Professional Documents

Culture Documents

Chapter 5 (Bullets)

Uploaded by

CHARRYSAH TABAOSARESCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 (Bullets)

Uploaded by

CHARRYSAH TABAOSARESCopyright:

Available Formats

CHAPTER 5

DOCUMENTS IN CREDIT TRANSACTIONS

Documents that are used in credit transactions could be classified into two major types:

Those used for credit evaluation to eventually approve or disapproved an applicant.

Those used to document an approved credit transaction.

PART I

Document Required for Credit Evaluation

INITIALS USED:

ITR – Income Tax Return

It would show the gross income and taxable income for salaried individual. It does not

reflect the applicant’s true “take-home” Income.

Bank Statement

is a document that is issued by a bank once a month to its customers, listing the

transactions impacting a bank account. The statement provides the following

information: The beginning cash balance in the account. + The total amount of each

deposited batch of checks and cash.

Board of Directors

A board resolution of a company authorizing the issue of corporate credit in the name of

the executive director.

Original Certificate of Title

A certificate of title is a state or municipal-issued document that identifies the owner or

owners of personal or real property. A certificate of title provides documentary

evidence of the right of ownership mainly for real estate.

SEC Registration (Securities and Exchange Commission)

It indicate the ‘birth’ of a corporation. Prior to the date of the registration certificate

from SEC, the corporation did not exist. Without a SEC registration, a corporation does

not exist, and cannot transact any business of any kind whatsoever.

Financial Statements

are formal records of the financial activities and position of a business, person, or other

entity. Relevant financial information is presented in a structured manner and in a form

which is easy to understand

DTI and Business Permits

These are required for every establishment and they have to be displayed prominently

in the place of business. All the applicant has to do is to make copies for submission to

the bank.

Serial Numbers

are a deterrent against theft and counterfeit products, as they can be recorded, and

stolen or otherwise irregular goods can be identified. Some items with serial numbers

are automobiles, electronics, and appliances.

With this, we can assure that the item that you have that would serve as collaterals in

future purposes was truly yours.

Transfer Certificate of Title

For starters, a transfer certificate of title (also known as a deed of sale or deed of

absolute sale) is the property title of a given piece of land with or without a physical

structure built on it.

It contains details pertaining to the geophysical elements of the land as well as its

registration number and name of the owner. The transfer certificate of title

authenticates the ownership of the land as well as the ‘air space’ in it, which is also

called ‘air rights’, which gives the owner the right to build or develop in the air space

above the property.

Furthermore, the TCT should also show the title’s transfer history which includes a

record of previous TCT’s that were legally canceled due to the cycle of ownership.

PART II

DOCUMENTATION AND INSTRUMENTS USED FOR APPROVED CREDIT APPLICATION

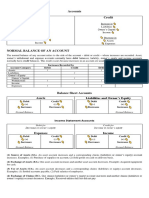

There is a need to distinguish between a document and an instrument.

A document, in this book, is defined as just any piece of paper on which is written words or

transactions; a document becomes an instrument when it confers the power to transfer, assign,

negotiate, alienate, buy or sell real or personal rights.

SAMPLE OF INSTRUMENTS

PROMISSORY NOTE

A promissory note is either negotiable or non-negotiable. A non-negotiable promissory note

cannot be transferred from one hand to another. It cannot be assigned or negotiated. By

contrast a negotiable promissory note can be purchased, sold, used as a collateral for a loan. For

a pronote to be negotiable, it must comply with requirements of the negotiable instruments

law:

It must be complete and regular in its face.

It must be signed by the maker.

It must contain an unconditional promise to pay a definite sum of money.

It must be payable on demand or a fixed future date.

It must be payable to a specific person or a bearer

DEED OF ABSOLUTE SALE

A deed of absolute sale transfers the ownership and possession of the thing bought to the

buyer. In the sale of a car or a motorcycle, the ownership must be transferred to the buyer so

that the vehicle can be registered with the LTO or Land Transportation Office.

CHATTEL MORTGAGE

Chattel mortgage, sometimes abbreviated CM, is the legal term for a type of loan contract used

in some states with legal systems derived from English law. Under a typical chattel mortgage,

the purchaser borrows funds for the purchase of movable personal property from the lender.

TRUST RECEIPTS

A trust receipt, by itself, is not a credit instrument. If it is used in a credit transaction, then

becomes a credit instrument. These are being used by a popular cosmetic company.

