Professional Documents

Culture Documents

Beta Debt To Capital Ratio (WD) Equity To Capital Ratio (WC) Debt To Equity Ratio (D/E)

Uploaded by

Glizette SamaniegoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beta Debt To Capital Ratio (WD) Equity To Capital Ratio (WC) Debt To Equity Ratio (D/E)

Uploaded by

Glizette SamaniegoCopyright:

Available Formats

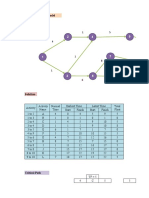

Debt to Capital Ratio Equity to Capital Debt to equity ratio

Beta

(wd) Ratio (wc) ( D/E)

0.00 100 0.00 1.2

0.20 0.80 0.25 1.3

0.40 0.60 0.67 1.4

0.60 0.40 1.50 1.5

0.80 0.20 4.00 16

Risk Free Rate 5%

Market Premium 6%

Tax rate 40%

Ebit 500,000

NOPAT 300,000

Required:

a. What is the firm’s optimal capital Structure and what would be its WACC at the optimal capital structure?

Based on the table, it means if you finance your investment and if you finance your debt to 60% and equity of 40% you will hav

and for the Weighted Average Cost of Capital its 9.92

b. What’s the Firms Value if it has a EBIT of $500,000?

The value of the firm is 3,024,193.55

Before cost of debt

Cost of equity Wacc Value

(rd)

7.0 0.122 12.20 2,459,016.39

8.0 0.128 11.20 2,678,571.43

10.0 0.134 10.44 2,873,563.22

12.0 0.140 9.92 3,024,193.55

15.0 1.010 27.40 1,094,890.51

e optimal capital structure?

ebt to 60% and equity of 40% you will have your optimal structure.

You might also like

- StatisticsDocument256 pagesStatisticsapi-3771570100% (12)

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Valcon 4Document153 pagesValcon 4Kim BihagNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Cost of Capital Wacc UpdatedDocument46 pagesCost of Capital Wacc UpdatedDEBAPRIYA SARKARNo ratings yet

- (Problems) - Audit of InventoriesDocument22 pages(Problems) - Audit of Inventoriesapatos40% (5)

- (Problems) - Audit of InventoriesDocument22 pages(Problems) - Audit of Inventoriesapatos40% (5)

- 15 Numerical RAROCDocument1 page15 Numerical RAROCVenkatsubramanian R IyerNo ratings yet

- Liverage Brigham Case SolutionDocument8 pagesLiverage Brigham Case SolutionShahid Mehmood100% (1)

- Ch 14-07 Build Elliott's Optimal Capital StructureDocument6 pagesCh 14-07 Build Elliott's Optimal Capital StructureHerlambang Prayoga100% (1)

- Accounting Errors Impact on Income and Retained EarningsDocument5 pagesAccounting Errors Impact on Income and Retained EarningsGlizette SamaniegoNo ratings yet

- Nama: Farihatul Dwi Khasanah NIM 5180211498 Kelas: MK 2 D Melengkapi Optimal Capital Structure Case. Chapter 14. CH 14-07 Build A ModelDocument6 pagesNama: Farihatul Dwi Khasanah NIM 5180211498 Kelas: MK 2 D Melengkapi Optimal Capital Structure Case. Chapter 14. CH 14-07 Build A ModelHerlambang PrayogaNo ratings yet

- Ipm Question SDocument7 pagesIpm Question SAamir AwanNo ratings yet

- Suggested - FM Eco - Test 1Document8 pagesSuggested - FM Eco - Test 1Ritam chaturvediNo ratings yet

- Memory Plus Gold For Mas5Document8 pagesMemory Plus Gold For Mas5Ashianna KimNo ratings yet

- DFM 15 SolutionDocument17 pagesDFM 15 SolutionAbhinav JainNo ratings yet

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- P13Document21 pagesP13Saeful AzizNo ratings yet

- Capital Structure and Gearing - Solutions To The Remaining QuestionsDocument4 pagesCapital Structure and Gearing - Solutions To The Remaining QuestionsGadafi FuadNo ratings yet

