Professional Documents

Culture Documents

Sampleprofit Forecast

Uploaded by

Khánh Linh Nguyễn Ngọc0 ratings0% found this document useful (0 votes)

14 views9 pagesFranchising business plan

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFranchising business plan

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views9 pagesSampleprofit Forecast

Uploaded by

Khánh Linh Nguyễn NgọcFranchising business plan

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 9

1.

FORECASTING SALES

Sales Volume ($) year 2014

1. Highlands Coffee 515000

2. Rita Võ Coffee 455000

3. Hot & Cold 444000

Average Level 471333

Gross Sales 0 471333

Annual Sales Forecast

Year 0 Year 1

471333

Initial Investment Capital: 250000

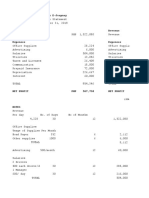

2. FORECASTED INCOME STATEMENT:

Year Year 0 Year 1

Gross Sales 471333

VAT 47133.3

Net Sales 424200

Cost of Goods Sold 199845

Inventory Beginning 23567

New Purchase 202673

Inventory Ending 26395

Gross Margin 224355

Expenses

Wages and benefits 93927

Transportation Cost 5995

Royalties 47133

Rental Payment 3000

Adverstising/Marketing 11783

Depreciation 10000

Property insurane 1000

Social and Health Insurance 14089

Other Operating costs 24509

Total Expenses 211438

EBIT (Earning Before Interest and Tax) 12917

Interest Payment 11250

Income Tax 3229

Net Income -1562

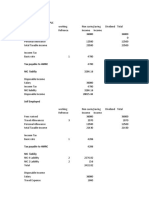

3. FORECASTED CASH-FLOW STATEMENT

Year Year 0 Year 1

Cash Inflow

Gross Sales 0 471333

Account Receivable 0 47133

Total Cash Inflow 0 424200

Cash Outflow

Initial Capital Invetsment 250000

Cost of Good Sold 199845

Expenses

Wages and benefits 93927

Transportation Cost 5995

Royalties 47133

Franchise Fee 10

Rental Payment 3000

Adverstising/Marketing 11783

Property insurane 1000

Social and Health Insurance 14089

Other Operating costs 24509

Interest Payment 11250

Income Tax 3229

Principal Payment

Total Cash Outflow 250010.00 415762.32

Net Cash Flow -250010 8438

4. FRANCHISE PROJECT APPRAISAL:

NPV ($15,593.06)

IRR 11%

THE BREAK-EVEN POINT

Fix cost each year. 289157

Price per unit. 3

Variable cost per unit. 2

Break-even volumn (unit) needed for covering fix cost. 289157

**With the specific informations below:

New purchase takes 43% of gross sale

Inventory of the end of each year is equal 5.6% of gross sale

Wages and benefit take 47% of cost of good sold

Annual interest payment takes 15% of Innitial investment multiplied with debt ration of 0.3

Transportation/tralvelling cost is 3% of cost of good sold

Royalty is 10% of gross sale

Property insurance expense is fixed at 1000USD/year

Location leasing fees is fixed at 10USD/m2

Advertising expense takes 2.5% of gross sale

Social and Health insurance expense for staff take 15% of wages and benefits

Annual depreciation is fixed at 4% of innitial investment capital

Other operating cost is 5.2% of gross sales

VAT : 10%

Income tax: 25%

Annual principle payment is fixed at 20% of initial investment multiplied with 0.3from the second year

