Professional Documents

Culture Documents

Know Your Customer Packaging (Please Ensure All Copies Sent Are Black & White)

Uploaded by

Petros 'King' SolomonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Know Your Customer Packaging (Please Ensure All Copies Sent Are Black & White)

Uploaded by

Petros 'King' SolomonCopyright:

Available Formats

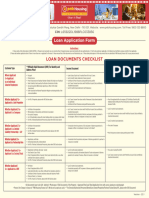

Know Your Customer packaging (please ensure all copies sent are black & white)

Required? Documents accepted Other requirements Covid 19 requirements

Yes – If not electronically Passport. Upload via PDF or Jpeg max 10mb via Website or You no longer need to certify the documents that you send to us.

Name verified. Full UK Driving Licence/UK Provisional Licence email to intermediarydocs@natwest.com That’s because we have updated the declarations that you

Identificatio For non UK/EU National we Military ID Card

including mortgage reference number. complete during the application process which now includes

wording confirming that:

n will always require a copy of EU/EEA National ID Card

For customer identification/address: The documents I am

the passport and valid VISA EU/EEA Driving Licence submitting are true copies of original documents relating to the

at the time of application. Biometric Residence Permit party/parties on this application.

Yes – If not electronically Bank Statement/Utility bill/Council Tax bill Upload via PDF or Jpeg max 10mb via Website or For income/expenditure: I am confirming that either the scanned

Address verified. Mortgage statement/Local Council Tenancy email to intermediarydocs@natwest.com documentation is a true copy of an original document OR, where

electronic documentation is being supplied, this is an unaltered

verification For EU, EEA or Swiss citizens we Agreement including mortgage reference number

document obtained by the customer directly from the

will require a copy of their UK Full Driving Licence/UK Provisional Driving corresponding business or organisation. Original copies of

Licence documents, required.

Settled/Pre- settled decision

letter HMRC Letter

Basic Income packaging (please ensure all copies sent are black & white)

Residential & B T L Lending

Documents accepted

Other requirements Covid 19 requirements

Less than 7 5 % & up to £500,000 Over 7 5 % or more than £500,000

Latest 3 months payslips We will be unable to help customers who are currently on

Employed Latest 3 months consectutive bank statements Not required for NatWest or RBS bank account holders Furlough/Flexi-Furlough.

income Latest months payslip from main bank account. Please see the additional packaging sheet for customers who have

returned from Furlough.

“If the latest accounts available are over 18 A Mandatory Self Employed Application submission sheet with

Self Employed See over 75% months’ old, please provide a letter from your all sections ticked and accompanying explanations completed

Last 2yrs SA302's or Fully submitted tax

customer’s accountant to confirm business is still

income for Sole assessments showing as 100% complete +

viable.

along with all documents detailed.

Tax year overview.

Trader or Submissions made via 3rd party software e.g.

accountants, are also acceptable on condition that Cases with incomplete documentation uploaded on submission will

Latest 3 months consecutive bank the Tax Year Overview is provided by the customer not be underwritten and will be lapsed.

Partnership statements from main bank account & confirming the unique Tax Reference number and

business bank accounts. the figures on the submission.”

See over 75% 2yrs Finalised accounts

Self Employed “For BTL applications we need to evidence via the

latest 3 months bank statements from the account

that the rental income is paid into, existing rental

income for income from buy-to-let and consent-to-let properties.

We will instruct a valuation report to be conducted on

Limited the property to be mortgaged and a background

Latest 3 months consecutive bank statements valuation assessment on an applicant’s existing

Company from main bank account & business bank rented properties.”

accounts.

Latest 3 months’ consecutive personal Not required for NatWest or RBS bank account holders

Contractors See over 75% bank statements.

earning more Copy of contract(s) to encompass a 12-month Where significant business expenses that are

period,with a minimum of 6 months’ contract(s) not reimbursed as part of the applicant’s

than £75,000 already completed. For example this could be a contract are identified on the application, 3

12-month contract where 6 months have been months’ bank

per annum completed, two 6-month contracts where one statements (personal or business) must be

has provided evidencing these.

been completed or four 3-month contracts where

two have been completed.

Only for use by Mortgage Intermediaries Information classification: Public

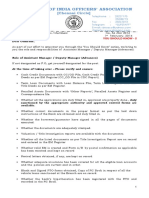

Additional Income Packaging (please ensure all copies sent are black & white)

Residential & B T L Lending

Other requirements Covid 19 requirements

Documents accepted

Overtime/Commission/ 3 months’ consecutive payslips and most recent P60. If P60 unavailable or due to salary increase/change Please refer to additional packaging requirements for customers who

Shift Allowance of job does not coralate to payslips we will require 6 have been Furloughed

months payslips.

