Professional Documents

Culture Documents

Cost Acc Chapter 3

Uploaded by

ElleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Acc Chapter 3

Uploaded by

ElleCopyright:

Available Formats

CHAPTER 3 (COST ACCOUNTING CYCLE) ▲ Elements of Manufacturing Cost

▲ Manufacturing Inventory Accounts • Direct materials – cost of material which become part of the product being

• Materials Inventory (Materials lnventory Control Account) – made up of manufactured and which can be readily identified with a certain product.

the balances of materials and supplies on hand. Examples: lumber used in making furniture, fabric used in the production of

clothing, crude oil used to make gasoline and leather used to make shoes and

- This account is maintain much the same way as the Merchandise Inventory bags.

accóunt.

■ Indirect materials – materials that cannot be readily identified with any

- The main difference is the way that the costs of items in inventory are particular item manufactured are called indirect materials.

assigned.

Examples: sandpaper used in sanding furniture, and lubricants used on

- For the merchandising company, goods taken out of inventory are items that machinery. Classified also as indirect materials are materials that actually

have been sold. become part of the finished product but whose costs are relatively

- When a sale is made, an entry is needed to debit Cost of Goods Sold and to insignificant, such as thread, screws, rivets, bolts, nails, and glue.

credit Merchandise Inventory for the cost of the item.

- Materials, on the other hand, usually not purchased for resale but for use in • Direct labor – the cost of labor for those employees who work directly on

manufacturing a product. the product manufactured are classified as direct labor.

- Therefore an item taken out of Materials Inventory and requisitioned into Examples: salaries of machine operators or assembly line workers.

production is transferred to the Work in Process Inventory account (not Cost

of Goods Sold). ■ Indirect labor – the wages and salaries of employees who are required for

the manufacturing process but who do not work directly on the units being

manufactured are considered indirect labor.

• Work in Process Inventory – composed of all manufacturing costs incurred Examples: wages and salaries of department heads, inspectors, supervisors,

and assigned to products being produced and maintenance personnel.

- This inventory account has no counterpart in merchandise accounting.

- The issuance of materials production, begins the production process. These • Factory overhead – Includes all costs related to the manufacturing of a

materials must be cut, molded, assembled, or in some other way changed into product except direct materials and dire t labor.

a finished product.

Examples: manufacturing expenses, such as depreciation on the factory

- To make this change, people, machines, and other factory resources building, machinery and equipment, supplies, heat, light, power, maintenance,

(buildings, electricity, supplies, and so on) must be used. All of these costs are insurance, rent and taxes indirect materials, indirect labor, and other

manufacturing cost elements (product costs), and all of them enter into

accounting for Work in Process Inventory

- Direct labor earned by factory employees are also product costs. Since these ▲ Manufacturing Cost Flow

people work on specific products, their labor costs are assigned to those

products by including the labor peso earned as part of the Work in Process

Inventory account.

- Overhead costs are product costs and must be assigned to specific products.

Thus, they, too, are included in the Work in Process Inventory account. As

discussed earlier, there are many overhead costs to account for on an

individual basis.

- To reduce the amount of work needed to assign these costs to products, they

are accumulated and accounted for under one account title: Factory Overhead

Control.

- These costs are then assigned to products by using an overhead rate. Using

this rate, called a predetermined overhead rate, costs are charged to Work in

Process Inventory account. ▲ The Manufacturing Statement

- As products are completed, they are put into the finished goods storage area. - Financial statements of manufacturing companies differ little from those of

- These products now have materials, direct labor, and factory overhead costs merchandising companies. Depending on the industry, the account titles found

assigned to them. on the balance sheet are the same in most corporation.

- When products are completed, their costs no longer belong to work in - Even the income statements for a merchandiser and a manufacturer are

process. Therefore, when the completed products are sent to the storage area, similar. However, a closer look shows that the head Cost of Goods

their costs are transferred from the Work in Process Inventory account to the Manufactured is used in place of the Purchases account. Also, the

Finished Goods Inventory. Merchandise replaced by Finished Goods Inventory.

