Professional Documents

Culture Documents

Exercise 9.1 Source Documents: A Source Document Transaction

Uploaded by

JefferyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 9.1 Source Documents: A Source Document Transaction

Uploaded by

JefferyCopyright:

Available Formats

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.1 Source documents

a

Source document Purchase invoice

Transaction Stitch in Time purchased 10 spools of thread on credit from

Common Thread for a total cost of $418 including $38 GST.

Explanation Stitch in Time must pay the whole amount owing in 15 days (net owing

15 days).

c

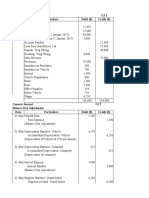

Purchases Journal

Date Accounts Payable Inv. Inventor GST Total

No. y of Accounts

materials Payable

Nov. 3 Common Thread 112 380 38 418

TOTALS $

Explanatio GST is a tax imposed on the sale of goods and services. The $380 paid

n is for the 10 spools of thread – this is the value of the Inventory of

materials. The $38 is separate as it is the GST charged by the Australian

Government, which is being collected by the supplier on the ATO’s

behalf. It is not part of the cost of the Inventory of materials and will in fact

reduce Stitch in Time’s GST liability to the ATO.

Element Increase/Decrease/No Effect Amount $

Asset Increase – Inventory of materials increase 380

Liability Increase – Accounts Payables increase $418; GST 380

liability decrease (GST credit) $38

Owner’s equity No effect

Simmons, Hardy 1 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.2 Purchases Journal

a

Explanation The purpose of a Purchases Journal is to summarise all purchases of

Inventory of materials on credit during a particular reporting period. This

aids in the process of turning raw data into financial information so it can

assist in decision-making.

b

Purchases Journal

Date Accounts Payable Inv. Inventory GST Total

No. of Accounts

materials Payable

July 2 Volt Industries V53 4 200 420 4 620

7 Wattage Supplies 346 2 500 250 2 750

16 Ampage Ltd A52 1 800 180 1 980

23 Wattage Supplies 387 1 400 140 1 540

28 Volt Industries V65 3 600 360 3 960

TOTALS $ 13 500 1 350 14 850

Explanation The source documents in the Purchases Journal won’t run in sequence

because they are not issued by Sparky Electricians but by their

suppliers who issue their invoices to all their customers. Therefore,

Sparky Electricians is receiving purchase invoices from a variety of

suppliers who have other customers as well.

Explanation The GST incurred on credit purchases will be forwarded to the ATO.

Therefore, this GST incurred by Sparky Electricians will reduce their

GST liability to the ATO.

Simmons, Hardy 2 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.3 Purchases Journal and Cash Payments Journal

a

Purchases Journal

Date Accounts Payable Inv. Inventory GST Total

No. of Accounts

materials Payable

Sept. 3 Leather Emporium L56 360 36 396

8 Sole Man 201 750 75 825

16 Lillies Laces LL314 240 24 264

24 Sole Man 246 400 40 440

TOTALS $ 1 750 175 1 925

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payables

Sept. 1 Lillies Laces 165 120 120

7 Wages WDWL 950 950

9560

11 Office equipment 166 2 200 2 000 200

14 Drawings ATM 500 500

653

19 Sole Man 167 770 770

21 Wages WDWL 950 950

9875

27 Drawings ATM 490 490

741

30 Leather 168 1 000 1 000

Emporium

TOTALS $ 6 980 1 890 990 1900 2 000 200

Explanation This transaction was a payment to an Accounts Payable. Therefore,

bank will decrease by $700, decreasing assets, and Accounts Payable

will decrease by $700, decreasing liabilities.

Simmons, Hardy 3 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Calculation

Accounts Payable balance 2 870

at start

+ Credit purchases incl. GST 1 925

4 795

– Payments to Accounts 1 890

Payable

Accounts Payable balance $2 905

at end

Accounts Payables balance $ 2 905

Explanation There is no GST on a payment to an Accounts Payable because the

GST is recognised and recorded at the time the purchase is made and

becomes a part of what is owed to the Accounts Payable. The GST has

been recorded in the Purchases Journal. If it was recorded in the Cash

Payments Journal again the GST would be double counted.

