Professional Documents

Culture Documents

The Lifestyle Planner by Miss Invest

Uploaded by

Bhergie EstabilloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Lifestyle Planner by Miss Invest

Uploaded by

Bhergie EstabilloCopyright:

Available Formats

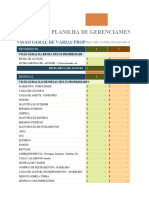

MONTHLY LIFESTYLE PLANNER

Engr. Lovely Charmaine Gomez

Licensed Financial Advisor | Chemical Engineer | Content Creator

fb.com/MissInvest | instagram.com/Miss.Invest | tiktok.com/@missinvest | glcharmaine@gmail.com

YTD Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Projected Net Income ₱ 15,000 ₱ 15,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Salary ₱ 15,000 ₱ 15,000 ₱ - ₱ - ₱ - ₱ - ₱ -

Side Hustle A ₱ -

Side Hustle B ₱ -

Business ₱ -

Allowances ₱ -

Receivables ₱ -

Others ₱ -

Target Money Jars BUDGET ALLOCATION PER MONEY JAR

55% Necessities ₱ 8,250 ₱ 8,250 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

10% Long Term-Savings ₱ 1,500 ₱ 1,500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

10% Financial Freedom ₱ 1,500 ₱ 1,500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

10% Play Jar ₱ 1,500 ₱ 1,500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

10% Education Jar ₱ 1,500 ₱ 1,500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

5% Give Jar ₱ 750 ₱ 750 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

55% Necessities ₱ 6,800 ₱ 6,800 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Food/Groceries ₱ 3,000 ₱ 3,000

Rent/Mortgage ₱ 1,000 ₱ 1,000

Transportation ₱ 1,000 ₱ 1,000

Water ₱ 500 ₱ 500

Electricity ₱ 500 ₱ 500

Credit Card ₱ - ₱ -

Phone Bill ₱ 300 ₱ 300

Internet ₱ - ₱ -

Insurance ₱ 500 ₱ 500

Others ₱ - ₱ -

10% Long-term Savings for Spending ₱ 1,000 ₱ 1,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Emergency Fund ₱ 1,000 ₱ 1,000

Vacation ₱ - ₱ -

Business Venture ₱ - ₱ -

Gadgets ₱ - ₱ -

Home Improvement ₱ - ₱ -

Other Big Purchases ₱ - ₱ -

10% Financial Freedom ₱ 1,000 ₱ 1,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Stocks ₱ - ₱ -

Mutual Funds ₱ 1,000 ₱ 1,000

MP2 ₱ - ₱ -

Forex Capital ₱ - ₱ -

Crypto ₱ - ₱ -

Business Capital ₱ - ₱ -

Others ₱ - ₱ -

10% Play ₱ 1,000 ₱ 1,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Clothes ₱ 1,000 ₱ 1,000

Shoes ₱ - ₱ -

Bags/Accessories ₱ - ₱ -

Dining out ₱ - ₱ -

NetFlix ₱ - ₱ -

Entertainment ₱ - ₱ -

Subscriptions ₱ - ₱ -

Others ₱ - ₱ -

10% Education ₱ 500 ₱ 500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Books ₱ 500 ₱ 500

Training/Worshops ₱ - ₱ -

Mentoring/Coaching ₱ - ₱ -

5% Give ₱ 1,000 ₱ 1,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Family Contribution ₱ 500 ₱ 500

Tithes/Charity ₱ 500 ₱ 500

Gifts ₱ -

Total Budget ₱ 11,300 ₱ 11,300 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Needs ₱ 6,800 ₱ 6,800 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Savings ₱ 2,000 ₱ 2,000 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Wants ₱ 2,500 ₱ 2,500 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Free Money for Savings ₱ 3,700 ₱ 3,700 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

Under/(Over) spending on Wants ₱ 1,250 ₱ 1,250 ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ - ₱ -

₱16,000

₱14,000

₱12,000

₱10,000

Wants; ₱2,500

₱8,000

Savings; ₱2,000 Needs; ₱6,800 ₱6,000

₱4,000

₱2,000

₱-

J an Feb Mar Ap r M ay Jun Jul Au g S ep Oc t No v D ec

Net Income Needs Savings Wants

How to use the Lifestyle Planner:

LIFESTYLE PLANNING - Input your data on gray cells only. Use dd-mmm-yyyy (01-Jan-1991) format for all dates.

- Mandatory Data: Birthdate, Retirement Age, Monthly Income and estimated Daily Expense, and first row of Needs, Savings and

Wants

Engr. Lovely Charmaine R. Gomez - Basic Cash Flow: 20% Savings, 50% Needs, 30% Wants / Net Worth = Assets - Liabilities

Licensed Financial Advisor | Chemical Engineer | Content Creator - You can duplicate the sheet to monitor Your Lifestyle on a monthly basis.

fb.com/MissInvest | instagram.com/Miss.Invest | tiktok.com/@missinvest

beacons.page/MissInvest | glcharmaine@gmail.com Inflation Rate: 4.20% Tuition Fee Hike: 6.96%

Date Birthdate 01-Jan-90 Current Age 31

Name Juan Dela Cruz Retirement Age 55 Working Years 24

Email Monthly Income ₱15,000.00 Future Value -₱40,304.06

Contact No. Daily Expense ₱500.00 Future Value -₱1,382.23

YOUR LIFESTYLE

Needs (50%) Savings (20%) Wants (30%)

Description Cost Description Cost Description Cost

House Rent ₱1,000.00 Mutual Fund ₱0.00 Online Shopping ₱0.00

Utilities - Water, Electricity ₱1,000.00 Insurance No. 1 ₱1,000.00 Travel ₱0.00

Internet ₱0.00 Insurance No. 2 ₱0.00 Entertainment ₱0.00

Mobile ₱300.00 Additional Emergency Fund ₱1,000.00 Subscriptions - NetFlix, Spotify, etc. ₱0.00

Transportation ₱1,000.00 Gifts/Tithes/Charity ₱1,000.00

Food/Groceries ₱5,000.00

TOTAL ₱2,000.00 TOTAL ₱1,000.00

Minimum Amount ₱3,000.00 Limit ₱4,500.00

Amount not invested ₱1,000.00 Excess Spending ₱0.00

MAGIC NUMBER

TOTAL ₱8,300.00 You need:

➤

This is the future value of your current Needs and

Limit ₱7,500.00

Unused Allocation ₱0.00

Wants starting from retirement until 80y.o.

(e.g. If you retire at 60 y.o.; this amount will sustain (₱7,501,128)

you for 20 years or from age 60 - 80)

Excess Spending -₱800.00 to afford the same Needs & Wants during retirement.

-25003.76

YOUR CASH FLOW

➤

You need to save:

Needs 55.33% AT RISK This is how much you need to save monthly

Savings 13.33% UNHEALTHY

starting today until you retire to be reach your

Magic Number.

(₱26,045.58)

Wants 6.67% HEALTHY per month from now until you retire.

Monthly Expense ₱9,300.00

Notes

Nagulat ka rin ba sa laki ng Magic Number mo? That's what inflation does.

What do I suggest? Don't save now. Postpone savings for later. But remember, the more you delay, the larger the amount you would need to save in the future.

Wanna talk about it?

Send me a message! ➤ m.me/MissInvest

You might also like

- Monthly Lifestyle Planner: Engr. Lovely Charmaine GomezDocument3 pagesMonthly Lifestyle Planner: Engr. Lovely Charmaine GomezRydel CuachonNo ratings yet

- 13 Ways To Control Time For You by Rahul BhatnagarDocument17 pages13 Ways To Control Time For You by Rahul BhatnagarIrfan BasheerNo ratings yet

- 70's Vibes Instagram Planner by SlidesgoDocument49 pages70's Vibes Instagram Planner by SlidesgoAirishaWilliamsNo ratings yet

- 20 Quick and Easy Marketing Tips: For Cake BusinessesDocument21 pages20 Quick and Easy Marketing Tips: For Cake BusinessesFatimah SaniNo ratings yet

- ACT202 Project Master Budgeting 1Document24 pagesACT202 Project Master Budgeting 1Asrafia Mim 1813026630No ratings yet

- 30 Emails Swipe For AffiliatesDocument76 pages30 Emails Swipe For AffiliatesnlemchipeterNo ratings yet

- Received: Product Name: Code: Sale PriceDocument3 pagesReceived: Product Name: Code: Sale PriceSai BomNo ratings yet

- Received: Product Name: Code: Sale PriceDocument3 pagesReceived: Product Name: Code: Sale PriceSai BomNo ratings yet

- Received: Product Name: Code: Sale PriceDocument3 pagesReceived: Product Name: Code: Sale PriceSai BomNo ratings yet

- Daily Budget Spreadsheet: Week 1: ParticularsDocument9 pagesDaily Budget Spreadsheet: Week 1: ParticularsRafleah RiojaNo ratings yet

- Budget Tracker 2023Document5 pagesBudget Tracker 2023Jansel Jayme BuencaloloyNo ratings yet

- Budget TemplateDocument2 pagesBudget TemplateJeffrey SapitanNo ratings yet

- Project Cash Flow: YEAR 2017Document7 pagesProject Cash Flow: YEAR 2017Charie Reyes GarciaNo ratings yet

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1Alam Mo Ba?No ratings yet

- Service Business TemplateDocument18 pagesService Business TemplatePrincess HernandezNo ratings yet

- Lifestyle Planning Worksheet: Beacons - Page/MissinvestDocument4 pagesLifestyle Planning Worksheet: Beacons - Page/MissinvestGIlbert EstrelladoNo ratings yet

- Personal Monthly Budget: Income 1 Extra Income Total Monthly IncomeDocument1 pagePersonal Monthly Budget: Income 1 Extra Income Total Monthly IncomeWinnie Crystal P. CruzNo ratings yet

- 000balance Sheet Chicken RunDocument3 pages000balance Sheet Chicken RunMadduma, Jeromie G.No ratings yet

- The Lifestyle Planner by Miss Invest 3.0 - 02-Jul-2021Document4 pagesThe Lifestyle Planner by Miss Invest 3.0 - 02-Jul-2021Kaya NedaNo ratings yet

- Ruiz Family Budget: Projected Monthly Income SourceDocument15 pagesRuiz Family Budget: Projected Monthly Income SourceLucio Jr RuizNo ratings yet

- Service Business TemplateDocument18 pagesService Business TemplateERICKA GRACE DA SILVANo ratings yet

- Cashflow Forecast - QuaterlyDocument1 pageCashflow Forecast - QuaterlyRickyNo ratings yet

- Excel Money Management TemplatesDocument5 pagesExcel Money Management TemplatesAhmad AkbarNo ratings yet

- Budget Sales Forecast TemplateDocument2 pagesBudget Sales Forecast TemplateKiyo AiNo ratings yet

- IC Startup Expenses 8857Document7 pagesIC Startup Expenses 8857Sorin Mihai MateiNo ratings yet

- IC Startup Templates Business Startup Costs TemplateDocument5 pagesIC Startup Templates Business Startup Costs TemplateSANDAMARNo ratings yet

- Monthly College Expense BudgetDocument8 pagesMonthly College Expense BudgetPrincess JoannaNo ratings yet

- Property TemplateDocument105 pagesProperty TemplateAnonymous 4PnhkGJ0P100% (1)

- 10 Personal Financial Plan Template-1Document2 pages10 Personal Financial Plan Template-1Emirish PNo ratings yet

- Business Startup CostsDocument5 pagesBusiness Startup CostsPm SpontanzNo ratings yet

- Cash Flow Forecast Template: Enter MONTH 1 Beginning Balance OnlyDocument2 pagesCash Flow Forecast Template: Enter MONTH 1 Beginning Balance OnlySabeoNo ratings yet

- Brett BudgetDocument3 pagesBrett BudgetmrlundtNo ratings yet

- Marketing BudgetDocument25 pagesMarketing BudgetJohnmark LiboonNo ratings yet

- Property Management Spreadsheet 57191 - PTDocument105 pagesProperty Management Spreadsheet 57191 - PTtiagohcorreiaNo ratings yet

- Released Id ID: Remaining ID W/out SlingDocument5 pagesReleased Id ID: Remaining ID W/out Slingusepjonah compostelaNo ratings yet

- IC-Daily-Cash-Flow-Template (1) 1Document1 pageIC-Daily-Cash-Flow-Template (1) 1Garlapati Santosh KumarNo ratings yet

- Cash Book With DiscountDocument2 pagesCash Book With DiscountKhadija MayarNo ratings yet

- Cash Book With DiscountDocument2 pagesCash Book With DiscountCorporate RishiNo ratings yet

- LalaDocument6 pagesLalaPrincess JoannaNo ratings yet

- Financial Budget PlanDocument11 pagesFinancial Budget PlanApril Dawn DaepNo ratings yet

- MergedDocument4 pagesMergedJoshNo ratings yet

- Cash Book With DiscountDocument8 pagesCash Book With DiscountJacelyn PuaNo ratings yet

- IC Annual Expense Report Template 10685Document6 pagesIC Annual Expense Report Template 10685Erica GaytosNo ratings yet

- Budget Worksheet 2Document17 pagesBudget Worksheet 2Jennifer McArthurNo ratings yet

- Copia de Budget Upload TemplateDocument54 pagesCopia de Budget Upload TemplateGuillermo Peñaloza CucumidesNo ratings yet

- May Expenses 2022Document3 pagesMay Expenses 2022rajatshubham.sharma9No ratings yet

- Event Budget Template 2019 SoBo Summer Music Series Event GrantDocument1 pageEvent Budget Template 2019 SoBo Summer Music Series Event GrantDavid D. MitchellNo ratings yet

- Linhhoang Yearly BudgetDocument1 pageLinhhoang Yearly Budgetapi-402116735No ratings yet

- Yearly BudgetDocument1 pageYearly Budgetapi-389746759No ratings yet

- Cashflow Forecast SpreadsheetDocument4 pagesCashflow Forecast SpreadsheetSaikatNo ratings yet

- HR Budget CalenderDocument39 pagesHR Budget Calendersham8130294095No ratings yet

- Trọn Bộ 180 Tập Truyện Chêm Tiếng AnhDocument27 pagesTrọn Bộ 180 Tập Truyện Chêm Tiếng AnhTa TranNo ratings yet

- Cash Book Template VATDocument2 pagesCash Book Template VATImienaz ChusNo ratings yet

- A58 ExpenseDocument30 pagesA58 ExpenseCheaSokimNo ratings yet

- Annual Marketing Budget TemplateDocument8 pagesAnnual Marketing Budget TemplateBharathiNo ratings yet

- Business Plan Budget 2107Document1 pageBusiness Plan Budget 2107api-382424539No ratings yet

- IC Budget Proposal 11142Document2 pagesIC Budget Proposal 11142Marvin ClutarioNo ratings yet

- IC Project Budget Breakdown 11292Document2 pagesIC Project Budget Breakdown 11292JEMAL DAWITNo ratings yet

- Rate Calculation FormulaDocument3 pagesRate Calculation FormulasaiNo ratings yet

- Euch - 6 Easter BDocument4 pagesEuch - 6 Easter BVal RenonNo ratings yet

- 2017 Pds GuidelinesDocument4 pages2017 Pds GuidelinesManuel J. Degyan75% (4)

- Sample ResumeDocument2 pagesSample ResumeBhergie EstabilloNo ratings yet

- Secretarial Correspondence PDFDocument54 pagesSecretarial Correspondence PDFIrina CăpățînăNo ratings yet

- Form Transmittal MemorandumDocument1 pageForm Transmittal MemorandumBhergie EstabilloNo ratings yet

- Narrative ReportDocument38 pagesNarrative Reportjessa may64% (28)

- PhilHealth Member Registration Form (PMRF)Document2 pagesPhilHealth Member Registration Form (PMRF)Vinson Gabato78% (9)

- Philippines - YEM - Final Narrative ReportDocument36 pagesPhilippines - YEM - Final Narrative ReportBhergie EstabilloNo ratings yet

- A Narrative Report of Accomplishment in PDFDocument5 pagesA Narrative Report of Accomplishment in PDFnikkoNo ratings yet

- OJT - Narrative ReportDocument31 pagesOJT - Narrative Reportzhaljoug89% (114)

- Current EventsDocument4 pagesCurrent EventsBhergie EstabilloNo ratings yet

- Employee Attendance Management SystemDocument73 pagesEmployee Attendance Management SystemBhergie EstabilloNo ratings yet

- Three (3) Branches of The GovernmentDocument12 pagesThree (3) Branches of The GovernmentBhergie EstabilloNo ratings yet

- AldrinDocument8 pagesAldrinBhergie EstabilloNo ratings yet

- Personal Philosophy ParentsDocument6 pagesPersonal Philosophy ParentsBhergie EstabilloNo ratings yet

- The Black ShipDocument1 pageThe Black ShipBhergie EstabilloNo ratings yet

- Bank Name Gate Way RRN Sr. No Payment ModeDocument2 pagesBank Name Gate Way RRN Sr. No Payment Modedeepakraj610No ratings yet

- History of The Municip Ality of Mapand AnDocument14 pagesHistory of The Municip Ality of Mapand AnCatalina G. SerapionNo ratings yet

- Indian Footwear IndustryDocument6 pagesIndian Footwear IndustryVishal DesaiNo ratings yet

- TQM Implementation in ToyotaDocument15 pagesTQM Implementation in ToyotaSaikat GhoshNo ratings yet

- Pharma Companies 177Document8 pagesPharma Companies 177Narendra ParthNo ratings yet

- Activity Porters 5FDocument3 pagesActivity Porters 5FLeilah CaitNo ratings yet

- Godrej Industries Ltd. Bharuch - GujaratDocument22 pagesGodrej Industries Ltd. Bharuch - GujaratAnoop PrajapatiNo ratings yet

- Agri-Tourism Baby ThesisDocument1 pageAgri-Tourism Baby ThesisArjee Louie Jimenez83% (12)

- Korindo ADocument8 pagesKorindo ATeuku Muhammad Iqbal AnwarNo ratings yet

- The National Standard of The People's Republic of China: ICS 65.020.01 B04Document9 pagesThe National Standard of The People's Republic of China: ICS 65.020.01 B04Monica Andrea Ramirez CastelblancoNo ratings yet

- Test Bank For Supply Chain Management A Logistics Perspective 9th Edition by CoyleDocument24 pagesTest Bank For Supply Chain Management A Logistics Perspective 9th Edition by CoyleMrsLindaDavisyawt100% (41)

- Contemporary Management 6th Edition Jones Test BankDocument25 pagesContemporary Management 6th Edition Jones Test BankDianaMartinpgtb100% (48)

- Fuyao Glass - SummarizationDocument2 pagesFuyao Glass - SummarizationLucas AalbersNo ratings yet

- Internet of ThingsDocument2 pagesInternet of ThingsJeffany NepomucenoNo ratings yet

- MMILINK ProfileDocument4 pagesMMILINK ProfileAli AhmedNo ratings yet

- Australian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKDocument5 pagesAustralian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKDylan AdrianNo ratings yet

- CostAccountingModule MidtermPeriod2022Document29 pagesCostAccountingModule MidtermPeriod2022Shawn PeridoNo ratings yet

- Abbreviations Used in The Pharmaceutical IndustryDocument8 pagesAbbreviations Used in The Pharmaceutical Industryatul8295No ratings yet

- Audi Case Solution - Preeti Anchan B065Document6 pagesAudi Case Solution - Preeti Anchan B065Adrian LopezNo ratings yet

- Partex Stargroup CorporateDocument2 pagesPartex Stargroup CorporateNazrul JewelNo ratings yet

- BNP Paribas Oil and Gas" Sector PolicyDocument12 pagesBNP Paribas Oil and Gas" Sector PolicyComunicarSe-ArchivoNo ratings yet

- Schedule Dynamic Table Report 63426Document16 pagesSchedule Dynamic Table Report 63426Ari cNo ratings yet

- PHARMA & DOOCTOR'S LISTDocument22 pagesPHARMA & DOOCTOR'S LISTankitNo ratings yet

- Foreignalpha 2014Document21 pagesForeignalpha 2014Palash KukwasNo ratings yet

- Waec Syllabus For Economics PDFDocument6 pagesWaec Syllabus For Economics PDFXanderian XavierNo ratings yet

- Reading Unit 1Document12 pagesReading Unit 1Hind BenelgamraNo ratings yet

- Case 2Document14 pagesCase 2Yuval AlfiNo ratings yet

- MainDocument72 pagesMainNikhil NikzNo ratings yet

- Sutrisno 2023 IOP Conf. Ser. Earth Environ. Sci. 1200 012064Document9 pagesSutrisno 2023 IOP Conf. Ser. Earth Environ. Sci. 1200 012064Hilda Anugrah PutriNo ratings yet

- Coimbatore Millet Tiruvila With Past ImageDocument5 pagesCoimbatore Millet Tiruvila With Past ImageAnu V PillaiNo ratings yet