Professional Documents

Culture Documents

Bustos V Millians Shoe (Jumamil)

Uploaded by

Homer Simpson0 ratings0% found this document useful (0 votes)

298 views2 pagesOriginal Title

2. Bustos v Millians Shoe (Jumamil)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

298 views2 pagesBustos V Millians Shoe (Jumamil)

Uploaded by

Homer SimpsonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

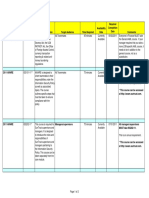

Bustos v Millians Shoe, Inc., G.R. No. 185024, 4 April 2017, FIRST DIVISION (Sereno, J.

Doctrine of the Case:

Doctrine of corporate entity (separate personality)

- a corporation has a legal personality separate and distinct from that of people

comprising it.

Facts:

Petitioner Bustos was able to win in a public auction a parcel of land that belonged to

Spouses Cruz. Said parcel of land was subject to a Stay Order by the RTC for the rehabilitation

proceedings for Millians Shoe, Inc. or MSI. Petitioner sought for the exclusion of the property of

the subject property stating that Spouses Cruz were mere stockholders and officers of MSI.

That the subject property is personally owned by Spouses Cruz and not part of the properties of

MSI. He further argued that since he had won the bidding of the property before the annotation

of the title, the auctioned property could no longer be part of the Stay Order.

The RTC denied the entreaty of Bustos. It ruled that because the period of redemption

had not yet lapsed at the time of the issuance of the Stay Order, the ownership thereof had not

yet been transferred to Bustos. Petitioner moved for reconsideration, but to no avail.

He then filed an action for certiorari before the CA. He asserted that the Stay Order

undermined the taxing powers of the local government unit. He also reiterated his arguments

that Spouses Cruz owned the property, and that the lot had already been auctioned to him. The

CA denied his motion. The said parcel of land which secured several mortgage liens for the

account of MSI remains to be an asset of the Cruz Spouses, who are the stockholders and

officers of MSI, classifying MSI as a close corporation. As an exception to the general rule, in a

close corporation, the stockholders and/or officers usually manage the business of the

corporation and are subject to all liabilities of directors, i.e. personally liable for corporate debts

and obligations. Thus, the Cruz Spouses being stockholders of MSI are personally liable for the

latter's debt and obligations.

Petitioner unsuccessfully moved for reconsideration. The CA maintained its ruling and

even held that his prayer to exclude the property was time-barred by the 10-day reglementary

period to oppose rehabilitation petitions under Rule 4, Section 6 of the Interim Rules of

Procedure on Corporate Rehabilitation Before this Court, petitioner maintains three points: (1)

the Spouses Cruz are not liable for the debts of MSI; (2) the Stay Order undermines the taxing

power of Marikina City; and (3) the time bar rule does not apply to him, because he is not a

creditor of MSI.

Issue:

Can the spouses Cruz be liable for the debts of MSI?

Ruling:

No. The CA erred in classifying MSI as a close corporation and in holding the subject

property liable. To be considered a close corporation, an entity must abide by the requirements

laid out in Section 96 of the Corporation Code, which reads:

Sec. 96. Definition and applicability of Title. - A close corporation, within the

meaning of this Code, is one whose articles of incorporation provide that:

(1) All the corporation's issued stock of all classes, exclusive of treasury shares,

shall be held of record by not more than a specified number of persons, not exceeding

twenty (20);

(2) all the issued stock of all classes shall be subject to one or more specified

restrictions on transfer permitted by this Title; and,

(3) The corporation shall not list in any stock exchange or make any public

offering of any of its stock of any class. Notwithstanding the foregoing, a corporation

shall not be deemed a close corporation when at least two-thirds (2/3) of its voting stock

or voting rights is owned or controlled by another corporation which is not a close

corporation within the meaning of this Code.

Here, neither the CA nor the RTC showed its basis for finding that MSI is a close corporation.

The courts a quo did not at all refer to the Articles of Incorporation of MSI. The Petition

submitted by respondent in the rehabilitation proceedings before the RTC did not even include

those Articles of Incorporation among its attachments.