- Optimal advertising budget allocationDocument4 pagesOptimal advertising budget allocationFurqan Farooq VadhariaNo ratings yet

- Tugas Analisis Kesehatan BankDocument9 pagesTugas Analisis Kesehatan Bank15.Krisna Rizqi WijayaNo ratings yet

- Capital StructureDocument13 pagesCapital Structureruchit guptaNo ratings yet

- CFS Lecture 2 Part 2Document7 pagesCFS Lecture 2 Part 2R VNo ratings yet

- Balance Sheet New TypeDocument293 pagesBalance Sheet New TypeMubashir AhmadNo ratings yet

- Bai Tap Ve Quan Ly RuiDocument10 pagesBai Tap Ve Quan Ly RuisinbdacutieNo ratings yet

- Risk Aversion ExampleDocument10 pagesRisk Aversion ExampleShashwat DeshmukhNo ratings yet

- RAROC ExampleDocument1 pageRAROC ExampleVenkatsubramanian R IyerNo ratings yet

- Chapter 3 Part 3Document30 pagesChapter 3 Part 3Aditya GhoshNo ratings yet

- Balance Sheet of CompanyDocument3 pagesBalance Sheet of Companyshubham jagtapNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- Shareholder Funds Net Fixed Assets Equity Capital (10 Crore Shares of Rs 10 Each) Net Working CapitalDocument4 pagesShareholder Funds Net Fixed Assets Equity Capital (10 Crore Shares of Rs 10 Each) Net Working CapitalSudhanshu Kumar SinghNo ratings yet

- YubarajDocument4 pagesYubarajYubraj ThapaNo ratings yet

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- Business Finance II: Marriott Corporation: The Cost of CapitalDocument5 pagesBusiness Finance II: Marriott Corporation: The Cost of CapitalJunaid SaleemNo ratings yet

- Working Capital Management Exam QuestionsDocument2 pagesWorking Capital Management Exam Questionsabhimani5472No ratings yet

- Food Distribution LBO Deleverage AnalysisDocument12 pagesFood Distribution LBO Deleverage AnalysismartinsiklNo ratings yet

- Capital Structure Theories: Numericals 1 SolutionsDocument6 pagesCapital Structure Theories: Numericals 1 SolutionsGazala KhanNo ratings yet

- Mid Term BAV - 12 Oct 2017 - SolutionDocument2 pagesMid Term BAV - 12 Oct 2017 - SolutionMAYANK JAINNo ratings yet

- Dividend Policy QuestionDocument3 pagesDividend Policy Questionraju kumarNo ratings yet

- Chapter 5Document12 pagesChapter 5Maria RahmanNo ratings yet

- Aminul Islam 2016209690 EMB-660-Assignment-2Document35 pagesAminul Islam 2016209690 EMB-660-Assignment-2Aminul Islam 2016209690No ratings yet

- Capital Structure & Dividend ImputationDocument53 pagesCapital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- Finace TestDocument6 pagesFinace TestMichael AzerNo ratings yet

- Solutions Manual Chapter 22 Estimating Risk Return AssetsDocument13 pagesSolutions Manual Chapter 22 Estimating Risk Return AssetsRonieOlarteNo ratings yet

- Cases Optimal CapitalDocument2 pagesCases Optimal CapitalRiya PandeyNo ratings yet

- Yogesh P Assignment PDFDocument2 pagesYogesh P Assignment PDFಯೋಗೇಶ್ ಪಿNo ratings yet

- OPTIMAL StructureDocument3 pagesOPTIMAL StructureAnonymous EErmsqjjpNo ratings yet

- Cost of debtDocument2 pagesCost of debtbekalgagan29No ratings yet

- HCL Technologies Financial Analysis 2018-21Document3 pagesHCL Technologies Financial Analysis 2018-21Joseph JohnNo ratings yet

- Chapter 5 - SupportDocument15 pagesChapter 5 - SupportwafarasoolNo ratings yet

- Portfolio TrackingDocument12 pagesPortfolio TrackingwonbenNo ratings yet

- Cost of Project Particulars Existing Proposed TotalDocument3 pagesCost of Project Particulars Existing Proposed TotalsanooNo ratings yet

