Professional Documents

Culture Documents

Audit Program - Amusement Tax

Uploaded by

Nanette Rose HaguilingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Program - Amusement Tax

Uploaded by

Nanette Rose HaguilingCopyright:

Available Formats

NAME OF AGENCY

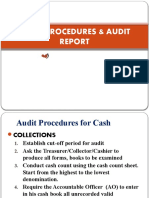

AUDIT PROGRAM

FOR THE PERIOD ________________

AMUSEMENT TAX

( Account Code 581 )

Account Description: This Account is used to record taxes imposed on gross receipts

from admission fees collected by the proprietors, lessees or operators of theaters,

cinemas, concert halls, circuses, boxing stadium and other places of amusement.

Audit Objectives:

1. To ascertain that all amusement taxes have been accurately recorded and properly

classified in the account and that account balance is accurate.

2. To determine whether amusement taxes so collected are generated from sources

expressly authorized by law rules and regulations and that rules and regulations

policies and procedures contribute to the realization of the goals or target through

efficient and economical means.

3. To determine whether amusement taxes collected are properly assessed, collected,

receipted, accounted for and remitted promptly.

4. To determine that amusement tax were properly presented and adequately

disclosed in the financial statement.

Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or

Regularity ( VR ), Rights and Obligations ( RO ), Valuation and Measurement

(VM), Presentation and disclosure ( PD )

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

1.1 Trace the FS balance to the general C

ledger (GL). EO

1.2 Verify the correctness of postings in the C

GL from the Cash Receipts Journal, EO

Cash Journal and the General Journal.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

1.3 Determine the total number of Journal

Entry Vouchers (JEV) to be sampled C

using the approved sampling

methodology.

1.4 Check correctness of the entries in the C

JEV from the Report of Collections EO

and Deposits and the source

documents.

1.5 Analyze income account for propriety C

of credits. EO

1.6 Review the general ledger account. C

Trace entries in the account through

the journals to the underlying Report

of Collections and Deposits (RCD).

1.7 Verify the correctness of vertical and C

horizontal footings of the RCD by

running an independent tape.

1.8 Trace transcription of the data from the C

official receipt to the RCD.

1.9 Trace column totals of the RCD to the C

entries in the Cash Receipts

Journal/Cash Journal.

1.10 Foot the Cash Receipts Journal/Cash C

Journal and trace to the postings in

the general ledger.

1.11 Verify or confirm with the C

bank/Bureau of Treasury the amounts EO

appearing on Remittance Advices as RO

having been deposited with

authorized depository bank/Bureau of

Treasury.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

1.12 On sample basis, and whenever

possible, confirm with payees and C

determine correct amount paid. EO

RO

1.13 From the books of accounts, prepare C

a schedule by months of all types of

income recorded during the audit

period. Foot the schedule and

compare the total with the general

ledger.

1.14 Compare the schedule with the C

earnings of similar past periods.

Check to see that all types of income

due are being recorded.

1.15 Investigate wide fluctuations between C

months and years. Watch for any

exceptional items or those that are

recurrent but not booked up.

1.16 Check to see whether proper cut-off C

for income realized has been

observed.

1.17 Review transactions for a few days C

before and after the end of the

accounting period under audit.

1.18 Check whether earned income for the C

period have been accrued and

recorded in the books.

1.19 Examine any charges/adjustments VR

made to the accounts. See that they VM

are proper and duly authorized.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

2.1 Examine whether credits to VM

income account are proper and that PD

the account classification is correct

and consistently followed.

2.2 Examine supporting

documents or other basis for credits C

to income for: EO

VR

regularity RO

authorization PD

accuracy

proper account classification

2.3 Review assessment/bills C

rendered/ collection records to VR

determine if tax laws, ordinances, VM

regulations, etc. are being applied

uniformly and in similar situations as

to:

rates

computation

manner of payment

penalties, if applicable

2.4 Inquire into the basis or VR

criterion in giving discounts or

exemptions, if any, and its effect on

income target.

