Professional Documents

Culture Documents

Exercise 9.1 Source Documents - Stitch in Time: A Source Document Transaction

Uploaded by

JefferyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 9.1 Source Documents - Stitch in Time: A Source Document Transaction

Uploaded by

JefferyCopyright:

Available Formats

Exercise 9.

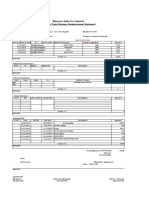

1 Source documents - Stitch in Time

Source document

Transaction

Explanation

Purchases Journal

Date Accounts Payable Inv. No. Inventory of GST Total

materials Accounts

Payable

TOTALS $

Explanation

© Simmons & Hardy 1 Cambridge University Press, 2019

e

Element Increase/Decrease/No Effect Amount $

Asset

Liability

Owner’s equity

© Simmons & Hardy 2 Cambridge University Press, 2019

Exercise 9.2 Purchases Journal - Sparky Electricians

Explanation

Purchases Journal

Date Accounts Payable Inv. No. Inventory of GST Total

materials Accounts

Payable

TOTALS $

Explanation

© Simmons & Hardy 3 Cambridge University Press, 2019

d

Explanation

© Simmons & Hardy 4 Cambridge University Press, 2019

Exercise 9.3 Purchases Journal and Cash Payments Journal - Heel ‘n’

Toe

Purchases Journal

Date Accounts Payable Inv. No. Inventory of GST Total

materials Accounts

Payable

TOTALS $

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payables

TOTALS $

© Simmons & Hardy 5 Cambridge University Press, 2019

b

Explanation

Calculatio

n

Accounts Payable balance $

Explanation

© Simmons & Hardy 6 Cambridge University Press, 2019

Exercise 9.4 Journals and Accounts Payable – ‘Mow and Mulch’

Purchases Journal

Date Accounts Payable Inv. No. Inventory of GST Total

materials Accounts

Payable

TOTALS $

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payables

TOTALS $

© Simmons & Hardy 7 Cambridge University Press, 2019

© Simmons & Hardy 8 Cambridge University Press, 2019

b

Calculatio

n

Accounts Payable balance $

Explanation

© Simmons & Hardy 9 Cambridge University Press, 2019

Exercise 9.5 Source documents - Good as New

Source document

Transaction

Explanation

Explanation

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

TOTALS $

© Simmons & Hardy 10 Cambridge University Press, 2019

e

Element Increase/Decrease/No Effect Amount $

Asset

Liability

Owner’s equity

© Simmons & Hardy 11 Cambridge University Press, 2019

Exercise 9.6 Sales Journal - Cut and Groom

Source document number

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

TOTALS $

Reason 1

Reason 2

Explanation

© Simmons & Hardy 12 Cambridge University Press, 2019

Exercise 9.7 Sales Journal and Cash Receipts Journal - Unbreakable

Gear

Explanation

Explanation

Sales Journal

Date Accounts Receivable Inv. No. Fees GST Total

Accounts

Receivable

TOTALS $

© Simmons & Hardy 13 Cambridge University Press, 2019

Cash Receipts Journal

Date Details Rec. No. Bank Accounts fees Sundries GST

Receivable

TOTALS $

Calculatio

n

Accounts Receivable balance $

Explanation

© Simmons & Hardy 14 Cambridge University Press, 2019

Exercise 9.8 Credit transactions - Musical Beat

Purchases Journal

Date Accounts Payable Inv. No. Inventory of GST Total

materials Accounts

Payable

TOTALS $

Sales Journal

Date Accounts Receivable Invoice No. Fees GST Total

Accounts

Receivable

TOTALS $

© Simmons & Hardy 15 Cambridge University Press, 2019

Cash Receipts Journal

Date Details Rec. No. Bank Accounts Fees Sundries GST

Receivable

TOTALS $

Cash Payments Journal

Date Details Doc. Bank Accounts Drawings Wages Sundries GST

Payable

TOTALS $

Calculatio

n

© Simmons & Hardy 16 Cambridge University Press, 2019

Accounts Payable balance $

Calculatio

n

Accounts Receivable balance $

Explanation

© Simmons & Hardy 17 Cambridge University Press, 2019

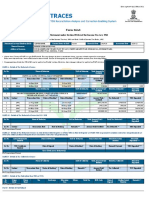

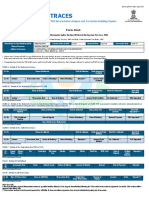

Exercise 9.9 Statement of Account - No Drips Painting

Explanation

Explanation

Explanation

© Simmons & Hardy 18 Cambridge University Press, 2019

You might also like

- Acc12 Workbook9Document19 pagesAcc12 Workbook9xxpandapatchxxNo ratings yet

- Exercise 14.1 Purchase of A Non-Current Asset - Knibs and PensDocument30 pagesExercise 14.1 Purchase of A Non-Current Asset - Knibs and PensSTATNo ratings yet

