Professional Documents

Culture Documents

Employer Indemnity Letter

Uploaded by

nanivenkatgauravOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employer Indemnity Letter

Uploaded by

nanivenkatgauravCopyright:

Available Formats

Letterhead ( Employer Only ) STAMPS

Date : ………………..

The Director of Inland Revenue Department

Inland Revenue Board

Collection Branch

UG 21, Wisma KWSG

Jalan Attap

50460 Kuala Lumpur

Dear Sir,

Mr/Mrs : …………………………

Passport No : ………………………….

Income Tax File No : ………….…….………..

INDEMNITY LETTER

In consideration of your granting repayment of tax overpaid in the case of the above

named taxpayer amounting to RM………………….. by cheque drawn in our

name(………………employer name……………………..), we hereby indemnify you

from and against all actions, proceedings, damages, costs, claims, demands, expenses or

losses which you may suffer, incur or sustain by reason or on account of your issuing the

repayment cheque in our name.

2. We also hereby undertake and agree that, the payment of RM ……………………

to us, shall be sufficient discharge as per your obligations for repayment concerning the

above mentioned tax payer.

3. We also assure and declare that no suit or legal action will be instituted against

the Inland Revenue Board either by us or by any parties or our employee by reason of

granting the above refund.

To expedite your prompt processing of the tax refund, we furnish our bank account

details as follows :

Payee Name : ……………………………………

Name and address of banker : ……………………………………

Bank account no : ……………………………………

Correspondence address : ……………………………………

Yours faithfully,

--------------------------

( Managing Director )

You might also like

- Letterhead (Employer Only) : Tax Borne LetterDocument1 pageLetterhead (Employer Only) : Tax Borne Letternanivenkatgaurav100% (2)

- Contoh Appointment LetterDocument3 pagesContoh Appointment LetterMuhammad Fitri SulaimanNo ratings yet

- 2.1 Demand LetterDocument3 pages2.1 Demand Letterciliciki350% (2)

- Bank Account Opening Letter For Company EmployeeDocument1 pageBank Account Opening Letter For Company EmployeeAng Eng How100% (1)

- Formal Letter of TerminationDocument1 pageFormal Letter of TerminationQamar Zahraa0% (1)

- Confirmation Letter PDFDocument1 pageConfirmation Letter PDFMadhan Manmadhan100% (2)

- Bank Statement LetterDocument2 pagesBank Statement LetterSanjay MalhotraNo ratings yet

- Appeal&Pending Review FormDocument9 pagesAppeal&Pending Review Formdaeshar14No ratings yet

- Letter of Award - Cleaning & Landscaping 2016janDocument2 pagesLetter of Award - Cleaning & Landscaping 2016jantilamisu100% (7)

- Cheque Book Application and Reporting Loss of Requsition Slip and Official StampDocument2 pagesCheque Book Application and Reporting Loss of Requsition Slip and Official StampHazwan StyntethNo ratings yet

- Solarvest Energy LOA ProjectDocument2 pagesSolarvest Energy LOA Projectbulat lala0% (1)

- Application For PanelshipDocument1 pageApplication For PanelshipAimi AzemiNo ratings yet

- Certification Letter for Lorry Driver PositionDocument1 pageCertification Letter for Lorry Driver PositionZulfahmi Ab SalamNo ratings yet

- Award Letter Elevator Repair WorksDocument2 pagesAward Letter Elevator Repair WorksSiti Jumaah Rahmat0% (1)

- MEMORANDUM OF SATISFACTION OF REGISTERED CHARGE - Section 360Document2 pagesMEMORANDUM OF SATISFACTION OF REGISTERED CHARGE - Section 360Lee Jun ZheNo ratings yet

- Confirmation LetterDocument1 pageConfirmation Letter伟龙100% (1)

- Flexible Work Application and Agreement FormDocument1 pageFlexible Work Application and Agreement FormSuganthi AravindNo ratings yet

- Request Bank Statement Nov 2014Document2 pagesRequest Bank Statement Nov 2014Thirumurthi SubramaniamNo ratings yet

- 2.1 Demand LetterDocument3 pages2.1 Demand Letterprem2506No ratings yet

- Personal Information SummaryDocument3 pagesPersonal Information SummaryDave PagaraNo ratings yet

- Sample LLP AgreementDocument18 pagesSample LLP AgreementSwarup SarkarNo ratings yet

- Contoh Surat PengesahanDocument1 pageContoh Surat PengesahanSirajvind SuriyaNo ratings yet

- Doctor's Appeal for Diabetic WorkerDocument5 pagesDoctor's Appeal for Diabetic WorkerAnbaraj ArunNo ratings yet