2.5 Compare income realized C

against target/projections for the

period. Analyze trend over several

years. Quantify differences.

2.6 Determine causes of C

shortfalls in income generation.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

2.7 Check if increased income VM

was caused by:

higher rates of income

more efficient system or effort by

management

understated estimate/projection of

income

2.8 Look into the agency’s VM

method or basis of estimating income

and see that it is reasonable and

attainable.

2.9 Check if the agency VM

provides for a mechanism to establish

and control the cost of realizing or

collecting income and compare and

analyze the cost per peso of income

generated/collected to determine

efficiency in operation.

Total cost of

income generation = Cost per peso of

Total income income realized

2.10 Discuss with management VM

the possibility of increasing income

thru improved assessment/billing/

collection procedures or by correcting

negative practices and other factors

that prevent the attainment of income

targets.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

3.1 Verify tax due from the order of C

payment: VM

Check the rates applied against

the rates embodied in the tax

ordinance

Re-compute the assessment

3.2 Secure and verify the Statements of

Gross Sales/Receipts if it includes the

following:

Total number of tickets

Total number of tickets sold

Unit price of each tickets

Total amount collected

Reports are duly signed by the

operators/promoter

3.3 Secure from the BIR the names of the C

promoters whose tickets have been EO

approved and registered with them

including the date of registration,

classes, admission prices and

inclusive serial numbers of the

admission tickets.

Compare the data gathered with

the information given by the

operators/promoters.

Note for any discrepancy found in

the comparison made.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

3.4 Determine whether tickets have been C

registered with the Treasurer's Office EO

and check their dates of registration,

classes, admission prices and

inclusive serial numbers.

3.5 Secure from the Treasurer’s Office list C

of promoters/operators who are VR

exempted from paying the

amusement tax and the corresponding

exemption certificates from

Sanggunian.

3.6 Verify whether the exemption is in C

accordance with the tax ordinance. If VR

not, determine the amount of revenue

that should have been realized if the

amusement tax is collected.

3.7 From the samples of Official Receipts C

(OR) and Report of Collections and EO

Deposits (RCD). Compare the

amount of taxes due per order of

payment with the amount collected

per OR.

3.8 Check the ORs whether the amount in

words agrees with the amount in C

figures. Take note of any alteration or

erasure and investigate if any.

3.9 See to it that the nature of payment is C

properly indicated in the ORs. EO

3.10 Check the numerical sequence of ORs C

issued. Investigate for the missing

receipts.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

3.11 Ascertain whether all copies of C

cancelled ORs are attached to the

RCD. Inquire for the cause of

cancellation.

3.12 Verify correctness of the Collector’s C

RCD. Ascertain that the RCDs have VR

been duly certified by the collector

and the liquidating officer/treasurer.

3.13 Match collections against deposits to C

establish undeposited collections

3.14 Compare the dates when collections VR

were made/turned over against the

dates of the teller’s validation in the

deposit slip to determine delays in the

deposit of collections.

3.15 Compare the amount of cash and C

checks collected/turned over against VR

the amount of cash and checks

deposited to determine

accommodated checks.

3.16 Match official receipts issued for C

checks collections against the list of

checks to determine all cash

collections are remitted.

ASSERTIONFS

TIME

AUDIT FRAME

TO

WP

PROCEDURES Ref

BE

DONE REMARKS

BY DATE DATE

STARTED COMPLETED

3.17 Check footings of the RCD and C

abstract of collections as well as the

movements of accountable forms.

Verify whether the balance

beginning of the accountable

forms is the ending balance per

last report.

Trace the serial numbers of

accountable forms entered in the

“Received” column of the RCD to

the covering Requisition and

Issue Slip (RIS).

3.18 Verify remittances from the C

Cashier’s/ Treasurer's RCD.

4.1 Check the propriety of the presentation VM

of the account. See that it conforms to PD

the provisions of the New

Government Accounting System.

4.2 Check whether adequate disclosure PD

concerning the accounting method of

recording income has been made in

the financial statements.

