Professional Documents

Culture Documents

12 Rectification Order Us 154

12 Rectification Order Us 154

Uploaded by

phani raja kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Rectification Order Us 154

12 Rectification Order Us 154

Uploaded by

phani raja kumarCopyright:

Available Formats

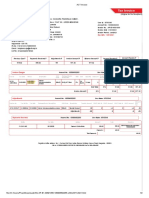

To

The Income Tax Officer, Ward-4(1)

Saraf Chambers, Sadar, Nagpur

(M.S)- 440001

PAN :

Assessee : Mr. ABC

A.Y. : 2009-10

Sub : Rectification Order u/s. 154 of the Income Tax Act 1961

Ref : Notice U/s 143(1) of Income Tax Act 1961

You’re Honor,

In respect of the above referred matter the assessee begs to submit as hereunder for your kind

consideration:

1. That the assessee has paid total income tax by way of T.D.S. and Advance Tax of

Rs.51010 /- (Advance Tax of Rs.22500/-, Self Assessment Tax of Rs.5440/-, TDS of

Rs.23070/-) for the said assessment year 2009-10 however your office did not allow

any credits of the TDS for Rs. 23070.

2. That the assessee has confirmed and verified all the T.D.S. certificates and

respectfully submits that the claimed amount of Rs.23070/- is proper and actual as is

evident T.D.S. certificates and statements enclosed.

3. That the assessee now submits that this short allowance of Rs.23070/- be treated as

mistake apparent from the records and appropriate credit be allowed to assessee.

4. That the assessee also submits that the intimation u/s.143 (1) may revised accordingly

and any tax payable/Refundable be recomputed and a fresh demand or otherwise may

be issued to the assessee which assessee undertakes pay forth with.

Thanking you

Yours truly,

XYZ

Encls:

1. Copy of intimation u/s 143(1)

2. True copies of TDS certificates.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Whats NewDocument3 pagesWhats Newphani raja kumarNo ratings yet

- GST Audit Cannot Be Conducted After Winding Up of BusinessDocument3 pagesGST Audit Cannot Be Conducted After Winding Up of Businessphani raja kumarNo ratings yet

- Test AttachmentDocument1 pageTest Attachmentphani raja kumarNo ratings yet

- Addition For Cash Deposited in Bank Out of Business Receipts - Draft SubmissionDocument69 pagesAddition For Cash Deposited in Bank Out of Business Receipts - Draft Submissionphani raja kumarNo ratings yet

- Leelavati Service Tax ReturnDocument6 pagesLeelavati Service Tax Returnphani raja kumarNo ratings yet

- ACT Invoice FOR JANDocument2 pagesACT Invoice FOR JANphani raja kumarNo ratings yet

- Vat 112Document2 pagesVat 112phani raja kumarNo ratings yet

- Taxation of Income Earned From Selling SharesDocument5 pagesTaxation of Income Earned From Selling Sharesphani raja kumarNo ratings yet

- Socieity Registration Required DetailsDocument1 pageSocieity Registration Required Detailsphani raja kumarNo ratings yet

- Stampduty For Firm ReconstitutionDocument2 pagesStampduty For Firm Reconstitutionphani raja kumarNo ratings yet

- I Disabled HiberfilDocument3 pagesI Disabled Hiberfilphani raja kumarNo ratings yet

- Affidavit For Society Registration For Own House Amma PremashramDocument1 pageAffidavit For Society Registration For Own House Amma Premashramphani raja kumarNo ratings yet

- Income Tax Scrutiny NormsDocument6 pagesIncome Tax Scrutiny Normsphani raja kumarNo ratings yet

- Capital Gain Compensation Recd From Central GovernmentDocument45 pagesCapital Gain Compensation Recd From Central Governmentphani raja kumarNo ratings yet

- Some Important Aspects of HUF Under Income Tax, 1961Document16 pagesSome Important Aspects of HUF Under Income Tax, 1961phani raja kumarNo ratings yet

- Tan Application Form Form-49b 1-3-19Document5 pagesTan Application Form Form-49b 1-3-19phani raja kumarNo ratings yet

- Channels ListDocument2 pagesChannels Listphani raja kumarNo ratings yet

- Acception of Cforms After Issuing of Assessment Order Godrej Agrovet CaseDocument1 pageAcception of Cforms After Issuing of Assessment Order Godrej Agrovet Casephani raja kumarNo ratings yet

- 2 of 2008 8 % To 10 % Duty ChangeDocument3 pages2 of 2008 8 % To 10 % Duty Changephani raja kumarNo ratings yet

- BALAJI SOFTTECK DIGITAL SIGNATURE APPLICATION TCS - Class 2 IndividualDocument2 pagesBALAJI SOFTTECK DIGITAL SIGNATURE APPLICATION TCS - Class 2 Individualphani raja kumarNo ratings yet

- Digital Signature Certificate Subscription FormDocument1 pageDigital Signature Certificate Subscription Formphani raja kumarNo ratings yet