However, Section 97 of the Corporation Code only specifies that "the stockholders of the

corporation shall be subject to all liabilities of directors." Nowhere in that provision do we find

any inference that stockholders of a close corporation are automatically liable for corporate

debts and obligations.

Parenthetically, only Section 100, paragraph 5, of the Corporation Code explicitly provides for

personal liability of stockholders of close corporation:

Sec. 100. Agreements by stockholders. - 5. To the extent that the stockholders are

actively engaged in the management or operation of the business and affairs of a close

corporation, the stockholders shall be held to strict fiduciary duties to each other and

among themselves. Said stockholders shall be personally liable for corporate torts

unless the corporation has obtained reasonably adequate liability insurance.

Thus applying the general doctrine of separate juridical personality, which provides that a

corporation has a legal personality separate and distinct from that of people comprising

it. By virtue of that doctrine, stockholders of a corporation enjoy the principle of limited liability:

the corporate debt is not the debt of the stockholder. Thus, being an officer or a stockholder

of a corporation does not make one's property the property also of the corporation.

You might also like

- Bustos vs. Millians Shoe, Inc.Document4 pagesBustos vs. Millians Shoe, Inc.Francis Coronel Jr.100% (1)

- PDF 6 Case Republic Planters Bank Vs Agana Corporation LawDocument2 pagesPDF 6 Case Republic Planters Bank Vs Agana Corporation LawPatatas SayoteNo ratings yet

- Sulo NG Bayan Vs AranetaDocument1 pageSulo NG Bayan Vs AranetaIan Jala Calmares100% (1)

- GR Nos. 163356 57Document3 pagesGR Nos. 163356 57Karen Gina DupraNo ratings yet

- Western Institute v. SalasDocument3 pagesWestern Institute v. SalasTricia SandovalNo ratings yet

- Filipinas Port Case DigestDocument2 pagesFilipinas Port Case DigestMaine Antonio GuzmanNo ratings yet

- 9 Teresa Electric Power v. PSCDocument2 pages9 Teresa Electric Power v. PSCJul A.No ratings yet

- Cua V TanDocument2 pagesCua V TanJohn Roel VillaruzNo ratings yet

- Gala v. Ellice Agro-Industrial CorpDocument3 pagesGala v. Ellice Agro-Industrial CorpMaria Analyn100% (2)

- ABS CBN vs. HilarioDocument3 pagesABS CBN vs. HilarioAnneNo ratings yet

- Tee Ling Kiat Vs Ayala CorpDocument2 pagesTee Ling Kiat Vs Ayala CorpAisha TejadaNo ratings yet

- Phil Trust Co Vs RiveraDocument1 pagePhil Trust Co Vs RiveraCJNo ratings yet

- Ong Yong Vs TiuDocument2 pagesOng Yong Vs TiuInnah Agito-RamosNo ratings yet

- Doctrine of Separate Judicial Personality - Linden V Meridien GR 211969Document2 pagesDoctrine of Separate Judicial Personality - Linden V Meridien GR 211969Amia Shun100% (3)

- Islamic Vs CA DigestDocument1 pageIslamic Vs CA DigestMarry Lasheras100% (1)

- Pirovano V Dela RamaDocument2 pagesPirovano V Dela RamaPio Guieb AguilarNo ratings yet

- Valle Verde Country Club v. AfricaDocument2 pagesValle Verde Country Club v. AfricaRap Santos100% (1)

- Revised-Philippine Veterans Bank V CallanganDocument1 pageRevised-Philippine Veterans Bank V CallanganAljenneth MicallerNo ratings yet

- DIGEST - Y-I LEISURE PHILIPPINES, INC., YATS INTERNATIONAL LTD. AND Y-I CLUBS AND RESORTS, INC., Petitioners, v. JAMES YU, Respondent. G.R. No. 207161, September 08, 2015Document3 pagesDIGEST - Y-I LEISURE PHILIPPINES, INC., YATS INTERNATIONAL LTD. AND Y-I CLUBS AND RESORTS, INC., Petitioners, v. JAMES YU, Respondent. G.R. No. 207161, September 08, 2015Astrid Gopo BrissonNo ratings yet