Monthly Bonus 3 months’ consecutive payslips and most recent P60. If P60 unavailable or due to salary increase/change Please refer to additional packaging requirements for customers who

of job does not coralate to payslips we will require 6 have been Furloughed

months payslips.

Quarterly Bonus 4 payslips detailing the most recent bonus payments – one from each quarter. Please refer to additional packaging requirements for customers who

have been Furloughed

Bi-Annual Bonus 4 payslips detailing the bonus payments over the latest 2 years. We will use 50% of the average bonus of the last 2 Please refer to additional packaging requirements for customers who

years. have been Furloughed

Annual Bonus 2 payslips detailing the bonus payments over the latest 2 years. We will use 50% of the average bonus of the last 2 Please refer to additional packaging requirements for customers who

years. have been Furloughed

2nd Job See under employed income at LTV/Loan size. 6 months employment history required . Please refer to additional packaging requirements for customers who

have been Furloughed

Maternity Pay 3 Months Payslips prior to maternity leave. Latest 3 months consectutive bank statements from Letter from customer confirming return to work on

main bank account. same terms or letter from employer detailing new

employment terms.

Child benefit

Most recent bank statement showing payment credit.

Other benefit

Up-to-date awards letter.

Maintenance Income Court approval letter if paid by court order.

6 Months banks statements.

Foster Carers Income A letter confirming they are a registered carer.

2 Years Remittance Slips or Annual statements.

Rental Income For BTL applications we need to evidence via the latest

3 months bank statements from the account that the

Last 2 years SA302s or Fully submitted tax assessments showing as 100% complete + Tax year

rental income is paid into, existing rental income from

overview.

buy-to-let and consent-to-let properties. We will instruct

a valuation report to be conducted on the property to

be mortgaged and a background

valuation assessment on an applicant’s existing rented

properties.”

Only for use by Mortgage Intermediaries Information classification: Public

You might also like

- PNG-Rules and RegulationsDocument5 pagesPNG-Rules and RegulationsNimesh ShahNo ratings yet

- Alfalah Ghar Asaan - (25-Mar-2021)Document3 pagesAlfalah Ghar Asaan - (25-Mar-2021)WaseemNo ratings yet

- BUCIO Assignment1 FINM6Document3 pagesBUCIO Assignment1 FINM6John McwayneNo ratings yet

- MCUS B0034 Full Doc Processing Checklist NRDocument3 pagesMCUS B0034 Full Doc Processing Checklist NRScott RoyvalNo ratings yet

- A Guide To Providing Proof of Your IdentityDocument4 pagesA Guide To Providing Proof of Your IdentityIsabell TindaleNo ratings yet

- NEW ACCOUNT - OPENING - FORM - IndiaDocument2 pagesNEW ACCOUNT - OPENING - FORM - IndiaDeepak PanghalNo ratings yet

- Demat Account BobDocument28 pagesDemat Account BobRavi AgarwalNo ratings yet

- Investment Declaration Form FY 2019-20 v2Document5 pagesInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsNo ratings yet

- Verifying Your Identity - YBM3838 - 071221Document2 pagesVerifying Your Identity - YBM3838 - 071221BusyharriedmumNo ratings yet

- ID Guidelines - CandidatesDocument1 pageID Guidelines - CandidatesEranda KarunarathnaNo ratings yet

- Proof of AddressDocument2 pagesProof of AddressTuyul EbokNo ratings yet

- Payufin High Ticket Loans PolicyDocument3 pagesPayufin High Ticket Loans PolicyMuskan RaoNo ratings yet

- Money Tree International Finance Corp. Checklist of Standard Loan RequirementsDocument2 pagesMoney Tree International Finance Corp. Checklist of Standard Loan RequirementsAgape LabuntogNo ratings yet

- Account Opening Form Quick ChecklistDocument18 pagesAccount Opening Form Quick ChecklistShubham SharmaNo ratings yet

- Limited Company Authority: This Is The Authority Form Referred To in The Application FormDocument4 pagesLimited Company Authority: This Is The Authority Form Referred To in The Application FormpietroNo ratings yet

- Checklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDocument2 pagesChecklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDain MedinaNo ratings yet

- Application As Well As at The Time of Personal Appearance Before The Competent AuthorityDocument4 pagesApplication As Well As at The Time of Personal Appearance Before The Competent AuthoritybehindthelinkNo ratings yet

- Loan Application Form: CIN: L65922DL1988PLC033856Document10 pagesLoan Application Form: CIN: L65922DL1988PLC033856Lucky SinghNo ratings yet

- Loan Application Form WebDocument10 pagesLoan Application Form WebSabuj SarkarNo ratings yet

- Application For Commercial Power Supply PDFDocument4 pagesApplication For Commercial Power Supply PDFKOKORANo ratings yet

