Professional Documents

Culture Documents

Tds Rates As Per Dtaa

Uploaded by

mahiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Rates As Per Dtaa

Uploaded by

mahiCopyright:

Available Formats

www.taxprintindia.

com

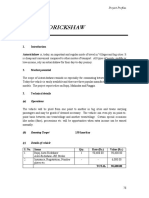

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

1 Australia 15% 15% Note 1 Note 1

2 Bangladesh 10% 10% 15% 10% 10% Note 3

3 Belarus 10% 25% 15% 10% 15% 15%

4 Belgium 15% 10% 10% 10% 10% tax on interest if loan granted

15% by bank, in other cases 15%

5 Botswana 7.50% 25% 10% 10% 10% 10%

6 Brazil 15% 15% 25% Note 3 Royalty arising from use or right

15% to use trade marks taxable @ 25%

in other case @ 15%

7 Bulgaria 15% 15% 15% 20% Royalty relating to copyright etc

20% taxable @ 15% , in other cases 20%

8 Canada 15% 10% 25% 15% Note 1 Note 1

9 Cyprus 10% 10% 15% 10% 15% 15%/

10%

10 Denmark 15% 25% 20% 10% 20% 20% 10% tax on interest if loan granted by

15% bank, in other cases 15%

11 Finland 15% 10% 10%/ 15% / For 1997-2001, rate for

15% 10% royalty & technical service 15% ifGovt/

Specified org is payer and 20% for

other payers. For subsequent yr - 15%

12 Greece Note 4 Note 4 Note 4 Note 3

13 Indonesia 10% 25% 15% 10% 15% Note 3

14 Italy 15% 10% 20% 15% 20% 20%

15 Jordan 10% 10% 20% 20%

16 Kenya 15% 15% 20% 17.5%

17 Korea 15% 20% 20% 10% 15% 15% 10% if recipient is a bank - in other

15% cases 15%

18 Kyrgyz Rep. 10% 10% 15% 15%

19 Libyan Arab Note 4 Note 4 Note 4 Note 3

Jamahiriya

20 Malta 10% 25% 15% 10% 15% 15% /

10%

21 Mauritius 5% 10% 15% 20% 15% Note 3 Tax on interest in Nil in some cases

22 Mongolia 15% 15% 15% 25%

dowload from www.simpletaxindia.org

www.taxprintindia.com

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

23 Montenegro 5% 25% 15% 10% 10% 10%

24 Myanmar 5% 10% 10% Note 3

25 Nepal 10% 10% 20% 10% 15% Note 3 10% if recipient is a bank-in

15% other cases 15%

26 New Zealand 15% 10% 10% 10%

27 Norway 15% 25% 20% 15% 10% 10%

28 Oman 10% 10% 12.5% 10% 15% 15%

29 Philippines 15% 10% 20% 10% 15% Note 3 Tax on interest @ 10% in

15% hands of financial institutions, insurance

companies, public issue of bonds/

debenture etc, in other cases 15%

30 Poland 15% 15% 22.5% 22.5%

31 Portuguese 10% 25% 10% 10% 10% 10%

Republic

32 Qatar 5% 10% 10% 10% 10% 10%

33 Romania 15% 25% 20% 15% 22.5% 22.5%

34 Saudi Arabia 5% 10% 10% Note 3

35 Serbia 5% 25% 15% 10% 10% 10%

36 Singapore 10% 25% 15% 10% 10% 10% Tax on interest @ 10% if loan granted

15% by bank/similar institution/ insurance

company, in other cases 15%

37 Slovenia 5% 10% 15% 10% 10% 10%

38 Spain 15% 15% Note 2 Note 2

39 Srilanka 15% 10% 10% 10%

40 Sudan 10% 10% 10% Note 3

41 Syria 5% 10% 10% 10% 10% Note 3

42 Tajikistan 5% 25% 10% 10% 10% Note 3

43 Tanzania 10% 10% 15% 12.5% 20% Note 3

44 Thailand 15% 10% 20% 10% 15% Note 3 Interest taxable @

25% 10% if recipient is financial institution /

insurance company, in other cases 25%

45 Turkey 15% 10% / 15% 15% Interest taxable @ 10% if recipient is

15% fin. institution/bank, in other cases 15%

10

dowload from www.simpletaxindia.org

www.taxprintindia.com

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

46 Ukraine 10% 25% 15% 10% 10% 10%

47 United 5% 10% 15% 5% 10% Note 3 Interest taxable @ 5% if loan is

