Professional Documents

Culture Documents

2019EOFYSummary

Uploaded by

sidney drecotteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019EOFYSummary

Uploaded by

sidney drecotteCopyright:

Available Formats

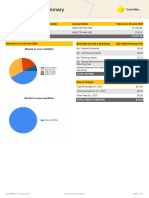

1 JULY 2018 - 30 JUNE 2019

Portfolio Valuation Account Number Account Name Value as at 30 June 2019

Shares 4399401 MR SHANE HOWARD $4,026.01

TOTAL PORTFOLIO VALUE $4,026.01

Allocation as at 30 June 2019 Estimated Interest & Dividends 2018-2019 Financial Year

Est. Franked Dividends $184.17

Est. Unfranked Dividends $0.00

Est. Franking Credits $78.93

Est. Interest Received from Interest

$0.00

Rate Securities

TOTAL INCOME $184.17

Fees & Charges 2018-2019 Financial Year

Total Brokerage (inc. GST) $179.70

Total Subscriptions (inc. GST) $0.00

Other Fees (inc. GST) $0.00

TOTAL FEES & CHARGES $179.70

Generated 20 May 2020 Financial Year Summary Page 1 of 3

1 JULY 2018 - 30 JUNE 2019

This statement only provides information for CDIA accounts that have been designated as the settlement account for your trading account as at 30 June. Please refer to NetBank for interest income from all other

CBA accounts.

The Interest shown is net of any non-resident or TFN withholding tax (if applicable). Please refer to Netbank for bank fees paid on your designated CDIA settlement account in the financial year.

This statement is issued by Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (''CommSec''), a participant of the ASX Group and Chi-X Australia. CommSec is a wholly owned but non-

guaranteed subsidiary of Commonwealth Bank of Australia Group (''CBA''). Information contained in this statement is believed to be accurate at the time the statement is generated. CBA and its subsidiaries do not

accept any liability for any errors or omissions contained in this statement, or any responsibility for any action taken in reliance on this statement. This statement is a summary document only and it is not intended

to replace any document which contains information that may be required for taxation purposes. You should therefore retain your CHESS statements, dividend statements, confirmation contract notes and bank

account statements for your records in this regard. If there are any errors in this statement, please contact us on 13 15 19.The total brokerage outlined does not include any rebates you may have received over

the financial year. Please refer to your transaction statement records for any rebates you may have received for the report period. This report only includes dividends paid for holdings held with CommSec. Any

dividends paid (based on the ex-dividend date) prior to holdings being transferred to CommSec are not included in this report. This report may not include information on some accounts if you have switched

products during the financial year. CommSec is not a registered tax practitioner and the information provided in this report does not constitute tax advice. The above information whilst based upon your holdings

only takes into account those of your circumstances of which we are aware. It is recommended that you provide the report to your tax adviser or accountant in order that your particular circumstances can be

properly addressed.

Address Commonwealth Securities Locked Bag 22, Australia Square NSW 1215 | Enquiries 13 15 19 | www.commsec.com.au

Generated 20 May 2020 Financial Year Summary Page 2 of 3

1 JULY 2018 - 30 JUNE 2019

GLOSSARY

Units The number of registered securities that you own.

Unit Price The Portfolio Valuation 'Unit Price' is calculated using a 'Reference' Price provided by the ASX which takes into account an adjustment to determine value at Close of

Market if the Security does not trade in the Closing Single Price Auction on the Valuation Date.

Brokerage The fee or charge that is paid by you when transacting a buy or sell.

Holder Identification Number (HIN) When you are CHESS sponsored with a Broker you will be issued a unique number, called a HIN. Multiple holdings can be registered under the single HIN. A HIN starts

with the letter X and usually followed by 10 numbers, e.g. X0001234567.

Dividend A dividend is a payment made to shareholders from the company. This payment is a portion of the company's profits. ASX listed companies typically pay dividends twice

a year, usually as an 'interim' dividend and a 'final dividend'. From time to time, a company may also pay a 'special' dividend.

Ex-dividend date The ex-dividend date occurs two business days before the company's Record Date. To be entitled to a dividend a shareholder must have purchased the shares before

the ex-dividend date. If you purchase shares on or after that date, the previous owner of the shares (and not you) is entitled to the dividend.

Interim dividend A dividend paid during a year representing a return based on the previous six months' financial performance and the outlook for the future.

Final dividend A dividend paid during a year representing a return based on the previous twelve months' financial performance.

