Professional Documents

Culture Documents

Chapter 2 - Audit Strategy, Planning and Programming

Uploaded by

thuzh007Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 - Audit Strategy, Planning and Programming

Uploaded by

thuzh007Copyright:

Available Formats

Chapter 2 - Audit Strategy, Planning and Programming

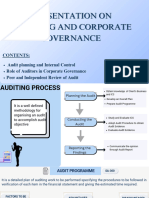

Audit Strategy Audit Planning Audit Programming

Meaning: Designing Audit Approaches to achieve necessary audit Developing an overall plan for the Detailed plan of work

Meaning

Meaning

assurance at the lowest cost. expected scope and conduct of the comprises of techniques and

1. Obtaining knowledge of business: audit and procedures,

It provides a frame of reference within which the auditor exercises Developing an audit programme

may also contain objectives

his professional judgement to assess risk, to plan audit, to evaluate showing NTE of Audit procedures

for each audit step.

audit evidence and providing quality services. Acquiring knowledge of client Nature of business.

2. Performing Analytical Procedures at Initial Stages: To assess the accounting system, policies and Overall Plan

Matters to be

considered

Aspects to be

potential for material misstatement in the F.S. as a whole. internal control procedures. System of internal control and

accounting procedures.

covered

3. Evaluating Inherent Risk: Establishing the expected degree

On the basis of prior audit experience, controls exercised by of reliance on internal control. Size and structure of

Steps involved in Audit Strategy

management, significant changes since last assessment. organization.

Determining the NTE of audit

Factors to be evaluated to assess inherent risk Information regarding the

At the level of F.S. At the level of A/c Balance

procedures. organization.

Integrity of Management. Quality of Accounting System. Coordinating the work to be Accounting policies followed.

Management experience Susceptibility to Misstatement performed.

Changes in management / Misappropriation of assets. To devote attention to important areas Draw a broad outline

First Time Audit

Development of Audit programme

Filled up the details on a

Importance of

Pressures on Management Complexity of transactions. Identify & resolve potential problems.

consideration of deficiencies

planning

Nature of entity business. Degree of judgement involved. Organized and managed audit.

in internal control.

Factors affecting industry. Unusual transactions Selection of suitable ET.

Coordination of work done Determine the special

4. Evaluating Internal Control System: procedures needs to be

By documenting the extent of computerization, preparing/updating Direction and supervision of applied.

flowcharts to record the transactions. engagement team.

5. Formulating Audit Strategy: Requires consideration of: Terms of engagement Review earlier programme

Engagement objective Nature & timing of reports and modified on account of:

Factors to be

Engagement

considered

Experience gained during

Subsequent

Knowledge of clients business Legal or statutory requirements.

Accounting policies & changes therein. the previous audit.

Preliminary judgements as to materiality

Effects of new accounting/auditing Important changes in

Identified inherent risks internal control system,

pronouncements.

Extent of compliance testing Identification of significant audit areas. accounting procedures etc.

NTE of Substantive testing Setting of materiality levels. Evaluation of internal

Points relating to planning and controlling the audit. Degree of reliance on internal control. control for current year.

1. Employment of Qualitative Resources. 1. Substantial increase in Volume of

Relationship - Audit Strategy & Audit Planning turnover.

requiring changes

2. Allocation of appropriate quantity of resources. 2. Significant changes in accounting

Circumstances

Benefits

Inter-related to each other because change in procedures.

3. Determining the timing of deployment of resources.

one would result change in other. 3. Observation w.r.t. ineffective internal

4. Better management of resources in terms of direction, Audit strategy is prepared before the audit plan control.

supervision, timing of team meetings etc. 4. Substantial increase in book debts or

and provides the guidelines for developing the inventory.

audit plan. 5. Suspicion as to misappropriation of assets.