- The balance remaining in the Work in Process Inventory account represents - The key to preparing an income statement for a manufacturing company is

the costs that were assigned to products partly completed and still in process to determine the cost of goods sold. The amount is the end result of a special

at the end of the period. manufacturing statement, the statement of cost of goods manufactured, which

is prepared to support the figure on the income statement

• Finished Goods Inventory

▲ Statement of Cost of Goods Manufactured and Sold

- Like Materials Inventory, has same characteristics of the Merchandise

Inventory account. At this point Finished Goods Inventory takes on the - The statement gives the peso amount of costs for products completed and

characteristics of Merchandise inventory. moved to Finished Goods Inventory during the year

- If we compare the Merchandise Inventory account with the accounting for - The amount for cost of goods manufactured should be the same as the

Finished Goods Inventory both show that when goods or products are sold, amount transferred from the Work in Process Inventory account to the

the costs of those goods are moved from the Finished Goods Inventory Finished Goods Inventory account during the year.

account to the Cost of Goods Sold account. - In the same way, the amount of cost of goods sold should be the same as the

- However, the accounting procedures affecting the debit side of the Finished amount transferred from the Finished Goods Inventory account to the Cost of

Goods Inventory account differ from those for the Merchandise Inventory. Goods Sold account during the year below.

- At this point Finished Goods Inventory takes on the account. In a The statement of cost of goods sold for Figure 3-1 through 3-4 is shown even

manufachuring firm salable products are produced rather than purchased. though this statement is rather complex, it can be pieced together in four

steps.

- All costs debited to the Finished Goods Inventory account represent

transfers from the Work in Process Inventory account.

- At the end of an accounting period, the balance in the Finished Goods

Inventory account is made up of the cost of products completed but unsold as

of that date.

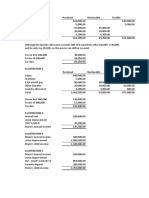

Name of Company

Cost of Goods Sold Statement

For the year ended December 31, 2019

Direct materials used

Materials Inventory, January 1 P xxx

Add: Purchases xxx

Total available for use xxx

Less: Materials Inventory, December 31 xxx P xxx

Direct labor xxx

Factory Overhead xxx

Total manufacturing costs xxx

Add: Work in process, January1 xxx

Cost of goods put into process xxx

Less: Work in process, December 31 xxx

Cost of goods manufactured xxx

Add: Finished goods, January 1 xxx

Total goods available for sale xxx

Less: Finished goods, December 31 xxx

Cost of goods sold—normal P xxx

▲ Cost Flow – Manufacturing Firms

▲ Cost Flow – Merchandising Firms

▲ Cost Flow – Service Firms

You might also like

- ITIL 4 Foundation Cram CardDocument5 pagesITIL 4 Foundation Cram Cardjorge_portocarrero_7100% (3)

- Law On Partnership and Corporation by Hector de LeonDocument113 pagesLaw On Partnership and Corporation by Hector de LeonShiela Marie Vics75% (12)

- Law On Sales - Villanueva 2009Document688 pagesLaw On Sales - Villanueva 2009Don Sumiog93% (27)

- Strategy SwiggyDocument11 pagesStrategy SwiggyARUSHI CHATURVEDI100% (1)

- Atty. D RFBT Notes PDFDocument28 pagesAtty. D RFBT Notes PDFRowell Bunan arevalo67% (3)

- Asset ManagementDocument31 pagesAsset ManagementRhama Wijaya100% (1)

- Group 1 Pa204 Public Administration and Management An Introduction 1Document23 pagesGroup 1 Pa204 Public Administration and Management An Introduction 1Marivic Penarubia100% (1)

- P2 Manufacturing Learning MaterialDocument5 pagesP2 Manufacturing Learning Materialchen.abellar.swuNo ratings yet

- Unit 4: Cost Accounting Cycle: 4.1 Difference Between Merchandising and Manufacturing OperationDocument13 pagesUnit 4: Cost Accounting Cycle: 4.1 Difference Between Merchandising and Manufacturing OperationCielo PulmaNo ratings yet

- Manufacturing Cost AcctgDocument6 pagesManufacturing Cost AcctgDivine Nicole Sabit AguirreNo ratings yet

- Managerial Accounting - Basic Concepts NotesDocument19 pagesManagerial Accounting - Basic Concepts NotesHareem Zoya WarsiNo ratings yet

- Managerial Accounting NotesDocument8 pagesManagerial Accounting NotesHareem Zoya WarsiNo ratings yet

- Module 1 Notes 2105Document10 pagesModule 1 Notes 2105MARIA THERESA AZURESNo ratings yet

- Powerpoint - Cost AccountingDocument24 pagesPowerpoint - Cost AccountingDan RyanNo ratings yet

