Professional Documents

Culture Documents

Hewlett-Packard Company Business Impact Analysis Report For BCP Project Qiib

Uploaded by

Xavi MilanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hewlett-Packard Company Business Impact Analysis Report For BCP Project Qiib

Uploaded by

Xavi MilanCopyright:

Available Formats

Hewlett-Packard Company

Business Impact Analysis

Report for

BCP Project

QIIB

Prepared by: Tomas Nilsson MBCI

Senior Consultant

tomas.nilsson@hp.com

Project Document Id: BIA Report

Date Prepared: 2008-01-11

BIA Report

Project ID No.:

Document Information

Project Name: BCP Project

Prepared By: Tomas Nilsson MBCI Document Version No: 1.4

Title: Senior Consultant Document Version Date: 2008-02-06

Reviewed By: Ahmed Tawfiq Review Date: 2008-02-06

Distribution List

From Date Phone/Fax/Email

Tomas Nilsson 2008-02-06 tomas.nilsson@hp.com

To Action* Due Date Phone/Fax/Email

Ahmed Tawfiq Approve 2008-02-06 ahmedtawfiq@qiib.com.qa

* Action Types: Approve, Review, Inform, File, Action Required, Attend Meeting, Other (please specify)

Version History

Ver. No. Ver. Date Revised By Description Reviewer Status

0.1 2008-01-07 TN First draft Self Completed

0.2 2008-01-09 TN Phase 1 analysis Self Completed

0.3 2008-01-11 TN Findings compilation, exec summary Self Completed

1.0 2008-01-11 TN Final Draft AT Completed

1.1 2008-01-22 TN Final following client review TN n/a

1.2 2008-01-28 TN Final (staff observation added after review) AT Completed

1.3 2008-02-06 TN Final after additional QIIB review BC Commit. Completed

1.4 2008-02-06 TN Final after Committee review/workshop Approval

HP Global Method HP Restricted Page 2 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Table of Contents

Proprietary Notice.............................................................................................................................................. 4

1 Executive Summary................................................................................................................................... 5

1.1 Summary of Key Findings.................................................................................................................. 5

1.2 Summary of Main Recommendations................................................................................................6

2 Introduction................................................................................................................................................ 7

3 Acknowledgements.................................................................................................................................... 8

4 Scope, Objectives and Approach............................................................................................................. 9

4.1 Scope................................................................................................................................................ 9

4.2 Objectives.......................................................................................................................................... 9

4.3 Approach........................................................................................................................................... 9

5 Business Impact Analysis....................................................................................................................... 10

5.1 Purpose........................................................................................................................................... 10

5.2 General Observations...................................................................................................................... 10

5.3 Findings & Recommendations......................................................................................................... 10

5.4 Business Impacts............................................................................................................................ 13

5.4.1 Financial Impacts............................................................................................................................ 13

5.4.2 Qualitative Impacts.......................................................................................................................... 14

5.5 Recovery Time and Recovery Point Objectives...............................................................................15

5.5.1 IT Systems...................................................................................................................................... 15

5.6 Phone & Fax.................................................................................................................................... 17

5.7 Priorities........................................................................................................................................... 17

5.8 Critical Staff by Department............................................................................................................. 18

5.9 Dependence on Key Staff................................................................................................................ 19

5.10 Facilities and Services..................................................................................................................... 20

5.11 Critical Documents.......................................................................................................................... 20

5.12 Critical Suppliers.............................................................................................................................. 21

6 Recommended Action............................................................................................................................. 22

Appendix A - Contributors.............................................................................................................................. 23

Appendix B – RTO & RPO................................................................................................................................. 24

HP Global Method HP Restricted Page 3 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Proprietary Notice

No part of this document (including any designs) may be reproduced in any form, published, broadcast or

transmitted or have an adaptation made of it, except with the prior written permission of Hewlett-Packard

Company to parties outside of QIIB.

Hewlett Packard makes no warranty of any kind concerning this document, including, but not limited to, the

implied warranties of merchantability and fitness for a particular purpose. Hewlett Packard shall not be liable for

errors contained herein or direct indirect, special incidental or consequential damages concerning the

furnishing, performance, or use of this material.

© Copyright 2007 Hewlett-Packard Company

HP Global Method HP Restricted Page 4 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

1 Executive Summary

Qatar International Islamic Bank (QIIB) has initiated a business continuity project, of which this

Business Impact Analysis (BIA) is the first step. The objective of this effort is to identify critical

business functions and to determine their business continuity requirements regarding people, data

and underpinning IT systems. This BIA addresses all business functions, primarily undertaken at

the QIIB headquarter and main branch site in Doha.

1.1 Summary of Key Findings

There is a high dependency on hard copy documentation, for which there is no resilience. These

files are often poorly protected, and the volumes are huge. The frequent usage of most hard

copy documentation presents an added challenge.

There is a strong and growing reliance on the IT infrastructure. IT is however not utilised to its full

extent, business processes are largely still manual and paper based.

Some critical business functions rely heavily on standalone PC applications, without utilising

available central backup capability.

There are virtually no manual fallback procedures for the functions relying on central IT.

There is not much current disaster readiness, only a limited IT DR solution for the AS/400

environment. The plan to establish a new DR site in Wakrah is a major step in the right direction.

BCP maturity is low, but all department heads and most interviewees appreciate the need for

improvement. There are no resources allocated to implement and maintain a business continuity

programme.

Recovery Time Objectives (i.e. the tolerable downtime according to users) for IT systems range

from virtually 0 to 2 weeks. Most IT managed systems has an RTO of 48 hours or less. This is

currently not achievable.

Recovery Point Objectives (i.e. the tolerable level of data loss) was either 0 (i.e. no data loss) or

24 hours (i.e. to the backup point of the day before). This should be achievable with the current

replication and backup regime, with the exception of critical standalone PCs.

Printing and mailing of statements and bills requires special equipment and is a single point of

failure.

HP Global Method HP Restricted Page 5 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

From a total headcount of approx. 150 (at the main site) 68 are deemed to be required within 4

hours, and up to 93 over the next few days. Assuming the main branch staff will relocate to

various other branches. Office space available at the (planned) Wakrah DR site and the Hilal

Call Centre should meet the immediate requirements.

Some departments seen to be critically understaffed. In some cases critical business functions

stand or fall with one single individual. The reliance on a largely expatriate workforce presents an

added risk.

1.2 Summary of Main Recommendations

These recommendations are mostly high level, and such that more or falls outside the scope of the on-going

BCP project. More specific recommendations will be presented in the sub-sequent Continuity Strategy

Document, which will be based on this BIA report and the Risk Assessment report.

Assign a full time Business Continuity Manager and plan for resources required to maintain the

total BC programme over time.

On completion of the initial BCP project, plan for on-going training and awareness activities.

Update documentation of business processes, departmental procedures and staff contact

information to facilitate recovery and to reduce people dependency. Also consider some process

re-engineering, to get away from hard copy dependency as far as possible.

Assess from all aspects (legal, regulatory, technical etc.) all possible options to duplicate or

digitalise critical hard copy documents. Additionally, review physical storage for critical paper

documents both on and off site. Identify those documents that require extra protection, especially

those that are difficult or impossible to recreate.

Prepare and commission the Wakrah DR facility as soon as possible.

Assess the availability of commercially available provisioning of workplace recovery space and

ship-to-site IT recovery services in Qatar.

Ensure there is a contingency solution for printing and mailing.

Review current replication and backup regime against stated RPOs (when verified). Consider

moving backup equipment to another location.

Check contractual obligations with vendors and suppliers in the event of a “disaster” or major

incident, e.g. do all relevant contracts have a “force majeure” clause, are there clear continuity

clauses in SLAs (if applicable)? Establishing SLA’s between Information Services and the

businesses could also be considered.

Check the level of Business Continuity capability/provision for key suppliers, especially where

they are a single-source supplier (e.g. NI, G4S), consider alternate supplier arrangements.

Reduce reliance on key members of staff (and if at all possible of expatriates) by cross training

and succession planning.

HP Global Method HP Restricted Page 6 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

2 Introduction

Qatar International Islamic Bank (QIIB) is the leading Islamic bank in Qatar, managing 8 Billion QAR

of assets & equity and employing 310 staff. Islamic banking is a rapidly growing business, prompting

more and more banks to offer Islamic banking services. This increases the competitive pressure on

QIIB. Qatar Central Bank (QCB), the governing body of the Qatari financial services sector, has

recently regulated that a business continuity programme is mandatory for all banks. To protect its

competitiveness and to meet regulatory requirements QIIB has therefore initiated a business

continuity project with the objective to implement a business continuity programme. The first and

significant step of that process is to conduct a Business Impact Analysis (BIA).

The BIA interviews were conducted by Tomas Nilsson MBCI between 11 th December and 18th December

2007, and are part of the QIIB Business Continuity Management project encompassing this BIA, a risk

assessment of the security and infrastructure of the site, a Business Continuity plan framework, and a

policy document. Information was gathered via questionnaire and interviews with client selected

personnel. The results were validated by the QIIB project lead, Mr. Ahmed Tawfiq.

This document summarises the findings from the BIA study of QIIB operations within the Doha

headquarter and main branch site. It describes how the business operations would be impacted in

the event of a disaster or major incident affecting this site. The report also considers appropriate

Business Continuity Management (BCM) strategies and makes recommendations for ensuring the

strategy and recovery solutions meet the requirements of the business.

It should be read in conjunction with the Risk Assessment conducted by Bob Draper FBCI between

8th January and 11th January 2008.

HP Global Method HP Restricted Page 7 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

3 Acknowledgements

The author would like to take this opportunity to thank all QIIB participants and contributors to the

study - a list can be found in Appendix A – who gave their time and responded positively to requests

for information, and in particular Mr Ahmed Tawfiq for coordinating this effort and for his hospitality.

HP Global Method HP Restricted Page 8 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

4 Scope, Objectives and Approach

4.1 Scope

The business functions addressed by the BIA comprise the following:

Executive and administrative Head Office functions

Corporate & Commercial Banking functions

Primary and DR Data Centres

Branch Offices

(A detailed list of departments/functions addressed can be seen in Appendix A).

The sites addressed by the BIA comprise the following:

Bank Street Doha Headquarter site and Main branch

Salwa Road Branch Office and current DR site

Not in scope is:

Any other QIIB location/business function

4.2 Objectives

Identify critical business functions and supporting systems

Identify Recovery Time and Recovery Point Objectives (RTO and RPO)

Summarise recovery requirements over time (people, facilities, IT)

Identify vital records required for recovery

Produce BIA report

4.3 Approach

Information was gathered from key personnel from each business area via interviews and associated

questionnaire. A list of interviewees can be found in Appendix A.

The results were consolidated by the author and validated by Mr. Ahmed Tawfiq. It is this validated

impact analysis and IT systems information that is contained in this report.

The questionnaire forms used have been typed up and will be made available to QIIB. T hey must however

not be regarded as a formal part of, or appendices to, this report.

HP Global Method HP Restricted Page 9 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

5 Business Impact Analysis

5.1 Purpose

The Business Impact Analysis (BIA) study identifies those parts of a business whose loss has the

potential for significant impact, threat to the company’s reputation or cause of internal disruption. It

also identifies the various resources needed to recover essential business functions. This

information is used as the basis for identifying an appropriate Business Continuity Management

strategy.

5.2 General Observations

Islamic banking is largely collateral based, and the financial products offered differ in most cases significantly

from those offered by commercial banks. In a BCP context this has two main implications; the heavy

dependence of hard copy documentation requiring a lot of manual processes, and the lack of commercially

available application software requiring a lot of software development and maintenance to be conducted in-

house.

Although IT is used for the most banking functions, it has not been utilised to a full extent. Overall QIIB

business is hard copy based, primarily because of the nature of Islamic banking but also by tradition. One

Assistant General Manager stated during the interview that “we want to get away from the papers”, so there is

certainly room for improvement. Business processes are mainly manual, and not always documented. This

situation has caused a high level of people dependency which poses a risk in continuity as well as pure

business terms.

Current disaster readiness is very limited. There is no corporate BCP programme, only a limited IT DR solution

for the AS/400 environment. Overall BCP maturity is low, although all department heads and most

interviewees appreciate the need for improvement.

5.3 Findings & Recommendations

The most time critical functions identified are the ones directly related to daily transaction

management and are client interfacing. A failure of those functions will cause damage within a

single day and are very visible. Less time critical functions, such as treasury, reconciliation and

risk management, becomes critical after a few days, but are probably more critical to the banks

survival over time.

Central Operations is most probably the single most critical business function. Although the direct

impact of a disaster will first affect the business functions, nothing can be resumed without the

back-office functions provided by Central Operations.

Most departments are inter-dependent and the inability of one to produce its output has a serious

knock-on effect to the others. There is a significant reliance on the IT infrastructure and the bank

could not survive without IT support. IT will become even more critical as electronic banking

services are introduced.

The IS/IT environment is well documented and managed.

Although IT is extremely critical, it is not utilised to a full extent. Most critical processes include a

significant amount of manual processing, e.g. front office – back office interface ismissing for

HP Global Method HP Restricted Page 10 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

some functions. All trading and treasury notifications (within International Banking), including

SWIFT tickets, are on paper. It is significant that the more complex products and services,

typically involving higher amounts and risk, the more manual processing is required.

Manual processing must therefore be considered in a Business Continuity Plan, but this will be a

complex task since these processes are not always well documented.

Streamlining and documenting these processes, utilising more IT support, would have the

combined benefit of improving productivity and facilitating recovery.

There are no practical manual fallback procedures for the fundamental banking functions such as

transfers and record keeping, so there is no question that the bank will not survive without

access to its IT infrastructure.

It is hence imperative that the IT systems are recovered within a very short time following an

incident.

Several critical functions, primarily at within treasury, risk management and the business

departments, rely heavily on MS-Office applications running on standalone PCs. These are not

always backed up properly and neither are the applications (typically advanced Excel

spreadsheets) controlled in a secure way.

It is imperative that provisions are made to make PC based IT tools, and associated data,

recoverable within the timeframes identified.

Recovery Time Objectives (RTO) for IT systems range from virtually 0 to 2 weeks. Most IT

managed systems has an RTO of 48 hours or less.

To ensure that an RTO of 12 hours or less can be met requires dedicated standby servers to be

available at a recovery site with applications pre-loaded and some form of data mirroring or

replication. An RTO in the area of 0 in addition requires the utilisation of cluster and/or automatic

failover technology.

An RTO of 1 day (24 hours) requires either dedicated standby hardware or a 3 rd party contract

for hardware provision at an alternative site within a very short time (the availability of such

services is however limited in Qatar). System/data restores may be performed from offsite

backup tapes.

An RTO of 2-3 days or longer can be achieved either via an equipment ship-in contract (again,

this service is not easily obtained in Qatar), or by procuring equipment post-incident, but with this

method availability cannot be guaranteed.

Practically, dedicated standby equipment is probably required to meet any RTO less than a

week or two.

Recovery Point Objectives (RPO) are either 0 (i.e. no data loss) or 24 hours (i.e. last

backup). For systems hosted by IT this should be achievable with the existing backup strategies,

but needs to be confirmed.

HP Global Method HP Restricted Page 11 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

The big issue here is the data kept on standalone PCs, for which the backup regime is not

sufficient to meet an RPO of 24 hours.

All data on the AS/400 is mirrored to the DR site, which facilitates an RPO of (close to) 0 for

most core banking applications.

The existing backup strategy involves daily backups, which would generally result in recovered

data being up to 24 hours old. Backup tapes are moved off site within Doha daily. An even

better solution would be to move the backup device to the DR site. QCB mandates that critical

data is also kept outside of Qatar, so shipping e.g. weekly full backups out of the country is

recommended.

A more detailed review is required to assess whether existing backup strategies and associated

processes are able to meet the identified Recovery Point Objectives.

From a total headcount of approx. 150 (at the main site) 58 are deemed to be required within 4

hours, and up to 93 over the next few days. Considering also the main branch adds 10 and 13

heads respectively to these numbers.

It is assumed that the main branch staff will relocate to various other branches. Office space

available at the Wakrah DR site and the Hilal Call Centre should, once Wakrah is fully equipped,

meet the immediate requirement for headquarter functions, but additional workspace must be

made available after a few days.

The printing and mailing equipment hosted in the mail room is a single point of failure, and should

be duplicated at the DR site. Alternatively, outsourcing of this non-core function could be

considered.

In several departments there is a total reliance on hardcopy information. Although many critical

documents are kept in fire safes, the general impression is that important documents are poorly

protected. Most of these would be difficult or impossible to recreate, and would severely impact

the ability to recover if the originals were destroyed. The majority of these documents are stored

in the same building as the IT servers and other computer equipment and there is a real danger

that all could be lost in the same incident.

A few hard copy documents are sent to offsite storage, but only for archiving purposes. Most of

these documents are required in the day-to-day operations, why offsite storage is impractical.

Keeping copies, either in electronic or hard copy form, of critical documents off site would be

difficult for several reasons. First there are regulatory issues, as copies are not considered

legally binding, then the sheer amount would require enormous storage capacity and is hard to

manage. The big issue is the very large number of legal or financial documents where the

original, signed version is particularly vulnerable.

The “paper issue” is worth quite some consideration, primarily from a continuity perspective, but

also to improve productivity. It should be seriously assessed from both aspects, in conjunction

with business process improvement initiatives.

There are a few critical suppliers, e.g. required to maintain transfers, cash handling and card

services, whose failure to deliver could cause significant damage to QIIB. If possible, alternatives

to these suppliers should be identified.

HP Global Method HP Restricted Page 12 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

The banks contractual and legal standing vs. clients, suppliers and other stakeholders in case of

a disaster is not clear. There are no internal Service Level Agreements (SLAs), but it is not clear

if there are SLAs with suppliers or clients.

All the bank’s contractual and legal obligations in the event of a major incident should be

reviewed, e.g. do all relevant contracts have a “force majeure” clause, and are there clear

continuity clauses in SLAs (if applicable)? The outcome of such a review may have a significant

impact on which continuity strategies to choose.

5.4 Business Impacts

Impact to the business was assessed in qualitative (reputation, internal disruption, non-compliance

etc.) and financial terms. Any of these indicators, if assessed as serious, can provide the justification

for expenditure on Business Continuity Planning.

When assessing impacts the interviewees were asked to assume the worst possible scenario striking

at the worst possible time (month-end, year-end, payroll etc.).

5.4.1 Financial Impacts

An accurate assessment of financial impacts proved difficult, or even impossible, for the majority of

interviewees. The main reason for that is that most departments are cost centres and their inability to

function would indirectly cause financial loss at business and corporate level. Furthermore, financial

reporting is primarily done on corporate level and financial data is not regularly communicated within

the organisation. All representatives of pure business functions, and of course IT, commented that

the loss could be considerable.

All numbers re financial impact of a disaster in the following paragraphs are based on interviewee

responses. They should therefore be validated by QIIB.

A few business functions were able to mention numbers. Corporate Banking Services, managing 2.2

Billion QAR in assets and equity, as well as Investments & International Banking estimated that

financial loss would be severe (100K$ - 250K$ per day) after 4 to 5 days following a disaster. SME

Business Finance expressed that their financial exposure is in the area of 1.7 Million QAR per week,

while the cash flow impact on Card Services is no more than 850K QAR per day.

Central Operations, who with their spider-in-the-web view of the whole bank, estimates that direct

losses from local and international operations combined could well be in the area of 60 to 65 Million

USD per day, more or less from day one.

Another aspect is the exposure to direct financial impact in terms of penalties and fines. Penalties

resulting from non-performance regarding client obligations are quite difficult to gauge, fines for non-

compliance with QCB regulations less so. Collateral Control estimates that the total exposure could

easily be above 2.5 Million USD, although most likely not from day one.

An additional interesting observation is that a failure of the Appraisal and Engineering functions could

have severe financial impacts, as real estate constitutes a large part of the overall portfolio.

HP Global Method HP Restricted Page 13 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

In spite of the difficulties obtaining hard financial numbers, it is obvious that the financial losses to

QIIB would be crippling if operations are not timely resumed after a disaster. This is of course hardly

surprising for a bank and a fair assumption is that QIIB is currently putting its survival at stake by not

having a proper BCP in place.

5.4.2 Qualitative Impacts

Respondents were asked to identify the non-financial impacts if their business unit were unable to

operate. These impacts were assessed by considering the effect on customers, company image,

regulators, employees, suppliers and management information. The next table shows the overall

impacts.

Time department unable to operate

Department

Intra-day 1 day 2-3 days 4-5 days 1-2 weeks > 2 weeks

Electronic Banking Services Critical Disastrous Disastrous Disastrous Disastrous Disastrous

Central Operations Disruptive Critical Disastrous Disastrous Disastrous Disastrous

Domestic Investment Ops /

Disruptive Critical Disastrous Disastrous Disastrous Disastrous

Collateral Control

Central Accounting Manageable Critical Disastrous Disastrous Disastrous Disastrous

Retail Banking Services Manageable Disruptive Disastrous Disastrous Disastrous Disastrous

Card Services Disruptive Critical Critical Disastrous Disastrous Disastrous

Call Centre Manageable Disruptive Critical Disastrous Disastrous Disastrous

Credit & Market Risk

Manageable Disruptive Critical Disastrous Disastrous Disastrous

Management

Domestic Investment Ops /

Manageable Disruptive Critical Disastrous Disastrous Disastrous

LoC Retail

Appraisal & Engineering Manageable Disruptive Critical Critical Disastrous Disastrous

Administrative Services Manageable Disruptive Critical Critical Disastrous Disastrous

Financial Control Manageable Manageable Disruptive Critical Disastrous Disastrous

Human Resources Manageable Manageable Disruptive Critical Critical Disastrous

Investment & International

Manageable Manageable Manageable Disruptive Critical Disastrous

Banking

Corporate Banking Services Manageable Manageable Manageable Disruptive Critical Disastrous

SME Business Finance Manageable Manageable Manageable Disruptive Critical Disastrous

Operational Risk Manageable Manageable Manageable Disruptive Disruptive Critical

Recovery & Past Due

Manageable Manageable Manageable Manageable Disruptive Critical

Collection

Media Communication Manageable Manageable Manageable Manageable Disruptive Critical

Internal Audit Manageable Manageable Manageable Manageable Manageable Disruptive

Information Services Critical Disastrous Disastrous Disastrous Disastrous Disastrous

(same as most critical user dept.)

Executive View Disruptive Critical Critical Disastrous Disastrous Disastrous

HP Global Method HP Restricted Page 14 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

The above table shows that significant disruption would occur within relatively short timescales

The findings support the view that key functions need to be up and running quickly following a

disruption, and that a standby work area recovery facility is required to enable critical functions to

relocate and be operable within a day. Relocation of critical staff would provide an acceptable short-

term recovery solution, as long as sufficient office space, critical documents and critical IT systems

were available.

The only specialist equipment that seems to be required is the printing and mailing system that is

hosted in the mail room. The availability of this equipment could well add serious delay for recovery

and an alternative should be identified.

5.5 Recovery Time and Recovery Point Objectives

Recovery Time Objective (RTO) means the elapsed time between a declared disaster and the

required resumption of services. Recovery Point Objective means the elapsed time for which data

may be lost without causing severe problems at resumption of services following a disaster.

Basically, the RTO states longest acceptable resumption time and RPO states the amount af

acceptable data loss.

5.5.1 IT Systems

Respondents were asked to identify which IT systems they use, how important these are to them and

how quickly they would need to be restored in the event of an IT disaster or major incident (e.g. loss

of hardware, physical environment, power or telecom’s), as opposed to day-to-day problems (which

ideally should be covered by Service Level Agreements). The next table identifies the applications

that are critical to the departments over time. The following chart was produced from the

interviewee’s requests for the various systems, and must be validated by QIIB before any decisions

on recovery strategies are taken.

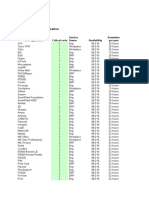

The table below is a subset of the complete table, showing the most critical applications with on RTO

of 3 days or less. A complete table including information on IT platforms utilised and location of the

backup devices can be found in appendix B.

Application User Department RTO RPO

System

Electronic Clearing Retail Banking Services 0 0

System Central Operations

USwitchware Card Services 0 0

Electronic Banking Services

Call Centre System Call Centre 0 0

Equation Investment & International Banking 30 min 0

Corporate Banking Services

SME Business Finance

Retail Banking Services

Financial Control

Credit & Market Risk Management

Appraisal & Engineering

HP Global Method HP Restricted Page 15 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Domestic Investment Ops/Collateral

Control

Central Operations

Domestic Investment Ops/LoC Retail

Past Due Collection

Card Services

Electronic Banking Services

Call Centre

Central Accounting

Internal Audit

Cashier Retail Banking Services 30 min 0

SWIFT Investment & International Banking 30 min 0

Central Operations

Electronic Banking Services

Trade Innovations Domestic Investment Ops/LoC Retail 30 min 0

Estisna’a Domestic Investment Ops/Collateral 4h 0

Control

Domestic Investment Ops/LoC Retail

Retail Banking Services

Ijara Domestic Investment Ops/Collateral 4h 0

Control

Domestic Investment Ops/LoC Retail

Retail Banking Services

Musawama Domestic Investment Ops/Collateral 4h 0

Control

Domestic Investment Ops/LoC Retail

Retail Banking Services

Mudarabah Domestic Investment Ops/Collateral 4h 0

Control

Appraisal & Engineering

Murabaha Domestic Investment Ops/Collateral 4h 0

Control

Wakala Domestic Investment Ops/Collateral 4h 0

Control

Network International Card Services 4h 0

Call Centre

ATM Electronic Journal Retail Banking Services 4h 0

Housemaid Financial Control 4h 0

Customer Card Call Centre 12h n/a

Management System Retail Banking Services

PIN Mailer Call Centre 12h n/a

Retail Banking Services

IVR Retail Banking Services 12h n/a

SMS Gateway Retail Banking Services 12h n/a

Collateral Management Domestic Investment Ops/Collateral 24h 0

System Control

Asset Management Administrative Services 24h 24h

System

Maintenance Administrative Services 24h 24h

Management System

Mail System Administrative Services 24h 24h

Placid Financial Control 24h 24h

Central Accounting

Delta Administrative Services 48h 24h

HP Global Method HP Restricted Page 16 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

MS-Office SME Business Finance 48h 24h

Credit & Market Risk Management

Internal Audit

Investment & International Banking

Corporate Banking Services

Financial Control

Appraisal & Engineering

Domestic Investment Ops/Collateral

Control

Domestic Investment Ops/LoC Retail

Administrative Services

Human Resources

AutoCAD Appraisal & Engineering 3 days 24h

Ofuq / Payroll and HR Human Resources 3 days 24h

System Financial Control

A few critical applications, and very critical Excel Macros, and associated data reside on stand-alone

PCs which more often than not are not backed up properly.

In addition to these application systems, IT infrastructure functions underpinning the applications,

such as firewalls and catalogue services, must be considered to have RTOs and RPOs

corresponding to the most critical applications.

5.6 Phone & Fax

A few functions (Investments & International Banking, Central Operations, Card Services) have implicitly stated

a reliance on fax communications. Considering the very low email utilisation, also for external communication, it

must be safe to assume that fax services are quite frequently used throughout the bank and that a considerably

amount of fax traffic is of a critical nature. Therefore fax capability must be made available instantly at any used

recovery location.

That voice communications is critical goes without saying in banking, and the existence of a state-of-the-art

PABX verifies that. Hence it goes without saying that provisions must be made to provide ample line capacity

and PABX functionality following a disaster. The telecom monopoly situation in Qatar may however cause

some concern here.

5.7 Priorities

The qualitative table illustrated in section 6.3.2 shows the relative priorities for recovery of the key

business functions within the scope of this review, and the timescales within which each

department/function should be operational. The underpinning IT systems must be recovered in the

same priority sequence.

It is important to understand however, that the table shows the maximum time within which an

acceptable level of service must be re-established and does not suggest that business units can “do

nothing” during this time. For instance, business partners, suppliers, regulators and other external

agencies may need to be contacted on day 1. This is reflected in the critical staff requirements shown

in section 6.6 and must be reflected in (planned) Incident Management procedures.

It is also important to note that the timescales are for restoration of the critical “normal” operations of

each function. Certain other departments or individuals, such as IT and Media Communication would

be required immediately to perform technical recovery and to manage external communication.

HP Global Method HP Restricted Page 17 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

5.8 Critical Staff by Department

Respondents were asked to state their minimum staff requirements for working at an alternative,

temporary location. Although they were asked to minimise their requirements and not to try and

replicate their normal working environment, it turned out that in most departments the entire staff is

required even to fulfil the basic business operations. One of the most significant observations made

during the interviews was that QIIB is severally understaffed (from an operational point of view). As

well as being a business risk as such, this will have a strong negative impact on the ability to recover

from a disaster. Also, it will make it rather difficult to implement and maintain a business continuity

programme.

The following table summarises the critical staff requirements which would need to be catered for

following a disaster or major incident affecting the headquarters site.

Please note that the total staff numbers were the sum of the departments represented in the

interviews. Although it may not match the HR official figures, it is used as a representative figure for

illustration purposes.

Required critical staff

Department

ASAP After 2-4 days

Information Services* 10 10

Electronic Banking Services 3 7

Central Operations 6 8

Domestic Investment Ops /

2 5

Collateral Control

Central Accounting 4 4

Retail Banking Services HQ 1 1

Per Category A Branch 10 15

Per Category B Branch 6 10

Per Category C Branch 3 3

Card Services 3 6

Call Centre 8 8

Credit & Market Risk Management 2 2

Domestic Investment Ops / LoC

5 5

Retail

Appraisal & Engineering 2 4

Administrative Services 3 6

Investment & International Banking 5 8

Financial Control 4 4

Human Resources 2 3

Corporate Banking Services 4 4

SME Business Finance 2 5

Operational Risk 1 2

HP Global Method HP Restricted Page 18 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Recovery & Past Due Collection 1 2

Media Communication 1 1

Internal Audit 0 0

Totals HQ Functions 59 85

Totals HQ Site incl. Main Branch 69 95

*Information Services not included in totals as space for IT staff will be available in the DR data

centre.

Generally, each recovery team member would require a workstation (desk, chair and PC). The above

recovery team staff numbers therefore also indicate the number of workstations that would need to

be provided at a recovery site over the time period indicated.

Working from home offices as often a suitable short term solution, providing VPN access to IT

systems and data can be provided. The high dependency upon collateral and other hard copy

documentation however makes this less practical for several critical business functions.

5.9 Dependence on Key Staff

As previously stated, most critical business processes are highly people dependent because of the

mainly manual processes and understaffing. Therefore there are several key staff whose absence

would be very difficult to cover. Some of the most critical areas in this respect are:

Investment & International Banking

Corporate Banking Services

Financial Control

Credit & Market Risk Management

Domestic Investment Operations/Collateral Control

Domestic Investment Operations/Loc Retail

Operational Risk

Information Services

At least these departments should review “single points of failure” to ensure that all critical work

functions are adequately covered should one or more the key persons be absent.

It is very likely that there are others who were not identified in the interview process, e.g. in various

back-office functions.

A general observation, valid for virtually all businesses in the Gulf Area, is the heavy reliance upon

an expatriate workforce. Several business critical positions at QIIB are held by expatriates, which

must be considered as a major risk factor when considering the relative political instability of the

greater Middle East. An unforeseen exodus of expatriates would indeed damage QIIB business.

5.10 Facilities and Services

The current contingency site at Salwa Road is by no means adequate. This is appreciated by QIIB and this site

will be replaced by another site that is fully adequate for IT recovery.

HP Global Method HP Restricted Page 19 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Workplace recovery capability is available as follows:

New DR site at Wakrah; room for 40 - 60 seats, not equipped

Call Centre Training Room; 14 seats, fully equipped

Main Branch functions, and staff, can be spread out over other branch offices.

Should the entire main QIIB site be inaccessible, the immediate workplace requirement is 58 seats growing to

83 seats over the next few days. This means the soon to be available capacity of up to 74 seats, assuming the

positions at the new site will be adequately equipped, is sufficient for the initial requirements but a few more

positions must be made available within two to four days. HP suggests that QIIB assesses the availability of as

commercially available recovery suites or other suitable office space and if there is available space at any of

the other branch offices.

A few staff, primarily at management level, could possible work from home, but the dependence on access to

shared hard-copy documentation means that is not a viable option for most functions.

5.11 Critical Documents

Most critical computer data is regularly backed up, and much of it would be available following a disaster.

All data stored on the AS/400 platform (i.e. most core banking applications, see Appendix B) are mirrored to the

DR site, and also backed up to tape at least daily.

All other data stored on storage equipment hosted by IT is backed up daily.

Some data stored on standalone PCs are backed up to file servers hosted by IT, and hence backed up to tape

daily, but most are typically backed up to CDs on a daily or weekly basis, but there are far too many PCs not

being regularly backed up.

Backup equipment are hosted in the main data centre, but tapes are brought off site weekly (full backups only).

Most departments rely heavily on collateral and other critical hard copy documents, often more than on

electronically stored data. The very large amount of hard copy documentation made it impossible to identify

each and every critical document during the BIA interviews. There is however no doubt that the bank can not

function without access to a very large amount of hard copy documents. The following table summarises

the critical documents identified and the current methods of storage:

Department Documents Comments

Investment & International Banking Collateral, e.g. deeds Stored locally in filing cabinets or

fire safes

Corporate Banking Services Client files, client reviews, Stored locally in fire safes

collateral

SME Business Finance Approvals, client files, collateral Stored locally in fire safes

Credit & Market Risk Rating reports Stored locally in filing cabinets

Management

Appraisal & Engineering Appraisals, collateral, blueprints Stored locally in filing cabinets or

(Huge volumes!) openly

Domestic Investment Ops / Collateral, approvals, Stored locally in fire safes

Collateral Control agreements, client files

Domestic Investment Ops / LoC Collateral, client files, transaction Stored locally in filing cabinets or

Retail summaries, insurance policies fire safes

(Huge volumes!)

Central Accounting Data entry forms, vouchers, Stored locally but moved off site

checks daily for archiving

HP Global Method HP Restricted Page 20 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Internal Audit Audit reports Stored locally in filing cabinets

Administrative Services Contracts, purchase agreements, Stored locally in filing cabinets or

insurance policies, compliance openly

registrations

Human Resources Employment contracts, passports, Stored locally in filing cabinets or

work permits, personnel files fire safes

5.12 Critical Suppliers

Comparatively few functions are outsourced, so there are a relatively small number of critical suppliers. Of

course some departments, in particular Administrative Services and Information Systems, work with several

suppliers, but they have identified alternative channels to source from.

The table below lists all critical suppliers for which there is no identified alternative. Some of the suppliers, in

particular service providers and software houses, are solid and stable (in terms of delivery capability) enough

not to be considered an issue from a continuity point of view, while others could potentially be a cause for some

concern.

Department Supplier Comments

Investment & International Clearstream Extranet based service, will

Banking become critical.

Not an issue.

Retail Banking Services G4S, NCR Cash replenishment, checks

Alternatives recommended.

Central Operations NCR, G4S, Proaeses Soft Several Back-office functions

Transfers & Clearing

Scanning etc.

Card Services Network International (Visa, Card supply and transaction

MasterCard) management.

Not an issue.

Electronic Banking Services G4S, NCR ATM replenishment, ATM

maintenance, checks

Alternatives recommended.

Call Centre EastNets Group, Network Call routing, Payment services,

International, Qtel, Nortel transaction management, phone

and comms lines, PBX.

Alternatives recommended

(although Qtel still has monopoly)

Administrative Services Qtel Phone and comms lines

Alternatives recommended

(although Qtel still has monopoly)

Information Systems ITS, MiSys, EastNets, GBM Application SW, Swift gateway

(IBM), Sun Not an issue.

HP Global Method HP Restricted Page 21 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

6 Recommended Action

QIIB has already initiated a Business Continuity project (of which this BIA is one task), so assuming

this project will continue as planned there are few additional actions to recommend. A single project

is however not the same as a complete, implemented and working, Business Continuity Management

Programme, so the following actions should be planned and performed in addition the the current

project:

Assign a full time Business Continuity Manager

Plan for additional resources to maintain the BC programme over time

Plan for on-going training and awareness activities

Review regulatory requirements, particularly re legality of copies of hardcopy collateral

HP Global Method HP Restricted Page 22 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Appendix A - Contributors

Department/Function Represented Name

Executives Mohsen Moustafa

Investment & International Banking Lotfi Zairi

Mohannad Quaddoura

Corporate Banking Services Alaa Eldin Ismail Mohamed

SME Business Finance Mahmoud Mohamed Mahmoud

Retail Banking Services Ali Hamad Al-Mesaifiri

Financial Control Ahmed Ayoub

Mahmoud El-Zayat

Credit & Market Risk Management Samir Abdel Naem

Appraisal & Engineering Dr. Abdul Raouf Al-Rasheed

Mortada Eltahir Mohamed Ahmed

Domestic Investment Operations & Fouad Said Ahmed Saleh

Collateral Control Abd Ul-Muniem Ali Marrie

Central Operations Syed Asim Mahmood

Hesham Mohamed Saad El Din

Domestic Investments Operations / Ekram M. Mohamed

LoC Retail Hesham Mohamed Saad El Din

Recovery & Past Due Collection Nabil Hamdi Allulu

Card Services Magdi Ali Fayed

Electronic Banking Services Magdi Farah

Call Centre Mohamed Saeed Mubarak

Central Accounting Sadat Badran Ibrahim

Internal Audit Faiha Al-Qodah

Administrative Services Hajjaj Mussad Atta

Media Communications Emad Husien Shaban

Human Resources Khaled Al-Sayeh

Kamal Mustafa

Information Services Nasser Hassan Mohamed Mahmoud

Zulqurnain Khan

HP Global Method HP Restricted Page 23 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

BIA Report

Project ID No.:

Appendix B – RTO & RPO

Application System User Department RTO RPO Comments Platform Backup Location

Electronic Clearing System Retail Banking Services 0 0 Red Tide Windows Client/Server Main Data Centre

Central Operations

USwitchware Card Services 0 0 Solaris Main Data Centre

Electronic Banking Services

Call Centre System Call Centre 0 0 Windows Client/server Helal

Equation Investment & International Banking 30 min 0 Includes: AS/400 DR Salwa

Corporate Banking Services EXP system

SME Business Finance Branch Automation

Retail Banking Services

Financial Control

Credit & Market Risk Management

Appraisal & Engineering

Domestic Investment Ops/Collateral Control

Central Operations

Domestic Investment Ops/LoC Retail

Past Due Collection

Card Services

Electronic Banking Services

Call Centre

Central Accounting

Internal Audit

Cashier Retail Banking Services 30 min 0 Windows Client/Server n/a

SWIFT Investment & International Banking 30 min 0 Standalone and Integrated Windows Client/Server Main Data Centre

Central Operations

Electronic Banking Services

Trade Innovations Domestic Investment Ops/LoC Retail 30 min 0 Windows Client/Server Main Data Centre

Estisna’a Domestic Investment Ops/Collateral Control 4h 0 AS/400 DR Salwa

Domestic Investment Ops/LoC Retail

Retail Banking Services

Ijara Domestic Investment Ops/Collateral Control 4h 0 AS/400 DR Salwa

Domestic Investment Ops/LoC Retail

Retail Banking Services

Musawama Domestic Investment Ops/Collateral Control 4h 0 Windows Client/Server Main Data Centre

Domestic Investment Ops/LoC Retail

Retail Banking Services

Mudarabah Domestic Investment Ops/Collateral Control 4h 0 AS400, so assign same RTO as rest AS/400 DR Salwa

Appraisal & Engineering

Murabaha Domestic Investment Ops/Collateral Control 4h 0 AS400, so assign same RTO as rest AS/400 DR Salwa

Wakala Domestic Investment Ops/Collateral Control 4h 0 AS400, so assign same RTO as rest AS/400 DR Salwa

Network International Card Services 4h 0 Link, hosted by NI n/a n/a

Call Centre

ATM Electronic Journal Retail Banking Services 4h 0 Windows Client/Server n/a

Housemaid Financial Control 4h 0 AS/400 DR Salwa

Customer Card Management System Call Centre 12h n/a Interface, no own data Windows Client/Server n/a

Retail Banking Services Solaris

PIN Mailer Call Centre 12h n/a Windows Main Data Centre

Retail Banking Services

IVR Retail Banking Services 12h n/a Windows Client/Server Main Data Centre

SMS Gateway Retail Banking Services 12h n/a Windows Client/Server n/a

Collateral Management System Domestic Investment Ops/Collateral Control 24h 0

Asset Management System Administrative Services 24h 24h Local PCs Windows Local (if any)

Maintenance Management System Administrative Services 24h 24h Local PCs Windows Local (if any)

Mail System Administrative Services 24h 24h Standalone, in mailroom ?? n/a

Placid Financial Control 24h 24h Not in IT? Windows Main Data Centre

Central Accounting

Delta Administrative Services 48h 24h Local PCs Windows Local (if any)

MS-Office SME Business Finance 48h 24h Excel critical Windows Local (if any)

Credit & Market Risk Management

Internal Audit

Investment & International Banking

Corporate Banking Services

Financial Control

Appraisal & Engineering

Domestic Investment Ops/Collateral Control

Domestic Investment Ops/LoC Retail

Administrative Services

Human Resources

AutoCAD Appraisal & Engineering 3 days 24h Local PCs Windows Local (if any)

Ofuq / Payroll and HR System Human Resources 3 days 24h Windows Client/Server n/a

Financial Control

Email Investment & International Banking 4 days 24h Card services need it in 30 min!?! Windows Client/Server n/a

(Exchange) SME Business Finance Mailboxes not backed up?

Appraisal & Engineering

Domestic Investment Ops/Collateral Control

Central Operations

Card Services

Central Accounting

Internal Audit

Administrative Services

Media Communication

Human Resources

CRM System Call Centre 1 week 24h Hosted at Call Centre

Dociware Electronic Banking Services 1 week 24h General archiving/retrieval interface, used by Windows Client/Server n/a

all functions. RPO refers to accessed

databases!

Primavera Appraisal & Engineering 1 week 24h Local PCs Windows Local (if any)

Signature Verification System Call Centre 1 week 24h Windows Client/Server Main Data Centre

Retail Banking Services

QCB Online System Corporate Banking Services 2 weeks n/a Interface Windows Client/Server n/a

Internet SME Business Finance 2 weeks n/a Card services need it in 30 min!?! Windows Client/Server n/a

Domestic Investment Ops/Collateral Control

Card Services

Administrative Services

Media Communication

Reuters Investment & International Banking 2 weeks n/a Feed only. Implemented Jan 2008. n/a n/a

Sharepoint All n/a n/a Not deemed critical Windows Client/Server Main Data Centre

HP Global Method HP Restricted Page 24 of 24

Document Version: 1.4 / 2008-02-06 © Copyright 2021 Hewlett-Packard Development Company, L.P. 519323989.doc

Project Document Id: BIA Report Valid agreement required. Last changed: 07 February 2008 at 07:19

You might also like

- Burgan Bank BIA Report 1.1aDocument28 pagesBurgan Bank BIA Report 1.1aXavi MilanNo ratings yet

- 10-Cisa It Audit - BCP and DRPDocument27 pages10-Cisa It Audit - BCP and DRPHamza NaeemNo ratings yet

- BIA TI Business Impact Assessment TemplateDocument49 pagesBIA TI Business Impact Assessment TemplateNicolas Alejandro Villamil GutierrezNo ratings yet

- Cybersecurity ISMS Policies And Procedures A Complete Guide - 2020 EditionFrom EverandCybersecurity ISMS Policies And Procedures A Complete Guide - 2020 EditionNo ratings yet

- ISO IEC 27001 Lead Implementer A Complete Guide - 2020 EditionFrom EverandISO IEC 27001 Lead Implementer A Complete Guide - 2020 EditionNo ratings yet

- Qualified Security Assessor Complete Self-Assessment GuideFrom EverandQualified Security Assessor Complete Self-Assessment GuideNo ratings yet

- Information technology audit The Ultimate Step-By-Step GuideFrom EverandInformation technology audit The Ultimate Step-By-Step GuideNo ratings yet

- IRAM - Business Impact AssessmentDocument52 pagesIRAM - Business Impact AssessmentJulio Armando Fabaz100% (2)

- Skybox Security Sales&Tech OverviewDocument46 pagesSkybox Security Sales&Tech Overviewerdem100% (1)

- Cyber Security Incident Response A Complete Guide - 2020 EditionFrom EverandCyber Security Incident Response A Complete Guide - 2020 EditionNo ratings yet

- Microsoft Zero Trust Maturity Model - Oct 2019Document7 pagesMicrosoft Zero Trust Maturity Model - Oct 2019Javier MoralesNo ratings yet

- NIST Questions For Admin Rights Users - BlankDocument12 pagesNIST Questions For Admin Rights Users - BlankRene HansenNo ratings yet

- BYOD Standards for Bank Staff Accessing Customer DataDocument11 pagesBYOD Standards for Bank Staff Accessing Customer Dataanna lee100% (1)

- Cloud Security Assessment Report Template (July 2020)Document23 pagesCloud Security Assessment Report Template (July 2020)Ah ChaiNo ratings yet

- CRMF Cyber Risk FrameworkDocument9 pagesCRMF Cyber Risk Frameworkleo58800% (1)

- Cissp Domain 2 Asset SecurityDocument8 pagesCissp Domain 2 Asset Securitysrivatsan_ece0% (1)

- Business Continuity Planning BCP A Complete Guide - 2019 EditionFrom EverandBusiness Continuity Planning BCP A Complete Guide - 2019 EditionNo ratings yet

- Cyber Incident ResponseDocument22 pagesCyber Incident ResponseROBERTO CARLOS GALLARDO ABARCA100% (2)

- MBCF BIA Template FinalDocument20 pagesMBCF BIA Template FinaldanirodigicomNo ratings yet

- It Disaster Recovery Plan TemplateDocument9 pagesIt Disaster Recovery Plan TemplateARCO EXPORTNo ratings yet

- Business Information (Only Fill Information That You Think Will Be Part of The Project Scope) Sr. No. Questions ResponseDocument2 pagesBusiness Information (Only Fill Information That You Think Will Be Part of The Project Scope) Sr. No. Questions ResponseIts greyer than you thinkNo ratings yet

- Disaster Recovery PlanDocument3 pagesDisaster Recovery Planrozeny2kNo ratings yet

- Security Vulnerability Threat Assessments A Complete Guide - 2019 EditionFrom EverandSecurity Vulnerability Threat Assessments A Complete Guide - 2019 EditionNo ratings yet

- Firewall Policy: Prepared byDocument8 pagesFirewall Policy: Prepared byChristine MbinyaNo ratings yet

- Iso/Iec: Group 3Document37 pagesIso/Iec: Group 3Abdunnajar MahamudNo ratings yet

- UCF ControlsDocument120 pagesUCF Controlsrajat_rathNo ratings yet

- Business Continuity Management A Complete Guide - 2020 EditionFrom EverandBusiness Continuity Management A Complete Guide - 2020 EditionNo ratings yet

- Vulnerability And Patch Management A Complete Guide - 2021 EditionFrom EverandVulnerability And Patch Management A Complete Guide - 2021 EditionNo ratings yet

- EC-Council Licensed Penetration Tester VA Summary ReportDocument42 pagesEC-Council Licensed Penetration Tester VA Summary ReportduochonNo ratings yet

- CSCF Assessment - Template - For - Advisory - Controls - (Version 2022) - v1.1Document108 pagesCSCF Assessment - Template - For - Advisory - Controls - (Version 2022) - v1.1PetrrNo ratings yet

- SAMA Cyber Security Framework PDFDocument56 pagesSAMA Cyber Security Framework PDFVo GiapNo ratings yet

- Security Incident Management ProcessDocument8 pagesSecurity Incident Management ProcessHiren DhadukNo ratings yet

- Major Incident ReportDocument5 pagesMajor Incident ReportKarthikeyan GurusamyNo ratings yet

- IT Risk Management Process A Complete Guide - 2020 EditionFrom EverandIT Risk Management Process A Complete Guide - 2020 EditionNo ratings yet

- Business Impact AnalysisDocument21 pagesBusiness Impact AnalysisJoel AFFIAN100% (1)

- Security And Risk Management Tools A Complete Guide - 2020 EditionFrom EverandSecurity And Risk Management Tools A Complete Guide - 2020 EditionNo ratings yet

- Incident Management for Procurement A Clear and Concise ReferenceFrom EverandIncident Management for Procurement A Clear and Concise ReferenceNo ratings yet

- SCF Secure Controls Framework GuideDocument23 pagesSCF Secure Controls Framework GuideManinder KaurNo ratings yet

- CIS RAM v2.1 IG2 Workbook Guide 2022 08Document53 pagesCIS RAM v2.1 IG2 Workbook Guide 2022 08Lukas PedrottaNo ratings yet

- Draft Cyber Security Audit Program: Based On Cse'S Top 10 Cyber Security Actions May 2020Document38 pagesDraft Cyber Security Audit Program: Based On Cse'S Top 10 Cyber Security Actions May 2020Nav Singh100% (1)

- SOW SecurityDocument3 pagesSOW SecurityJohn Croson100% (2)

- Disaster Recovery PlanDocument14 pagesDisaster Recovery PlanAnis GharbiNo ratings yet

- Intrusion Detection System (Ids) ReviewDocument7 pagesIntrusion Detection System (Ids) Reviewcgarcias76No ratings yet

- Operational Technology Security A Complete Guide - 2019 EditionFrom EverandOperational Technology Security A Complete Guide - 2019 EditionNo ratings yet

- Zero Trust Readiness Assessment: BenefitsDocument3 pagesZero Trust Readiness Assessment: BenefitsLuis Barreto100% (1)

- Business Continuity Management and IT Disaster RecoveryDocument4 pagesBusiness Continuity Management and IT Disaster RecoveryKeith Parker100% (3)

- Site Preparation Guide: Reference 86 A1 40FA 05Document70 pagesSite Preparation Guide: Reference 86 A1 40FA 05Xavi MilanNo ratings yet

- SUSE Training and Certification HPE TechTalk-2016-09-15Document30 pagesSUSE Training and Certification HPE TechTalk-2016-09-15Xavi MilanNo ratings yet

- Sap Standard Application Benchmarks: Measuring in SapsDocument1 pageSap Standard Application Benchmarks: Measuring in SapsXavi MilanNo ratings yet

- LinuxKI 4.1 CURSODocument78 pagesLinuxKI 4.1 CURSOXavi MilanNo ratings yet

- GSESeminar NUMA Optimization Approaches - Sept 19 2016Document48 pagesGSESeminar NUMA Optimization Approaches - Sept 19 2016Xavi MilanNo ratings yet

- Aibel RA v1Document15 pagesAibel RA v1Xavi MilanNo ratings yet

- Enterprise Business Continuity and Disaster Recovery PlanDocument1 pageEnterprise Business Continuity and Disaster Recovery PlanXavi MilanNo ratings yet

- Hewlett-Packard Company Business Impact Analysis Report For BCP Project QiibDocument24 pagesHewlett-Packard Company Business Impact Analysis Report For BCP Project QiibXavi MilanNo ratings yet

- Hewlett-Packard Company Business Impact Analysis (BIA) For AibelDocument18 pagesHewlett-Packard Company Business Impact Analysis (BIA) For AibelXavi MilanNo ratings yet

- Critical Application ListDocument2 pagesCritical Application ListXavi MilanNo ratings yet

- SNIA - Business ContinuityDocument12 pagesSNIA - Business ContinuityXavi MilanNo ratings yet

- Poweredge Fx2: With Fc640 and Fd332Document10 pagesPoweredge Fx2: With Fc640 and Fd332Xavi MilanNo ratings yet

- GEMB BIA Report 1.0Document51 pagesGEMB BIA Report 1.0Xavi MilanNo ratings yet

- Strategy Definition 1.2Document24 pagesStrategy Definition 1.2Xavi MilanNo ratings yet

- RA Report 1.0Document16 pagesRA Report 1.0Xavi MilanNo ratings yet

- Aibel Risk Assessment Risk Analysis QuestionnaireDocument17 pagesAibel Risk Assessment Risk Analysis QuestionnaireXavi MilanNo ratings yet

- Forrester - Total-Economic-Impact-Of-The-Dell-Boomi-PlatformDocument24 pagesForrester - Total-Economic-Impact-Of-The-Dell-Boomi-PlatformXavi MilanNo ratings yet

- Dell Technologies Master PDFDocument75 pagesDell Technologies Master PDFXavi MilanNo ratings yet

- Security Value Map™: Next Generation Firewall (NGFW)Document1 pageSecurity Value Map™: Next Generation Firewall (NGFW)Xavi MilanNo ratings yet

- Dell Technologies Hyperconverged Solutions: Modernize Your Infrastructure and Accelerate IT TransformationDocument21 pagesDell Technologies Hyperconverged Solutions: Modernize Your Infrastructure and Accelerate IT TransformationXavi MilanNo ratings yet

- Aliens RulebookDocument28 pagesAliens RulebookTsudakis Prod Ld100% (6)

- Dharanidharan Mohan Resume - Nanoscience GraduateDocument3 pagesDharanidharan Mohan Resume - Nanoscience Graduatehitesh VariyaNo ratings yet

- 心理年齡測試Document1 page心理年齡測試紅小姐No ratings yet

- Voice-Controlled-Wheelchair-using-Arduino Re-1 2024Document19 pagesVoice-Controlled-Wheelchair-using-Arduino Re-1 2024Aryan PandyaNo ratings yet

- Final Year Project Log Book (Part-1/Part-2) : Gantt Chart (Part-1 / Part-2)Document3 pagesFinal Year Project Log Book (Part-1/Part-2) : Gantt Chart (Part-1 / Part-2)SLashShahNo ratings yet

- Lista de Repuestos Recomendados (RSPL) : #De Pedido de Dorr-Oliver Eimco: BAP2058-100Document3 pagesLista de Repuestos Recomendados (RSPL) : #De Pedido de Dorr-Oliver Eimco: BAP2058-100A̶l̶x̶a̶n̶d̶e̶r̶ PaniNo ratings yet

- Iprocurement Features and FunctionsDocument50 pagesIprocurement Features and FunctionssrpothulNo ratings yet

- Pittsburgh (Harbor Freight) 92649 A-C Manifold Gauge Set Quick ReferenceDocument4 pagesPittsburgh (Harbor Freight) 92649 A-C Manifold Gauge Set Quick ReferenceRick McGuire0% (1)

- Pipe Thickness Limits PDFDocument18 pagesPipe Thickness Limits PDFCameliaNo ratings yet

- Eliminate Online Movie PiracyDocument13 pagesEliminate Online Movie PiracySai RavindraNo ratings yet

- RED Stripe#4-FY23-CRM-SS (Eng)Document2 pagesRED Stripe#4-FY23-CRM-SS (Eng)Lokesh SahuNo ratings yet

- Hack Camera From Grabcam Tool in Termux English (By Noob Hackers)Document5 pagesHack Camera From Grabcam Tool in Termux English (By Noob Hackers)oloserNo ratings yet

- Tender Document 4666Document128 pagesTender Document 4666KishoreNo ratings yet

- 4 Arup Airbag Particle Course Folding 2015 v1.3 PDFDocument120 pages4 Arup Airbag Particle Course Folding 2015 v1.3 PDFliyanhuaNo ratings yet

- SAP ESS Emplpoyee Self Service Made Easy GuideDocument365 pagesSAP ESS Emplpoyee Self Service Made Easy GuideKhushbu DaveNo ratings yet

- Cit ProjectDocument1 pageCit Projectapi-311901251No ratings yet

- Filtration Unit: Operating and Maintenance InstructionsDocument68 pagesFiltration Unit: Operating and Maintenance InstructionsAkash RockNo ratings yet

- C 0.8 Reference Manual: ArdpeekDocument60 pagesC 0.8 Reference Manual: ArdpeekMarcos FidelisNo ratings yet

- SMD Type Diodes: 1A Rectifier Diodes 1N4001-1N4007Document1 pageSMD Type Diodes: 1A Rectifier Diodes 1N4001-1N4007rNo ratings yet

- Triangle Tube SME Hybrid Solar/Geothermal DHW Storage Tanks BrochureDocument4 pagesTriangle Tube SME Hybrid Solar/Geothermal DHW Storage Tanks Brochuree-ComfortUSANo ratings yet

- Pinaka Final Edit Natin AhahahDocument88 pagesPinaka Final Edit Natin Ahahahpia espanilloNo ratings yet

- Ehab El Sayed's Project Management ProfileDocument3 pagesEhab El Sayed's Project Management ProfileEhab IbrahimNo ratings yet

- Materi Pertemuan Komunitas Robotik Balai Tekkomdik Diy 2023 Ke2Document4 pagesMateri Pertemuan Komunitas Robotik Balai Tekkomdik Diy 2023 Ke2muhammad dzakiNo ratings yet

- PSTN Network Technologies GuideDocument4 pagesPSTN Network Technologies GuideAkmal KhanNo ratings yet

- Sensors: Sensors in The Autoclave-Modelling and Implementation of The Iot Steam Sterilization Procedure CounterDocument17 pagesSensors: Sensors in The Autoclave-Modelling and Implementation of The Iot Steam Sterilization Procedure CounterUsman Ali Usman AliNo ratings yet

- Address Customer NeedsDocument13 pagesAddress Customer Needsterefe kassaNo ratings yet

- SS 4r3a5 EpDocument2 pagesSS 4r3a5 EpangelroNo ratings yet

- Document Management PDFDocument82 pagesDocument Management PDFTester25896No ratings yet

- Jeppesen chart for RNAV arrival and departure procedures at Axum Airport in EthiopiaDocument6 pagesJeppesen chart for RNAV arrival and departure procedures at Axum Airport in EthiopiaAbdulfetah NesredinNo ratings yet

- Raytheon 1900C 1984 Ub009Document3 pagesRaytheon 1900C 1984 Ub009Ridzuan MohammadNo ratings yet