Compiled by: CA. Pankaj Garg Page 42

You might also like

- REVIEWER2 - Introduction To Audit of Historical Financial InformationDocument8 pagesREVIEWER2 - Introduction To Audit of Historical Financial InformationErine ContranoNo ratings yet

- Template Presentation - Entrance and Exit MeetingsDocument48 pagesTemplate Presentation - Entrance and Exit MeetingsRheneir MoraNo ratings yet

- 2020 Phil Healey ProfileDocument25 pages2020 Phil Healey ProfilePhilip HealeyNo ratings yet

- International Law LLB First Part NotesDocument20 pagesInternational Law LLB First Part NotesRAJAT DUBEYNo ratings yet

- Audit ProcessDocument43 pagesAudit Processpiyush singh100% (2)

- Lecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsDocument8 pagesLecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsMaeNo ratings yet

- Larrys Cheat Sheet Auditing TechniquesDocument2 pagesLarrys Cheat Sheet Auditing TechniquesMay Chen100% (1)

- Information Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessFrom EverandInformation Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessRating: 3 out of 5 stars3/5 (2)

- Corporate Governance and Internal AuditDocument10 pagesCorporate Governance and Internal AuditItdarareNo ratings yet

- At Audit PlanningDocument7 pagesAt Audit PlanningRey Joyce AbuelNo ratings yet

- IPCC Auditing Chapter II: Audit Strategy, Planning and ProgrammeDocument8 pagesIPCC Auditing Chapter II: Audit Strategy, Planning and ProgrammeAlphy maria cherianNo ratings yet

- Tarek Ahmed Solution ManualDocument3 pagesTarek Ahmed Solution Manualsina giahkar0% (3)

- Audit PlanningDocument21 pagesAudit Planningablay logeneNo ratings yet

- Auditing IT Controls Part 1: SOX and GovernanceDocument5 pagesAuditing IT Controls Part 1: SOX and GovernanceMylene Sunga AbergasNo ratings yet

- Maturity of Internal AuditDocument4 pagesMaturity of Internal AuditSofyan TimotyNo ratings yet

- Holy Spirit National High SchoolDocument5 pagesHoly Spirit National High Schoolmaribel m. molinaNo ratings yet

- Compliance AuditDocument37 pagesCompliance AuditADITYA GAHLAUT100% (2)

- Fraud Detection - Using Data Analysis TechniquesDocument6 pagesFraud Detection - Using Data Analysis Techniqueswesternwound82No ratings yet

- SAMPLE Auditing PDFDocument74 pagesSAMPLE Auditing PDFMiku LendioNo ratings yet

- Nayong Pilipino FoundationDocument7 pagesNayong Pilipino FoundationXaimin MequiNo ratings yet

- Election CodeDocument13 pagesElection CodeGertrudeRosebelleRimandoBenavidezNo ratings yet

- Audit Planning: Auditor's Main ObjectiveDocument7 pagesAudit Planning: Auditor's Main Objectivemarie aniceteNo ratings yet

- Pre0131 Midterm Reviewer.pdf PlanningDocument2 pagesPre0131 Midterm Reviewer.pdf PlanningEliny CruzNo ratings yet

- Sia Kelompok 10Document16 pagesSia Kelompok 10Desy manurungNo ratings yet

- This Study Resource Was Shared Via: Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageThis Study Resource Was Shared Via: Chapter 2 - Audit Strategy, Planning and ProgrammingNavneet NandaNo ratings yet

- Lesson 2 - Audit PlanningDocument24 pagesLesson 2 - Audit PlanningrylNo ratings yet

- Audit Plan Includes A Description ofDocument9 pagesAudit Plan Includes A Description of03LJNo ratings yet

- Operations Auditing Phases: Learning ObjectivesDocument20 pagesOperations Auditing Phases: Learning ObjectivesRamil SagubanNo ratings yet

- iau_manual_section_i1Document30 pagesiau_manual_section_i1Herbert NgwaraiNo ratings yet

- Santa Rita College of PampangaDocument4 pagesSanta Rita College of PampangaVanessa HaliliNo ratings yet

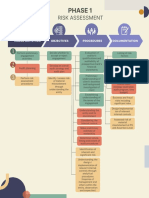

- GROUP 8 - Risk AssessmentDocument1 pageGROUP 8 - Risk AssessmentRhad Lester C. MaestradoNo ratings yet

- P7 - Planning PartDocument15 pagesP7 - Planning PartArab AhmedNo ratings yet

- Auditing PPT G1Document48 pagesAuditing PPT G1Anishka GoyalNo ratings yet

- Materi Test of ControlDocument66 pagesMateri Test of ControlIntan100% (1)

- Auditing Full Version Sir Jaypee Tinipid Version1Document17 pagesAuditing Full Version Sir Jaypee Tinipid Version1Lovely Rose ArpiaNo ratings yet