Simmons, Hardy 4 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.4 Journals and Accounts Payable

a

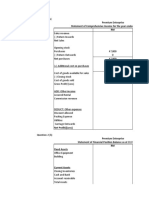

Purchases Journal

Date Accounts Payable Inv. Inventory GST Total

No. of Accounts

materials Payable

7 Victor Mowers 385 1 800 180 1 980

12 ReeObi R47 2 100 210 2 310

18 Victor Mowers 413 6 350 635 6 985

23 Parts and Pieces P2501 5 000 500 5 500

28 ReeObi R65 4 500 450 4 950

TOTALS $ 19 750 1 975 21 725

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payable

Apr. 2 ReeObi 215 6 000 6 000

5 Drawings ATM 800 800

902

8 Wages WDWL 1 200 1 200

6095

10 Victor Mowers 216 8 500 8 500

13 Electricity Bpay 341 310 31

612

19 ReeObi 217 2 000 2 000

21 Drawings ATM 600 600

6679

22 Wages WDWL 1 200 1 200

6438

24 Victor Mowers 218 3 500 3 500

27 Water bill Bpay 253 230 23

946

29 Parts and 219 12 000 12 000

Pieces

TOTALS $ 36 394 32 000 1 400 2 400 540 54

Simmons, Hardy 5 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Calculation

Accounts Payable balance at start 34 400

+ Credit purchases incl. GST 19 750

54 150

– Payments to Accounts Payable 32 000

Accounts Payable balance at end $22 150

Accounts Payable balance $ 22 150

Qualitative characteristic Verifiability

Explanation Mow and Mulch must keep all the firm’s source documents as these

provide evidence of all the firms transactions. This makes sure that all

figures can be verified and ensures that the figures in the Financial

Statements are accurate and free from bias. Verifiability is maintained

by retention of source documents.

Simmons, Hardy 6 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.5 Source documents

a

Source document Sales invoice

Transaction Credit fee – Good as New repaired a 3 three-seater Chesterfield

on credit for Ouch Dental for a total cost of $4 950, including $450

GST.

b

Explanation It is important that credit terms are stated on the invoice so that the

customer knows when they must pay the amount owing. A business will

only grant credit for a specific period of time as they require the cash

from the credit fee to pay their obligations.

Explanation This transaction is considered revenue because it has arisen from the

ordinary activities of the business and the transaction has increased

assets (Accounts Receivable) and will lead to an increase in owner’s

equity and it is not Capital contribution.

d

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

Oct. 5 Ouch Dental 149 4 500 450 4 950

TOTALS $

e

Element Increase/Decrease/No Effect Amount $

Asset Increase – Accounts Receivable increase $4 950 4 950

Liability Increase – GST liability increase $450 450

Owner’s equity Increase – Revenue increase $4 500 4 500

Simmons, Hardy 7 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.6 Sales Journal

a

Source document number Inv. 107

b

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

Feb. 4 Plus Accounting 102 270 27 297

9 Shone Lawyers 103 520 52 572

15 French Apartments 104 850 85 935

22 Shone Lawyers 105 430 43 473

27 Plus Accounting 106 300 30 330

TOTALS $ 2 370 237 2 607

Reason 1 This does not take into account any existing balances of Accounts

Receivable that may have existed at the start of the period.

Reason 2 This does not take into account any receipts from Accounts Receivable

that may have occurred at the start of the period.

Explanation Any GST charged on Credit fees is GST charged and collected later by

the business on the Australian Government’s behalf. Therefore, this is

owed to the ATO and will increase GST payable.

Simmons, Hardy 8 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.7 Sales Journal and Cash Receipts Journal

a

Explanatio The transaction on 1 May is not revenue as it is a receipt from an

n Account Receivable. Even though cash is flowing into the business it is a

transfer of assets from Accounts Receivable to Bank and has no resulting

impact on owner’s equity. The revenue has already been recorded in the

Sales Journal. To record it again would be to double count the revenue.

Explanation There is no GST to account for from a receipt from an Account

Receivable because the GST is recognised and recorded at the time the

fee is made and becomes a part of what is owed by the Accounts

Receivable to the business. The GST has been recorded in the Sales

Journal. If it was recorded in the Cash Receipts Journal again the GST

would be double counted.

c

Sales Journal

Date Accounts Receivable Inv.No. Fees GST Total

Accounts

Receivable

May 3 Fab Events 271 1 420 142 1 562

9 Party Dayz 272 1 450 145 1 595

13 Lando’s Café 273 900 90 990

16 Wow ART 274 720 72 792

27 Party Dayz 275 3 200 320 3 520

TOTALS $ 7 690 769 8 459

Simmons, Hardy 9 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Cash Receipts Journal

Date Details Rec. Bank Accounts Fees Sundries GST

No. Receivable

May 1 Fab Events 56 1 500 1 500

4 Cash fees 57 308 280 28

6 Loan – Fincorp BS 8 000 8 000

10 Fab Events 58 1 800 1 800

18 Party Dayz 59 4 450 4 450

22 Lando’s Café 60 990 990

25 Cash fees 61 132 120 12

31 Wow ART 62 500 500

TOTALS $ 17 680 9 240 400 8 000 40

Calculation

Accounts Receivable 8 000

balance at start

+ Credit fees incl. GST 8 459

16 459

– Receipts from Accounts 9 240

Receivable

Accounts Receivable $ 7 219

balance at end

Accounts Receivable balance $ 7 219

Explanation Not all Accounts Receivable have met their credit terms as Fab Events

still has $250 outstanding from the last period that exceeds the 30-day

credit terms set by Unbreakable Gear. Party Dayz and Lando’s Café

paid within the specified credit terms. Party Dayz and Wow ART are still

within their credit terms.

Simmons, Hardy 10 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.8 Credit transactions

a

Purchases Journal

Date Accounts Payable Inv. Inventor GST Total

No. y of Accounts

materials Payable

Jul. 7 Buff and Shine 16X 3 100 310 3 410

9 Strung Instruments 403 1 780 178 1 958

20 Buff and Shine B71 2 200 220 2 420

24 Strung Instruments 431 850 85 935

TOTALS $ 7 930 793 8 723

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

Jul. 2 Sunshine Secondary College 109 3 400 340 3 740

5 Blackburn Secondary College 110 1 530 153 1 683

12 Beaconsfield Primary 111 400 40 440

23 Sunshine Secondary College 112 1 000 100 1 100

30 Beaconsfield Primary 113 510 51 561

TOTALS $ 6 840 684 7 524

Cash Receipts Journal

Date Details Rec. Bank Accounts Fees Sundries GST

No. Receivable

Jul. 3 Beaconsfield 57 500 500

Primary

14 Cash fees 58 242 220 22

17 Sunshine 59 4 100 4 100

Secondary

College

25 Cash fees 60 253 230 23

28 Blackburn 61 3 113 3 113

Secondary

College

31 Interest BS 8 8

Simmons, Hardy 11 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

TOTALS $ 8 216 7 713 450 8 45

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payables

Jul. 1 Rent 205 1 320 1 200 120

4 Buff and Shine 206 800 800

8 Wages WDW 1 100 1 100

L 3864

11 Drawings ATM 1 500 1 500

6309

16 Strung 207 1 900 1 900

Instruments

22 Wages WDW 600 600

L 3892

27 Advertising BPay 539 490 49

495

29 Buff and Shine 208 1 000 1 000

TOTALS $ 8 759 3 700 1 500 1 700 1 690 169

Calculation

Accounts Payable balance 3 150

at start

+ Credit purchases incl. GST 8 723

11 873

– Payments to Account 3 700

Payable

Accounts Payable balance $8 173

at end

Accounts Payable balance $ 8 173

Simmons, Hardy 12 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Calculation

Accounts Receivable 5 280

balance at start

+ Credit fees incl. GST 7 524

12 804

– Receipts from Accounts 7 713

Receivable

Accounts Receivable $5 091

balance at end

Accounts Receivable balance $ 5 091

Explanation Musical Beat can verify these balances by cross checking the original

source documents with the relevant journals to ensure all information is

correct and free from bias. Another double check would be to add up all

the relevant Account Receivables / Payables and see if the same

answer was reached.

Simmons, Hardy 13 © Cambridge University Press 2019

Chapter 9 – Credit transactions – solutions for exercises

Exercise 9.9 Statement of Account

a

Explanation The function of a Statement of Account is to inform the customer of their

recent transactions. It can also serve as a reminder of a balance that is

owing. If a business receives a Statement of Account, they can check

the transactions against their records and source documents.