- Unit 4 Chapter 15 Exercise ProformaDocument11 pagesUnit 4 Chapter 15 Exercise ProformaValeria MaiNo ratings yet

- Exercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1Document46 pagesExercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1STATNo ratings yet

- GPR Accounting & Auditing Firm Chart of Accounts: InstructionsDocument5 pagesGPR Accounting & Auditing Firm Chart of Accounts: InstructionsKrizza Sajonia TaboclaonNo ratings yet

- Review of Accounting CycleDocument4 pagesReview of Accounting CycleBrit NeyNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationhbuzdarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961adityaNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument20 pagesCambridge Ordinary Level: Cambridge Assessment International EducationAnonymous hrjVVKNo ratings yet

- 9706 m19 QP 12Document12 pages9706 m19 QP 12Ryan Xavier M. BiscochoNo ratings yet

- Domestic Travel Settlement Form 26-1-19Document2 pagesDomestic Travel Settlement Form 26-1-19BMU CMACNo ratings yet

- General Journal Date Account Titles Debit CreditDocument6 pagesGeneral Journal Date Account Titles Debit CreditHaris MuktafinnNo ratings yet

- Form 26ASDocument4 pagesForm 26ASJKMSMM BNo ratings yet

- Depreciation Expense A/c: Statement FormatDocument7 pagesDepreciation Expense A/c: Statement FormatAnup PandeyNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationBEeNaNo ratings yet

- Toa03 05 SBC BC GG Dividends Beps and DepsDocument2 pagesToa03 05 SBC BC GG Dividends Beps and DepsMerliza JusayanNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelPark MinyiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Manav ChaudharyNo ratings yet

- Ch04CashTransactions Exercise SolutionsDocument39 pagesCh04CashTransactions Exercise Solutionsobiscarsgovroom123No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961unknown_0303No ratings yet

- General Accounting Principles - PRUDocument41 pagesGeneral Accounting Principles - PRUerjuniorsanjipNo ratings yet

- 1.3 Worksheet - T Account, Trial Balance & Income StatementDocument1 page1.3 Worksheet - T Account, Trial Balance & Income StatementĐức NguyễnNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Madhukar GuptaNo ratings yet

- Gojps4182g 2022Document4 pagesGojps4182g 2022Raj MishraNo ratings yet

- Workpapers - Activity Statement AnswerDocument24 pagesWorkpapers - Activity Statement AnswerElvie BangcoyoNo ratings yet

- Week 7 Tutorial HomeworkDocument17 pagesWeek 7 Tutorial HomeworkTanya ShaikNo ratings yet

- Sunflower Landscaping ServiceDocument6 pagesSunflower Landscaping ServiceJamila Mesha Ordo�ezNo ratings yet

- Bocpv0011d 2023Document4 pagesBocpv0011d 2023Vyshak Bisha ValsanNo ratings yet

- 10 Steps of Accounting CycleDocument8 pages10 Steps of Accounting CycleYakkstar 21No ratings yet

- 26as 202223Document4 pages26as 202223bhavneshsinghNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961pritam kumar DasNo ratings yet

- Unit 1 Practice Exam 1Document8 pagesUnit 1 Practice Exam 1milk shakeNo ratings yet

- Ubs Exercise 1Document11 pagesUbs Exercise 1Nor Irdina SofirnaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sandip JadhavNo ratings yet

- Crzpb6128e 2022Document4 pagesCrzpb6128e 2022PAMELANo ratings yet

- MMFPS8373F 2022Document4 pagesMMFPS8373F 2022Bhavesh SharmaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Swetabh SahayNo ratings yet

- Finman Formulas PDFDocument4 pagesFinman Formulas PDFAvliah Tabao DatimbangNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Maurya KabraNo ratings yet

- Amlpg1858p 2016Document4 pagesAmlpg1858p 2016UmasankarNo ratings yet

- TIMTADocument2 pagesTIMTAhavkas cooperativeNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Annual Tax Statement: (All Amount Values Are in INR)Document4 pagesAnnual Tax Statement: (All Amount Values Are in INR)NIKHIL DHAKNENo ratings yet