Total Liabilities: 28% of initial Capital Invetsment

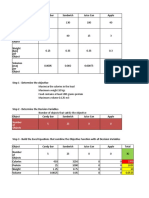

Growth rate Expected efficiency

0.3 90%

0.22 90%

0.2 90%

0.24 90%

0.24

Year 2 Year 3 Year 4 Year 5 Year 6

579740 713080 877089 1078819 1326947

Year 2 Year 3 Year 4 Year 5 Year 6

579740 713080 877089 1078819 1326947

57974.0 71308.0 87708.9 107881.9 132694.7

521766 641772 789380 970937 1194253

245810 302346 371886 457419 562626

28987 35654 43854 53941 66347

249288 306624 377148 463892 570587

32465 39932 49117 60414 74309

275956 339426 417494 513518 631627

115531 142103 174786 214987 264434

7374 9070 11157 13723 16879

57974 71308 87709 107882 132695

3000 3000 3000 3000 3000

14494 17827 21927 26970 33174

10000 10000 10000 10000 10000

1000 1000 1000 1000 1000

17330 21315 26218 32248 39665

30146 37080 45609 56099 69001

256848 312704 381405 465909 569848

19108 26723 36089 47609 61779

11250 11250 11250 11250 11250

4777 6681 9022 11902 15445

3081 8792 15817 24457 35084

Year 2 Year 3 Year 4 Year 5 Year 6

579740 713080 877089 1078819 1326947

57974 71308 87709 107882 132695

521766 641772 789380 970937 1194253

245810 302346 371886 457419 562626

115531 142103 174786 214987 264434

7374 9070 11157 13723 16879

57974 71308 87709 107882 132695

3000 3000 3000 3000 3000

14494 17827 21927 26970 33174

1000 1000 1000 1000 1000

17330 21315 26218 32248 39665

30146 37080 45609 56099 69001

11250 11250 11250 11250 11250

4777 6681 9022 11902 15445

15000 15000 15000 15000 15000

523685.16 637980.24 778563.20 951480.23 1164168.19

-1919 3792 10817 19457 30084

354743 435414 534639 656686 806803

3 3.5 4 4 4

2 2 2 2.5 2.5

354743 290276 267319 437790 537869

the second year

Year 7 Year 8 Year 9 Year 10 Year 11 Year 12

1632145 2007539 2469273 3037205 3735763 4594988

Year 7 Year 8 Year 9 Year 10 Year 11 Year 12

1632145 2007539 2469273 3037205 3735763 4594988

163214.5 200753.9 246927.3 303720.5 373576.3 459498.8

1468931 1806785 2222345 2733485 3362186 4135489

692030 851196 1046972 1287775 1583963 1948275

81607 100377 123464 151860 186788 229749

701822 863242 1061787 1305998 1606378 1975845

91400 112422 138279 170084 209203 257319

776901 955588 1175374 1445710 1778223 2187214

325254 400062 492077 605254 744463 915689

20761 25536 31409 38633 47519 58448

163215 200754 246927 303721 373576 459499

3000 3000 3000 3000 3000 3000

40804 50188 61732 75930 93394 114875

10000 10000 10000 10000 10000 10000

1000 1000 1000 1000 1000 1000

48788 60009 73811 90788 111669 137353

84872 104392 128402 157935 194260 238939

697693 854942 1048359 1286261 1578881 1938804

79209 100647 127015 159449 199342 248411

11250 11250 11250 11250 11250 11250

19802 25162 31754 39862 49835 62103

48156 64235 84011 108337 138256 175058

Year 7 Year 8 Year 9 Year 10 Year 11 Year 12

1632145 2007539 2469273 3037205 3735763 4594988

163215 200754 246927 303721 373576 459499

1468931 1806785 2222345 2733485 3362186 4135489

692030 851196 1046972 1287775 1583963 1948275

325254 400062 492077 605254 744463 915689

20761 25536 31409 38633 47519 58448

163215 200754 246927 303721 373576 459499

3000 3000 3000 3000 3000 3000

40804 50188 61732 75930 93394 114875

1000 1000 1000 1000 1000 1000

48788 60009 73811 90788 111669 137353

84872 104392 128402 157935 194260 238939

11250 11250 11250 11250 11250 11250

19802 25162 31754 39862 49835 62103

15000 15000 15000 15000 15000 15000

1425774.37 1747549.97 2143333.97 2630148.28 3228929.89 3965431.26

43156 59235 79011 103337 133256 170058

991448 1218561 1497910 1841509 2264136 2783968

4 4 4.5 4.5 5 5

2.5 2.5 2.5 2.5 2.5 2.5

660965 812374 748955 920755 905655 1113587

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument8 pagesThe Accounting Cycle: Reporting Financial ResultsOmar KhanNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Cash Flow Statement - Amith PanickerDocument5 pagesCash Flow Statement - Amith PanickerAmith PanickerNo ratings yet

- FABM2 - QuizDocument4 pagesFABM2 - QuizlabayanjoshuaNo ratings yet

- Tax Return Summary for Tony & Jeannie NelsonDocument24 pagesTax Return Summary for Tony & Jeannie Nelsonさくら樱花No ratings yet

- Mas Mas Q&aDocument2 pagesMas Mas Q&aCraig MadziyireNo ratings yet

- Advance Tax-Basis PeriodDocument6 pagesAdvance Tax-Basis PeriodFunshoNo ratings yet