- EJ - TAM WING TAK, Petitioner, Vs. HON. RAMON P. MAKASIAR (in His Capacity as Presiding Judge of the Regional Trial Court of Manila, Branch 35) and ZENON de GUIA (in His Capacity as Chief State Prosecutor), Respondents.Document1 pageEJ - TAM WING TAK, Petitioner, Vs. HON. RAMON P. MAKASIAR (in His Capacity as Presiding Judge of the Regional Trial Court of Manila, Branch 35) and ZENON de GUIA (in His Capacity as Chief State Prosecutor), Respondents.Ej TuringanNo ratings yet

- Grace Christian High School Vs CADocument1 pageGrace Christian High School Vs CAIan Jala Calmares0% (1)

- Bataan Shipyard Engineering Co Vs PCGGDocument2 pagesBataan Shipyard Engineering Co Vs PCGGpresjm100% (2)

- 101 - Republic vs. Acoje Mining Co.Document2 pages101 - Republic vs. Acoje Mining Co.mimiyuki_No ratings yet

- 172 - Villongco v. YabutDocument2 pages172 - Villongco v. YabutPre Pacionela100% (1)

- Lim VS MoldexDocument2 pagesLim VS MoldexMark Anjo Atienza100% (1)

- Manuel Torres, Jr. Vs Court of Appeals - DigestedDocument1 pageManuel Torres, Jr. Vs Court of Appeals - Digestedgherold benitezNo ratings yet

- Singian v. SandiganbayanDocument1 pageSingian v. SandiganbayanIvee OngNo ratings yet

- Edward J Nell V Pacific FarmsDocument1 pageEdward J Nell V Pacific FarmsJepoy Francisco100% (1)

- Magsaysay-Labrador vs. CADocument1 pageMagsaysay-Labrador vs. CAKris Cancino100% (2)

- Cagayan Valley Drug Corporation V CirDocument1 pageCagayan Valley Drug Corporation V CirArnaldo DomingoNo ratings yet

- Mindanao Savings and Loan Association, Et Al. v. Willkom, Et Al.Document1 pageMindanao Savings and Loan Association, Et Al. v. Willkom, Et Al.CheChe100% (1)

- 3-Corpo-Macasaet VS Co. JRDocument2 pages3-Corpo-Macasaet VS Co. JRCzarina Lynne YeclaNo ratings yet

- Zuellig Freight v. NLRCDocument1 pageZuellig Freight v. NLRClovekimsohyun89No ratings yet

- People's Aircargo Vs CA Case DigestDocument2 pagesPeople's Aircargo Vs CA Case DigestKarlo Marco Cleto100% (1)

- 095 Lee Vs CADocument2 pages095 Lee Vs CAjoyce100% (3)

- 146 - Nell v. Pacific Farms Inc.Document2 pages146 - Nell v. Pacific Farms Inc.MariaHannahKristenRamirezNo ratings yet

- Republic Planters Bank Vs AganaDocument2 pagesRepublic Planters Bank Vs AganaHoven Macasinag100% (2)

- Associated Bank V SPS PronstrollerDocument2 pagesAssociated Bank V SPS PronstrollerArnaldo DomingoNo ratings yet

- Wesleyan University-Philippines v. Maglaya, Sr.Document2 pagesWesleyan University-Philippines v. Maglaya, Sr.Donnie Ray Olivarez SolonNo ratings yet

- Bataan Shipyard V PCGGDocument3 pagesBataan Shipyard V PCGGAnn QuebecNo ratings yet

- Filipinas Broadcasting Network, Inc., vs. Ago Medical and Educational Center-Bicol Christian College of Medicine, (Amec-Bccm) and Angelita F. AgoDocument2 pagesFilipinas Broadcasting Network, Inc., vs. Ago Medical and Educational Center-Bicol Christian College of Medicine, (Amec-Bccm) and Angelita F. AgoJoseph AspiNo ratings yet

