Professional Documents

Culture Documents

An Overview of Financial Inclusion Through DBT in India

Uploaded by

PARAMASIVAN CHELLIAHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Overview of Financial Inclusion Through DBT in India

Uploaded by

PARAMASIVAN CHELLIAHCopyright:

Available Formats

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

Available online @ www.iaraindia.com

SELP Journal of Social Science

ISSN : 0975-9999 (P) 2349-1655 (O)

Impact Factor : 3.655(CIF), 2.78(IRJIF), 2.77(NAAS)

Volume. IX, Issue 37 - April 2018

UGC Approved Journal (46622), © Author

AN OVERVIEW OF FINANCIAL INCLUSION THROUGH DBT IN

INDIA

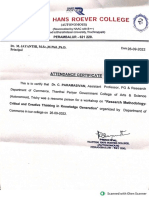

Dr.C.Paramasivan

Assistant Professor & Research Advisor

G.Arunkumar

Ph.D. Full Time Research Scholar

Department of Commerce, Periyar E.V.R. College (Autonomous), Tiruchirappalli

Abstract

Financial Inclusion is one of the effective and innovative approach which helps to

reach the financial services, assistance and subsidies to the real beneficiaries. Government

of India introduced the Scheme on financial inclusion to provide financial services to the

unreached people at an affordable or free of cost. RBI instructed to all the commercial banks

to open No frills accounts to all the people those who are don’t have bank account. To speedy

and digitalised financial inclusion in the country, Government implemented a new scheme

in the name of Pradhan Mantri Jan Dhan Yojana in August, 2014. With this effects total

number of beneficiaries amounted to 320215027 with the deposits of Rs. 793711.06 Lakhs.

And 240921418 Rupay cards have been issued to beneficiaries as on up to April 2018. The

present paper discusses about the financial inclusion through Direct Benefit Transfer in

India with respect to the major social defence schemes such as Pratyaksha Hastaantarit

Laabh (PAHAL) or Direct Benefit Transfer for LPG, Mahatma Gandhi National Rural

Employment Guarantee Act, National Social Assistant Programme, Scholarship scheme,

Public Distribution System and others. The major social defence schemes are highlighted

such as Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), The

National Social Assistance Programme (NSAP) and Pratyaksha Hastaantarit Laabh

(PAHAL) or Direct Benefit Transfer for LPG (DBTL).

Key Words: Direct benefit transfer, Financial inclusion, Digital transaction.

DIRECT BENEFIT TRANSFER under the Employment Guarantee Scheme and

Direct Benefit Transfer is one of the benefits/subsidies under other Government

new approaches where the Government funds welfare programs. This can facilitate the

reach the beneficiaries bank account directly beneficiaries to use this money to buy goods

and systematically. The Direct Cash / Benefit and services in quantity and of quality from the

Transfer scheme provides for direct transfer of market at competitive prices. Under the scheme

money into the bank accounts of eligible the difference between the market price and

persons for pension, scholarship, payments subsidized price is directly transferred to the

SELP Journal of Social Science 79 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

beneficiary in cash in proportion to the quantity India directly or through implementing

uplifted from the market. The scheme depends agencies, which involve cash / kind benefits'

upon basic two requirements viz. Aadhaar, the transfers to individuals. Accordingly, the scope

Unique Identification (UID) Number and Bank of DBT covers the following categories of

Account. Aadhaar is a 12-digit individual schemes.

identification number issued by the Unique Cash Transfer

Identification Authority of India [UDAI] to This category includes schemes or

serve as proof of identity and address. The cash components of schemes wherein cash benefits

transfer will be enabled through ‘Aadhaar,’ a are transferred by Government to individual

numerical biometric identification that is beneficiaries. Example PAHAL, MGNREGA,

currently being given to all citizens of the NSAP etc. This transfer of cash benefits from

country. The bank account is the most Ministry/Department to beneficiaries happens

important criterion for the scheme. through different routes, as given below:

Direct Benefit Transfer Mission was Directly to beneficiaries

created in the Planning Commission to act as Through State Treasury Account to beneficiaries

the nodal point for the implementation of the Through any Implementing Agency as appointed

DBT programmes. The Mission was transferred Centre/State Governments to beneficiaries

to the Department of Expenditure in July, 2013 In-kind

and continued to function till 14.9.2015. To This category includes schemes or

give more impetus, DBT Mission and matters components of schemes wherein kind benefits

related thereto has been placed in Cabinet are given by the Government to individuals

Secretariat under Secretary w.e.f. 14.9.2015. through an intermediate agency. Typically,

First phase of DBT was initiated in 43 districts Government or its agent incurs expenditure

and later on 78 more districts were added in 27 internally to procure goods for public

schemes pertaining to scholarships, women, distribution and make services available for

child and labour welfare. DBT was further targeted beneficiaries. Individual beneficiaries

expanded across the country on 12.12.2014. 7 receive these goods or services for free or at

new scholarship schemes and Mahatma Gandhi subsidised rates.

National Rural Employment Guarantee Act REVIEW OF LITERATURE

(MGNREGA) was brought under DBT in 300 Some of the review of literature have

identified districts with higher Aadhaar been undertaken to understand the financial

enrolment. inclusion DBT and social defence schemes. The

Electronic Payment Framework was following review has been categories into

laid down vide O.M. dated 13.2.2015 and financial inclusion, DBT etc.

19.2.2015. This Framework is to be followed by Sarah, F., Pearce, D., & Sebnem, S.

all Ministries/ Departments and their attached (2015), Financial inclusion strategies are the

Institutions/PSUs and is applicable on all roadmaps of actions, decided and defined at

Central Sector (CS)/ Centrally Sponsored national or sub national level which stakeholder

Schemes (CSS) and for all schemes where a follows to achieve financial inclusion

component of cash is transferred to individual objectives. More than 50 countries across the

beneficiaries. Aadhaar is not mandatory in DBT globe has made commitments towards the

schemes. Since Aadhaar provides unique financial inclusion and many of them including

identity and is useful in targeting the intended India has already developed the National

beneficiaries, Aadhaar is preferred and Financial Inclusion Strategies (NFIS) and

beneficiaries are encouraged to have Aadhaar. remaining nations are developing the same to

JAM i.e. Jan Dhan, Aadhaar and Mobile are accelerate the level of financial inclusion in that

DBT enablers. These provide a unique specific nation.

opportunity to implement DBT in all welfare Rajasekaram N (2018), In his article

schemes across country including States & he has concluded and suggested that The

UTs. Reserve Bank of India and Government of India

Schemes covered under DBT has taken many initiatives to include the people

The scope of DBT include all those who financially excluded. This paper

welfare/subsidy schemes operated by all the outlines the various barriers that impede

Ministries/ Departments of Government of financial inclusion in India. The government of

SELP Journal of Social Science 80 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

India has overcome the barrier of “Lack of legal for delivery of financial services at the doorstep

documents” by issuing Aadhaar number to of all. However, the study finds through

everyone. Now the banks are accepting the primary survey that the low income groups are

Aadhaar card as a legal document for opening even not able to utilize the existing financial

bank account. RBI has identified five target structure due to lack of sufficient sustainable

groups of people for improving the financial income. Government efforts can put efforts to

literacy level and conducted many outbound only open bank accounts for the poor in an

camps. No Frill and Basic Services Demat active way through Fund Transfer.

Account (BSDA) were created for serving the Grakolet Arnold Zamereith

poor people. Gour`ene and Pierre Mendy(2017), In their

Gwalani and Parkhi (2014), have articles would stimulate the economic growth

studied the financial inclusion in the Indian by increasing savings and therefore

context. They pointed out that poverty, investments. At the same time, they should

unavailability of banking services, complex strengthen and liberalize the investment

procedures, financial illiteracy, traditional regulatory framework and create an

cultural values and lack of faith in the banking environment conducive to exports by

system are the reasons for financial exclusion. facilitating administrative procedures and

They discussed the different models such as fighting against corruption. All of this will

lead bank system, correspondent banking, promote the economic growth which in turn

mobile banking, microfinance model to include will increase the supply of available financial

the financially excluded people. services. Policymakers and financial authorities

Jisha Joseph and Titto Varghese should promote the financial inclusion,

(2014), have studied the role of financial simulate macroeconomic growth, giving its

inclusion in the development of Indian strong positive impact on financial inclusion.

economy. They made this study based on Onaolapo (2015), studied the effects

secondary data from RBI, GOI and another of Financial Inclusion on the economic growth

review of the literature. They pointed out that of Nigeria. He found a significant positive

the RBI and Government of India (GOI) have relationship between financial inclusion and

taken many initiatives to include the financially economic growth. The author also showed that

excluded people such as Branch expansion, Financial Inclusion greatly influenced poverty

business correspondent, business facilitator reduction and financial intermediation through

model, Relaxed KYC norms, acceptance of positively impacted Bank Branch Networks,

Aadhaar card for opening a bank account, Loans to Rural Areas and small enterprises.

opening no-frill accounts, General Purpose Das and Bhattacharjee (2016),

Credit Card (GCC) and Kisan Credit Card revealed that DBT is to bring transparency and

(KCC) and direct benefit transfer etc. terminated pilferage from distribution of funds

Mahasweta M. Banerjee (2016), has sponsored by Central Government. DBT in

indicated that the opportunity to earn, save, Food Grains is an essential commodity. It helps

borrow, and invest money as well as the ability the 60 percent households of the country to

to understand and manage one’s finance skill provide necessary food. But still there are some

fully are critically important for family well- problems and challenges like subsidy transfer,

being. Policy recommendations to address the information gap and financial inclusion.

FC of poor people in India require significant Sakthivel Nand Mailsamy R, (2018),

research evidence. Longitudinal, randomized, have revealed about LPG PAHAL scheme is a

mixed-methods research should examine result of an intensive Information Education

existing FC programs and disentangle the Campaign comprising advertising through

effects of occupation, gender, marital status, various means, direct reaching out to

family size, family type, education, and health consumers, and dealer level campaigns. The

in both financial inclusion and abilities. Ministry of Petroleum and Natural Gas has

Kumar Bijoy (2018), has undertaken several innovative measures such as

recommended to policy makers to concentrate guardian officers for each district, deployment

on the creation of job opportunities for all of technology by use of SMS, and a single

through financial inclusion in India. There is a window portal to enable consumers to join the

need to strengthen the financial infrastructure scheme. This portal is an important step in

SELP Journal of Social Science 81 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

bringing transparency and gives details of who or provide some really deprived ones the basics

is benefiting from subsidy. of the life by providing them access to cash.

Neha Sharma (2017), has concluded Amiya (2015), stressed the Direct

that at an implementation level, there still exists Benefit Transfer as an initiative for inclusive

scope for improvement. Also, improvement in growth and suggested its merits and future

financial awareness can indirectly help in probability of the schemes. The researcher says

successful implementation of this scheme. DBT that the schemes have potential to control much

Policy is pro-poor policy which can surely rooted corruption in public distribution system

accomplish the anticipation of the stake holders its success in fact depends upon institutional

(Both the people and the government). The and infrastructural development in the rural and

scheme may not fully eliminate the all urban areas. Although the scheme comes with

anomalies but will surely bring some principal best of intentions, there is a spring of

changes in the delivery of benefits. It will surely impractical idealism in the way proposed has

eliminate the growth of black marketing. Also, been drafted and no fool proof measures have

it will enhance the standard of living of people been taken to cater the benefits as desired and

perceived.

Table 1: Combined Progress Report of Key Programme under DBT

Fund Transferred

seeded with Aadhaar

Name of the Scheme

Beneficiaries seeded

Beneficiaries data

with Aadhaar (%)

Total number of

Total number of

Bridge Payment

Aadhaar Bridge

Electronic Fund

Using Aadhaar

Beneficiaries*

Percentage of

Transfer W/o

Payment

Total

MGNREGS 11.15 9.11 81.75% 13,354.11 69,829.68 83,183.79

NSAP 2.76 1.44 52% 2,963.09 17,767.15 20,730.24

PAHAL 18.73 15.32 81.79% 35,546.30 16,530.54 52,076.85

(DBTL)

All Scholarship 2.27 1.18 52% 873.73 21,022.86 21,896.59

Schemes

Other Schemes 0.81 0.3 37% 263.79 4,520.12 4,783.91

Grand Total 35.71 27.35 76.60% 53,001.01 129,670.35 182,671.36

Source: DBT Progress Report, March 2018, Cabinet Secretariat, Government of India, New Delhi.

Total number of beneficiaries transfer amount through using Aadhaar Bridge

amounted to 35.71 crore, of which 27.35 crore payment and electronic fund transfer amount to

of beneficiaries data seeded with Aadhaar Rs. 182671.36 crore from 01.01.2013 to

which constitutes 76.60 percentage. Total fund 31.03.2017.

Table 2: Total funds disbursed and fund disbursed through Aadhaar Payment Bridge from

01.01.2013 to 31.03.2017.

Fund Transfer % of Fund

Total Fund Through Transfer Through

No. of Scheme Transfer Aadhaar Aadhhar

MGNREGS 83183.79 13354.11 16.05%

NSAP 20730.24 2963.09 14%

PAHAL (DBTL) 52076.85 35546.3 68.26%

All Scholarship Schemes 21896.59 873.73 4%

Other Schemes 4783.91 263.79 6%

Total 182671.36 53001.01 29.01%

Source: Direct Benefit Transfer, Government of India.

Nate: The figures are indicating the percentages of total fund transfer through Aadhaar

SELP Journal of Social Science 82 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

Total funds transferred amounted to Fund transfer through Aadhaar

Rs. 182671.36 crore of which MGNREGS, amounted to Rs. 53001.01 of which

amounted to Rs. 83183.79 crore, NSAP MGNREGS, amounted to Rs. 13354.11 crore,

amounted to Rs. 20730.24 crore, PAHAL NSAP amounted to Rs. 2963.09 crore, PAHAL

amounted to Rs. 52076.85 crore, All amounted to Rs. 35546.30 crore, All

Scholarship Schemes amounted to Rs. Scholarship Schemes amounted to Rs. 873.73

21896.59 crore and others amounted to Rs. crore and others amounted to Rs. 263.79 crore.

4783.91 crore.

Table 3:Total funds disbursed and funds disbursed through Aadhaar payment Bridge

from 01.01.2013 to 31.03.2017

Sl. % In Share of

No. of Scheme Total Fund Transfer

No Major Schemes

1 MGNREGS 83183.79 46

2 NSAP 20730.24 11

3 PAHAL (DBTL) 52076.85 28

4 All Scholarship Schemes 21896.59 12

5 Other Schemes 4783.91 3

Total 182671.36 100

Source: Direct Benefit Transfer, Government of India.

Nate: The figures are indicating the percentages in share of major schemes

MGNREGS constitutes 46 percent of PAHAL (28 %), all Scholarship schemes (12

the total fund to the major schemes followed by %), NSAP (11 %) and other schemes (3 %).

Table 4: Total beneficiaries & Beneficiaries with Aadhaar seeding from 01.01.2013 to

31.03.2017

Total No. of % In Share of

Sl. No No. of Scheme Beneficiaries in Cr Major Schemes

1 MGNREGS 11.15 31

2 NSAP 2.76 8

3 PAHAL (DBTL) 18.73 53

4 All Scholarship Schemes 2.27 6

5 Other Schemes 0.81 2

Total 35.71 100

Source: Direct Benefit Transfer, Government of India.

Nate: The figures are indicating the percentages in share of major schemes

PAHAL constitutes 53 percent of the scholarship schemes (6 %) and other schemes

total fund to the major schemes followed by (2 %).

MGNREGS (31%), NSAL (8%), all

Table 5: Total beneficiaries & Beneficiaries with Aadhaar seeding as of 31.03.2017

No. of Beneficiares Aadhaar

Total

Sl. No No. of Scheme data Seeding with seeding

Beneficiaries

Aadhaar %

1 MGNREGS 11.15 9.11 81.75%

2 NSAP 2.76 1.44 52%

3 PAHAL (DBTL) 18.73 15.32 81.79%

4 All Scholarship Schemes 2.27 1.18 52%

5 Other Schemes 0.81 0.3 37%

Total 35.71 27.35 76.60%

Source: Direct Benefit Transfer, Government of India.

Nate: The figures are indicating the percentages in Aadhaar Seeding Beneficiaries

SELP Journal of Social Science 83 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

Total beneficiaries of PAHAL Public sector banks play a major role in

amounted to 18.73 crore of which 15.32 crore opening of bank accounts under the PMJDY.

(81.79 %) beneficiaries data seeding Aadhaar As the end of April, 2018, total number of

followed by total beneficiaries of MGNREGS beneficiaries amounted to 314521825 with the

amounted to 11.15 of which 9.11 crore (81.75 deposit of 8054569.93.

%), total beneficiaries of NSAP amounted to Total number of beneficiaries under

2.76 of which 1.44 crore (52 %), total DBT from 01.01.2013 to 31.03.2017 amounted

beneficiaries of all scholarship schemes to 35.71 crore the fund transfer of Rs.

amounted to 2.27 of which 1.18 crore (52 %) 182671.36 crore, which resulted that,

and total beneficiaries of other schemes beneficiaries are able to avail their financial

amounted to 0.81 % of which 0.3 crore (37 %). subsidies through DBT.

Table 6: Direct Benefit Transfer and total Total funds transferred amounted to

number of transaction as on 2018-19 Rs.182671.3.6 crore of which Rs.53001.01

Total No. of crore fund transferred through Aadhaar

Total DBT

Schemes Transaction (29.01%).

in Cr

in Cr 46 percent of the total funds transferred

PAHAL 95372.87 387.89 to the MGNREGS followed by PAHAL (28 %)

MGNREGS 92795.16 73.32 and scholarship scheme (12%).

PAHAL constitutes 53 percent of the

NSAP 14338.61 17.73 total fund to the major schemes followed by

Scholarship MGNREGS (31%), NSAL (8%), all

11274.37 0.40

Schemes scholarship schemes (6%) and other schemes

PDS 73788.19 127.49 (2%).

Others 152634.35 21.45 Total number of beneficiaries

amounted to 35.71 crore, of which 27.35 crore

Total 440203.54 628

of beneficiaries data seeded with Aadhaar

Source: Direct Benefit Transfer, Government of

India.

which constitutes 76.60 percentage.

Note: The figures are indicating the Total No. DBT amounted to Rs. 95372.87 crore

Transaction, 2018-19 is not considered as it is not with 387.89 crore of transaction under PAHAL

completed schemes, PDS amounted to Rs. 73788.19 crore

DBT amounted to Rs. 95372.87 crore with 127.49 crore transaction, MGNREGS

with 387.89 crore of transaction under PAHAL amounted to 92795.16 with 73.32 crore

schemes, PDS amounted to Rs. 73788.19 crore transaction, other schemes amounted to Rs.

with 127.49 crore transaction, MGNREGS 152634.35 crore with 21.45 crore transaction,

amounted to 92795.16 with 73.32 crore NSAP amounted to Rs. 14338.61 crore with

transaction, other schemes amounted to Rs. 17.73 crore transaction and Scholarship

152634.35 crore with 21.45 crore transaction, schemes amounted to Rs. 11274.37 with .40

NSAP amounted to Rs. 14338.61 crore with crore transaction.

17.73 crore transaction and Scholarship CONCLUSION

schemes amounted to Rs. 11274.37 with .40 Direct benefit transfer is a scheme

crore transaction. On the whole, total DBT which enable with the help of digitalisation of

amounted to Rs. 440203.54 crore with 628 the financial transaction with a common and the

crore transaction during the year 2018-19. accessible network. Digital India facilitates the

MAJOR FINDINGS AND DBT made easy to perform financial inclusion

SUGGESTIONS in a digital format. More than 80 percent of the

Financial inclusion is one of the population in the country have bank account

sustainable inclusive scheme which helps to with Aadhaar seeding to avail incentives,

eradicate the financial untouchability among subsidies and benefits through DBT. DBT

the people in the country. With this aspects provide an opportunity to utilise banking and

Financial Inclusion schemes was initiated in the financial services to empower the people

year 2006 and it extended as PMJDY on 2014. economically and also it reduces corruption and

As on 31.03.2018, there are 236784654 bank commission by middleman. It ensures

accounts opened under PMJDY in India. beneficiaries directly enjoy the schemes of the

Government with this aspects, it is conducted

SELP Journal of Social Science 84 Volume. IX, Issue 37

April 2018 ISSN: 0975-9999 (P), 2349-1655(O)

that DBT is one of innovate player is the field 8. Laskar, R. K. (April 2, 2013). "Direct cash

of financial inclusion with the help of transfer: A game changer move". The Financial

information and communication technology. World. Retrieved 30 January 2018.

9. Mani N., (2015), Financial Inclusion in India:

REFERENCES Policies and Proghrammes, New Century

1. Das, “DBT for LPG- A Consumer Perspective”

Publication, New Delhi.

Assam, India: Abhinav Publication, Volume 5,

10. Mishra Padmaja et.al, (2014), Financial

2016

Inclusion, Inclusive Growth and the Poor,

2. Gerschenkron A., (1962), Economic

Century Publications, New Delhi.

Backwardness in Historical Perspective: A

11. Neha Sharma (2017) “Impact Of Direct Cash

Book of Essays, Harward University press,

Transfer In Lieu Of Public Distribution System:

Cambridge.

A Policy Review Of Chandigarh, India”

3. Grakolet Arnold Zamereith Gour`ene and Pierre

International Journal of Scientific &

Mendy. https://mpra.ub.uni-

Engineering Research Volume 8, Issue 6, June-

muenchen.de/82251/ MPRA Paper No. 82251,

2017 1189 ISSN 2229-5518.

posted 28 October 2017 14:21 UTC.

12. Onaolapo, A. R., (2015) ”Effects of Financial

4. Hema Gwalani and Shilpa Parkhi (2014),

Inclusion on the economic growth of Nigeria

“Financial inclusion - Building a success model

(1982-2012)”. International Journal of Business

in the Indian context”, Procedia - Social and

and Management Review, 3(8), 11-28.

Behavioral Sciences, 133, 372 – 378.

13. Rajasekaran N e-ISSN: 2278-487X, p-ISSN:

5. JishaJoseph and Dr. Titto Varghese (2014),

2319-7668. Volume 20, Issue 2. Ver. VII

“Role of Financial Inclusion in the

(February. 2018), PP 64-69

Development of Indian Economy”, Journal of

www.iosrjournals.org.

Economics and Sustainable Development,

14. Rao P.K., (2013), Development Finance,

Vol.5, No.11, 2014.

Springer Publication, New York.

6. Karmakar K, Banerjee G and Mahapatra N.,

15. Sarah, F., Pearce, D., & Sebnem, S. (2015).

(2011) Towards Financial Inclusion in India,

National Financial Inclusion Strategies.

Sage Publication, New Delhi.

Retrieved from http://pubdocs.worldbank.org

7. Kumar Bijoy (2018), “Financial Inclusion in

/en/889991430496150181/National-Financial-

India and PMJDY: A Critical Review “ISSN

Inclusion-Strategies-BRIEF-by-WBG.pdf

2300-5963 ACSIS, Vol. 14

SELP Journal of Social Science 85 Volume. IX, Issue 37

You might also like

- Entrepreneurial Mindset For Sustainable DevelopmentDocument11 pagesEntrepreneurial Mindset For Sustainable DevelopmentPARAMASIVAN CHELLIAHNo ratings yet

- Attentance CertificateDocument1 pageAttentance CertificatePARAMASIVAN CHELLIAHNo ratings yet

- Cutting-Edge Research in BusinessDocument29 pagesCutting-Edge Research in BusinessPARAMASIVAN CHELLIAHNo ratings yet

- KSRCAS - IIC - Lecture Series Programme ScheduleDocument3 pagesKSRCAS - IIC - Lecture Series Programme SchedulePARAMASIVAN CHELLIAHNo ratings yet

- Invitation-26 08 2022Document2 pagesInvitation-26 08 2022PARAMASIVAN CHELLIAHNo ratings yet

- Research Publication and PopularizationDocument55 pagesResearch Publication and PopularizationPARAMASIVAN CHELLIAHNo ratings yet

- Research Funding OppurtunitiesDocument69 pagesResearch Funding OppurtunitiesPARAMASIVAN CHELLIAHNo ratings yet

- A Study On Technology Driven Innovation Practices in Banking Sector in Tiruchirappalli DistrictDocument11 pagesA Study On Technology Driven Innovation Practices in Banking Sector in Tiruchirappalli DistrictPARAMASIVAN CHELLIAHNo ratings yet

- Financial Performance of Commercial Banks in IndiaDocument11 pagesFinancial Performance of Commercial Banks in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- Brief Resume With Recent Publication-October 2021Document3 pagesBrief Resume With Recent Publication-October 2021PARAMASIVAN CHELLIAHNo ratings yet

- A Study On Customer Perception Towards Business Innovation Practices in Tiruchirappalli DistrictDocument28 pagesA Study On Customer Perception Towards Business Innovation Practices in Tiruchirappalli DistrictPARAMASIVAN CHELLIAHNo ratings yet

- Iara Research GrantsDocument1 pageIara Research GrantsPARAMASIVAN CHELLIAHNo ratings yet

- An Overview of Branches and Atms of Commercial Banks in IndiaDocument12 pagesAn Overview of Branches and Atms of Commercial Banks in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- IARA Membership Application 2019Document2 pagesIARA Membership Application 2019PARAMASIVAN CHELLIAHNo ratings yet

- 14 A Study On Women Empowerment Through Self Help Groups in IndiaDocument6 pages14 A Study On Women Empowerment Through Self Help Groups in IndiaPARAMASIVAN CHELLIAH100% (1)

- Scopus Article 2021Document12 pagesScopus Article 2021PARAMASIVAN CHELLIAHNo ratings yet

- Indian Accounting Association: Tiruchirappalli BranchDocument1 pageIndian Accounting Association: Tiruchirappalli BranchPARAMASIVAN CHELLIAHNo ratings yet

- Sustainablity and Success of Msme in India: Dr.G.SrividhyaDocument5 pagesSustainablity and Success of Msme in India: Dr.G.SrividhyaPARAMASIVAN CHELLIAHNo ratings yet

- 8 A Study On Problem and Prospects of Women EntrepreneurDocument5 pages8 A Study On Problem and Prospects of Women EntrepreneurPARAMASIVAN CHELLIAHNo ratings yet

- IARA Conference & Awards 2021Document8 pagesIARA Conference & Awards 2021PARAMASIVAN CHELLIAHNo ratings yet

- 16 Factors Affecting The Customer Satisfaction inDocument6 pages16 Factors Affecting The Customer Satisfaction inPARAMASIVAN CHELLIAHNo ratings yet

- 13 Growth of E - Banking Challenges and Opportunities in IndiaDocument5 pages13 Growth of E - Banking Challenges and Opportunities in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- 14 E-Payment System in Rural India Issues and ChellengesDocument3 pages14 E-Payment System in Rural India Issues and ChellengesPARAMASIVAN CHELLIAHNo ratings yet

- 11 Performance of Life Insurance Corporation of IndiaDocument4 pages11 Performance of Life Insurance Corporation of IndiaPARAMASIVAN CHELLIAHNo ratings yet

- 3 Problems of Agriculturists in India - A StudyDocument5 pages3 Problems of Agriculturists in India - A StudyPARAMASIVAN CHELLIAHNo ratings yet

- An Overview of Financial Inclusion Through DBT in IndiaDocument7 pagesAn Overview of Financial Inclusion Through DBT in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- 5 Financial Inclusion and Digital IndiaDocument3 pages5 Financial Inclusion and Digital IndiaPARAMASIVAN CHELLIAHNo ratings yet

- 7 Corporate Social Responsibility Perspectives and Challenges in Rural IndiaDocument5 pages7 Corporate Social Responsibility Perspectives and Challenges in Rural IndiaPARAMASIVAN CHELLIAHNo ratings yet

- 1 Digital India Implications in Education SectorDocument6 pages1 Digital India Implications in Education SectorPARAMASIVAN CHELLIAHNo ratings yet

- 107 Udyog Aadhaar - Made Easy For Industry RegistrationDocument6 pages107 Udyog Aadhaar - Made Easy For Industry RegistrationPARAMASIVAN CHELLIAHNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Brief Industrial Profile Virudhunagar District: MSME-Development Institute, ChennaiDocument21 pagesBrief Industrial Profile Virudhunagar District: MSME-Development Institute, Chennai63070No ratings yet

- History of Samsung FridgeDocument2 pagesHistory of Samsung FridgeAarthi AarthiNo ratings yet

- EIL Underground StoragesDocument12 pagesEIL Underground StoragesanandelectricalsNo ratings yet

- CONGSONDocument2 pagesCONGSONBananaNo ratings yet

- Philippine Bank vs. NLRC Case DigestDocument1 pagePhilippine Bank vs. NLRC Case Digestunbeatable38No ratings yet

- Uh Econ 607 NotesDocument255 pagesUh Econ 607 NotesDamla HacıNo ratings yet

- LC DraftDocument3 pagesLC DraftNRVision Exim100% (3)

- Cbip Manual CapitalizationDocument2 pagesCbip Manual CapitalizationMahidhar Talapaneni100% (1)

- Microeconomics Test 1Document14 pagesMicroeconomics Test 1Hunter Brown100% (1)

- Proceeding IWRE2013Document420 pagesProceeding IWRE2013Nguyen Doan QuyetNo ratings yet

- Fatalities - VariablesDocument2 pagesFatalities - Variablesmarkyyy12No ratings yet

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- 0 Method Statement-Trench Cutter FinalDocument36 pages0 Method Statement-Trench Cutter FinalGobinath GovindarajNo ratings yet

- Tut9 Soln SlidesDocument20 pagesTut9 Soln SlidesNathan HuangNo ratings yet

- Structural,: PDF Compression, Ocr, Web-Optimization With Cvision'S PdfcompressorDocument174 pagesStructural,: PDF Compression, Ocr, Web-Optimization With Cvision'S PdfcompressorZuhal ZaeemNo ratings yet

- OperatingReview2014 EngDocument37 pagesOperatingReview2014 EngBinduPrakashBhattNo ratings yet

- Procurement Statement of WorkDocument4 pagesProcurement Statement of WorkAryaan RevsNo ratings yet

- Industry Analysis of InsuranceDocument48 pagesIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- 158Document2 pages158S MedhiNo ratings yet

- One Region: Promoting Prosperity Across RaceDocument70 pagesOne Region: Promoting Prosperity Across RaceCenter for Social InclusionNo ratings yet

- Ca Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument5 pagesCa Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalROHIT JAIN100% (1)

- Case StudyDocument5 pagesCase StudyDarshit Pachchigar0% (1)

- Michael Porter - What Is StrategyDocument19 pagesMichael Porter - What Is Strategysidharth.bediNo ratings yet

- Marketing Management-Ass 2Document4 pagesMarketing Management-Ass 2A Kaur MarwahNo ratings yet

- Lecture 5 - Competitive StrategyDocument17 pagesLecture 5 - Competitive StrategySachin kumarNo ratings yet

- Business Environment Presentation On Wto, Gats and GattDocument18 pagesBusiness Environment Presentation On Wto, Gats and GattYogi JiNo ratings yet

- Azulcocha 43-101 Tailing ReportDocument80 pagesAzulcocha 43-101 Tailing Reportwalter sanchez vargasNo ratings yet

- Power Sector Market Report EthiopiaDocument11 pagesPower Sector Market Report EthiopiaephremNo ratings yet

- Standard Chartered Vs ConfessorDocument2 pagesStandard Chartered Vs ConfessorAshley Candice100% (1)

- EY Global Mobility SurveyDocument24 pagesEY Global Mobility SurveyEuglena VerdeNo ratings yet