- Housing Loan Requirement PAGIBIGDocument2 pagesHousing Loan Requirement PAGIBIGMaria Lena HuecasNo ratings yet

- Assignment OnDocument14 pagesAssignment OnmehediNo ratings yet

- Documentation Requirement - Salaried Segment OriginalDocument3 pagesDocumentation Requirement - Salaried Segment OriginalAli Azhar KhanNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- Pagibig RequirementsDocument4 pagesPagibig RequirementsDanzen SenolosNo ratings yet

- A Guide To Providing Proof of Your IdentityDocument4 pagesA Guide To Providing Proof of Your Identitykisalsajana97No ratings yet

- HLF065 ChecklistRequirementsWindow1Accounts V05Document2 pagesHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboNo ratings yet

- OVFA FormDocument2 pagesOVFA FormanetecdNo ratings yet

- Id and VDocument2 pagesId and VMuhammad WaqarNo ratings yet

- For Pag-IBIG Housing Loan Restructuring and Penalty Condonation ProgramDocument2 pagesFor Pag-IBIG Housing Loan Restructuring and Penalty Condonation Programnick bacalsoNo ratings yet

- Metrobank Loan RequirementsDocument2 pagesMetrobank Loan RequirementsKate BautistaNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- FEA SubsidyDocument2 pagesFEA SubsidyvitiengineeringNo ratings yet

- Document Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byDocument1 pageDocument Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byRonnel S. DabuNo ratings yet

- 100 UACC Guidelines 08.2020Document2 pages100 UACC Guidelines 08.2020Aut BeatNo ratings yet

- 3 Sales Process and Turnover Process 1 Pager As of Oct 1 2022Document9 pages3 Sales Process and Turnover Process 1 Pager As of Oct 1 2022inigobonaNo ratings yet

- Signed - Business Permit Renewal FY 2023Document7 pagesSigned - Business Permit Renewal FY 2023Paula AntalanNo ratings yet

- Acfrogamw68s Ivb0x4savprvphwgyvov Othndcwxcmb1mwcw7ciylzw8sqzgvsfnhmt72fq6lfrq8ftcipvdlaongvq6tpzl0xktbvhwhzsujve01h0sjbyw9i9hgDocument5 pagesAcfrogamw68s Ivb0x4savprvphwgyvov Othndcwxcmb1mwcw7ciylzw8sqzgvsfnhmt72fq6lfrq8ftcipvdlaongvq6tpzl0xktbvhwhzsujve01h0sjbyw9i9hgEmily MandinNo ratings yet

- CMRL.12.18 : Section A: New Business, Regulatory and Sales-Related RequirementsDocument2 pagesCMRL.12.18 : Section A: New Business, Regulatory and Sales-Related RequirementsJovelyn ArgeteNo ratings yet

- Chinabank Home Loan Updated List of Requirements - 2023Document2 pagesChinabank Home Loan Updated List of Requirements - 2023ANDI CastroNo ratings yet

- Tax Proof Guidelines FAQDocument19 pagesTax Proof Guidelines FAQRoshan LewisNo ratings yet

- Customer Service Manual For Pulse PoweeDocument7 pagesCustomer Service Manual For Pulse PoweeAngel RamírezNo ratings yet

- Checklist Housing LoanDocument2 pagesChecklist Housing LoanJulius LuzonNo ratings yet

- Ecobank PDFDocument2 pagesEcobank PDFObert MarongedzaNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- Due Diligence of BorrowerDocument15 pagesDue Diligence of BorrowerRajesh shethNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- Proof of IncomeDocument3 pagesProof of IncomeKenan DuranNo ratings yet

- Converge - SME (Business) : Enjoy Reliable Pure Fiber Internet Speed Throughout The Day For Maximum UsageDocument3 pagesConverge - SME (Business) : Enjoy Reliable Pure Fiber Internet Speed Throughout The Day For Maximum UsageKenyNo ratings yet

- Converge - SME (Business) : Enjoy Reliable Pure Fiber Internet Speed Throughout The Day For Maximum UsageDocument3 pagesConverge - SME (Business) : Enjoy Reliable Pure Fiber Internet Speed Throughout The Day For Maximum UsageKenyNo ratings yet

- WA NILS Document Checklist v2Document1 pageWA NILS Document Checklist v2Adam Di GiuseppeNo ratings yet

- Local Authority Home Loan - Application Form - June 2023Document22 pagesLocal Authority Home Loan - Application Form - June 2023ollie.brady780No ratings yet

- Emaar Land Registration Title Deed FactsheetDocument3 pagesEmaar Land Registration Title Deed FactsheetHassan AliNo ratings yet

- Check ListDocument3 pagesCheck Listabhishekdwivedi0% (1)