4.3 Note and document exceptions, if any.

Prepare and issue AOM.

PREPARED BY : REVIEWED BY : APPROVED BY :

Date Date Date

You might also like

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Ap - Cost of Goods SoldDocument2 pagesAp - Cost of Goods SoldRoby Renna EstoqueNo ratings yet

- Creative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceFrom EverandCreative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceRating: 3.5 out of 5 stars3.5/5 (5)

- Audit Working Program - Loans PayableDocument5 pagesAudit Working Program - Loans PayableNanette Rose HaguilingNo ratings yet

- AP - Accounts PayableDocument5 pagesAP - Accounts PayableKristofer John RufoNo ratings yet

- Audit Program - Awards and Indemnities RewardsDocument4 pagesAudit Program - Awards and Indemnities RewardsNanette Rose HaguilingNo ratings yet

- Audit Program - LRDocument2 pagesAudit Program - LRKathleenNo ratings yet

- Audit Program - Capital StockDocument4 pagesAudit Program - Capital StockNanette Rose HaguilingNo ratings yet

- Audit Program - Breeding StockDocument4 pagesAudit Program - Breeding StockNanette Rose HaguilingNo ratings yet

- SEECS Auditing and Consultancy Services: Audit ProceduresDocument2 pagesSEECS Auditing and Consultancy Services: Audit ProceduresKathleenNo ratings yet

- Aud. Program - Accounts PayableDocument6 pagesAud. Program - Accounts PayableRalph Christer MaderazoNo ratings yet

- PT - Cash and Cash Equivalents Period Ended - Audit ObjectivesDocument32 pagesPT - Cash and Cash Equivalents Period Ended - Audit ObjectivesVera Magdalena HutaurukNo ratings yet

- Audit ProgramsDocument492 pagesAudit ProgramsNa-na Bucu100% (7)

- LGS-B Antique - AP - Cash-and-Cash-Equivalents (Edited)Document7 pagesLGS-B Antique - AP - Cash-and-Cash-Equivalents (Edited)Ei Mi SanNo ratings yet

- Lesson 2 The Accounting Process 1Document56 pagesLesson 2 The Accounting Process 1sottomaryrose1214No ratings yet

- 19l (12-00) Develop The Audit Program - RevenuesDocument2 pages19l (12-00) Develop The Audit Program - RevenuesAnh Tuấn TrầnNo ratings yet

- WP Asset A - Cash On Hand and in BanksDocument7 pagesWP Asset A - Cash On Hand and in BanksDikdikNo ratings yet

- Roles and Responsibilities - Accounting ClerkDocument3 pagesRoles and Responsibilities - Accounting ClerktrainershipsolutionsNo ratings yet

- 3 - Audit ProgramDocument2 pages3 - Audit ProgramMitzi WamarNo ratings yet

- Eco-Edge Home Interiors and Supplies, Inc. Audit Program For Performance Audit - Accounts ReceivableDocument2 pagesEco-Edge Home Interiors and Supplies, Inc. Audit Program For Performance Audit - Accounts ReceivableMitzi WamarNo ratings yet

- Audit Program Cash & BankDocument23 pagesAudit Program Cash & BankSarang SinghNo ratings yet

- P - VENITURI SI CHELT FIN - Financial Inc&expDocument1 pageP - VENITURI SI CHELT FIN - Financial Inc&expovidiu.tisloveanuNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- FinancialapgDocument2 pagesFinancialapgDivine GraceNo ratings yet

- WP Asset B - Trade ReceivablesDocument15 pagesWP Asset B - Trade ReceivablesDikdikNo ratings yet

- General Ledger-PSP PresentationDocument19 pagesGeneral Ledger-PSP PresentationOmar TarekNo ratings yet

- Roles and Responsibilities - ALLDocument57 pagesRoles and Responsibilities - ALLtrainershipsolutions0% (2)

- 19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeDocument2 pages19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeTran AnhNo ratings yet

