Professional Documents

Culture Documents

Modules 4-5 Financial Assets

Uploaded by

Nesty SarsateOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Modules 4-5 Financial Assets

Uploaded by

Nesty SarsateCopyright:

Available Formats

CRT LEARNING MODULE

Course Code: FIN01

Course Title: FINANCIAL MARKETS

Units: 3

Module Title: PROPERTIES AND PRICING OF FINANCIAL

ASSETS

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 1

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

HOW TO USE THIS DIGITIZED LEARNING MODULE

Welcome to the module in PROPERTIES AND PRICING OF FINANCIAL

ASSETS. This module contains training materials and activities for you to

complete this module. This module also covers the processes involved in

communication process, as well as its elements and salient features.

You are required to go through a series of learning activities in order to

complete each learning outcome of the module. Each of the learning outcomes

is provided with Modules. Follow these activities on your own and answer the

self-check at the end of each learning outcome. You may remove a blank

answer sheet at the end of each module (or get the answer sheets from the

online facilitator) to write the answers for each self-check. If you have

questions, don’t hesitate to ask your facilitator for assistance.

This module was prepared to help you gain fundamentals and basic

knowledge about communication processes. This will be the source of

Information for you to acquire knowledge and skill in this particular trade

independently and at your own pace, with minimum supervision of help from

your instructor.

Talk to your online facilitator and agree on how you will both organize

the Training of this unit. Read each through the module carefully. It is

divided into sections, which cover all the skills and knowledge you need

to successfully complete this module.

Work through all the information and complete the activities in each

section. Read Modules and complete self-check. Suggested references are

included to supplement the materials provided in this module.

Most probably your facilitator will be your supervisor or manager. Your

online facilitator will support and correct you.

Your online facilitator will tell you about the important things you need

consider when you are completing activities and it is important that you

listen and take notes.

You will be given plenty of opportunity to ask questions and practice on

the job. Make sure you practice new skills during regular work shifts.

This way you will improve both your speed and memory and also your

confidence.

Talk to more experienced workmates and ask for their guidance.

Kindly the self-check questions at the LMS (EDMODO) to test your own

progress.

When you are ready, ask your online facilitator to watch you online via

Zoom or Google Meet to perform the activities outlined in this module.

Ask your online facilitator work through the activities: ask for written

feedback on your progress. Your online facilitator keeps feedback/pre-

assessment reports for this reason. When you have successfully

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 2

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

completed each element, ask the facilitator to mark on the reports that

you are ready for assessment.

When you have completed this module, and feel confident that you have

sufficient practice, your online facilitator will arrange an appointment

with registered assessor’s to assess you. The results of your assessment

will be recorded in your competency Achievement Record.

College for Research & Technology of Cabanatuan

FINANCIAL MARKETS 01

Contents of this Learning Module

No. Module Title Topic Code

ASSET/LIABILITY

PROBLEM Module 4

PROPERTIES LIQUIDITY

AND PRICING CONCERNS

OF FINANCIAL DEPOSITORY

4-5

INSTITUTIONS

ASSETS Module 5

COMMERCIAL

BANKS

BANK SERVICES

CREDIT UNIONS

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 3

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

MODULE CONTENT

MODULE TITLE : PROPERTIES AND PRICING OF FINANCIAL ASSETS

MODULE DESCRIPTOR:

The module provides an overview of the financial information

sector and global financial markets, which constitute an important application

domain of computer science in the Greater London area. The module prepares

students with sufficient domain knowledge so that they can continue with

module COMPGS07 to learn and understand the functioning of the many kinds

of financial information systems used in this domain.

NUMBER OF HOURS:

3 hours a week/ 12 hours in a month

LEARNING OUTCOMES:

At the end of this lesson students are expected to:

1. Students will understand the characteristics of different financial

assets such as money market instruments, bonds, and stocks, and how to buy

and sell these assets in financial markets.

2. Understand the benefit of diversification of holding a portfolio of

assets, and the importance played by the market portfolio.

3. Identify how to apply different valuation models to evaluate fixed

income securities, stocks, and how to use different derivative securities to

manage their investment risks.