- Cruz v. DalisayDocument1 pageCruz v. DalisayJL A H-DimaculanganNo ratings yet

- Demetrio Ellao vs. Barangas Electric CoopDocument2 pagesDemetrio Ellao vs. Barangas Electric Coopchris0% (1)

- Hall, Et. All v. Piccio, 86 Phil 603Document2 pagesHall, Et. All v. Piccio, 86 Phil 603Charmila SiplonNo ratings yet

- Roque v. People G.R. 211108Document3 pagesRoque v. People G.R. 211108Jr Maitem100% (1)

- Agdao V MaramionDocument3 pagesAgdao V MaramionGlenn Mikko Mendiola100% (1)

- Digest. Sci-Nacusip vs. NWPC 269 Scra 173 (1997)Document2 pagesDigest. Sci-Nacusip vs. NWPC 269 Scra 173 (1997)IamIvy Donna PondocNo ratings yet

- Singian vs. SandiganbayanDocument2 pagesSingian vs. SandiganbayanRaven Claire MalacaNo ratings yet

- Bataan Shipyard Engineering Co., Inc. vs. PCGG (G.R. No. 75885 May 27, 1987) FactsDocument2 pagesBataan Shipyard Engineering Co., Inc. vs. PCGG (G.R. No. 75885 May 27, 1987) FactsJohn AmbasNo ratings yet

- GR 113032 Case DigestDocument2 pagesGR 113032 Case DigestLindsay MillsNo ratings yet

- Concept Builders Vs NLRCDocument2 pagesConcept Builders Vs NLRCBion Henrik PrioloNo ratings yet

- 202 - Lim vs. Lim-YuDocument2 pages202 - Lim vs. Lim-YuAdi HernandezNo ratings yet

- Global Business Holdings, Inc. v. Surecomp Software, B.V.Document1 pageGlobal Business Holdings, Inc. v. Surecomp Software, B.V.CheCheNo ratings yet

- FS Velasco Company v. Madrid 2015Document2 pagesFS Velasco Company v. Madrid 2015nathNo ratings yet

- 05 Donina Halley vs. Printwell, IncDocument2 pages05 Donina Halley vs. Printwell, IncrbNo ratings yet

- Missionary Sisters of Our Lady of Fatima vs. Alzona DigestDocument4 pagesMissionary Sisters of Our Lady of Fatima vs. Alzona DigestEmir Mendoza100% (2)

- Jiao vs. NLRCDocument1 pageJiao vs. NLRCApureelRoseNo ratings yet

- G.R. No. 181455-56 Case DigestDocument2 pagesG.R. No. 181455-56 Case DigestKevin Jeason PerdidoNo ratings yet

- The Case Involved Rehabilitation Proceedings For - The Property Was Included in A Stay Order Issued by The RTCDocument18 pagesThe Case Involved Rehabilitation Proceedings For - The Property Was Included in A Stay Order Issued by The RTCJude Thaddeus DamianNo ratings yet

- Pendens Were Annotated. These Markings Indicated That SEC Corp. Case No. 036-04, Which Was Filed BeforeDocument2 pagesPendens Were Annotated. These Markings Indicated That SEC Corp. Case No. 036-04, Which Was Filed BeforeJohn BasNo ratings yet

- Ancheta v. Dalaygon, 490 SCRA 140Document20 pagesAncheta v. Dalaygon, 490 SCRA 140Homer SimpsonNo ratings yet

- Bellis vs. Bellis, 20 SCRA 358, June 06, 1967Document7 pagesBellis vs. Bellis, 20 SCRA 358, June 06, 1967KPPNo ratings yet

- in Re Probation of The Will of Jose Riosa, 39 Phil., 23Document7 pagesin Re Probation of The Will of Jose Riosa, 39 Phil., 23Homer SimpsonNo ratings yet

- The Matter of The Testate Estate of Edward Christensen, Adolfo Aznar and Lucy Christensen vs. Helen Christensen GarciaDocument15 pagesThe Matter of The Testate Estate of Edward Christensen, Adolfo Aznar and Lucy Christensen vs. Helen Christensen GarciaJerome ArañezNo ratings yet

- 3) Enriquez, Et Al. vs. Abadia (95 Phil 627)Document6 pages3) Enriquez, Et Al. vs. Abadia (95 Phil 627)Shien TumalaNo ratings yet

- Child Learning Center, Inc. v. Tagario (Valeros)Document2 pagesChild Learning Center, Inc. v. Tagario (Valeros)Homer SimpsonNo ratings yet

- Maricalum Mining Corporation v. Florentino (DATILES)Document4 pagesMaricalum Mining Corporation v. Florentino (DATILES)Homer SimpsonNo ratings yet

- 26) Sevilla vs. Court OfAppealsDocument15 pages26) Sevilla vs. Court OfAppealsDar CoronelNo ratings yet

- Heirs of Pajarillo v. CA (Sales)Document3 pagesHeirs of Pajarillo v. CA (Sales)Homer Simpson100% (1)

- Zambrano v. Phil. CarpetDocument2 pagesZambrano v. Phil. CarpetHomer Simpson100% (1)

- Lao v. NLRC (Hilario)Document2 pagesLao v. NLRC (Hilario)Homer SimpsonNo ratings yet

- First International v. CA, 252 SCRA 259Document56 pagesFirst International v. CA, 252 SCRA 259Homer SimpsonNo ratings yet

- Abs-Cbn v. Hilario (Alariao)Document3 pagesAbs-Cbn v. Hilario (Alariao)Homer SimpsonNo ratings yet

- Republic v. Evangelista, 466 SCRA 544Document13 pagesRepublic v. Evangelista, 466 SCRA 544Homer SimpsonNo ratings yet

- People Vs ChowduryDocument14 pagesPeople Vs ChowduryEmma Ruby Aguilar-ApradoNo ratings yet

- Bache & Co. v. Ruiz (Santiago)Document1 pageBache & Co. v. Ruiz (Santiago)Homer SimpsonNo ratings yet

- Veterans Federation v. Reyes (Santos)Document1 pageVeterans Federation v. Reyes (Santos)Homer SimpsonNo ratings yet

- Liban v. Gordon (Valeros)Document4 pagesLiban v. Gordon (Valeros)Homer SimpsonNo ratings yet

- Fontanilla v. Maliaman, 179 SCRA 685Document12 pagesFontanilla v. Maliaman, 179 SCRA 685Homer SimpsonNo ratings yet

- Feliciano v. COA (Sta. Ana)Document1 pageFeliciano v. COA (Sta. Ana)Homer SimpsonNo ratings yet

- Boy Scout of The Philippines v. COA (Sales)Document2 pagesBoy Scout of The Philippines v. COA (Sales)Homer SimpsonNo ratings yet

- UP v. Dizon (Sta. Ana)Document1 pageUP v. Dizon (Sta. Ana)Homer SimpsonNo ratings yet

- (Case Digest) Fuji Television v. Espiritu, 744 SCRA 31, 3 Dec. 2014Document3 pages(Case Digest) Fuji Television v. Espiritu, 744 SCRA 31, 3 Dec. 2014Homer SimpsonNo ratings yet

- Stradcom v. OrpillaDocument2 pagesStradcom v. OrpillaHomer SimpsonNo ratings yet

- Stradcom v. OrpillaDocument2 pagesStradcom v. OrpillaHomer SimpsonNo ratings yet

- Homar v. People, 768 SCRA 584Document1 pageHomar v. People, 768 SCRA 584Homer Simpson100% (1)

- Simon v. CHR (Digest)Document2 pagesSimon v. CHR (Digest)Homer SimpsonNo ratings yet

- (Digest) Republic v. Sunvar, 674 SCRA 320, 20 Jun. 2012Document2 pages(Digest) Republic v. Sunvar, 674 SCRA 320, 20 Jun. 2012Homer SimpsonNo ratings yet

