Professional Documents

Culture Documents

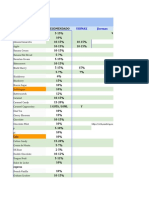

Tarif Pasal 26

Uploaded by

lelaleria110 ratings0% found this document useful (0 votes)

11 views2 pagesThis document provides the tax rates for withholding tax on income from dividends, interest, royalties, portfolio income, substantial shareholding, and branch profits based on Indonesia's tax treaties with various countries. The tax rates range from 5% to 25% depending on the type of income and country. Some countries like Saudi Arabia are not covered for certain types of income.

Original Description:

terkait pajak

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides the tax rates for withholding tax on income from dividends, interest, royalties, portfolio income, substantial shareholding, and branch profits based on Indonesia's tax treaties with various countries. The tax rates range from 5% to 25% depending on the type of income and country. Some countries like Saudi Arabia are not covered for certain types of income.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesTarif Pasal 26

Uploaded by

lelaleria11This document provides the tax rates for withholding tax on income from dividends, interest, royalties, portfolio income, substantial shareholding, and branch profits based on Indonesia's tax treaties with various countries. The tax rates range from 5% to 25% depending on the type of income and country. Some countries like Saudi Arabia are not covered for certain types of income.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 2

TARIF PPh PASAL 26

UNTUK P3B YANG BERLAKU EFEKTIF

DIVIDEN BRANCH

NO. COUNTRY INTEREST ROYALTIES PROFIT

PORTFOLIO SUBSTANTIAL TAX

HOLDING

1 Algeria 15% 15% 15% 15% 10%

2 Australia 10% 10%/15% 15% 15% 15%

3 Austria 10% 10% 15% 10% 12%

4 Bangladesh 10% 10% 15% 10% 10%

5 Belgium 10% 10% 15% 10% 10%

6 Brunei Darussalam 10% 15% 15% 15% 10%

7 Bulgaria 10% 10% 15% 15% 15%

8 Canada 10% 10% 15% 10% 15%

9 Czech 12,5% 12,5% 15% 10% 12,5%

10 China 10% 10% 10% 10% 10%

11 Croatia 10% 10% 10% 10% 10%

12 Denmark 10% 15% 20% 10% 15%

13 Egypt 15% 15% 15% 15% 15%

14 Finland 10% 10%/15% 15% 10% 15%

15 France 15% 10% 15% 10% 10%

16 Germany 10% 10%/15% 15% 10% 10%

17 Hungary 15% 15% 15% 15% N/A

18 Hongkong 10% 5% 10% 5% 5%

19 India 10% 10% 15% 10% 10%

20 Iran 10% 12% 7% 7% 7%

21 Italy 10% 10%/15% 15% 10% 12%

22 Japan 10% 10% 15% 10% 10%

23 Jordan 10% 10% 10% 10% N/A

24 Korea, Republic of 10% 15% 15% 10% 10%

Korea, Democratic

25 People’s Republic 10% 10% 10% 10% 10%

of

26 Kuwait 5% 20% 10% 10% 10%

27 Luxembourg 10% 12,5% 15% 10% 10%

28 Malaysia 10% 10% 10% 10% 12,5%

29 Maroko 10% 10% 20% 10% 10%

30 Mexico 10% 10% 10% 10% 10%

31 Mongolia 10% 10% 10% 10% 10%

32 Netherlands 10% 10% 10% 10% 10%

33 New Zealand 10% 15% 15% 15% N/A

34 Norway 10% 10%/15% 15% 15% 15%

35 Pakistan 15% 15% 15% 10% 10%

36 Papua New 10% 10% 15% 15% 15%

Guinea

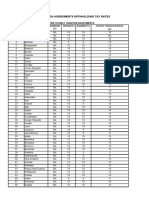

COUNTRY INTEREST ROYALTIES DIVIDEN BRANCH

TaxBase 6.0 Document - Page : 1

NO. PROFIT

PORTFOLIO SUBSTANTIAL

TAX

HOLDING

37 Philippines 15% 15%/25% 20% 15% 20%

38 Poland 10% 15% 15% 10% 10%

39 Portuguese 10% 10% 10% 10% 10%

40 Qatar 10% 5% 10% 10% 10%

41 Romania 12,5% 12,5%/15 % 15% 12,5% 12,5%

42 Russia 15% 15% 15% 15% 12,5%

43 Saudi Arabia * N/A N/A N/A N/A N/A

44 Serbia 10% 15% 15% 15% 15%

45 Seychelles 10% 10% 10% 10% N/A

46 Singapore 10% 10%/8% 15% 10% 10%

