet NandaNo ratings yet

- Chapter 587Document36 pagesChapter 587Suraj DecorousNo ratings yet

- Impact of Covid-19 On The Global Economy: (With Special Reference To Financial Institutions in India)Document17 pagesImpact of Covid-19 On The Global Economy: (With Special Reference To Financial Institutions in India)Navneet NandaNo ratings yet

- Cosumers Perception Towards Insurance - Project ReportDocument112 pagesCosumers Perception Towards Insurance - Project Reportkamdica93% (54)

- 08 - Chapter 2 Insurance LawDocument24 pages08 - Chapter 2 Insurance Lawashwani100% (1)

- 8 Employee Turnover and Retention StrategiesDocument8 pages8 Employee Turnover and Retention StrategiesMohammad MoosaNo ratings yet

- Unit 07. Surveying, Measuring and Setting Out Assignment 2022Document8 pagesUnit 07. Surveying, Measuring and Setting Out Assignment 2022kash0% (1)

- WEEK25 - FINALDEMO Technical Terms Used in ResearchDocument12 pagesWEEK25 - FINALDEMO Technical Terms Used in ResearchJellah GicosoNo ratings yet

- (Statistik) Tutorial 2-Sampling and Data CollectionDocument2 pages(Statistik) Tutorial 2-Sampling and Data CollectionAzuan Afizam Bin Azman H19A00730% (1)

- Seleksi SupplierDocument9 pagesSeleksi SupplierFendiNo ratings yet

- Confidence IntervalDocument16 pagesConfidence IntervalSamuel Antobam100% (1)

- D 596 - 91 R95 - Rdu5ni05mvi5nqDocument3 pagesD 596 - 91 R95 - Rdu5ni05mvi5nqAnilNo ratings yet

- Cape Information Technology: Unit 1: Module 1 Objectives 3Document15 pagesCape Information Technology: Unit 1: Module 1 Objectives 3Drake JuneNo ratings yet

- Performance AppraisalDocument34 pagesPerformance AppraisalbunkusaikiaNo ratings yet

- Lecture 1 Survey 1Document35 pagesLecture 1 Survey 1m saadullah khanNo ratings yet

- Manufacturing Technology AssignmentDocument15 pagesManufacturing Technology AssignmentDan Kiama MuriithiNo ratings yet

- US Internal Revenue Service: p4579Document208 pagesUS Internal Revenue Service: p4579IRSNo ratings yet

- EGSEN Volume 60 Issue 1 Pages 16-9Document8 pagesEGSEN Volume 60 Issue 1 Pages 16-9SaRa MaarufNo ratings yet

- RDL 1 Intervention MatatagDocument9 pagesRDL 1 Intervention MatatagRenz DumpNo ratings yet

- Wilcoxon Test in Ordinal DataDocument15 pagesWilcoxon Test in Ordinal DataElizabeth CollinsNo ratings yet

- IDF Ps. ConductualDocument16 pagesIDF Ps. ConductualKarla BFNo ratings yet

- A Study of Different Compensation Plans at PTCL and Their Effect On EmployeeDocument38 pagesA Study of Different Compensation Plans at PTCL and Their Effect On Employeeabdulsaqib0% (1)

- Yanow - Conducting Interpretive Policy Analysis (... )Document31 pagesYanow - Conducting Interpretive Policy Analysis (... )Juan Cll100% (1)

- CE 111chapgoalswebDocument9 pagesCE 111chapgoalswebHamidNo ratings yet

- Example Memorandum of Understanding MOUDocument3 pagesExample Memorandum of Understanding MOUMaja AtanasovaNo ratings yet

- Employee Readiness To Change and Individual IntelligenceDocument9 pagesEmployee Readiness To Change and Individual IntelligenceWessam HashemNo ratings yet

- Effect of Insufficient Computer Equipment Toward The Grade 11 ICT LearnersDocument16 pagesEffect of Insufficient Computer Equipment Toward The Grade 11 ICT LearnersRalph Sapphire SmithNo ratings yet

- Knowledge Hiding in OrganizationsDocument25 pagesKnowledge Hiding in OrganizationsMaryam MalikNo ratings yet

- Grade 12 Research Full DocumentsDocument76 pagesGrade 12 Research Full DocumentsKyoshiro80% (5)

- Synopsis Title:-: "A Comprehensive Study On Employee Motivation at Bata India LTD."Document6 pagesSynopsis Title:-: "A Comprehensive Study On Employee Motivation at Bata India LTD."saikiabhascoNo ratings yet

- BloomsDocument2 pagesBloomsV SATYA KISHORENo ratings yet

- Kritik Jurnal Kuantitatif Survey: Ns. Yufitriana Amir., MSC., PHD., Fisqua Dosen Ilmu Keperawatan Universitas RiauDocument18 pagesKritik Jurnal Kuantitatif Survey: Ns. Yufitriana Amir., MSC., PHD., Fisqua Dosen Ilmu Keperawatan Universitas RiauLuthi PratiwiNo ratings yet

- English10 - Mod1 - Distinguish Technical Terms Used in Research - FinalDocument36 pagesEnglish10 - Mod1 - Distinguish Technical Terms Used in Research - Finalmavlazaro.1995No ratings yet

- Personality Assessment Overview by Daniel BuanDocument21 pagesPersonality Assessment Overview by Daniel BuanAnton BuanNo ratings yet

- Pew Upgrading Voter RegistrationDocument12 pagesPew Upgrading Voter RegistrationLaney SommerNo ratings yet