This type of transaction is governed by P.D. 115, or the Trust Receipts Law. The seller is called

the ‘entruster’ and the holder of the goods the ‘entrustee’.

WAREHOUSE RECEIPTS

A warehouse receipt, obviously issued by a warehouse (usually a government-registered and

bonded warehouse. It is not a credit instrument. It is a document used in a deposit transaction.

However when the farmer uses his warehouse receipt to obtain a loan, then a credit transaction

arises, and the warehouse receipt becomes a credit instrument.

PLEDGE

In a contract of pledge, used in pawnshops, it is essential that the thing pledged is in the

possession of the pledgee. (or with a 3 rd party by mutual agreement. The borrower is called

pledger, who puts up his personal property (the thing pledged) and the lender, who takes

possession of the thing pledged, is called the pledgee (the pawnshop). Every movable property

or incorporeal right could be the object of a pledge provided that it is capable of possession.

You might also like

- Lecture Credit and Collection Chapter 1Document7 pagesLecture Credit and Collection Chapter 1Celso I. MendozaNo ratings yet

- Philippine Deposit Insurance CorporationDocument10 pagesPhilippine Deposit Insurance Corporationelizabeth culaNo ratings yet

- FMPR2 Module BookletDocument66 pagesFMPR2 Module BookletMarjorie Onggay MacheteNo ratings yet

- BUSINESS LAW MODULE 2 RevisedDocument12 pagesBUSINESS LAW MODULE 2 RevisedArchill YapparconNo ratings yet

- Accounts Debit Credit: Normal Balance Normal BalanceDocument4 pagesAccounts Debit Credit: Normal Balance Normal BalanceVG R1NG3RNo ratings yet

- Fundamentals of Accountancy, Business, and Management 1Document12 pagesFundamentals of Accountancy, Business, and Management 1Muyco Mario AngeloNo ratings yet

- CFAS Reviewer (Unedited)Document13 pagesCFAS Reviewer (Unedited)Kevin OnaroNo ratings yet

- Statement of Financial PositionDocument28 pagesStatement of Financial Positionsammie helsonNo ratings yet

- Chapter 8 - Roculas, SylviaDocument22 pagesChapter 8 - Roculas, SylviaAmbray Lynjoy100% (1)

- Common Account TitlesDocument4 pagesCommon Account TitlesJaydie CruzNo ratings yet

- Learning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingDocument6 pagesLearning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingAira AbigailNo ratings yet

- Coblaw Chap1 3Document25 pagesCoblaw Chap1 3Charlene Tia100% (1)

- Human Behavior in OrganizationDocument22 pagesHuman Behavior in Organizationmirmo tokiNo ratings yet

- Condonation or RemissionDocument6 pagesCondonation or RemissionRhon Mhiel RomanoNo ratings yet

- Customs Bonded Warehousing SystemDocument28 pagesCustoms Bonded Warehousing SystemJen CastroNo ratings yet

- Background History of The Development of Credit in The Philippines How Credit Instruments Are NegotiatedDocument33 pagesBackground History of The Development of Credit in The Philippines How Credit Instruments Are Negotiatedelizabeth bernalesNo ratings yet

- The Philippine National Bank History and FunctionsDocument10 pagesThe Philippine National Bank History and FunctionsJared Andre CarreonNo ratings yet

- Types of Credit TransactionDocument2 pagesTypes of Credit Transactionjoshua aguirre0% (1)

- Compensation Swot Analysis of Bdo Unibank, Inc. Company ProfileDocument3 pagesCompensation Swot Analysis of Bdo Unibank, Inc. Company ProfileChari Ty TabafaNo ratings yet

- Chapter 1 - General Provisions, Basic Standards and PoliciesDocument10 pagesChapter 1 - General Provisions, Basic Standards and Policiesdar •No ratings yet

- Obicon FinalDocument32 pagesObicon FinalJessNo ratings yet

- SRGGDocument31 pagesSRGGPinky LongalongNo ratings yet

- Topic I Introduction To CreditDocument4 pagesTopic I Introduction To CreditLemon OwNo ratings yet

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- Personal SellingDocument3 pagesPersonal SellingUransh MunjalNo ratings yet

- Unit 2 CreditDocument13 pagesUnit 2 Creditcharlyn mae generalNo ratings yet

- BSPDocument11 pagesBSPMeloy ApiladoNo ratings yet

- CHAPTER 1, 2, 3 and 4Document33 pagesCHAPTER 1, 2, 3 and 4Jobelle MalabananNo ratings yet

- CreditCollection ModulesDocument71 pagesCreditCollection ModulesShaina Angel FulgencioNo ratings yet

- Juridical Necessity - It Means The Rights andDocument18 pagesJuridical Necessity - It Means The Rights andJeric RealNo ratings yet

- Advantage and Disadvantages of Business OrganizationDocument3 pagesAdvantage and Disadvantages of Business OrganizationJustine VeralloNo ratings yet

- Chapter IX Credit InstrumentDocument3 pagesChapter IX Credit InstrumentHoney LimNo ratings yet

- OBLICONDocument19 pagesOBLICONIan WolfgangNo ratings yet

- Substance Over FormDocument2 pagesSubstance Over Formsimson singawahNo ratings yet

- PDIC Illustrative ProblemsDocument5 pagesPDIC Illustrative ProblemsDiscord HowNo ratings yet

- Filipino Social NormsDocument3 pagesFilipino Social NormsMarevi DichosoNo ratings yet

- Unit VI (Accounting For Promissory Note)Document14 pagesUnit VI (Accounting For Promissory Note)bum_24100% (7)

- Ethics 3.1 1Document38 pagesEthics 3.1 1Nicole Tonog AretañoNo ratings yet

- Assignment #5Document4 pagesAssignment #5Lenmariel GallegoNo ratings yet

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocument41 pagesCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8No ratings yet

- Economic DevelopmentDocument17 pagesEconomic DevelopmentVher Christopher Ducay100% (1)

- 9Document2 pages9Patricia CruzNo ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- The Philippine Financial SystemDocument20 pagesThe Philippine Financial Systemjhun labangNo ratings yet

- Rescissible Contracts 2Document36 pagesRescissible Contracts 2madelc_1No ratings yet

- Acct TutorDocument22 pagesAcct TutorKthln Mntlla100% (1)

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- ReviewerDocument48 pagesReviewerJana GreenNo ratings yet

- Types of AssetsDocument19 pagesTypes of AssetsMylene SalvadorNo ratings yet

- Law 1 Handout Part 2-ADocument3 pagesLaw 1 Handout Part 2-AAshley Niña Lee HugoNo ratings yet

- (GEPCOMM) Diagnostic Writing Task by Martinez, Irish Benette M.Document3 pages(GEPCOMM) Diagnostic Writing Task by Martinez, Irish Benette M.Irish Benette MartinezNo ratings yet

- Assessment On The Practice of Corporate Social ResponsibilityDocument12 pagesAssessment On The Practice of Corporate Social ResponsibilityJayson Tom Briva CapazNo ratings yet

- Analysis of Financial Statements Mix RatioDocument30 pagesAnalysis of Financial Statements Mix RatioBianca Angela Camayra QuiaNo ratings yet

- Global Finance and Electronic BankingDocument2 pagesGlobal Finance and Electronic BankingMhars Dela CruzNo ratings yet

- Gourmet KesoDocument8 pagesGourmet KesoAra Jane T. PiniliNo ratings yet

- Lesson 1 CreditDocument4 pagesLesson 1 CreditMylene SalvadorNo ratings yet

- Mashudul Assignment 1Document10 pagesMashudul Assignment 1Ayaz KhanNo ratings yet

- 1.1 Identify TyDocument7 pages1.1 Identify TyTarekegn DemiseNo ratings yet

- Notice Under Transfer of PropertyDocument11 pagesNotice Under Transfer of Propertytej chopraNo ratings yet

- Franchising: Final Quiz CASE STUDY "7-Eleven: A Way of Life"Document6 pagesFranchising: Final Quiz CASE STUDY "7-Eleven: A Way of Life"CHARRYSAH TABAOSARESNo ratings yet

- Appendix B: Job Analysis Questionnaire Managerial and Supervisory PositionDocument66 pagesAppendix B: Job Analysis Questionnaire Managerial and Supervisory Positiongeofrey gepitulanNo ratings yet

- CHARRYSAH TABAOSARES - Importance of Studying LiteratureDocument3 pagesCHARRYSAH TABAOSARES - Importance of Studying LiteratureCHARRYSAH TABAOSARESNo ratings yet

- Charrysah Tabaosares - Concept of FranchisingDocument5 pagesCharrysah Tabaosares - Concept of Franchisinggeofrey gepitulanNo ratings yet

- Charrysah Tabaosares - Reflections On Global Electronic BankingDocument6 pagesCharrysah Tabaosares - Reflections On Global Electronic Bankinggeofrey gepitulanNo ratings yet

- Charrysah Tabaosares - Case StudyDocument86 pagesCharrysah Tabaosares - Case Studygeofrey gepitulanNo ratings yet

- Chapter 9 Taxation Income and WealthDocument7 pagesChapter 9 Taxation Income and WealthCHARRYSAH TABAOSARESNo ratings yet

- An Overview of Financial ManagementDocument8 pagesAn Overview of Financial ManagementCHARRYSAH TABAOSARESNo ratings yet

- Charrysah Tabaosares - Franchising (Case Study 1)Document3 pagesCharrysah Tabaosares - Franchising (Case Study 1)CHARRYSAH TABAOSARES100% (1)

- Midterm Assignment 2 Public FinanceDocument4 pagesMidterm Assignment 2 Public FinanceCHARRYSAH TABAOSARESNo ratings yet

- Midterm Quiz Number 2 Credit Collection Learning InsightDocument7 pagesMidterm Quiz Number 2 Credit Collection Learning InsightCHARRYSAH TABAOSARESNo ratings yet

- Credit & Collection: Midterm Quiz 1Document3 pagesCredit & Collection: Midterm Quiz 1CHARRYSAH TABAOSARESNo ratings yet

- Midterm Learning Insight FranchisingDocument8 pagesMidterm Learning Insight Franchisinggeofrey gepitulanNo ratings yet

- Midterm Assignment 2 Public FinanceDocument4 pagesMidterm Assignment 2 Public FinanceCHARRYSAH TABAOSARESNo ratings yet

- CTT - LOP Assignment (Describing A Short Story) 09320 @11.33AMDocument3 pagesCTT - LOP Assignment (Describing A Short Story) 09320 @11.33AMCHARRYSAH TABAOSARESNo ratings yet

- CTT - LOP Assignment (Describing A Short Story) 09320 @11.50AMDocument11 pagesCTT - LOP Assignment (Describing A Short Story) 09320 @11.50AMgeofrey gepitulanNo ratings yet

- CTT-Public Finance (Midterm Quiz 1) 100920Document2 pagesCTT-Public Finance (Midterm Quiz 1) 100920CHARRYSAH TABAOSARESNo ratings yet

- CTT - LOP (Short Story Analysis)Document4 pagesCTT - LOP (Short Story Analysis)CHARRYSAH TABAOSARESNo ratings yet

- CTT - Franchising (Chapter 7 Midterm Exam)Document3 pagesCTT - Franchising (Chapter 7 Midterm Exam)CHARRYSAH TABAOSARESNo ratings yet

- CTT-Franchising (Quiz 3) 100820Document3 pagesCTT-Franchising (Quiz 3) 100820CHARRYSAH TABAOSARESNo ratings yet

- Classification and Sources of CreditDocument8 pagesClassification and Sources of Creditgeofrey gepitulan100% (1)

- CTT - Franchising (Chapter 5 Learning Insights)Document6 pagesCTT - Franchising (Chapter 5 Learning Insights)CHARRYSAH TABAOSARESNo ratings yet

- CTT-Franchising (Quiz 3) 100820Document3 pagesCTT-Franchising (Quiz 3) 100820CHARRYSAH TABAOSARESNo ratings yet

- CTT - Franchising (Essay) 102220Document3 pagesCTT - Franchising (Essay) 102220CHARRYSAH TABAOSARESNo ratings yet

- Credit & Collection: Midterm Quiz 1Document5 pagesCredit & Collection: Midterm Quiz 1geofrey gepitulanNo ratings yet

- My Proposed Business in A Capital of 15 MilionDocument11 pagesMy Proposed Business in A Capital of 15 MilionCHARRYSAH TABAOSARESNo ratings yet

- CTT - Franchising (Chapter 5 Midterm Exam)Document5 pagesCTT - Franchising (Chapter 5 Midterm Exam)CHARRYSAH TABAOSARESNo ratings yet

- My Proposed Business in A Capital of 15 MilionDocument11 pagesMy Proposed Business in A Capital of 15 MilionCHARRYSAH TABAOSARESNo ratings yet

- Chapter 10: Recovery of Credit Granted Final Quiz 1 Learning InsightsDocument4 pagesChapter 10: Recovery of Credit Granted Final Quiz 1 Learning InsightsCHARRYSAH TABAOSARESNo ratings yet

- CTT - LOP Assignment (Describing A Short Story) 102320 @08.47AMDocument3 pagesCTT - LOP Assignment (Describing A Short Story) 102320 @08.47AMCHARRYSAH TABAOSARESNo ratings yet

- Developing Singapore's Corporate Bond Market: Building A Liquid Government Benchmark Yield CurveDocument6 pagesDeveloping Singapore's Corporate Bond Market: Building A Liquid Government Benchmark Yield CurveMOHAMED RIZWANNo ratings yet

- Claim Settlement of GICDocument51 pagesClaim Settlement of GICSusilPandaNo ratings yet

- Condensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015Document42 pagesCondensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015api-307565920No ratings yet

- Rak BankDocument12 pagesRak Banknaresh4mrktg100% (1)

- Villa vs. Garcia Bosque DIGESTDocument1 pageVilla vs. Garcia Bosque DIGESTJoseph MacalintalNo ratings yet

- Amrita Deb Law ProfessionalDocument3 pagesAmrita Deb Law ProfessionalnitschemistryNo ratings yet

- Investor Document Package - Borrower Dependent Notes 1Document87 pagesInvestor Document Package - Borrower Dependent Notes 1api-274293476No ratings yet

- Ruiz Vs Ca GR No. 146942 April 22, 2003Document1 pageRuiz Vs Ca GR No. 146942 April 22, 2003juhrizNo ratings yet

- Assumption of Mortgage (Naguit)Document3 pagesAssumption of Mortgage (Naguit)Albert FranciscoNo ratings yet

- Bank of England and The British Empire: A "New World Order"?Document157 pagesBank of England and The British Empire: A "New World Order"?William Litynski100% (6)

- Post Shipment FinanceDocument4 pagesPost Shipment FinanceambrosialnectarNo ratings yet

- Mico Metals V CADocument2 pagesMico Metals V CAPerry RubioNo ratings yet

- 05-03-13 EditionDocument28 pages05-03-13 EditionSan Mateo Daily JournalNo ratings yet

- Financial Education Investing Retirement ResearchDocument397 pagesFinancial Education Investing Retirement ResearchCKJJ55@hotmail.cm0% (2)

- Rescission of Insurance ContractsDocument12 pagesRescission of Insurance ContractsCari Mangalindan MacaalayNo ratings yet

- Module 3 - Deductions On Gross Estate - v.3Document7 pagesModule 3 - Deductions On Gross Estate - v.3John Vincent ManuelNo ratings yet

- USA v. Coleman Et Al Doc 001 Indictment 08 Dec 2011Document13 pagesUSA v. Coleman Et Al Doc 001 Indictment 08 Dec 2011kplatinumNo ratings yet

- Rahul Sir Maths Questions Special of Compound InterestDocument3 pagesRahul Sir Maths Questions Special of Compound InterestAnjan BahugunaNo ratings yet

- Obligations of The VendorDocument8 pagesObligations of The Vendorlorenceabad07No ratings yet

- Template - MOUDocument5 pagesTemplate - MOUKara CuaromNo ratings yet

- Bibliography Financial CrisisDocument41 pagesBibliography Financial CrisisaflagsonNo ratings yet

- What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document7 pagesWhat Is The Philippine Deposit Insurance Corporation (PDIC) ?Jo Vic Cata BonaNo ratings yet

- Mortgage Foreclosures, Promissory Notes, and The UCC DWhaleyDocument28 pagesMortgage Foreclosures, Promissory Notes, and The UCC DWhaleyCarrieonic100% (2)

- Civproc Digest RFC Vs AltoDocument1 pageCivproc Digest RFC Vs Altojoselle gaviolaNo ratings yet

- Midterm Examination Law On Sales 2022Document17 pagesMidterm Examination Law On Sales 2022Mandy GimeNo ratings yet

- Credit Surety Fund BSP PDFDocument12 pagesCredit Surety Fund BSP PDFLeomard SilverJoseph Centron LimNo ratings yet

- Standard Request For ProposalDocument55 pagesStandard Request For ProposalNasir R AyubNo ratings yet

- Insurance Related Current Affairs Last 6 MonthsDocument6 pagesInsurance Related Current Affairs Last 6 MonthsdeepakNo ratings yet

- Manthan997 Welcome LetterDocument3 pagesManthan997 Welcome LetterManthan ShahNo ratings yet

- Naim Polanco CVDocument3 pagesNaim Polanco CVFavio FernándezNo ratings yet