47 Slovak 10% 10%/15% 10% 10% 10%

48 South Africa 10% 10% 15% 10% 10%

49 Spain 10% 10% 15% 10% 10%

Sesuai

50 Sri Lanka 15% 15% 15% 15% UU

Domestik

51 Sudan 15% 10% 10% 10% 10%

52 Suriname 15% 15% 15% 15% 15%

53 Sweden 10% 10%/15% 15% 10% 15%

54 Switzerland 10% 12,5% 15% 10% 10%

55 Syria 10% 15%/20% 10% 10% 10%

56 Taipei / Taiwan 10% 10% 10% 10% 5%

RI = 15% Sesuai

57 Thailand THAI = 15% 20% 15% UU

10%/25% ** Domestik

58 Tunisia 12% 15% 12% 12% 12%

59 Turkey 10% 10% 15% 10% 15%

60 UAE (United Arab 7% 5% 10% 10% 5%

Emirates)

61 Ukraine 10% 10% 15% 10% 10%

62 United Kingdom 10% 10%/15% 15% 10% 10%

63 United States of 10% 10% 15% 10% 10%

America

64 Uzbekistan 10% 10% 10% 10% 10%

65 Venezuela 10% 20% 15% 10% 10%

Vietnam 15% 15% 15% 15% 10%

Keterangan :

* P3B antara Indonesia dengan Saudi Arabia hanya mengatur mengenai transportasi penerbangan dalam jalur

internasional.

** Berdasarkan ketentuan pasal 11 ayat 2 P3B RI-Thailand, terdapat pembedaan tarif atas bunga.

N/A P3B tersebut tidak mengatur mengenai Tarif PPh Pasal 26.

TaxBase 6.0 Document - Page : 2

You might also like

- Tarif Tax TreatyDocument2 pagesTarif Tax TreatyJokoWidodo0% (1)

- Ringkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyDocument2 pagesRingkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyAchmad MudaniNo ratings yet

- TX Text Control WordsDocument2 pagesTX Text Control Wordsritter.sjdNo ratings yet

- Daftar Tarif P3B IndonesiaDocument2 pagesDaftar Tarif P3B IndonesiaNurul ardiansahNo ratings yet

- NO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioDocument4 pagesNO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioSatrio YuliawanNo ratings yet

- Rangkuman Tarif P3BDocument5 pagesRangkuman Tarif P3BJuni PrastyanggaNo ratings yet

- Withholding Tax Rate - 195Document1 pageWithholding Tax Rate - 195avishal_jainNo ratings yet

- Tds Rates As Per DtaaDocument3 pagesTds Rates As Per DtaamahiNo ratings yet

- Lampiran Surat Edaran Direktur Jenderal Pajak Nomor SE-2 - PJ.03 - 2008 PDFDocument3 pagesLampiran Surat Edaran Direktur Jenderal Pajak Nomor SE-2 - PJ.03 - 2008 PDFNadya Nurul ImaniNo ratings yet

- Corporate Tax Rates 2017-2021Document8 pagesCorporate Tax Rates 2017-2021LM VS81No ratings yet

- Cash Flow StudentsDocument38 pagesCash Flow StudentsPreet KawediaNo ratings yet

- TAXATION in INDIADocument11 pagesTAXATION in INDIAChaitanya PatilNo ratings yet

- TDS Rates Under DTAA Treaties: DividendDocument3 pagesTDS Rates Under DTAA Treaties: DividendRani AryaNo ratings yet

- All CountriesDocument3 pagesAll CountriesbrnjarcevskiNo ratings yet

- Us Index Group Tax Withholding TableDocument2 pagesUs Index Group Tax Withholding TableAnne G.No ratings yet

- Updated VDS Rate Through Finance Act 2020Document2 pagesUpdated VDS Rate Through Finance Act 2020Hossain RonyNo ratings yet

- DSP The Report Card 1h23Document30 pagesDSP The Report Card 1h23NikhilKapoor29No ratings yet

- Countrywise Withholding Tax Rates Chart As Per DTAADocument8 pagesCountrywise Withholding Tax Rates Chart As Per DTAAajithaNo ratings yet

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

- Withholding Tax Rates Under DTAADocument7 pagesWithholding Tax Rates Under DTAAOM JARWALNo ratings yet

- 1Document1 page1lucky.labialNo ratings yet

- Summary of WHT Rates Under Oman Tax Treaties in Force PDFDocument2 pagesSummary of WHT Rates Under Oman Tax Treaties in Force PDFMoneycomeNo ratings yet

- Camposol Real Food For Life: CAMPOSOL Holding LTD Fourth Quarter and Preliminary Full Year 2015 ReportDocument25 pagesCamposol Real Food For Life: CAMPOSOL Holding LTD Fourth Quarter and Preliminary Full Year 2015 Reportkaren ramosNo ratings yet

- Tax Rates As Per IT Act Vis A Vis Tax TreatiesDocument14 pagesTax Rates As Per IT Act Vis A Vis Tax TreatiesEswarReddyEegaNo ratings yet

- Porcentajes Aromas TpaDocument16 pagesPorcentajes Aromas TpaIván FerreteNo ratings yet

- Botswana Withholding Tax RatesDocument4 pagesBotswana Withholding Tax Ratesjiwon leeNo ratings yet

- Income Category: Summary of Final TaxesDocument3 pagesIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaNo ratings yet

- Ielts General Training Top Nationality Frequency 2022Document4 pagesIelts General Training Top Nationality Frequency 2022Moo YuetyNo ratings yet

- Book 2Document15 pagesBook 2anjaliNo ratings yet

- Magh FFRDocument44 pagesMagh FFRVikas SharmaNo ratings yet

- DOW Investor - Day - 2022 - PresentationDocument102 pagesDOW Investor - Day - 2022 - PresentationALNo ratings yet

- Ielts Academic Top Nationality Frequency 2022Document4 pagesIelts Academic Top Nationality Frequency 2022Anh Trần TrungNo ratings yet

- AIS AIM Implementation TableDocument2 pagesAIS AIM Implementation Tablevatm ban ky thuatNo ratings yet

- Pie ChartsDocument6 pagesPie ChartsPREETI GUPTANo ratings yet

- Gss Sheet SampleDocument9 pagesGss Sheet Sampledr.kabirdevNo ratings yet

- Fabrication ProgressDocument8 pagesFabrication ProgressYana CahyanaNo ratings yet

- Roa RoeDocument4 pagesRoa RoeEdwin Ernesto Mariano SalazarNo ratings yet

- Emirates TelecommunicationsDocument6 pagesEmirates TelecommunicationsSunil KumarNo ratings yet

- GSS Sheet SAMPLEDocument9 pagesGSS Sheet SAMPLERakesh BehuriaNo ratings yet

- 1 Page Summary of NR Tax Rates-1Document1 page1 Page Summary of NR Tax Rates-1PaulNo ratings yet

- Financial Reporting Analysis: Presented By: Ramila AnwarDocument44 pagesFinancial Reporting Analysis: Presented By: Ramila AnwarAbdul KhaliqNo ratings yet

- DATA ANALYSIS DheerajDocument13 pagesDATA ANALYSIS DheerajShivam SadoriaNo ratings yet

- Ussmax Jiormax Conejusred Dezer Chrisscarr Erquillo2000 Mendel Esmulet Palmero Indor Pepolacas Pizcolq Vappergun TristeroeDocument2 pagesUssmax Jiormax Conejusred Dezer Chrisscarr Erquillo2000 Mendel Esmulet Palmero Indor Pepolacas Pizcolq Vappergun TristeroeIván FerreteNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- A Project On A Statistical Analysis of The OTT Platform Business in Bangladesh-PresentationDocument21 pagesA Project On A Statistical Analysis of The OTT Platform Business in Bangladesh-PresentationNayeem Ahamed AdorNo ratings yet

- Double Taxation Agreement RatesDocument2 pagesDouble Taxation Agreement RatesNovialita RestutiNo ratings yet

- Hurdle Rare Benchamark - 0930Document3 pagesHurdle Rare Benchamark - 0930Pedro K. LatapíNo ratings yet

- CFA Curriculum Changes 2024 - A Solid Summary - 300hoursDocument1 pageCFA Curriculum Changes 2024 - A Solid Summary - 300hoursClareNo ratings yet

- Total Student GrowthDocument4 pagesTotal Student GrowthParam ShahNo ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- Dealers Stock Share (0-10%) Total Number of Dealers:-106Document6 pagesDealers Stock Share (0-10%) Total Number of Dealers:-106Karan TrivediNo ratings yet

- Indonesian Tax Treaties Quick Reference Guide - RevisedDocument7 pagesIndonesian Tax Treaties Quick Reference Guide - RevisedWahyuni LestariNo ratings yet

- TABLESDocument11 pagesTABLEScontreraskristine091No ratings yet

- QUESTIONSDocument19 pagesQUESTIONSrahidarzooNo ratings yet

- Acid ReportDocument21 pagesAcid Reportsyahirah shamsudinNo ratings yet

- Invest SystemDocument23 pagesInvest SystemChristiano OliveiraNo ratings yet

- Ceo2023 Crosstabs Final All 1Document14 pagesCeo2023 Crosstabs Final All 1Karlin RickNo ratings yet

