Professional Documents

Culture Documents

BPT Tariffs Indonesia Tax Treaties

Uploaded by

Nadya Nurul Imani0 ratings0% found this document useful (0 votes)

22 views3 pagesOriginal Title

Lampiran Surat Edaran Direktur Jenderal Pajak Nomor SE-2_PJ.03_2008.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views3 pagesBPT Tariffs Indonesia Tax Treaties

Uploaded by

Nadya Nurul ImaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

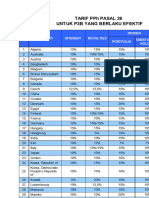

Lampiran SE-2 /PJ.

03/2008

Tanggal 31 Juli 2008

TARIF BRANCH PROFIT TAX (BPT)

P3B INDONESIA DENGAN NEGARA MITRA

No. Negara Tarif BPT

1. Algeria 10%

2. Australia 15%

3. Austria 12%

4. Bangladesh 10%

5. Belgium 15%

-Renegosiasi 10%

6. Brunei Darussalam 10%

7. Bulgaria 15%

8. Canada 15%

-Renegosiasi

9. Czech 15%

10. China 10%

11. Denmark 15%

12. Egypt 15%

13. Findland 15%

14. France 10%

15. Germany 10%

16. Hungary Tidak ada

17. India 10%

18. Italy 12%

19. Japan 10%

20. Jordan Tidak ada

21. Korea Republic of 10%

22. Korea, Democratic People’s 10%

Republic

Of

23. Kuwait 10%

24. Luxemburg 10%

25. Malaysia 10%

26. Mauritius 10%

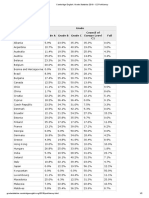

No. Negara Tarif BPT

27. Mexico 10%

28. Mongolia 10%

29. Netherlands 9%

-Renegosiasi 9%

-Renegosiasi ke 2 10%

30. New Zealand Tidak ada

31. Norway 15%

32. Pakistan 10%

33. Philipines The 20%

34. Poland 10%

35. Qatar 10%

36. Romania 12,5%

37. Russia 12,5%

38. Saudi Arabia** Tidak ada

39. Seychelles Tidak ada

40. Singapore 15%

41. Slovak 10%

42. South Africa 10%

43. Spain 10%

44. Srilanka Sesuai UU

domestik

45. Sudan 10%

46. Sweden 15%

47. Switzerland 10%

48. Syria 10%

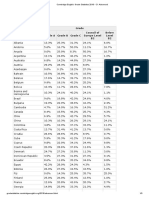

Lampiran SE-2 /PJ.03/2008

Tanggal 31 Juli 2008

No. Negara Tarif BPT

49. Taiwan 5%

50. Thailand Sesuai UU

domestik

51. Tunisia 12%

52. Turkey 15%

53. U.A.E 5%

54. Ukraine 10%

55. United Kingdom 10%

-Renegoisasi 10%

56. USA 15%

-Renegoisasi 10%

57. Uzbekistan 10%

58. Venezuela 10%

59. Vietnam 15%

*terminasi mulai 1 Januari 2005

** khusus Saudi Arabia, P3B hanya mencakup Lalu lintas Internasional

You might also like

- The 2015-2020 Worldwide Digital English Language Learning MarketDocument27 pagesThe 2015-2020 Worldwide Digital English Language Learning MarketJesús LacónNo ratings yet

- The Story of Elijah HarperDocument4 pagesThe Story of Elijah HarperSaskia LagemanNo ratings yet

- TOM Study Guide - First Australians - Ep.5Document17 pagesTOM Study Guide - First Australians - Ep.5Moala TessNo ratings yet

- TX Text Control WordsDocument2 pagesTX Text Control Wordsritter.sjdNo ratings yet

- Withholding Tax Rate - 195Document1 pageWithholding Tax Rate - 195avishal_jainNo ratings yet

- Tarif PPh Pasal 26 untuk P3B yang Berlaku EfektifDocument2 pagesTarif PPh Pasal 26 untuk P3B yang Berlaku EfektifJokoWidodo0% (1)

- Tarif Pasal 26Document2 pagesTarif Pasal 26lelaleria11No ratings yet

- Ringkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyDocument2 pagesRingkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyAchmad MudaniNo ratings yet

- NO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioDocument4 pagesNO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioSatrio YuliawanNo ratings yet

- Daftar Tarif P3B IndonesiaDocument2 pagesDaftar Tarif P3B IndonesiaNurul ardiansahNo ratings yet

- Rangkuman Tarif P3BDocument5 pagesRangkuman Tarif P3BJuni PrastyanggaNo ratings yet

- Us Index Group Tax Withholding TableDocument2 pagesUs Index Group Tax Withholding TableAnne G.No ratings yet

- All CountriesDocument3 pagesAll CountriesbrnjarcevskiNo ratings yet

- M Ridho HusaeniDocument16 pagesM Ridho HusaeniRidho HusaeniNo ratings yet

- Tu Clothing Approved Laboratory Contact DetailsDocument19 pagesTu Clothing Approved Laboratory Contact DetailsDyeing DyeingNo ratings yet

- Major Depressive Disorder Epidemiology and BurdenDocument24 pagesMajor Depressive Disorder Epidemiology and BurdenAbel ObosiNo ratings yet

- Country Wise Year Wise Value in Million US DollarsDocument2 pagesCountry Wise Year Wise Value in Million US DollarsNikhil SinghalNo ratings yet

- Summary of WHT Rates Under Oman Tax Treaties in Force PDFDocument2 pagesSummary of WHT Rates Under Oman Tax Treaties in Force PDFMoneycomeNo ratings yet

- Country RankingsDocument9 pagesCountry Rankingsapi-13547001100% (2)

- Top 30 Countries by Average Daily Oil ConsumptionDocument8 pagesTop 30 Countries by Average Daily Oil Consumptionmix quanNo ratings yet

- FTTH Global Ranking 2021Document5 pagesFTTH Global Ranking 2021María MidiriNo ratings yet

- 11.30 Imran Akram IA CementDocument12 pages11.30 Imran Akram IA CementParamananda SinghNo ratings yet

- 2020 지구촌 한류현황 (4.아프리카중동지역)Document365 pages2020 지구촌 한류현황 (4.아프리카중동지역)김유경No ratings yet

- Lista 2.1 - AFADocument167 pagesLista 2.1 - AFASlaslasla SlaslaslaNo ratings yet

- Barometer 20205Document11 pagesBarometer 20205ahmad ragabNo ratings yet

- Global energy production, consumption and trade in 2021Document10 pagesGlobal energy production, consumption and trade in 2021Sazzad HossainNo ratings yet

- 2020 Global Hunger Index Scores, and Change Since 2000Document21 pages2020 Global Hunger Index Scores, and Change Since 2000lllNo ratings yet

- Ppul25342 Sup 0001 Suplementary - TableDocument3 pagesPpul25342 Sup 0001 Suplementary - TableIgnacio GuzmánNo ratings yet

- 8 p7 GarrettdoddsDocument1 page8 p7 Garrettdoddsapi-377079997No ratings yet

- ISAPS International Survey On Aesthetic/Cosmetic Procedures Performed in 2009Document9 pagesISAPS International Survey On Aesthetic/Cosmetic Procedures Performed in 2009j_xavier3006No ratings yet

- PHWL by Size - 02 - 2021Document1 pagePHWL by Size - 02 - 2021ziauddin2No ratings yet

- 8-7 Clothing BenlunderbyDocument1 page8-7 Clothing Benlunderbyapi-334900017No ratings yet

- GDP RankingsDocument15 pagesGDP Rankingsashutosh_103No ratings yet

- ICCT Annual Report 2021Document39 pagesICCT Annual Report 2021The International Council on Clean TransportationNo ratings yet

- Report On Covid-19: Assessment of Regulatory Compliance Management in OMCDocument7 pagesReport On Covid-19: Assessment of Regulatory Compliance Management in OMCSATYA NARAYAN SAHUNo ratings yet

- Cambridge English - Grade Statistics 2018 - C2 ProficiencyDocument2 pagesCambridge English - Grade Statistics 2018 - C2 ProficiencyLali SalamiNo ratings yet

- Australia's Top Export Markets By CountryDocument1 pageAustralia's Top Export Markets By Countrybackch9011No ratings yet

- Top 50 Countries by Muslim Population in 1971Document3 pagesTop 50 Countries by Muslim Population in 1971Mubashir TariqNo ratings yet

- Global - E-Commerce Retail Sales CAGR 2023-2027 - StatistaDocument4 pagesGlobal - E-Commerce Retail Sales CAGR 2023-2027 - StatistaVikas SharmaNo ratings yet

- TheSun 2009-04-09 Page13 Asias International School Boom CoolsDocument1 pageTheSun 2009-04-09 Page13 Asias International School Boom CoolsImpulsive collectorNo ratings yet

- Ielts Academic Top Nationality Frequency 2022Document4 pagesIelts Academic Top Nationality Frequency 2022Anh Trần TrungNo ratings yet

- Cambridge English - Grade Statistics 2018 - C1 AdvancedDocument3 pagesCambridge English - Grade Statistics 2018 - C1 AdvancedLali SalamiNo ratings yet

- Where Did My Clothes Come From?: Meixico 5.00%Document2 pagesWhere Did My Clothes Come From?: Meixico 5.00%api-377086629No ratings yet

- International Student Enrollment by Country at Multiple US InstitutionsDocument9 pagesInternational Student Enrollment by Country at Multiple US InstitutionsDavid AlexanderNo ratings yet

- Education Statistics: T o T A L S Bar GraphDocument4 pagesEducation Statistics: T o T A L S Bar GraphPhlawless FluffNo ratings yet

- Persentase Tahun Terbitnya JurnalDocument2 pagesPersentase Tahun Terbitnya JurnalRoasted BananaNo ratings yet

- Tds Rates As Per DtaaDocument3 pagesTds Rates As Per DtaamahiNo ratings yet

- Indiawitharnab CountrywiseDocument5 pagesIndiawitharnab CountrywiseRepublic WorldNo ratings yet

- Loginro Tech InsightsDocument37 pagesLoginro Tech InsightsIulia ABNo ratings yet

- Cambridge English - Grade Statistics 2018 - C1 Business HigherDocument2 pagesCambridge English - Grade Statistics 2018 - C1 Business HigherLali SalamiNo ratings yet

- ESG Reporting TrendsDocument4 pagesESG Reporting TrendsSalsa BilaNo ratings yet

- Financial Accounting AssignmentDocument10 pagesFinancial Accounting AssignmentVisaj BansalNo ratings yet

- World Official Gold Holdings As of August2015 IFSDocument3 pagesWorld Official Gold Holdings As of August2015 IFSJULIAN REYESNo ratings yet

- Analytics Pageviews by Countries EuropeDocument2 pagesAnalytics Pageviews by Countries Europesameh aboulsoudNo ratings yet

- Can You Beat The Age of Inflation by Umair Haque Jun, 2023 Eudaimonia and CoDocument1 pageCan You Beat The Age of Inflation by Umair Haque Jun, 2023 Eudaimonia and CoMuralidharanNo ratings yet

- 8-4 Clothing Shoua VangDocument2 pages8-4 Clothing Shoua Vangapi-335030604No ratings yet

- Ejemplo 4 - Agresti Franklin (2013)Document4 pagesEjemplo 4 - Agresti Franklin (2013)luli2ferrarisNo ratings yet

- PSC TrendsDocument48 pagesPSC TrendsNurul AtiqahNo ratings yet

- CGPSS4 Section IIIRetail PaymentsDocument94 pagesCGPSS4 Section IIIRetail PaymentsEko YuliantoNo ratings yet

- Directory of Institutions and Individuals Active in Environmentally-Sound and Appropriate Technologies: UNEP Reference SeriesFrom EverandDirectory of Institutions and Individuals Active in Environmentally-Sound and Appropriate Technologies: UNEP Reference SeriesNo ratings yet

- International Debt Report 2022: Updated International Debt StatisticsFrom EverandInternational Debt Report 2022: Updated International Debt StatisticsNo ratings yet

- NSTP Module 3Document9 pagesNSTP Module 3Nekka Ella TañadaNo ratings yet

- Hello There!: Here Are Sample Questions For DebateDocument34 pagesHello There!: Here Are Sample Questions For DebateJude Thaddeus DamianNo ratings yet

- Box Culvert (Balisian)Document2 pagesBox Culvert (Balisian)Gervin Meine Vidad100% (2)

- BE 2019 Course Fiber Optics Lab (404195)Document6 pagesBE 2019 Course Fiber Optics Lab (404195)Pratibha KulkarniNo ratings yet

- League of Women Voters of Texas' Nonpartisan Voters GuideDocument20 pagesLeague of Women Voters of Texas' Nonpartisan Voters GuideRebecca SalinasNo ratings yet

- Earmark RequestDocument1 pageEarmark RequestdjsunlightNo ratings yet

- 1st Political Science OM PDFDocument2 pages1st Political Science OM PDFMuhammad JawadNo ratings yet

- Sample Ballot SPG ELECTIONSDocument2 pagesSample Ballot SPG ELECTIONSPaul John MacasaNo ratings yet

- DR PLO Lumumba Fit To Lead KenyaDocument4 pagesDR PLO Lumumba Fit To Lead KenyaopulitheNo ratings yet

- Huttle Dale Plea 2Document8 pagesHuttle Dale Plea 2Indiana Public Media NewsNo ratings yet

- Merdeka Puppet StoryDocument2 pagesMerdeka Puppet StoryFarhana RosliNo ratings yet

- Analysis of Mariam's Struggles in A Thousand Splendid SunsDocument3 pagesAnalysis of Mariam's Struggles in A Thousand Splendid Sunsbadriyatus solihahNo ratings yet

- Syed Muhammad Awais Tariq 2022388048Document11 pagesSyed Muhammad Awais Tariq 2022388048Awais ShahNo ratings yet

- Regionalization vs Globalization in AsiaDocument18 pagesRegionalization vs Globalization in AsiaJewdaly Lagasca Costales60% (10)

- "Toward A Theory of Latin American Politics" C.W. Anderson (1964)Document8 pages"Toward A Theory of Latin American Politics" C.W. Anderson (1964)Iker Diaz de DuranaNo ratings yet

- Crossing x answers multiple choice test local governmentDocument1 pageCrossing x answers multiple choice test local governmentEny AriyantiNo ratings yet

- Bontilao Shaznay RhodeDocument13 pagesBontilao Shaznay RhodeJimnah Rhodrick BontilaoNo ratings yet

- Working PaperDocument6 pagesWorking PaperHari AshwinNo ratings yet

- 2024 United States Presidential ElectionDocument20 pages2024 United States Presidential ElectionParsa RangiNo ratings yet

- Women's Political Participation in Himachal Pradesh: A Case StudyDocument808 pagesWomen's Political Participation in Himachal Pradesh: A Case StudyWilliam StantonNo ratings yet

- Foreign Policy and Diplomacy of Ethiopia NotesDocument45 pagesForeign Policy and Diplomacy of Ethiopia NotesBoru WarioNo ratings yet

- Political System of China NotesDocument15 pagesPolitical System of China NotesHaider JaffarNo ratings yet

- Aleyomi 5 - Renewing Nigeria's Democracy - The Role of Political Party System ViabilityDocument18 pagesAleyomi 5 - Renewing Nigeria's Democracy - The Role of Political Party System ViabilityJake Dan-AzumiNo ratings yet

- List of shortlisted candidates for mining sirdar postDocument39 pagesList of shortlisted candidates for mining sirdar postakhilesh yadavNo ratings yet

- Adsum Notes - Public Corp Reviewer MidtermDocument13 pagesAdsum Notes - Public Corp Reviewer MidtermRaz SPNo ratings yet

- Quiz 16Document2 pagesQuiz 16Coco SpencerNo ratings yet

- ICSE Class 10 History 2002Document5 pagesICSE Class 10 History 2002Adnan KhanNo ratings yet

- Ideology Security As National SecurityDocument14 pagesIdeology Security As National SecurityM Abdillah JundiNo ratings yet