Arab Emirates 12.5% granted by a bank / similar institute, in

other cases 12.5%

48 United Arab Note 4 Note 4 Note 4 Note 3

Republic

(Egypt)

49 United 15% 10% Note 1 Note 1 Interest taxable @ 10% if recipient is a

Kingdom 15% resident bank , in other cases 15%

50 United States 15% 10% 20% 10% Note 1 Note 1 Interest taxable @ 10% if loan is

15% granted by a bank / similar institute, in

other cases 15%

51 Uzbekistan 15% 15% 15% 15%

52 Zambia 5% 25% 15% 10% 10% Note 3

53 * 10% 10% 10% 10%

* Armenia, Austria, China, Czeck Republic, France, Germany, Hungary, Iceland, Ireland, Israel, Japan,

Kazakstan, Kuwait, Luxembourg, Malaysia, Morocco, Namibia, Netherlands, Russian Federation,

South Africa, Sweden, Swiss, Trinidad and Tobago, Turkmenistan, Uganda, Vietnam,

Note 1: Tax on royalties and fees for technical services will be levied in the country of source as follows

A. 10% in case of rental of equipments and services provided alongwith know-how and technical services

B. In any other cases

- During first 5 years of agreement - 15% if payer is Govt/ Specified Organisation - 20% in other cases

- Subsequent Years - 15% in all cases

Income of Govt/ certain institutions exempt from taxation in the country of source

Note 2: Tax on royalties and fees for technical services will be levied in the country of source as follows

A. 10% in case of royalties relating to payments for the use of industrial, commercial or scientific equipments

B. 20% in all other case

Note 3: No separate provision

Note 4: As per Domestic Law

1 2

- Rate of tax for majority share holders. - Percentage of share holding for Majority stake holders

11

dowload from www.simpletaxindia.org

You might also like

- Complaint For Divorce and Motion For Temporary Emergency Relief (With Blanks For Identifying Info)Document10 pagesComplaint For Divorce and Motion For Temporary Emergency Relief (With Blanks For Identifying Info)AmeliaNo ratings yet

- Buffett and Munger On Modern Academic Finance RevisedDocument25 pagesBuffett and Munger On Modern Academic Finance RevisedMohit MittalNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- For Paypal VerificationDocument6 pagesFor Paypal VerificationSoon Samuel100% (1)

- Excel Template, Equipment Inventory ListDocument2 pagesExcel Template, Equipment Inventory ListiPakistan100% (1)

- Advanced AccountingDocument107 pagesAdvanced AccountingSyedAshirBukhariNo ratings yet

- Financial Forecasting: Production Requirements (LO2) Sales For Western Boot Stores Are Expected To Be 40,000Document13 pagesFinancial Forecasting: Production Requirements (LO2) Sales For Western Boot Stores Are Expected To Be 40,000Juliet Dorado100% (1)

- Mortgages 2019Document60 pagesMortgages 2019Ivana JayNo ratings yet

- Investment Banking & Financial Services IDocument407 pagesInvestment Banking & Financial Services Iapi-371582583% (18)

- Fit Income TaxDocument8 pagesFit Income TaxadrianoedwardjosephNo ratings yet

- Loewen Group Inc.Document18 pagesLoewen Group Inc.Muntasir Bin MostafaNo ratings yet

- Bank Reconciliation Statements (With Answers) : Advanced LevelDocument21 pagesBank Reconciliation Statements (With Answers) : Advanced LevelPrassanna Kumari100% (2)

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Successful CandidatesDocument97 pagesSuccessful CandidatesShafiq Rehman100% (1)