LEARNING OUTCOME #4-5: PROPERTIES AND PRICING OF FINANCIAL

ASSETS

Contents:

1. Public and Private Sector Institutional Participants:

2. Overview of Consumer, Corporate and Investment Banking Financial

Services:

3. The Factors Affecting Economic Cycles and Financial Institution Risk

Adjusted Returns:

4. Time Value of Money, Discounting, Nominal and Effective Yield

Measurement:

5. Capital Equilibrium between Issuer and Investor:

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 4

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

6. Capital Market Valuation and Measurement:

7. A Day in the Life of a Transaction:

8. Roles, Responsibilities and Controls of Deal Makers and Processing

Staff:

9. Cash and Derivative Instruments, Transaction Services, and Advisory

Assessment Criteria

1. Watch a video for enrichment ( The shape of things, Fibonacci

Sequence Documentaries) URL: https://www.youtube.com/watch?

v=w2JmEoV_V0o ; https://www.youtube.com/watch?v=4ToUaU4vPks

2. Solving Symmetries is given to practice the knowledge to study the

reasons and benefits of the occurrences of the symmetries in those

objects/organisms.

3. Decoding Nature’s Rule is also provided to describe the shape of an

object, then the students will try to figure out the possible reason or

explanation as to why they are shape the way they are.

4. Finding the Golden Ratio by creating a table to show the occurrence of

it between the first 30 Fibonacci numbers.

Conditions

The students must be provided the following:

1. Hard / soft copy of the course syllabus.

2. Access to the internet/mobile data

3. Notebook

4. Laptop/mobile phone

Assessment Method:

1. Written Assessment

2. Submission of Reflection Paper

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 5

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

Learning Activity (Study Guide)

1. Using EDMODO app or Google Classroom on your phone or laptop, go to the

Mathematics in the Modern world class provided by the assigned teacher.

2. Click on the FOLDERS section (on menu/library bar).

3. Click the folder PROPERTIES AND PRICING OF FINANCIAL ASSETS. The

digitized Modules, Task Sheets and Job Sheets are available in this folder.

4. The activity/ self – check for this topic is all contained in the folder

PROPERTIES AND PRICING OF FINANCIAL ASSETS.

Learning Outcome #4-5

1. PROPERTIES AND PRICING OF FINANCIAL ASSETS /Written Exercise

Learning Activity Special Instructions

Read Module No. 4-5- Inside the Folder, it contains the

(PROPERTIES AND PRICING information about “PROPERTIES AND

OF FINANCIAL ASSETS) in the PRICING OF FINANCIAL ASSETS”

Use the EDMODO app.

given FOLDER

(FINANCIAL MARKETS).

2. Answer the activity/self- The activity is available in the folder

check for Module 4-5. PROPERTIES AND PRICING OF

FINANCIAL ASSETS. (The activity is

timed (20 minutes). The result will be

immediately available after clicking

SUBMIT.

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 6

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

MODULE 4-5

PROPERTIES AND PRICING OF FINANCIAL ASSETS

Learning Objective: After reading this MODULE, you should be able to:

1. Students will understand the characteristics of different financial

assets such as money market instruments, bonds, and stocks, and how to buy

and sell these assets in financial markets.

2. Understand the benefit of diversification of holding a portfolio of

assets, and the importance played by the market portfolio.

3. Identify how to apply different valuation models to evaluate fixed

income securities, stocks, and how to use different derivative securities to

manage their investment risks.

FINANCIAL ASSET

A financial asset is a liquid asset that gets its value from a

contractual right or ownership claim. Cash, stocks, bonds, mutual

funds, and bank deposits are all are examples of financial assets.

Unlike land, property, commodities, or other tangible physical

assets, financial assets do not necessarily have inherent physical

worth or even a physical form. Rather, their value reflects factors of

supply and demand in the marketplace in which they trade, as well

as the degree of risk they carry.

PROPERTIES AND PRICING OF FINANCIAL

ASSETS

1. Moneyness - some financial asset used as a medium of

exchange or in settlement of transactions. Could be cash or

near money, such as time & savings deposits and Treasury

Bills.

Can asset be used as a medium of exchange, or easily

converted to money?

money—yes

checking account—yes

Tbill--easily converted

real estate—no

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 7

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

2. Divisibility - relates to the minimum size in which a financial

asset can be liquidated and exchanged for money. The smaller,

the more divisible.

3. Reversibility - the cost of investing in a financial asset and

then getting out of it and back into cash again.

