Professional Documents

Culture Documents

Petrozuata Financial Model

Uploaded by

RialeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petrozuata Financial Model

Uploaded by

RialeeCopyright:

Available Formats

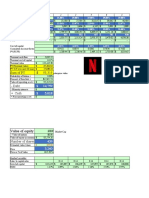

Petrolera Zuata, Petrozuata C.A.

: Analysis of Sponsor Returns and Debt Coverage Ratios

Assumptions (Change these six RED variables)

Initial Oil Price in 1996 $12.25

Annual Change in Oil Price (1996-2012) 2.5%

Royalty Rate (2001-2008) 1.0%

Royalty Rate (2009-2034) 16.7%

Total Debt Financing $1,450,000

Leverage: Debt/Total Project Cost 60%

Project's Total Cost $2,416,667

Tax Rate 34%

Asset Beta 0.60

Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997) 6.81%

Market Risk Premium 7.50%

Country Risk Premium 0.00%

Cash

Available Debt

Forecasted Change for Debt Total Total Equity Service

Maya in Maya Total Service Debt Debt Cash Coverage

Year Price Price Revenue (CADS) Outstanding Service Flows Ratio

1996 $12.25 2.5% $0 ($80,007) $0 $0 ($79,035)

1997 $12.56 2.5% $0 ($610,492) $1,000,000 $935,950 ($1,986)

1998 $12.87 2.5% $78,524 ($820,154) $1,024,299 ($63,079) ($550,148)

1999 $13.19 2.5% $429,059 ($139,352) $1,242,981 $113,580 $1,576

2000 $13.52 2.5% $803,290 $243,952 $1,450,000 $85,113 $185,047

2001 $13.86 2.5% $560,499 $383,869 $1,411,120 ($157,629) $227,819 2.44

2002 $14.21 2.5% $580,141 $374,482 $1,372,240 ($154,472) $221,589 2.42

2003 $14.56 2.5% $594,310 $351,470 $1,333,360 ($151,315) $190,031 2.32

2004 $14.93 2.5% $608,833 $383,135 $1,268,892 ($171,563) $214,719 2.23

2005 $15.30 2.5% $623,720 $379,409 $1,205,447 ($165,270) $199,063 2.30

2006 $15.68 2.5% $638,978 $415,819 $1,103,295 ($195,423) $220,578 2.13

2007 $16.07 2.5% $654,618 $416,376 $992,187 ($195,059) $218,294 2.13

2008 $16.47 2.5% $670,649 $417,733 $864,195 ($201,103) $236,588 2.08

2009 $16.89 2.5% $687,081 $364,040 $768,166 ($161,187) $210,755 2.26

2010 $17.31 2.5% $703,924 $353,700 $680,692 ($145,382) $204,461 2.43

2011 $17.74 2.5% $721,187 $359,505 $576,861 ($153,095) $203,439 2.35

2012 $18.19 2.5% $738,882 $367,531 $456,838 ($159,037) $246,435 2.31

2013 $18.64 0.0% $757,020 $309,595 $408,576 ($83,154) $225,711 3.72

2014 $18.64 0.0% $758,224 $341,704 $354,212 ($84,614) $239,522 4.04

2015 $18.64 0.0% $759,457 $373,643 $256,355 ($119,749) $248,128 3.12

2016 $18.64 0.0% $760,722 $365,851 $136,753 ($131,281) $266,131 2.79

2017 $18.64 0.0% $762,018 $366,964 $75,000 ($68,159) $329,682 5.38

2018 $18.64 0.0% $763,347 $312,682 $75,000 ($6,405) $306,277 48.82

2019 $18.64 0.0% $764,708 $293,660 $75,000 ($6,405) $287,255 45.85

2020 $18.64 0.0% $766,104 $264,839 $75,000 ($6,405) $258,434 41.35

2021 $18.64 0.0% $767,535 $281,934 $75,000 ($6,405) $241,232 44.02

2022 $18.64 0.0% $769,001 $276,305 $0 ($75,000) $201,306 3.68

2023 $18.64 0.0% $770,504 $278,150 $0 $278,150

2024 $18.64 0.0% $772,045 $273,514 $0 $273,514

2025 $18.64 0.0% $773,624 $274,138 $0 $274,138

2026 $18.64 0.0% $775,243 $263,068 $0 $263,068

2027 $18.64 0.0% $776,902 $262,329 $0 $262,329

2028 $18.64 0.0% $778,603 $260,484 $0 $260,484

2029 $18.64 0.0% $780,346 $250,113 $0 $250,113

2030 $18.64 0.0% $782,133 $234,648 $0 $234,648

2031 $18.64 0.0% $783,964 $238,181 $0 $238,181

2032 $18.64 0.0% $785,842 $231,118 $0 $231,118

2033 $18.64 0.0% $787,766 $229,576 $0 $229,576

2034 $18.64 0.0% $789,738 $215,770 $0 $215,770

Note: This simplified version of the Petrozuata project's economics is designed to accompany Petrolera Zuata, Petrozuata C.A. , HBS No. 299-012. Although the have been made to

