Professional Documents

Culture Documents

Afar Assessment Special Procedures

Uploaded by

jajajaredredOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afar Assessment Special Procedures

Uploaded by

jajajaredredCopyright:

Available Formats

merchandise cost should not include excessive freight charges from the transfer of merchandise

between a home office and its branches or between branch locations

if the home office fails to adjust the unrealized mark-up at the end of the period, its consolidated net profit will

be equal to the total sum of the net profit per branch's and home office's books

if the shipments of merchandise consist of mark-up, the home office credits investment in branch at cost whle

the brach credits home office current at billed price

the adjusting entry to record the realized mark-up on branch inventory is recorded in the brach

books

freight in returning the goods from the branch to the home office, paid by either the home office or

the branch, has a corresponding journal entry in the branch books

as far as the branch is concerned, if the realized mark-up on branch inventory remains to be unadjusted, the

ending inventory in the branch books will become overstated

all interbranch transactions requires a correspinding entry in the home office books

interbrach transfre of cash requires the home office to debit the investment in branch account for

the transferor branch

if the home office current account is credited, the transaction would be the following except

which of the following would require a credit to branch current account? Select all that applies

shipments from home office account is presented as

approportionment of expenses by home office to a branch requires

if branch purchases plant assets that are recorded on the books of the home office, entries

requiring reciprocal accounts would include, except

entries that would require only in the home office books is

investment in branch is credited during

1

both credit sabi dito so false, dapat reciprocal

0

1

ho- transferor cash

credit niya dapat si transferor cash ho-recipient

0

cash remittance

branch loss;

an adjunct account to arrive at cogas in the

branch income statement

a credit to expense account by invt in branch expenses

home office expenses ho

installation cost on plant asset paid

by home office

shipment of fixed asset to branch where the

home office maintains the fixed asset account

write off of branch accounts receivable, where

receivable account is maintained in home office

books

invt in b- r

ho-recipient invt in b- t

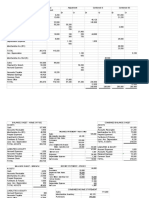

ho branch combined

beg invty 200 100 300

purchases from outside 1400 800 2200

freight in 280 160 440

purch disc 35 20 55

pra 98 56 154

net purch 1547 884 2431

shipments to branch 40

shipments from ho 40

cogas 1707 1024 2731 2731

end invty 341 204 545

cogs 1366 820 2186

ho branch combined

beg invty 400 150 550

purchases from outside 2800 1200 4000

freight in 560 240 800

purch disc -70 -30 -100

pra -196 -84 -280

net purch 3094 1326 4420

shipments to branch 100

shipments from ho 120

cogas 3374 1596 4970

end invty 643 210 873 853

cogs 2731 1386 4117

4097

COGAS 600 450

Unrealized intercompany profit, ending 40

COGAS 600 410 1010

COGS 320 240

Realized intercompany profit 100

COGS 320 140 460

You might also like

- Seven Secrets To Real Estate WealthDocument11 pagesSeven Secrets To Real Estate WealthBlvsr100% (1)

- Secreg - Gun Jumping Exam SheetDocument5 pagesSecreg - Gun Jumping Exam SheetRaj VashiNo ratings yet

- 1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Document12 pages1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Shasha GuptaNo ratings yet

- AFAR Summative Assessment Problems (Kay Jared)Document75 pagesAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- AFAR Summative Assessment Problems (Kay Jared)Document75 pagesAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- Ias 1 QuestionsDocument7 pagesIas 1 QuestionsIssa AdiemaNo ratings yet

- 3RD Activity - ComprehensiveDocument19 pages3RD Activity - ComprehensiveJJ Longno100% (2)

- Dave Ulrich PresentationDocument81 pagesDave Ulrich PresentationIoana DragneNo ratings yet

- MCQ Bcom II Principles of Insurance 1 PDFDocument16 pagesMCQ Bcom II Principles of Insurance 1 PDFNaïlêñ Trïpūrå Jr.100% (1)