- Section 2: Audit Plan Overall Audit Strategy (Audit Approach)Document7 pagesSection 2: Audit Plan Overall Audit Strategy (Audit Approach)April ManjaresNo ratings yet

- Audit Liquid Measurement (Class 7050)Document4 pagesAudit Liquid Measurement (Class 7050)yoyokpurwantoNo ratings yet

- ACCO 30043 Assignment No.4 RevisedDocument9 pagesACCO 30043 Assignment No.4 RevisedRoseanneNo ratings yet

- Audit PlanningDocument4 pagesAudit PlanningLoo Bee YeokNo ratings yet

- 4 5850471109056532136Document38 pages4 5850471109056532136Yehualashet MulugetaNo ratings yet

- Holographic Gradients Risk AssessmentDocument33 pagesHolographic Gradients Risk AssessmentMylaNo ratings yet

- Substantive TestingDocument18 pagesSubstantive TestingMichelle SicangcoNo ratings yet

- Audit planning essentialsDocument2 pagesAudit planning essentialsIsabell CastroNo ratings yet

- Russian Audit Planning ProcedureDocument17 pagesRussian Audit Planning ProcedureSyedur RahmanNo ratings yet

- Audit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiDocument15 pagesAudit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiLeo DanuartaNo ratings yet

- Planning Comparison External vs COA AuditsDocument35 pagesPlanning Comparison External vs COA AuditsShiela Marie GadayosNo ratings yet

- Assurance Chapter-5 (04-09-2018)Document9 pagesAssurance Chapter-5 (04-09-2018)Shahid MahmudNo ratings yet

- External Audit ScopeDocument2 pagesExternal Audit ScopeBennice 8No ratings yet

- Study Unit 1 - The Audit ProcessDocument9 pagesStudy Unit 1 - The Audit ProcessRobinson ChinyerereNo ratings yet

- CHAPTER 5 - AudTheoDocument4 pagesCHAPTER 5 - AudTheoVicente, Liza Mae C.No ratings yet

- 01 Review of The Auditing ProcessDocument34 pages01 Review of The Auditing ProcessGwyneth Ü ElipanioNo ratings yet

- Module 1 AUDIT PLANNINGDocument3 pagesModule 1 AUDIT PLANNINGLady BirdNo ratings yet

- GROUP 2 - Audit Phase II Risk ResponseDocument8 pagesGROUP 2 - Audit Phase II Risk ResponseRhad Lester C. MaestradoNo ratings yet

- Understanding the Audit ProcessDocument5 pagesUnderstanding the Audit ProcessJoyce Ann CortezNo ratings yet

- Lecture Notes: Auditing Theory AT.1808-Audit Planning-An Overview MAY 2015Document8 pagesLecture Notes: Auditing Theory AT.1808-Audit Planning-An Overview MAY 2015Misa AmaneNo ratings yet

- Rticle: CRAS-CBR: Internal Control Risk Assessment System Using Case-Based ReasoningDocument12 pagesRticle: CRAS-CBR: Internal Control Risk Assessment System Using Case-Based ReasoningLauraCamilaDuqueNo ratings yet

- AAA Webinar 6 Semester 1 2020 For DownloadDocument38 pagesAAA Webinar 6 Semester 1 2020 For DownloadPeggy ChuNo ratings yet

- Audit Planning and Materiality in CIS EnvironmentsDocument4 pagesAudit Planning and Materiality in CIS EnvironmentsLady BirdNo ratings yet

- Final Exam: Assoumou Kouame Jose Auditing DR BoguiDocument2 pagesFinal Exam: Assoumou Kouame Jose Auditing DR BoguiEudes Salvy AssoumouNo ratings yet

- Chapter 4Document3 pagesChapter 4Gerrelle Cap-atanNo ratings yet

- Audit Procedures and Risk ResponseDocument7 pagesAudit Procedures and Risk ResponseJwyneth Royce DenolanNo ratings yet

- Chapter 1 AuditingDocument29 pagesChapter 1 AuditingAisa TriNo ratings yet

- Chapter14 - Auditing IT Controls Part 1 - BSA2ADocument10 pagesChapter14 - Auditing IT Controls Part 1 - BSA2AjejelaNo ratings yet

- The Risk-Based Audit Process - Phase 1-BDocument15 pagesThe Risk-Based Audit Process - Phase 1-BJoseph LomboyNo ratings yet

