Professional Documents

Culture Documents

Annexure-F For HL

Uploaded by

nakul ahirraoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure-F For HL

Uploaded by

nakul ahirraoCopyright:

Available Formats

APPLICABLE ONLY FOR OLD TAX REGIME

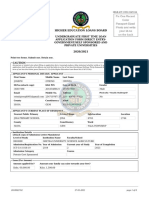

ANNEXURE – ‘F’ Annexure to Investment Declaration Form for 2020-20

DECLARATION FOR CLAIM OF DEDUCTION FOR LOSS FROM HOUSE PROPERTY (Interest paid on Home Loan)

01 Date of sanction of loan

02 Purpose of loan

(Purchase/Construction/Repairs**/Renovation/Extension/Improvement). Home loan

benefit is applicable only after taking possession of the house and during construction

period IT benefit is not applicable.

Section 80EE deduction - Amount of Loan sanctioned doesn’t exceed 35 lacs and

03

sanctioned during the period 1st April 2016 to 31 st March 2017.

A) Value of residential property doesn’t exceed Rs. 50 lacs

B) Do you own any residential house property on the date of sanction of loan?

If yes not applicable for 80EE deduction.

Section 80EEA: Interest on housing Loan on purchase of an affordable house

04

sanctioned during the period 1st April 2019 to 31 st March 2020.

A) Stamp duty value of house property (does not exceed Rs 45 lakh.)

B) Do you own any residential house property on the date of sanction of loan?

If yes not applicable for 80EEA deduction.

C) Mention Carpet area of the residential unit (doesn’t exceed 60 square meter

or 90 square meter) and mention property location / city

For details Refer to ABB India salary tax guidelines FY 2020-21

05 In case of purchase of House Property, please mention:

(A) Date of Purchase of House Property

(B) Date of Occupancy/Possession of the House

04 In case of construction, date of completion of construction

05 In case the House in joint names, mention the % to be considered for your IT

exemption.

06 HRA benefit under Sec.10 is to be discontinued from date (If your own house and

rental accommodation are in the same City, income-tax benefit is applicable to any

one only).

07. Name of Loan Lender (Bank Name and PAN)

(All the above columns are mandatory and hence please ensure to fill all the columns)

I, _____________________________ do hereby declare that property is owned / jointly owned by me what is stated above is true to the best of

my knowledge and belief. ____________________________________

Place : Signature of Employee

Date : Emp. No. _________________ Mobile No.____________________

1. Attach Provisional Letter from the Bank for the Principal & Interest payment for the current financial year.

2. In case you are availing Income-tax benefit for home loan for the first time, please attach Possession Certificate from the builder or

completion certificate in case of independent house.

Full Address of House Property for which such loan has been taken:-

________________________________________________________________________________________________________________________

____________________________________________________________________________________________________

**If capital is borrowed for reconstruction, repairs, renewals of a house property, then the maximum amount of deduction on account of interest is

Rs. 30,000/-. The payment of principle, if any, is not eligible for any deduction in this case.

You might also like

- Maha Super Housing LoanDocument4 pagesMaha Super Housing Loansakshishree09No ratings yet

- Bill For BusDocument2 pagesBill For BusAjay J RaoNo ratings yet

- Tax invoice for headphonesDocument1 pageTax invoice for headphonesRichest TechNo ratings yet

- Kerala State Electricity Board Limited: Demand Cum Disconnection NoticeDocument1 pageKerala State Electricity Board Limited: Demand Cum Disconnection NoticeTECH ALTHAF FASILNo ratings yet

- Bajaj Finserv Loan ApprovalDocument2 pagesBajaj Finserv Loan Approvalprsnjt11No ratings yet

- Midnapore College admission receiptDocument1 pageMidnapore College admission receiptDebmalya KarNo ratings yet

- English Literature Class 5Document56 pagesEnglish Literature Class 5ANIKA PRASHANTKUMAR JAISWALNo ratings yet

