Professional Documents

Culture Documents

Holy Rosary College of Santa Rosa Laguna, Inc.: Lesson 3 Simple Annuity

Uploaded by

John ClarenceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Holy Rosary College of Santa Rosa Laguna, Inc.: Lesson 3 Simple Annuity

Uploaded by

John ClarenceCopyright:

Available Formats

Holy Rosary College of Santa Rosa Laguna, Inc.

Tagapo, City of Santa Rosa, Laguna

LEARNING MODULE

School Year 2020-2021

General Mathematics

Grade 11

nd

2 Quarter, Week 5-6

Mark Alexis K. Ferrer

mark.ferrer@hrcsrl.edu.ph

Chapter 4 Math of Investment

Lesson 3 Simple Annuity

Lesson Description:

This module will help you learn the different types of functions and their corresponding

graphical representations. You will also learn the applications of these functions to real life;

some of which can be linked with other fields such as in business, medicine, sciences and others.

You will also learn that a certain function is unique to a specific situation. Functions will also

allow us to visualize existing between two variables. Also, we will investigate, analyze,

and solve problems involving simple and compound interests, simple and general annuities,

stocks and bonds, loans and amortization, and using appropriate business and financial

instruments.

Lesson Objectives:

At the end of the lesson, the student must be able to

1. Define annuity payment.

2. Identify different types of annuity

3. Find the future and present value of simple annuity.

Review and Prerequisite Activity

Answer each of the following:

1. P 50, 000 is invested for 5 years at 8% compounded quarterly. Give the value of each

r

variable in the formula A=P(1+i)n where i= and n=Kt

K

a. P = P 50,000

b. r = 0.08

c. i = 0.02

d. n = 20

2. If P10,000 is invested for 10 years at 6% compounded semi-annually, the final amount

is P 18, 061.11. Give the value of the following

a. P = P 10,000

b. r = 0.06

c. i = 0.03

d. n = 20

e. A = 18,061.11

Introduction

If the payment for each period is fixed, and the compound interest rate is fixed over a

specified time, the payment is called Annuity Payment. Accounts associated with streams of

annuity payment are called annuities. Each payment in an annuity is called the Periodic

Payment. The time between the succesive payments date of an annuity is called the Payment

Interval. The interval between the beginning of the first payment period and the end of last

payment period is called the Term of the Annuity.

HRC General Mathematics, Grade 11, Second Quarter Page 1 of 5

Holy Rosary College of Santa Rosa Laguna, Inc.

Tagapo, City of Santa Rosa, Laguna

LEARNING MODULE

School Year 2020-2021

The following are examples of annuities:

1. Rent payment

2. Investment/Insurance

3. Pension

4. Monthly payment of car loan or mortgage.

5. Credit card payment

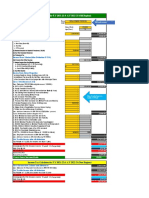

The flowchart below gives the different kinds of annuities.

Annuity

Simple General

Annuity Annuity

Ordinary Deferred

Annuity Annuity

Mr. and Ms. Ferrer deposits P 20, 000 at the end of each year for 5 years in an investment

account that earns 10% per year compounded annually, what is the amount of annuity?

We can use a table to organize the calculations.

Period Payment per Period Amount at 5 years

1 P 20, 000 P 20, 000

2 P 20, 000 20,000(1+0.1)4 or P 29, 282

3 P 20, 000 20,000(1+0.1)3 or P 26, 620

4 P 20, 000 20,000(1+0.1)2 or P 24, 200

5 P 20, 000 20,000(1+0.1)1 or P 22, 200

Total P 122, 102

The Future Value of an annuity is the total accumulations of the payments and

interest earned.

The Present Value of an annuity is the principal that must be invested today to

provide the regular payments of an annuity.

The term future value that has been used with compound interest means the

same term as used with annuity: Future value comes at the end.

Annuity is a fixed sum of money paid to someone at regular intervals, subject

to fixed compound interest.

HRC General Mathematics, Grade 11, Second Quarter Page 2 of 5

Holy Rosary College of Santa Rosa Laguna, Inc.