- Peninsular Malaysia Electricity Supply Outlook 2017Document60 pagesPeninsular Malaysia Electricity Supply Outlook 2017You Wei WongNo ratings yet

- Law On Corporations and Securities CodesDocument36 pagesLaw On Corporations and Securities CodesjajajaredredNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Kareen LeonDocument10 pagesKareen LeonaminoacidNo ratings yet

- Solution To Assign - Prob 3 Home Office, Branch and Agency AccountingDocument4 pagesSolution To Assign - Prob 3 Home Office, Branch and Agency Accountingmhikeedelantar100% (1)

- AFAR Compi For SA2Document82 pagesAFAR Compi For SA2jajajaredredNo ratings yet

- Managerial AccountingDocument18 pagesManagerial Accountingirfan103158No ratings yet

- Question 1 of The FAR ExamDocument5 pagesQuestion 1 of The FAR ExamShazaib Khalish0% (7)

- Sarah Hani EntDocument2 pagesSarah Hani EntDeeaan21 Deeaan03No ratings yet

- Cash FlowwDocument6 pagesCash FlowwSyeda IsmailNo ratings yet

- Financial Reporting Ii AssignmentDocument7 pagesFinancial Reporting Ii AssignmentemeraldNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- 5 6Document3 pages5 6VasunNo ratings yet

- Business Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017Document6 pagesBusiness Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017NomaSonto NaMakoNo ratings yet

- 03 - Excelfiles - Student Text - Assignments - 2010Document12 pages03 - Excelfiles - Student Text - Assignments - 2010leuleuNo ratings yet

- CCP102Document13 pagesCCP102api-3849444No ratings yet

- Answer To Sample Question 3Document3 pagesAnswer To Sample Question 3Farid Abbasov0% (1)

- Worksheet: Medicare Contributions PayableDocument2 pagesWorksheet: Medicare Contributions PayableShaira Mica SanitaNo ratings yet

- AFAR-Enabling-Assessments General ProceduresDocument6 pagesAFAR-Enabling-Assessments General ProceduresjajajaredredNo ratings yet

- Trial Balance Home Office DR (CR) Branch Office DR (CR)Document2 pagesTrial Balance Home Office DR (CR) Branch Office DR (CR)Adriana CarinanNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsRobin ScherbatskyNo ratings yet

- Calculate The Following Ratios:: A) Roce B) Current RatioDocument9 pagesCalculate The Following Ratios:: A) Roce B) Current RatioPham TrangNo ratings yet

- B326 MTA - Fall 2022-2023 BakriDocument6 pagesB326 MTA - Fall 2022-2023 Bakribinafif67No ratings yet

- This Study Resource Was: Key To Exercise ProblemsDocument8 pagesThis Study Resource Was: Key To Exercise ProblemsJamaica DavidNo ratings yet

- Amount of Tax WithheldDocument1 pageAmount of Tax WithheldFSJVVNo ratings yet

- 三部曲之二 Revaluation (Basic)Document13 pages三部曲之二 Revaluation (Basic)Jennifer LauNo ratings yet

- Bebanco Edward - Cash Flow StatementDocument6 pagesBebanco Edward - Cash Flow StatementBebanco EdwardNo ratings yet

- Mock Final F3.2Document3 pagesMock Final F3.2Phạm Việt BáchNo ratings yet

- Ass FS AnsDocument4 pagesAss FS AnsJhay Sy LynNo ratings yet

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- Week 4Document2 pagesWeek 4maybefault1408No ratings yet

- 00000Document30 pages00000ImanNo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Meiditya Larasati - 01017190019 - PR Pertemuan 03Document9 pagesMeiditya Larasati - 01017190019 - PR Pertemuan 03Haikal RafifNo ratings yet

- Applications TD-1Document6 pagesApplications TD-1babyNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash Equivalentsbella dwiyantiNo ratings yet

- BudgetDocument60 pagesBudgetmimo11112222No ratings yet

- HOBA - SeatworkDocument2 pagesHOBA - Seatworkahyenn cabelloNo ratings yet

- Comparative StatementDocument2 pagesComparative StatementRevati ShindeNo ratings yet