- Accounting AssignmentDocument15 pagesAccounting AssignmentYusef ShaqeelNo ratings yet

- Amlpg1858p 2022Document4 pagesAmlpg1858p 2022UmasankarNo ratings yet

- Aqbpj6946k 2022Document4 pagesAqbpj6946k 2022shree juvekarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarNo ratings yet

- Apmpb8479d 2022Document4 pagesApmpb8479d 2022SUNIL GAIKWADNo ratings yet

- DuragDocument24 pagesDuragobiscarsgovroom123No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNo ratings yet

- Aalcr1757k 2022Document4 pagesAalcr1757k 2022GST BACANo ratings yet

- Akrpb2039b 2010Document4 pagesAkrpb2039b 2010soujanya rajeshNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961digi timeNo ratings yet

- Aecpv2564e 2019Document4 pagesAecpv2564e 2019Quality CapitalNo ratings yet

- Dezpk8283p 2022Document4 pagesDezpk8283p 2022Yash NaraniyaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNo ratings yet

- Physics em SpectrumDocument4 pagesPhysics em Spectrumneponcrt12No ratings yet

- Cambridge International AS & A Level: Accounting 9706/11Document12 pagesCambridge International AS & A Level: Accounting 9706/11mungulnirvan7No ratings yet

- We Lied To YouDocument50 pagesWe Lied To YouJefferyNo ratings yet

- Accounting 2020 Unit 1 KTT 6 - Question BookDocument12 pagesAccounting 2020 Unit 1 KTT 6 - Question BookJefferyNo ratings yet

- Global Summer School Online Programme TimeTable 2021Document2 pagesGlobal Summer School Online Programme TimeTable 2021JefferyNo ratings yet

- Language Analysis Frugal Air: Part 1: WHATDocument4 pagesLanguage Analysis Frugal Air: Part 1: WHATJefferyNo ratings yet

- Metalanguage and Persu Asive StrategiesDocument3 pagesMetalanguage and Persu Asive StrategiesJefferyNo ratings yet

- Accounting 2020 Unit 1 KTT 6 - Solution BookDocument5 pagesAccounting 2020 Unit 1 KTT 6 - Solution BookJefferyNo ratings yet

- Cambridge 1&2 Solutions PDFDocument642 pagesCambridge 1&2 Solutions PDFDanielle WatsonNo ratings yet

- 11SPE - 2021 Semester 1 Exam 1 TECH FREE V2Document12 pages11SPE - 2021 Semester 1 Exam 1 TECH FREE V2JefferyNo ratings yet

- 11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideDocument11 pages11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideJefferyNo ratings yet

- 11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideDocument11 pages11SPE - 2021 Semester 1 Exam 1 TECH FREE Marking GuideJefferyNo ratings yet

- 2020 VCE Chemistry Examination ReportDocument24 pages2020 VCE Chemistry Examination ReportJefferyNo ratings yet

- Vce Chemistry Unit 3 Sac 2 Equilibrium Experimental Report: InstructionsDocument5 pagesVce Chemistry Unit 3 Sac 2 Equilibrium Experimental Report: InstructionsJefferyNo ratings yet

- ERR Holiday HomeworkDocument6 pagesERR Holiday HomeworkJefferyNo ratings yet

- English ExamDocument3 pagesEnglish ExamJefferyNo ratings yet

- Revise and Finalise UNIT 3... : and Get A HeadDocument2 pagesRevise and Finalise UNIT 3... : and Get A HeadJefferyNo ratings yet

- Exercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1Document30 pagesExercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1JefferyNo ratings yet

- A Message From The Principal - 25 May 2021Document1 pageA Message From The Principal - 25 May 2021JefferyNo ratings yet

- 3.1 Electrostatics: Year 11 PhysicsDocument11 pages3.1 Electrostatics: Year 11 PhysicsJefferyNo ratings yet

- Exercise 9.1 Source Documents - Stitch in Time: A Source Document TransactionDocument18 pagesExercise 9.1 Source Documents - Stitch in Time: A Source Document TransactionJefferyNo ratings yet

- Cellular RespirationDocument11 pagesCellular RespirationJefferyNo ratings yet

- Exercise 6.1 Cash Transaction - Ripper Repair: A Source Document DescriptionDocument12 pagesExercise 6.1 Cash Transaction - Ripper Repair: A Source Document DescriptionJefferyNo ratings yet

- Exercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1Document30 pagesExercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1JefferyNo ratings yet

