Professional Documents

Culture Documents

VAT Illustrations

VAT Illustrations

Uploaded by

Minh Hương TrầnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT Illustrations

VAT Illustrations

Uploaded by

Minh Hương TrầnCopyright:

Available Formats

VAT Illustrations

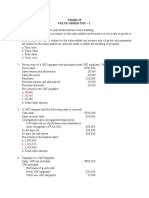

Problem 1

XYZ is VAT deduction method trading company with total sales of the month from 1 July

2014 to 31 July 2014 amounting to VND530 million. The total sale figure includes VAT

charged to the purchasers where applicable. Included in the sales was VND200 million of

export sales. The company satisfies all required documents/procedures for the export.

Proceeds from disposal of a fixed asset is VND11 million, inclusive of VAT, and was not

included in the total sale figure. The fixed asset was subject to 10% VAT on purchase. In

the same period the company had the following purchases (inclusive of VAT and purchased

from VAT deduction method tax payers unless otherwise mentioned).

VND

Purchase of goods for trading 247,500,000

Purchase of goods for trading from VAT direct method tax payer 65,000,000

Computers 20,000,000

Office stationery 14,700,000

Electricity 27,500,000

Salary and statutory contribution 70,000,000

Fuel 6,600,000

Gift stuff for sales promotion purposes (these are still in stock at

theend of the month, VAT at 10%) 55,000,000

Goods purchased for donation to locality (fully used for donation

purposes). The marketable value at the time of use (excluding VAT)

is VND19,000,000 19,800,000

Required:

A. Calculate the VAT payable to or receivable from the tax authority for July 2014. You are

required to show items for which input VAT cannot be claimed stating clearly the reason.Round off

your calculation to the nearest VND.

B. In case of XYZ, state the latest date for declaration and payment of VAT to the taxauthority in

respect of July VAT liability.

Problem 2

TPT Co. is a trading company. It has the following transactions in the month ended 31

December 2018

02/12/18 Import 10 cars from overseas for US$15,000 each. 2 cars will be used as

fixed asset of the company. The minimum price for import duty is

VND300,000,000. The Special Sales Tax rate is 80%, and import duty rate

is 100%.

12/12/18 Import 2 special machines into Vietnam for US$25,000 each. The minimum

price for import duty is VND250,000,000. These machines will be used by the

company as fixed asset. Import duty for these 2 machines is exempted.

20.12.18 Sell 8 cars imported to customers, of which 5 cars are for immediate cash for

VND1,200,000,000 each. The remaining 3 cars are sold on hiredpurchase terms, payments will be in 5

instalments of VND300,000,000each

31.12.18 Invoices for rental expenses in November 2018 for VND120,000,000

All the prices above are contractual / invoice price (i.e. without VAT or import duty).

Required

Calculate VAT incurred during December for TPT Co., assuming the company can separately account for

VAT of each activity

You might also like

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Chapter 7-The Regular Output VatDocument7 pagesChapter 7-The Regular Output VatJamaica DavidNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Business Tax - Prelim Exam - Set BDocument6 pagesBusiness Tax - Prelim Exam - Set BRenalyn ParasNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Syllabus Portfolio AUNDocument6 pagesSyllabus Portfolio AUNThu ThuNo ratings yet

- 2019 Fall - Off - Campus Dormitory Housing InfoDocument3 pages2019 Fall - Off - Campus Dormitory Housing InfoeecygNo ratings yet

- Revision For CIT & VAT 2017Document2 pagesRevision For CIT & VAT 2017Ý PhanNo ratings yet

- Chapter 15 PDFDocument11 pagesChapter 15 PDFG & E ApparelNo ratings yet

- VAT-problems-key by Andrew Gil AmbrayDocument10 pagesVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- Exercise 2Document15 pagesExercise 2Riezel PepitoNo ratings yet

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- Output Vat Quiz - HernandezDocument4 pagesOutput Vat Quiz - HernandezDigna HernandezNo ratings yet

- ApplicationTAX - LecturePROBLEMDocument2 pagesApplicationTAX - LecturePROBLEMAyessa ViajanteNo ratings yet

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Business Tax - Prelim Exam - Set ADocument7 pagesBusiness Tax - Prelim Exam - Set ARenalyn Paras0% (1)

- Value Added TaxDocument3 pagesValue Added TaxChristine Igna100% (1)

- TBLTAX Chapter 4 VAT Integrative ProblemsDocument4 pagesTBLTAX Chapter 4 VAT Integrative ProblemsBeny MiraflorNo ratings yet

- Local Media603729699590229664Document3 pagesLocal Media603729699590229664Mallari, Princess Diane D.No ratings yet

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Vat Seatwork - NeDocument3 pagesVat Seatwork - NeMarvin San JuanNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Pre Finals Manacc 1Document8 pagesPre Finals Manacc 1Gesselle Acebedo0% (1)

- Output and Input VAT: Business TaxDocument13 pagesOutput and Input VAT: Business TaxKathleen AgustinNo ratings yet

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Review Problems and Notes in VAT - With Answers and SolutionsDocument27 pagesReview Problems and Notes in VAT - With Answers and Solutionsangel caoNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- Problem 1: Additional InformationDocument3 pagesProblem 1: Additional InformationAngela Ricaplaza ReveralNo ratings yet

- Vat QuestionsDocument4 pagesVat Questionsjoseph mbuguaNo ratings yet

- Computaion Pre FinalDocument4 pagesComputaion Pre FinalPaupauNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document10 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Taxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mDocument32 pagesTaxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mnga vuNo ratings yet

- Session 5Document19 pagesSession 5youssef.oubenaliNo ratings yet

- 06 Actvity 1 1Document4 pages06 Actvity 1 14mpspxd5msNo ratings yet

- Output and Input VAT1Document21 pagesOutput and Input VAT1Eza MayandiaNo ratings yet

- 01 Seatwork VAT Subject TransactionDocument2 pages01 Seatwork VAT Subject TransactionJaneLayugCabacunganNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- Vat On SaleDocument6 pagesVat On Saleangel caoNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- Input TaxDocument10 pagesInput TaxJan ernie MorillaNo ratings yet

- TAX RefExamDocument16 pagesTAX RefExamjeralyn juditNo ratings yet

- Vat 5Document3 pagesVat 5Allen KateNo ratings yet

- Written ReportDocument10 pagesWritten ReportSamantha TayoneNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- BSA 2105 Atty. F. R. Soriano Value-Added VAT Exercises - 3 (Transactions Deemed Sale, Presumptive Input Tax, Transitional Input Tax)Document2 pagesBSA 2105 Atty. F. R. Soriano Value-Added VAT Exercises - 3 (Transactions Deemed Sale, Presumptive Input Tax, Transitional Input Tax)ela kikayNo ratings yet

- Information For Items 21 & 22Document3 pagesInformation For Items 21 & 22Kurt Morin CantorNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- Output VAT Answer KeyDocument4 pagesOutput VAT Answer Keygeraldjohn.mondejarNo ratings yet

- Tutorial 6Document4 pagesTutorial 6MisteroNo ratings yet

- Quiz 2 Part 2Document5 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Nput Vat On Mixed TransactionsDocument15 pagesNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYNo ratings yet

- Ho 08 VatDocument11 pagesHo 08 VatRachel LuberiaNo ratings yet

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet

- Tax.3113-8 Registration Update Application of Refund Administrative RequirementsDocument6 pagesTax.3113-8 Registration Update Application of Refund Administrative RequirementsZee QBNo ratings yet

- Value Added TaxDocument17 pagesValue Added TaxkirigofortunateNo ratings yet

- I. Investment Objectives: Stocks ExpectationDocument3 pagesI. Investment Objectives: Stocks ExpectationThu ThuNo ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- International University: Vietnam National University HCMCDocument10 pagesInternational University: Vietnam National University HCMCThu ThuNo ratings yet

- Gamuda Land (HCMC) Joint Stock Company: TO: Gamuda Land (HCMC) JSC 68 N1 Street, Son Ky Ward District HCMC, VietnamDocument2 pagesGamuda Land (HCMC) Joint Stock Company: TO: Gamuda Land (HCMC) JSC 68 N1 Street, Son Ky Ward District HCMC, VietnamThu ThuNo ratings yet

- Banker AcceptanceDocument2 pagesBanker AcceptanceThu ThuNo ratings yet

- BMP Bav ValuationDocument4 pagesBMP Bav ValuationThu ThuNo ratings yet

- BMP Bav ReportDocument79 pagesBMP Bav ReportThu ThuNo ratings yet

- BMP Bav Report FinalDocument93 pagesBMP Bav Report FinalThu ThuNo ratings yet

- Welcome To Our Presentation: Topic: Money Market in Viet NamDocument27 pagesWelcome To Our Presentation: Topic: Money Market in Viet NamThu ThuNo ratings yet

- Apologize BCDocument1 pageApologize BCThu ThuNo ratings yet

- Tính Break EvenDocument1 pageTính Break EvenThu ThuNo ratings yet

- Pre BCDocument22 pagesPre BCThu ThuNo ratings yet

- Additional Documents: DATE: 4/7/2020Document2 pagesAdditional Documents: DATE: 4/7/2020Thu ThuNo ratings yet

- Negotiable certificates of deposit (CD) 1: Định nghĩaDocument2 pagesNegotiable certificates of deposit (CD) 1: Định nghĩaThu ThuNo ratings yet

- Iii. Leadership: Motivational EnvironmentDocument6 pagesIii. Leadership: Motivational EnvironmentThu ThuNo ratings yet

- Functionalist ViewDocument2 pagesFunctionalist ViewThu ThuNo ratings yet

- Fundamental of Financial Management January 1, 2019: Tutorial: BondsDocument1 pageFundamental of Financial Management January 1, 2019: Tutorial: BondsThu ThuNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- IV. Any New Managerial Practices: 1. Technology UtilizationDocument4 pagesIV. Any New Managerial Practices: 1. Technology UtilizationThu ThuNo ratings yet