- CVP Analysis and Decision Making - ExamDocument9 pagesCVP Analysis and Decision Making - ExamBNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Latihan Soal 1Document1 pageLatihan Soal 1Anggraeni AyuningtyasNo ratings yet

- Assignment 1 - Financial ManagementDocument2 pagesAssignment 1 - Financial Managementizza zahratunnisaNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- Noman Ahmed Consulting - Profit and LossDocument1 pageNoman Ahmed Consulting - Profit and LossNoman ChoudharyNo ratings yet

- Notes To The Income Statement: 8 RevenueDocument8 pagesNotes To The Income Statement: 8 RevenueShivankit BishtNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Kent's E-Jeepney Kent's E-Jeepney: TotalDocument20 pagesKent's E-Jeepney Kent's E-Jeepney: TotalKentNo ratings yet

- 21 2plDocument1 page21 2plRAHUL NATH RNo ratings yet

- TABANI’S SCHOOL OF ACCOUNTANCY MOCK EXAMDocument5 pagesTABANI’S SCHOOL OF ACCOUNTANCY MOCK EXAMBilal ShaikhNo ratings yet

- This Study Resource Was: Problem 5-3ADocument6 pagesThis Study Resource Was: Problem 5-3AAlche MistNo ratings yet

- Accounting ExerciseDocument4 pagesAccounting ExercisegogulfNo ratings yet

- Answers Case 4.2Document12 pagesAnswers Case 4.2Christina SmartNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- Income Statement: (Company Name)Document3 pagesIncome Statement: (Company Name)Cj BarrettoNo ratings yet

- Projected Income StatementDocument4 pagesProjected Income StatementRavi DhillonNo ratings yet

- P14-9 and P14-10 Financial StatementsDocument8 pagesP14-9 and P14-10 Financial StatementsAi TanahashiNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Revenue Note 2020: Total Revenues 819,000Document9 pagesRevenue Note 2020: Total Revenues 819,000Lemonade Ave. BeverageNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- Profit and Loss StatementDocument1 pageProfit and Loss Statementselina fraserNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- BDFA1103Document5 pagesBDFA1103Yukie LimNo ratings yet

- Nahiyan - Rahman - Firat - 02 - Term PaperDocument10 pagesNahiyan - Rahman - Firat - 02 - Term PaperNahiyan RahmanNo ratings yet

- Company Name Balance Sheet and Income Statement for 2020 and 2019Document4 pagesCompany Name Balance Sheet and Income Statement for 2020 and 2019Kim FloresNo ratings yet

- MANAJEMEN KEUANGANDocument8 pagesMANAJEMEN KEUANGANDeslia AnggraeniNo ratings yet

- Feasib - Fin. State.Document28 pagesFeasib - Fin. State.aldric taclanNo ratings yet

- MFIs Income Statement Q12009Document1 pageMFIs Income Statement Q12009kabwe mulengaNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Business Income TutorialDocument5 pagesBusiness Income TutorialzulfikriNo ratings yet

- COPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTDocument7 pagesCOPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTCHERRYL VALMORESNo ratings yet

- Basic Financial Accounting Course for Human Resource StudentsDocument10 pagesBasic Financial Accounting Course for Human Resource StudentsNur Syafiqah NurNo ratings yet

- Profit and LossDocument3 pagesProfit and Lossgregdavies27No ratings yet

- Income Sttatement & Balance Sheet Further Consideration: DetailsDocument8 pagesIncome Sttatement & Balance Sheet Further Consideration: DetailsXX OniiSan XXNo ratings yet

- Income StatementDocument2 pagesIncome StatementClemyNo ratings yet

- FMA AnswersDocument9 pagesFMA AnswersPriyadarshini PandaNo ratings yet

- NuPetCo Slides - DahliaDocument24 pagesNuPetCo Slides - Dahliacik bungaNo ratings yet

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- FSA - Tutorial 6-Fall 2023 With SolutionsDocument5 pagesFSA - Tutorial 6-Fall 2023 With SolutionsnourbenmiledtbsNo ratings yet

- Income Statement For The End of Period December 31, 2022 (RP)Document1 pageIncome Statement For The End of Period December 31, 2022 (RP)ahmadiNo ratings yet

- Quiz Financial StatementDocument3 pagesQuiz Financial StatementJasmine ManingoNo ratings yet

- BKAR3063 Tutorial 2Document3 pagesBKAR3063 Tutorial 2Thermen DarenNo ratings yet

- Red PLC Employment Tax CalculationsDocument5 pagesRed PLC Employment Tax CalculationsIftekhar AsifNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- NM1603 Resit - ISBSDocument4 pagesNM1603 Resit - ISBSrecovaNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Decision Analysis Techniques for Industrial Robot PurchaseDocument33 pagesDecision Analysis Techniques for Industrial Robot PurchaseKhánh Linh Nguyễn NgọcNo ratings yet

- Chapter01 3eDocument13 pagesChapter01 3eKhánh Linh Nguyễn NgọcNo ratings yet

- Chapter02 3eDocument15 pagesChapter02 3eKhánh Linh Nguyễn NgọcNo ratings yet

- Consumer Analysis: Anuradha ILA Charvee PoorvaDocument20 pagesConsumer Analysis: Anuradha ILA Charvee PoorvaKhánh Linh Nguyễn NgọcNo ratings yet

- Note Mid BeDocument4 pagesNote Mid BeKhánh Linh Nguyễn NgọcNo ratings yet

- MIDTERMDocument2 pagesMIDTERMKhánh Linh Nguyễn NgọcNo ratings yet

- Final-Past Exam QuestionsDocument8 pagesFinal-Past Exam QuestionsKhánh Linh Nguyễn NgọcNo ratings yet

- 1 Access2010 GettingStarted PDFDocument20 pages1 Access2010 GettingStarted PDFGoldy AndrewNo ratings yet

- CSR in Several Factors With EvidenceDocument11 pagesCSR in Several Factors With EvidenceKhánh Linh Nguyễn NgọcNo ratings yet

- Assignment 2Document4 pagesAssignment 2Khánh Linh Nguyễn NgọcNo ratings yet

- Exercise2g-Past Exam QuestionsDocument2 pagesExercise2g-Past Exam QuestionsKhánh Linh Nguyễn NgọcNo ratings yet

- Hot Tube Installation Labour Hours and Profits TableDocument7 pagesHot Tube Installation Labour Hours and Profits TableKhánh Linh Nguyễn NgọcNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument3 pagesScenario Summary: Changing Cells: Result CellsKhánh Linh Nguyễn NgọcNo ratings yet

- Q1. (15 Marks) : Aqua HydroDocument5 pagesQ1. (15 Marks) : Aqua HydroKhánh Linh Nguyễn NgọcNo ratings yet

- PastmidtermexamDocument2 pagesPastmidtermexamKhánh Linh Nguyễn NgọcNo ratings yet

- Geo DiscussionDocument2 pagesGeo DiscussionKhánh Linh Nguyễn NgọcNo ratings yet

- Solution To Chap 1 Accounting 26e WarrenDocument55 pagesSolution To Chap 1 Accounting 26e WarrenKhánh Linh Nguyễn NgọcNo ratings yet

- 2.2 Radical Rewrite: Watch Your Tone! (Objs. 4, 5)Document1 page2.2 Radical Rewrite: Watch Your Tone! (Objs. 4, 5)Khánh Linh Nguyễn Ngọc0% (1)

- Solver KnapsackDocument2 pagesSolver KnapsackKhánh Linh Nguyễn NgọcNo ratings yet

- Regression Models: Eaching UggestionsDocument7 pagesRegression Models: Eaching UggestionsKhánh Linh Nguyễn NgọcNo ratings yet

- 3 37Document1 page3 37Khánh Linh Nguyễn NgọcNo ratings yet

- Chart HomeworkDocument5 pagesChart HomeworkKhánh Linh Nguyễn NgọcNo ratings yet

- 2.21 2.22Document1 page2.21 2.22Khánh Linh Nguyễn NgọcNo ratings yet

- Quiz ManaDocument2 pagesQuiz ManaKhánh Linh Nguyễn NgọcNo ratings yet

- 11 ArgumentsDocument2 pages11 ArgumentsKhánh Linh Nguyễn NgọcNo ratings yet

- Decision Analysis Techniques for Industrial Robot PurchaseDocument33 pagesDecision Analysis Techniques for Industrial Robot PurchaseKhánh Linh Nguyễn NgọcNo ratings yet

- Economic Growth:: 1. Offering Tax Incentives For Investment by Local FirmsDocument3 pagesEconomic Growth:: 1. Offering Tax Incentives For Investment by Local FirmsKhánh Linh Nguyễn NgọcNo ratings yet

- ACCTG 106 STOCK VALUATIONDocument4 pagesACCTG 106 STOCK VALUATIONMary Justine PaquibotNo ratings yet

- SFM Case 4 Strategic ValuationDocument3 pagesSFM Case 4 Strategic ValuationPatrick RomeroNo ratings yet

- Pas 1, Presentation of Financial Statements: Philippine Institute of Certified Public AccountantsDocument38 pagesPas 1, Presentation of Financial Statements: Philippine Institute of Certified Public AccountantsAie GeraldinoNo ratings yet

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- JURNALDocument9 pagesJURNALrahmat razeeqNo ratings yet

- Financial Analysis of Himalayan BankDocument31 pagesFinancial Analysis of Himalayan Banksuraj banNo ratings yet

- The Effect of Timeliness and Credit Ratings On The Information Content of Earnings AnnouncementsDocument32 pagesThe Effect of Timeliness and Credit Ratings On The Information Content of Earnings AnnouncementsgeetaNo ratings yet

- ENTREPRENEURSHIP MANAGEMENT - MMS Notes (Anant Dhuri) PDFDocument30 pagesENTREPRENEURSHIP MANAGEMENT - MMS Notes (Anant Dhuri) PDFAnant Dhuri100% (5)

- CH 06 Intercompany Transfers of Services and Noncurrent AssetsDocument41 pagesCH 06 Intercompany Transfers of Services and Noncurrent Assetsjohn paulNo ratings yet

- Singapore Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreDocument28 pagesSingapore Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax Centrehằng phạmNo ratings yet

- Budgeting As A Tool of ControlDocument3 pagesBudgeting As A Tool of ControlAbdul WahabNo ratings yet

- NYPRoDocument13 pagesNYPRowaymaulanaNo ratings yet

- Chapter 03 Systems Design Job-Order CostingDocument38 pagesChapter 03 Systems Design Job-Order CostingFarihaNo ratings yet

- Cint 2021Document94 pagesCint 2021IrenemartinNo ratings yet

- Study on the Banking Sector and Performance of ICICI BankDocument7 pagesStudy on the Banking Sector and Performance of ICICI BankDivya KardaNo ratings yet

- Lecture Notes Dealings in PropertyDocument9 pagesLecture Notes Dealings in PropertyweewoouwuNo ratings yet

- PC Repair Table of Contents SummaryDocument31 pagesPC Repair Table of Contents SummaryAnselm66% (38)

- Accounts Partnership ProjectDocument24 pagesAccounts Partnership ProjectastrobhavikNo ratings yet

- aud1-prelim-exercises-1Document4 pagesaud1-prelim-exercises-1skyvy27No ratings yet

- Excel Project 2 1Document12 pagesExcel Project 2 1api-674809646No ratings yet

- IAS 16 - PPE Question BankDocument31 pagesIAS 16 - PPE Question Bankcouragemutamba3No ratings yet

- Ebook Ebook PDF Short Term Financial Management Fifth Edition PDFDocument41 pagesEbook Ebook PDF Short Term Financial Management Fifth Edition PDFlaura.gray126100% (40)

- Ratio Analysis of L&T InfotechDocument36 pagesRatio Analysis of L&T Infotechrajwindernijjar1100% (1)

- Corporate Reporting Paper 3.1march 2023Document28 pagesCorporate Reporting Paper 3.1march 2023JAMAN SOUTH MUNICIPAL HEALTH DIRECTORATENo ratings yet

- Form PDF 768656890080722Document10 pagesForm PDF 768656890080722naveen kumarNo ratings yet

- FIFO Inventory Valuation and CostingDocument28 pagesFIFO Inventory Valuation and Costingrizwan ul hassanNo ratings yet

- A Vision For The Future of Cross Border Payments Web Final PDFDocument22 pagesA Vision For The Future of Cross Border Payments Web Final PDFFerdian Perdana KusumaNo ratings yet

- Accounts Receivable Job Interview Preparation GuideDocument8 pagesAccounts Receivable Job Interview Preparation Guideganesanmani1985No ratings yet

- ICAI CA Questions and Answers on IND ASDocument176 pagesICAI CA Questions and Answers on IND ASMohan AddankiNo ratings yet

- Labor Exercise - Cost AccountingDocument3 pagesLabor Exercise - Cost AccountingKolins ChakmaNo ratings yet