- Calculating The Right Audit Coverage Part2 Rationalizing Audit Activities PDFDocument20 pagesCalculating The Right Audit Coverage Part2 Rationalizing Audit Activities PDFLorena MartínezNo ratings yet

- Aud1206 Operation Auditing Midterm ReviewerDocument3 pagesAud1206 Operation Auditing Midterm ReviewerJazmine Arianne DalayNo ratings yet

- Section 2 Comparative AnalysisDocument34 pagesSection 2 Comparative AnalysisShiela Marie GadayosNo ratings yet

- Chapter 5 - SOX AUDITDocument1 pageChapter 5 - SOX AUDITthuzh007No ratings yet

- Fdocuments - in - Ais Romney 2006 Slides 08 Is Control2Document138 pagesFdocuments - in - Ais Romney 2006 Slides 08 Is Control2thuzh007No ratings yet

- Chapter 3 - Risk Assessment & Internal ControlDocument1 pageChapter 3 - Risk Assessment & Internal Controlthuzh007No ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- Georgia Myerson Resume 2021 - FinalDocument2 pagesGeorgia Myerson Resume 2021 - Finalapi-541211114No ratings yet

- NGO and Rular Development PresentationDocument11 pagesNGO and Rular Development PresentationEfty M E IslamNo ratings yet

- A Summer Training Project Report ON: "An Analysis of Financial Statement of A Company"Document5 pagesA Summer Training Project Report ON: "An Analysis of Financial Statement of A Company"NAVEEN ROY67% (3)

- Mid-Day MealDocument27 pagesMid-Day Mealshailesh gusainNo ratings yet

- Napoleon LauraDocument2 pagesNapoleon Laurashalom napoleonNo ratings yet

- How To Write A Letter To AuthoritiesDocument4 pagesHow To Write A Letter To Authoritiesarjun singhNo ratings yet

- Organizational Culture Views of ExcellenceDocument25 pagesOrganizational Culture Views of ExcellenceElia Kim FababeirNo ratings yet

- TimelineDocument6 pagesTimelineAryan RajNo ratings yet

- Industry & Competitive Landscape Analysis: Session 6Document16 pagesIndustry & Competitive Landscape Analysis: Session 6SHIVAM VARSHNEYNo ratings yet

- Study Buddy Survey of Grade 9 StudentsDocument4 pagesStudy Buddy Survey of Grade 9 StudentsKayen MarasiganNo ratings yet

- 1 India Foreign Trade FeautresDocument12 pages1 India Foreign Trade Feautresvanshii100% (1)

- BASIC SKILLS IN CONSTRUCTIVE COMMUNICATIONDocument3 pagesBASIC SKILLS IN CONSTRUCTIVE COMMUNICATIONraja naiduNo ratings yet

- Siaton Science High School 2nd Grading Exam ReportDocument1 pageSiaton Science High School 2nd Grading Exam ReportEugene JamandronNo ratings yet

- SAftex Company ProfileDocument5 pagesSAftex Company ProfileLeulNo ratings yet

- General notes on roof structure drawingDocument1 pageGeneral notes on roof structure drawingZaidNo ratings yet

- Application No.: LLR Fresh AcknowledgementDocument1 pageApplication No.: LLR Fresh AcknowledgementAlapati RajasekharNo ratings yet

- Delhi Urban Art Commission ReviewDocument11 pagesDelhi Urban Art Commission ReviewSmritika BaldawaNo ratings yet

- 4th Grade Editing Mini-LessonDocument4 pages4th Grade Editing Mini-Lessonapi-355852282No ratings yet

- Cyber Laws Notes001Document2 pagesCyber Laws Notes001Dipanshu KambojNo ratings yet

- Questions For Young PeopleDocument1 pageQuestions For Young PeopleKJNo ratings yet

- The Importance of Creating Brand Recognition in Resort IndustryDocument7 pagesThe Importance of Creating Brand Recognition in Resort IndustryardNo ratings yet

- Etsi Deus Non DareturDocument14 pagesEtsi Deus Non DareturDaniel Dascalu100% (1)

- Implementing Odoo ERP for Business AppsDocument8 pagesImplementing Odoo ERP for Business AppsSohail HamidNo ratings yet

- BC2 222 - 2012Document6 pagesBC2 222 - 2012Matumbi NaitoNo ratings yet