Tagapo, City of Santa Rosa, Laguna

LEARNING MODULE

School Year 2020-2021

Future Value of Simple Ordinary Annuity Present Value of Simple Ordinary Annuity

FV =P ¿ PV =P ¿

Where

FV = Future Value

PV = Present Value

P = Periodic Payment

i = interest per period

r

i=

K

n = number of conversion period

n = tK

Example

1. Mr. and Ms. Ferrer deposits P 20, 000 at the end of each year for 5 years in an

investment account that earns 10% per year compounded annually, what is the amount of

annuity?

Solution

we have P = P 20,000, i = r/K = 0.1/1 = 0.1, and n = tK = 5(1) = 5, thus,

FV =P ¿

FV =20,000 ¿

2. If you pay P 50 at the end of each month for 40 years on account that pays interest at

10% compounded monthly, how much money do you have after 40 years?

Solution

we have P = P 50, i = r/K = 0.1/12 , and n = tK = 40(12) = 480, thus,

FV =P ¿

FV =50 ¿

3. Aaron’s mother saved P 5, 000 at the end of every 6 months in an educational plan that earns

6% per year compounded semi-annually. What is the amount at the end of 18 years?

Solution

we have P = P 5,000, i = r/K = 0.06/2 = 0.03, and n = tK = 18(2) = 36, thus,

FV =P ¿

FV =5,000 ¿

4. Fernan borrows money to buy a motorcycle. He will repay the loan by making montly

payments of P 1,500 per month for the next 2 years at an interest rate of 9% per year

compounded monthly. How much did Fernan borrows?

HRC General Mathematics, Grade 11, Second Quarter Page 3 of 5

Holy Rosary College of Santa Rosa Laguna, Inc.

Tagapo, City of Santa Rosa, Laguna

LEARNING MODULE

School Year 2020-2021

Solution

we have P = P 1,500, i = r/K = 0.09/12 = 0.0075, and n = tK = 2(12) = 24, thus,

1−(1+i)−n

PV =P [ i ]

1−( 1+ 0.0075)−24

PV =1,500 [ 0.0075 ]

=P32 , 833.72

Regular Payment (P) of an Annuity Regular Payment (P) of an Annuity

(for Future Value) (for Present Value)

( FV ) i ( PV ) i

P= P=

(1+i)n−1 1−(1+i)−n

Where

FV = Future Value

PV = Present Value

P = Periodic Payment

i = interest per period

r

i=

K

n = number of conversion period

n = tK

5. Eva obtained a loan of P 50,000 for the tuition fee of her son. She has to repay the loan by

equal payments at the end of every six months for 3 years at 10% interest compounded semi-

annually. Find the periodic payment.

Solution:

PV = 50, 000 r = .10

t = 3 years i = .10/2 = 0.05

K=2

n = 3(2) = 6

( 50,000 ) ( 0.05 )

P=

1−( 1+0.05 )−6

P=9 ,850.87

6. Mary borrows P 500, 000 to buy a car. She has two options to repay her loan. the interest is

compounded monthly.

Option 1: 24 monthly payments every end of the month at 12% per year.

HRC General Mathematics, Grade 11, Second Quarter Page 4 of 5

Holy Rosary College of Santa Rosa Laguna, Inc.

Tagapo, City of Santa Rosa, Laguna

LEARNING MODULE

School Year 2020-2021

Option 2: 60 monthly payments every end of the month at 15% per year.

Solution:

For option 1:

PV = P 500, 000

i = r/K = .12/12 = 0.01

n = tK = 2(12) = 24

( 500,000 ) ( 0.01 )

P= =P23 , 536.74

1− (1+0.01 )−24

For option 2:

PV = P 500, 000

i = r/K = .15/12 = 0.0125

n = tK = 5(12) = 60

( 500,000 ) ( 0.0125 )

P= =P11 ,894.97

1− (1+ 0.0125 )−60

Application

Answer Vocabulary and concepts, Practice and Application I to II page 227 of your book

General Mathematics. Write your answers on Class Notebook – Exercises. You may also attach a

picture of your work on the indicated page of Class Notebook.