Special dividend A dividend paid by the company outside typical recurring (interim and final) dividend cycle.

Record date The record date is the date the share registries use in determining who is entitled to a dividend or entitlement associated with a security. Those who held the security in

the company and were on the register on the record date are eligible for the entitlement.

Payment date The date on which a declared dividend is scheduled to be paid.

Unfranked dividend Dividends which do not carry a franking credit.

Franked dividend Franked dividends are paid to security holders out of profits on which the company has already paid tax.

Franking /Imputation Credit A franking credit is your share of tax paid by a company on the profits from which your dividend are paid. They are also known as Imputation Credits.

Total subscription Total subscription can include, but are not limited to: CommSecIRESS fees, Morningstar research subscription fees and CommSec share trade alerts.

Other fees Other fees can include, but are not limited to: Off market transfer fees, conditional trading fees, rejection fees, early and late settlement fees, fail fees, SRN query,

rebooking fees, cheque payment fee or cheque dishonour fees and the printing and posting of contract notes.

Corporate action (CA) Any action initiated by the company or corporation, for the purpose of giving an entitlement to shareholders.

Generated 20 May 2020 Financial Year Summary Page 3 of 3

You might also like

- 2022EOFYSummaryDocument3 pages2022EOFYSummaryHanny KeeNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- 2020EOFYTransactionsDocument3 pages2020EOFYTransactionsManthan VekariyaNo ratings yet

- ndbjnnTjDocument2 pagesndbjnnTjlebogangmahlangu990No ratings yet

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet

- CPU - Financial Acctg & Reporting II - CHAPTER 2Document25 pagesCPU - Financial Acctg & Reporting II - CHAPTER 2Princess Jonabelle BaylonNo ratings yet

- FS - RAYOS, MARTIN JOSEPH M. 2020 - NotesDocument5 pagesFS - RAYOS, MARTIN JOSEPH M. 2020 - NotesMa Teresa B. CerezoNo ratings yet

- Afar 2 Module CH 9 & 10Document126 pagesAfar 2 Module CH 9 & 10Ella Mae TuratoNo ratings yet

- 600136659Document2 pages600136659subhamsavailable4714No ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Global Investment Centre - Statement - DocumentDocument11 pagesGlobal Investment Centre - Statement - DocumentjohnNo ratings yet

- DriveWealth 2020 Financial StatementDocument10 pagesDriveWealth 2020 Financial StatementMihai FoxNo ratings yet

- Afar NotesDocument6 pagesAfar NotesGio BurburanNo ratings yet

- FI - UITF - BPI Money Market Fund - May 2017Document3 pagesFI - UITF - BPI Money Market Fund - May 2017Yanyan RivalNo ratings yet

- Study Unit 20Document13 pagesStudy Unit 20Hazem El SayedNo ratings yet

- Entrepreneurship Quarter 2: Module10Document19 pagesEntrepreneurship Quarter 2: Module10Primosebastian Tarrobago0% (1)

- Acc708 Lecture 1Document16 pagesAcc708 Lecture 1Emjes GianoNo ratings yet

- 1 - Week Partnership FormationDocument24 pages1 - Week Partnership FormationAlrac Garcia100% (1)

- IndiaDocument6 pagesIndiachandra bhumiNo ratings yet

- Module 3 Divisible ProfitsDocument8 pagesModule 3 Divisible ProfitsVijay KumarNo ratings yet

- Ulipstatement 2Document2 pagesUlipstatement 2Shashwat DuggalNo ratings yet

- Sweda Arifah (1862201120)Document7 pagesSweda Arifah (1862201120)Sweda ArifahNo ratings yet

- Financial Management II 2020: Aims and Objectives After Completing This Chapter, You Should Have A Good Understanding ofDocument15 pagesFinancial Management II 2020: Aims and Objectives After Completing This Chapter, You Should Have A Good Understanding ofSintu TalefeNo ratings yet

- Assignment 2: Measuring and Reporting Assets and LiabilitiesDocument9 pagesAssignment 2: Measuring and Reporting Assets and LiabilitiesDerek DalgadoNo ratings yet

- Dividend Policy: FM, PGDM 2019-21Document27 pagesDividend Policy: FM, PGDM 2019-21chandel08No ratings yet

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanNo ratings yet

- AR201920Document185 pagesAR201920utkarsh tripathiNo ratings yet

- Accounting Principles and StandardsDocument6 pagesAccounting Principles and StandardswondmagegnNo ratings yet

- 2021 Annual Member StatementDocument9 pages2021 Annual Member Statementkz2w4tx6prNo ratings yet

- GICB - Annual Report 2017 PDFDocument40 pagesGICB - Annual Report 2017 PDFÛbř ÖňNo ratings yet

- Financial Accounting, 4eDocument71 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- Accounting For Franchise ContractsDocument7 pagesAccounting For Franchise ContractsRoi Martin A. De VeyraNo ratings yet

- Kunci Jawaban Advance Accounting Chapter 3Document25 pagesKunci Jawaban Advance Accounting Chapter 3jiajia67% (6)

- Earning Per ShareDocument22 pagesEarning Per Sharekimuli FreddieNo ratings yet

- Kotak Mahindra General Insurance Limited FY20Document80 pagesKotak Mahindra General Insurance Limited FY20Shreya AmboleNo ratings yet

- Vanguard VTIDocument110 pagesVanguard VTIRaka AryawanNo ratings yet

- Partnership Operations and Financial ReportingDocument50 pagesPartnership Operations and Financial ReportingMark Ambuang100% (1)

- Noa 2022Document2 pagesNoa 2022ragprasathNo ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- InstaSummary Report of SCOREME SOLUTIONS PRIVATE LIMITED - 28-07-2020Document11 pagesInstaSummary Report of SCOREME SOLUTIONS PRIVATE LIMITED - 28-07-2020RajiNo ratings yet

- Big Increase in Trade ReceivableseDocument4 pagesBig Increase in Trade ReceivableseShesharam ChouhanNo ratings yet

- Annual Statement: 1 July 2021 - 30 June 2022Document6 pagesAnnual Statement: 1 July 2021 - 30 June 2022Thong THAONo ratings yet

- Dividends: Factors Affecting Dividend PolicyDocument7 pagesDividends: Factors Affecting Dividend PolicyNouman MujahidNo ratings yet

- DriveWealth - June 2021 Unaudited Statement of Financial ConditionDocument9 pagesDriveWealth - June 2021 Unaudited Statement of Financial ConditionArchi OrtizNo ratings yet

- Mutual FundDocument2 pagesMutual FundSabiul HaquedNo ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityEduardo PerezNo ratings yet

- Dividend: HistoryDocument20 pagesDividend: Historyanup bhattNo ratings yet

- Name: Mehreen Khan ENROLL NO:01-112171-013 Submitted To: Mam Amal Khan Subject: Advance TaxationDocument7 pagesName: Mehreen Khan ENROLL NO:01-112171-013 Submitted To: Mam Amal Khan Subject: Advance TaxationMehreen KhanNo ratings yet

- PL Appropriation AcDocument6 pagesPL Appropriation AcShivangi Aggarwal100% (1)

- Page 1 of 23: AddressDocument23 pagesPage 1 of 23: AddressSanjayNo ratings yet

- Accenture Dividend FAQsDocument4 pagesAccenture Dividend FAQsxNo ratings yet

- Joaxjill NotesDocument6 pagesJoaxjill NotesAlliah Czyrielle Amorado PersinculaNo ratings yet

- M and MDocument478 pagesM and MAnoop KularNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- OfferLetterDocument15 pagesOfferLetterSai muleNo ratings yet

- 03 Zutter Smart MFBrief 15e ch03Document85 pages03 Zutter Smart MFBrief 15e ch03Komang MulianaNo ratings yet

- Jain Irrragation SytemDocument3 pagesJain Irrragation SytemMorya Zerox BuldanaNo ratings yet

- RWC Global Emerging Equity Fund: 30th June 2020Document2 pagesRWC Global Emerging Equity Fund: 30th June 2020Nat BanyatpiyaphodNo ratings yet

- The Ultimate First Year OT ExperienceDocument33 pagesThe Ultimate First Year OT Experiencesidney drecotteNo ratings yet

- Sydney Drecott: Date of Birth: Mydna Id: Pathology NoDocument22 pagesSydney Drecott: Date of Birth: Mydna Id: Pathology Nosidney drecotteNo ratings yet

- Radial Nerve Palsy Splint - UnisDocument10 pagesRadial Nerve Palsy Splint - Unissidney drecotteNo ratings yet

- Tlac 3.0 PDFDocument26 pagesTlac 3.0 PDFFook Ngo83% (6)

