Professional Documents

Culture Documents

Operating Expenses: - Currenttaxation

Uploaded by

NarinderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operating Expenses: - Currenttaxation

Uploaded by

NarinderCopyright:

Available Formats

Group

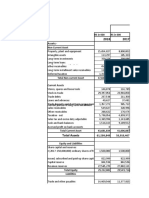

Note 2016

RM'OOO

Revenue l la) 6,846,085

Other Income l ib) 352,703

Operating expenses

Sroff cosrs 2 l l,015,2581

Depreciation of property,planr and equipment 8 (710,8431

Alrcrah fuel expenses (1,578,4731

Maintenance andoverhaul (218,7531

Usercharges 4 (801,6561

Aircraft operating leo,se expenses (479,4851

Otheroperating expenses 3 (283,031I

operating profir 2, 111,289

finance income 5 134,923

finance cosrs 5 (593,0611

Net operating profit 1,653,151

Foreign exchange gain/(losses) 5 484,685

Goin on disposalof Interest In a joint venture 11

Impairment of lnvesrmenr inassoc lores 11,637,501

Share of results of jointvenrures 10 24,285

Shore of resulrs of assoclores 11 134,704

Profir/(loss) before taxation

Taxo:rion

- Currenttaxation 6

6

Il - Deferred taxation

D

Net profit for the financial year 2,046,942

2, 133,075 215,150 2,309,916 (253,362)

(6,394) (35,852) (5,3961 (35,838)

(79,739) 361,982 1,797,391 361,809

(86,1331 326,130 (85,1351 325,971

Company

2015 2016 2015

RM'OOO RM'OOO RM'OOO

6,297,658 5,948,139 6,001,933

257,975 917,035 212,153

(759,420) 19,648,251 1732,935)

(703,245) 15,620,241 1691,853)

(2,000,650) ( 1,578,4731 (2,000,650)

1196,883) (227,9581 (196,637)

(685,013) 18,016,561 1684,342)

1330.791J (90,8441 ( 102,232)

1283.758) 12,316,791 (260,394)

1,595,873 2,407,715 1,545,043

154,148 110,190 127,004

1724,035) (526,3441 (713,196)

1,025,986 1,991,561 958,851

(331,338) 482, 105 1336,560)

320,500

( 163,7501 (875,653)

25,492

(825,490)

541,280 2,224,781 72,609

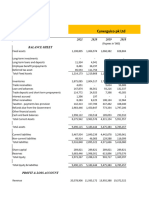

Group Company

Note 2016 2015 2016 2015

RM'OOO RM'OOO RM'OOO RM'OOO

NON-CURR ENT ASSETS

Properry, plant and equipment 8 10,826,682 10,927,645 7,858,892 9,805,655

lnvesmienr in subsiciorles 9 179,754 64,860

lnvesmienr in jointvenrures 10 188,309 164,024 81,559 81,559

lnvesmienr in o,ssoc lares 11 2,210,587 1,020,640 1,533,678 712,398

Available-for-sole financialasseis 12 356,605 235,097 351,167 235,097

lnrangible assets 13 121,829 19,184

Deferredtax as.sets 14 749,211 828,950 749,038 828,777

Receivables and prepayments 15 1,433,054 1,412,242 1,379,778 1,385,308

Deposits on alrcrah purchase 16 112, 133 334,487 112, 132 334,487

Amounrsdue fromassoclo:res 17 344,861 1,142,119 344,861 1,034,869

Derivative financial insrrumenrs 18 867,949 945,490 867,949 945,490

17,211,220 17,029,878 ### ###

CURRENT ASSETS

Inventories 19 43,866 26,152 43,650 26,152

Receivables and prepayments 15 1,087,657 617,422 1,004,718 536,340

Deposits on aircraft purchase 16 658,115 348,820 658,115 348,820

Derivative financial insrrumenrs 18 665,668 419,112 665,668 419,112

Amounts due from subsi ories 20 800,970 406,225

Amounts due from jointvenrures 21 8,952 5,708 8,952 5,708

Amounisdue from o.ssociares 17 511,446 394,970 282,047 297,976

Amounts due from relo:red parries 20 37, 424 43,851 16,102 15,787

Tax recoverable 19,466 3,648 19,856 3,338

Deposits, co,sh and bank balances 22 1.741573 2,426,696 1,426,886 2,262,641

4.774167 4,286,379 4,926,964 4,322,099

Note 2016 2015 2016 2015

RM'OOO RM'OO RM'OOO RM'OO

O O

lESSt CU RRENT LIABI LITI ES

Tradeand oilier payables 23 1,882,183 1,634,057 1,819,376 1,523,359

Soles In advance 607,735 664,251 606,018 662,330

Amounrsdue ro subsidiaries 24 341,216

Amounrsdue ro associates 17 3,978 25,290

Amounrsdue ro related parries 24 29,999 13,661 58,351 13,661

Borrowings 25 1,945,203 2,377,256 1,575,n1 2,251,537

Derivative financ al nsrrumenrs 18 448,873 582,491 448,873 582,491

4,917,971 5,271,716 4,533,629 5,374,594

N ET CURRENT (LIABI LITI ( 143,804) (985,337) 393,335 ( 1,052,49

ES)/ASSETS 5)

NON-CU RRENT LIABI LITIES

Tradeand oilier payables 23 1,529,293 1,043,994 1,497,466 1,013,936

Amounts due toassociates 17 118,898 76,216 21,934 21,622

Amount due to a related parry 24 9,455

Borrowings 25 8,633,939 ### 6,219,922 9,431,567

Derivative financ al nsrrumenrs 18 148,052 237,898 148,052 237,898

10,439,637 ### 7,887,374 ###

6,627,779 4,450,854 5,964,769 3,670,982

CAPITAL AND RESERVES

Shore caplral 26 278,297 278,297 278,297 278,297

Shore premium 1,230,941 1,230,941 1,230,941 1,230,941

Treasury shares ( 160) ( 160)

Foreign exchange reserve 46,993 18,948

Retained earnings 27(al 5,294,468 3,355,740 4,644,678 2,531,212

Other reserves 27(bl (217,554) (431,598) ( 188,987) (369,468)

6,632,985 4,452,328 5,964,769 3,670,982

Non-controllinginterests (5,206) 11,474)

Toral equiry 6,627,779 4,450,854 5,964,769 3,670,982

2016

debt to asset ratio liablity /assets

15354608 21,985,387

0.698400624

ard for companies of similar size and activity. For creditors, a lower debt-to-asset ratio is preferred as it means shareh

17,211,220 21,985,387

4,774,167

2017

5,333,843 17,351,383

9,630,155 4,322,695

total liablity 14,963,998 21,674,078 total asset

debt to asset ratio liablity /assets

0.690409898866

2018

total libality 12,364,506 total asset 18,549,771

6,850,358 9,731,923

5,514,148 8,817,848

debt to asset ratio liablity /assets

0.666558417351891

2019

total liablity total assets

7,135,469 22,683,978 25,594,718 5,292,363

15,548,509 20,302,355

debt to asset ratio liablity /assets

debt to asset ratio 0.886275754239605

2016 2017 2018

Return on equity (ROE) 0.30884283 0.23418111 0.27410208

~ Dividend pay-out ratio -0.05438112 -0.5104132 -1.0250284

~ Net cash from operations to profit before tax (PBT) 53,938 2,252,034 -302,423

~ Current ratio 0.97075949 0.81042787 1.28720981

~ Price / earnings (PE) 0.30257802 0.46896552 0.28913413

Return on equity (ROE)

net income 2,046,942 1,571,374 1,695,394

shareholder equity 6,627,779 6,710,080 6,185,265

~ Dividend pay-out ratio

dividend -111,315 -802,050 -1,737,827

net income 2,046,942 1,571,374 1,695,394

~ Net cash from operations to profit before tax (PBT)

Net Operating (Loss)/ Profit 2,169,911

-82,123

NA

~ Current ratio

current asset 4,774,167 4,322,695 8,817,848

current liab 4,917,971 5,333,843 6,850,358

~ Price / earnings (PE)

share price 22.3 23.12 17.03

earning per share 73.7 49.3 58.9

2019 2020

-0.09730275 1.1064652598811

NA 3.14440907417947

-521,660 -3,347,084

0.74169799 0.44217391625957

-1.84574468 -0.7627450980392

-283,223 -1,084,087

2,910,740 -979,775

0 -3,408,813

-283,223 -1,084,087

68,834 3,150,542

105,973 52,454

247,593 248,996

448,874

5,292,363 3,347,536

7,135,469 7,570,632

17.35 19.45

-9.4 -25.5

You might also like

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- Case 14 ExcelDocument8 pagesCase 14 ExcelRabeya AktarNo ratings yet

- Rafhan Maize Products Company LTDDocument10 pagesRafhan Maize Products Company LTDALI SHER HaidriNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Directors' Report: For The Period Ended 31 March 2018Document24 pagesDirectors' Report: For The Period Ended 31 March 2018Asma RehmanNo ratings yet

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchDocument5 pagesChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RNo ratings yet

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Document4 pagesSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675No ratings yet

- MCB Financial AnalysisDocument30 pagesMCB Financial AnalysisMuhammad Nasir Khan100% (4)

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờNo ratings yet

- SHV Port - FS English 31 Dec 2019 - SignedDocument54 pagesSHV Port - FS English 31 Dec 2019 - SignedNithiaNo ratings yet

- Golden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012Document8 pagesGolden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012khurshid topuNo ratings yet

- For The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisDocument37 pagesFor The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisAbdul MajeedNo ratings yet

- Recap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioDocument7 pagesRecap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioSiddharth PujariNo ratings yet

- Finance Ratios AnalysisDocument27 pagesFinance Ratios AnalysisIfraNo ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- Company Information: Fecto Sugar Mills LimitedDocument30 pagesCompany Information: Fecto Sugar Mills LimitedSyeda Kainat AqeelNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- KINSTEL-AnnualReport2005 (Appendix 1 To IM-2)Document38 pagesKINSTEL-AnnualReport2005 (Appendix 1 To IM-2)Takahiro HakiNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- Galadari PDFDocument7 pagesGaladari PDFRDNo ratings yet

- AHTM 2003 - OpenDoors - PKDocument11 pagesAHTM 2003 - OpenDoors - PKWaleed KhalidNo ratings yet

- Maple Leaf Cement Factory Limited.Document17 pagesMaple Leaf Cement Factory Limited.MubasharNo ratings yet

- Oil & Gas Development Company Limited: Equity and LiabilitiesDocument56 pagesOil & Gas Development Company Limited: Equity and LiabilitiesFariaFaryNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Antler Fabric Printers (PVT) LTD 2016Document37 pagesAntler Fabric Printers (PVT) LTD 2016IsuruNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Financial Statement 2010-11Document64 pagesFinancial Statement 2010-11Fazal4822No ratings yet

- Financial Statements: Engro PakistanDocument6 pagesFinancial Statements: Engro PakistanUsman ChNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Oil and Gas Development Company Limited Income Statement For The Year Ended 30 June 2018Document11 pagesOil and Gas Development Company Limited Income Statement For The Year Ended 30 June 2018kinzaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetMuazzam AliNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- TSLADocument23 pagesTSLAtlarocca1No ratings yet

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- Consolidated Financial Statements Mar 09Document15 pagesConsolidated Financial Statements Mar 09Naseer AhmadNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobNo ratings yet

- Statements of Comprehensive IncomeDocument7 pagesStatements of Comprehensive IncomewawanNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- Proforma Balance SheetDocument24 pagesProforma Balance SheetBarbara YoungNo ratings yet

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNo ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- Babar Ali 5114516680Document1 pageBabar Ali 5114516680Fida Hussain SahitoNo ratings yet

- PERKMA DEVI 021-16-36747 BBA-H ContinueDocument1 pagePERKMA DEVI 021-16-36747 BBA-H ContinueNarinderNo ratings yet

