Professional Documents

Culture Documents

List Tarif P3B

List Tarif P3B

Uploaded by

FaceShield Jayapura0 ratings0% found this document useful (0 votes)

8 views2 pagesCopyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesList Tarif P3B

List Tarif P3B

Uploaded by

FaceShield JayapuraCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 2

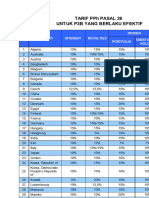

TARIF PPh PASAL 26

UNTUK P3B YANG BERLAKU EFEKTIF

DIVIDEN BRANCH

NO. COUNTRY INTEREST ROYALTIES SUBSTANTIAL PROFIT

PORTFOLIO TAX

HOLDING

1 Algeria 15% 15% 15% 15% 10%

2 Australia 10% 10%/15% 15% 15% 15%

3 Austria 10% 10% 15% 10% 12%

4 Bangladesh 10% 10% 15% 10% 10%

5 Belgium 10% 10% 15% 10% 10%

6 Brunei Darussalam 10% 15% 15% 15% 10%

7 Bulgaria 10% 10% 15% 15% 15%

8 Canada 10% 10% 15% 10% 15%

9 Czech 12,5% 12,5% 15% 10% 12,5%

10 China 10% 10% 10% 10% 10%

11 Croatia 10% 10% 10% 10% 10%

12 Denmark 10% 15% 20% 10% 15%

13 Egypt 15% 15% 15% 15% 15%

14 Finland 10% 10%/15% 15% 10% 15%

15 France 15% 10% 15% 10% 10%

16 Germany 10% 10%/15% 15% 10% 10%

17 Hungary 15% 15% 15% 15% N/A

18 Hongkong 10% 5% 10% 5% 5%

19 India 10% 10% 15% 10% 10%

20 Iran 10% 12% 7% 7% 7%

21 Italy 10% 10%/15% 15% 10% 12%

22 Japan 10% 10% 15% 10% 10%

23 Jordan 10% 10% 10% 10% N/A

24 Korea, Republic of 10% 15% 15% 10% 10%

Korea, Democratic

25 People’s Republic 10% 10% 10% 10% 10%

of

26 Kuwait 5% 20% 10% 10% 10%

27 Luxembourg 10% 12,5% 15% 10% 10%

28 Malaysia 10% 10% 10% 10% 12,5%

29 Maroko 10% 10% 20% 10% 10%

30 Mexico 10% 10% 10% 10% 10%

31 Mongolia 10% 10% 10% 10% 10%

32 Netherlands 10% 10% 10% 10% 10%

33 New Zealand 10% 15% 15% 15% N/A

34 Norway 10% 10%/15% 15% 15% 15%

35 Pakistan 15% 15% 15% 10% 10%

Papua New

36 10% 10% 15% 15% 15%

Guinea

COUNTRY INTEREST ROYALTIES DIVIDEN BRANCH

NO. PROFIT

PORTFOLIO SUBSTANTIAL TAX

TaxBase 6.0 Document - Page : 1

HOLDING

37 Philippines 15% 15%/25% 20% 15% 20%

38 Poland 10% 15% 15% 10% 10%

39 Portuguese 10% 10% 10% 10% 10%

40 Qatar 10% 5% 10% 10% 10%

41 Romania 12,5% 12,5%/15 % 15% 12,5% 12,5%

42 Russia 15% 15% 15% 15% 12,5%

43 Saudi Arabia * N/A N/A N/A N/A N/A

44 Seychelles 10% 10% 10% 10% N/A

45 Singapore 10% 15% 15% 10% 15%

46 Slovak 10% 10%/15% 10% 10% 10%

47 South Africa 10% 10% 15% 10% 10%

48 Spain 10% 10% 15% 10% 10%

Sesuai

49 Sri Lanka 15% 15% 15% 15% UU

Domestik

50 Sudan 15% 10% 10% 10% 10%

51 Suriname 15% 15% 15% 15% 15%

52 Sweden 10% 10%/15% 15% 10% 15%

53 Switzerland 10% 12,5% 15% 10% 10%

54 Syria 10% 15%/20% 10% 10% 10%

55 Taipei / Taiwan 10% 10% 10% 10% 5%

RI = 15% Sesuai

56 Thailand THAI = 15% 20% 15% UU

10%/25% ** Domestik

57 Tunisia 12% 15% 12% 12% 12%

58 Turkey 10% 10% 15% 10% 15%

UAE (United Arab

59 5% 5% 10% 10% 5%

Emirates)

60 Ukraine 10% 10% 15% 10% 10%

61 United Kingdom 10% 10%/15% 15% 10% 10%

United States of

62 10% 10% 15% 10% 10%

America

63 Uzbekistan 10% 10% 10% 10% 10%

64 Venezuela 10% 20% 15% 10% 10%

65 Vietnam 15% 15% 15% 15% 10%

Keterangan :

* P3B antara Indonesia dengan Saudi Arabia hanya mengatur mengenai transportasi penerbangan

dalam jalur internasional.