- Paper:: Summarize Related Literature Review and Hypothesis Group 12Document4 pagesPaper:: Summarize Related Literature Review and Hypothesis Group 12Thu ThuNo ratings yet

- Increase The Number of Children Successfully Adopted:: ReasonsDocument2 pagesIncrease The Number of Children Successfully Adopted:: ReasonsThu ThuNo ratings yet

- Discussion QuestionsDocument1 pageDiscussion QuestionsThu ThuNo ratings yet

- How Does Analysts' Forecast Quality Relate To Corporate Investment Efficiency?Document2 pagesHow Does Analysts' Forecast Quality Relate To Corporate Investment Efficiency?Thu ThuNo ratings yet

- Do State and Foreign Ownership Affect Investment Efficiency? Evidence From PrivatizationsDocument2 pagesDo State and Foreign Ownership Affect Investment Efficiency? Evidence From PrivatizationsThu ThuNo ratings yet

- Exercise in Class For Week 3Document1 pageExercise in Class For Week 3Thu ThuNo ratings yet

- Impact of Tax Incentives and Foreign Direct InvestDocument10 pagesImpact of Tax Incentives and Foreign Direct Investtouaf zinebNo ratings yet

- Indian Oil Corporation Limited: Supplier ConsigneeDocument1 pageIndian Oil Corporation Limited: Supplier ConsigneeMONTUPRONo ratings yet

- Agriculture Job Interview Questions and AnswersDocument7 pagesAgriculture Job Interview Questions and AnswersGURURAJNo ratings yet

- Coal Import ProcessDocument5 pagesCoal Import Processsmyns.bwNo ratings yet

- Sujet 2013 DCG Ue12 AnglaisDocument6 pagesSujet 2013 DCG Ue12 AnglaisInès MissourNo ratings yet

- Factors Leading To The Greater Integration of Asian RegionsDocument32 pagesFactors Leading To The Greater Integration of Asian Regionsughmalum xx100% (1)

- Indirect TaxesDocument18 pagesIndirect TaxesIshmael OneyaNo ratings yet

- Deed of Absolute SaleDocument3 pagesDeed of Absolute SaleGerald RojasNo ratings yet

- Mathematical Literacy Scope Grade 12Document1 pageMathematical Literacy Scope Grade 12gchabwera1No ratings yet

- E-Pembayaran UPSI PDFDocument1 pageE-Pembayaran UPSI PDFHilmiNo ratings yet

- Bhutan Electricity Authority: December 2019Document17 pagesBhutan Electricity Authority: December 2019Sonam PhuntshoNo ratings yet

- St. Joseph County ProposalsDocument1 pageSt. Joseph County ProposalsWXMINo ratings yet

- Miss. Dipti Dipak Patil: Taxation As A Significant Tool For Economic DevelopmentDocument70 pagesMiss. Dipti Dipak Patil: Taxation As A Significant Tool For Economic DevelopmentGKNo ratings yet

- Global Governance in The 21 CenturyDocument10 pagesGlobal Governance in The 21 CenturyRental SystemNo ratings yet

- Your IndiGo Itinerary - UHMCMMDocument2 pagesYour IndiGo Itinerary - UHMCMMSundaresan NeelamegamNo ratings yet

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- Calculate Tax Fees and Charge PDFDocument30 pagesCalculate Tax Fees and Charge PDFJamal83% (6)

- Project Rupee Raftaar: An Analysis: BackgroundDocument5 pagesProject Rupee Raftaar: An Analysis: BackgroundAriance ProjectNo ratings yet

- E Tax 2Document1 pageE Tax 2TemesgenNo ratings yet

- Taxation NotesDocument54 pagesTaxation Notesmuskansethi2001No ratings yet

- Taxation in Ancient World IndiaDocument12 pagesTaxation in Ancient World IndiaArsha SureshNo ratings yet

- Paper3 DP2 October Exercise 2Document5 pagesPaper3 DP2 October Exercise 2desecih806No ratings yet

- Brain DumpDocument1 pageBrain DumpChantie BorlonganNo ratings yet

- SNGPL - Web BillDocument1 pageSNGPL - Web BillT SeriesNo ratings yet

- KSDC - Payment ReceiptDocument1 pageKSDC - Payment Receiptvandv printsNo ratings yet

- Capital Gains Tax (CGT) RatesDocument15 pagesCapital Gains Tax (CGT) RatesMargaretha PaulinaNo ratings yet

- 0455 w15 QP 21 PDFDocument8 pages0455 w15 QP 21 PDFMost. Amina KhatunNo ratings yet

- LAPD-Gen-G01 - Taxation in South Africa - External GuideDocument116 pagesLAPD-Gen-G01 - Taxation in South Africa - External GuideTheoNo ratings yet

- Epgtd Assignment-1Document2 pagesEpgtd Assignment-1Sagar MudunuriNo ratings yet