4. Bid ask spread - the most relevant component of round-trip

cost, which might be added commissions and the time and

cost, if any, of delivering the asset.

5. Thickness of the market - the prevailing rate at which buying

and selling orders reach the market. That is, the frequency of

transactions.

6. Thin Market - one that has few trades on a regular or

continuing basis.

7. Nominal expected return - the net real expected return after

adjustment for the loss of purchasing power (due to inflation)

8. Term to maturity - the length of the period until the date at

which the instrument is scheduled to make its final payment,

or the owner is entitled to demand liquidation.

FINANCIAL MARKETS Date Developed:

MODULE 4-5: Date Revised:

PROPERTIES Developed by: Issued by: Page 8

AND PRICING Jherolyn Decena CRT

OF FINANCIAL

ASSETS

You might also like

- Module 2 Financial MarketsDocument11 pagesModule 2 Financial MarketsNesty SarsateNo ratings yet

- Depository Institutions ModuleDocument8 pagesDepository Institutions ModuleNesty SarsateNo ratings yet

- Module Guide Fund Mangment 2021Document16 pagesModule Guide Fund Mangment 2021Dvea ShippinNo ratings yet

- Finm3401 Ecp 2013Document14 pagesFinm3401 Ecp 2013dmscott10No ratings yet

- Learner GuideDocument66 pagesLearner Guidenarasi640% (1)

- Applied Business Tools Module (Midterm) (No Self Activity)Document51 pagesApplied Business Tools Module (Midterm) (No Self Activity)Verdida JovelynNo ratings yet

- Toulouse Business School: C O U R S E C O N T E N TDocument28 pagesToulouse Business School: C O U R S E C O N T E N TlocoNo ratings yet

- Managerial FinanceDocument69 pagesManagerial Financeaimanhassan100% (3)

- Part 1 Course GuideDocument12 pagesPart 1 Course GuideealselwiNo ratings yet

- Www Plan Training Sessions (1)Document278 pagesWww Plan Training Sessions (1)tayegebremichael33No ratings yet

- Course Outline Business FinanceDocument6 pagesCourse Outline Business FinanceKalonduMakauNo ratings yet

- MKT 8035 Instructional PlanDocument12 pagesMKT 8035 Instructional PlanmayraNo ratings yet

- Fin222 So s12019 Iicsj - ApprovedDocument13 pagesFin222 So s12019 Iicsj - ApprovedraphaelrachelNo ratings yet

- Rhona Tm1 Portfolio CompleteDocument108 pagesRhona Tm1 Portfolio CompleteGie marie MontealtoNo ratings yet

- PRD - Module 3 PrefinalDocument22 pagesPRD - Module 3 PrefinalJhon Carlo GonoNo ratings yet

- Evm - Nciii - CBLM - Plan and Develop Event Proposal or BidDocument54 pagesEvm - Nciii - CBLM - Plan and Develop Event Proposal or BidOrlando Umali67% (3)

- FUN D Amentals of Events ManagementDocument46 pagesFUN D Amentals of Events ManagementEdgar Junior PahonangNo ratings yet

- International Pricing and Performence Module GuideDocument26 pagesInternational Pricing and Performence Module GuidebarnaNo ratings yet

- IVC Real Estate 172 - #64930 - Syllabus - 2nd 8wk-Sp2023Document10 pagesIVC Real Estate 172 - #64930 - Syllabus - 2nd 8wk-Sp2023alysa zavalaNo ratings yet

- Machinery Lubrication Technician (MLT) I and II Certification Exam GuideFrom EverandMachinery Lubrication Technician (MLT) I and II Certification Exam GuideRating: 2 out of 5 stars2/5 (1)

- FMA SyllabusDocument5 pagesFMA SyllabusThanh MaiNo ratings yet

- FIN3024 Module Outline Mar 2014Document7 pagesFIN3024 Module Outline Mar 2014Gurrajvin SinghNo ratings yet

- Sybfm Semiv Sle GuidelinesDocument9 pagesSybfm Semiv Sle GuidelinesshivamNo ratings yet

- International Finance ReportDocument31 pagesInternational Finance ReportLegend AkNo ratings yet

- CSS11 q1 Mod1 PersonalEntrepreneurialCompetencies v1.2Document16 pagesCSS11 q1 Mod1 PersonalEntrepreneurialCompetencies v1.2Franklin Benitez100% (1)

- Module 1-Week 1-Introduction To EntrepreneurshipDocument16 pagesModule 1-Week 1-Introduction To EntrepreneurshipJenny Rose Libo-onNo ratings yet

- Module Handbook: Module Title Managerial FinanceDocument12 pagesModule Handbook: Module Title Managerial FinanceReswinNo ratings yet

- Duik CBLMDocument53 pagesDuik CBLMINQI SubjectNo ratings yet

- MQ Il 12 Ifm 8 Ar QOa X1 T 0 P 7 I Aol OXG7 Jy 6 Rxi BTLCJDocument131 pagesMQ Il 12 Ifm 8 Ar QOa X1 T 0 P 7 I Aol OXG7 Jy 6 Rxi BTLCJayo kunleNo ratings yet

- Applied Business Tools and Technologies With Laboratory: Taguig City UniversityDocument53 pagesApplied Business Tools and Technologies With Laboratory: Taguig City UniversityJoshua Guerrero100% (1)

- Utilize Electronic Media 2011Document103 pagesUtilize Electronic Media 2011vinceldaNo ratings yet

- Integrated Business Management Simulation - Module Handbook 2020-2021Document28 pagesIntegrated Business Management Simulation - Module Handbook 2020-2021Cecilia LecuvaNo ratings yet

- Graduation Project Prof Hassan El Sady English Section ZayedDocument4 pagesGraduation Project Prof Hassan El Sady English Section ZayedAhmed IsmaelNo ratings yet

- FIN42A - Corporate Finance ModuleDocument6 pagesFIN42A - Corporate Finance ModuleVũ Thị Lan HươngNo ratings yet

- 6 Present Reelevant InformationDocument74 pages6 Present Reelevant InformationCzar InaNo ratings yet

- Financial Markets and Valuation: Course PurposeDocument7 pagesFinancial Markets and Valuation: Course PurposeVishakha ChopraNo ratings yet

- UC 1. Plan and Develop Event Proposal or BidDocument74 pagesUC 1. Plan and Develop Event Proposal or BidIris Lianne Bonifacio100% (2)

- ACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Document6 pagesACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Klarissemay MontallanaNo ratings yet

- Week 1 Module 1 Chapter 1 Statement of Financial Position 2Document10 pagesWeek 1 Module 1 Chapter 1 Statement of Financial Position 2Joyce TanNo ratings yet

- 2019 01 Baguio Learning Resource Module English TemplateDocument17 pages2019 01 Baguio Learning Resource Module English TemplateSedelina GuidangenNo ratings yet

- Personal Effectiveness in The WorkplaceDocument16 pagesPersonal Effectiveness in The WorkplaceThol LynaNo ratings yet

- Bwrr3103 - Estate PlanningDocument7 pagesBwrr3103 - Estate PlanningBaby KhorNo ratings yet

- Performing Mensuration and CalculationDocument31 pagesPerforming Mensuration and CalculationAlex J Robles100% (1)

- ACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDocument6 pagesACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDanyalSamiNo ratings yet

- Advanced Corporate Finance Course OutlineDocument10 pagesAdvanced Corporate Finance Course OutlineGilbert ShonhiwaNo ratings yet

- Comm 3FH3 - 2021-1-WDocument9 pagesComm 3FH3 - 2021-1-WAlyssa PerzyloNo ratings yet

- GMS Week by WeekDocument12 pagesGMS Week by Weeksugar cuteNo ratings yet

- Capital Market and Portfolio Theory BFN403Document145 pagesCapital Market and Portfolio Theory BFN403Najeem olawunmiNo ratings yet

- 1-5 Using and Applying Lubricants and Coolants PDFDocument34 pages1-5 Using and Applying Lubricants and Coolants PDFAlex J Robles100% (1)

- CBLM Common UC5Document36 pagesCBLM Common UC5Rodel P. PilloNo ratings yet

- SMAW NC I (Franklin Lirazan)Document119 pagesSMAW NC I (Franklin Lirazan)Franklin LirazanNo ratings yet

- BA RPA StudentWorkbookDocument35 pagesBA RPA StudentWorkbookAna Paula Ribas KrumNo ratings yet

