Professional Documents

Culture Documents

This Study Resource Was

Uploaded by

SmartunblurrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Study Resource Was

Uploaded by

SmartunblurrCopyright:

Available Formats

Economics 406

Spring 2015

Problem Set 4

Due Tuesday, February 24, by the end of class.

om

1. Consider a Cournot game between two firms. The firms face an inverse demand function

described by the equation P (Q) = α − Q if Q ≤ α, P (Q) = 0 if Q > α, where P is the

price of output and Q is the total output produced by the two firms. Firm 1 produces its

r.c

output q1 at a constant unit cost c1 (i.e, the total cost to firm 1 of producing q1 units of

output is c1 q1 ). Firm 2 produces output q2 at a constant unit cost c2 .

er asblur

(a) Solve for the Nash equilibrium output choices of each firm, (q1∗ , q2∗ ), as a function of α,

c1 , and c2 . You may assume that both firms choose a positive quantity of output in

the Nash equilibrium (this will be true as long as c1 and c2 are not too big, or not too

m

far apart). Solve also for each firm’s profit, total output, and the Nash equilibrium

eH wtun

price, also as functions of α, c1 and c2 .

co

(b) Suppose firm 2 has an innovation that reduces its cost (that is, makes c2 smaller).

What is the directional effect (up or down) on the Nash equilibrium outputs and

rs mear

o.

profits of the firms, and on the Nash equilibrium price?

ou Src

2. Consider the following Bertrand game between two firms, firm 1 and firm 2. As in the

standard Bertrand game, each firm’s action is a choice of price (that is, some nonnegative

viaou

real number). However, the firms produce goods that are not identical, and thus consumers

do not use the rule of buying only from the firm that charges a lower price. Instead,

aC d s

the demand for each firm’s good is a continuous function of the prices they choose. In

vi are re

particular, demand for firm 1’s good as a function of p1 and p2 is 1 + p2 − p1 , and demand

for firm 2’s good as a function of p1 and p2 is 1 + p1 − p2 . Each firm has a constant unit

d Sh y

cost of production c.

reis tud

(a) Write down each firm’s profit as functions of c, p1 , and p2 .

(b) Solve for each firm’s best response function.

(c) Find the Nash equilibrium of the game (as a function of c).

s

(d) Are there any outcomes that yield both firms a higher payoff than the Nash equilib-

rium? If not, prove your answer. If so, give one example.

is

Th

3.

(a) Suppose that there are four firms in the standard Hotelling game, in which each firm

faile

wishes to locate in a place that maximizes its market share. Find a Nash equilibrium

in which each firm sells to 1/4 of the market. Demonstrate that each firm is using a

ish

best response in your Nash equilibrium.

(b) Consider the Hotelling game with three firms. Write down firm 1’s best response as a

Th

function of firm 2’s and firm 3’s choices of location, x2 and x3 . A best response will

not exist for some values of x2 and x3 , but for others it will. Given your answer, can

there be a Nash equilibrium in pure strategies of the Hotelling game with three firms?

Explain.

https://www.coursehero.com/file/12401250/15PS4/

We provide unlocked studymaterials from popular websites at affordable price, email enquiries to rishabhk28@live.com

Powered by TCPDF (www.tcpdf.org)

You might also like

- CB2 Booklet 1Document114 pagesCB2 Booklet 1Somya AgrawalNo ratings yet

- Business Finance: A Pictorial Guide for ManagersFrom EverandBusiness Finance: A Pictorial Guide for ManagersRating: 4 out of 5 stars4/5 (1)

- General Equilibrium PDFDocument42 pagesGeneral Equilibrium PDFArchana RajNo ratings yet

- Elasticity of Demand and SupplyDocument18 pagesElasticity of Demand and SupplyMochimNo ratings yet

- Micro Economics Elasticity of DemandDocument13 pagesMicro Economics Elasticity of DemandSurajNo ratings yet

- Ana Espinola-Arredondo, Felix Munoz-Garcia - Intermediate Microeconomic Theory - Tools and Step-by-Step Examples-The MIT Press (2020)Document505 pagesAna Espinola-Arredondo, Felix Munoz-Garcia - Intermediate Microeconomic Theory - Tools and Step-by-Step Examples-The MIT Press (2020)RAJIN RAIHAN ANIK ISLAM100% (1)

- This Study Resource WasDocument2 pagesThis Study Resource WasSmartunblurrNo ratings yet

- Bits F314 - Q2Document2 pagesBits F314 - Q2f20221182No ratings yet

- Solutions Strategic Pricing TechniquesDocument7 pagesSolutions Strategic Pricing Techniquesarun ladeNo ratings yet

- Practice Problems 7 Topic: Cournot and Bertrand EquilibriaDocument2 pagesPractice Problems 7 Topic: Cournot and Bertrand Equilibriajinnah kayNo ratings yet

- ECO101 Solved Problems Games and Oligopoly SolutionsDocument10 pagesECO101 Solved Problems Games and Oligopoly Solutionsphineas12345678910ferbNo ratings yet

- Exam 1 - Mock SolutionDocument3 pagesExam 1 - Mock SolutionDaneil JosephNo ratings yet

- Sample Questions PDFDocument3 pagesSample Questions PDFMeha Sandeep PatelNo ratings yet

- EC2066Document49 pagesEC2066Josiah KhorNo ratings yet

- Problem Set 4Document4 pagesProblem Set 4Mane HarutyunyanNo ratings yet

- Ps IndustrialDocument5 pagesPs Industrialanapaula.barriga123No ratings yet

- Exercises Course8 OligopolyDocument4 pagesExercises Course8 OligopolyWaldo OCNo ratings yet

- Bits f314 Mids QDocument2 pagesBits f314 Mids QArshdeep Singh KochharNo ratings yet

- 214ECN Managerial Economics Seminar 4Document2 pages214ECN Managerial Economics Seminar 4phuongfeoNo ratings yet

- ECN2217 - Intermediate Microeconomics 2022Document5 pagesECN2217 - Intermediate Microeconomics 2022Luke GaleaNo ratings yet

- Econ 2022.2022.23. Assignment 1.WoADocument2 pagesEcon 2022.2022.23. Assignment 1.WoABereket AdamssegedNo ratings yet

- Microeconomic Theory I QP2Document3 pagesMicroeconomic Theory I QP2Anand KoleNo ratings yet

- EC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-BDocument6 pagesEC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-BAishwarya PotdarNo ratings yet

- Study Questions1Document3 pagesStudy Questions1Peter HuaNo ratings yet

- ASB2307-Final Exam Questions - 18-19Document6 pagesASB2307-Final Exam Questions - 18-19Anshuman GuptaNo ratings yet

- Econ2020a 14 ps04Document4 pagesEcon2020a 14 ps04samuelifamilyNo ratings yet

- Homework 2Document1 pageHomework 2jfksldjfNo ratings yet

- Homework 2Document1 pageHomework 2jfksldjfNo ratings yet

- Tutorial Week11 SolutionsDocument2 pagesTutorial Week11 SolutionshazelismNo ratings yet

- Exercises Part2Document9 pagesExercises Part2christina0107No ratings yet

- Microeconomics-Final.: October 8, 2010Document3 pagesMicroeconomics-Final.: October 8, 2010Anu AmruthNo ratings yet

- Topic 2 - Product Differentiation 2 PDFDocument3 pagesTopic 2 - Product Differentiation 2 PDFRebeccaNo ratings yet

- Second Midterms From Previous YearsDocument22 pagesSecond Midterms From Previous YearsHi nice to meet youNo ratings yet

- Problem Set 3Document1 pageProblem Set 3samx9950No ratings yet

- Eco101a Tutorial Problem Set 12Document2 pagesEco101a Tutorial Problem Set 12Rhythm's PathakNo ratings yet

- Game Theory - QuestionsDocument7 pagesGame Theory - QuestionsBerk YAZAR100% (1)

- Zy 170478719146681Document3 pagesZy 1704787191466817xy29kg2zcNo ratings yet

- Economics 106P E. Mcdevitt Study Questions-Set #1Document13 pagesEconomics 106P E. Mcdevitt Study Questions-Set #1Zhen WangNo ratings yet

- Session 16 - Producer's EquilibriumDocument16 pagesSession 16 - Producer's EquilibriumSweet tripathiNo ratings yet

- Examination: June 2016: Subject, Course and Code: Economics HonoursDocument9 pagesExamination: June 2016: Subject, Course and Code: Economics HonoursMichelNo ratings yet

- Seminar 4 - SolutionsDocument4 pagesSeminar 4 - SolutionsphuongfeoNo ratings yet

- EC203 - Problem Set 7Document2 pagesEC203 - Problem Set 7Yiğit KocamanNo ratings yet

- Problem Set 3Document4 pagesProblem Set 3Sudisha DasNo ratings yet

- The Inverse Market Demand Curve For Bean Sprouts Is GivenDocument1 pageThe Inverse Market Demand Curve For Bean Sprouts Is Giventrilocksp SinghNo ratings yet

- Production in Advance Versus Production To Order: Attila Tasn AdiDocument17 pagesProduction in Advance Versus Production To Order: Attila Tasn AdiRajatTripathiNo ratings yet

- Centralisedbargaining Cournotvs - BertrandDocument10 pagesCentralisedbargaining Cournotvs - Bertrand李毓恒 YuhengNo ratings yet

- Module 3 Lecture 11Document7 pagesModule 3 Lecture 11Swapan Kumar SahaNo ratings yet

- Exercises05052023 SolutionsDocument6 pagesExercises05052023 SolutionsomerogolddNo ratings yet

- Practice Set 2 NNNDocument12 pagesPractice Set 2 NNNC CNo ratings yet

- Consider A Competitive Industry With A Large Number of FirmsDocument1 pageConsider A Competitive Industry With A Large Number of Firmstrilocksp SinghNo ratings yet

- 09 Imperfect CompetitionDocument35 pages09 Imperfect CompetitionMatej VlcekNo ratings yet

- Extra Credit AssignmentDocument2 pagesExtra Credit AssignmentAnanya ChabaNo ratings yet

- hmwk4 QuestionsDocument5 pageshmwk4 Questionstszkei.tang.christyNo ratings yet

- Final ADocument10 pagesFinal ACindy WuNo ratings yet

- Problem Set5 KeyDocument7 pagesProblem Set5 Keygorski29No ratings yet

- Game Theory and Strategic BehaviourDocument10 pagesGame Theory and Strategic BehaviourVatsala ChaudhryNo ratings yet

- HW3 QuestionsDocument5 pagesHW3 QuestionsJason LeungNo ratings yet

- Ejercicio 9 Teams EtdDocument3 pagesEjercicio 9 Teams Etdaaxel0702No ratings yet

- CC5 2019 Question PaperDocument4 pagesCC5 2019 Question PaperRatnadeep GhosalNo ratings yet

- Class Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25Document2 pagesClass Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25amrat meenaNo ratings yet

- 2014 ZaDocument5 pages2014 ZaShershah KakakhelNo ratings yet

- ECC3830 2017 MidSem & Solutions PDFDocument5 pagesECC3830 2017 MidSem & Solutions PDFTim DaviesNo ratings yet

- Exerscise 2 Micro Theory 1Document2 pagesExerscise 2 Micro Theory 1Tclgmes02 GmesNo ratings yet

- Problem Set 1 Markets and StrategyDocument4 pagesProblem Set 1 Markets and StrategyRick HeunisNo ratings yet

- Lesson 4 MicroeconomicsDocument8 pagesLesson 4 MicroeconomicsNogegiNo ratings yet

- Anth 1120 Fall Semester Exam Review SheetDocument16 pagesAnth 1120 Fall Semester Exam Review SheetSmartunblurrNo ratings yet

- PS262 Study Guide: Midterm ExamDocument53 pagesPS262 Study Guide: Midterm ExamSmartunblurrNo ratings yet

- Webassign: Carbon Dioxide Nitrates Sucrose Glucose Vitamin C Lipid Starch Vitamin D ProteinDocument12 pagesWebassign: Carbon Dioxide Nitrates Sucrose Glucose Vitamin C Lipid Starch Vitamin D ProteinSmartunblurrNo ratings yet

- Respond Document Prin-1Document58 pagesRespond Document Prin-1SmartunblurrNo ratings yet

- Final EXAM: RyersonDocument30 pagesFinal EXAM: RyersonSmartunblurrNo ratings yet

- Respond Document PrintDocument93 pagesRespond Document PrintSmartunblurrNo ratings yet

- Cosmopolitan (1890s) About The TelegraphDocument13 pagesCosmopolitan (1890s) About The TelegraphSmartunblurrNo ratings yet

- Biof325 Exam 1answersDocument7 pagesBiof325 Exam 1answersSmartunblurrNo ratings yet

- This Study Resource Was: E106: Ecology and Evolution Final ExamDocument8 pagesThis Study Resource Was: E106: Ecology and Evolution Final ExamSmartunblurrNo ratings yet

- Lab Manual Summary Lab 2: 2+ IntracellularDocument15 pagesLab Manual Summary Lab 2: 2+ IntracellularSmartunblurrNo ratings yet

- BIO350r2 The Scientific MethodDocument9 pagesBIO350r2 The Scientific MethodSmartunblurrNo ratings yet

- E106: Ecology and Evolution Final ExamDocument11 pagesE106: Ecology and Evolution Final ExamSmartunblurrNo ratings yet

- BIO350r2 The Scientific Method PDFDocument30 pagesBIO350r2 The Scientific Method PDFSmartunblurrNo ratings yet

- Exam IVDocument50 pagesExam IVSmartunblurrNo ratings yet

- BIO181Exam3 1Document14 pagesBIO181Exam3 1SmartunblurrNo ratings yet

- Bioc385 Ec2 Spr2015 KeyDocument2 pagesBioc385 Ec2 Spr2015 KeySmartunblurrNo ratings yet

- BIO235F12FinalExamAnswers 1Document12 pagesBIO235F12FinalExamAnswers 1SmartunblurrNo ratings yet

- Bio 235 F 12 Final Exam AnswersDocument12 pagesBio 235 F 12 Final Exam AnswersSmartunblurrNo ratings yet

- Bio 181 Final Exam 2013Document14 pagesBio 181 Final Exam 2013SmartunblurrNo ratings yet

- Use The Figure Below To Answer Questions 1-3Document12 pagesUse The Figure Below To Answer Questions 1-3SmartunblurrNo ratings yet

- BIO204Finalf10v0 W AnswerDocument13 pagesBIO204Finalf10v0 W AnswerSmartunblurrNo ratings yet

- Bio1361 Quiz1 Summer2010Document2 pagesBio1361 Quiz1 Summer2010SmartunblurrNo ratings yet

- Bio 181 Lab Assignment 11Document4 pagesBio 181 Lab Assignment 11SmartunblurrNo ratings yet

- Bio 181 Final Exam 2013Document14 pagesBio 181 Final Exam 2013SmartunblurrNo ratings yet

- StudentDocument23 pagesStudentSmartunblurrNo ratings yet

- This Study Resource Was: Chapter 21: Civilization and UrbanizationDocument4 pagesThis Study Resource Was: Chapter 21: Civilization and UrbanizationSmartunblurrNo ratings yet

- Webassign: Green Algae MossDocument13 pagesWebassign: Green Algae MossSmartunblurrNo ratings yet

- Webassign: Carbon Dioxide Nitrates Sucrose Glucose Vitamin C Lipid Starch Vitamin D ProteinDocument12 pagesWebassign: Carbon Dioxide Nitrates Sucrose Glucose Vitamin C Lipid Starch Vitamin D ProteinSmartunblurrNo ratings yet

- This Study Resource Was: Chapter 22: Location, Pattern, and Structure of CitiesDocument4 pagesThis Study Resource Was: Chapter 22: Location, Pattern, and Structure of CitiesSmartunblurrNo ratings yet

- This Study Resource WasDocument7 pagesThis Study Resource WasSmartunblurrNo ratings yet