- Accounting Procedures For Early Terminate HPDocument11 pagesAccounting Procedures For Early Terminate HPNelsonMoseMNo ratings yet

- 06 - Breach of Contract-Sample Show Cause LetterDocument2 pages06 - Breach of Contract-Sample Show Cause Letterlooikokhua0% (1)

- 9.letter of SecondmentDocument1 page9.letter of SecondmentChin Su Jing100% (7)

- Weekly DTRDocument1 pageWeekly DTRLovelyn Gabuat100% (1)

- Bank Cheque Book - AuthorizationDocument1 pageBank Cheque Book - AuthorizationNayeem AhmedNo ratings yet

- Letter For Acquiring Deduction Certificates by Rehan Aziz Shervani - Public WelfareDocument1 pageLetter For Acquiring Deduction Certificates by Rehan Aziz Shervani - Public WelfareRehan Shervani100% (2)

- Claim For Out Station Duty AllowanceDocument1 pageClaim For Out Station Duty AllowanceDeyzan HusainNo ratings yet

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomNo ratings yet

- Letter of Consent for Credit Information DisclosureDocument1 pageLetter of Consent for Credit Information DisclosureLagenda KejoraNo ratings yet

- Offer Letter FormatDocument6 pagesOffer Letter Formatshinji sanNo ratings yet

- Investment Application FormDocument2 pagesInvestment Application FormAdnan Zahid100% (1)

- Application For Internet Banking Maybank2u Biz ServiceDocument1 pageApplication For Internet Banking Maybank2u Biz ServiceMohamad Sallihin100% (1)

- Demand Letter and Employment LetterDocument6 pagesDemand Letter and Employment LetterFarhana AnuarNo ratings yet

- Memo Public Holiday 2015Document1 pageMemo Public Holiday 2015hanwee100% (2)

- Car Undertaking Passport DetailsDocument1 pageCar Undertaking Passport DetailsMirza Farouq Beg0% (1)

- Kod BankDocument2 pagesKod BankpravimNo ratings yet

- Account Opening LetterDocument1 pageAccount Opening Letterbaloch4all50% (2)

- Kurunegala - Site Expenses: in HandDocument22 pagesKurunegala - Site Expenses: in HandKrishan RodrigoNo ratings yet

- Celcom Mobile Registration RequestDocument1 pageCelcom Mobile Registration RequestKendrel TanNo ratings yet

- Covering Letter For Visa Application For EgyptDocument1 pageCovering Letter For Visa Application For EgyptKarolinafischer100% (1)

- Letter To Notify The Domestic InquiryDocument1 pageLetter To Notify The Domestic InquiryZaara Khan67% (3)

- 3 - Contoh Rekod Cuti Pekerja (A3)Document1 page3 - Contoh Rekod Cuti Pekerja (A3)taska flamingo100% (2)

- Urus Akaun CarasimpleDocument112 pagesUrus Akaun CarasimpleNidaSyam100% (1)

- Rental Property Profit and Loss Statement (租金收入损益表)Document1 pageRental Property Profit and Loss Statement (租金收入损益表)Meng Chuan Ng100% (1)

- Borang KWSP 1 - V23092014Document5 pagesBorang KWSP 1 - V23092014Apeng Bah Ini0% (1)

- CRD - 12-Application For Opening Account and Credit Facilities FormDocument3 pagesCRD - 12-Application For Opening Account and Credit Facilities FormkufikuNo ratings yet

- Sample Letter of Undertaking To Bank and Confirmation To Loan SolicitorsDocument2 pagesSample Letter of Undertaking To Bank and Confirmation To Loan SolicitorsDzulaikhaAinaa71% (14)

- Directors Written ResolutionDocument2 pagesDirectors Written ResolutiononiongurlzNo ratings yet

- MOF Certificate Application ChecklistDocument2 pagesMOF Certificate Application ChecklistaszNo ratings yet

- Job Offer Letter FormatDocument2 pagesJob Offer Letter FormatSachin SharmaNo ratings yet

- Capital Allowance ScheduleDocument4 pagesCapital Allowance ScheduleAmu KrishnanNo ratings yet

- ASB - Maxis Termination LetterDocument1 pageASB - Maxis Termination Letteramrianah100% (2)

- CP 600 - Registration Form For Individual Income Tax FileDocument2 pagesCP 600 - Registration Form For Individual Income Tax FileArh Ying0% (1)

- INLAND REVENUE BOARD ENTRY DEPARTURE SCHEDULEDocument4 pagesINLAND REVENUE BOARD ENTRY DEPARTURE SCHEDULEJohnyReuben0% (2)