- Customer Details: (Please Fill The Application From in Capital Letters Only) DateDocument2 pagesCustomer Details: (Please Fill The Application From in Capital Letters Only) DateKrisna Fulari GuravNo ratings yet

- MOL RegulationsDocument82 pagesMOL RegulationsHadji RietaNo ratings yet

- Cash Credit: OverviewsDocument1 pageCash Credit: OverviewsViswa KeerthiNo ratings yet

- Documentation-LCH NotesDocument2 pagesDocumentation-LCH NotesmedcoffeepaidNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Ci - Cni/ Nci-Cni Cni/Group NiDocument2 pagesCi - Cni/ Nci-Cni Cni/Group NiMark CalapatanNo ratings yet

- Technological Revolutions and Financial Capital (2002) PDFDocument219 pagesTechnological Revolutions and Financial Capital (2002) PDFBenny Apriariska Syahrani89% (9)

- Entrepreneurship & Start-UpsDocument2 pagesEntrepreneurship & Start-UpsRocky RajNo ratings yet

- Intermediate Financial Accounting I: Inventories: MeasurementDocument89 pagesIntermediate Financial Accounting I: Inventories: MeasurementDaphne BlakeNo ratings yet

- Unit 4 INTERNATIONAL BUSINESS MANAGEMENTDocument11 pagesUnit 4 INTERNATIONAL BUSINESS MANAGEMENTnoroNo ratings yet

- IA1 - Midterm ExamDocument25 pagesIA1 - Midterm ExamDaniella Mae ElipNo ratings yet

- Carding Vocabulary and Understanding Terms PDFDocument4 pagesCarding Vocabulary and Understanding Terms PDFcreative84No ratings yet

- The Budget Explained in 5 MinutesDocument5 pagesThe Budget Explained in 5 MinutesTulsi OjhaNo ratings yet

- Your Adv Plus Banking: Account SummaryDocument4 pagesYour Adv Plus Banking: Account SummaryGuilherme Gaspar67% (3)

- Contents of Valuation ReportDocument5 pagesContents of Valuation ReportTerry Hao Hao0% (1)

- MCX FinalDocument29 pagesMCX Finalloveaute15No ratings yet

- Working Capital Project - Oman Air BenchmarkingDocument29 pagesWorking Capital Project - Oman Air BenchmarkingAnonymous o1o3GuNo ratings yet

- Restoration of Certificate of PracticeDocument1 pageRestoration of Certificate of PracticevishnuameyaNo ratings yet

- CFAS-Quiz 1Document6 pagesCFAS-Quiz 1hannahNo ratings yet

- 3 - MAF603 - Efficient Market HypothesisDocument26 pages3 - MAF603 - Efficient Market HypothesisWan WanNo ratings yet

- Tecnored Ironmaking ProcessDocument2 pagesTecnored Ironmaking ProcessMarcelo RivellinoNo ratings yet

- Pro Forma Invoice: SGS Pakistan (Private) LimitedDocument1 pagePro Forma Invoice: SGS Pakistan (Private) LimitedNimra RizwanNo ratings yet

- Manisha'S Online Study CircleDocument4 pagesManisha'S Online Study CircleSrinivas JupalliNo ratings yet

- Entrepreneur ObjDocument93 pagesEntrepreneur ObjNitin Bhardwaj0% (1)

- Conventional RatesDocument1 pageConventional RatesRiaz AhmedNo ratings yet

- Capital Expenditure Formula Excel TemplateDocument3 pagesCapital Expenditure Formula Excel TemplateKSXNo ratings yet

- 1 Cash Dividends On The 10 Par Value Common Stock PDFDocument2 pages1 Cash Dividends On The 10 Par Value Common Stock PDFHassan JanNo ratings yet

- The Small Print in ICICI BondsDocument3 pagesThe Small Print in ICICI BondsBharat SahniNo ratings yet

- Soalan Struktur Modalsoalan Struktur ModalDocument1 pageSoalan Struktur Modalsoalan Struktur ModalNur FahanaNo ratings yet

- MH 2223 90443 PDFDocument6 pagesMH 2223 90443 PDFHarsh PatelNo ratings yet

- CitiBank-Statement Jan01-Jan30Document2 pagesCitiBank-Statement Jan01-Jan30hzservices70No ratings yet

- Isa 200 PDFDocument28 pagesIsa 200 PDFAhmed Raza Mir NewNo ratings yet

- SAP ECC and BW Report MapingDocument6 pagesSAP ECC and BW Report Mapingskskumar4848No ratings yet

- PFRS For SMEs Illustrative FSDocument69 pagesPFRS For SMEs Illustrative FSJake Aseo BertulfoNo ratings yet

- Pak-Kuwait Investment Company PVT LTDDocument30 pagesPak-Kuwait Investment Company PVT LTDSohailNo ratings yet