- IctfhfghjmkkDocument11 pagesIctfhfghjmkkJerald BrillantesNo ratings yet

- Name of Agency Audit Program CY 2016: Ap - Due To Bir Page 1 of 2Document2 pagesName of Agency Audit Program CY 2016: Ap - Due To Bir Page 1 of 2jaymark camachoNo ratings yet

- 19l (12-00) Develop The Audit Program - COGSDocument1 page19l (12-00) Develop The Audit Program - COGSAnh Tuấn TrầnNo ratings yet

- TO AccountingDocument12 pagesTO AccountingAditi SinghNo ratings yet

- AUD589 Tutorial Aud of SOPL SOFPDocument4 pagesAUD589 Tutorial Aud of SOPL SOFPRABIATULNAZIHAH NAZRINo ratings yet

- AP - Audit of INVENTORY - Office Supplies - PRESENTATION.fDocument6 pagesAP - Audit of INVENTORY - Office Supplies - PRESENTATION.fCirilo CabadaNo ratings yet

- Accounting and Bookkeeping SOPDocument22 pagesAccounting and Bookkeeping SOPJessa Mae Cac100% (2)

- This Study Resource WasDocument8 pagesThis Study Resource WasMubarrach MatabalaoNo ratings yet

- 19b (12-00) Develop The Audit Program - Accounts ReceivableDocument3 pages19b (12-00) Develop The Audit Program - Accounts ReceivableTran AnhNo ratings yet

- 02 Trade PayableDocument14 pages02 Trade PayableRuwan GunarathnaNo ratings yet

- Oracle Test CasesDocument7 pagesOracle Test Casessanjeev19_ynr0% (1)

- Best Practices - OPERA Accounts Receivable Checklist v5Document3 pagesBest Practices - OPERA Accounts Receivable Checklist v5Jawad HussainNo ratings yet

- Audit Program: Provision Against Long Term Deposits Against UtilitiesDocument4 pagesAudit Program: Provision Against Long Term Deposits Against UtilitiesAqib SheikhNo ratings yet

- Process Manual: PurposesDocument5 pagesProcess Manual: PurposesNoteefied GovNo ratings yet

- ACCTG1 Chapter 4Document11 pagesACCTG1 Chapter 4Mark Kevin JavierNo ratings yet

- 19a (12-00) Develop The Audit Program - CashDocument2 pages19a (12-00) Develop The Audit Program - CashTran AnhNo ratings yet

- Cash Collection Processes3Document11 pagesCash Collection Processes3Atis Madri AmandaNo ratings yet

- Work Program - Income TaxesDocument5 pagesWork Program - Income TaxesHarold Dan AcebedoNo ratings yet

- I Audit Objectives: Finance & Risk ManagementDocument9 pagesI Audit Objectives: Finance & Risk ManagementChinh Le DinhNo ratings yet

- General Ledger Reconciliation Process FlowchartDocument6 pagesGeneral Ledger Reconciliation Process FlowchartNarayan KulkarniNo ratings yet

- Chartered Accountants: Member Crowe GlobalDocument20 pagesChartered Accountants: Member Crowe Globalemaan fatimaNo ratings yet

- FAR Module 3Document21 pagesFAR Module 3Michael Angelo DawisNo ratings yet

- Month End Closing ChecklistDocument4 pagesMonth End Closing ChecklistSanjeev AroraNo ratings yet

- Saor Addalam Rhs 2018Document15 pagesSaor Addalam Rhs 2018gilbertNo ratings yet

- Audit Procedures & Audit ReportDocument8 pagesAudit Procedures & Audit ReportJohn Ian LaudNo ratings yet

- Accounts From Incomplete RecordsDocument38 pagesAccounts From Incomplete RecordsSuriya Arun prasathNo ratings yet

- Income Audit and AR Checklist - No 1 - Oasis Balance Against DRS From PeopleSoftDocument14 pagesIncome Audit and AR Checklist - No 1 - Oasis Balance Against DRS From PeopleSoftMaximillian DjunaidyNo ratings yet