- Occupational Therapy Practice Educator Manual: Faculty of HealthDocument24 pagesOccupational Therapy Practice Educator Manual: Faculty of Healthsidney drecotteNo ratings yet

- Occupational Therapy Practice Educator Manual: Faculty of HealthDocument24 pagesOccupational Therapy Practice Educator Manual: Faculty of Healthsidney drecotteNo ratings yet

- Occupational Therapy Practice Educator Manual: Faculty of HealthDocument24 pagesOccupational Therapy Practice Educator Manual: Faculty of Healthsidney drecotteNo ratings yet

- Occupational Therapy's Role in Post Concussion Management: Aimil Parmelee, MOT, OTR/L Marlaina Montgomery, MOT, OTR/LDocument27 pagesOccupational Therapy's Role in Post Concussion Management: Aimil Parmelee, MOT, OTR/L Marlaina Montgomery, MOT, OTR/Lsidney drecotteNo ratings yet

- 2019EOFYSummaryDocument3 pages2019EOFYSummarysidney drecotteNo ratings yet

- Roles/scope of Practice of Disciplines in IRC: MedicalDocument5 pagesRoles/scope of Practice of Disciplines in IRC: Medicalsidney drecotteNo ratings yet

- Australian healthcare practitioners identify barriers to advance care planningDocument9 pagesAustralian healthcare practitioners identify barriers to advance care planningsidney drecotteNo ratings yet

- HSO408: Transition To Practice: Trimester 2 2019Document32 pagesHSO408: Transition To Practice: Trimester 2 2019sidney drecotteNo ratings yet

- HSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD PlansDocument8 pagesHSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD Planssidney drecotteNo ratings yet

- 2012 AWMA Pan Pacific Guidelines PDFDocument124 pages2012 AWMA Pan Pacific Guidelines PDFhidayat0781No ratings yet

- HSO408: Transition To Practice: Trimester 2 2019Document32 pagesHSO408: Transition To Practice: Trimester 2 2019sidney drecotteNo ratings yet

- Australian healthcare practitioners identify barriers to advance care planningDocument9 pagesAustralian healthcare practitioners identify barriers to advance care planningsidney drecotteNo ratings yet

- HSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD PlansDocument8 pagesHSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD Planssidney drecotteNo ratings yet

- Week 3 HSO408 2018 StudentsDocument22 pagesWeek 3 HSO408 2018 Studentssidney drecotteNo ratings yet

- Australian healthcare practitioners identify barriers to advance care planningDocument9 pagesAustralian healthcare practitioners identify barriers to advance care planningsidney drecotteNo ratings yet

- Best PracticeDocument11 pagesBest Practicesidney drecotteNo ratings yet

- HSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD PlansDocument8 pagesHSO 417 AT3 Critique and Analysis of The Implementation of Learning and CPD Planssidney drecotteNo ratings yet

- HSO408: Transition To Practice: Trimester 2 2019Document32 pagesHSO408: Transition To Practice: Trimester 2 2019sidney drecotteNo ratings yet

- Neuropsychological Rehabilitation Multiple Sclerosis RostiDocument84 pagesNeuropsychological Rehabilitation Multiple Sclerosis Rostisidney drecotteNo ratings yet

- Characterizing OT Practice Stroke Rehab RichardsDocument10 pagesCharacterizing OT Practice Stroke Rehab Richardssidney drecotteNo ratings yet

- Critical Analysis of an OT Field of PracticeDocument5 pagesCritical Analysis of an OT Field of Practicesidney drecotteNo ratings yet

- Current Trends Stroke Rehabilitation JohanssonDocument13 pagesCurrent Trends Stroke Rehabilitation Johanssonsidney drecotteNo ratings yet

- HSO408 Assessment Task 4 Oral PresentationDocument8 pagesHSO408 Assessment Task 4 Oral Presentationsidney drecotteNo ratings yet

- CDPHE PSD EPE Literature Review Critique ToolDocument2 pagesCDPHE PSD EPE Literature Review Critique ToolsleshiNo ratings yet

- Guidelines For Final Year Students Djerriwarrh Health ServicesDocument1 pageGuidelines For Final Year Students Djerriwarrh Health Servicessidney drecotteNo ratings yet

- Nike Inc Strategic Recommendation Report Part IDocument13 pagesNike Inc Strategic Recommendation Report Part IIkram Chakir100% (1)

- Mount ST Mary's CollegeDocument9 pagesMount ST Mary's CollegeIvan GutierrezNo ratings yet

- Removal of Corporate PresidentDocument5 pagesRemoval of Corporate PresidentDennisSaycoNo ratings yet

- NDMC vs Prominent Hotels Limited Delhi High Court Judgement on Licence Fee DisputeDocument84 pagesNDMC vs Prominent Hotels Limited Delhi High Court Judgement on Licence Fee DisputeDeepak SharmaNo ratings yet

- View - Print Submitted Form PassportDocument2 pagesView - Print Submitted Form PassportRAMESH LAISHETTYNo ratings yet

- Misconduct Policy: UrposeDocument4 pagesMisconduct Policy: Urposeali rezaNo ratings yet

- Trash Essay Emma LindheDocument2 pagesTrash Essay Emma Lindheapi-283879651No ratings yet

- A Cancer in The Army Identifying and Removing Toxic LeadersDocument47 pagesA Cancer in The Army Identifying and Removing Toxic LeadersFirebrand38No ratings yet

- What You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)Document26 pagesWhat You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)8thestate50% (2)

- 231 PC00165 - Cerificate English PDFDocument1 page231 PC00165 - Cerificate English PDFrajenrao51777564No ratings yet

- Rape Case AppealDocument11 pagesRape Case AppealEricson Sarmiento Dela CruzNo ratings yet

- Report On Sexual Abuse in The Catholic Church in FloridaDocument19 pagesReport On Sexual Abuse in The Catholic Church in FloridaABC Action NewsNo ratings yet

- Ticket(s) Issued : Flight DetailsDocument2 pagesTicket(s) Issued : Flight DetailswinstevenrayNo ratings yet

- The New Islamic Republic (The True Future of Islam)Document224 pagesThe New Islamic Republic (The True Future of Islam)mason4life100% (2)

- Chapter 1 1Document4 pagesChapter 1 1Arhann Anthony Almachar Adriatico67% (3)

- Römer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Document186 pagesRömer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Keith Hurt100% (1)

- Affidavit of Loss (Official Receipt)Document5 pagesAffidavit of Loss (Official Receipt)Christian GonzalesNo ratings yet

- Assessing Contribution of Research in Business To PracticeDocument5 pagesAssessing Contribution of Research in Business To PracticeAga ChindanaNo ratings yet

- TCS Configuration PDFDocument20 pagesTCS Configuration PDFrishisap2No ratings yet

- LLF 2017 ProgramDocument2 pagesLLF 2017 ProgramFasih Ahmed100% (2)

- Padua vs. People, G.R. No. 220913, February 04, 2019 FactsDocument3 pagesPadua vs. People, G.R. No. 220913, February 04, 2019 FactsRhea Mae A. SibalaNo ratings yet

- Name: - 2019 Political Documentary - War TV-14Document5 pagesName: - 2019 Political Documentary - War TV-14Yairetza VenturaNo ratings yet

- Neptel Company ProfileDocument12 pagesNeptel Company Profileghe12No ratings yet

- Sunnah Salah of FajrDocument8 pagesSunnah Salah of FajrAbdullah100% (2)

- AO6418 Tender ConditionsDocument4 pagesAO6418 Tender ConditionsBryan RodgersNo ratings yet

- Requirements For Marriage Licenses in El Paso County, Texas: Section 2.005. See Subsections (B 1-19)Document2 pagesRequirements For Marriage Licenses in El Paso County, Texas: Section 2.005. See Subsections (B 1-19)Edgar vallesNo ratings yet

- Annexure M - Bank Guarantee FormatDocument2 pagesAnnexure M - Bank Guarantee FormatRafikul RahemanNo ratings yet

- Secondary School Voluntary Secondary SchoolDocument1 pageSecondary School Voluntary Secondary SchoolvinayakNo ratings yet

- Arvin Lloyd D. SuniegaDocument3 pagesArvin Lloyd D. SuniegaApril Joy Sumagit HidalgoNo ratings yet

- Rifa A Rafi Al - TahtawiDocument17 pagesRifa A Rafi Al - TahtawiPauline Ochoa LeónNo ratings yet

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Business Buyout Agreements: Plan Now for All Types of Business TransitionsFrom EverandBusiness Buyout Agreements: Plan Now for All Types of Business TransitionsNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- How to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionFrom EverandHow to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionNo ratings yet

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2022From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2022No ratings yet

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet