Professional Documents

Culture Documents

9MFY21 Result Review: Stance Upgraded To BUY: Company Update

Uploaded by

ali ahmadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9MFY21 Result Review: Stance Upgraded To BUY: Company Update

Uploaded by

ali ahmadCopyright:

Available Formats

COMPANY UPDATE

DCR

9MFY21 Result Review: Stance Upgraded to BUY

Equity Research | Real Estate Investment Trust | Friday, 16 April, 2021

DCR has announced its 9MFY21 result where it posted profit after tax of Rs 4.13bn

Key Statistics

as compared to profit after tax of Rs 4.86bn in same period last year, down by 15.1%

YoY.

Symbol DCR

The company has posted the revenue of Rs 2.3bn against Rs 2.7bn in SPLY, recording TP - Dec 21 11.00

a decline of 14.7% YoY. We note that this negative growth is attributed to the LDCP 10.25

waivers, the management had provided to its tenants amid Covid-19 crises. Upside (%) 7.32

Free Float ('mn) 556

Administrative expenses have slightly been increased by 0.3% YoY to Rs 332mn.

Market Cap. (Rs.'mn) 22,793

Other income has been declined by 38% YoY to Rs 102mn as compared to Rs 164mn

during the same period last year on account of lower rate of return on fixed income

securities.

DCR vs KSE 100

According to the management, annual increment of rent is currently kept on hold

12 50

which would be increased once the economic activity has fully recovered. Tax on

10 40

REIT dividends has been increased to 25% from 7.5%. The company is still under

8

negotiations with the Government to decrease it again to provide incentives to 30

6

investors. 20

4

DCR is currently trading at FY21E PE of 8.45x. We have a BUY stance on the script 2 10

with a DDM based Dec-21 TP of Rs 11 which provides an upside potential of 7.32%. 0 -

Jul-20 Oct-20 Jan-21 Apr-21

Furthermore, it also offers an attractive dividend yield of 11.5% which makes the

DCR KSE 100 ('000)

total return of 18.8%.

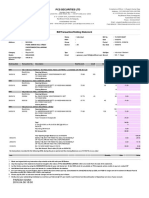

Rupees' millions 3QFY21 3QFY21 YoY 9MFY21 9MFY20 YoY

Rental vs Marketing Income (Rs'mn)

Rental Income 779 859 9.3% ▼ 2,197 2,557 14.1% ▼

Marketing Income 48 49 3.0% ▼ 109 146 25.6% ▼ 859

815

Total Income 826 908 9.0% ▼ 2,306 2,704 14.7% ▼ 779

603

SG&A Expenses -117 -89 31.3% ▲ -332 -332 0.3% ▲

Operating Profit 709 819 13.4% ▼ 1,973 2,372 16.8% ▼ 256

49 17 44 48

Other Income 24 54 54.4% ▼ 102 164 38.0% ▼ 5

Management Fee -21 -25 13.4% ▼ -59 -71 16.8% ▼ 3QFY20 4QFY20 1QFY21 2QFY21 3QFY21

Trustee Remn. -4 -4 13.4% ▼ -10 -12 16.8% ▼

Rental Income Marketing Income

Profit Before Change in FV 706 840 16.0% ▼ 1,997 2,443 18.2% ▼

Change in fair value 0 0 - 2,128 2,418 12.0% ▼

PBCFV (Rs'mn) vs Net Margin

Profit Before Taxation 706 840 16.0% ▼ 4,125 4,860 15.1% ▼

840

737

Taxation 0 0 - 0 0 - 706

Profit After Taxation 706 840 16.0% ▼ 4,125 4,860 15.1% ▼ 554

Distributable EPU 0.32 0.38 16.0% ▼ 0.90 1.10 18.2% ▼ 216

Dividend 0.33 0.35 5.7% ▼ 0.91 1.05 13.3% ▼

Bonus - - - -

Closing Period: 1 May 21 - 7 May 21 3QFY20 4QFY20 1QFY21 2QFY21 3QFY21

SG&A Expenses to T.Income -14.2% -9.8% 4.3% ▲ -14.4% -12.3% 2.2% ▲ Profit before change in FV NM