HRC General Mathematics, Grade 11, Second Quarter Page 5 of 5

You might also like

- Module 2: Trigonometric IdentitiesDocument5 pagesModule 2: Trigonometric IdentitiesSerjohnRapsing100% (1)

- Schools Division Office of Quirino Cabarroguis National School of Arts and TradesDocument3 pagesSchools Division Office of Quirino Cabarroguis National School of Arts and TradesLeizel Jane LjNo ratings yet

- Pre-Calculus: Quarter 1 - Module 7: Determine The Standard Form of Equation of An EllipseDocument32 pagesPre-Calculus: Quarter 1 - Module 7: Determine The Standard Form of Equation of An Ellipselucas scottNo ratings yet

- Gen-Math11 Q1 Mod1 Functions With-08082020Document29 pagesGen-Math11 Q1 Mod1 Functions With-08082020Ira CaballeroNo ratings yet

- General Mathematics Module1Document25 pagesGeneral Mathematics Module1ELESIO MAURIN JR.100% (1)

- Pre-Calculus-11 Quarter1 Module12 SeriesDocument26 pagesPre-Calculus-11 Quarter1 Module12 SeriesChaine CandaNo ratings yet

- Module 5 - Rational Functions Equations and InequalitiesDocument32 pagesModule 5 - Rational Functions Equations and InequalitiesSuzuri L100% (1)

- GMQ1M14 Week 4Document16 pagesGMQ1M14 Week 4Ashley Kait Marcelo100% (1)

- Pre-Calculus Learning Activity Sheet Quarter 2 - Melc 4: (Stem - Pc11T-Iib-1)Document7 pagesPre-Calculus Learning Activity Sheet Quarter 2 - Melc 4: (Stem - Pc11T-Iib-1)Lara Krizzah MorenteNo ratings yet

- Pre Calculus Week 1 4Document16 pagesPre Calculus Week 1 4Hannah NacarNo ratings yet

- Module 3 Gen MathDocument15 pagesModule 3 Gen MathGrant Hill AtienzaNo ratings yet

- Signed Off General Mathematics11 q1 m2 Rational Functions v3Document47 pagesSigned Off General Mathematics11 q1 m2 Rational Functions v3HONEY LYN PARASNo ratings yet

- General Mathematics: Quarter 1 - Module 9: Inverse of One-to-One FunctionsDocument25 pagesGeneral Mathematics: Quarter 1 - Module 9: Inverse of One-to-One FunctionsJerald SamsonNo ratings yet

- General Mathematics: Quarter 2 - Module 6: Fair Market Value of A Cash FlowDocument27 pagesGeneral Mathematics: Quarter 2 - Module 6: Fair Market Value of A Cash FlowAivan Jake ArellanoNo ratings yet

- Genmath q1 Mod4 Solvingreallifeproblemsinvolvingfunctions v2-1-1Document18 pagesGenmath q1 Mod4 Solvingreallifeproblemsinvolvingfunctions v2-1-1Edel Polistico Declaro BisnarNo ratings yet

- Genmath 11 q1 w2 Mod6Document10 pagesGenmath 11 q1 w2 Mod6Barez Fernandez ZacNo ratings yet

- MOdule GRADE 11 Module 1-2Document8 pagesMOdule GRADE 11 Module 1-2Christian CabadonggaNo ratings yet

- General Mathematics: Quarter 1 - Module 1: FunctionsDocument30 pagesGeneral Mathematics: Quarter 1 - Module 1: FunctionsRyzhiel MirabelNo ratings yet

- GenMath11 Q1 Mod2 KDoctoleroDocument32 pagesGenMath11 Q1 Mod2 KDoctoleroNicoleNo ratings yet

- Competencies: Redgie G. UbayDocument3 pagesCompetencies: Redgie G. UbayRed Zye UbayNo ratings yet

- Gen-Math11 Q1 Mod7 Presentions-Of-functions 08082020Document16 pagesGen-Math11 Q1 Mod7 Presentions-Of-functions 08082020Ralph MapacpacNo ratings yet

- General Mathematics: Quarter 1 - Module 9Document20 pagesGeneral Mathematics: Quarter 1 - Module 9Aljhon A. MarajuniNo ratings yet

- Module 1 Gen MathDocument15 pagesModule 1 Gen MathGrant Hill AtienzaNo ratings yet

- Representation of Functions: General MathematicsDocument20 pagesRepresentation of Functions: General MathematicsStephany BartianaNo ratings yet

- Inverse Function: Determine Whether A Function Is One-To-One, and Find The Inverse of A One-To-One FunctionDocument16 pagesInverse Function: Determine Whether A Function Is One-To-One, and Find The Inverse of A One-To-One FunctionLee Ming ShengNo ratings yet

- Gen Math As Week 7-8Document4 pagesGen Math As Week 7-8Ce MoranNo ratings yet

- Gen Math Q1 Mod 1Document21 pagesGen Math Q1 Mod 1Joselito UbaldoNo ratings yet

- Gen Math-4 PDFDocument24 pagesGen Math-4 PDFshamera binayonNo ratings yet

- GenMath - q1 - Module3 - For Upload PDFDocument20 pagesGenMath - q1 - Module3 - For Upload PDFStephanie MinorNo ratings yet

- GenMath11 Q1 Mod5 KDoctoleroDocument28 pagesGenMath11 Q1 Mod5 KDoctoleroNicoleNo ratings yet

- GenMath11 Q1 Mod7 ExponentialFunctions Week7 (Revised)Document15 pagesGenMath11 Q1 Mod7 ExponentialFunctions Week7 (Revised)Jovic rullepaNo ratings yet

- General Mathematics: Quarter 1 Relational FunctionsDocument31 pagesGeneral Mathematics: Quarter 1 Relational FunctionsManelyn TagaNo ratings yet

- Subject: Oral Communication in Context Week: 7 (4 Hours) Lesson: Communicative Competence Strategies in Various Speech Situations Content StandardDocument5 pagesSubject: Oral Communication in Context Week: 7 (4 Hours) Lesson: Communicative Competence Strategies in Various Speech Situations Content StandardMaria Ana Patron100% (1)

- Quarter 2 - Module 2 General MathematicsDocument6 pagesQuarter 2 - Module 2 General MathematicsKristine AlcordoNo ratings yet

- M11GM I B 4Document2 pagesM11GM I B 4Gemark D. Gebone100% (2)

- Gen-Math11 Q1 Mod3 Operations-On-functions v3Document28 pagesGen-Math11 Q1 Mod3 Operations-On-functions v3Madel BrunoNo ratings yet

- Translate The Given Verbal Phrase To Mathematical PhaseDocument3 pagesTranslate The Given Verbal Phrase To Mathematical PhaseBOBBY BRAIN ANGOSNo ratings yet

- Precalculus Q1 Mod3 The-Ellipse v5Document37 pagesPrecalculus Q1 Mod3 The-Ellipse v5Vhea Czaryse Ibañez LokingNo ratings yet

- Earth Science: Quarter 2 - Module 5 Rock Behaviors Under StressDocument21 pagesEarth Science: Quarter 2 - Module 5 Rock Behaviors Under StresssammieNo ratings yet

- Pre-Calculus: Quarter 2 - Module 3Document21 pagesPre-Calculus: Quarter 2 - Module 3Cesa BuhianNo ratings yet

- General Mathematics: Learning Activity SheetDocument11 pagesGeneral Mathematics: Learning Activity SheetImjesrel PeriodNo ratings yet

- GenMath11 Q1 Mod3.1 KDoctoleroDocument32 pagesGenMath11 Q1 Mod3.1 KDoctoleroNicoleNo ratings yet

- ADM SHS StatProb Q3 M9 Solving Real Life Preoblems Involving Mean and Variance - Version 2 NNDLDocument28 pagesADM SHS StatProb Q3 M9 Solving Real Life Preoblems Involving Mean and Variance - Version 2 NNDLGotenks DelacruzNo ratings yet

- General MathematicsDocument1 pageGeneral MathematicsCyril Kate Basilan TabinasNo ratings yet

- GenMath11 Q2 Mod7 Deffered-Annuity Version2-From-CE1-CE2 EvaluatedDocument25 pagesGenMath11 Q2 Mod7 Deffered-Annuity Version2-From-CE1-CE2 EvaluatedLarilyn BenictaNo ratings yet

- GenMath11 Q2 Mod6 Fair Market Value of A Cash Flow - Version 1 From CE1 Ce2 EvaluatedDocument27 pagesGenMath11 Q2 Mod6 Fair Market Value of A Cash Flow - Version 1 From CE1 Ce2 EvaluatedLarilyn BenictaNo ratings yet

- 2nd Quarter Exam Gen MathDocument5 pages2nd Quarter Exam Gen Mathargie joy marie100% (1)

- Genmath q1 Mod7 Representationsofrationalfunction v2Document27 pagesGenmath q1 Mod7 Representationsofrationalfunction v2Lyndon AL Lilang CumlaNo ratings yet

- General Mathematics: 1 Quarter ExaminationDocument7 pagesGeneral Mathematics: 1 Quarter ExaminationSerjohnRapsingNo ratings yet

- Pre-Calculus-11 Quarter1 Module13 SeriesandsequenceDocument21 pagesPre-Calculus-11 Quarter1 Module13 SeriesandsequenceChaine Canda100% (1)

- BasicCalculus - G11 - Q4Mod5 - Antiderivatives and Reimann IntegralDocument41 pagesBasicCalculus - G11 - Q4Mod5 - Antiderivatives and Reimann IntegralMARLA RUBY PAZ YTINGNo ratings yet

- Grade11 Statistics and Probabilty - Module 1Document4 pagesGrade11 Statistics and Probabilty - Module 1Erickson SongcalNo ratings yet

- SHS Lesson 1Document11 pagesSHS Lesson 1Tisha Galolo100% (1)

- G11 Pre Cal W2 LASDocument12 pagesG11 Pre Cal W2 LASStreaming Lalisa03100% (1)

- GenMath11 Q2 Mod6 Fair Market Value of A Cash Flow - Version 1 From CE1 Ce2 EvaluatedDocument27 pagesGenMath11 Q2 Mod6 Fair Market Value of A Cash Flow - Version 1 From CE1 Ce2 EvaluatedLarilyn BenictaNo ratings yet

- Basic Calculus Teachers GuideDocument328 pagesBasic Calculus Teachers GuideDarren CalabiaNo ratings yet

- Earth and Life Science: Quarter 1 - Module 5: Exogenic ProcessesDocument22 pagesEarth and Life Science: Quarter 1 - Module 5: Exogenic ProcessesJulius GamayanNo ratings yet

- General Mathematics: Quarter 1 - Module 10: Intercepts, Zeroes and Asymptotes of Rational FunctionsDocument15 pagesGeneral Mathematics: Quarter 1 - Module 10: Intercepts, Zeroes and Asymptotes of Rational FunctionsAshley Kait Marcelo100% (1)

- Activity Sheets: Quarter 2 - MELC 5Document8 pagesActivity Sheets: Quarter 2 - MELC 5MARIBETH BABANo ratings yet

- Shs General Mathematics q2 m4Document16 pagesShs General Mathematics q2 m4Christian Leimer Gahisan100% (1)

- Math-11-Stats-Sir Mark-3rd-q-Week-7 Answer SheetDocument1 pageMath-11-Stats-Sir Mark-3rd-q-Week-7 Answer SheetJohn ClarenceNo ratings yet

- 3rd QUARTER PR1 MODULE 4Document3 pages3rd QUARTER PR1 MODULE 4John ClarenceNo ratings yet

- Activity #2 - LANDMARKS-MAITIMDocument3 pagesActivity #2 - LANDMARKS-MAITIMJohn ClarenceNo ratings yet

- 3rd QUARTER PR1 MODULE 4Document3 pages3rd QUARTER PR1 MODULE 4John ClarenceNo ratings yet

- John Clarence B.Maitim 11-Shakespeare Empowerment TechnologiesDocument1 pageJohn Clarence B.Maitim 11-Shakespeare Empowerment TechnologiesJohn ClarenceNo ratings yet

- Holy Rosary College of Santa Rosa Laguna, Inc.: Learning ModuleDocument5 pagesHoly Rosary College of Santa Rosa Laguna, Inc.: Learning ModuleJohn ClarenceNo ratings yet

- Math 11 Stats Sir Mark 3rd Week 5 6Document5 pagesMath 11 Stats Sir Mark 3rd Week 5 6John ClarenceNo ratings yet

- 3rd Quarter Pr1 Module 3Document3 pages3rd Quarter Pr1 Module 3John ClarenceNo ratings yet

- Everur Nan Drama Television Series Created by Greg BerlantiDocument1 pageEverur Nan Drama Television Series Created by Greg BerlantiJohn ClarenceNo ratings yet

- PT Normal Distribution - MaitimDocument1 pagePT Normal Distribution - MaitimJohn ClarenceNo ratings yet

- Wandavision Is An American TelevisionDocument1 pageWandavision Is An American TelevisionJohn ClarenceNo ratings yet

- Hope 1 - MaitimDocument3 pagesHope 1 - MaitimJohn ClarenceNo ratings yet

- Everwood (Known As Our New Life in Everwood in The United Kingdom (1) ) Is An American Drama Television Series Created by Greg BerlantiDocument1 pageEverwood (Known As Our New Life in Everwood in The United Kingdom (1) ) Is An American Drama Television Series Created by Greg BerlantiJohn ClarenceNo ratings yet

- 3rd QUARTER PR1 MODULE 3Document3 pages3rd QUARTER PR1 MODULE 3John ClarenceNo ratings yet

- 3rd QUARTER PR1 MODULE 4Document3 pages3rd QUARTER PR1 MODULE 4John ClarenceNo ratings yet

- Caring For Common InjuriesDocument4 pagesCaring For Common InjuriesJohn ClarenceNo ratings yet

- Maitim - Philippine Politics and GovernanceDocument2 pagesMaitim - Philippine Politics and GovernanceJohn ClarenceNo ratings yet

- John Clarence B. Maitim 11-Shakespeare Statistics and ProbabilityDocument2 pagesJohn Clarence B. Maitim 11-Shakespeare Statistics and ProbabilityJohn ClarenceNo ratings yet

- 3rd Quarter Activity 1 - MaitimDocument3 pages3rd Quarter Activity 1 - MaitimJohn ClarenceNo ratings yet

- Poster Activity: John Clarence B. Maitim 11-ShakespeareDocument2 pagesPoster Activity: John Clarence B. Maitim 11-ShakespeareJohn ClarenceNo ratings yet

- Hope 1 - MaitimDocument3 pagesHope 1 - MaitimJohn ClarenceNo ratings yet

- PT Normal Distribution - MaitimDocument1 pagePT Normal Distribution - MaitimJohn ClarenceNo ratings yet

- PT Normal Distribution - MaitimDocument1 pagePT Normal Distribution - MaitimJohn ClarenceNo ratings yet

- John Clarence B.Maitim 11-Shakespeare Statistics and Probability Assignment No. 1Document1 pageJohn Clarence B.Maitim 11-Shakespeare Statistics and Probability Assignment No. 1John ClarenceNo ratings yet

- Reaction On The West Philippine Sea IssueDocument2 pagesReaction On The West Philippine Sea IssueJoshua Adrian Bautista82% (89)

- 2nd Quarter Week 7 ModuleDocument4 pages2nd Quarter Week 7 ModuleJohn Clarence67% (3)

- Lesson 2 Models of CommunicationDocument28 pagesLesson 2 Models of CommunicationJohn ClarenceNo ratings yet

- World Religion 11 - Module - Lesson 8&9Document6 pagesWorld Religion 11 - Module - Lesson 8&9John ClarenceNo ratings yet

- 2nd Quarter Week 3-4Document7 pages2nd Quarter Week 3-4John Clarence89% (9)

- Simple Interest - Part 1Document44 pagesSimple Interest - Part 1Rodin PaspasanNo ratings yet

- James McAluney Investor Group Awarded Priority Substantial Contribution ClaimDocument26 pagesJames McAluney Investor Group Awarded Priority Substantial Contribution ClaimJim McaluneyNo ratings yet

- Income Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaKunal KhandualNo ratings yet

- First Such Collaboration For India Upi-Paynow Linkage World'S First To Feature Cloud-Based InfrastructureDocument2 pagesFirst Such Collaboration For India Upi-Paynow Linkage World'S First To Feature Cloud-Based InfrastructureRibhi ShindeNo ratings yet

- New App Form 2023Document2 pagesNew App Form 2023Drexler FelicianoNo ratings yet

- Foundations of Financial Management 14th Edition Block Test BankDocument64 pagesFoundations of Financial Management 14th Edition Block Test Bankhieudermotjm7w100% (32)

- Narasimhan Committee Upsc Notes 33Document2 pagesNarasimhan Committee Upsc Notes 33Gauravpatel CHSNo ratings yet

- Sample Qualified Written Request Under Re SpaDocument3 pagesSample Qualified Written Request Under Re SpaPamGrave100% (1)

- Centurion University of Technology and Management: Project Report OnDocument23 pagesCenturion University of Technology and Management: Project Report OnKING ZINo ratings yet

- Credit ManualDocument106 pagesCredit ManualTony Green100% (2)

- Au 1Document1 pageAu 1ubattleg5No ratings yet

- SOC Branchless Banking April June 2023 PDFDocument2 pagesSOC Branchless Banking April June 2023 PDFVijay VijdanNo ratings yet

- Stanbic Bank Q3 2023 Financial ResultsDocument1 pageStanbic Bank Q3 2023 Financial Resultskaranjamike565No ratings yet

- Schedule 2Document2 pagesSchedule 2Myreddy VijayaNo ratings yet

- FM Lecture 4Document26 pagesFM Lecture 4NguyenNo ratings yet

- References - Law of Banking-1Document27 pagesReferences - Law of Banking-1Ibidun TobiNo ratings yet

- Account Transactions (Accrual)Document4 pagesAccount Transactions (Accrual)qy9482qrk8No ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyMae Althea TidalgoNo ratings yet

- Master Repurchase AgreementDocument41 pagesMaster Repurchase AgreementTerry GreenNo ratings yet

- Estmt - 2023 05 05Document6 pagesEstmt - 2023 05 05manolo IamanditaNo ratings yet

- MSY Affidavit FormatDocument2 pagesMSY Affidavit FormatInamul HaqNo ratings yet

- Chattel MortgageDocument3 pagesChattel MortgageMetoi AlcruzeNo ratings yet

- GPF Final PaymentDocument6 pagesGPF Final Paymentsaifyan321312No ratings yet

- UnknownDocument11 pagesUnknown瑜惜No ratings yet

- Consumer and High Net Worth Tariff Guide 2021Document1 pageConsumer and High Net Worth Tariff Guide 2021Davis ManNo ratings yet

- MBS FormDocument1 pageMBS Formcmog adjutantNo ratings yet

- 109 SIPcomboDocument2 pages109 SIPcombo1947 Abhishek TripathiNo ratings yet

- RMC Minutes November 13, 2023 - DraftDocument30 pagesRMC Minutes November 13, 2023 - Draftranuagrawal2023No ratings yet

- Lesson 10 Cash Flow and Deferred AnnuityDocument19 pagesLesson 10 Cash Flow and Deferred AnnuityGeraldine ElisanNo ratings yet

- Credit Transactions - PNB Vs MallorcaDocument2 pagesCredit Transactions - PNB Vs MallorcaJp tan britoNo ratings yet