- HM106 Module 2.1 Receive and Process ReservationsDocument23 pagesHM106 Module 2.1 Receive and Process Reservationslyndzsay de veraNo ratings yet

- Welcomeservlet Retail SecurityDocument12 pagesWelcomeservlet Retail SecurityLiviu LiviuNo ratings yet

- San Francisco Javier College Housekeeping Date Developed Document No - 052609Document33 pagesSan Francisco Javier College Housekeeping Date Developed Document No - 052609Laila MartinezNo ratings yet

- Fin 440 Course Outline Fall 2017Document4 pagesFin 440 Course Outline Fall 2017Tasnim Mahmud Rana 1921142630No ratings yet

- Solution Manual For Corporate Finance Online 2nd Edition Stanley Eakins William McnallyDocument36 pagesSolution Manual For Corporate Finance Online 2nd Edition Stanley Eakins William Mcnallygalbehiphaltkll3100% (49)

- Economics for Investment Decision Makers: Micro, Macro, and International EconomicsFrom EverandEconomics for Investment Decision Makers: Micro, Macro, and International EconomicsNo ratings yet

- AC 4103 OBEdized SyllabusDocument21 pagesAC 4103 OBEdized SyllabusAyame KusuragiNo ratings yet

- UKULELE123Document2 pagesUKULELE123Nesty SarsateNo ratings yet

- Module 2 Ode To JoyDocument1 pageModule 2 Ode To JoyNesty SarsateNo ratings yet

- SPIELDocument2 pagesSPIELNesty SarsateNo ratings yet

- Guitar 123Document4 pagesGuitar 123Nesty SarsateNo ratings yet

- Module 1 TwinkleDocument1 pageModule 1 TwinkleNesty SarsateNo ratings yet

- Piano ModulesDocument3 pagesPiano ModulesNesty SarsateNo ratings yet

- Dwight July 2022 Journal NewDocument3 pagesDwight July 2022 Journal NewNesty SarsateNo ratings yet

- Critic 1Document1 pageCritic 1Nesty SarsateNo ratings yet

- Online Computer System Servicing Ncii Tutorial Using PHP and MysqlDocument23 pagesOnline Computer System Servicing Ncii Tutorial Using PHP and MysqlNesty SarsateNo ratings yet

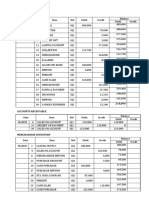

- Nesty Sarsate - Ledger AssignementDocument4 pagesNesty Sarsate - Ledger AssignementNesty SarsateNo ratings yet

- FunctionsDocument1 pageFunctionsNesty SarsateNo ratings yet

- Implementing Milktea Project Inventory System using PHP and MySQLDocument15 pagesImplementing Milktea Project Inventory System using PHP and MySQLNesty SarsateNo ratings yet

- Establishment Profile/Company History Company Overview / Brief HistoryDocument33 pagesEstablishment Profile/Company History Company Overview / Brief HistoryNesty SarsateNo ratings yet

- PHP MySQL LMSDocument26 pagesPHP MySQL LMSNesty SarsateNo ratings yet

- Sarsate, Nesty y Bsit3 CRT Guimba Elec9 MidtermDocument4 pagesSarsate, Nesty y Bsit3 CRT Guimba Elec9 MidtermNesty SarsateNo ratings yet

- Sarsate, Nesty Yangga: ObjectivesDocument3 pagesSarsate, Nesty Yangga: ObjectivesNesty SarsateNo ratings yet

- Fin01 Final NarrativeDocument2 pagesFin01 Final NarrativeNesty SarsateNo ratings yet

- Assignment 1Document1 pageAssignment 1Nesty SarsateNo ratings yet

- Following Are The Key Characteristics of MIS:: System ApproachDocument2 pagesFollowing Are The Key Characteristics of MIS:: System ApproachAnanya SarangiNo ratings yet

- ErovoutikaDocument1 pageErovoutikaNesty SarsateNo ratings yet

- Cant Take My Eyes Off YouDocument3 pagesCant Take My Eyes Off YouNesty SarsateNo ratings yet

- AaahhhhDocument1 pageAaahhhhNesty SarsateNo ratings yet

- Selector Example Selects: $ (" ") All ElementsDocument12 pagesSelector Example Selects: $ (" ") All ElementsNesty SarsateNo ratings yet

- Research PaperDocument1 pageResearch PaperNesty SarsateNo ratings yet

- ErovoutikaDocument1 pageErovoutikaNesty SarsateNo ratings yet

- AhmieDocument2 pagesAhmieNesty SarsateNo ratings yet

- EdisonDocument1 pageEdisonNesty SarsateNo ratings yet

- Euromoney TrainingDocument4 pagesEuromoney Trainingharry_1981100% (1)

- Fraud Complaint Marcus RenslowDocument7 pagesFraud Complaint Marcus RenslowWayne LundNo ratings yet

- Revenue Requirements and RAB WebinarDocument26 pagesRevenue Requirements and RAB WebinarDallas Dragon100% (1)

- Presented By-Ritika Sood Sahil Kataria Surbhi SoodDocument28 pagesPresented By-Ritika Sood Sahil Kataria Surbhi SoodAkhil GoyalNo ratings yet

- Nifty Trading ProposalDocument9 pagesNifty Trading ProposalmmyemailNo ratings yet

- Indian Salon Hair and Skin Products Industry ReportDocument24 pagesIndian Salon Hair and Skin Products Industry ReportReevolv Advisory Services Private LimitedNo ratings yet

- Approaches To ValueDocument9 pagesApproaches To ValuebeaNo ratings yet

- Ethics AssignmentDocument16 pagesEthics AssignmentNghĩaTrầnNo ratings yet

- Security Valuation: Meaning and FactorsDocument7 pagesSecurity Valuation: Meaning and FactorsRohit BajpaiNo ratings yet

- UTS Aplikasi Manajemen Keuangan Take HomeDocument10 pagesUTS Aplikasi Manajemen Keuangan Take HomeRifan Herwandi FauziNo ratings yet

- Behavioral Bias Among Professionals With Respect To Investment in Mutual FundsDocument6 pagesBehavioral Bias Among Professionals With Respect To Investment in Mutual FundsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 1 - Introduction: 1.1 - Objective of The StudyDocument28 pagesChapter 1 - Introduction: 1.1 - Objective of The StudySpandan GhoshNo ratings yet

- Green Field TownshipsDocument8 pagesGreen Field Townshipssharad yadavNo ratings yet

- Im 04Document8 pagesIm 04Ayesha KousarNo ratings yet

- An Investment Perspective of HRMDocument18 pagesAn Investment Perspective of HRMSoyed Mohammed Zaber HossainNo ratings yet

- Paper 1 - Fundamentals of Securities and Futures RegulationDocument50 pagesPaper 1 - Fundamentals of Securities and Futures RegulationBogey Pretty100% (1)

- Teknikal - 17 03 15eDocument1 pageTeknikal - 17 03 15eAdy HasbullahNo ratings yet

- Thesis Group IVDocument14 pagesThesis Group IVAldrene KyuNo ratings yet

- Sample Quiz Partnership and CorporationDocument9 pagesSample Quiz Partnership and CorporationKristine Salvador CayetanoNo ratings yet

- Financial ManagementDocument25 pagesFinancial ManagementReymart Castillo Hamo100% (6)

- Inside Bar Article Colibri TraderDocument23 pagesInside Bar Article Colibri Traderabiel_guerra100% (2)

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocument5 pagesACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCalyx ImperialNo ratings yet

- Vsa Basics PDFDocument31 pagesVsa Basics PDFdiogonbig100% (1)

- Stamford Industrial Group, Inc. 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Document4 pagesStamford Industrial Group, Inc. 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNo ratings yet

- Projek Ternakan UdangDocument11 pagesProjek Ternakan UdangkidungbhayangkaraNo ratings yet

- Mindshift ChallengeDocument94 pagesMindshift ChallengeSerene Heather Renze100% (6)

- Imu600 Final July 2022Document3 pagesImu600 Final July 2022fathul dzarifNo ratings yet

- Coca-Cola Financial AnalysisDocument6 pagesCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNo ratings yet

- How to interpret candlestick patterns and identify trading opportunitiesDocument56 pagesHow to interpret candlestick patterns and identify trading opportunitiessuresh100% (4)

- CBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetJenneil CarmichaelNo ratings yet