Professional Documents

Culture Documents

Profile of The Indian Automobile Industry: Chapter - Iii

Uploaded by

Pranay BhardwajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profile of The Indian Automobile Industry: Chapter - Iii

Uploaded by

Pranay BhardwajCopyright:

Available Formats

CHAPTER - III

PROFILE OF THE INDIAN AUTOMOBILE INDUSTRY

3.1 INTRODUCTION

The history of the Indian automobile industry comprises of three qualitatively

distinct periods: a) the first phase, 1928 – 1955 dominated by import and assembly

activity. During the British regime, India had no auto industry to begin with and all the

automobiles were imported from the global auto manufacturers such as General Motors

and Ford Motors. In the 1940s, Hindustan Motors and Premier Motors were established

by Indian entrepreneurs, by importing know-how from General Motors and Fiat

respectively, b) the next phase, 1955-1974 should be characterized as the phase of import

substitution and emergence of indigenous automobile manufacture and industry’s maturity

towards self-reliance. In the 1950s, a few companies such as Mahindra and Mahindra,

Ashok Motors (with technical collaboration with Leyland Motors) and Bajaj Auto

entered the market for commercial vehicles and two wheelers. Most of them either

imported auto – components or produced them in house. Later on as a result of the L.K. Jha

committee’s recommendations in 1960 indigenous ancillaries sector evolved as a separate

auto components sector, c) The third period spans since the mid 70’s and thereafter is

marked by structural adjustments and liberalization. The automobile industry in India, the

tenth largest in the world with an annual production of approximately 2 million units is

expected to become one of the major global automobile industries in the coming years.

A number of domestic companies produce automobiles in India and the growing presence

of multinational investment, too, has led to an increase in overall growth.

The global auto industry is a key sector of the economy for every major country

in the world. Today, the Indian automobile industry presents a galaxy of varieties and

models meeting all possible expectations and globally established industry standards.

Some of the leading names echoing in the Indian automobile industry include Maruti

Suzuki, Tata Motors, Mahindra and Mahindra, Hyundai Motors, Hero Honda and

Hindustan Motors in addition to a number of others. During the early stages of its

development, Indian automobile industry heavily depended on foreign technologies.

64

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

However, over the years, the manufacturers in India have started using their own

technology evolved in the native soil. The thriving market place in the country has

attracted a number of automobile manufacturers including some of the reputed global

leaders to set their foot in the soil looking forward to enhance their profile and prospects

to new heights.

3.2 EVOLUTION OF INDIAN AUTOMOBILE INDUSTRY

The Investment Information and Credit Rating Agency of India (ICRA, 2003)

studies the competitiveness of the Indian auto industry, by globally comparisons of macro

environment, policies and cost structure. This has a detailed account on the evolution of

the global auto industry. The United States was the first major players from 1900 to 1960,

after which Japan took its place as the cost-efficient leader. Cost efficiency being the only

real means in as mature an industry as automobiles to retain or improve market share,

global auto manufacturers have been sourcing from the first-tier OEMs since late 1980s.

There are only a few dominant Indian OEMs, while the number of OEMs is very large in

China (122 car manufacturers and 120 motor cycle manufacturers).

While the genesis of Indian automotive industry can be traced to the 1940’s

distinct growth decades started in the 1970’s. Between 1970 and 1984 cars were

considered a luxury product; manufacturing was licensed, expansion was restricted; there

were quantitative restriction (QR) on imports and a tariff structure designed to restrict the

market. The market was dominated by six manufactures- Telco (now Tata Motors),

Ashok Leyland, Mahindra & Mahindra, Hindustan Motors, Premier Automobiles and

Bajaj Auto. The decades of 1985 to 1995 show the entry of Maruti Udyog in the passenger

car segment and Japanese manufacturers in the two wheelers and light commercial

vehicle segments. Economic liberalization, stated in 1991, led to the delicensing of the

passenger car segment in 1993. QR on imports continued. This decade witnessed the

emergence of Hero Honda as a major player in the two wheeler segments and Maruti

Udyog as the market leader in the passenger car segment. Between 1995 and 2000

several international players entered the market. Advanced technology was introduced to

meet competitive pressures, and environmental and safety imperative. Automobile

companies started investing in service network to support maintenance of on-road

vehicles. Auto financing started emerging as an important driver for demand.

65

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Starting in 2000, several landmark policy changes like removal of quantitative

restrictions (QR) and 100 percent FDI through automatic route were introduced.

Indigenously developed (Made in India) vehicles were introduced in the domestic market

and exports were given a thrust. Auto companies started collaboration with financial

firms to provide auto financing and insurance services to customers. Manufacturers also

introduced systems to improve capacity utilization and adopted quality and environmental

management systems. In 2003, Core-group on Automotive R&D (C.A.R) was set up to

identify priority areas for automotive R&D in India.

Rising per capita income and changing demographic distribution are conductive

for growth. India has the highest proportion of population below 35 years, 70% (potential

buyers), which means that 130 million people will get added to the working population

between 2003 and 2009. The trends indicate that small and medium cars would remain

dominant and a shift towards high end cars is expected at a faster rate. The SUV market

is expected to develop rapidly in future. Higher disposable incomes coupled with

availability of easy finance options have driven the passenger vehicle segment.

In the commercial vehicle segment, increased investment in road infrastructure

and availability of cheaper finance has led to a growth in multi axle vehicles. This is

expected to be followed by a shift to tractors-trailer combinations on account of operating

economics of higher power-to-weight ratio vehicles. Growth in the demand for pick-up

trucks has coincided with the growth in multi axle vehicles. The nest growth driver for

LCVs is expected to be the introduction of lighter pick-ups.

The two wheeler segment growth is led by rapid urbanization and resultant raised

in demand from semi-urban and rural areas, increasing income levels, and wider product

range available to customers and easy finance options. The growth in tractor industry is

linked with the growth in agricultural output and exports to neighbouring countries.

Auto component industry growth is directly linked to the growth of automobile industry

since more than 65% sales is to the OEMs. However, in recent years, component exports

are becoming an important growth driver and it is expected to assume greater importance

in future.

66

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Compared to domestic sales, vehicle exports have grown at the rate of 39%

CAGR over the last five years, led by exports of passenger cars at 57% and two wheeler

exports at 35%. Last year however, overall exports registered a growth of around 28%.