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Tarif Tax TreatyDocument2 pagesTarif Tax TreatyJokoWidodo0% (1)

- ADocument67 pagesApiyushsithaNo ratings yet

- NILDocument12 pagesNILreese93No ratings yet

- TDS Rates Under DTAA Treaties: DividendDocument3 pagesTDS Rates Under DTAA Treaties: DividendRani AryaNo ratings yet

- Tarif Pasal 26Document2 pagesTarif Pasal 26lelaleria11No ratings yet

- Ringkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyDocument2 pagesRingkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyAchmad MudaniNo ratings yet

- TX Text Control WordsDocument2 pagesTX Text Control Wordsritter.sjdNo ratings yet

- Tax Rates As Per IT Act Vis A Vis Tax TreatiesDocument14 pagesTax Rates As Per IT Act Vis A Vis Tax TreatiesEswarReddyEegaNo ratings yet

- NO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioDocument4 pagesNO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioSatrio YuliawanNo ratings yet

- Botswana Withholding Tax RatesDocument4 pagesBotswana Withholding Tax Ratesjiwon leeNo ratings yet

- Rangkuman Tarif P3BDocument5 pagesRangkuman Tarif P3BJuni PrastyanggaNo ratings yet

- Withholding Tax Rates Under DTAADocument7 pagesWithholding Tax Rates Under DTAAOM JARWALNo ratings yet

- Countrywise Withholding Tax Rates Chart As Per DTAADocument8 pagesCountrywise Withholding Tax Rates Chart As Per DTAAajithaNo ratings yet

- TAXATION in INDIADocument11 pagesTAXATION in INDIAChaitanya PatilNo ratings yet

- Withholding Tax Rate - 195Document1 pageWithholding Tax Rate - 195avishal_jainNo ratings yet

- Ghana - Corporate - Withholding TaxesDocument3 pagesGhana - Corporate - Withholding TaxesFrancisNo ratings yet

- Ghana Fiscal Guide 2015 2016Document10 pagesGhana Fiscal Guide 2015 2016batuchemNo ratings yet

- Daftar Tarif P3B IndonesiaDocument2 pagesDaftar Tarif P3B IndonesiaNurul ardiansahNo ratings yet

- Double Taxation - Rates of WithholdingDocument6 pagesDouble Taxation - Rates of Withholdingunderstated1313100% (1)

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

- Tax Notes Aug 10-11Document15 pagesTax Notes Aug 10-11Reiner NuludNo ratings yet

- Gss Sheet SampleDocument9 pagesGss Sheet Sampledr.kabirdevNo ratings yet

- GSS Sheet SAMPLEDocument9 pagesGSS Sheet SAMPLERakesh BehuriaNo ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Cash Flow StudentsDocument38 pagesCash Flow StudentsPreet KawediaNo ratings yet

- Ghana Double Taxation and Double Taxation TreatiesDocument6 pagesGhana Double Taxation and Double Taxation Treatiesbr942vhj8xNo ratings yet

- Tax TreatyDocument54 pagesTax TreatyDevin WinataNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Passive Incomefor Both Individual and Corporation Individual CorporationDocument4 pagesPassive Incomefor Both Individual and Corporation Individual CorporationYrolle Lynart AldeNo ratings yet

- Income Category: Summary of Final TaxesDocument3 pagesIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaNo ratings yet

- C. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptDocument1 pageC. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptNajira HassanNo ratings yet

- GSS To Be BuyDocument9 pagesGSS To Be BuyRakesh BehuriaNo ratings yet

- Q1 Merged PDFDocument20 pagesQ1 Merged PDFHibah RajaNo ratings yet

- Holding Period, Taxes, and Required Performance: September 22, 2013Document11 pagesHolding Period, Taxes, and Required Performance: September 22, 2013RamasamyShenbagarajNo ratings yet

- 1 Page Summary of NR Tax Rates-1Document1 page1 Page Summary of NR Tax Rates-1PaulNo ratings yet