- Directory of Institutions and Individuals Active in Environmentally-Sound and Appropriate Technologies: UNEP Reference SeriesFrom EverandDirectory of Institutions and Individuals Active in Environmentally-Sound and Appropriate Technologies: UNEP Reference SeriesNo ratings yet

- (Cô Vũ Mai Phương) Đề thi thử tốt nghiệp THPT Quốc Gia 2024 - Sở giáo dục và đào tạo Hải Dương (Lần 1)Document6 pages(Cô Vũ Mai Phương) Đề thi thử tốt nghiệp THPT Quốc Gia 2024 - Sở giáo dục và đào tạo Hải Dương (Lần 1)nguyengiangulis03No ratings yet

- The Field Artillery Observation BattalionDocument10 pagesThe Field Artillery Observation BattalionHaider ZamanNo ratings yet

- SUDARSANAM Margazhi EnglishDocument15 pagesSUDARSANAM Margazhi EnglishduhacNo ratings yet

- Hinduism 1Document24 pagesHinduism 1api-267066288No ratings yet

- Modul Japanese 17 - 20 (Pre Advance + Advance)Document36 pagesModul Japanese 17 - 20 (Pre Advance + Advance)Eva Karunia100% (1)

- Exam F2: IT Certification Guaranteed, The Easy Way!Document84 pagesExam F2: IT Certification Guaranteed, The Easy Way!Rudrakumar AhilanNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- "Networked World Readiness" Contains 5 and PolicyDocument9 pages"Networked World Readiness" Contains 5 and PolicyLaiza Mae LasutanNo ratings yet

- Data ReadyDocument148 pagesData Readysonabeta07No ratings yet

- Project of Pankaj MishraDocument69 pagesProject of Pankaj MishraNitesh SharmaNo ratings yet

- Quality Circles and Teams-Tqm NotesDocument8 pagesQuality Circles and Teams-Tqm NotesStanley Cheruiyot100% (1)

- Feminist Literary TheoryDocument11 pagesFeminist Literary TheoryDori Casado0% (1)

- Calvert Calvert: County Times County TimesDocument24 pagesCalvert Calvert: County Times County TimesSouthern Maryland OnlineNo ratings yet

- GFF - Eternal Dynasty 3.1.0Document3 pagesGFF - Eternal Dynasty 3.1.0afwsefwefvNo ratings yet

- Unit 1: Overview of Cape Sociology Unit 1Document19 pagesUnit 1: Overview of Cape Sociology Unit 1Devika KhanNo ratings yet

- Water ConservationDocument4 pagesWater Conservationmnt6176No ratings yet

- Ketikan Project 1 (Melva, Lora, Thomy, Yuliana)Document20 pagesKetikan Project 1 (Melva, Lora, Thomy, Yuliana)melva_banjarnahorNo ratings yet

- Q3W1 TLECCSG10 COT1pptxDocument27 pagesQ3W1 TLECCSG10 COT1pptxMeann ViNo ratings yet

- Unit 4 - Test 2Document4 pagesUnit 4 - Test 2Trương Ngọc Bích TrânNo ratings yet

- Cosmo's Pizza MenuDocument3 pagesCosmo's Pizza Menusupport_local_flavorNo ratings yet

- 305Document34 pages305Kahfi Revi AlfatahNo ratings yet

- Lehman BrothersDocument10 pagesLehman BrothersJaikishin RuprajNo ratings yet

- Philippine Setting During 19th CenturyDocument18 pagesPhilippine Setting During 19th CenturyCjoyNo ratings yet

- Letters To JessicaDocument73 pagesLetters To JessicaBillNo ratings yet

- Financial Accounting and Reporting AssignmentDocument5 pagesFinancial Accounting and Reporting AssignmentMia Casas80% (5)

- E-Commerce in India Future and Its Perspective: A StudyDocument7 pagesE-Commerce in India Future and Its Perspective: A StudyInternational Journal of Scientific Research and Engineering StudiesNo ratings yet

- Working Notes On Katko, Lindsay, TipladyDocument8 pagesWorking Notes On Katko, Lindsay, TipladyJoe LunaNo ratings yet

- Road Map For Interview PreprationDocument9 pagesRoad Map For Interview PreprationMadara UchihaNo ratings yet

- 3 Dec KPK - Abccc - Fide Rapid TMTDocument4 pages3 Dec KPK - Abccc - Fide Rapid TMTVenkatesan RamalingamNo ratings yet

- Deep Delusions, Bitter TruthDocument44 pagesDeep Delusions, Bitter Truthcirqueminime100% (2)