In value terms exports crossed USD 2 billion. The key destinations are the SAARC

countries, European Union (Germany, UK, Belgium, Netherlands and Italy), Middle East

and North America. Maruti Udyog, Tata Motors and Hyundai Motor India are key

exporters for passenger cars; Mahindra & Mahindra and Tata Motors for light

commercial vehicles, medium and heavy commercial vehicles, Mahindra & Mahindra for

MUVs, Bajaj Auto for two and three wheelers and Mahindra & Mahindra and TAFE for

tractors. A 3% growth in global demand is anticipated over the next five years and it will

be led by Asia (mainly by China, India and ASEAN). Also global auto companies are

increasingly sourcing components and vehicles from low cost countries. The outsourcing

pie is slowly extending to service like engineering design and other business processes.

India is well positioned to take advantage of the outsourcing opportunities.

3.3 GLOBAL SCENARIO OF INDIAN AUTOMOBILE INDUSTRY

The industry being highly capital intensive, has entry barriers for smaller players.

Even the existing global auto majors themselves are realigning their production bases

coming closer to the scene of action in Asia – Pacific region, mainly in China, India and

Thailand. Besides the above, the constant pressure for cost reduction on OEMs is

compelling them to outsource more and more components from low cost countries.

The changing scenario has opened up opportunities for Indian automobile industry. India,

with huge domestic market, rapidly growing purchasing power, and market linked

exchange rate and well established financial market and stable corporate governance

framework is emerging as an attractive destination for new investments in this sector.

The rapid improvement in infrastructure including road, port, power and world

class facilities for testing, certification and homologation coupled with availability of

manpower and enabling government policies to promote fair competition and make

Indian automotive industry more competitive in world besides making the country a

favourable destination for investment by global majors in auto industry.

67

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

After liberalization of Indian economy in general and automobile industry in

particular, considerable number of Multinational Companies are operating in India either

as wholly owned subsidiaries or in collaboration with their Indian partners. This automotive

sector has taken benefit of liberalization of Indian economy to a large extent and made

available various international brands in India for Indian consumers. Firms like Hyundai

are supplying manufactures cars in the international market using its manufacturing

facility in India in a big way. These firms are using locally available efficient and cost

competitive huge pool of human resource in India.

3.4 FDI IN INDIAN AUTOMOBILE INDUSTRY

Foreign Direct Investment capital flows into India have increased dramatically

since 1991, when India’s opened it economy in FDI, and inflows have accelerated since

2000. FDI inflows into India reached $ 11.1 billion in calendar year 2006 almost double

in the year 2005 and are expected to continue increasing after 2010.(Global FDI has

experienced a corresponding resurgence since 2004, after declining for several years. FDI

inflows into India declined between 2001 and 2003, before experiencing a resurgence

that surpassed average global growth, with a year on-year increased.( UNTAD, world

report 2006, data based on official Indian government.) During the nineties, foreign direct

investment (FDI) accounted for an increasing share of private capital flows to developing

countries. According to the World Investment Report 2002 (WIR02) published by United

Nations Conference on Trade and Development (UNCTAD), developing countries

received 28 per cent of the world FDI inflows in 2001. Global FDI inflows have,

however, declined by 51 per cent in 2001, which also affected the flow to developing

countries. Developing countries witnessed a 14 per cent decline in FDI inflows in 2001 to

US $ 205 billion from US $ 238 billion in 2000. A few developing countries like China

and India, however, registered increased FDI inflows in 2001, which is indicative of their

attractiveness for international investment. The basic advantages provided by FDI to

India in the automobile sector include, advanced technology, cost-effectiveness, and efficient

manpower. Besides, India has a well-developed and competent auto ancillary industry

along with automobile testing and R&D centers. The automobile sector in India ranks

third in manufacturing three wheelers and second in manufacturing of two wheelers.

68

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

FDI Inflows to Automobile Industry have been at an increasing rate as India has

witnessed a major economic liberalization over the years in terms of various industries.

The automobile sector in India is growing by 18 percent per year. The major investing

countries are Mauritius (mainly routed from developed countries), USA, Japan, UK,

Germany, the Netherlands and South Korea. India needs to worry on the foreign direct

investment (FDI) front. According to the statistics released by India’s Ministry of

Commerce and Industry, the country has received only $18.35 billion in FDI in the first

11 months (April-February) of the financial year 2010-2011, compared to $ 6.3 billion

that came in the 11 months of the previous financial year. Future prospect of Indian

Automotive Sector is looking bright. Indigenous automobile companies are replacing

foreign multinational companies in terms of consumer satisfaction.

A cumulative FDI inflow during January 2000-2009 (up to December 2009) is

Rs. 472,231.23 crores (US$ 105.99 billion). Out of this, the amount of FDI inflows in the

automobile Industry during this period is Rs. 20,554.56 crores (US$ 4.55 billion) which

4.29% of the total FDI inflows.

Further, the FDI inflows data on country specific in respect of automobile

industry is available only for the period January 2000 to December 2009. The amount of

FDI inflows project specific in respect of all countries & sector are not centrally

maintained prior to January 2000. The table shows the sector wise classification of FDI

inflow in automobile industry.

Table 3.1

SECTOR- WISE CLASSIFICATION OF FDI INFLOWS IN AUTOMOBILE

INDUSTRY (from January 2000 to December 2009)

Amount of FDI inflows Percentage with

total FDI inflows

S.No Sub Sector Rupees in US$ in

in Automobile

Crores million

Industry

1. Automobile industry 6,651.65 1,441.17 1.36

2. Auto ancillaries/Parts 8,823.97 1,965.54 1.85

3. Passenger Cars 2,891.56 647.11 0.61

4. Others (Transport) 2,187.38 492.69 0.46

Total of above 20,554.56 4,546.51 4.28

Source: dipp.nic.in

69

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

The table 3.1 narrates the sector-wise classification of FDI inflows in automobile

industry during 2000 to 2009. Out of 4.28percent the FDI inflows in automobile industry

(including passenger car and others) is 2.43 percent (US$ 2580.97 million)

India is considered to be one of the fastest growing auto markets in the world

owing to its huge market size, expanding middle class, availability of finance options and

a high percentage of young aspirational population. Apart from these from the viewpoint

of a manufacturer India provides auto companies with low cost production facility, a

growing talent pool of technical personnel, and a growing and competent auto

components market. A look at some of the key parameters of the industry shows that the

sector has been growing continuously thereby benefitting both the manufacturers as well

as the consumers. A look at the production, sales and exports figures suggest that all the

three indicators have shown an upward trend along with the rise in FDI flows into the

sector. The table below shows the top five countries attracting FDI inflow for automobile

industry.