model is based on the actual model used, a number of changes have been made to facilitate the analysis.

Model Output

Minimum Debt Service Coverage Ratio (DSCR) 2.08

Year of Minimum DSCR 2008

Average DSCR 10.46

Internal Rate of Return 25.1%

Net Present Value $267,607

IRR as a Function of the Number

IRR and Minimum DSCR Output Table of Years of Cash Flow

Leverage IRR Min. DSCR Number of Years

25.1% 2.08 With Cash Flow IRR

40% 18.4% 3.05

45% 19.5% 2.73 5 15.9%

50% 21.0% 2.47 10 22.7%

55% 22.8% 2.25 15 24.3%

60% 25.1% 2.08 20 24.9%

65% 28.2% 1.93 25 25.0%

70% 32.5% 1.80 30 25.0%

75% 39.0% 1.69 34 25.1%

80% 49.0% 1.59

Petrolera Zuata, Petrozuata C.A.: Analysis of Sponsor Returns and Debt Coverage Ratios

Cash

Available Debt

Forecasted Change for Debt Total Total Equity Cash Service Equity/Total

Maya in Maya Total Service Debt Debt Cash Return on Coverage Capital at Equity Cost of Discount PV

Year Price Price Revenue (CADS) Outstanding Service Flows Investment Ratio BOOK VALUES Beta Equity Factor ECF

1996 $12.25 2.5% $0 ($80,007) $0 $0 ($79,035) 100% 0.60 11.31% 1.000 ($79,035)

1997 $12.56 2.5% $0 ($610,492) $1,000,000 $935,950 ($1,986) 10% 6.00 51.81% 0.659 ($1,308)

1998 $12.87 2.5% $78,524 ($820,154) $1,024,299 ($63,079) ($550,148) 40% 1.52 18.18% 0.557 ($306,647)

1999 $13.19 2.5% $429,059 ($139,352) $1,242,981 $113,580 $1,576 41% 1.46 17.74% 0.473 $746

2000 $13.52 2.5% $803,290 $243,952 $1,450,000 $85,113 $185,047 42% 1.44 17.57% 0.403 $74,511

2001 $13.86 2.5% $560,499 $383,869 $1,411,120 ($157,629) $227,819 68.5% 2.44 42% 1.41 17.41% 0.343 $78,133

2002 $14.21 2.5% $580,141 $374,482 $1,372,240 ($154,472) $221,589 64.6% 2.42 43% 1.39 17.24% 0.293 $64,822

2003 $14.56 2.5% $594,310 $351,470 $1,333,360 ($151,315) $190,031 59.1% 2.32 44% 1.37 17.07% 0.250 $47,484

2004 $14.93 2.5% $608,833 $383,135 $1,268,892 ($171,563) $214,719 62.9% 2.23 45% 1.33 16.79% 0.214 $45,939

2005 $15.30 2.5% $623,720 $379,409 $1,205,447 ($165,270) $199,063 60.8% 2.30 46% 1.29 16.52% 0.184 $36,551

2006 $15.68 2.5% $638,978 $415,819 $1,103,295 ($195,423) $220,578 65.1% 2.13 49% 1.24 16.08% 0.158 $34,892

2007 $16.07 2.5% $654,618 $416,376 $992,187 ($195,059) $218,294 63.6% 2.13 51% 1.17 15.60% 0.137 $29,872

2008 $16.47 2.5% $670,649 $417,733 $864,195 ($201,103) $236,588 62.3% 2.08 55% 1.10 15.04% 0.119 $28,142

2009 $16.89 2.5% $687,081 $364,040 $768,166 ($161,187) $210,755 53.0% 2.26 58% 1.04 14.63% 0.104 $21,870

2010 $17.31 2.5% $703,924 $353,700 $680,692 ($145,382) $204,461 50.2% 2.43 60% 0.99 14.25% 0.091 $18,570

2011 $17.74 2.5% $721,187 $359,505 $576,861 ($153,095) $203,439 49.8% 2.35 64% 0.93 13.80% 0.080 $16,236

2012 $18.19 2.5% $738,882 $367,531 $456,838 ($159,037) $246,435 49.7% 2.31 70% 0.86 13.28% 0.070 $17,362

2013 $18.64 0.0% $757,020 $309,595 $408,576 ($83,154) $225,711 40.9% 3.72 72% 0.84 13.08% 0.062 $14,063

2014 $18.64 0.0% $758,224 $341,704 $354,212 ($84,614) $239,522 45.1% 4.04 75% 0.80 12.84% 0.055 $13,225

2015 $18.64 0.0% $759,457 $373,643 $256,355 ($119,749) $248,128 49.2% 3.12 80% 0.75 12.42% 0.049 $12,187

2016 $18.64 0.0% $760,722 $365,851 $136,753 ($131,281) $266,131 48.1% 2.79 88% 0.68 11.90% 0.044 $11,681

2017 $18.64 0.0% $762,018 $366,964 $75,000 ($68,159) $329,682 48.2% 5.38 93% 0.64 11.63% 0.039 $12,962

2018 $18.64 0.0% $763,347 $312,682 $75,000 ($6,405) $306,277 41.0% 48.82 93% 0.64 11.63% 0.035 $10,787

2019 $18.64 0.0% $764,708 $293,660 $75,000 ($6,405) $287,255 38.4% 45.85 93% 0.64 11.63% 0.032 $9,063

2020 $18.64 0.0% $766,104 $264,839 $75,000 ($6,405) $258,434 34.6% 41.35 93% 0.64 11.63% 0.028 $7,304

2021 $18.64 0.0% $767,535 $281,934 $75,000 ($6,405) $241,232 36.7% 44.02 93% 0.64 11.63% 0.025 $6,107

2022 $18.64 0.0% $769,001 $276,305 $0 ($75,000) $201,306 35.9% 3.68 100% 0.60 11.31% 0.023 $4,579

2023 $18.64 0.0% $770,504 $278,150 $0 $278,150 36.1% 100% 0.60 11.31% 0.020 $5,683

2024 $18.64 0.0% $772,045 $273,514 $0 $273,514 35.4% 100% 0.60 11.31% 0.018 $5,021

2025 $18.64 0.0% $773,624 $274,138 $0 $274,138 35.4% 100% 0.60 11.31% 0.016 $4,521

2026 $18.64 0.0% $775,243 $263,068 $0 $263,068 33.9% 100% 0.60 11.31% 0.015 $3,898

2027 $18.64 0.0% $776,902 $262,329 $0 $262,329 33.8% 100% 0.60 11.31% 0.013 $3,492

2028 $18.64 0.0% $778,603 $260,484 $0 $260,484 33.5% 100% 0.60 11.31% 0.012 $3,115

2029 $18.64 0.0% $780,346 $250,113 $0 $250,113 32.1% 100% 0.60 11.31% 0.011 $2,687

2030 $18.64 0.0% $782,133 $234,648 $0 $234,648 30.0% 100% 0.60 11.31% 0.010 $2,265

2031 $18.64 0.0% $783,964 $238,181 $0 $238,181 30.4% 100% 0.60 11.31% 0.009 $2,065

2032 $18.64 0.0% $785,842 $231,118 $0 $231,118 29.4% 100% 0.60 11.31% 0.008 $1,800

2033 $18.64 0.0% $787,766 $229,576 $0 $229,576 29.1% 100% 0.60 11.31% 0.007 $1,607

2034 $18.64 $789,738 $215,770 $0 $215,770 27.3% 100% 0.60 11.31% 0.006 $1,357

Assumptions

Initial Oil Price in 1996 $12.25 IRR and Minimum DSCR Output Table IRR as a Function of the Number

Annual Change in Oil Price (1996-2012) 2.5% of Years of Cash Flow

Royalty Rate (2001-2008) 1.0% Leverage IRR Min. DSCR

Royalty Rate (2009-2034) 16.7% 25.1% 2.08 Number of Years

Total Debt Financing $1,450,000 40% 25.1% 2.08 With Cash Flow IRR

Leverage: Debt/Total Project Cost 60% 45% 25.1% 2.08

Project's Total Cost $2,416,667 50% 25.1% 2.08 5 15.9%

Tax Rate 34% 55% 25.1% 2.08 10 22.7%

0% 60% 25.1% 2.08 15 24.3%

Asset Beta 0.60 65% 25.1% 2.08 20 24.9%

Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997) 6.81% 70% 25.1% 2.08 25 25.0%