- IRCTC E-ticket details for travel from Bhatpara to ItwariDocument2 pagesIRCTC E-ticket details for travel from Bhatpara to ItwariManish RathodNo ratings yet

- Maharashtra Death CertificateDocument1 pageMaharashtra Death CertificateShyam DongareNo ratings yet

- Sale AgreementDocument5 pagesSale AgreementJaipal ReddyNo ratings yet

- PrmPayRcptSign PR0445228800021011Document1 pagePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- Exam Form Fee ReceiptDocument1 pageExam Form Fee ReceiptIsha MahajanNo ratings yet

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarNo ratings yet

- English Specimen Paper 1Document8 pagesEnglish Specimen Paper 1Tuyết Nga NguyễnNo ratings yet

- Consent Form for Proposed Company ShareholderDocument1 pageConsent Form for Proposed Company ShareholderStephen Kingscrown Favour MathameNo ratings yet

- Rental Agreement TermsDocument2 pagesRental Agreement TermsparimalinNo ratings yet

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjasNo ratings yet

- 9702 w11 QP 23Document16 pages9702 w11 QP 23Hubbak KhanNo ratings yet

- Vimal PDFDocument1 pageVimal PDFJofin TMNo ratings yet

- English Specimen Paper 1 2018 1 PDFDocument8 pagesEnglish Specimen Paper 1 2018 1 PDFSan SanNo ratings yet

- 9701 s07 QP 4Document16 pages9701 s07 QP 4Hubbak Khan100% (1)

- Home loan interest certificate for Satyendra Kumar TripathiDocument1 pageHome loan interest certificate for Satyendra Kumar TripathiShivam Mani Tripathi x-c 11No ratings yet

- HDFC Credila-Check ListDocument2 pagesHDFC Credila-Check ListAshok BarikiNo ratings yet

- LIC - Premium - UploadDocument1 pageLIC - Premium - UploadCA Ashish MehtaNo ratings yet

- Life insurance premium paid certificateDocument1 pageLife insurance premium paid certificateShyamsunder KaranamNo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGONo ratings yet

- Donor FormDocument1 pageDonor FormKalpesh MangeNo ratings yet

- Cambridge IGCSE (9-1) : Computer Science 0984/11Document12 pagesCambridge IGCSE (9-1) : Computer Science 0984/11hussain korirNo ratings yet

- Sanction Letter SpecimenDocument25 pagesSanction Letter SpecimenJoyson JoyNo ratings yet

- Bennett University: Fee Receipt (Student Copy)Document1 pageBennett University: Fee Receipt (Student Copy)Vinayak TripathiNo ratings yet

- English Check Point Paper 2 Sample 2012Document8 pagesEnglish Check Point Paper 2 Sample 2012Thien Kim DoNo ratings yet

- Cambridge IGCSE: First Language English 0500/21Document12 pagesCambridge IGCSE: First Language English 0500/21EffNo ratings yet

- Slaley Offer LetterDocument1 pageSlaley Offer Letterudaya moorthyNo ratings yet

- Branch Code 05999 Home Loan Interest CertificateDocument1 pageBranch Code 05999 Home Loan Interest CertificateKRIS BARSAGADE100% (1)

- Fee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMDocument1 pageFee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMKRISHNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- Rent Agreement 2020 EditedDocument3 pagesRent Agreement 2020 EditedNovice VlogsNo ratings yet

- 2018091800024Document3 pages2018091800024Gunjan ShahNo ratings yet

- Declaration 80EEDocument1 pageDeclaration 80EERanga.SathyaNo ratings yet

- Ielts Score Card PDFDocument1 pageIelts Score Card PDFAarya RaichuraNo ratings yet

- 1 3 1 Verification For TenentDocument2 pages1 3 1 Verification For Tenentatul karwasara100% (2)

- GMBAausDocument2 pagesGMBAausshiva2490No ratings yet

- SBI Housing Loan Details for IndividualsDocument9 pagesSBI Housing Loan Details for IndividualsPandurangbaligaNo ratings yet

