Professional Documents

Culture Documents

Taxable Income Defined - Key Terms Explained

Uploaded by

RoMeoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxable Income Defined - Key Terms Explained

Uploaded by

RoMeoCopyright:

Available Formats

Taxable Income Defined.

- The term taxable income means the pertinent items of gross

income specified in this Code, less the deductions and/or personal and additional

exemptions, if any, authorized for such types of income by this Code or other special laws.

Fringe Benefit defined.- For purposes of this Section, the term "fringe benefit" means any

good, service or other benefit furnished or granted in cash or in kind by an employer to an

individual employee (except rank and file employees

[

Capital assets shall refer to all real properties held by a taxpayer, whether or not connected

with his trade or business, and which are not included among the real properties considered

as ordinary assets under Sec. 39(A)(1) of the Code.

Ordinary assets shall refer to all real properties specifically excluded from the definition of

capital assets under Sec. 39(A)(1) of the Code, namely:

1. Stock in trade of a taxpayer or other real property of a kind which would properly be included in the inventory of the taxpayer if

on hand at the close of the taxable year; or

2. Real property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business; or

3. Real property used in trade or business (i.e., buildings and/or improvements) of a character which is subject to the allowance for

depreciation provided for under Sec. 34(F) of the Code; or

4. Real property used in trade or business of the taxpayer.

De minimis benefits are facilities and privileges of relatively small value and provided by

an employer to employees merely as a means to promote their health, good will,

contentment, or efficiency

A tax amnesty is a general pardon or the intentional overlooking by the State of its

authority to impose penalties on persons otherwise guilty of violation of a tax law.

Tax Benefit Rule - If a taxpayer recovers an expense or loss that was written off against the

previous year's income, the recovered amount must be included in the current year's gross

income for computing taxable income.

Doctrine of equitable recoupment. It provides that a claim for refund barred by

prescription may be allowed to offset unsettled tax liabilities should be pertinent only

to taxes arising from the same transaction on which an overpayment is made and

underpayment is due.

MOST FAVORED NATION CLAUSE - The essence of the principle is to allow the

taxpayer in one state to avail of more liberal provisions granted in another tax treaty to which

the country of residence of such taxpayer is also a party provided that the subject matter of

taxation, in this case royalty income, is the same as that in the tax treaty under which the

taxpayer is liable.

You might also like

- Lecture Notes Allowable DeductionsDocument51 pagesLecture Notes Allowable DeductionsRaymond MedinaNo ratings yet

- Definition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeDocument13 pagesDefinition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeSKEETER BRITNEY COSTANo ratings yet

- Tax I-TSN-Finals Coverage: Tax 1-Lectures by Atty. AbrantesDocument107 pagesTax I-TSN-Finals Coverage: Tax 1-Lectures by Atty. AbrantesEmma PaglalaNo ratings yet

- Deductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inDocument22 pagesDeductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inJamilenePandanNo ratings yet

- ACP Allowable Deductions Under Philippine Tax LawDocument20 pagesACP Allowable Deductions Under Philippine Tax LawRon Ramos100% (1)

- Midterm tax deductions guideDocument9 pagesMidterm tax deductions guideThe Second OneNo ratings yet

- 38 CIR Vs SEA GATEDocument4 pages38 CIR Vs SEA GATEIshNo ratings yet

- DRAFT REVENUE REGULATIONS IMPLEMENT TRAIN LAWDocument25 pagesDRAFT REVENUE REGULATIONS IMPLEMENT TRAIN LAWGenesis ManaliliNo ratings yet

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- 2018-Train ActDocument65 pages2018-Train ActAnthonette ManagaytayNo ratings yet

- Taxation TermDocument4 pagesTaxation TermStephen SalemNo ratings yet

- Capital Asset Vs Ordinary AssetDocument3 pagesCapital Asset Vs Ordinary AssetKR Reboroso100% (1)

- Explain The Difference Between Ordinary Assets and Capital Assets?Document1 pageExplain The Difference Between Ordinary Assets and Capital Assets?JeromeNo ratings yet

- Barangay Tax Code Sample PDFDocument14 pagesBarangay Tax Code Sample PDFSusan Carbajal100% (2)

- Deductions From Gross IncomeDocument23 pagesDeductions From Gross IncomeAidyl PerezNo ratings yet

- Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlDocument6 pagesChamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlMathew Beniga GacoNo ratings yet

- March 23, 2024 - Notes of BepitelDocument5 pagesMarch 23, 2024 - Notes of BepitelbepitelbreylleNo ratings yet

- Income From Profits and Gains of Business and Profession: (A) (B) (C) (D)Document9 pagesIncome From Profits and Gains of Business and Profession: (A) (B) (C) (D)Harshit YNo ratings yet

- Chapter 3 Concept of IncomeDocument6 pagesChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- TAXDocument2 pagesTAXJANNA GRACE DELA CRUZNo ratings yet

- Cornejo Bt211Document41 pagesCornejo Bt211Kristine Kate CornejoNo ratings yet

- Income Tax On IndividualsDocument25 pagesIncome Tax On IndividualsMohammadNo ratings yet

- Income Tax On Individuals and Tax RatesDocument25 pagesIncome Tax On Individuals and Tax RatesmmhNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- Income Tax Rates & ClassificationsDocument216 pagesIncome Tax Rates & ClassificationsalicorpanaoNo ratings yet

- Barangay Tax Code SampleDocument14 pagesBarangay Tax Code SampleMark Andrei Gubac100% (1)

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- DeductionsDocument6 pagesDeductionsjerome rodejoNo ratings yet

- Income Tax GuideDocument85 pagesIncome Tax GuidevicsNo ratings yet

- Notes On Income TaxationDocument21 pagesNotes On Income TaxationBen Dela Cruz100% (2)

- National TaxationDocument18 pagesNational TaxationShiela Joy CorpuzNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Taxation powers and conceptsDocument3 pagesTaxation powers and conceptsyanaNo ratings yet

- General Tax Liabilities of Domestic CorpsDocument5 pagesGeneral Tax Liabilities of Domestic CorpsCora EleazarNo ratings yet

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Tax Aspects AssignmentDocument5 pagesTax Aspects AssignmentJohn Klein SantillanNo ratings yet

- Midterm Reviewer - Taxation Key ConceptsDocument5 pagesMidterm Reviewer - Taxation Key ConceptsMaria RochelleNo ratings yet

- Introduction to Income Taxation PrinciplesDocument10 pagesIntroduction to Income Taxation PrinciplesArielNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- MAT and AMT ExplainedDocument17 pagesMAT and AMT ExplainedNitin ChoudharyNo ratings yet

- Taxation CasesDocument251 pagesTaxation CasesRowena NapaoNo ratings yet

- Princples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterDocument43 pagesPrincples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterMae NamocNo ratings yet

- TAXATIONDocument21 pagesTAXATIONRichelle Ann CarinoNo ratings yet

- Quezon City Revenue Regulations No. 16 - 2008 ExplainedDocument8 pagesQuezon City Revenue Regulations No. 16 - 2008 ExplainedRuby ReyesNo ratings yet

- Bac03-Chapter 5Document25 pagesBac03-Chapter 5Rea Mariz JordanNo ratings yet

- Tax 2 Finals Exam ReviewerDocument64 pagesTax 2 Finals Exam ReviewerFlorence RoseteNo ratings yet

- Tax 1 Notes 2Document20 pagesTax 1 Notes 2Kate CalansinginNo ratings yet

- Tax Planning in Business Bangladesh Perspective - by Swapan Kumar Bala - SSRN-id991329Document21 pagesTax Planning in Business Bangladesh Perspective - by Swapan Kumar Bala - SSRN-id991329Rahmat UllahNo ratings yet

- Income Tax in GeneralDocument6 pagesIncome Tax in GeneralMatt Marqueses PanganibanNo ratings yet

- Cir Vs SeagateDocument5 pagesCir Vs SeagateRenz Amon0% (1)

- CIR vs. Seagate TechnologyDocument3 pagesCIR vs. Seagate TechnologyKayee KatNo ratings yet

- RR 2-98 and 3-98Document103 pagesRR 2-98 and 3-98Ria Camille de JesusNo ratings yet

- Tax Q&ADocument4 pagesTax Q&AOnat PNo ratings yet

- Case DigestsDocument67 pagesCase DigestsCattleyaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Case Scenario - 1Document3 pagesCase Scenario - 1RoMeoNo ratings yet

- READ - Full Decision On Maguindanao Massacre Case - ABS-CBN NewsDocument14 pagesREAD - Full Decision On Maguindanao Massacre Case - ABS-CBN NewsRoMeoNo ratings yet

- Edz-Affidavit of Loss (Edwin Taneca) 15 July 2014Document1 pageEdz-Affidavit of Loss (Edwin Taneca) 15 July 2014RoMeoNo ratings yet

- Case Scenario - 1Document3 pagesCase Scenario - 1RoMeoNo ratings yet

- 128 Moncado V People S CourtDocument1 page128 Moncado V People S CourtRoMeoNo ratings yet

- VERIFICATION and CERTIFICATION - AnnulmentDocument1 pageVERIFICATION and CERTIFICATION - AnnulmentRoMeoNo ratings yet

- Affidavit of Mechanic detailing motorcycle changesDocument2 pagesAffidavit of Mechanic detailing motorcycle changesRoMeo67% (12)

- Conflict of Laws by Sempio DiyDocument81 pagesConflict of Laws by Sempio DiyAp Arc100% (9)

- Problems and Issues in Philippine EducationDocument16 pagesProblems and Issues in Philippine EducationRoMeoNo ratings yet

- Uy Vs Puson (PAT-FullText)Document8 pagesUy Vs Puson (PAT-FullText)RoMeoNo ratings yet

- RA 3019 Prohibited Acts for Public Officers and Private IndividualsDocument32 pagesRA 3019 Prohibited Acts for Public Officers and Private IndividualsRoMeoNo ratings yet

- Organizationalstructureppt 120821070841 Phpapp02Document32 pagesOrganizationalstructureppt 120821070841 Phpapp02RoMeoNo ratings yet

- Torrent Downloaded From Extratorrent - CCDocument1 pageTorrent Downloaded From Extratorrent - CCcoolzatNo ratings yet

- Insurance Memoaid 1Document42 pagesInsurance Memoaid 1washburnx20No ratings yet

- Complaint - Cancellation of TitleDocument11 pagesComplaint - Cancellation of TitleRoMeo100% (1)

- Statcon CasesDocument6 pagesStatcon CasesRoMeoNo ratings yet

- Affidavit of LossDocument2 pagesAffidavit of LossRoMeo0% (1)

- Petition For AdoptionDocument4 pagesPetition For AdoptionRoMeo100% (3)

- Contract To Buy and Sell (T-53.139)Document3 pagesContract To Buy and Sell (T-53.139)RoMeoNo ratings yet

- Collection case motion for executionDocument3 pagesCollection case motion for executionRoMeoNo ratings yet

- Formal OfferDocument5 pagesFormal OfferRoMeoNo ratings yet

- Spa BailbondDocument1 pageSpa BailbondRoMeo80% (5)

- Counter-Affidavit Murder Case PhilippinesDocument4 pagesCounter-Affidavit Murder Case PhilippinesRoMeo100% (2)

- Special Proceedings CasesDocument6 pagesSpecial Proceedings CasesRoMeoNo ratings yet

- Contract of Lease Between Catholic Church and Marketing FirmDocument4 pagesContract of Lease Between Catholic Church and Marketing FirmRoMeoNo ratings yet

- Cases On Special ProceedingsDocument8 pagesCases On Special ProceedingsRoMeoNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossRoMeo0% (1)

- Special Proceedings CasesDocument10 pagesSpecial Proceedings CasesRoMeoNo ratings yet

- TESDA Case Opposition EvidenceDocument5 pagesTESDA Case Opposition EvidenceRoMeoNo ratings yet

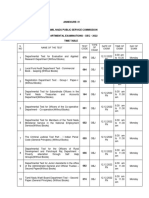

- ANNEXURE IV Dec 2022 enDocument17 pagesANNEXURE IV Dec 2022 enadvocacyindyaNo ratings yet

- Beef & Dairy 2016Document36 pagesBeef & Dairy 2016The Standard NewspaperNo ratings yet

- Difference between Especially and SpeciallyDocument2 pagesDifference between Especially and SpeciallyCarlos ValenteNo ratings yet

- Air Brake System For Railway CoachesDocument40 pagesAir Brake System For Railway CoachesShashwat SamdekarNo ratings yet

- Basic Computer Quiz - MCQ on Components, Generations & HistoryDocument7 pagesBasic Computer Quiz - MCQ on Components, Generations & Historyprem sagar100% (2)

- Assignement 4Document6 pagesAssignement 4sam khanNo ratings yet

- Computer 8 Q2 Set B ModuleDocument6 pagesComputer 8 Q2 Set B ModuleEmvie Loyd Pagunsan-ItableNo ratings yet

- Bahasa Inggris RanggaDocument3 pagesBahasa Inggris RanggaArdiyantoNo ratings yet

- RCD-GillesaniaDocument468 pagesRCD-GillesaniaJomarie Alcano100% (2)

- Ms. Rochelle P. Sulitas – Grade 7 SCIENCE Earth and Space Learning PlanDocument4 pagesMs. Rochelle P. Sulitas – Grade 7 SCIENCE Earth and Space Learning PlanEmelynNo ratings yet

- BOM RMCC Parking-Shed Rev2Document15 pagesBOM RMCC Parking-Shed Rev2Ephrem Marx AparicioNo ratings yet

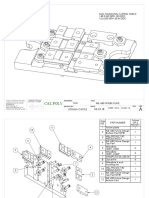

- Fixture Design ProjectDocument4 pagesFixture Design ProjectJosh CastleNo ratings yet

- Nej Mo A 1311738Document7 pagesNej Mo A 1311738cindy315No ratings yet

- PILE LOAD TEST PROCEDURE GUIDEDocument2 pagesPILE LOAD TEST PROCEDURE GUIDEJEFFY JACOBNo ratings yet

- Sample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Document2 pagesSample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Praveen KumarNo ratings yet

- Microsoft Security Product Roadmap Brief All Invitations-2023 AprilDocument5 pagesMicrosoft Security Product Roadmap Brief All Invitations-2023 Apriltsai wen yenNo ratings yet

- PRM Vol1 SystemsDocument1,050 pagesPRM Vol1 SystemsPepe BondiaNo ratings yet

- CENELEC RA STANDARDS CATALOGUEDocument17 pagesCENELEC RA STANDARDS CATALOGUEHamed AhmadnejadNo ratings yet

- Telegram Log File Details Launch Settings Fonts OpenGLDocument5 pagesTelegram Log File Details Launch Settings Fonts OpenGLThe nofrizalNo ratings yet

- (Drago) That Time I Got Reincarnated As A Slime Vol 06 (Sub Indo)Document408 pages(Drago) That Time I Got Reincarnated As A Slime Vol 06 (Sub Indo)PeppermintNo ratings yet

- Handwashing and Infection ControlDocument23 pagesHandwashing and Infection ControlLiane BartolomeNo ratings yet

- Steady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkDocument9 pagesSteady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkZangNo ratings yet

- Body Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able ToDocument19 pagesBody Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able TomahdiNo ratings yet

- Product Catalog Encoders en IM0038143Document788 pagesProduct Catalog Encoders en IM0038143Eric GarciaNo ratings yet

- Anubis - Analysis ReportDocument17 pagesAnubis - Analysis ReportÁngelGarcíaJiménezNo ratings yet

- UK Journal Compares Clove & Rosemary Oil Antibacterial ActivityDocument5 pagesUK Journal Compares Clove & Rosemary Oil Antibacterial ActivityNurul Izzah Wahidul AzamNo ratings yet

- Rick CobbyDocument4 pagesRick CobbyrickcobbyNo ratings yet

- Nad C541iDocument37 pagesNad C541iapi-3837207No ratings yet

- Internship Report On Incepta PharmaceutiDocument31 pagesInternship Report On Incepta PharmaceutihhaiderNo ratings yet

- Diesel fuel system for Caterpillar 3208 engineDocument36 pagesDiesel fuel system for Caterpillar 3208 engineLynda CarrollNo ratings yet