Other Income to T.Income 3.0% 5.9% 2.9% ▼ 4.4% 6.1% 1.7% ▼

Mgmt. Fee to T.Income -2.6% -2.7% 0.1% ▼ -2.6% -2.6% 0.1% ▼ Sources: ACPL Research, Company Financials

Trustee Remn. to T.Income -0.4% -0.5% 0.0% ▼ -0.4% -0.4% 0.0% ▼

Net Margin 85.4% 92.5% 7.1% ▼ 86.6% 90.3% 3.7% ▼ M. Fawad Naveed

Phone: (+92) 42 38302028; Ext: 117

Source: ACPL Research, Company Financials

Email: fawad@abbasiandcompany.com

Abbasi and Company (Pvt.) Ltd. 1

Dolmen City REIT | Real Estate Investment Trust

Financial Projections

Rupees' millions FY16A FY17A FY18A FY19A FY20A FY21E FY22E FY23E

Rental Income 2,527 2,842 3,047 3,344 2,814 2,954 3,250 3,575

Marketing Income 138 168 210 183 151 136 150 165

Total Income 2,664 3,010 3,257 3,527 2,965 3,090 3,400 3,740

Administrative & Operating Expenses -345 -428 -484 -513 -396 -426 -469 -516

Net Operating Income 2,319 2,582 2,773 3,014 2,568 2,664 2,930 3,223

Other income 109 123 113 140 192 139 153 168

Management Fee -70 -77 -83 -90 -77 -80 -88 -97

FED on Management Fee -11 0 0 0 0 0 0 0

SST on Management Fee -11 -10 -11 -12 -10 -10 -11 -13

Trustee Remuneration -12 -13 -14 -15 -13 -13 -15 -16

SST on Trustee Remuneration -2 -2 -2 -2 -2 -2 -2 -2

Reversal of provision for WWF 0 3 0 0 0 0 0 0

Charity Expense -2 0 0 0 0 0 0 0

Profit before change in fair value of investment property 2,321 2,606 2,776 3,034 2,659 2,698 2,967 3,264

Change in fair value of investment property / unrealized gain 15,422 1,181 2,279 3,835 5,459 4,508 4,186 4,605

Profit before taxation 17,743 3,787 5,055 6,870 8,118 7,206 7,154 7,869

Income tax expense 0 0 0 0 0 0 0 0

Profit for the year 17,743 3,787 5,055 6,870 8,118 7,206 7,154 7,869

EPU 7.98 1.70 2.27 3.09 3.65 3.24 3.22 3.54

Distributable EPU 1.04 1.17 1.25 1.36 1.20 1.21 1.33 1.47

Source: ACPL Research, Company Financials

Horizontal Analysis

FY16A FY17A FY18A FY19A FY20A FY21E FY22E FY23E

Rental Income 12.5% 7.2% 9.8% -15.9% 5.0% 10.0% 10.0%

Marketing Income 21.9% 25.1% -13.1% -17.1% -10.0% 10.0% 10.0%

Total Income 13.0% 8.2% 8.3% -15.9% 4.2% 10.0% 10.0%

Administrative & Operating Expenses 23.8% 13.2% 6.0% -22.8% 7.6% 10.0% 10.0%

Net Operating Income 11.3% 7.4% 8.7% -14.8% 3.7% 10.0% 10.0%

Other income 13.0% -8.3% 23.7% 37.5% -27.6% 10.0% 10.0%

Management Fee 11.3% 7.4% 8.7% -14.8% 3.7% 10.0% 10.0%

FED on Management Fee -100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

SST on Management Fee -10.9% 7.4% 8.7% -14.8% 3.7% 10.0% 10.0%

Trustee Remuneration 11.3% 7.4% 8.7% -14.8% 3.7% 10.0% 10.0%

SST on Trustee Remuneration 3.4% 7.4% 8.7% -14.8% 3.7% 10.0% 10.0%

Reversal of provision for WWF 0.0% -100.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Charity Expense -88.8% -100.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Profit before change in fair value of investment property 12.3% 6.5% 9.3% -12.4% 1.5% 10.0% 10.0%

Change in fair value of investment property / unrealized gain -92.3% 93.0% 68.3% 42.3% -17.4% -7.1% 10.0%

Profit before taxation -78.7% 33.5% 35.9% 18.2% -11.2% -0.7% 10.0%

Income tax expense 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Profit for the year -78.7% 33.5% 35.9% 18.2% -11.2% -0.7% 10.0%

EPU -78.7% 33.5% 35.9% 18.2% -11.2% -0.7% 10.0%

Distributable EPU 12.3% 6.5% 9.3% -12.4% 1.5% 10.0% 10.0%

Source: ACPL Research, Company Financials

Abbasi and Company (Pvt.) Ltd. 2

Dolmen City REIT | Real Estate Investment Trust

Key Ratios

Profitability Ratios FY16A FY17A FY18A FY19A FY20E FY21E FY22E FY23E

OP Margin % 87.04 85.79 85.13 85.45 86.63 86.20 86.20 86.20

ROE % 44.07 9.07 11.97 14.86 15.83 12.90 11.89 12.13

ROCE % 5.72 6.16 6.53 6.49 4.99 6.24 6.22 6.21

ROA % 43.40 8.93 11.76 14.61 15.60 16.66 15.01 14.99

Liquidity Ratios FY16A FY17A FY18A FY19A FY20E FY21E FY22E FY23E

Current x 9.86 7.56 3.41 3.51 2.96 2.56 2.93 3.34

Quick x 8.90 6.96 2.92 3.01 2.42 2.02 2.39 2.81

Activity Ratios FY16A FY17A FY18A FY19A FY20E FY21E FY22E FY23E

Receivables Days 11.69 11.05 14.35 15.54 26.34 25.27 22.98 20.89

Payables Days 82.16 67.03 61.58 55.11 7.68 7.14 6.49 5.90

Investment Ratios FY16A FY17A FY18A FY19A FY20A FY21E FY22E FY23E

DPS 1.04 1.15 1.20 1.32 1.25 1.17 1.29 1.42

Div. Yield % 10.15 11.22 11.71 12.88 12.20 11.45 12.59 13.85

Dividend Cover x 7.67 1.48 1.89 2.34 2.92 2.76 2.49 2.49

Retention % 0.34 1.88 3.88 3.26 3.26 3.26 3.26 3.26

Payout % 99.66 98.12 96.12 96.74 96.74 96.74 96.74 96.74

No. of Shares ('m) 2223.7 2223.7 2223.7 2223.7 2223.7 2223.7 2223.7 2223.7

EPU 7.98 1.70 2.27 3.09 3.65 3.24 3.22 3.54

Distributable EPU 1.04 1.17 1.25 1.36 1.20 1.21 1.33 1.47

Un-Distributable EPU 6.94 0.53 1.02 1.72 2.45 2.03 1.88 2.07

BVPS 18.11 18.77 18.99 20.79 23.06 25.13 27.05 29.17

P/E x 9.82 8.75 8.21 7.51 8.57 8.45 7.68 6.98

P/BV x 0.57 0.55 0.54 0.49 0.44 0.41 0.38 0.35

Source: ACPL Research, Company Financials

Abbasi and Company (Pvt.) Ltd. 3

DISCLAIMER

This report has been prepared by Abbasi & Company (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation of any offer to buy. While reasonable care has been taken to ensure that the information contained therein is not untrue or misleading at the time of publication, we make no representation

as to its accuracy or completeness and it should not be relied upon as such. From time to time, Abbasi & Company (Private) Limited and or any of its officers or directors may, as permitted by applicable

laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report. This report is provided only for the information of professional advisers

who are expected to make their own investment decisions without undue reliance on this report. Investments in capital markets are subject to market risk and Abbasi & Company (Private) Limited accepts

no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents. In particular, the report takes no account of the investment objectives, financial

situation and needs of investors, who should seek further professional advice or rely upon their own judgment and acumen before making any investment. The views expressed in this report are those of

Abbasi & Company (Private) Limited Research Department and do not necessarily reflect those of the company or its directors. Abbasi & Company (Private) Limited as a firm may have business relationships,

including investment‐-banking relationships, with the companies referred to in this report. Abbasi & Company (Private) Limited does not act as a market maker in the securities of the subject company.

Abbasi & Company (Private) Limited or any officers, directors, associates or close relatives do not have a financial interest in the securities of the subject company to an amount exceeding 1% of the value

of the securities of the subject company at the time of issuance of this report. Abbasi & Company (Private) Limited or any officers, directors, associates or close relatives are not currently serving or have

served in the past three years as a director or officer of the subject company. Abbasi & Company (Private) Limited or any officers, directors, associates or close relatives have not received compensation

from the subject company in the previous 12 months. The subject company currently is not, or during the 12-month period preceding the date of publication or distribution of this report, was not, a client

of Abbasi & Company (Private) Limited. We have not managed or co-managed a public offering or any take-over, buyback or delisting offer of securities for the subject company in the past 12 months

and/or received compensation for corporate advisory services, brokerage services or underwriting services from the subject company in the past 12 months. Abbasi & Company (Private) Limited does not

expect to receive or intend to seek compensation for corporate advisory services or underwriting services from the subject company in the next 3 months

All rights reserved by Abbasi & Company (Private) Limited. This report or any portion hereof may not be reproduced, distributed or published by any person for any purpose whatsoever. Nor can it be sent

to a third party without prior consent of Abbasi & Company (Private) Limited. Action could be taken for unauthorized reproduction, distribution or publication

VALIDITY OF THE PUBLICATION OR REPORT

The information in this publication or report is, regardless of source, given in good faith, and may only be valid as of the stated date of this publication or report. The information may be subject to change

without notice, its accuracy is not guaranteed, it may be incomplete or condensed and it may not contain all material information concerning the company, jurisdiction or financial instruments referred

to in this report. The valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report and were based upon several estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the valuations, opinions, estimates, forecasts, ratings

or risk assessments were based will not materialize or will vary significantly from actual results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments

described herein is not to be relied upon as a representation and/or warranty by Abbasi & Company (Private) Limited and/or its other associated and affiliated companies, that:

I. Such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

II. There is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein

DEFINITION OF TERMS

TP Target Price CAGR Compound Annual Growth Rate FCF Free Cash Flows

FCFE Free Cash Flows to Equity FCFF Free Cash Flows to Firm DCF Discounted Cash Flows

PE Price to Earnings Ratio PB Price to Book Ratio BVPS Book Value Per Share

EPS Earnings Per Share DPS Dividend Per Share ROE Return of Equity

ROA Return on Assets SOTP Sum of the Parts LDCP Last Day Closing Price

VALUATION METHODOLOGY

To arrive at our Target Price, Abbasi & Company (Private) Limited uses different valuation methods which include:

I. Discounted Cash Flow Model

II. Dividend Discount Model

III. Relative Valuation Model

IV. Sum of Parts Valuation

RATINGS CRITERIA

Abbasi & Company (Private) Limited employs a three-tier ratings system to rate a stock and sector, as mentioned below, which is based upon the level of expected return for a specific stock and outlook

of sector. The rating is based on the following with stated time horizon

Stock Rating Expected Total Return Sector Rating Sector Outlook

BUY Greater than 15% Overweight Positive

HOLD Between -5% to 15% Market Weight Neutral

SELL Less than and equal to -5% Underweight Negative

Ratings are updated to account for any development impacting the economy/sector/company, changes in analysts’ assumptions or a combination of these factors.

RESEARCH DISSEMINATION POLICY

Abbasi & Company (Private) Limited endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as

email, fax mail etc. Nevertheless, all clients may not receive the material at the same time

OTHER DISCLOSURES

The research analyst is primarily involved in the preparation of this report, certifies that:

I. The views expressed in this report accurately reflect his/her personal views about the subject company/stock /sector and economy

II. No part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report

The Research Analyst is not and was not involved in issuing of a research report on any of the subject company’s associated companies

RESEARCH DEPARTMENT HEAD OFFICE BRANCH OFFICE

6 - Shadman, Lahore 6 - Shadman, Lahore 42 - Mall Road, Lahore

Phone: (+92) 42 38302028; Ext 116, 117 Phone: (+92) 42 38302028 Phone: (+92) 42 37320707

Email: research@abbasiandcompany.com Email: info@abbasiandcompany.com Email: info@abbasiandcompany.com

web: www.abbasiandcompany.com web: www.abbasiandcompany.com web: www.abbasiandcompany.com

Abbasi and Company (Pvt.) Ltd. 4

You might also like

- Equity Reserach 2Document8 pagesEquity Reserach 2SBNo ratings yet

- ZEE Q4FY20 RESULT UPDATEDocument5 pagesZEE Q4FY20 RESULT UPDATEArpit JhanwarNo ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Eicher Motors CFProject Group11Document10 pagesEicher Motors CFProject Group11Greeshma SharathNo ratings yet

- Mahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesMahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Oil & Gas Report Flags Weaker Serba Dinamik EarningsDocument6 pagesOil & Gas Report Flags Weaker Serba Dinamik EarningsRichbull TraderNo ratings yet

- PGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncDocument7 pagesPGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncJNo ratings yet

- Serba Dinamik Holdings Under Review: Another Results DisappointmentDocument4 pagesSerba Dinamik Holdings Under Review: Another Results DisappointmentZhi_Ming_Cheah_8136No ratings yet

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- Barclays Q318 Results AnnouncementDocument49 pagesBarclays Q318 Results AnnouncementAnonymous g7LakmNNGHNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- Wells FargoDocument11 pagesWells FargoRafa BorgesNo ratings yet

- Sunway Reit: Company ReportDocument4 pagesSunway Reit: Company ReportBrian StanleyNo ratings yet

- DLF Limited: Long Way To Bottom: SellDocument17 pagesDLF Limited: Long Way To Bottom: Sellnirav87404No ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- RIL 2Q FY21 Analyst Presentation 30oct20Document60 pagesRIL 2Q FY21 Analyst Presentation 30oct20ABHISHEK GUPTANo ratings yet

- DILIP BUILDCON Ltd Accumulate Target Rs 656 RETURN 10Document5 pagesDILIP BUILDCON Ltd Accumulate Target Rs 656 RETURN 10bradburywillsNo ratings yet

- Emlak Konut REIC: Price Target RevisionDocument6 pagesEmlak Konut REIC: Price Target RevisionCbpNo ratings yet

- 2023 q1 Earnings Results PresentationDocument14 pages2023 q1 Earnings Results PresentationZerohedgeNo ratings yet

- Q3 2021 Financial Highlights: October 27, 2021Document23 pagesQ3 2021 Financial Highlights: October 27, 2021gvrabbitNo ratings yet

- ACC For Managers NewDocument7 pagesACC For Managers NewGodfred OpokuNo ratings yet

- DB Corp Limited (DBCORP) : Impressive Ad GrowthDocument5 pagesDB Corp Limited (DBCORP) : Impressive Ad GrowthIqbal KhanNo ratings yet

- BFD Merged Q Tahapopatia +923453086312Document96 pagesBFD Merged Q Tahapopatia +923453086312Abdul BasitNo ratings yet

- Dalmia Bharat - 2QFY20 - HDFC Sec-201910222145294572701Document11 pagesDalmia Bharat - 2QFY20 - HDFC Sec-201910222145294572701praveensingh77No ratings yet

- CBA Full-Year ResultsDocument156 pagesCBA Full-Year ResultsTim MooreNo ratings yet

- FINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswersDocument11 pagesFINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswerssummerfashionlimitedNo ratings yet

- Business Restructuring Led To Negativity Profitability: Result UpdateDocument8 pagesBusiness Restructuring Led To Negativity Profitability: Result UpdateraguramrNo ratings yet

- Cyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsDocument6 pagesCyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsADNo ratings yet

- Citi 2nd QTR ResultsDocument10 pagesCiti 2nd QTR ResultsTim MooreNo ratings yet

- HSIE ResultsDocument2 pagesHSIE ResultsJessy PadalaNo ratings yet

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocument4 pagesRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJNo ratings yet

- Cipla Q3 Profit Beats Estimates As Sales Jump In India, EuropeDocument2 pagesCipla Q3 Profit Beats Estimates As Sales Jump In India, EuropeSagar TandonNo ratings yet

- DBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesDocument7 pagesDBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesCalebNo ratings yet

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocument9 pagesCyient: Poor Quarter Recovery Likely in The Current QuarterADNo ratings yet

- IRCON'S FINANCIALSDocument3 pagesIRCON'S FINANCIALSshruthi sainathNo ratings yet

- 1391-Monthly Fiscal Bulletin 6Document16 pages1391-Monthly Fiscal Bulletin 6Macro Fiscal PerformanceNo ratings yet

- Oil & Gas Firm Earnings Rise Despite CovidDocument5 pagesOil & Gas Firm Earnings Rise Despite CovidBrian StanleyNo ratings yet

- Century IDBI Q2FY21 12nov20Document7 pagesCentury IDBI Q2FY21 12nov20Tai TranNo ratings yet

- Business Studies FinalDocument20 pagesBusiness Studies FinalWillard MusengeyiNo ratings yet

- Results in Line, Sales Momentum Continues: PL Mid-Cap DayDocument5 pagesResults in Line, Sales Momentum Continues: PL Mid-Cap DaymaheshhaseNo ratings yet

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- Silo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BDocument13 pagesSilo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BSaladin JaysiNo ratings yet

- KKCL margins to remain stressed, book outDocument4 pagesKKCL margins to remain stressed, book outdarshanmadeNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- IDirect JustDial CoUpdate Jul21Document5 pagesIDirect JustDial CoUpdate Jul21ShivangimahadevNo ratings yet

- Earnings Update ZENITHBANK 2022FYDocument6 pagesEarnings Update ZENITHBANK 2022FYShehu MusaNo ratings yet

- Balkrishna Industries Investor PresentationDocument34 pagesBalkrishna Industries Investor PresentationAnand SNo ratings yet

- Exide Industries (EXIIND) : Earning Surprises! Exide Back On TrackDocument9 pagesExide Industries (EXIIND) : Earning Surprises! Exide Back On TrackRahul RegeNo ratings yet

- 1391-Monthly Fiscal Bulletin 7Document16 pages1391-Monthly Fiscal Bulletin 7Macro Fiscal PerformanceNo ratings yet

- Cyient 28 11 2022 AnandDocument13 pagesCyient 28 11 2022 AnandParth DongaNo ratings yet

- Dilip Buildcon: Strong ComebackDocument11 pagesDilip Buildcon: Strong ComebackPawan AsraniNo ratings yet

- 2 B&K 3qfy20Document7 pages2 B&K 3qfy20Girish Raj SankunnyNo ratings yet

- Results Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyDocument1 pageResults Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyMeharwal TradersNo ratings yet

- Calculation of The Financial Ratios of GPH Ispat - 2019-2020Document10 pagesCalculation of The Financial Ratios of GPH Ispat - 2019-2020Yasir ArafatNo ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Take-Two Interactive Software, Inc. Reports Strong Results For Fiscal Year 2022Document21 pagesTake-Two Interactive Software, Inc. Reports Strong Results For Fiscal Year 2022Ricardo :vNo ratings yet

- ITMGDocument5 pagesITMGjovalNo ratings yet

- V.I.P. Industries (VIP IN) : Q1FY21 Result UpdateDocument6 pagesV.I.P. Industries (VIP IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Case Study 2 AnswerDocument6 pagesCase Study 2 AnswerWilson Jose Soto De LeonNo ratings yet

- Elevated Complete Bus Plan 1.2Document15 pagesElevated Complete Bus Plan 1.2ee sNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- GR 2. TreasuryDocument11 pagesGR 2. TreasuryRoby IbeNo ratings yet

- Residual Income Valuation:: Valuing Common EquityDocument39 pagesResidual Income Valuation:: Valuing Common EquitywinwinNo ratings yet

- Head Retail Banking President in Memphis TN Resume Terry RenouxDocument3 pagesHead Retail Banking President in Memphis TN Resume Terry RenouxTerryRenouxNo ratings yet

- The Triadic "Politics-Economics-EthicsDocument293 pagesThe Triadic "Politics-Economics-EthicsLeonidaNeamtuNo ratings yet

- Forex Fund Manager Trade With Cabana CapitalsDocument2 pagesForex Fund Manager Trade With Cabana Capitalsneil fxNo ratings yet

- Csec Pob January 2013 p2Document6 pagesCsec Pob January 2013 p2Ikera ClarkeNo ratings yet

- Renunciation of POA PowersDocument2 pagesRenunciation of POA PowersJatin SharanNo ratings yet

- Project Report On IIFLDocument8 pagesProject Report On IIFLPRIYA SHARMANo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 1Document24 pagesNism 5 A - Mutual Fund Exam - Practice Test 1Aditi Sawant100% (5)

- Philip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Document117 pagesPhilip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Mohamed Hussien100% (1)

- Titman CH 16 - Dividend PolicyDocument55 pagesTitman CH 16 - Dividend PolicyIKA RAHMAWATINo ratings yet

- Common and Preferred Stock TypesDocument12 pagesCommon and Preferred Stock TypesAmna ImranNo ratings yet

- Chap Two Risk and ReturenDocument12 pagesChap Two Risk and ReturenAdugna KeneaNo ratings yet

- Statement859 092010Document2 pagesStatement859 092010Behnam AryafarNo ratings yet

- Advanced Financial Accounting 11th Edition Christensen Solutions ManualDocument43 pagesAdvanced Financial Accounting 11th Edition Christensen Solutions Manualtiffanywilliamsenyqjfskcx100% (18)

- Compliance Officer Details and Client Transaction StatementDocument1 pageCompliance Officer Details and Client Transaction Statementganesanmani1985No ratings yet

- E11 Optimum Capital StructureDocument10 pagesE11 Optimum Capital StructureTENGKU ANIS TENGKU YUSMANo ratings yet

- Flujo de Caja PalantirDocument8 pagesFlujo de Caja PalantirPablo Alejandro JaldinNo ratings yet

- CFA Level 1 Corporate Finance E Book - Part 1 PDFDocument23 pagesCFA Level 1 Corporate Finance E Book - Part 1 PDFZacharia Vincent67% (3)

- Oil and Gas Asset Backed SecuritizationsDocument9 pagesOil and Gas Asset Backed SecuritizationsCDNo ratings yet

- Organisation and Function of Securities MarketsDocument19 pagesOrganisation and Function of Securities MarketsSyed Arham MurtazaNo ratings yet

- Enduring LessonsDocument4 pagesEnduring LessonsPradeep RaghunathanNo ratings yet

- Part I. Partnership Formation (Theories)Document5 pagesPart I. Partnership Formation (Theories)Ella AlmazanNo ratings yet

- The Effect of Profitability, Firm Size, Financial Leverage and Firm Growth On Dividend Policy: A Study On PSX Listed Non-Financial FirmsDocument28 pagesThe Effect of Profitability, Firm Size, Financial Leverage and Firm Growth On Dividend Policy: A Study On PSX Listed Non-Financial FirmsHinaNo ratings yet

- Assignment Financial Analysis Chapter 2.Document2 pagesAssignment Financial Analysis Chapter 2.Shaimaa MuradNo ratings yet

- Probability ConceptsDocument5 pagesProbability ConceptsAslam HossainNo ratings yet