- Stage 7 T1P1 NonFiction MarkschemeDocument9 pagesStage 7 T1P1 NonFiction MarkschemeTeng Xuen ChanNo ratings yet

- 10 0837 03 MS 3RP tcm142-606621Document4 pages10 0837 03 MS 3RP tcm142-606621ReneereneeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akshay HarekarNo ratings yet

- Received With Thanks ' 5,324.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 5,324.00 Through Payment Gateway Over The Internet Fromabhishek barmanNo ratings yet

- Parent Consent FormDocument1 pageParent Consent FormSeema ChaturvediNo ratings yet

- Stanford Center For Professional Development ReceiptDocument2 pagesStanford Center For Professional Development ReceiptRicardo MaduroNo ratings yet

- I. Part A - General: Kerala Financial CorporationDocument22 pagesI. Part A - General: Kerala Financial CorporationRajeshRajanRaashettanNo ratings yet

- Rent ReceiptDocument1 pageRent ReceiptUday ReddyNo ratings yet

- School Fee Receipt Sample PDFDocument1 pageSchool Fee Receipt Sample PDFPrincipal Govt.Sr.Sec.School Daha KarnalNo ratings yet

- Formal Letter Writing: Class ViDocument21 pagesFormal Letter Writing: Class ViZebaNo ratings yet

- 2 10 17 PM PDFDocument1 page2 10 17 PM PDFAllurDevuduSrinivasanNo ratings yet

- JJJHJHDocument1 pageJJJHJHDrAbhishek SarafNo ratings yet

- Admit CardDocument1 pageAdmit CardPOORAN LALNo ratings yet

- Form 12 C Cum Declaration Form To Claim Housing Loan DeductionsDocument3 pagesForm 12 C Cum Declaration Form To Claim Housing Loan DeductionsBhooma ShayanNo ratings yet

- Home Loan - Tax Benefit - 2Document3 pagesHome Loan - Tax Benefit - 2Rajesh KumarNo ratings yet

- Tax Benefit On Home Loan - Section 24, 80C, 80EE PDFDocument5 pagesTax Benefit On Home Loan - Section 24, 80C, 80EE PDFRajiv RanjanNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- VGE4-DL Report APRIL-MAY2017Document6 pagesVGE4-DL Report APRIL-MAY2017nakul ahirraoNo ratings yet

- f2019 20mi b0cc55b3dc3f301Document6 pagesf2019 20mi b0cc55b3dc3f301nakul ahirraoNo ratings yet

- Brain and Nondirectional Cycle PowerPoint TemplateDocument3 pagesBrain and Nondirectional Cycle PowerPoint Templatenakul ahirraoNo ratings yet

- Odoo Product - TemplateDocument10 pagesOdoo Product - Templatechowdary_mv645No ratings yet

- Flow of Financial Resources From Scheduled Commercial Banks To The Commercial SectorDocument6 pagesFlow of Financial Resources From Scheduled Commercial Banks To The Commercial Sectornakul ahirraoNo ratings yet

- Heat Exchanger Calculations: Inside Heat Trasfer CoefficientDocument4 pagesHeat Exchanger Calculations: Inside Heat Trasfer CoefficientBimal DeyNo ratings yet

- Kirti Engineering Works: QuotqtionDocument1 pageKirti Engineering Works: Quotqtionnakul ahirraoNo ratings yet

- Sr. No. Tasks Plan Date ResponsibilityDocument3 pagesSr. No. Tasks Plan Date Responsibilitynakul ahirraoNo ratings yet

- Night Shift Support-TEF31-32Document3 pagesNight Shift Support-TEF31-32nakul ahirraoNo ratings yet

- IMS Objectives - Maint - 2011Document9 pagesIMS Objectives - Maint - 2011nakul ahirraoNo ratings yet

- Filter List VI DEPT: AHU Filters/ Hepa Filters Type Washable / Non Washable Varient Diemension Quantity RemarkDocument1 pageFilter List VI DEPT: AHU Filters/ Hepa Filters Type Washable / Non Washable Varient Diemension Quantity Remarknakul ahirraoNo ratings yet

- Business Award Summary SheetDocument2 pagesBusiness Award Summary Sheetnakul ahirraoNo ratings yet

- Six Sigma Template KitDocument57 pagesSix Sigma Template KitheeralalpannalalNo ratings yet

- LAXMI TECHNO SERVICES proposal for M/S ABB LTDDocument5 pagesLAXMI TECHNO SERVICES proposal for M/S ABB LTDnakul ahirraoNo ratings yet

- Turnover Declaration Letter - de RegistrationDocument4 pagesTurnover Declaration Letter - de RegistrationGeraldJadeLazaroNo ratings yet

- Business and Investment Income Integration for Private CorporationsDocument2 pagesBusiness and Investment Income Integration for Private CorporationsMichael KemifieldNo ratings yet

- 02B Income Taxes: Clwtaxn de La Salle UniversityDocument35 pages02B Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDocument1 pageFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDeus DulayNo ratings yet

- W2 & Earnings: Emma MimsDocument1 pageW2 & Earnings: Emma MimsIsaiah MimsNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Problem 1 Communal PropertiesDocument11 pagesProblem 1 Communal PropertiesJuanaNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Pay Slip 13867 July, 2021Document1 pagePay Slip 13867 July, 2021Jemal YayaNo ratings yet

- University of Lahore Fee Structure for BALLB and BSCCJ Fall 2021Document1 pageUniversity of Lahore Fee Structure for BALLB and BSCCJ Fall 2021Ali SohuNo ratings yet

- Lecture 2c - Dealings in PropertyDocument4 pagesLecture 2c - Dealings in PropertyCPANo ratings yet

- Sarayu Dna Wifi 2021Document1 pageSarayu Dna Wifi 2021AbhijeetNo ratings yet

- Income Tax 2022 Part 2Document6 pagesIncome Tax 2022 Part 2Chezkie EmiaNo ratings yet

- MG 3027 TAXATION - Week 23 Introduction To Corporation TaxDocument27 pagesMG 3027 TAXATION - Week 23 Introduction To Corporation TaxSyed SafdarNo ratings yet

- Salary Slip PDFDocument3 pagesSalary Slip PDFmohd aslamNo ratings yet

- Giroplan Iit - Ob2120210316115617kia 2Document2 pagesGiroplan Iit - Ob2120210316115617kia 2jali nottiNo ratings yet

- CH 3 Intro To Income TaxDocument16 pagesCH 3 Intro To Income TaxGabriel Trinidad SonielNo ratings yet

- Topic 9 - Foreign IncomeDocument39 pagesTopic 9 - Foreign Incomemichael krueseiNo ratings yet

- TSD 428522500305 R PosDocument3 pagesTSD 428522500305 R Posvxryg557pfNo ratings yet

- Fesco Online BilllDocument1 pageFesco Online BilllToqeer RazaNo ratings yet

- Welcome To Greater Chennai CorporationDocument1 pageWelcome To Greater Chennai CorporationStella-JebasNo ratings yet

- Company PIN Certificate SiconDocument1 pageCompany PIN Certificate SiconChristopher MochereNo ratings yet

- GRATUITY BY Pooja MiglaniDocument9 pagesGRATUITY BY Pooja MiglaniBrahamdeep KaurNo ratings yet

- 2020 Annual Tax SummaryDocument2 pages2020 Annual Tax SummaryGLO RellyNo ratings yet

- Residential property cost detailsDocument1 pageResidential property cost detailsManohar Reddy MavillaNo ratings yet

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- 1 Ca Irs 3176CDocument3 pages1 Ca Irs 3176CStephen Monaghan100% (1)

- Revised Excercises On Estate TaxDocument3 pagesRevised Excercises On Estate TaxAgayatak Sa ManenNo ratings yet

- Tax PaidDocument1 pageTax PaidRiya Mazumder Roll 286No ratings yet

- Chapter 2 Multiple ChoiceDocument4 pagesChapter 2 Multiple ChoiceLess Balesoro100% (1)