Explanation Paint World would be reported as an Accounts Payable under current

liabilities in the Balance Sheet of No Drips Painting. This is because the

business has purchased goods on credit and now has a present

obligation that it must transfer economic resources to meet within 12

months after the end of a reporting period.

c

Explanation No Drips Painting would be reported as an Account Receivable under

current assets in the Balance Sheet of Paint World. This is because

Paint World has sold goods on credit to the No Drips Painting and now

has a present economic resource which has the potential to produce

future economic benefits within 12 months at the end of a reporting

period.

Simmons, Hardy 14 © Cambridge University Press 2019

You might also like

- InnitDocument35 pagesInnitobiscarsgovroom123No ratings yet

- Practice Questions DM112 No 22Document13 pagesPractice Questions DM112 No 22Bianca BenNo ratings yet

- Assignment 2Document12 pagesAssignment 2Geetu SharmaNo ratings yet

- Week - 10 Workbook - SolutionsDocument5 pagesWeek - 10 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Accounting 2020 Unit 1 KTT 6 - Solution BookDocument5 pagesAccounting 2020 Unit 1 KTT 6 - Solution BookJefferyNo ratings yet

- ZULUAGA, 2020 - Cash Flow Cycle Analysis TemplateDocument8 pagesZULUAGA, 2020 - Cash Flow Cycle Analysis TemplateandreaNo ratings yet

- BusinessDocument13 pagesBusinessralph ghazziNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- Assignment 1 Acc 401 2022 Kirti DeviDocument4 pagesAssignment 1 Acc 401 2022 Kirti DevikirtiNo ratings yet

- Ch04CashTransactions Exercise SolutionsDocument39 pagesCh04CashTransactions Exercise Solutionsobiscarsgovroom123No ratings yet

- Solutions To More SAC 1 Revision 2021Document5 pagesSolutions To More SAC 1 Revision 2021anshsinghsoniNo ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- 2020 Unit 2 SAC 2 Question BookDocument7 pages2020 Unit 2 SAC 2 Question BookSarita SinghNo ratings yet

- Exercise Chap 2 NLKTDocument10 pagesExercise Chap 2 NLKTalexnguyen21007No ratings yet

- TR2 - Posting Journals To LedgersDocument9 pagesTR2 - Posting Journals To LedgersBagya SuraweeraNo ratings yet

- 2019 TSSM Exam 4 SolutionsDocument12 pages2019 TSSM Exam 4 Solutionsdyted73No ratings yet

- GJ No. 1Document6 pagesGJ No. 1AN AdeNo ratings yet

- Ems GR 08 p1 Nov Quest Paper With Answer Book 2023Document8 pagesEms GR 08 p1 Nov Quest Paper With Answer Book 2023athianathingemaNo ratings yet

- 5010 Ohada Fin Reporting p2Document12 pages5010 Ohada Fin Reporting p2serge folegweNo ratings yet

- Bbaw 2103 - Financial AccountingDocument8 pagesBbaw 2103 - Financial AccountingRainie LimNo ratings yet

- Kelly Consulting - Assignment1Document14 pagesKelly Consulting - Assignment1krystallanedenice.manansalaNo ratings yet

- Activities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerDocument9 pagesActivities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerEfril Joy AlbitoNo ratings yet

- Tamisha McQuilkin Final ExamDocument8 pagesTamisha McQuilkin Final ExamTamisha McQuilkinNo ratings yet

- Intermediate Accounting 2008 PDFDocument7 pagesIntermediate Accounting 2008 PDFchin leaNo ratings yet

- Fa Templete HomeworkDocument5 pagesFa Templete Homework李斯琪No ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Problems & Solutions - Final Accounts - QuestionsDocument36 pagesProblems & Solutions - Final Accounts - QuestionsYerramsetti Sri HarshaNo ratings yet

- ExercisesDocument3 pagesExercisesThiều Xuân LamNo ratings yet

- Topic 6 Multiple Choice QuestionDocument8 pagesTopic 6 Multiple Choice Question黄颀桓No ratings yet

- Final (Question) BTM 4103 Financial Accounting IDocument3 pagesFinal (Question) BTM 4103 Financial Accounting ITasfia MeherNo ratings yet

- Preparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018Document11 pagesPreparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018IlovejjcNo ratings yet

- BTRN V3 Progress Check 1 Tutor Marked - Question Paper July19Document17 pagesBTRN V3 Progress Check 1 Tutor Marked - Question Paper July19Zach SullivanNo ratings yet

- ExamDocument3 pagesExamMIN THANTNo ratings yet

- InstructionsDocument8 pagesInstructionsPhuong ThuyNo ratings yet

- n560 - Financial Accounting n5 Memo June 2019 - AdallDocument9 pagesn560 - Financial Accounting n5 Memo June 2019 - AdallemgnNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- Gr10 Acc (English) June 2019 Possible AnswersDocument13 pagesGr10 Acc (English) June 2019 Possible AnswersLethabo Mmankale TabaneNo ratings yet

- Rama Raju Final Workings 30.08.2020Document2 pagesRama Raju Final Workings 30.08.2020Varma RebalNo ratings yet

- Group #1 - Presentation - Super Sports - QuestionDocument8 pagesGroup #1 - Presentation - Super Sports - QuestionNaruto MangaNo ratings yet

- BBAW2103Document10 pagesBBAW2103Zack MJNo ratings yet

- Coursebook Section 3 Practice Question AnswersDocument9 pagesCoursebook Section 3 Practice Question AnswersAhmed Zeeshan91% (11)

- Acct Project J Question 1Document12 pagesAcct Project J Question 1graceNo ratings yet

- Voucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Document9 pagesVoucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Salma AbdullahNo ratings yet

- Acc 3 Unit 3 Revision Questions 13Document12 pagesAcc 3 Unit 3 Revision Questions 13Danielle WatsonNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- PART 4 - Opening BalancesDocument2 pagesPART 4 - Opening BalancesTabani RobertNo ratings yet

- TLE Group 1 St. PhilipDocument9 pagesTLE Group 1 St. Philipdaphnie ashley alcazarinNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- Sarfuddin BhaiDocument2 pagesSarfuddin Bhainoor alamNo ratings yet

- Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Document15 pagesExercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Doan Chan PhongNo ratings yet

- Finance ExamDocument14 pagesFinance ExamAnanthu NairNo ratings yet

- 2016 December Financial Reporting L1 PDFDocument158 pages2016 December Financial Reporting L1 PDFDixie Cheelo100% (2)

- 4 5805514475188521061Document8 pages4 5805514475188521061Gena HamdaNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Tugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumereDocument23 pagesTugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumererickyNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Metalanguage and Persu Asive StrategiesDocument3 pagesMetalanguage and Persu Asive StrategiesJefferyNo ratings yet

- Accounting 2020 Unit 1 KTT 6 - Question BookDocument12 pagesAccounting 2020 Unit 1 KTT 6 - Question BookJefferyNo ratings yet

- Language Analysis Frugal Air: Part 1: WHATDocument4 pagesLanguage Analysis Frugal Air: Part 1: WHATJefferyNo ratings yet

- 11SPE - 2021 Semester 1 Exam 1 TECH FREE V2Document12 pages11SPE - 2021 Semester 1 Exam 1 TECH FREE V2JefferyNo ratings yet

- 2020 VCE Chemistry Examination ReportDocument24 pages2020 VCE Chemistry Examination ReportJefferyNo ratings yet

- 11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideDocument11 pages11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideJefferyNo ratings yet

- English ExamDocument3 pagesEnglish ExamJefferyNo ratings yet

- Vce Chemistry Unit 3 Sac 2 Equilibrium Experimental Report: InstructionsDocument5 pagesVce Chemistry Unit 3 Sac 2 Equilibrium Experimental Report: InstructionsJefferyNo ratings yet

- ERR Holiday HomeworkDocument6 pagesERR Holiday HomeworkJefferyNo ratings yet

- 3.1 Electrostatics: Year 11 PhysicsDocument11 pages3.1 Electrostatics: Year 11 PhysicsJefferyNo ratings yet

- Revise and Finalise UNIT 3... : and Get A HeadDocument2 pagesRevise and Finalise UNIT 3... : and Get A HeadJefferyNo ratings yet

- Cellular RespirationDocument11 pagesCellular RespirationJefferyNo ratings yet

- Exercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1Document30 pagesExercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1JefferyNo ratings yet