- Chapter 2 - Cost Accounting CycleDocument16 pagesChapter 2 - Cost Accounting CycleJoey Lazarte100% (1)

- Notes On Week 13 - ManufacturingDocument2 pagesNotes On Week 13 - ManufacturingChristy CaneteNo ratings yet

- Chapter Two: Cost Terms, Concepts and ClassificationsDocument72 pagesChapter Two: Cost Terms, Concepts and ClassificationsYuvaraj SubramaniamNo ratings yet

- 03 Cost BehaviorDocument71 pages03 Cost BehaviorKrizah Marie CaballeroNo ratings yet

- Basics of CMADocument45 pagesBasics of CMAPoint BlankNo ratings yet

- Sesi 2 Akuntansi ManajemenDocument33 pagesSesi 2 Akuntansi ManajemenDian Permata SariNo ratings yet

- Cost Accounting and ControlDocument14 pagesCost Accounting and Controlkaye SagabaenNo ratings yet

- Cost Accaunting 2Document12 pagesCost Accaunting 2ዝምታ ተሻለNo ratings yet

- Group 1 - Managerial Accounting and Cost ConceptsDocument47 pagesGroup 1 - Managerial Accounting and Cost ConceptsJeejohn SodustaNo ratings yet

- Chapter 3Document40 pagesChapter 3Korubel Asegdew YimenuNo ratings yet

- 5 Cost Accounting CycleDocument16 pages5 Cost Accounting CycleZenCamandang67% (3)

- LESSON 1: Introduction To Cost AccountingDocument4 pagesLESSON 1: Introduction To Cost AccountingChriselda CabangonNo ratings yet

- Job Order Costing ModuleDocument9 pagesJob Order Costing ModuleClaire BarbaNo ratings yet

- Unit 15Document11 pagesUnit 15takudzwa kamuchetaNo ratings yet

- Chapter 2 Cost Terms Concepts and ClassificationsDocument51 pagesChapter 2 Cost Terms Concepts and ClassificationsMulugeta Girma100% (1)

- PDF Document 3Document112 pagesPDF Document 3Yarka Buuqa Neceb MuuseNo ratings yet

- Systems Designs - Job and Process CostingDocument49 pagesSystems Designs - Job and Process Costingjoe6hodagameNo ratings yet

- CHAPTER4Document34 pagesCHAPTER4Nour NaakhuudeNo ratings yet

- Problem Lecture - Manufacturing Business With ANSWERSDocument16 pagesProblem Lecture - Manufacturing Business With ANSWERSNia BranzuelaNo ratings yet

- These Are The Key Points You Should Know For Chapter 1Document7 pagesThese Are The Key Points You Should Know For Chapter 1Jane VillanuevaNo ratings yet

- Lesson 10 - Manufacturing BusinessDocument4 pagesLesson 10 - Manufacturing BusinessVISITACION JAIRUS GWENNo ratings yet

- Part III-Managerial AccountingDocument91 pagesPart III-Managerial AccountingGebreNo ratings yet

- Ae11 Cost ConceptDocument48 pagesAe11 Cost ConceptMich CandiaNo ratings yet

- Cost AccountingDocument21 pagesCost Accountingabdullah_0o0No ratings yet

- Chapter 5 Accounting For Other BusinessDocument27 pagesChapter 5 Accounting For Other BusinessNUR IRDINA SOFEA MOHD YUSRINo ratings yet

- Accounting Notes: Product CostingDocument4 pagesAccounting Notes: Product Costinggracel angela tolejanoNo ratings yet

- Sesi 2 Akuntansi Manajemen - Rev1Document32 pagesSesi 2 Akuntansi Manajemen - Rev1Dian Permata SariNo ratings yet

- Chapter TwoDocument33 pagesChapter TwoTerefe DubeNo ratings yet

- Basic Costing Principles and Manufacturing Concerns PresentationDocument16 pagesBasic Costing Principles and Manufacturing Concerns Presentationzinhlezwane2708No ratings yet

- Lesson 3 Cost Accounting CycleDocument20 pagesLesson 3 Cost Accounting CycleRovic OrdonioNo ratings yet

- Int To Management AccDocument53 pagesInt To Management AccPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Ekotek Chapter 10Document9 pagesEkotek Chapter 10muhammad cayoNo ratings yet

- COST I CH 2Document58 pagesCOST I CH 2YemaneNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument5 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoshinne Lea Ang BialaNo ratings yet

- Managerial Accounting and CostDocument19 pagesManagerial Accounting and CostIqra MughalNo ratings yet

- Garrison Lecture Chapter 2 - Cost ConceptsDocument80 pagesGarrison Lecture Chapter 2 - Cost Conceptsnahid mushtaqNo ratings yet

- Chapter 1 - Manufacturing AccountDocument32 pagesChapter 1 - Manufacturing AccountNORZAIHA BINTI ALI MoeNo ratings yet

- Supplementary Learning Resource Material SUMMARY-due Nov.10Document5 pagesSupplementary Learning Resource Material SUMMARY-due Nov.10LIGAWAD, MELODY P.No ratings yet

- Accounting For Manjufacturing Operation PDFDocument7 pagesAccounting For Manjufacturing Operation PDFZairah HamanaNo ratings yet

- Merchandising and ManufacturingDocument23 pagesMerchandising and ManufacturingARABELLA CLARICE JIMENEZNo ratings yet

- ACTG 22A-Cost Accounting and Control-ReviewerDocument8 pagesACTG 22A-Cost Accounting and Control-ReviewerLolli PopNo ratings yet

- Process Costing FIFO CRDocument21 pagesProcess Costing FIFO CRMiyangNo ratings yet

- 201 NotesDocument18 pages201 NotesSky SoronoiNo ratings yet

- 2 - Cost Terms Concepts and Classifications - EtudiantDocument38 pages2 - Cost Terms Concepts and Classifications - EtudiantheniosyoutubeNo ratings yet

- Financial Statements: The Bases For Planning and Control: Lecture # 3Document22 pagesFinancial Statements: The Bases For Planning and Control: Lecture # 3Amna NasserNo ratings yet

- Journal Entries For ManufacturersDocument2 pagesJournal Entries For Manufacturersايهاب غزالةNo ratings yet

- CHAPTER 3-Cost Accounting CycleDocument2 pagesCHAPTER 3-Cost Accounting CycleRosiel Mae CadungogNo ratings yet

- BIAYA: Konsep, Klasifikasi Dan PerilakuDocument44 pagesBIAYA: Konsep, Klasifikasi Dan PerilakuAlit SanjayaaNo ratings yet

- Lecture 05Document19 pagesLecture 05Mahnoor AzizNo ratings yet

- Job Order and Process CostingDocument56 pagesJob Order and Process CostingTRYANANo ratings yet

- MA CH 1 HighlightsDocument12 pagesMA CH 1 HighlightsnidaNo ratings yet

- Bernie Madoff - Overview, History, and The Ponzi SchemeDocument7 pagesBernie Madoff - Overview, History, and The Ponzi SchemeElleNo ratings yet

- SEC Was Charmed by Madoff and Failed To Act Quickly, Here's Why - FortuneDocument6 pagesSEC Was Charmed by Madoff and Failed To Act Quickly, Here's Why - FortuneElleNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- Enron Scandal - Summary, Explained, History, & Facts - BritannicaDocument4 pagesEnron Scandal - Summary, Explained, History, & Facts - BritannicaElleNo ratings yet

- Bernie Madoff Dies - Mastermind of The Nation's Biggest Investment Fraud Was 82Document11 pagesBernie Madoff Dies - Mastermind of The Nation's Biggest Investment Fraud Was 82ElleNo ratings yet

- Bernie Madoff, Mastermind of Largest Ponzi Scheme in History, Dies at 82Document7 pagesBernie Madoff, Mastermind of Largest Ponzi Scheme in History, Dies at 82ElleNo ratings yet

- Bernie Madoff - Biography, Ponzi Scheme, & Facts - BritannicaDocument5 pagesBernie Madoff - Biography, Ponzi Scheme, & Facts - BritannicaElleNo ratings yet

- Bernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJDocument4 pagesBernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJElleNo ratings yet

- StratCost Chapter 7Document1 pageStratCost Chapter 7ElleNo ratings yet

- Chapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RDocument3 pagesChapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RElleNo ratings yet

- SCM Chapter 7Document2 pagesSCM Chapter 7ElleNo ratings yet

- StratCost Chapter 8Document13 pagesStratCost Chapter 8ElleNo ratings yet

- StratCost Chapter 5Document2 pagesStratCost Chapter 5ElleNo ratings yet

- InTax Quiz 3Document7 pagesInTax Quiz 3ElleNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- InTax Unit 8Document3 pagesInTax Unit 8ElleNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- InTax Quiz 1Document7 pagesInTax Quiz 1ElleNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- InTax Unit 8 Fringe BenefitsDocument3 pagesInTax Unit 8 Fringe BenefitsElleNo ratings yet

- Special Tax LawsDocument33 pagesSpecial Tax LawsValerieNo ratings yet

- Securities Regulations CodeDocument5 pagesSecurities Regulations Codeariane espirituNo ratings yet

- InTax Unit 2Document2 pagesInTax Unit 2ElleNo ratings yet

- InTax Final Quiz (Unit 7-9)Document15 pagesInTax Final Quiz (Unit 7-9)ElleNo ratings yet

- Intellectual Property LawDocument11 pagesIntellectual Property LawaiswiftNo ratings yet

- ADB QualificationsDocument10 pagesADB QualificationsMark MedinaNo ratings yet

- Board of Directors and Leadership Team - GSKDocument8 pagesBoard of Directors and Leadership Team - GSKkelvinkinergyNo ratings yet

- Part 1 - Cost Concepts and Costing MethodsDocument13 pagesPart 1 - Cost Concepts and Costing MethodsJames Ryan AlzonaNo ratings yet

- 80-Article Text-127-1-10-20200330Document6 pages80-Article Text-127-1-10-20200330Chzndr SnagaNo ratings yet

- Hrmc003 Human Resource Management Final Exam DumpDocument58 pagesHrmc003 Human Resource Management Final Exam DumpNageshwar SinghNo ratings yet

- Understanding Reality of Indian MGTDocument18 pagesUnderstanding Reality of Indian MGTBhavya JainNo ratings yet

- Technical Proposal (Igp For Women) I. Proposal Information SheetDocument9 pagesTechnical Proposal (Igp For Women) I. Proposal Information SheetALLAN SANORIA100% (1)

- Fampulme - The Planning Functions of The ControllershipDocument22 pagesFampulme - The Planning Functions of The ControllershipCarla Pianz FampulmeNo ratings yet

- Tle Reviewerq2Document4 pagesTle Reviewerq2AskhitowNo ratings yet

- Chapter 5 - PROCESS SELECTIONDocument8 pagesChapter 5 - PROCESS SELECTIONLong Đoàn PhiNo ratings yet

- ADVISORY vs. CONSULTANCYDocument3 pagesADVISORY vs. CONSULTANCYDiane Libatique AntonioNo ratings yet

- DLL (Entre) 3Document5 pagesDLL (Entre) 3Elizer FillomenaNo ratings yet

- Occ Week 14 Principles of Speech According To Delivery ManuscriptDocument18 pagesOcc Week 14 Principles of Speech According To Delivery ManuscriptTeyangNo ratings yet

- Bilal Cv-Acca & MbaDocument6 pagesBilal Cv-Acca & MbaBilal BhattiNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Information Systems DevelopmentDocument34 pagesInformation Systems DevelopmentSamvid007No ratings yet

- Sayas ReportDocument16 pagesSayas ReportArvin Capapas0% (1)

- 4+1 ModelDocument2 pages4+1 ModelAnil RelhanNo ratings yet

- (Company Letterhead) : Re: Letter of Employment Reference For Indumathi KumarDocument2 pages(Company Letterhead) : Re: Letter of Employment Reference For Indumathi KumarNabin Kumar DasNo ratings yet

- Branch Manager CV TemplateDocument2 pagesBranch Manager CV Templatejpsmu09No ratings yet

- RISE With SAP For Building Products - L1 PresentationDocument37 pagesRISE With SAP For Building Products - L1 PresentationAyazNo ratings yet

- Annex A1 - The Standard For Project Management of A ProjectDocument1 pageAnnex A1 - The Standard For Project Management of A ProjectFaizal HidayatNo ratings yet

- Data Quality Issues For Accounting Information Systems' Implementation: Systems, Stakeholders and Organizational FactorsDocument24 pagesData Quality Issues For Accounting Information Systems' Implementation: Systems, Stakeholders and Organizational FactorsadityaksinghNo ratings yet

- Cost Accounting - QuizDocument5 pagesCost Accounting - QuizAnna Mae SanchezNo ratings yet

- Entrepreneurship IntroductionDocument25 pagesEntrepreneurship IntroductionRoveline GenonNo ratings yet

- Study of Business Strategy of Novartis: OverviewDocument22 pagesStudy of Business Strategy of Novartis: OverviewAKASH SANDILYANo ratings yet