- International Woodland Vs UP (Digest)Document2 pagesInternational Woodland Vs UP (Digest)Homer SimpsonNo ratings yet

- Aligarh Muslim University: Malappuram Centre, KeralaDocument16 pagesAligarh Muslim University: Malappuram Centre, KeralaHarendra TeotiaNo ratings yet

- Marketing Cost Etc. ConceptsDocument27 pagesMarketing Cost Etc. ConceptsMOHIT CHAUDHARYNo ratings yet

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxDocument27 pagesChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaNo ratings yet

- Internship Report On Capital Structure of Islamic Bank LimitedDocument47 pagesInternship Report On Capital Structure of Islamic Bank LimitedFahimNo ratings yet

- Revised Booking - Confirmation - EBKG06645778Document4 pagesRevised Booking - Confirmation - EBKG06645778Ribeiro Eugenio SardenhaNo ratings yet

- Chapter 4Document2 pagesChapter 4Dai Huu0% (1)

- DONE Sumifru Philippines Corp. vs. Nagkahiusang Mamumuo Sa Sayapa FarmDocument2 pagesDONE Sumifru Philippines Corp. vs. Nagkahiusang Mamumuo Sa Sayapa FarmKathlene JaoNo ratings yet

- Duke Cannon Inv 88607Document2 pagesDuke Cannon Inv 88607api-609272624No ratings yet

- Citi Bank Card PaymentsDocument6 pagesCiti Bank Card PaymentsMohd AtNo ratings yet

- Who Owns Offshore Real Estate? Evidence From DubaiDocument46 pagesWho Owns Offshore Real Estate? Evidence From Dubaiatlatszo100% (1)

- Central Action Plan 2021-22Document73 pagesCentral Action Plan 2021-22raj27385No ratings yet

- MKTG446 Case 12-2Document2 pagesMKTG446 Case 12-2kanyaNo ratings yet

- LAtihan CH 18Document19 pagesLAtihan CH 18laurentinus fikaNo ratings yet

- Interface Between Government and Public EnterprisesDocument21 pagesInterface Between Government and Public EnterprisesGemechu BirehanuNo ratings yet

- Preparation of Annual Accounts GuidelineDocument23 pagesPreparation of Annual Accounts Guidelinenancy amooNo ratings yet

- Parts of Business PlanDocument4 pagesParts of Business PlanClaudineNo ratings yet

- Audit of Shareholders' Equity - July 22, 2021Document35 pagesAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNo ratings yet

- Fidelity InvestmentsDocument1 pageFidelity InvestmentsJack Carroll (Attorney Jack B. Carroll)No ratings yet

- 2000 Oxfam Tax Havens Releasing Hidden Billions To Poverty EradicationDocument26 pages2000 Oxfam Tax Havens Releasing Hidden Billions To Poverty EradicationJuan Enrique ValerdiNo ratings yet

- Utility Bill Template 01Document2 pagesUtility Bill Template 01Ooo SssNo ratings yet

- BS FormatDocument12 pagesBS Formatsudershan90% (1)

- Aptitude Part ThreeDocument3 pagesAptitude Part ThreeAddisu Zeleke100% (1)

- Final Exam FundDocument5 pagesFinal Exam FundISee YouNo ratings yet

- Can Fin Homes LTD., Branch Address CIN No. L85110KA1987PLC008699Document2 pagesCan Fin Homes LTD., Branch Address CIN No. L85110KA1987PLC008699swaroop24x7No ratings yet

- Jundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetDocument4 pagesJundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetMeroz JunditNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- Intermediate Accounting 2: Hkfrs 13Document8 pagesIntermediate Accounting 2: Hkfrs 13tinna makNo ratings yet

- LKPM Q2 2022Document4 pagesLKPM Q2 2022Iqbal HattaNo ratings yet

- Situational AnalysisDocument9 pagesSituational AnalysisPratyaksh JainNo ratings yet

- All SonsDocument14 pagesAll SonsMay BalangNo ratings yet