- 15 MyingrowDocument14 pages15 MyingrowKiddNo ratings yet

- Calculating Breakeven Point and Capital Structure ImpactDocument3 pagesCalculating Breakeven Point and Capital Structure Impactsultan altamashNo ratings yet

- Bharti Airtel Capital Structure and Financing AnalysisDocument11 pagesBharti Airtel Capital Structure and Financing AnalysisDavid WilliamNo ratings yet

- 5.1 Holding Period ReturnDocument48 pages5.1 Holding Period ReturnSrilekha BasavojuNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- 4.2 - Cost of Equity - ExerciseDocument7 pages4.2 - Cost of Equity - ExerciseHTNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Capital budgeting techniques in ExcelDocument51 pagesCapital budgeting techniques in ExcelMohammad RekabderNo ratings yet

- AE 315 Case Study 1 Curt Manufacturing Solution Support MJBTDocument4 pagesAE 315 Case Study 1 Curt Manufacturing Solution Support MJBTArly Kurt TorresNo ratings yet

- Laguador, Edjay A. Bsa 3 Year Assignment:: AnswerDocument4 pagesLaguador, Edjay A. Bsa 3 Year Assignment:: AnswerGlizette SamaniegoNo ratings yet

- Order Summary Report with Customer DetailsDocument117 pagesOrder Summary Report with Customer DetailsGlizette SamaniegoNo ratings yet

- Reviewer in PartnershipDocument121 pagesReviewer in PartnershipGlizette SamaniegoNo ratings yet

- DocxDocument352 pagesDocxsino akoNo ratings yet

- WelcomeDocument3 pagesWelcomeGlizette SamaniegoNo ratings yet

- DocxDocument2 pagesDocxGlizette SamaniegoNo ratings yet

- Samaniego, Glizette-Ms QuizDocument4 pagesSamaniego, Glizette-Ms QuizGlizette SamaniegoNo ratings yet

- Resignation LetterDocument1 pageResignation LetterGlizette Samaniego100% (1)

- Sample QuestionnaireDocument1 pageSample QuestionnaireGlizette SamaniegoNo ratings yet

- Cash Balance P 1,430,000Document1 pageCash Balance P 1,430,000Glizette SamaniegoNo ratings yet

- Auditing Problems SolvedDocument9 pagesAuditing Problems SolvedGlizette SamaniegoNo ratings yet

- Samaniego, Glizette-Ms QuizDocument4 pagesSamaniego, Glizette-Ms QuizGlizette SamaniegoNo ratings yet

- Allied Food Products' 2015 Statement of Comprehensive Income and Financial PositionDocument4 pagesAllied Food Products' 2015 Statement of Comprehensive Income and Financial PositionGlizette SamaniegoNo ratings yet

- Allied Food Products' 2015 Statement of Comprehensive Income and Financial PositionDocument4 pagesAllied Food Products' 2015 Statement of Comprehensive Income and Financial PositionGlizette SamaniegoNo ratings yet

- GGDocument3 pagesGGGlizette SamaniegoNo ratings yet

- Cash account audit of Makati CorporationDocument8 pagesCash account audit of Makati CorporationGlizette SamaniegoNo ratings yet

- Balance Per Bank: MAY Receipts Disbursements JuneDocument1 pageBalance Per Bank: MAY Receipts Disbursements JuneGlizette SamaniegoNo ratings yet

- Happy LifeDocument1 pageHappy LifeGlizette SamaniegoNo ratings yet

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Sample QuestionnaireDocument1 pageSample QuestionnaireGlizette SamaniegoNo ratings yet

- Local Media4259111667694600482Document1 pageLocal Media4259111667694600482Glizette SamaniegoNo ratings yet

- Place A Check Mark in The Column That Corresponds To The Rating You Have Chosen.Document2 pagesPlace A Check Mark in The Column That Corresponds To The Rating You Have Chosen.Glizette SamaniegoNo ratings yet