- Ind As 103 Revision Notes FinalDocument19 pagesInd As 103 Revision Notes Finaljmpnv007No ratings yet

- N5 Financial Accounting November 2019Document7 pagesN5 Financial Accounting November 2019Anil HarichandreNo ratings yet

- List of Accounts CodeDocument4 pagesList of Accounts CodeShandya MaharaniNo ratings yet

- Kathmandu Hospital UpdatedDocument7 pagesKathmandu Hospital Updatedone twoNo ratings yet

- Official Template For Abm ProjectDocument17 pagesOfficial Template For Abm ProjectPersephoneeeiNo ratings yet

- StudyDocument10 pagesStudyirahQNo ratings yet

- W8 TutorialSolutionsDocument12 pagesW8 TutorialSolutionsCJNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Chapter 4 Financial AnilsisDocument5 pagesChapter 4 Financial AnilsisIzo Izo GreenNo ratings yet

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsRobin ScherbatskyNo ratings yet

- Comprehensive ProblemDocument14 pagesComprehensive ProblemMarian Augelio PolancoNo ratings yet

- Pert 4 ExcelDocument8 pagesPert 4 ExcelSagita RajagukgukNo ratings yet

- Taj Power TechDocument12 pagesTaj Power TechNujhat SharminNo ratings yet

- Branch Account2Document20 pagesBranch Account2choudharidip8No ratings yet

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- Practice Set 2Document8 pagesPractice Set 2Ace BautistaNo ratings yet

- Joinpdf PDFDocument428 pagesJoinpdf PDFOwen Bawlor Manoz100% (1)

- N5 Financial Accounting November 2016Document10 pagesN5 Financial Accounting November 2016TsholofeloNo ratings yet

- Notes - Cash Flow Statement and ProblemsDocument4 pagesNotes - Cash Flow Statement and ProblemsDhruv MalhotraNo ratings yet

- Joint ArrangementsDocument18 pagesJoint ArrangementsJessalyn CilotNo ratings yet

- Orkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesDocument7 pagesOrkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesOmar SrourNo ratings yet

- Insights Part 2 Online WP Candidate Jan-Feb 2023 (2-Part Exam)Document1 pageInsights Part 2 Online WP Candidate Jan-Feb 2023 (2-Part Exam)jajajaredredNo ratings yet

- IPCRF TolosaDocument12 pagesIPCRF TolosajajajaredredNo ratings yet

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- AFAR2 - Sales Agency, H.O., & Branch AccountingDocument12 pagesAFAR2 - Sales Agency, H.O., & Branch AccountingjajajaredredNo ratings yet

- Formation of Rock Layers - Week 5Document41 pagesFormation of Rock Layers - Week 5jajajaredredNo ratings yet

- Consolidated Fs Subsequent To Acquisition Date (Tik and Tok)Document59 pagesConsolidated Fs Subsequent To Acquisition Date (Tik and Tok)jajajaredredNo ratings yet

- AFAR-Enabling-Assessments General ProceduresDocument6 pagesAFAR-Enabling-Assessments General ProceduresjajajaredredNo ratings yet

- AFAR Offline Assessment Foreign Currency TranslationDocument2 pagesAFAR Offline Assessment Foreign Currency TranslationjajajaredredNo ratings yet

- AFAR Stock Aquisition GarrisonDocument16 pagesAFAR Stock Aquisition GarrisonjajajaredredNo ratings yet

- Afar Concepts 25Document2 pagesAfar Concepts 25jajajaredredNo ratings yet

- Afar Probs Journal Entry SpecialDocument9 pagesAfar Probs Journal Entry SpecialjajajaredredNo ratings yet

- Afar Quiz 5 Probs Subsequent To Acqui DateDocument13 pagesAfar Quiz 5 Probs Subsequent To Acqui DatejajajaredredNo ratings yet

- Answer The Following Questions: (2 Points Each) : Shelby CompanyDocument8 pagesAnswer The Following Questions: (2 Points Each) : Shelby CompanyjajajaredredNo ratings yet

- AFAR Problems WorksheetDocument13 pagesAFAR Problems WorksheetjajajaredredNo ratings yet

- Case Study - Plasma MembraneDocument5 pagesCase Study - Plasma MembranejajajaredredNo ratings yet

- Case Study 3 Team 4 BSA 32Document7 pagesCase Study 3 Team 4 BSA 32jajajaredredNo ratings yet

- Joice Anne U. Tolosa Cell BiologyDocument4 pagesJoice Anne U. Tolosa Cell BiologyjajajaredredNo ratings yet

- Mgac Forum 1Document2 pagesMgac Forum 1jajajaredredNo ratings yet

- Intercompany Sale of Fixed AssetDocument33 pagesIntercompany Sale of Fixed AssetjajajaredredNo ratings yet

- Cellular Respiration (MAEd Assign)Document4 pagesCellular Respiration (MAEd Assign)jajajaredredNo ratings yet

- Sun Silk 1Document22 pagesSun Silk 1Nikhil Vijay ChavanNo ratings yet

- Soal Try Out Akl 2Document5 pagesSoal Try Out Akl 2Ilham Dwi NoviantoNo ratings yet

- Allied Bank App FormDocument2 pagesAllied Bank App FormChristian LarkinNo ratings yet

- Module 3 ComputationDocument16 pagesModule 3 ComputationGhillian Mae GuiangNo ratings yet

- Project Report On FdiDocument15 pagesProject Report On FdiAkshata ZopayNo ratings yet

- Group Assignment - 2021Document26 pagesGroup Assignment - 2021Nam NguyễnNo ratings yet

- Total Factor ProductivityDocument17 pagesTotal Factor ProductivityAshwath K Mundoor100% (1)

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- DND Noida Flyway Case StudyDocument12 pagesDND Noida Flyway Case Studysidcooper123No ratings yet

- FMCG Industry Profile:: Fast-Moving Consumer Goods (FMCG) Are Products That Are Sold Quickly and at Relatively LowDocument11 pagesFMCG Industry Profile:: Fast-Moving Consumer Goods (FMCG) Are Products That Are Sold Quickly and at Relatively LowDinesh AndersonNo ratings yet

- Chapter 14 - PERFORMANCE MEASUREMENT, BALANCED SCORECARDS, AND PERFORMANCE REWARDSDocument20 pagesChapter 14 - PERFORMANCE MEASUREMENT, BALANCED SCORECARDS, AND PERFORMANCE REWARDSGRACE ANN BERGONIONo ratings yet

- List of World Bank MembersDocument4 pagesList of World Bank MembersUsman KhalidNo ratings yet

- Practical Accounting Problems IIDocument12 pagesPractical Accounting Problems IIJericho PedragosaNo ratings yet

- Managing Global Treasury Technology: A Case Study On Prologis and In-House Banking (IHB)Document21 pagesManaging Global Treasury Technology: A Case Study On Prologis and In-House Banking (IHB)Nilesh JainNo ratings yet

- Working Capital AnalysisDocument9 pagesWorking Capital AnalysisDr Siddharth DarjiNo ratings yet

- Saral Gyan Stocks Past Performance 050113Document13 pagesSaral Gyan Stocks Past Performance 050113saptarshidas21No ratings yet

- Initial Public Offering (IPO)Document15 pagesInitial Public Offering (IPO)ackyriotsxNo ratings yet

- PartnershipDocument1 pagePartnershipsamdhathriNo ratings yet

- Warren Buffett Squawk Box Transcript, October 24, 2012Document52 pagesWarren Buffett Squawk Box Transcript, October 24, 2012CNBCNo ratings yet

- Cricklewood Brent Cross Opportunity AreaDocument12 pagesCricklewood Brent Cross Opportunity AreascribdstorageNo ratings yet

- Stock Valuation: Div PP R PDocument7 pagesStock Valuation: Div PP R PLeanne TehNo ratings yet

- Fractional ProgrammingDocument53 pagesFractional Programmingjc224No ratings yet