Market Risk Premium 7.50% 75% 25.1% 2.08 30 25.0%

Country Risk Premium 0.00% 80% 25.1% 2.08 34 25.1%

Model Output

Minimum Debt Service Coverage Ratio (DSCR) 2.08

Year of Minimum DSCR 2008

Average DSCR 10.46

Internal Rate of Return 25.1%

Net Present Value $267,607

You might also like

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Business Combination by DayagDocument37 pagesBusiness Combination by Dayagkristian Garcia85% (13)

- Business Combination by DayagDocument37 pagesBusiness Combination by Dayagkristian Garcia85% (13)

- Quizzes - Chapter 5 - Books of Accounts & Double-Entry SystemDocument4 pagesQuizzes - Chapter 5 - Books of Accounts & Double-Entry SystemAmie Jane Miranda89% (9)

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- Instant Download Ebook PDF Entrepreneurship Theory Process Practice 11th Edition 2 PDF ScribdDocument41 pagesInstant Download Ebook PDF Entrepreneurship Theory Process Practice 11th Edition 2 PDF Scribdjohn.brandt885100% (38)

- Buffets Bid For Media GeneralDocument23 pagesBuffets Bid For Media GeneralTerence TayNo ratings yet

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Document3 pagesThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderNo ratings yet

- Intrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Document41 pagesIntrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Clarence Ryan100% (2)

- PDF The Subtle Art of Not Giving A F C K by Mark Manson PDFDocument206 pagesPDF The Subtle Art of Not Giving A F C K by Mark Manson PDFjoanna manabat6% (16)

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- Assignment #1 PDFDocument1 pageAssignment #1 PDFJeevan Abbass0% (1)

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- Rental Property Calculator: ResultDocument3 pagesRental Property Calculator: ResultHarsh AcharyaNo ratings yet

- Johnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueDocument12 pagesJohnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueOld School Value100% (2)

- FY2018 - JUN Fincl Comparative SummaryDocument1 pageFY2018 - JUN Fincl Comparative SummaryNewsChannel 9 StaffNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Darling Ingredients SlidesDocument20 pagesDarling Ingredients SlidesLourdu XavierNo ratings yet

- Hubbard County Payable 2024 Preliminary Levy ChartDocument2 pagesHubbard County Payable 2024 Preliminary Levy ChartShannon GeisenNo ratings yet

- WWE q1 2020 Trending SchedulesDocument6 pagesWWE q1 2020 Trending SchedulesHeel By NatureNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- JLL Q2 2019 Earnings ReleaseDocument20 pagesJLL Q2 2019 Earnings ReleaseAnonymous 5nGhgttNo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Real Estate Investment AnalysisDocument6 pagesReal Estate Investment AnalysisA jNo ratings yet

- Bear Stearns 4q2005 - TablesDocument4 pagesBear Stearns 4q2005 - Tablesjoeyn414No ratings yet

- IC Discounted Cash Flow Analysis 10840Document5 pagesIC Discounted Cash Flow Analysis 10840Vishwas ParakkaNo ratings yet

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocument3 pagesQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghNo ratings yet

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Document40 pagesSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghNo ratings yet

- Irving Budget Update 2010-07-07Document22 pagesIrving Budget Update 2010-07-07Irving BlogNo ratings yet

- 3 2 Final Project Milestone Two Vertical and Horizontal AnalysisDocument2 pages3 2 Final Project Milestone Two Vertical and Horizontal AnalysisAlison JcNo ratings yet

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- CCME Financial Analysis ReportDocument5 pagesCCME Financial Analysis ReportOld School ValueNo ratings yet

- 23 q4 Earnings Presentation American TowerDocument20 pages23 q4 Earnings Presentation American TowerDaniel KwanNo ratings yet

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNo ratings yet

- Georgetown University Public Real Estate Fund Valuation ModelDocument35 pagesGeorgetown University Public Real Estate Fund Valuation Modelmzhao8No ratings yet

- BF 07arDocument86 pagesBF 07arAlexander HertzbergNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- ProformaDocument1 pageProformaapi-401204785No ratings yet

- Maiden Lane III First CutDocument7 pagesMaiden Lane III First Cutoctothorpe2294No ratings yet

- Phase in FinalDocument2 pagesPhase in FinalRuss LatinoNo ratings yet

- CPRT Us Equity - Model - ZCK - Mar 15 2023Document23 pagesCPRT Us Equity - Model - ZCK - Mar 15 2023Ekambaram Thirupalli TNo ratings yet

- FTNT - Q2'21 Investor Slides FinalDocument14 pagesFTNT - Q2'21 Investor Slides FinalJOhnNo ratings yet

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliNo ratings yet

- Historical ProjectionsDocument2 pagesHistorical ProjectionshekmatNo ratings yet

- Bellingham Crossroads Economics 9-23-22Document7 pagesBellingham Crossroads Economics 9-23-22deresensNo ratings yet

- Start Startup Financial ModelDocument5 pagesStart Startup Financial ModelRaman TiwariNo ratings yet

- Commission Structure and FinancialsDocument5 pagesCommission Structure and Financialsgabrielagl10No ratings yet

- Ejercicio Estados Financieros Vertical y Horizontal 22 SepDocument5 pagesEjercicio Estados Financieros Vertical y Horizontal 22 Sepgracy yamileth vasquez garayNo ratings yet

- Questions of Part I - A 1 2 3 4Document11 pagesQuestions of Part I - A 1 2 3 4api-382153962No ratings yet

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethNo ratings yet

- 14-NURFC Financial Analysis 8.07Document3 pages14-NURFC Financial Analysis 8.07COASTNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- real_estate_development_proformaDocument3 pagesreal_estate_development_proformaartsan3No ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- Bac DCFDocument7 pagesBac DCFVivek GuptaNo ratings yet

- Federalcompliancecosts 20061026Document1 pageFederalcompliancecosts 20061026Andrew NeuberNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- Peer Forest and Wood Working IndustriesDocument6 pagesPeer Forest and Wood Working Industriessetiawan etyNo ratings yet

- ABNB ValuationDocument4 pagesABNB ValuationKasturi MazumdarNo ratings yet

- Mercury CaseDocument23 pagesMercury Caseuygh gNo ratings yet

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- CDL Ar2013Document224 pagesCDL Ar2013lizNo ratings yet

- A02 BcaDocument103 pagesA02 BcaAlejandro RamosNo ratings yet

- Microsoft Corporation NasdaqGS MSFT FinancialsDocument35 pagesMicrosoft Corporation NasdaqGS MSFT FinancialssimplyashuNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Adoc - Pub - Keywords Librarian Certification Librarian ProfessDocument15 pagesAdoc - Pub - Keywords Librarian Certification Librarian ProfessRialeeNo ratings yet

- Vbook - Pub Business Combination QuizDocument3 pagesVbook - Pub Business Combination QuizRialeeNo ratings yet

- Card Combinations: Missing The Queen Missing The KingDocument14 pagesCard Combinations: Missing The Queen Missing The KingT ChatterjeeNo ratings yet

- Tax Facilty and Tax ComplianceDocument13 pagesTax Facilty and Tax ComplianceRialeeNo ratings yet

- Card Combinations: Missing The Queen Missing The KingDocument14 pagesCard Combinations: Missing The Queen Missing The KingT ChatterjeeNo ratings yet

- AAP Activity Consideration of Internal Control PDFDocument13 pagesAAP Activity Consideration of Internal Control PDFRialeeNo ratings yet

- Business Policy and Strategic ManagementDocument38 pagesBusiness Policy and Strategic ManagementRialeeNo ratings yet

- Chapter 3 Auditors ResponsibilityDocument20 pagesChapter 3 Auditors ResponsibilityNhaj50% (2)

- Business Policy and Strategic ManagementDocument38 pagesBusiness Policy and Strategic ManagementRialeeNo ratings yet

- Combination Summer Hat V1Document5 pagesCombination Summer Hat V1momoinwonderland100% (1)

- Combination Summer Hat V1Document5 pagesCombination Summer Hat V1momoinwonderland100% (1)

- Use The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseDocument33 pagesUse The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseAlarich Catayoc80% (5)

- Bustax Compilation ExamsDocument194 pagesBustax Compilation ExamsRialeeNo ratings yet

- Pool Canvas: Creation SettingsDocument14 pagesPool Canvas: Creation SettingsRialeeNo ratings yet

- Andrix Asterix Co liquidation statementDocument17 pagesAndrix Asterix Co liquidation statementaleachon100% (1)

- Afar Mixauthors PDFDocument78 pagesAfar Mixauthors PDFGamers HubNo ratings yet

- Lesson 4 Partnership DissolutionDocument17 pagesLesson 4 Partnership DissolutionheyheyNo ratings yet

- This Study Resource Was: ACC131 - PQ5Document2 pagesThis Study Resource Was: ACC131 - PQ5RialeeNo ratings yet

- Use The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseDocument33 pagesUse The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseAlarich Catayoc80% (5)

- Lesson 4 Partnership DissolutionDocument17 pagesLesson 4 Partnership DissolutionheyheyNo ratings yet

- Quiz in Partnership Operations PDF FreeDocument1 pageQuiz in Partnership Operations PDF FreeKristine Esplana Toralde100% (1)

- This Study Resource Was: A. The Partnership Itself Pays No Income TaxesDocument9 pagesThis Study Resource Was: A. The Partnership Itself Pays No Income TaxesJaceNo ratings yet

- Afar Exercise 5 PDF FreeDocument8 pagesAfar Exercise 5 PDF FreeRialeeNo ratings yet

- CMPC 221 Punzalan PDFDocument9 pagesCMPC 221 Punzalan PDFRialeeNo ratings yet

- Afar Exercise 5 PDF FreeDocument8 pagesAfar Exercise 5 PDF FreeRialeeNo ratings yet

- Formation of DD and EE partnershipDocument3 pagesFormation of DD and EE partnershipmiss independent100% (1)

- Fahim Final ReportDocument63 pagesFahim Final Reportmahbub rahman100% (2)

- Accounting For BranchesDocument53 pagesAccounting For Branchesalemayehu100% (2)

- General Proposal EditedDocument13 pagesGeneral Proposal EditedRecious NguluvheNo ratings yet

- Abu Girma - Determinants Domestic Savings in EthDocument34 pagesAbu Girma - Determinants Domestic Savings in Ethwondimg100% (3)

- Faysal BankDocument113 pagesFaysal BanksaharsaeedNo ratings yet

- Darby Sporting Goods Inc Has Been Experiencing Growth in The PDFDocument2 pagesDarby Sporting Goods Inc Has Been Experiencing Growth in The PDFAnbu jaromiaNo ratings yet

- Kowloon DM 2014Document32 pagesKowloon DM 2014Chetana DiduguNo ratings yet

- Investor Presentation Highlights Hudbay's Diversified PortfolioDocument67 pagesInvestor Presentation Highlights Hudbay's Diversified PortfolioAndrewNo ratings yet

- H 4Document26 pagesH 4Sunil PandeyNo ratings yet

- Phillips PLL 6e Chap05Document38 pagesPhillips PLL 6e Chap05snsahaNo ratings yet

- Advanced Corporate AccountingDocument242 pagesAdvanced Corporate AccountingMuskan GuptaNo ratings yet

- RFQ Fuel Farm PakistanDocument23 pagesRFQ Fuel Farm PakistanBilel Markos100% (1)

- Sox PDFDocument8 pagesSox PDFRoland ValNo ratings yet

- Hedging StrategiesDocument10 pagesHedging StrategiesLakshman Kumar YalamatiNo ratings yet

- خالد الخالدDocument1 pageخالد الخالدaana rkshNo ratings yet

- SAP BalanceSheetDocument1 pageSAP BalanceSheetBlesszie VillegasNo ratings yet

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- Sfac 6Document91 pagesSfac 6Raymond Parmonangan Hutahaean100% (1)

- Entrepreneurship Chapter TwoDocument9 pagesEntrepreneurship Chapter TwochuchuNo ratings yet

- UBS Global Wealth Report 2018 enDocument60 pagesUBS Global Wealth Report 2018 enDavid KwokNo ratings yet

- Nil TFDocument3 pagesNil TFlachimolala. kookieee97No ratings yet

- Who Is The Ostensible OwnerDocument10 pagesWho Is The Ostensible OwnerdeepakNo ratings yet

- ICB's Role in Capital MarketsDocument22 pagesICB's Role in Capital MarketsHabibur RahmanNo ratings yet

- 35intercontinental Broadcasting Corporation VDocument2 pages35intercontinental Broadcasting Corporation Vcrisanto perezNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- QuizletDocument4 pagesQuizletKizzea Bianca GadotNo ratings yet