- Supplementary Material Module 5Document10 pagesSupplementary Material Module 5Darwin Dionisio ClementeNo ratings yet

- CH 3.0-CONDUCT THE CASH EXAMINATIONDocument22 pagesCH 3.0-CONDUCT THE CASH EXAMINATIONBon Carlo Medina MelocotonNo ratings yet

- Accounting Cycle Applied To Servic BusinessDocument4 pagesAccounting Cycle Applied To Servic BusinessRhai zah MhayNo ratings yet

- OJT Scope of WorkDocument4 pagesOJT Scope of WorkSheena Marie OuanoNo ratings yet

- Risk Statements:: Audit Program CASH IN BANK - Local CurrencyDocument3 pagesRisk Statements:: Audit Program CASH IN BANK - Local CurrencyJona De Castro - ManongdoNo ratings yet

- BOT PartBDocument49 pagesBOT PartBNanette Rose HaguilingNo ratings yet

- Audit Program - Breeding StockDocument4 pagesAudit Program - Breeding StockNanette Rose HaguilingNo ratings yet

- Audit Program - Capital StockDocument4 pagesAudit Program - Capital StockNanette Rose HaguilingNo ratings yet

- A. Preliminary EvaluationDocument8 pagesA. Preliminary EvaluationNanette Rose HaguilingNo ratings yet

- Annex 1 RiskDocument11 pagesAnnex 1 RiskNanette Rose HaguilingNo ratings yet

- Res92 217Document1 pageRes92 217Nanette Rose HaguilingNo ratings yet

- c82-179 To Travel Via PALDocument2 pagesc82-179 To Travel Via PALNanette Rose HaguilingNo ratings yet

- CC-2004-06 (Guidelines On Payment of Disbursement)Document4 pagesCC-2004-06 (Guidelines On Payment of Disbursement)Kiddo ApolinaresNo ratings yet

- Eo 888Document3 pagesEo 888Nanette Rose HaguilingNo ratings yet

- CertificateofauthenticityDocument1 pageCertificateofauthenticityNanette Rose HaguilingNo ratings yet

- Cir 95-005 Private AuditorsDocument2 pagesCir 95-005 Private AuditorsNanette Rose HaguilingNo ratings yet

- Coa C96-010Document2 pagesCoa C96-010Florz GelarzNo ratings yet

- Commission On Audit: Republic of The PhilippinesDocument8 pagesCommission On Audit: Republic of The PhilippinesNanette Rose HaguilingNo ratings yet

- NBC452Document4 pagesNBC452Emmanuel AbadNo ratings yet

- COMMISSION ON AUDIT CIRCULAR NO. 77-61 September 26, 1977Document1 pageCOMMISSION ON AUDIT CIRCULAR NO. 77-61 September 26, 1977Rene BalloNo ratings yet

- Commission On Audit Circular No. 77-55 March 29, 1977Document8 pagesCommission On Audit Circular No. 77-55 March 29, 1977Gerry MicorNo ratings yet

- C76 41Document2 pagesC76 41Shenilyn MendozaNo ratings yet

- Anniversary Bonus PDFDocument4 pagesAnniversary Bonus PDFOrenz MendozaNo ratings yet

- NBC452Document4 pagesNBC452Emmanuel AbadNo ratings yet

- Primer CnaDocument9 pagesPrimer CnaJuris ArrestNo ratings yet

- Working Program-Cash and Cash EquivalentDocument3 pagesWorking Program-Cash and Cash EquivalentNanette Rose HaguilingNo ratings yet

- Haley V London Electricity Board (1964) 3 All Er 185 - HLDocument26 pagesHaley V London Electricity Board (1964) 3 All Er 185 - HLAzizul KirosakiNo ratings yet

- VANLANDINGHAM Defendant Memorandum in Support of Motion To DismissDocument71 pagesVANLANDINGHAM Defendant Memorandum in Support of Motion To DismissRickey Stokes100% (2)