** Berdasarkan ketentuan pasal 11 ayat 2 P3B RI-Thailand, terdapat pembedaan tarif atas bunga.

N/A P3B tersebut tidak mengatur mengenai Tarif PPh Pasal 26.

TaxBase 6.0 Document - Page : 2

You might also like

- HT Media Facing Competitive & Technological Convergence Challenges in 21st CenturyDocument10 pagesHT Media Facing Competitive & Technological Convergence Challenges in 21st CenturyPrabal Pratim DasNo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- Soal Latihan Sia 20192020 Dagang-JasaDocument3 pagesSoal Latihan Sia 20192020 Dagang-JasaJhoni LimNo ratings yet

- SIA 1 ProblemDocument7 pagesSIA 1 Problemleny prianiNo ratings yet

- Penggunaan Forward Contract Hedging Untuk Menurunkan Risiko Eksposur Transaksi (Studi Pada Pt. Unilever Indonesia, TBK)Document9 pagesPenggunaan Forward Contract Hedging Untuk Menurunkan Risiko Eksposur Transaksi (Studi Pada Pt. Unilever Indonesia, TBK)Dewi SafitriNo ratings yet

- Kunci Jawaban Semua BabDocument46 pagesKunci Jawaban Semua BabMuhammad RifqiNo ratings yet

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- Annual Report PT Pyridam 2011Document132 pagesAnnual Report PT Pyridam 2011Vania WimayoNo ratings yet

- TFCO - Annual Report 2019 - LAMPDocument83 pagesTFCO - Annual Report 2019 - LAMProsida ibrahimNo ratings yet

- Intermediate Debt and Leasing: Debagus SubagjaDocument12 pagesIntermediate Debt and Leasing: Debagus SubagjaDebagus SubagjaNo ratings yet

- Integrated Telecommunications Case: AcquisitionDocument7 pagesIntegrated Telecommunications Case: AcquisitionMarsa Syahda NabilaNo ratings yet

- ACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineDocument16 pagesACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineGaidon HercNo ratings yet

- Chapter 17 - Working Capital ManagementDocument34 pagesChapter 17 - Working Capital Managementcharry anonuevoNo ratings yet

- Chapter 1 - Cost Management StrategyDocument35 pagesChapter 1 - Cost Management StrategyHaniedar NadifaNo ratings yet

- Tugas Sesi 7Document5 pagesTugas Sesi 7mutmainnahNo ratings yet

- AK Kieso Chapter 13-14Document106 pagesAK Kieso Chapter 13-14Desinta Putri100% (1)

- Capitalization of Interest Langer Airline Is Converting From Pis PDFDocument1 pageCapitalization of Interest Langer Airline Is Converting From Pis PDFAnbu jaromiaNo ratings yet

- Tugas Bahasa InggrisDocument1 pageTugas Bahasa InggrisAriq Hasyemi RafsanjaniNo ratings yet

- Synchronous Manufacturing and The Theory of ConstraintsDocument27 pagesSynchronous Manufacturing and The Theory of ConstraintsAristianto ZXNo ratings yet

- Penngaruh Intensitas Research and Development Dan Keuangan Sebagai Variabel Intervening Pada Perusahaan Lq45 Yang Terdaftar Di Bei Periode 2016-2020Document15 pagesPenngaruh Intensitas Research and Development Dan Keuangan Sebagai Variabel Intervening Pada Perusahaan Lq45 Yang Terdaftar Di Bei Periode 2016-2020Nur WijayantiNo ratings yet

- Tugas 8Document2 pagesTugas 8Zahratul Yusfa100% (1)

- Aqua Ar08 PDFDocument96 pagesAqua Ar08 PDFTens GravyNo ratings yet

- Exercise CH 14: This Study Resource Was Shared ViaDocument9 pagesExercise CH 14: This Study Resource Was Shared Vianaura syahdaNo ratings yet

- Exercise 3-14 MADocument2 pagesExercise 3-14 MAsesegar_nailofar0% (1)

- AR2013 UltrajayaDocument166 pagesAR2013 UltrajayaTeri GregNo ratings yet

- Bab 18 Standard Costing PDFDocument8 pagesBab 18 Standard Costing PDFSandi SetiawanNo ratings yet

- Meeting 5Document13 pagesMeeting 5Priyadi As SaridinNo ratings yet

- Annrep ETWA 2017 FinalDocument207 pagesAnnrep ETWA 2017 FinalAry LayNo ratings yet

- (1210000) Statement of Financial Position Presented Using Current and Non-Current - General IndustryDocument9 pages(1210000) Statement of Financial Position Presented Using Current and Non-Current - General IndustryMila JordanNo ratings yet

- Template PowerPoint Kalbe 2018 Plus KALBE Is YOUDocument24 pagesTemplate PowerPoint Kalbe 2018 Plus KALBE Is YOURyan MwNo ratings yet

- OPIM ForecastingDocument4 pagesOPIM ForecastingHumphrey OsaigbeNo ratings yet

- Required: Chapter 12 / Tactical Decision MakingDocument3 pagesRequired: Chapter 12 / Tactical Decision MakingJanine TupasiNo ratings yet

- Implikasi Terhadap Pertumbuhan Ekonomi IndoDocument17 pagesImplikasi Terhadap Pertumbuhan Ekonomi IndoirwandkNo ratings yet

- Pengantar Akuntansi 1: Prodi Perbankan Syariah SMT 2Document29 pagesPengantar Akuntansi 1: Prodi Perbankan Syariah SMT 2Syahrul KNo ratings yet

- PT Alkindo Naratama TBK Dan Entitas Anak/ and SubsidiariesDocument99 pagesPT Alkindo Naratama TBK Dan Entitas Anak/ and SubsidiariesTiara AprilliaNo ratings yet

- UTS SPM - Salman Hafidz Iriansyah - 120620170003Document13 pagesUTS SPM - Salman Hafidz Iriansyah - 120620170003Rizal AlfianNo ratings yet

- Bab 9 IndonesiaDocument31 pagesBab 9 IndonesiaMarco PangerapanNo ratings yet

- Rev 3.0 Daftar Gambar - User Manual - Toyota Dealer Management SystemDocument184 pagesRev 3.0 Daftar Gambar - User Manual - Toyota Dealer Management SystemCindi AnisiaNo ratings yet

- Kieso CH 10 Aset Tetap Versi IFRS LilikDocument44 pagesKieso CH 10 Aset Tetap Versi IFRS LilikSri Apriyanti Husain100% (1)

- Lakewood Laser Skincare S Ending Cash Balance As of January 31Document1 pageLakewood Laser Skincare S Ending Cash Balance As of January 31Let's Talk With HassanNo ratings yet

- Week9 CashflowDocument28 pagesWeek9 CashflowmskiNo ratings yet

- Bankrupt PT SariwangiDocument5 pagesBankrupt PT Sariwangifasha muthaharNo ratings yet

- Pajak Internasional Seminar PerpajakanDocument35 pagesPajak Internasional Seminar Perpajakantoton akNo ratings yet

- E3-5 (LO 3) Adjusting Entries: InstructionsDocument6 pagesE3-5 (LO 3) Adjusting Entries: InstructionsAntonios Fahed0% (1)

- Finmene Angelyca NatasyaDocument4 pagesFinmene Angelyca NatasyaANGELYCA LAURANo ratings yet

- Soal Ujian Akhir Semester Semester Ganjil Tahun Akademik 2020/2021Document8 pagesSoal Ujian Akhir Semester Semester Ganjil Tahun Akademik 2020/2021Nabila AwaliaNo ratings yet

- Revenue Recognition: Assignment Classification Table (By Topic)Document32 pagesRevenue Recognition: Assignment Classification Table (By Topic)BryanaNo ratings yet

- 2013 IKBI IKBI Annual Report 2013Document120 pages2013 IKBI IKBI Annual Report 2013PrabowoBektiSantoso50% (2)

- Perlakuan PPN Atas Penyerahan BKP Oleh Perusahaan Real Estate Dan Kegiatan Membangun Sendiri PPN Atas Sewa Guna UsahaDocument8 pagesPerlakuan PPN Atas Penyerahan BKP Oleh Perusahaan Real Estate Dan Kegiatan Membangun Sendiri PPN Atas Sewa Guna UsahaMuhammad Ainul YakinNo ratings yet

- Latian Soal Bahasa Inggris Paket 2Document15 pagesLatian Soal Bahasa Inggris Paket 2Charis Tristianto PNo ratings yet

- B.Inggris PTS 22-9-2020Document3 pagesB.Inggris PTS 22-9-2020Wahyu BaskaraNo ratings yet

- Accounting For LeasesDocument112 pagesAccounting For LeasesPoomza TaramarukNo ratings yet

- Fy 2019 JKSWDocument58 pagesFy 2019 JKSWsofyan100% (1)

- Jawaban Kertas Kerja Neraca Lajur - UAS EFA KA-52Document45 pagesJawaban Kertas Kerja Neraca Lajur - UAS EFA KA-52Sri Winarsih Ramadana100% (1)

- Soal 15 12.145Document2 pagesSoal 15 12.145Rendy KurniawanNo ratings yet

- Time DrivenDocument2 pagesTime DrivenwellaNo ratings yet

- Tarif Pasal 26Document2 pagesTarif Pasal 26lelaleria11No ratings yet

- Ringkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyDocument2 pagesRingkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyAchmad MudaniNo ratings yet

- TX Text Control WordsDocument2 pagesTX Text Control Wordsritter.sjdNo ratings yet

- Daftar Tarif P3B IndonesiaDocument2 pagesDaftar Tarif P3B IndonesiaNurul ardiansahNo ratings yet

- Magna Carta of The Delinquent Versus Victim S Criminal Law in The Penal Reform of The Crime of RapeDocument8 pagesMagna Carta of The Delinquent Versus Victim S Criminal Law in The Penal Reform of The Crime of RapeJokoWidodoNo ratings yet

- Annual Report 2018Document126 pagesAnnual Report 2018JokoWidodoNo ratings yet

- 1 PBDocument11 pages1 PBJokoWidodoNo ratings yet

- 6074 Final Baltic++102,+ (1388+to+1402)Document15 pages6074 Final Baltic++102,+ (1388+to+1402)JokoWidodoNo ratings yet

- Conflict of Interest As A Cognitive BiasDocument19 pagesConflict of Interest As A Cognitive BiasJokoWidodoNo ratings yet

- Public Choice: An Introduction: OriginsDocument16 pagesPublic Choice: An Introduction: OriginsJokoWidodoNo ratings yet

- BF 02538141Document22 pagesBF 02538141JokoWidodoNo ratings yet

- Majority Rule and The Public Provision of A Private Good: Miguel GouveiaDocument24 pagesMajority Rule and The Public Provision of A Private Good: Miguel GouveiaJokoWidodoNo ratings yet

- Tomer Broude CULTURAL PROTECTION N TerjemahanDocument76 pagesTomer Broude CULTURAL PROTECTION N TerjemahanJokoWidodoNo ratings yet

- Imparsial HR Defender 2007Document7 pagesImparsial HR Defender 2007JokoWidodoNo ratings yet

- Valentina S. Vadi INDIGENOUS HERITAGE N TerjemahanDocument78 pagesValentina S. Vadi INDIGENOUS HERITAGE N TerjemahanJokoWidodoNo ratings yet

- Patologi Korupsi Kesehatan PDFDocument8 pagesPatologi Korupsi Kesehatan PDFJokoWidodoNo ratings yet

- Wenwei Guan Intellectual Property N TerjemahanDocument57 pagesWenwei Guan Intellectual Property N TerjemahanJokoWidodoNo ratings yet

- William Cornish Culture and CopyrightDocument29 pagesWilliam Cornish Culture and CopyrightJokoWidodoNo ratings yet

- Wend B. Wendland Folklore Wipo's Exploratory N TerjemahanDocument25 pagesWend B. Wendland Folklore Wipo's Exploratory N TerjemahanJokoWidodoNo ratings yet

- Analisis Hukum Mengenai Surat Keterangan Asal (Ska) Untuk Barang Ekspor IndonesiaDocument20 pagesAnalisis Hukum Mengenai Surat Keterangan Asal (Ska) Untuk Barang Ekspor IndonesiaJokoWidodoNo ratings yet

- Weerawit Weeraworawit FOLKLORE N TerjemahanDocument18 pagesWeerawit Weeraworawit FOLKLORE N TerjemahanJokoWidodoNo ratings yet

- Trevor Cox Wipo Trips Ip CopyrightDocument40 pagesTrevor Cox Wipo Trips Ip CopyrightJokoWidodoNo ratings yet

- Tunisia L. Staten TRIPS AGREEMENT N TerjemahanDocument26 pagesTunisia L. Staten TRIPS AGREEMENT N TerjemahanJokoWidodoNo ratings yet

- (Doi 10.1017/CBO9780511973154.011) Tanzi, Vito - Government Versus Markets (The Changing Economic Role of The State) - Theories of Public-Sector BehaviorDocument18 pages(Doi 10.1017/CBO9780511973154.011) Tanzi, Vito - Government Versus Markets (The Changing Economic Role of The State) - Theories of Public-Sector BehaviorJokoWidodoNo ratings yet