Professional Documents

Culture Documents

Analyzing Recording Classifying Summarizing Reporting Interpreting

Uploaded by

Andre Philip Castillo TacderasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing Recording Classifying Summarizing Reporting Interpreting

Uploaded by

Andre Philip Castillo TacderasCopyright:

Available Formats

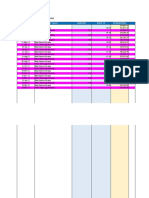

PROCESS OF ACCOUNTING

a. Analyzing- examining transactions. For example, you the owner if a business bought a computer equipment. From this transaction you have to

analyze what are the accounts under this transaction. Under this transaction, CASH and COMPUTER EQUIPMENT are involved.

b. Recording- With the help of journal and ledger, you can record the two accounts involved. Debit, Computer Equipment and Credit,

c. Classifying- grouping the same activities together for the purpose of summarizing a total of what happened. Example: grouping all the purchase

made. Or all accounts under Assets, to determine the total amount for each account.

d. Summarizing- totaling the results of each groupings made from the classifying process.

e. Reporting- preparation of the Financial Statement through the help of the summaries.

f. Interpreting- taking information, if the business is gaining or losing. With the help of the Analysis

MANAGEMENT

• includes the activities of setting the strategy of an organization and coordinating the efforts of its employees (or of volunteers) to

accomplish its objectives through the application of available resources, such as financial, natural, technological, and human

resources. (WIKIPEDIA)

• consists of the interlocking functions of creating corporate policy and organizing, planning, controlling, and directing an

organization's resources in order to achieve the objectives of that policy.

FOUR FINANCIAL STATEMENTS

A. STATEMENT OF FINANCIAL POSITION

• also known as the Balance Sheet, presents the financial position of an entity at a given date.

• provides an overview of assets, liabilities and stockholders' equity as a snapshot in time.

• identifies how assets are funded, either with liabilities, such as debt, or stockholders' equity, such as retained earnings and additional

paid-in capital. Assets are listed on the balance sheet in order of liquidity.

• Liabilities are listed in the order in which they will be paid.

B. STATEMENT OF COMPREHENSIVE INCOME

• also known as the Profit and Loss Statement, reports the company's financial performance in terms of net profit or loss over a specified

period

• covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income

statement provides an overview of revenues, expenses, net income and earnings per share. It usually provides two to three years of data

for comparison.

C. STATEMENT OF CHANGES IN OWNER’S EQUITY

• also known as the Statement of Retained Earnings, details the movement in owners' equity over a period.

• Presents changes in equity during the reporting period. The report format varies, but can include the sale or repurchase of stock, dividend

payments, and changes caused by reported profits or losses. This is the least used of the financial statements, and is commonly only

included in the audited financial statement package.

D. CASHFLOW STATEMENT

• presents the movement in cash and bank balances over a period.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Four Green Houses... One Red HotelDocument325 pagesFour Green Houses... One Red HotelDhruv Thakkar100% (1)

- Exit Interview HandbookDocument10 pagesExit Interview HandbookAndre Philip Castillo TacderasNo ratings yet

- Isys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleDocument37 pagesIsys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleEdwar ArmandesNo ratings yet

- Government Accounting & Financial RulesDocument9 pagesGovernment Accounting & Financial RulesSouvik DattaNo ratings yet

- Chapter 3 and 4Document304 pagesChapter 3 and 4April Erin0% (2)

- Corporation Code of The Philippines ReviewerDocument3 pagesCorporation Code of The Philippines ReviewerJohnNo ratings yet

- Financial Statements OverviewDocument36 pagesFinancial Statements OverviewIrvin OngyacoNo ratings yet

- Financial planning tools and concepts guideDocument31 pagesFinancial planning tools and concepts guideBryan Sandaga58% (12)

- Standard Chart of Accounts For Manufacturing OperationsDocument31 pagesStandard Chart of Accounts For Manufacturing Operationswpentinio67% (15)

- PNB allowed to foreclose on mortgaged propertiesDocument2 pagesPNB allowed to foreclose on mortgaged propertiesRaymond ChengNo ratings yet

- Chapter 6 Financial Statements Tools For Decision MakingDocument25 pagesChapter 6 Financial Statements Tools For Decision MakingEunice NunezNo ratings yet

- Pantawid Pamilyang Pilipino ProgramDocument3 pagesPantawid Pamilyang Pilipino ProgramGercel Therese SerafinoNo ratings yet

- Article ReviewDocument1 pageArticle ReviewAndre Philip Castillo TacderasNo ratings yet

- Business - Finance 2PPSDocument26 pagesBusiness - Finance 2PPSkalghamdi24No ratings yet

- Acct ReviewerDocument22 pagesAcct ReviewerAMANDANo ratings yet

- Accounting-CASH FLOW and CGDocument58 pagesAccounting-CASH FLOW and CGBoogy Grim100% (1)

- BusFin NotesDocument10 pagesBusFin NotesJeremae EtiongNo ratings yet

- Chapter 1 2 Advance Financial Analysis and Stock MarketDocument18 pagesChapter 1 2 Advance Financial Analysis and Stock MarketNoel Salazar JrNo ratings yet

- Acctg 5-8Document5 pagesAcctg 5-8Cristle ServentoNo ratings yet

- Accounting and Financial StatementsDocument14 pagesAccounting and Financial StatementsMitha LarasNo ratings yet

- Agricultural Business ManagementDocument5 pagesAgricultural Business ManagementAreicra NutNo ratings yet

- Ch.2b Accounting QCs and AssumptionsDocument13 pagesCh.2b Accounting QCs and Assumptionsyfzhizhi0214No ratings yet

- Lecture Notes: Financial Modeling: Session 4Document3 pagesLecture Notes: Financial Modeling: Session 4janakNo ratings yet

- Allahabad BankDocument103 pagesAllahabad BankPiyush Gehlot0% (1)

- SHS Business Finance Chapter 2Document24 pagesSHS Business Finance Chapter 2Ji BaltazarNo ratings yet

- 03 BSAIS 2 Financial Management Week 5 6Document8 pages03 BSAIS 2 Financial Management Week 5 6Ace San GabrielNo ratings yet

- Statement of Financial PositionDocument14 pagesStatement of Financial PositionLeomar CabandayNo ratings yet

- Pfm3 ReviewerDocument2 pagesPfm3 ReviewerJudayNo ratings yet

- DM 223Document7 pagesDM 223Lee SeokminNo ratings yet

- Report in Business Finance: Group 2 - Review of Financial Statement Preparation, Analysis, and InterpretationDocument14 pagesReport in Business Finance: Group 2 - Review of Financial Statement Preparation, Analysis, and InterpretationKOUJI N. MARQUEZNo ratings yet

- V - BSBFIM601 Powerpoint - v1Document65 pagesV - BSBFIM601 Powerpoint - v1vaibhavacademicmantraNo ratings yet

- FINANCIALSTUDYDocument47 pagesFINANCIALSTUDYoliverreromaNo ratings yet

- Financial Project Appraisal and Cash Flow AnalysisDocument16 pagesFinancial Project Appraisal and Cash Flow AnalysisGemechis BekeleNo ratings yet

- Parlingayan - Home Absed ActivityDocument10 pagesParlingayan - Home Absed ActivityMaria JessaNo ratings yet

- 5 Financial StatementsDocument8 pages5 Financial StatementsMuhammad Muzammil100% (2)

- Financial Statements, Tools and BudgetsDocument20 pagesFinancial Statements, Tools and BudgetsVanessa Mae AguilarNo ratings yet

- Accounting ReviewDocument19 pagesAccounting ReviewAmoya EllisNo ratings yet

- The Financial Statements: Chapter OutlineDocument15 pagesThe Financial Statements: Chapter OutlineBhagaban DasNo ratings yet

- FABM 2 Key Elements and Financial StatementsDocument5 pagesFABM 2 Key Elements and Financial StatementsLenard TaberdoNo ratings yet

- Report G1 IS202Document25 pagesReport G1 IS202Nonelon SalvadoraNo ratings yet

- Understanding Financial StatementsDocument30 pagesUnderstanding Financial StatementsTeh PohkeeNo ratings yet

- Business Finance: FinalDocument8 pagesBusiness Finance: FinalBryanNo ratings yet

- Chapter 1 Part A - Student SlidesDocument48 pagesChapter 1 Part A - Student Slidesrebeccahf7No ratings yet

- Financial Statement Analysis (Nov-20)Document51 pagesFinancial Statement Analysis (Nov-20)Aminul Islam AmuNo ratings yet

- Financial Management ReportDocument27 pagesFinancial Management ReportCristine CatalunaNo ratings yet

- Module 1Document14 pagesModule 1Shayek tysonNo ratings yet

- Grade 12 Business Finance Planning and Working CapitalDocument9 pagesGrade 12 Business Finance Planning and Working CapitalJade MonteverosNo ratings yet

- UntitledDocument78 pagesUntitledyanelisa100% (1)

- Bea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orDocument4 pagesBea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orBea ArellanoNo ratings yet

- Introduction To AccountingDocument4 pagesIntroduction To Accountingdenisjoseph759No ratings yet

- SFAC No 5Document28 pagesSFAC No 5Clara Indira PurnamasariNo ratings yet

- Solutions Manual - Chapter 3Document7 pagesSolutions Manual - Chapter 3Renu TharshiniNo ratings yet

- 1Document34 pages1TOLENTINO, Julius Mark VirayNo ratings yet

- Libby 4ce Solutions Manual - Ch04Document92 pagesLibby 4ce Solutions Manual - Ch047595522No ratings yet

- Chapter 1 and 2Document5 pagesChapter 1 and 2Lemeul PaquintalNo ratings yet

- Financial ReportsDocument31 pagesFinancial ReportsJose Intraboy Arais Tabugoc Jr.No ratings yet

- Chapter 2 Analysis of Financial StatementsDocument12 pagesChapter 2 Analysis of Financial Statementskram nhojNo ratings yet

- CMCP Chap 8Document2 pagesCMCP Chap 8Kei SenpaiNo ratings yet

- FinAcc Class 3-4Document6 pagesFinAcc Class 3-4kalineczka.rausNo ratings yet

- Funds Flow AnalysisDocument31 pagesFunds Flow Analysisadnan arshadNo ratings yet

- Session 6.0 Financial StatementsDocument11 pagesSession 6.0 Financial StatementsBenzon Agojo OndovillaNo ratings yet

- Chapter 2 Financing EnterpriseDocument9 pagesChapter 2 Financing EnterpriseMaheen AtharNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Report Form vs Account Form for Financial PositionDocument1 pageReport Form vs Account Form for Financial PositionAndre Philip Castillo TacderasNo ratings yet

- You Already Know The Basics of SFP. As You Have Read On The Title Part, One of The Competencies You Have To Learn Is How To Prepare SFP. Lets Us Now Go Through The Format of SFP. FormatDocument1 pageYou Already Know The Basics of SFP. As You Have Read On The Title Part, One of The Competencies You Have To Learn Is How To Prepare SFP. Lets Us Now Go Through The Format of SFP. FormatAndre Philip Castillo TacderasNo ratings yet

- Classifying Financial Accounts As Current Or Non-Current Assets And LiabilitiesDocument1 pageClassifying Financial Accounts As Current Or Non-Current Assets And LiabilitiesAndre Philip Castillo TacderasNo ratings yet

- 011Document1 page011Andre Philip Castillo TacderasNo ratings yet

- The Two Tasks Must Be Answered in The Activity Sheets AttachedDocument1 pageThe Two Tasks Must Be Answered in The Activity Sheets AttachedAndre Philip Castillo TacderasNo ratings yet

- 006Document1 page006Andre Philip Castillo TacderasNo ratings yet

- Understanding the Statement of Financial PositionDocument1 pageUnderstanding the Statement of Financial PositionAndre Philip Castillo TacderasNo ratings yet

- 003Document1 page003Andre Philip Castillo TacderasNo ratings yet

- Concept Paper RubricDocument1 pageConcept Paper RubricAndre Philip Castillo TacderasNo ratings yet

- CritiqueDocument1 pageCritiqueAndre Philip Castillo TacderasNo ratings yet

- 004Document1 page004Andre Philip Castillo TacderasNo ratings yet

- Rubric For Article Critiques 10 PointsDocument1 pageRubric For Article Critiques 10 PointsAndre Philip Castillo TacderasNo ratings yet

- Title Defense SHS Rubric 2020Document2 pagesTitle Defense SHS Rubric 2020Ejay Voy CaubaNo ratings yet

- Article Critique Rubric: Analyzing Research Methods and DesignDocument1 pageArticle Critique Rubric: Analyzing Research Methods and DesignAndre Philip Castillo TacderasNo ratings yet

- Brazil Accounting Tax Processes v1 PDFDocument163 pagesBrazil Accounting Tax Processes v1 PDFGustavo GonçalvesNo ratings yet

- Daulat FinalDocument88 pagesDaulat FinalBhola ThNo ratings yet

- "Centralni Hali" Case:: Background Information For The Creation of Anti-Corruption Guide For The Municipal AdministrationDocument4 pages"Centralni Hali" Case:: Background Information For The Creation of Anti-Corruption Guide For The Municipal AdministrationPetrus van DuyneNo ratings yet

- Advanced Part 2 Solman MillanDocument320 pagesAdvanced Part 2 Solman Millanlily janeNo ratings yet

- Most Important One Liner Questions and Answers, July 2022Document16 pagesMost Important One Liner Questions and Answers, July 2022HarishankarsoniNo ratings yet

- Adv 2 ch6 Elimination of Unrealized Profit On Intercompany Sales of InventoryDocument49 pagesAdv 2 ch6 Elimination of Unrealized Profit On Intercompany Sales of InventorySella Destika0% (1)

- Almc - Cash Position - 11may2021Document246 pagesAlmc - Cash Position - 11may2021ACYATAN & CO., CPAs 2020No ratings yet

- Week 1 & 2: A. Statutory Definition of A Corporation (Section 2, CC)Document5 pagesWeek 1 & 2: A. Statutory Definition of A Corporation (Section 2, CC)Jade Marlu DelaTorreNo ratings yet

- Invitation To Bid: General GuidelinesDocument13 pagesInvitation To Bid: General GuidelinesEdward TangonanNo ratings yet

- Slides Set3Document116 pagesSlides Set3Vaishnavi GnanasekaranNo ratings yet

- EM5 UNIT 3 INTEREST FORMULAS & RATES Part 2Document7 pagesEM5 UNIT 3 INTEREST FORMULAS & RATES Part 2MOBILEE CANCERERNo ratings yet

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- GLEF 4020 International Banking and Financial Regulation 2020-21 Term 2 Course OutlineDocument3 pagesGLEF 4020 International Banking and Financial Regulation 2020-21 Term 2 Course Outlinewang wendaNo ratings yet

- Melese ProposalDocument27 pagesMelese Proposalkassahun mesele100% (1)

- Study Guide Topic A: European CouncilDocument9 pagesStudy Guide Topic A: European CouncilAaqib ChaturbhaiNo ratings yet

- OCWchapter 7Document22 pagesOCWchapter 7Charmine agbonNo ratings yet

- Ahmad Zubir Bin Jusoh 1721, JLN Panji Alam 21100 Kuala Terengganu TRGDocument1 pageAhmad Zubir Bin Jusoh 1721, JLN Panji Alam 21100 Kuala Terengganu TRGAhmad ZubirNo ratings yet

- H. R. 6433Document3 pagesH. R. 6433ABC6/FOX28No ratings yet

- Working Capital Management OF: Submitted by Priya BanerjeeDocument102 pagesWorking Capital Management OF: Submitted by Priya BanerjeeSushmita BarlaNo ratings yet

- Country Commercial Guide 2014Document70 pagesCountry Commercial Guide 2014btittyNo ratings yet

- Analysis of Non-fund Business for BanksDocument2 pagesAnalysis of Non-fund Business for BanksUtkarsh PrasadNo ratings yet

- Conference: 2021 International VirtualDocument5 pagesConference: 2021 International Virtualusama zedanNo ratings yet

- NIT31Document129 pagesNIT31abhishitewariNo ratings yet

- Dividend Summary Report 1510807Document2 pagesDividend Summary Report 1510807Murtaza LakhaNo ratings yet

- IB Bussiness Management Financial Statements Layout GuideDocument2 pagesIB Bussiness Management Financial Statements Layout GuideBhavish Adwani100% (1)