- Team Code - R-430 Before The Hon'Ble High Court of Wakanda: W.P. (C) N - 2020Document23 pagesTeam Code - R-430 Before The Hon'Ble High Court of Wakanda: W.P. (C) N - 2020kumar PritamNo ratings yet

- Torres-Madrid V Feb MitsuiDocument6 pagesTorres-Madrid V Feb MitsuiBrian TomasNo ratings yet

- Articles of PartnershipDocument2 pagesArticles of Partnershiprethiram100% (4)

- Judgment (: Criminal Appeal No. 1160 of 2019 at SLP (CRL.) No.3342 of 2019 G.J. Raja vs. Tejraj SuranaDocument15 pagesJudgment (: Criminal Appeal No. 1160 of 2019 at SLP (CRL.) No.3342 of 2019 G.J. Raja vs. Tejraj SuranaJayakrishnan UNo ratings yet

- G.R. No. L-28379 March 27, 1929 The Government of The Philippine Islands, ApplicantDocument6 pagesG.R. No. L-28379 March 27, 1929 The Government of The Philippine Islands, Applicantbbbmmm123No ratings yet

- The Procter & Gamble Company v. Kraft Foods Global, Inc. - Document No. 53Document30 pagesThe Procter & Gamble Company v. Kraft Foods Global, Inc. - Document No. 53Justia.comNo ratings yet

- Spouses Francisco Sierra VsDocument7 pagesSpouses Francisco Sierra VsaNo ratings yet

- In Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCDocument3 pagesIn Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCgraceNo ratings yet

- Appeal Judgment Best V Minister of Home Affairs2Document41 pagesAppeal Judgment Best V Minister of Home Affairs2BernewsAdminNo ratings yet

- The Philippine Environmental Assessment PoliciesDocument20 pagesThe Philippine Environmental Assessment PoliciesKringNo ratings yet

- Job Application Form (CFO)Document3 pagesJob Application Form (CFO)Waqas100% (1)

- Tootle v. Uitenham, 10th Cir. (2004)Document3 pagesTootle v. Uitenham, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- Salita vs. Magtolis DigestDocument1 pageSalita vs. Magtolis DigestVince Albert TanteNo ratings yet

- Times Leader 08-09-2012Document40 pagesTimes Leader 08-09-2012The Times LeaderNo ratings yet

- Form 1 - ApplicationDocument2 pagesForm 1 - ApplicationAnonymous ORP6BYb4No ratings yet

- Student Organization and Club Application FormDocument1 pageStudent Organization and Club Application FormDaniel BalubalNo ratings yet

- LBA MEA Booklet FinalDocument35 pagesLBA MEA Booklet FinalAditya Vardhan MadabhushaniNo ratings yet

- Kaine Files War Powers Resolution To Prevent War With IranDocument5 pagesKaine Files War Powers Resolution To Prevent War With IranU.S. Senator Tim KaineNo ratings yet

- MemorialDocument13 pagesMemorialHarshil ShahNo ratings yet

- Legal MemorandumDocument11 pagesLegal MemorandumGermaine CarreonNo ratings yet

- Karen Salvacion CaseDocument2 pagesKaren Salvacion CaseDave Lumasag CanumhayNo ratings yet

- Attorney's Fees PALEDocument5 pagesAttorney's Fees PALEerlaine_franciscoNo ratings yet

- DRCDocument13 pagesDRCaasi121No ratings yet

- MSRTC Sample TicketDocument1 pageMSRTC Sample TicketGanesh Newarkar33% (3)

- Intramuros Administration, Petitioner, Vs - Offshore Construction Development Company, RespondentDocument2 pagesIntramuros Administration, Petitioner, Vs - Offshore Construction Development Company, RespondentAljay LabugaNo ratings yet

- Nina Ravey FilesDocument793 pagesNina Ravey FilesEthan BrownNo ratings yet

- Perry 2016Document254 pagesPerry 2016chiquiNo ratings yet

- G.R. No. L-54470Document4 pagesG.R. No. L-54470Evangelyn EgusquizaNo ratings yet