- List of 100 New English Words and MeaningsDocument5 pagesList of 100 New English Words and MeaningsNenad AngelovskiNo ratings yet

- Chewable: Buy Pepcid AC Packages, Get Pepcid AC 18'sDocument2 pagesChewable: Buy Pepcid AC Packages, Get Pepcid AC 18'sMahemoud MoustafaNo ratings yet

- Intershield803 MDSDocument4 pagesIntershield803 MDSSahanNo ratings yet

- Comprehensive Safe Hospital FrameworkDocument12 pagesComprehensive Safe Hospital FrameworkEbby OktaviaNo ratings yet

- Assignment - Lab Accidents and PrecautionsDocument6 pagesAssignment - Lab Accidents and PrecautionsAnchu AvinashNo ratings yet

- As ISO 9919-2004 Pulse Oximeters For Medical Use - RequirementsDocument10 pagesAs ISO 9919-2004 Pulse Oximeters For Medical Use - RequirementsSAI Global - APACNo ratings yet

- Weld Metal Overlay & CladdingDocument2 pagesWeld Metal Overlay & CladdingbobyNo ratings yet

- ASOTDocument4 pagesASOTemperors_nestNo ratings yet

- HVAC (Heating, Ventilation and Air Conditioning) : SRS PrecautionsDocument1 pageHVAC (Heating, Ventilation and Air Conditioning) : SRS PrecautionssoftallNo ratings yet

- Itrogen: by Deborah A. KramerDocument18 pagesItrogen: by Deborah A. KramernycNo ratings yet

- انظمة انذار الحريقDocument78 pagesانظمة انذار الحريقAhmed AliNo ratings yet

- Not Really A StoryDocument209 pagesNot Really A StorySwapnaNo ratings yet

- Jeremy A. Greene-Prescribing by Numbers - Drugs and The Definition of Disease-The Johns Hopkins University Press (2006) PDFDocument337 pagesJeremy A. Greene-Prescribing by Numbers - Drugs and The Definition of Disease-The Johns Hopkins University Press (2006) PDFBruno de CastroNo ratings yet

- J130KDocument6 pagesJ130KBelkisa ŠaćiriNo ratings yet

- Cover Letter UchDocument1 pageCover Letter UchNakia nakia100% (1)

- 41 Assignment Worksheets For SchoolDocument26 pages41 Assignment Worksheets For Schoolsoinarana456No ratings yet

- Sanctuary Policy PomonaDocument3 pagesSanctuary Policy PomonaGabriel EliasNo ratings yet

- 2020 ROTH IRA 229664667 Form 5498Document2 pages2020 ROTH IRA 229664667 Form 5498hk100% (1)

- Phardose Lab Prep 19 30Document4 pagesPhardose Lab Prep 19 30POMPEYO BARROGANo ratings yet

- The Vapour Compression Cycle (Sample Problems)Document3 pagesThe Vapour Compression Cycle (Sample Problems)allovid33% (3)

- PPR Soft Copy Ayurvedic OkDocument168 pagesPPR Soft Copy Ayurvedic OkKetan KathaneNo ratings yet

- Task 5 Banksia-SD-SE-T1-Hazard-Report-Form-Template-V1.0-ID-200278Document5 pagesTask 5 Banksia-SD-SE-T1-Hazard-Report-Form-Template-V1.0-ID-200278Samir Mosquera-PalominoNo ratings yet

- Art of Facing InterviewsDocument15 pagesArt of Facing Interviewskrish_cvr2937100% (2)

- 10 2005 Dec QDocument6 pages10 2005 Dec Qspinster40% (1)

- 2 Dawn150Document109 pages2 Dawn150kirubelNo ratings yet

- ZX110to330 ELEC E PDFDocument1 pageZX110to330 ELEC E PDFYadi100% (1)

- Aldehydes, Ketones, Carboxylic Acids, and EstersDocument11 pagesAldehydes, Ketones, Carboxylic Acids, and EstersNATURE COMPUTERNo ratings yet

- Answer Keys: Science, Biology ReviewerDocument3 pagesAnswer Keys: Science, Biology ReviewerEnc TnddNo ratings yet

- Mycotoxin in Food Supply Chain (Peanuts)Document2 pagesMycotoxin in Food Supply Chain (Peanuts)Ghanthimathi GvsNo ratings yet

- Analysis of Pure Copper - A Comparison of Analytical MethodsDocument12 pagesAnalysis of Pure Copper - A Comparison of Analytical Methodsban bekasNo ratings yet