Table 3.2

Share of top five countries attracting FDI Inflows for Automobile Industry (From

January 2000 To December 2009)

Amount of FDI inflows Percentage with

total FDI inflows in

S.No Sub Sector

Rupees in Automobile

US$ in million

Crores Industry

1. Japan 5,129.46 1,114.97 24.52

2. U.S.A 3,811.89 832.44 18.31

3. Italy 2,544.51 595.93 13.11

4. Mauritius 1,566.01 348.18 7.66

5. Sweden 1,598.78 343.61 7.56

Total of above 14,650.65 3,235.13 71.16

Source: dipp.nic.in

70

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

The table 3.2 shows that share of top five countries attracting FDI inflows for

automobile industry during 2000 to 2009. Japan is attracting highest FDI inflows when

compared to other countries which are 34.46 percent of total FDI inflows during the period.

3.5 RECENT TRENDS IN INDIAN AUTOMOBILE INDUSTRY

One of the major industrial sectors in India is the automobile sector. Subsequent

to the liberalization, the automobile sector has been aptly described as the sunrise sector

of the Indian economy as this sector has witnessed tremendous growth.

Automobile Industry was delicensed in July 1991 with the announcement of the

New Industrial Policy. The passenger car industry was, however, delicensed in 1993. No

industrial license is required for setting up of any unit for manufacture of automobiles

except in some special cases. The norms for Foreign Investment and import of technology

have also been progressively liberalized over the years for manufacture of vehicles

including passenger cars in order to make this sector globally competitive.

At present 100% Foreign Direct Investment (FDI) is permissible under automatic

route in this sector including passenger car segment. The import of technology/technological

upgradation on the royalty payment of 5% without any duration limit and lump sum

payment of US$ 2 million is also allowed under automatic route in this sector. With the

gradual liberalization of the automobile sector since 1991, the number of manufacturing

facilities in India has grown progressively.

3.5.1 Domestic Market Share for 2010-11

The table below shows that, the domestic automobile industry market is divided

in to four divisions. They are passenger car, commercial vehicle, three wheelers and two

wheelers. In these divisions, two wheelers segment occupies the highest portion of

market share (76%) in the total market.

71

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Table 3.3

S.No Classification Total Market share (%)

1. Passenger Vehicles 16.25

2. Commercial Vehicles 4.36

3 Three Wheelers 3.39

4. Two Wheelers 76.00

Total 100.00

Production during 2012

According to Society of Indian Automobile Manufacturers (SIAM), the

cumulative production data for April-February 2012 shows overall production growth of

14.56 percent as compared to last year. Production in February 2012 registered growth of

14.62 percent as compared to February 2011.

The overall sales growth rate recorded for April-February 2012 was

12.46 percent. In February 2012, domestic sales registered growth at 12.07 percent as

compared to February 2011. Passenger vehicles segment recovered marginally at

2.95 percent during April-February 2012 over same period last year. Passenger cars

recorded marginal growth of 0.31 percent, utility vehicles grew by 14.66 percent and

vans grew by 10.01 percent in this period. In February 2012, passenger cars, vans and

utility vehicles recorded growth at 13.12 percent, 25.34 percent and 30.04 percent

respectively. And growth in overall passenger vehicles was at 16.07 percent in the month

of February 2012.

The overall Commercial Vehicles (CV) segment registered growth of 18.63 percent

during April-February 2012 as compared to the same period last year. While Medium &

Heavy Commercial Vehicles (M&HCVs) registered growth of 9.23 percent, light

commercial vehicles grew at 26.85 percent. However, in the month of February 2012

over February 2011, the growth in sales of the overall CV segment was 18.70 percent.

72

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Three Wheelers sales recorded further de-growth of (-) 1.78 percent in April-

February 2012. While passenger carriers registered decline by (-) 4.12 percent during

April-February 2012, goods carriers registered growth of 8.32 percent. Two wheelers

registered a growth of 14.77 percent during April-February 2012. Mopeds, motorcycles

and scooters grew by 10.86 percent, 13.12 percent and 23.28 percent respectively.

After comparing data from February 2012 to February 2011, the growth figure for

two wheelers was at 11.96 percent. Three wheelers registered de-growth at (-) 13.58 percent

in the month of February 2012.

During April-February 2012, overall automobile exports registered a growth rate

of 26.12 percent. Passenger vehicles registered growth at 16.17 percent during this

period. Two wheelers, commercial vehicles and three wheelers segments recorded growth

of 26.86 percent, 28.17 percent and 37.05 percent respectively during April-February

2012. In February 2012 compared to February 2011, overall automobile exports

registered a growth of only 5.70 percent.

3.6 Key Challenges faced by the Indian automobile industry

Indian auto industry is one of the most promising and growing auto industries

across the world. But at this juncture the Indian auto industry is facing various challenges

catering to the growing domestic market. Some of the key challenges faced by auto

industry are fuel technology and nurturing talented manpower. These challenges are

explained below in detail:

Fuel Technology

Technology is significant and needed to ignite the growth of auto industry.

Whether it’s a two-wheeler or a car, technology drives the growth. The challenge of

alternative fuel technology ensures a brighter vision of the auto industry in the country.

The increasing environmental pollution has become a concern for manufacturers and all

associated with the industry. All of them are struggling hard to come up with a holistic

and integrated approach to reduce carbon dioxide emission. Some of the initiatives to

reduce the level of automotive emission include introduction of fuel-efficient cars,

obligatory periodic maintenance, and inspection of automotives, designing automotives

73

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

with recyclable materials, use of alternative fuels like CNG, LPG, biodiesel, and

introduction of electric and hybrid cars. Car manufacturer like Maruti Suzuki has already

introduced the new concept of using recyclable substance for car production in its

dazzling car Maruti Suzuki A-Star. After the production of Maruti Suzuki A-Star, the

company thrives to apply the same concept in all its future car models.

In addition, it is believed that the Bharat IV Emission Norms are stringent and are

to become mandatory in the next couple of years. The growing industry is hunting for

more advanced ways and measures to meet the stringent norms. Some of the cars and

other automotives may even be phased out during that period.

Nurturing Talented Manpower

Manpower and human resources has always been a key growth driver in any

industry including the automobile industry. Though India has a vast pool of talented and

skilled professionals, the country needs initiatives and support to treasure these resources

to excel in all areas of the industries.

Automobile industry is no exception and highly skilled manpower will further

become the most reliable source of competitive advantage across the global as well as

Indian automobile industry. More than even before creativity, innovative ideas, and

expertise in different areas have become an asset these days. Talking about cars, car

designers infuse their creativity in their designed car models and that’s something which

attracts car customers.

Further to that, the industry has to foster the talent for servicing and maintenance

as well. India has personnel to create better and reliable automotives but still lack the

expertise in servicing and maintenance of the automotives through their life span. Some

professionals, who feel they are over-talented move across the boundaries. According to

SIAM, India is expected to have shortage of well qualified manpower. Therefore, SIAM

introduces new strategies to optimize the skills and support proposals to train youth

across the country including the rural areas. Today, SIAM, Ministry of Rural Development,

National Skills Development Corporation, Indian Government, and the Indian Automotive

Industry, are working in synergy to generate a vast pool of skilled manpower for the

Indian auto industry.

74

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

3.7 Potential of Indian Automobile Industry

There is a very stiff competition in the automobile industry segment in India.

This has helped many to realize their dreams of driving the most luxurious cars. During

the recent past, a number of overseas companies have started grabbing a big chunk of the

market share in both domestic and export sales. Every new day dawns in India with some

new launches by active players in the Indian automobile arena. By introducing some low

cost cars, the industry had made it possible for common men to buy cars for their

personal use. With some innovative strategies and by adopting some alternative remedial

measures, the Indian automobile industry has successfully come unaffected out of the

global financial crisis.

While the automobile industry in India is the ninth largest in the world, the

country emerged as the fourth largest automobiles exporter on the globe following Japan,

South Korea and Thailand, in the year 2009. Over and above, a number of automobile

manufacturers based in India have expanded their operations around the globe also giving

way for a number of reputed MNCs to enthusiastically invest in the Indian automobile

sector.

During the fiscal year 2011, the Indian automobile industry rode high on the

resurgence of consumer demand in the country as a result of the Government’s fiscal

stimulus and attractively low interest rates. As a result the total turnover of the domestic

automobile industry increased by about 27 per cent. This is a remarkable achievement

compared with the total revenue of Rs 1, 28,384.53 crore reported during the same period

of last fiscal year. Specifically, the segment of commercial vehicles witnessed the biggest

jump in revenues by 31 per cent by reporting Rs 38,845.09 crore. During the same

period, the passenger vehicle segment in the country witnessed a growth of 27 per cent

over the last fiscal year by reporting total revenue of Rs 76,545.96 crores. These figures

imply a highly prospective road lying immediately ahead of the Indian automobile industry.

3.8 PROFILE OF SELECTED AUTOMOBILE COMPANIES

The companies under automobile industry are classified into three sectors namely:

commercial vehicles, passenger car and multi-utility vehicle and two & three wheelers

for the purpose of the study.

75

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

a. Commercial Vehicles by Make

Commercial vehicles influence the trade, commerce and industry of a country in a

major way. Vehicles falling under this category are buses, trucks, ambulance, jeeps and

many others. It comes in various uses such as transportation of goods, shipping, and

handling of various commodities and so on.

b. Passenger Car and Multi utility Vehicles

It is the fast growing automobile segment in India and has become the most

popular mode of transportation in rural areas. Multi Utility Vehicles gained momentum in

India due to its higher utility however with lower cost of operation.

c. Two Wheelers by Make:

India is the second largest producer of two-wheelers in the world. In the last few

years, the Indian two-wheeler industry has seen spectacular growth. The country stands

next to China and Japan in terms of production and sales respectively.

Brief descriptions about the selected automobile companies are given under:

1. Ashok Leyland Limited (ALL)

It is a commercial vehicle manufacturing company based in Chennai, India.

Founded in 1948, the company is one of India's leading manufacturers of commercial

vehicles, such as trucks and buses, as well as emergency and military vehicles. Operating

six plants, Ashok Leyland also makes spare parts and engines for industrial and marine

applications. It sells about 60,000 vehicles and about 7,000 engines annually.

2. Atul Auto Limited (AAL)

For more than two decades, Atul Group is renowned as leading manufacturer of

three-wheeled commercial vehicles in the state of Gujarat. From common people's

favourite vehicle CHHAKADA to today's SHAKTI Atul Group had come a long way.

Back in the 1970’s, when transportation was a crucial problem especially in rural areas,

decided to blaze a new trail. The Atul Group was thinking of an affordable mode of

transportation which can benefit rural folks of Saurashtra. The road conditions were not

good but the need for transportation was increasing day in and day out. The improvements in

technologies were done from time to time to make it a sturdy and comfortable vehicle.

76

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

3. Eicher Motors Limited (EML)

Eicher Motors is a commercial vehicle manufacturer in India. The company's

origins date back to 1948, when Good Earth Company was established for the distribution

and service of imported tractors. The Eicher Company has around 2500 employees

located in four manufacturing facilities and 49 marketing and area offices around India.

The group has around 600 suppliers of components and sub-assemblies. The group’s

products are supplied by a network of around 381 dealers distributed across India. Eicher

is present in over 40 other countries.

4. Force Motors Limited (FML)

Force Motors, is the Pune based pioneer of the Light Commercial Vehicle (LCV)

industry that gave India iconic brands like the Tempo, Matador, Minidor and Traveller.

Force Motors is completely vertically integrated, making its own engines, chassis, gear

boxes, axles, bodies, etc. for their entire product range. In 1958, the company started

production of the HANSEAT 3-Wheelers in collaboration with Vidal & Sohn Tempo

Werke Germany. Today, they manufacture a wide range of vehicles including Small

Commercial Vehicles (SCV), Light Commercial Vehicles (LCV), Multi Utility Vehicles

(MUV), Sports Utility Vehicles (SUV), Heavy Commercial Vehicles (HCV) and

Agricultural Tractors. In a move away from its long-established business, of being a

commercial vehicle maker, Force Motors has chosen to enter the personal vehicles arena

with a Sports Utility Vehicle the FORCE ONE.

5. Hero Moto Corp. (HMC)

Formerly Hero Honda Motors Ltd. is the world's largest manufacturer of two -

wheelers, based in India. In 2001, the company achieved the coveted position of being

the largest two-wheeler manufacturing company in India and also, the 'World No.1' two-

wheeler company in terms of unit volume sales in a calendar year. Hero Moto Corp Ltd.

continues to maintain this position till date.

77

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

6. Hindustan Motors Limited (HML),

India's pioneering automobile manufacturing company and flagship company of

the C.K. Birla Group was established just before Indian independence, in 1942 by Mr.

B.M. Birla of the industrious Birla family. Commencing operations in a small assembly

plant in Port Okha near Gujarat, the manufacturing facilities later moved to Uttarpara,

West Bengal in 1948, where it began the production of - the Ambassador.

7. Honda Siel Cars India Ltd (HSCI)

It was incorporated in December 1995 as a joint venture between Honda Motor

Co. Ltd., Japan and Siel Limited, a Siddharth Shriram Group company, with a commitment

to providing Honda’s latest passenger car models and technologies, to the Indian

customers. The total investment made by the company in India till date is Rs 1620 crores

in greater Noida plant and Rs 784 crores in Tapukara plant. HSCI’s first state-of-the-art

manufacturing unit was set up at greater Noida, U.P in 1997. The green-field project is

spread across 150 acres of land. The annual capacity of this facility is 100,000 units.

The company’s second manufacturing facility is in Tapukara, Rajasthan. This facility is

spread over 600 acres and will have an initial production capacity of 60,000 units per

annum, with an investment of about Rs 1,000 crore. Honda’s models are strongly

associated with advanced design and technology, apart from its established qualities of

durability, reliability and fuel-efficiency.

8. Hyundai Motor India Limited (HMIL)

Hyundai Motor India Limited is a wholly owned subsidiary of world’s fifth

largest automobile company, Hyundai Motor Company, South Korea, and is the largest

passenger car exporter. It presently markets 49 variants of passenger cars across

segments. Hyundai Motor currently exports cars to more than 110 countries across

European Union, Africa, Middle East, Latin America and Asia. It has been the number

one exporter of passenger car of the country for the sixth year in a row. In a little over a

decade since Hyundai has been present in India, it has become the leading exporter of

passenger cars with a market share of 66% of the total exports of passenger cars from

India, making it a significant contributor to the Indian automobile industry.

78

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

9. Maharashtra Scooters Limited (MSL)

It is a joint sector Public Limited Company, listed on the Bombay Stock Exchange

and National Stock Exchange, jointly promoted by Western Maharashtra Development

Corporation Limited, a wholly-owned Govt. of Maharashtra undertaking and Bajaj

Holdings & Investment Ltd. (BHIL) while the joint promoter was initially erstwhile

BAL, after its demerger in 2008, the current joint promoter is BHIL.

10. Mahindra & Mahindra (M&M)

Mahindra & Mahindra is mainly engaged in the Multi Utility Vehicle and Three

Wheeler segments directly. The company competes in the Light Commercial Vehicle

segment through its joint venture subsidiary Mahindra Navistar Automotives Limited and

in the passenger car segment through another joint venture subsidiary Mahindra Renault.

Mahindra & Mahindra is expanding its footprint in the overseas market. The company

formed a new joint venture Mahindra Automotive Australia Pty. Limited, to focus on the

Australian Market.

11. Majestic Auto Limited (MAL)

The Company was originally incorporated as a Private Limited Company on

23.4.1973 under the name "Majestic Gears (P) Limited". It was manufacturing various

bicycle components for M/S Hero Cycles Pvt. Ltd. It was promoted by Sh. Satyanand

Munjal, Sh.Brijmohan Lall Munjal and Sh. Om Parkash Munjal of Hero Cycles Limited.

The Company, having understood the requirement of Indian markets of two wheeler

industry, decided to go in for producing of a suitable moped in the year1975. This company

converted to a public limited company on 2nd April, 1977. The name of the company had

been changed to M/s Majestic Auto limited and a fresh certificate of incorporation was

obtained. Majestic auto ltd (Hero Majestic) launched its first moped in the year 1978.

Hero Majestic Mopeds have found acceptance in the overseas markets, including

countries in Africa, North & South America, Europe and the far & Middle East and are

homologated in Europe & USA

79

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

12.Maruti Suzuki India Limited (MSIL)

MSIL, (formerly known as Maruti Udyog Limited) Maruti Suzuki India Limited,

a subsidiary of Suzuki Motor Corporation of Japan, is India's largest passenger car

company, accounting for over 45% of the domestic car market. The company offers a

complete range of cars. Since inception in 1983, Maruti Suzuki India has produced and

sold over 7.5 million vehicles in India and exported over 500,000 units to Europe and

other countries. . MSIL has been the leader of the Indian car market for over two and a

half decades. The company has two manufacturing facilities located at Gurgaon and

Manesar, south of New Delhi, India. Both the facilities have a combined capability to

produce over 1.2 million (1,200,000) vehicles annually.

13.Scooters India Limited (SIL)

Incorporated in 1972, Scooters India Limited is an ISO 9001:2000 and ISO 14001

Company. It is a totally integrated automobile plant, engaged in designing, developing,

manufacturing and marketing a broad spectrum of conventional and non-conventional

fuel driven 3-wheelers. In 1975, company started its commercial production of Scooters

under the brand name of Vijai Super for domestic market and Lambretta for overseas

market. It added one more wheel to its product range and introduced three wheelers under

the brand name of VIKRAM/LAMBRO. However, in 1997, strategically, the company

discontinued its two-wheeler production and concentrated only on manufacturing and

marketing of 3 wheelers. These three wheelers have become more relevant in the present

socio-economic environment as it transports goods and passengers at least cost. The company

has its own marketing network of Regional Sales Offices all over India, catering to

customer’s requirements in the areas of sales and services.

14.SML Isuzu Ltd (SML)

The Company was incorporated on 26th July, 1983 under the name Swaraj

Vehicles Ltd. and changed to the present name on 27th November, 1984. The Company

has been promoted by Punjab Tractors Ltd., in technical collaboration with Mazda Motor

Corporation, Japan and Sumitomo Corporation, Japan. The main object of the company is

to manufacture light commercial vehicles. The factory is located at village Asron, Dist.

Hosiarpur, Punjab.

80

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

15.Tata Motors Limited (TML)

It is India's largest automobile company. Established in 1945, Tata Motors'

presence indeed cuts across the length and breadth of India. Over 6.5 million Tata

vehicles ply on Indian roads, since the first rolled out in 1954. The company's manufacturing

base in India is spread across Jamshedpur (Jharkhand), Pune (Maharashtra), Lucknow

(Uttar Pradesh), Pantnagar (Uttarakhand), Sanand (Gujarat) and Dharwad (Karnataka).

It is the leader in commercial vehicles in each segment, and in passenger vehicles with

winning products in the compact, midsize car and utility vehicle segments. The

company's over 25,000 employees are guided by the vision to be ''best in the manner in

which we operate, best in the products we deliver, and best in our value system and

ethics.'' Tata Motors has operations in the UK, South Korea, Thailand, Spain and South

Africa. Among them is Jaguar Land Rover, a business comprising the two iconic British

brands that was acquired in 2008.

16.TVS Motor Company Limited (TVS)

It is the flagship company of the parent TVS Group employing over 40,000

people with an estimated 15 million customers. It manufactures motorcycles, scooters,

mopeds and auto rickshaws. It is India's only two-wheeler company to have won the

Deming Prize awarded for commitment to quality control, received in 2002.

TVS Motor traces its origins back to the entrepreneurial spirit of Trichur

Vengatram Sundaram Iyengar who gave up lucrative careers in the Indian Railways and

in banking to set up his own business. He began with Madurai's first bus service in 1911

and founded T.V.Sundaram Iyengar and Sons Limited, a company that consolidated its

presence in the transportation business with a large fleet of trucks and buses under the

name of Southern Roadways Limited.[3] When he died in 1955 his sons took the company

ahead with several forays in the automobile sector, including finance, insurance,

manufacture of two-wheelers, tyres and components.

17. V.S.T Tillers Tractors Ltd (VST)

It was incorporated in the year 1967 in Bangalore, India. It was promoted by the

V.S.T Group, a well known business house in South India, in technical collaboration and

joint venture with Mitsubishi Heavy Industries and Mitsubishi Corporation, Japan for the

81

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

You might also like

- Ashok Leyland MultiDocument119 pagesAshok Leyland Multibaranimba5100% (3)

- Project: (A Case Study of Kanpur Nagar)Document16 pagesProject: (A Case Study of Kanpur Nagar)RAHULNo ratings yet

- Automotive Industry in IndiaDocument17 pagesAutomotive Industry in IndiaSiddharth GuptaNo ratings yet

- CCC C CCC C CCCC CCDocument11 pagesCCC C CCC C CCCC CCPragati A SubbannavarNo ratings yet

- Evolution and Growth of Indian Auto Industry: Research ArticleDocument6 pagesEvolution and Growth of Indian Auto Industry: Research ArticleArshwin SinghNo ratings yet

- 1.1: Overview of Automobile Industry in India: Chapter 1: Industrial ProfileDocument93 pages1.1: Overview of Automobile Industry in India: Chapter 1: Industrial Profiletamal mukherjeeNo ratings yet

- A Study of Tata Motors Vehicle Services in Gorakhpur 27-11-2012Document122 pagesA Study of Tata Motors Vehicle Services in Gorakhpur 27-11-2012Shakti Singh RawatNo ratings yet

- Project Marketing Strategy of Maruti SuzukiDocument38 pagesProject Marketing Strategy of Maruti SuzukiJalesh mehta100% (1)

- 34 Tvs Apache in ShimogaDocument102 pages34 Tvs Apache in Shimogaavinash_s1302No ratings yet

- Automobile Industry ProfileDocument9 pagesAutomobile Industry ProfileMohan Ravi90% (10)

- AutomobileDocument5 pagesAutomobilePretty RitzNo ratings yet

- 1860s Horseless Carriage. United States Great Depression,: Introduction of Industry in WorldDocument7 pages1860s Horseless Carriage. United States Great Depression,: Introduction of Industry in WorlddasnadasNo ratings yet

- Auto in IndiaDocument13 pagesAuto in Indiaarunjoseph143No ratings yet

- Automotive Industry in IndiaDocument25 pagesAutomotive Industry in IndiaDeepti GuptaNo ratings yet

- Automotive Industry in IndiaDocument35 pagesAutomotive Industry in IndiasreedhanyNo ratings yet

- Industry Profile: Facts & FiguresDocument11 pagesIndustry Profile: Facts & FiguresGokula KannanNo ratings yet

- Auto IndustryDocument19 pagesAuto IndustryAditya SharmaNo ratings yet

- Bharat BenzDocument31 pagesBharat BenzMUHAMMED ASLAMNo ratings yet

- History and Development of Amul Indusries Pvt. Ltd.Document79 pagesHistory and Development of Amul Indusries Pvt. Ltd.asn8136No ratings yet

- Globalization of Indian Automobile IndustryDocument25 pagesGlobalization of Indian Automobile IndustryAjay Singla100% (2)

- Pre Owned Cars and BikesDocument83 pagesPre Owned Cars and Bikesdarshan1793No ratings yet

- Final ProjectDocument15 pagesFinal Projecttrisanka banikNo ratings yet

- Chapter 1: Industrial/Sectoral Scenario: - History / Evolution of The SectorDocument28 pagesChapter 1: Industrial/Sectoral Scenario: - History / Evolution of The SectorDevender DhakaNo ratings yet

- Industry AnalysisDocument38 pagesIndustry AnalysisIbrahim RaghibNo ratings yet

- Tvs ReportDocument62 pagesTvs ReportvipinkathpalNo ratings yet

- Motorbikes Full PDFDocument14 pagesMotorbikes Full PDFPratima ChaudharyNo ratings yet

- Tata Motors and Maruti Suzuki 1Document16 pagesTata Motors and Maruti Suzuki 1unnati guptaNo ratings yet

- Porter's Five Forces Analysis - Indian Automobile Industry 2Document60 pagesPorter's Five Forces Analysis - Indian Automobile Industry 2Ashish Mendiratta50% (2)

- Auto Industry: Growth Drivers of Indian Automobile MarketDocument5 pagesAuto Industry: Growth Drivers of Indian Automobile Marketbipin3737No ratings yet

- Project Report On Impact of Promotional Tools in Selling Hero Honda BikesDocument64 pagesProject Report On Impact of Promotional Tools in Selling Hero Honda Bikesgangaprasada50% (4)

- JBMDocument53 pagesJBMVaibhav Ahlawat100% (1)

- ProjectDocument122 pagesProjectYashwanth RajNo ratings yet

- Promotional Tools in Selling Hero Honda BikesDocument65 pagesPromotional Tools in Selling Hero Honda BikesMohit kolli0% (1)

- Maruti Suzuki AnalysisDocument136 pagesMaruti Suzuki AnalysissspmNo ratings yet

- Project Final YearDocument79 pagesProject Final YearTamil film zoneNo ratings yet

- FinalDocument58 pagesFinalJumki SNo ratings yet

- Industry Profile 5PGSDocument5 pagesIndustry Profile 5PGSRahul KNo ratings yet

- RESEARCH PROJECT Auvesh Buisness EnviroDocument19 pagesRESEARCH PROJECT Auvesh Buisness EnviroDevesh ShuklaNo ratings yet

- Automobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureDocument7 pagesAutomobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureMohammad HasanNo ratings yet

- Ashok Leyland: The Federation of UniversitiesDocument17 pagesAshok Leyland: The Federation of UniversitiesKunal AhiwaleNo ratings yet

- A Study On Maruti Suzuki Cars and Comparison of Maruti Suzuki Cars With Other Companies CarsDocument80 pagesA Study On Maruti Suzuki Cars and Comparison of Maruti Suzuki Cars With Other Companies CarssspmNo ratings yet

- Role of HRM in An Organization (Automobile Industry)Document17 pagesRole of HRM in An Organization (Automobile Industry)Saransh NeeradNo ratings yet

- Career in Automobile IndustryDocument6 pagesCareer in Automobile Industrythukral86amitNo ratings yet

- A Study On Employee Welfare at Bimal Auto AgencyDocument73 pagesA Study On Employee Welfare at Bimal Auto AgencypraveenNo ratings yet

- Mutual FundDocument61 pagesMutual FundkomalNo ratings yet

- Discussion About Impact On Indian Economy by Automobile SectorDocument26 pagesDiscussion About Impact On Indian Economy by Automobile SectorprakashinaibsNo ratings yet

- Report File of MSD (BBA-214) : Bachelor of Business Adimistration ACADMIC SESSION: - 2021-22 (EVEN) BATCH-2020-23Document20 pagesReport File of MSD (BBA-214) : Bachelor of Business Adimistration ACADMIC SESSION: - 2021-22 (EVEN) BATCH-2020-23Tushar GuptaNo ratings yet

- Indian Automobile MarketDocument13 pagesIndian Automobile MarketSiddharth JhalaNo ratings yet

- Automotive Industry in India: HistoryDocument11 pagesAutomotive Industry in India: HistoryNiharika SharmaNo ratings yet

- Introduction To The Study On Brand ImageDocument79 pagesIntroduction To The Study On Brand ImageArun Mannur0% (1)

- abt auttoРmobile induspryDocument11 pagesabt auttoРmobile induspryAditi PathakNo ratings yet

- Industry ProfileDocument54 pagesIndustry ProfileJumki SNo ratings yet

- Car AssignmentDocument80 pagesCar AssignmentVineet SharmaNo ratings yet

- The Growth of The Indian Automobile Industry - Analysis of The Roles of Government Policy and Other Enabling Factors - SpringerLinkDocument24 pagesThe Growth of The Indian Automobile Industry - Analysis of The Roles of Government Policy and Other Enabling Factors - SpringerLinkRamk TandonNo ratings yet

- Automotive Industry Report PDFDocument44 pagesAutomotive Industry Report PDFdangerous saifNo ratings yet

- Aditya NewDocument72 pagesAditya NewShanthkumar Ramakrishnaiah100% (1)

- From the Cradle to the Craze: China's Indigenous Automobile IndustryFrom EverandFrom the Cradle to the Craze: China's Indigenous Automobile IndustryNo ratings yet

- Designated Drivers: How China Plans to Dominate the Global Auto IndustryFrom EverandDesignated Drivers: How China Plans to Dominate the Global Auto IndustryNo ratings yet

- Contracts 2Document14 pagesContracts 2Pranay BhardwajNo ratings yet

- AdfsdafsdDocument2 pagesAdfsdafsdPranay BhardwajNo ratings yet

- Dfdsgekt W4T Er Ger G Eg Adb, Adb, Adf, B, A DB A, Dbregistration Form To The Branch Manager State Bank of India .Document1 pageDfdsgekt W4T Er Ger G Eg Adb, Adb, Adf, B, A DB A, Dbregistration Form To The Branch Manager State Bank of India .Pranay BhardwajNo ratings yet

- Statement of JurisdictionDocument1 pageStatement of JurisdictionPranay BhardwajNo ratings yet

- BV JKL ,. M,,kjiuo89p0 (P-) ( L KM., Njkop (0i9uhygjhkl M.nbvgyuijlkmn, Bgvhukj SL No Roll No Name of The Student TopicDocument5 pagesBV JKL ,. M,,kjiuo89p0 (P-) ( L KM., Njkop (0i9uhygjhkl M.nbvgyuijlkmn, Bgvhukj SL No Roll No Name of The Student TopicPranay BhardwajNo ratings yet

- Statement of JurisdictionDocument1 pageStatement of JurisdictionPranay BhardwajNo ratings yet

- What Amount To Corrupt Practices-According To The Section 123 (3) A of RPA 1951Document2 pagesWhat Amount To Corrupt Practices-According To The Section 123 (3) A of RPA 1951Pranay BhardwajNo ratings yet

- Htt878uhiopn Cuy8tpuop9u9yoihnb To The Branch Manager State Bank of India .Document1 pageHtt878uhiopn Cuy8tpuop9u9yoihnb To The Branch Manager State Bank of India .Pranay BhardwajNo ratings yet

- Religion and Economic Growth Across CountriesDocument23 pagesReligion and Economic Growth Across CountriesPranay BhardwajNo ratings yet

- A. Alagiriswami, R.S. Sarkaria and V.R. Krishna Iyer, JJDocument16 pagesA. Alagiriswami, R.S. Sarkaria and V.R. Krishna Iyer, JJPranay BhardwajNo ratings yet

- Moot Court MeMorial (Mystery)Document18 pagesMoot Court MeMorial (Mystery)Pranay BhardwajNo ratings yet

- Issue 1Document8 pagesIssue 1Pranay BhardwajNo ratings yet

- Academic Calendar - 2020-21.Document2 pagesAcademic Calendar - 2020-21.Pranay BhardwajNo ratings yet

- As We All Know That This Is The Time When Whole World Is Worst Hit by The Coronavirus, Which Got Genesis From TheDocument2 pagesAs We All Know That This Is The Time When Whole World Is Worst Hit by The Coronavirus, Which Got Genesis From ThePranay BhardwajNo ratings yet

- Equiv Alent Citation: AIR1975SC 290, (1974) 2SC C 660, (1975) 1SC R643Document22 pagesEquiv Alent Citation: AIR1975SC 290, (1974) 2SC C 660, (1975) 1SC R643Pranay BhardwajNo ratings yet

- Jurisprudence - Project TopicsDocument5 pagesJurisprudence - Project TopicsPranay BhardwajNo ratings yet

- Chapter6hindu Marriage ACtDocument213 pagesChapter6hindu Marriage ACtPranay BhardwajNo ratings yet

- ChatDocument1 pageChatPranay BhardwajNo ratings yet

- Final Appellant MemoxDocument34 pagesFinal Appellant MemoxPranay BhardwajNo ratings yet

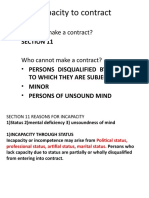

- Capacity To Contract: Who Can Make A Contract?Document16 pagesCapacity To Contract: Who Can Make A Contract?Pranay BhardwajNo ratings yet

- Production Function Slides (F)Document44 pagesProduction Function Slides (F)Pranay BhardwajNo ratings yet

- Consideration Section 2d: Nudum Pactum A Nude or Bare Agreement Is VoidDocument17 pagesConsideration Section 2d: Nudum Pactum A Nude or Bare Agreement Is VoidPranay BhardwajNo ratings yet

- Equiv Alent Citation: AIR1995SC 605, JT1994 (6) SC 632, (1994) 6SC C 360, (1994) Supp5SC R1Document55 pagesEquiv Alent Citation: AIR1995SC 605, JT1994 (6) SC 632, (1994) 6SC C 360, (1994) Supp5SC R1Pranay BhardwajNo ratings yet

- Boschmrp Jan24Document38 pagesBoschmrp Jan24diesel.jabalpurNo ratings yet

- Industry ProfileDocument16 pagesIndustry ProfilePrem RajNo ratings yet

- Shareholding Pattern of Force MotorsDocument5 pagesShareholding Pattern of Force MotorsImran KhanNo ratings yet

- Three WheelerDocument6 pagesThree WheelerSutanoy Dattagupta100% (1)

- Profile of The Indian Automobile Industry: Chapter - IiiDocument19 pagesProfile of The Indian Automobile Industry: Chapter - IiiPranay BhardwajNo ratings yet

- Bajaj Auto - Strategic ManagementDocument42 pagesBajaj Auto - Strategic ManagementShashank JoganiNo ratings yet

- PuneDocument61 pagesPunerutuja chaudharyNo ratings yet

- Midc List PuneDocument4 pagesMidc List PuneHonNo ratings yet

- Final Summer Training Report Mohit PalDocument110 pagesFinal Summer Training Report Mohit Palbharat sachdevaNo ratings yet

- Logos ListDocument109 pagesLogos ListMallidi Charishma ReddyNo ratings yet

- India - Automotive Plants in IndiaDocument9 pagesIndia - Automotive Plants in Indiagouthambv100% (2)

- Abbreviations Used For Vehicle ManufacturersDocument36 pagesAbbreviations Used For Vehicle ManufacturersRavikant Saini100% (1)

- 14 - Chapter 7Document15 pages14 - Chapter 718-UBU-150 SARAN. SNo ratings yet

- Acquisition Project Group 8Document42 pagesAcquisition Project Group 8VIVEKNo ratings yet

- Capital Strutur of FMCG &automobile SectorDocument39 pagesCapital Strutur of FMCG &automobile SectorJithin PonathilNo ratings yet

- Powertrain Engine Manufacturer IndiaDocument6 pagesPowertrain Engine Manufacturer Indiana_1nana0% (1)

- Internship Project RanjanDocument20 pagesInternship Project RanjanRanjan MandalNo ratings yet

- Manil West 1sept13 DoenDocument310 pagesManil West 1sept13 DoenRumelaSamantaDattaNo ratings yet

- FADA Press Release - FADA Releases October'21 & Festive Season Vehicle Retail Data - FinalDocument8 pagesFADA Press Release - FADA Releases October'21 & Festive Season Vehicle Retail Data - FinalSamrat SharmaNo ratings yet

- BFWDocument35 pagesBFWanand003No ratings yet

- Recruitment & SelectionDocument83 pagesRecruitment & SelectionprateekNo ratings yet

- EVA - Indian Automobile IndustryDocument30 pagesEVA - Indian Automobile IndustryleoatcitNo ratings yet

- EXHIBITOR DIRECTORY PRAWAAS 2019 With Advt Updated 12 08 19Document80 pagesEXHIBITOR DIRECTORY PRAWAAS 2019 With Advt Updated 12 08 19amandeepNo ratings yet

- Investment Management-Equity Research Group 1 Fundamental and Technical AnalysisDocument18 pagesInvestment Management-Equity Research Group 1 Fundamental and Technical AnalysisRuchikaNo ratings yet

- Resume - Sheetal Tantia Dec 2017Document4 pagesResume - Sheetal Tantia Dec 2017Tantia AadityaNo ratings yet

- Force Motors LCV - 18.9.2020Document8 pagesForce Motors LCV - 18.9.2020rajanNo ratings yet

- Top 10 Tractors in IndiaDocument7 pagesTop 10 Tractors in IndiaRamanan MrrNo ratings yet

- Pinki Project ReportDocument63 pagesPinki Project ReportRaja KumarNo ratings yet

- BERGER Company ProfileDocument22 pagesBERGER Company ProfileAkhil Narain BahadurNo ratings yet

- IMS Proschool CFA EbookDocument356 pagesIMS Proschool CFA EbookAjay Yadav0% (1)