- In This Modern World Where Every Organization Is Competing With Their SubstituteDocument1 pageIn This Modern World Where Every Organization Is Competing With Their SubstituteNarinderNo ratings yet

- OB Sunday FINAL EXAM (Subjective Paper)Document2 pagesOB Sunday FINAL EXAM (Subjective Paper)NarinderNo ratings yet

- Job Opportunities: Instructions & General ConditionsDocument1 pageJob Opportunities: Instructions & General ConditionsSaad MajeedNo ratings yet

- FPSC@FPSC Gov PKDocument72 pagesFPSC@FPSC Gov PKNarinderNo ratings yet

- Narinder - Kumar - CVDocument1 pageNarinder - Kumar - CVNarinderNo ratings yet

- Narinderkumar 41131167Document1 pageNarinderkumar 41131167NarinderNo ratings yet

- Anandam Manufacturing Company: Analysis of Financial StatementsDocument5 pagesAnandam Manufacturing Company: Analysis of Financial StatementsNarinderNo ratings yet

- Running Head: QVC 1Document13 pagesRunning Head: QVC 1NarinderNo ratings yet

- Water & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)Document4 pagesWater & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)NarinderNo ratings yet

- 9706 s19 QP 31-1 PDFDocument12 pages9706 s19 QP 31-1 PDFsanchia masiwaNo ratings yet

- Smith Family Financial PDocument11 pagesSmith Family Financial PNarinder50% (2)

- Jetblue Airways: Deicing at Logan AirportDocument4 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- GuidelinesforOnlineSubmissionofApplications Updated 10-04-2018 PDFDocument17 pagesGuidelinesforOnlineSubmissionofApplications Updated 10-04-2018 PDFBilal ArshadNo ratings yet

- Running Head: K.Peabody Firm: Creating Elusive Profits 1Document13 pagesRunning Head: K.Peabody Firm: Creating Elusive Profits 1NarinderNo ratings yet

- The Walt Disney CompanyDocument11 pagesThe Walt Disney CompanyNarinderNo ratings yet

- By Plagiarism ReportDocument14 pagesBy Plagiarism ReportNarinderNo ratings yet

- Application For Work HomeDocument1 pageApplication For Work HomeNarinderNo ratings yet

- Sciencedirect: Guidelines For Successful CrowdfundingDocument6 pagesSciencedirect: Guidelines For Successful CrowdfundingNarinderNo ratings yet

- Areas in Which The Human Assets of HarrahDocument1 pageAreas in Which The Human Assets of HarrahNarinderNo ratings yet

- Enhancing Green Brand Loyalty (Aneel Kumar)Document47 pagesEnhancing Green Brand Loyalty (Aneel Kumar)NarinderNo ratings yet

- RayovacDocument9 pagesRayovacNarinderNo ratings yet

- Narinderkumar 41131167Document1 pageNarinderkumar 41131167NarinderNo ratings yet

- Final Examination Case Study FIN 855 Spring 2021 Professor Jim SewardDocument1 pageFinal Examination Case Study FIN 855 Spring 2021 Professor Jim SewardNarinderNo ratings yet

- Man Brewing CaseDocument9 pagesMan Brewing CaseNarinderNo ratings yet

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderNo ratings yet

- Before EPS Earning Before Tax 1,500,000 Less Interest 2,000,000 Earning Before Tax - 500,000 Tax 0 Earning of Shareholder - 500,000 No of Shares 8,000,000 EPS - 0.0625Document5 pagesBefore EPS Earning Before Tax 1,500,000 Less Interest 2,000,000 Earning Before Tax - 500,000 Tax 0 Earning of Shareholder - 500,000 No of Shares 8,000,000 EPS - 0.0625NarinderNo ratings yet

- Format For AssignmentDocument3 pagesFormat For AssignmentNarinderNo ratings yet

- Narinderkumar 41131167Document1 pageNarinderkumar 41131167NarinderNo ratings yet

- IT Return - FAST Builder - 2022Document3 pagesIT Return - FAST Builder - 2022Shakir MuhammadNo ratings yet

- Portfolio Theory, CAPM, WACC and Optimal Capital Structure - 20072018 PDFDocument50 pagesPortfolio Theory, CAPM, WACC and Optimal Capital Structure - 20072018 PDFdevashnee100% (2)

- Aubank 26042022164457 Ausfb Outcome BMDocument23 pagesAubank 26042022164457 Ausfb Outcome BMrkumar_81No ratings yet

- Tata Motors DCF Valuation, Financial Statements Forecast and Fundamental AnalysisDocument71 pagesTata Motors DCF Valuation, Financial Statements Forecast and Fundamental Analysissulaimani keedaNo ratings yet

- Question 18Document7 pagesQuestion 18chitra lounganiNo ratings yet

- Option Pricing TheoryDocument5 pagesOption Pricing TheoryNadeemNo ratings yet

- Partnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipDocument28 pagesPartnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipChristine SalvadorNo ratings yet

- Calls in AdvanceDocument14 pagesCalls in AdvanceShruti GoswamiNo ratings yet

- Bank of Boroda RajibDocument131 pagesBank of Boroda Rajibutpalbagchi100% (5)

- Estimating Walmarts Cost of CapitalDocument6 pagesEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- Analysis of US 30, S&P 500, Nasdaq 100 US 30: (Citation Mon21 /L 1033)Document3 pagesAnalysis of US 30, S&P 500, Nasdaq 100 US 30: (Citation Mon21 /L 1033)Naheed SakhiNo ratings yet

- Asset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDocument48 pagesAsset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDyan Palupi WidowatiNo ratings yet

- Cost of CapitalDocument27 pagesCost of CapitalMadhukant KumarNo ratings yet

- P4Document21 pagesP4reviska100% (1)

- BAFM6102 - Prelim Quiz 1 - Attempt ReviewDocument4 pagesBAFM6102 - Prelim Quiz 1 - Attempt ReviewKinglaw PilandeNo ratings yet

- ABM PRINCIPLES OF MARKETING 11 - Q1 - W2 - Mod2Document10 pagesABM PRINCIPLES OF MARKETING 11 - Q1 - W2 - Mod2Alex M. PinoNo ratings yet

- e-StatementBRImo 157901013063500 Mar2023 20230626 152453Document3 pagese-StatementBRImo 157901013063500 Mar2023 20230626 152453PoncolFc TVNo ratings yet

- Minicase - Ratio Analysis at S&S Air Inc.Document4 pagesMinicase - Ratio Analysis at S&S Air Inc.belle crisNo ratings yet

- Financial MarketDocument50 pagesFinancial MarketJocel VictoriaNo ratings yet

- Rekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoDocument6 pagesRekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoWira indah ZebuaNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- AC216 Unit 4 Assignment 5 - Amortization MorganDocument2 pagesAC216 Unit 4 Assignment 5 - Amortization MorganEliana Morgan100% (1)

- ICICI Direct Balkrishna IndustriesDocument9 pagesICICI Direct Balkrishna Industriesshankar alkotiNo ratings yet

- Speculation in Foreign Exchange and Money MarketDocument14 pagesSpeculation in Foreign Exchange and Money MarketNiharika RawatNo ratings yet

- A NuDocument7 pagesA NuAnusha RamanNo ratings yet

- Financial Accounting An Introduction To Concepts Methods and Uses Weil 14th Edition Solutions ManualDocument24 pagesFinancial Accounting An Introduction To Concepts Methods and Uses Weil 14th Edition Solutions Manualstubbleubiquistu1nNo ratings yet

- Corporate Finance (FINA0050) 2018 - Exercises Session 3 SolutionsDocument7 pagesCorporate Finance (FINA0050) 2018 - Exercises Session 3 SolutionsLouisRemNo ratings yet

- 5 6188064231535936141Document95 pages5 6188064231535936141SRISAI SURYANo ratings yet

- Role of Central BankDocument15 pagesRole of Central BankJayson100% (1)

- 2023 Financial StatementsDocument27 pages2023 Financial Statementsdemo040804No ratings yet