- Indonesian Tax Treaties Quick Reference Guide - RevisedDocument7 pagesIndonesian Tax Treaties Quick Reference Guide - RevisedWahyuni LestariNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Summary of WHT Rates Under Oman Tax Treaties in Force PDFDocument2 pagesSummary of WHT Rates Under Oman Tax Treaties in Force PDFMoneycomeNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- Sugar Project QuestionDocument21 pagesSugar Project QuestionHardik ThackerNo ratings yet

- Hurdle Rare Benchamark - 0930Document3 pagesHurdle Rare Benchamark - 0930Pedro K. LatapíNo ratings yet

- Brokerage Offices Ranking ProjectDocument10 pagesBrokerage Offices Ranking ProjectEhsan NaderiNo ratings yet

- WHT-Card - (TY 2024)Document1 pageWHT-Card - (TY 2024)yahya zafarNo ratings yet

- DSP The Report Card 1h23Document30 pagesDSP The Report Card 1h23NikhilKapoor29No ratings yet

- AIT Matrix Expanded Withholding TaxDocument1 pageAIT Matrix Expanded Withholding TaxSherleen GallardoNo ratings yet

- QUESTIONSDocument19 pagesQUESTIONSrahidarzooNo ratings yet

- PASSIVE INCOME Individual With CREATEDocument2 pagesPASSIVE INCOME Individual With CREATERacelle FlorentinNo ratings yet

- Corporate Tax Rates 2017-2021Document8 pagesCorporate Tax Rates 2017-2021LM VS81No ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- Updated VDS Rate Through Finance Act 2020Document2 pagesUpdated VDS Rate Through Finance Act 2020Hossain RonyNo ratings yet

- Chapter 05 Final Income Taxation TableDocument4 pagesChapter 05 Final Income Taxation TablejannyNo ratings yet

- Slide Kafalah Imu 502Document5 pagesSlide Kafalah Imu 502Luqman SyahbudinNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- IIBPS PO DI English - pdf-38 PDFDocument11 pagesIIBPS PO DI English - pdf-38 PDFRahul GaurNo ratings yet

- Accounting FraudDocument71 pagesAccounting FraudDebabrat MishraNo ratings yet

- Development Bank of Rizal V Sima Wei, GR No. 85419, Mar 9, 1993Document3 pagesDevelopment Bank of Rizal V Sima Wei, GR No. 85419, Mar 9, 1993MykaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Basic Budgeting Tips Everyone Should KnowDocument2 pagesBasic Budgeting Tips Everyone Should KnowharissonNo ratings yet

- Unit 6 Libro 2Document3 pagesUnit 6 Libro 2Thiany VergaraNo ratings yet

- Asian Development Bank - Pasig River Environmental Management and Rehabilitation Sector Development Program (Policy Loan) - 2016-09-16 PDFDocument3 pagesAsian Development Bank - Pasig River Environmental Management and Rehabilitation Sector Development Program (Policy Loan) - 2016-09-16 PDFjohn7astoriaNo ratings yet

- Financial Accounting II - MGT401 Spring 2012 Mid Term Solved QuizDocument21 pagesFinancial Accounting II - MGT401 Spring 2012 Mid Term Solved Quizsania.mahar0% (1)

- Au Cases NSW NSWSC 2018 886Document48 pagesAu Cases NSW NSWSC 2018 886Michael SmithNo ratings yet

- Security Analysis Chapter 10 Specific Standards For Bond InvestmentDocument2 pagesSecurity Analysis Chapter 10 Specific Standards For Bond InvestmentTheodor ToncaNo ratings yet

- Promissory NoteDocument4 pagesPromissory NoteJuricoAlonzoNo ratings yet

- ABI Means TestDocument97 pagesABI Means TestmenschNo ratings yet

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet

- Auto RickshawDocument4 pagesAuto Rickshawpradip_kumarNo ratings yet

- Fy 2018 Midyear UpdateDocument388 pagesFy 2018 Midyear UpdateNick ReismanNo ratings yet