- Managerial Economics 11 Edition: by Mark HirscheyDocument30 pagesManagerial Economics 11 Edition: by Mark HirscheyFàrhàt Hossain100% (1)

- 2.5 Elasticity of DemandDocument38 pages2.5 Elasticity of DemandibcvivesNo ratings yet

- Microeconomics II: Game Theory and Its ApplicationsDocument31 pagesMicroeconomics II: Game Theory and Its ApplicationsSaniya Siddhika Ahmed SyedNo ratings yet

- Maximizing Utility - Krugman PDFDocument8 pagesMaximizing Utility - Krugman PDFdenny_sitorusNo ratings yet

- Lec 3 MacroeconomicsDocument18 pagesLec 3 MacroeconomicsSaraNo ratings yet

- Investment FunctionDocument17 pagesInvestment Functionapi-3757629No ratings yet

- BHMCT/Managerial Economics: Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Document2 pagesBHMCT/Managerial Economics: Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Xiaomi TvNo ratings yet

- Chapter 2 Demand and SupplyDocument21 pagesChapter 2 Demand and Supply刘文雨杰No ratings yet

- ECO 11 (Chapter 2)Document63 pagesECO 11 (Chapter 2)Prabin KhanalNo ratings yet

- Economics Study Material For Junior InterDocument30 pagesEconomics Study Material For Junior InterNooruddin SheikNo ratings yet

- Chapter-4 Elasticity of Demand Q.1 What Is Price Elasticity of Demand? Explain Various Types of PriceDocument14 pagesChapter-4 Elasticity of Demand Q.1 What Is Price Elasticity of Demand? Explain Various Types of PricePriya VarenyaNo ratings yet

- Game Theory Lecture 5Document24 pagesGame Theory Lecture 5Jessica ChenNo ratings yet

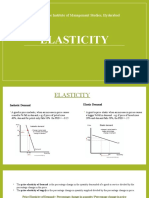

- Elasticity: Narsee Monjee Institute of Management Studies, HyderabadDocument5 pagesElasticity: Narsee Monjee Institute of Management Studies, HyderabadAishwaryaNo ratings yet

- Optimizing Olivia Option-AnswerDocument3 pagesOptimizing Olivia Option-Answershafa anisa ramadhaniNo ratings yet

- Chapter 4Document48 pagesChapter 4RAY VEGANo ratings yet

- Market Structure and Game Theory (Part 4)Document7 pagesMarket Structure and Game Theory (Part 4)Srijita GhoshNo ratings yet

- Sulalitha Economics EMDocument74 pagesSulalitha Economics EMrakeshsi563100% (1)

- Theme 1 - Rapid Recall QuestionsDocument3 pagesTheme 1 - Rapid Recall QuestionsSatvir GillNo ratings yet

- Learning Journal Unit 4 15-07-2021Document3 pagesLearning Journal Unit 4 15-07-2021Winnerton GeochiNo ratings yet

- Decision Analysis: To AccompanyDocument40 pagesDecision Analysis: To AccompanyVery Dani SitorusNo ratings yet

- 3 Consumer Behavior - Utility Analysis - Indifference Curve Analysis PDFDocument51 pages3 Consumer Behavior - Utility Analysis - Indifference Curve Analysis PDFSelvam RajNo ratings yet

- Value and Wage Labor: Capital. More Modern Theories Are Needed, The Public Was Told, and in Any Case The EconomicDocument36 pagesValue and Wage Labor: Capital. More Modern Theories Are Needed, The Public Was Told, and in Any Case The EconomicJordan MajszakNo ratings yet

- Practiceproblem1 23839Document3 pagesPracticeproblem1 23839Karamveer SinghNo ratings yet

- The Concept of Elasticity: Rhyan Mike R. BacaroDocument18 pagesThe Concept of Elasticity: Rhyan Mike R. BacaroLovelyn Ramirez100% (1)

- IS-LM Model: Theory of Employment, Interest, and Money To Small Systems of SimultaneousDocument6 pagesIS-LM Model: Theory of Employment, Interest, and Money To Small Systems of SimultaneousTalat KhanamNo ratings yet