- Form - 1 Application For Opening An Account: Paste Photograph of Applicant/sDocument9 pagesForm - 1 Application For Opening An Account: Paste Photograph of Applicant/sSundar RajanNo ratings yet

- Application Side Payment Order: D D M M Y Y Y YDocument1 pageApplication Side Payment Order: D D M M Y Y Y YAjay RajNo ratings yet

- Bank Letter FormatDocument1 pageBank Letter FormatNuwan RulzNo ratings yet

- UntitledDocument1 pageUntitlednanivenkatgauravNo ratings yet

- UntitledDocument1 pageUntitlednanivenkatgauravNo ratings yet

- Personnel Time Sheet Month:: Work Activity Total HrsDocument3 pagesPersonnel Time Sheet Month:: Work Activity Total HrsnanivenkatgauravNo ratings yet

- Location Thickness Type of LiningDocument7 pagesLocation Thickness Type of LiningPaul PhiliphsNo ratings yet

- Total Procedure NDT Procedure (Ut For Steel Structure) - 1Document35 pagesTotal Procedure NDT Procedure (Ut For Steel Structure) - 1nanivenkatgauravNo ratings yet

- RCC53 Column DesignDocument15 pagesRCC53 Column DesignnanivenkatgauravNo ratings yet

- I-Gohar Ayub KhanDocument2 pagesI-Gohar Ayub KhannanivenkatgauravNo ratings yet

- Total Procedure NDT Procedure (Ut For Steel Structure) - 1Document35 pagesTotal Procedure NDT Procedure (Ut For Steel Structure) - 1nanivenkatgauravNo ratings yet

- WK RtoDocument2 pagesWK RtonanivenkatgauravNo ratings yet

- Total Procedure NDT Procedure (Ut For Steel Structure) - 1Document35 pagesTotal Procedure NDT Procedure (Ut For Steel Structure) - 1nanivenkatgauravNo ratings yet

- Total Procedure NDT Procedure (Ut For Steel Structure) - 1Document35 pagesTotal Procedure NDT Procedure (Ut For Steel Structure) - 1nanivenkatgauravNo ratings yet

- EN ISO 15609-1: European Standard Norme Européenne Europäische NormDocument10 pagesEN ISO 15609-1: European Standard Norme Européenne Europäische NormnanivenkatgauravNo ratings yet

- 1500-MCQs WITH Answer (Civil Engg.)Document132 pages1500-MCQs WITH Answer (Civil Engg.)karpagavalliNo ratings yet

- WK RtoDocument2 pagesWK RtonanivenkatgauravNo ratings yet

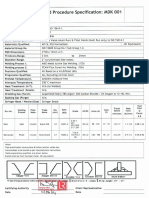

- Weld Procedure MDK001Document5 pagesWeld Procedure MDK001nanivenkatgauravNo ratings yet

- LEAK TEST REPORT MODIFIED - OfficeRecovery Online DemoDocument1 pageLEAK TEST REPORT MODIFIED - OfficeRecovery Online DemonanivenkatgauravNo ratings yet

- HYSYS TrainingDocument11 pagesHYSYS TrainingnanivenkatgauravNo ratings yet

- Fabrication and Erection of Steel StructureDocument29 pagesFabrication and Erection of Steel Structure978060143692% (48)

- Flower TestDocument1 pageFlower TestnanivenkatgauravNo ratings yet

- STEELDocument5 pagesSTEELnanivenkatgauravNo ratings yet

- Coatings BasicsDocument11 pagesCoatings Basicsnanivenkatgaurav100% (1)

- Structural Steel Inspection ReportDocument2 pagesStructural Steel Inspection ReportnanivenkatgauravNo ratings yet

- NDT (Ut) - Twi - Part (4) .Document31 pagesNDT (Ut) - Twi - Part (4) .nanivenkatgauravNo ratings yet

- Coatings Basics PDFDocument167 pagesCoatings Basics PDFnanivenkatgauravNo ratings yet

- Coatings Basics PDFDocument167 pagesCoatings Basics PDFnanivenkatgauravNo ratings yet

- Wilhelmsen Ships Service - Unitor Welding Handbook PDFDocument561 pagesWilhelmsen Ships Service - Unitor Welding Handbook PDFNaseer HydenNo ratings yet

- Steel Design Guide 14 - Staggered Truss Framing Systems PDFDocument45 pagesSteel Design Guide 14 - Staggered Truss Framing Systems PDFAndré Luiz Nogueira100% (1)

- DGS PlanDocument7 pagesDGS PlannanivenkatgauravNo ratings yet