- Exercise 9.1 Source Documents - Stitch in Time: A Source Document TransactionDocument18 pagesExercise 9.1 Source Documents - Stitch in Time: A Source Document TransactionJefferyNo ratings yet

- Entrepreneurial Finance 5th Edition Leach Test BankDocument13 pagesEntrepreneurial Finance 5th Edition Leach Test Banklukehernandeztgjemdinfc100% (12)

- Part 2 Financial Statement in General FS Analysis - Qs 04 Sept 2021Document21 pagesPart 2 Financial Statement in General FS Analysis - Qs 04 Sept 2021Alyssa PilapilNo ratings yet

- Basic Accounting Course ModuleDocument5 pagesBasic Accounting Course ModuleBlairEmrallafNo ratings yet

- Business ValuationsDocument29 pagesBusiness ValuationsRishabh singhNo ratings yet

- Session 4,5 & 6 The Analysis Framework and Financial StatementsDocument15 pagesSession 4,5 & 6 The Analysis Framework and Financial StatementsPooja MehraNo ratings yet

- Advanced FA I - Individual Assignment 1Document4 pagesAdvanced FA I - Individual Assignment 1Hawultu AsresieNo ratings yet

- Ratio Analysis FormulaDocument14 pagesRatio Analysis FormulaEmranul Islam ShovonNo ratings yet

- (Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Document231 pages(Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Radar NhậtNo ratings yet

- Midterm-Exam Accounting Magno Test4-1Document21 pagesMidterm-Exam Accounting Magno Test4-1Castor, Cyril Nova T.No ratings yet

- Basic Accounting Terms Chapter-2Document7 pagesBasic Accounting Terms Chapter-2jaysahu9826No ratings yet

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDocument4 pagesQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNo ratings yet

- Sample Past Year Exam QuestionDocument12 pagesSample Past Year Exam QuestionFazlin GhazaliNo ratings yet

- Advacc2 Guerrero Chapter 14Document14 pagesAdvacc2 Guerrero Chapter 14jediiik50% (2)

- Unit 5: Death of A PartnerDocument23 pagesUnit 5: Death of A PartnerKARTIK CHADHANo ratings yet

- LK - Final - Chandra Asri Petrochemical TBK 06 2020Document91 pagesLK - Final - Chandra Asri Petrochemical TBK 06 2020herriNo ratings yet

- R15 PDFDocument119 pagesR15 PDFIndonesian ProNo ratings yet

- 202 FM MCQsDocument39 pages202 FM MCQsAK Aru ShettyNo ratings yet

- Notes-INTERM 2-Module 4-Depletion of Natural ResourcesDocument3 pagesNotes-INTERM 2-Module 4-Depletion of Natural ResourcesLeonoramarie BernosNo ratings yet

- Prelims Reviewer Financial ControllershipDocument12 pagesPrelims Reviewer Financial ControllershipErika Mae MedenillaNo ratings yet

- ACCTDocument7 pagesACCTAshley San LuisNo ratings yet

- Solution Manual For Financial Acct2 2nd Edition by GodwinDocument36 pagesSolution Manual For Financial Acct2 2nd Edition by GodwinArielCooperbzqsp100% (83)

- 9706 s06 QP 1Document12 pages9706 s06 QP 1roukaiya_peerkhanNo ratings yet

- Internship Report Finance PTCLDocument78 pagesInternship Report Finance PTCLayub_balticNo ratings yet

- Auditing and Assurance Services Louwers 4th Edition Solutions ManualDocument26 pagesAuditing and Assurance Services Louwers 4th Edition Solutions ManualRichardThomasrfizy100% (26)

- Edexcel International Accounting 8011 9011 GCE Syllabus Revised IAS and A2Document21 pagesEdexcel International Accounting 8011 9011 GCE Syllabus Revised IAS and A2Malika Navaratna0% (1)

- CH 1 Test BankDocument17 pagesCH 1 Test BankShiko TharwatNo ratings yet

- Debt Financing: Promise To Repay The LoanDocument3 pagesDebt Financing: Promise To Repay The LoanMicahNo ratings yet

- Chapter 2Document35 pagesChapter 2Aimes AliNo ratings yet

- Accounting ProjectDocument31 pagesAccounting ProjectDaisy Marie A. Rosel50% (2)

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet