Professional Documents

Culture Documents

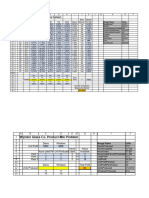

Beating The Market (Evolutionary Solver) : Range Name Cells

Uploaded by

Alyssa Tordesillas0 ratings0% found this document useful (0 votes)

36 views3 pagesOriginal Title

Redila_Chapter8 (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views3 pagesBeating The Market (Evolutionary Solver) : Range Name Cells

Uploaded by

Alyssa TordesillasCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

A B C D E F G H I J K L M N O P

1 Beating the Market (Evolutionary Solver)

2 Beat Market

3 Quarter Year DIS BA GE PG MCD Return Market? (NYSE) Range Name Cells

4 Q4 2016 13.10% 19.08% 7.47% -5.59% 6.34% 8.24% Yes 3.13% BeatMarket? J4:J27

5 Q3 2016 -4.38% 2.28% -5.17% 1.32% -3.39% -3.20% No 2.21% Market K4:K27

6 Q2 2016 -1.50% 3.14% -0.23% 9.35% -3.55% -0.87% No 2.77% NumberBeatingTheMarkJ36

7 Q1 2016 -5.49% -11.39% 2.87% 4.55% 7.19% 0.85% Yes 0.63% OneHundredPercent D33:H33

8 Q4 2015 3.47% 11.10% 24.46% 11.37% 20.84% 12.47% Yes 3.51% OneHundredPercent2 K31

9 Q3 2015 -9.94% -4.99% -4.25% -7.30% 4.55% -3.55% Yes -9.31% Portfolio D31:H31

10 Q2 2015 8.82% -6.98% 8.03% -3.75% -1.58% 2.84% Yes -0.86% Return I4:I27

11 Q1 2015 11.37% 16.18% -0.94% -9.41% 4.90% 6.00% Yes 0.55% StockData D4:H27

12 Q4 2014 7.14% 2.63% -0.42% 9.61% -0.30% 3.99% Yes 1.27% Sum I31

13 Q3 2014 3.83% 0.72% -1.67% 7.41% -5.07% 0.38% Yes -2.52% ZeroPercent D29:H29

14 Q2 2014 7.08% 1.96% 2.30% -1.71% 3.59% 4.33% Yes 4.29%

15 Q1 2014 4.81% -7.54% -6.83% -0.25% 1.89% 2.12% Yes 1.23%

16 Q4 2013 19.93% 16.59% 18.33% 8.53% 1.70% 11.36% Yes 8.10%

17 Q3 2013 2.12% 15.23% 3.80% -1.08% -2.04% 0.61% No 5.58%

18 Q2 2013 11.18% 19.93% 1.08% 0.65% 0.09% 5.40% Yes 0.06%

19 Q1 2013 14.07% 14.66% 11.06% 14.42% 13.92% 13.91% Yes 7.86%

20 Q4 2012 -3.29% 8.94% -6.74% -1.31% -2.99% -2.77% No 2.33%

21 Q3 2012 7.78% -5.76% 9.81% 14.22% 4.46% 6.92% Yes 5.76%

22 Q2 2012 10.80% 0.49% 5.01% -8.10% -9.05% 0.33% Yes -4.94%

23 Q1 2012 16.74% 1.99% 13.05% 1.56% -1.53% 7.28% No 9.76%

24 Q4 2011 26.43% 21.99% 18.83% 6.45% 15.11% 19.25% Yes 10.09%

25 Q3 2011 -22.76% -17.60% -18.56% 0.19% 4.84% -9.05% Yes -18.36%

26 Q2 2011 -9.39% 0.54% -5.13% 4.07% 11.64% 0.84% Yes -1.02%

27 Q1 2011 14.87% 13.94% 10.39% -3.55% -0.06% 6.72% Yes 5.54%

28

29 0% 0% 0% 0% 0%

30 <= <= <= <= <= Sum

31 Portfolio 41.5% 3.0% 5.3% 11.3% 39.0% 100% = 100%

32 <= <= <= <= <=

33 100% 100% 100% 100% 100%

34 Number of Quarters

35 Beating the Market

36 Err:508

A B C D E F G H I J K L M N O P

1 Beating the Market (Evolutionary Solver)

2 Beat Market

3 Quarter Year DIS BA GE PG MCD Return Market? (NYSE) Range Name Cells

4 Q4 2016 13.10% 19.08% 7.47% -5.59% 6.34% 8.24% Yes 0.00% BeatMarket? J4:J27

5 Q3 2016 -4.38% 2.28% -5.17% 1.32% -3.39% -3.20% No 0.00% Market K4:K27

6 Q2 2016 -1.50% 3.14% -0.23% 9.35% -3.55% -0.88% No 0.00% NumberBeatingTheMarkJ36

7 Q1 2016 -5.49% -11.39% 2.87% 4.55% 7.19% 0.85% Yes 0.00% OneHundredPercent D33:H33

8 Q4 2015 3.47% 11.10% 24.46% 11.37% 20.84% 12.46% Yes 0.00% OneHundredPercent2 K31

9 Q3 2015 -9.94% -4.99% -4.25% -7.30% 4.55% -3.55% No 0.00% Portfolio D31:H31

10 Q2 2015 8.82% -6.98% 8.03% -3.75% -1.58% 2.84% Yes 0.00% Return I4:I27

11 Q1 2015 11.37% 16.18% -0.94% -9.41% 4.90% 6.00% Yes 0.00% StockData D4:H27

12 Q4 2014 7.14% 2.63% -0.42% 9.61% -0.30% 3.99% Yes 0.00% Sum I31

13 Q3 2014 3.83% 0.72% -1.67% 7.41% -5.07% 0.38% Yes 0.00% ZeroPercent D29:H29

14 Q2 2014 7.08% 1.96% 2.30% -1.71% 3.59% 4.33% Yes 0.00%

15 Q1 2014 4.81% -7.54% -6.83% -0.25% 1.89% 2.12% Yes 0.00%

16 Q4 2013 19.93% 16.59% 18.33% 8.53% 1.70% 11.36% Yes 0.00%

17 Q3 2013 2.12% 15.23% 3.80% -1.08% -2.04% 0.61% Yes 0.00%

18 Q2 2013 11.18% 19.93% 1.08% 0.65% 0.09% 5.40% Yes 0.00%

19 Q1 2013 14.07% 14.66% 11.06% 14.42% 13.92% 13.91% Yes 0.00%

20 Q4 2012 -3.29% 8.94% -6.74% -1.31% -2.99% -2.77% No 0.00%

21 Q3 2012 7.78% -5.76% 9.81% 14.22% 4.46% 6.92% Yes 0.00%

22 Q2 2012 10.80% 0.49% 5.01% -8.10% -9.05% 0.33% Yes 0.00%

23 Q1 2012 16.74% 1.99% 13.05% 1.56% -1.53% 7.28% Yes 0.00%

24 Q4 2011 26.43% 21.99% 18.83% 6.45% 15.11% 19.24% Yes 0.00%

25 Q3 2011 -22.76% -17.60% -18.56% 0.19% 4.84% -9.05% No 0.00%

26 Q2 2011 -9.39% 0.54% -5.13% 4.07% 11.64% 0.84% Yes 0.00%

27 Q1 2011 14.87% 13.94% 10.39% -3.55% -0.06% 6.72% Yes 0.00%

28

29 0% 0% 0% 0% 0%

30 <= <= <= <= <= Sum

31 Portfolio 41.5% 3.0% 5.3% 11.2% 39.0% 100% = 100%

32 <= <= <= <= <=

33 100% 100% 100% 100% 100%

34 Number of Quarters

35 Beating the Market

36 Err:508

A B C D E F G H I J K L M N O P

1 Beating the Market (Evolutionary Solver)

2 Beat Market

3 Quarter Year DIS BA GE PG MCD Return Market? (NYSE) Range Name Cells

4 Q4 2016 13.10% 19.08% 7.47% -5.59% 6.34% 14.12% Yes 10.00% BeatMarket? J4:J27

5 Q3 2016 -4.38% 2.28% -5.17% 1.32% -3.39% -1.33% No 10.00% Market K4:K27

6 Q2 2016 -1.50% 3.14% -0.23% 9.35% -3.55% 0.84% No 10.00% NumberBeatingTheMarkJ36

7 Q1 2016 -5.49% -11.39% 2.87% 4.55% 7.19% -6.12% No 10.00% OneHundredPercent D33:H33

8 Q4 2015 3.47% 11.10% 24.46% 11.37% 20.84% 10.06% Yes 10.00% OneHundredPercent2 K31

9 Q3 2015 -9.94% -4.99% -4.25% -7.30% 4.55% -6.25% No 10.00% Portfolio D31:H31

10 Q2 2015 8.82% -6.98% 8.03% -3.75% -1.58% 0.83% No 10.00% Return I4:I27

11 Q1 2015 11.37% 16.18% -0.94% -9.41% 4.90% 11.25% Yes 10.00% StockData D4:H27

12 Q4 2014 7.14% 2.63% -0.42% 9.61% -0.30% 4.12% No 10.00% Sum I31

13 Q3 2014 3.83% 0.72% -1.67% 7.41% -5.07% 1.53% No 10.00% ZeroPercent D29:H29

14 Q2 2014 7.08% 1.96% 2.30% -1.71% 3.59% 3.93% No 10.00%

15 Q1 2014 4.81% -7.54% -6.83% -0.25% 1.89% -1.91% No 10.00%

16 Q4 2013 19.93% 16.59% 18.33% 8.53% 1.70% 16.77% Yes 10.00%

17 Q3 2013 2.12% 15.23% 3.80% -1.08% -2.04% 7.54% No 10.00%

18 Q2 2013 11.18% 19.93% 1.08% 0.65% 0.09% 12.98% Yes 10.00%

19 Q1 2013 14.07% 14.66% 11.06% 14.42% 13.92% 14.09% Yes 10.00%

20 Q4 2012 -3.29% 8.94% -6.74% -1.31% -2.99% 1.76% No 10.00%

21 Q3 2012 7.78% -5.76% 9.81% 14.22% 4.46% 2.13% No 10.00%

22 Q2 2012 10.80% 0.49% 5.01% -8.10% -9.05% 3.89% No 10.00%

23 Q1 2012 16.74% 1.99% 13.05% 1.56% -1.53% 8.34% No 10.00%

24 Q4 2011 26.43% 21.99% 18.83% 6.45% 15.11% 22.46% Yes 10.00%

25 Q3 2011 -22.76% -17.60% -18.56% 0.19% 4.84% -17.58% No 10.00%

26 Q2 2011 -9.39% 0.54% -5.13% 4.07% 11.64% -2.88% No 10.00%

27 Q1 2011 14.87% 13.94% 10.39% -3.55% -0.06% 12.48% Yes 10.00%

28

29 0% 0% 0% 0% 0%

30 <= <= <= <= <= Sum

31 Portfolio 38.1% 43.1% 8.8% 3.3% 6.7% 100% = 100%

32 <= <= <= <= <=

33 100% 100% 100% 100% 100%

34 Number of Quarters

35 Beating the Market

36 Err:508

You might also like

- Chapter 11 - Joint and by ProductDocument41 pagesChapter 11 - Joint and by ProductSheena Belleza Fernan89% (28)

- Water Desalination Using Electrodialysis (EDDocument18 pagesWater Desalination Using Electrodialysis (EDibrahimawad06No ratings yet

- B737 MaxDocument4 pagesB737 MaxEmerson Juncom33% (3)

- Robinsons Retail Holding Inc. 2019 1st Quarter Financial ReportDocument116 pagesRobinsons Retail Holding Inc. 2019 1st Quarter Financial ReportRyan CervasNo ratings yet

- QuantityWare Quantity Data Flow BCPDocument16 pagesQuantityWare Quantity Data Flow BCPspsuman05No ratings yet

- 02 Activity 1Document1 page02 Activity 1Wesley MorgaNo ratings yet

- Network Representations Can Be Used For The Following ProblemsDocument14 pagesNetwork Representations Can Be Used For The Following ProblemsAlyssa TordesillasNo ratings yet

- Oracle Fixed AssetsDocument1,204 pagesOracle Fixed AssetsYudha Prayoga100% (1)

- Question # 1: Calculation of EoqDocument3 pagesQuestion # 1: Calculation of EoqUnzila AtiqNo ratings yet

- MSQ-02 - Variable & Absorption Costing (Final)Document11 pagesMSQ-02 - Variable & Absorption Costing (Final)Kevin James Sedurifa OledanNo ratings yet

- Cost AccountinCAgADocument86 pagesCost AccountinCAgAJenifer Belangel100% (4)

- Manual de Operación y Mantenimiento Sistema de Bombeo Contra Incendios SCDocument157 pagesManual de Operación y Mantenimiento Sistema de Bombeo Contra Incendios SCAndres Bojorquez100% (3)

- Four Laning Irc SP 84 2019Document3 pagesFour Laning Irc SP 84 2019Suyog Gore100% (2)

- Checal2 LauritoDocument1 pageChecal2 LauritoGarcia RaphNo ratings yet

- ACCCOB 2 Reflection 4 PDFDocument4 pagesACCCOB 2 Reflection 4 PDFMIGUEL DIEGO PANGILINANNo ratings yet

- Auditing and Internal Control IT Auditing, Hall, 4eDocument32 pagesAuditing and Internal Control IT Auditing, Hall, 4eMarco LamNo ratings yet

- Machine Learning Guide For Oil and Gas Using PythonDocument1 pageMachine Learning Guide For Oil and Gas Using Pythonogiri agbehiNo ratings yet

- ACT 1107 - Strategic Cost Management - SyllabusDocument13 pagesACT 1107 - Strategic Cost Management - SyllabusAlyssa TordesillasNo ratings yet

- DGD 9Document24 pagesDGD 9Sophia SaidNo ratings yet

- Quiz I. Problem Solving: Property of STIDocument2 pagesQuiz I. Problem Solving: Property of STIarisuNo ratings yet

- 07 Task Performance 1Document1 page07 Task Performance 1beverlybandojoNo ratings yet

- Management Science 1107 - Midterms AnswersDocument4 pagesManagement Science 1107 - Midterms AnswersHans DelimaNo ratings yet

- FIMA 40023 Security Analysis FinalsDocument14 pagesFIMA 40023 Security Analysis FinalsPrincess ErickaNo ratings yet

- BS Accountancy Qualifying Exam: Management Advisory ServicesDocument7 pagesBS Accountancy Qualifying Exam: Management Advisory ServicesMae Ann RaquinNo ratings yet

- Cost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)Document46 pagesCost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)KemerutNo ratings yet

- Overview of Financial MarketsDocument15 pagesOverview of Financial MarketsDavidNo ratings yet

- Group 7 Final Strategy Paper - Maycar Foods Inc.Document34 pagesGroup 7 Final Strategy Paper - Maycar Foods Inc.Mig SablayNo ratings yet

- QUESTIONSDocument19 pagesQUESTIONSrahidarzooNo ratings yet

- AP Yakult 05 08 RevisedDocument33 pagesAP Yakult 05 08 Revisedhana_kimi_91No ratings yet

- Exam2 Solutions 40610 2008Document8 pagesExam2 Solutions 40610 2008blackghostNo ratings yet

- Employee Absenteeism and Distance to Work RelationshipDocument11 pagesEmployee Absenteeism and Distance to Work RelationshipLianne Claire San JoseNo ratings yet

- Operations Management 4Document17 pagesOperations Management 4Fery Ann C. BravoNo ratings yet

- DS TUTORIAL 1 Decision Analysis Sem 1 2016-17Document6 pagesDS TUTORIAL 1 Decision Analysis Sem 1 2016-17Debbie DebzNo ratings yet

- CMA Accelerated Program Test 2Document26 pagesCMA Accelerated Program Test 2bbry1No ratings yet

- At 3Document8 pagesAt 3Ley EsguerraNo ratings yet

- Unit 2 International Marketing Environment: StructureDocument20 pagesUnit 2 International Marketing Environment: Structuresathishar84No ratings yet

- Intermediate Spreadsheet Concepts Exercise 1Document1 pageIntermediate Spreadsheet Concepts Exercise 1api-221897434No ratings yet

- Father Saturnino Urios University Accountancy Program San Francisco St. Butuan CityDocument9 pagesFather Saturnino Urios University Accountancy Program San Francisco St. Butuan CityHanna Niña MabrasNo ratings yet

- Naqdown Final QuestionsDocument16 pagesNaqdown Final QuestionsDiether ManaloNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Episode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are TradedDocument1 pageEpisode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are Tradeddani qintharaNo ratings yet

- SasaDocument9 pagesSasaJill DagreatNo ratings yet

- A Bond Issue May Be Retired byDocument5 pagesA Bond Issue May Be Retired bynaztig_017No ratings yet

- Legaspi Oil Co., Inc. vs. The Court of Appeals and Bernard Oseraos (G.R. No. 96505 July 1, 1993)Document2 pagesLegaspi Oil Co., Inc. vs. The Court of Appeals and Bernard Oseraos (G.R. No. 96505 July 1, 1993)Gabriel TantiongcoNo ratings yet

- Topic 8 International StrategyDocument54 pagesTopic 8 International Strategy--bolabolaNo ratings yet

- Polaroid Corporation - MP19006, 19015, 19016,19026Document8 pagesPolaroid Corporation - MP19006, 19015, 19016,19026KshitishNo ratings yet

- Case 7 - Can One Size Fits AllDocument4 pagesCase 7 - Can One Size Fits AllMariaAngelicaMargenApeNo ratings yet

- John Carlos B. Santos BSA301Document1 pageJohn Carlos B. Santos BSA301John SantosNo ratings yet

- Jose Miguel Vienes Ms. Maria Felisa Calicdan BSBA 311 14 Quiz 1Document2 pagesJose Miguel Vienes Ms. Maria Felisa Calicdan BSBA 311 14 Quiz 1Miguel VienesNo ratings yet

- Tugas Individu I MKB Capital BudgetingDocument4 pagesTugas Individu I MKB Capital BudgetingAndryo RachmatNo ratings yet

- Part 5 Consolidating and Linking Spreadsheets - ParticipantsDocument4 pagesPart 5 Consolidating and Linking Spreadsheets - ParticipantsJheilson S. DingcongNo ratings yet

- 3 6 Use The Following Graph For Yolandas Frozen Yogurt Stand To Answer The Questions A Use TheDocument2 pages3 6 Use The Following Graph For Yolandas Frozen Yogurt Stand To Answer The Questions A Use TheCharlotteNo ratings yet

- LBOMGTS Final Paper OutlineDocument2 pagesLBOMGTS Final Paper OutlineJohn Jet TanNo ratings yet

- Understanding ERP and IoT SystemsDocument8 pagesUnderstanding ERP and IoT SystemsCatherine LaguitaoNo ratings yet

- BIR Standard Success IndicatorsDocument5 pagesBIR Standard Success IndicatorsEarl PatrickNo ratings yet

- Mod 03Document13 pagesMod 03Wolf's RainNo ratings yet

- 02 Task Performance 1 - Prelim Exam - PMDocument3 pages02 Task Performance 1 - Prelim Exam - PMJosie Lou RanqueNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- Chapter 9Document10 pagesChapter 9Caleb John SenadosNo ratings yet

- H2 Accounting ProfessionDocument9 pagesH2 Accounting ProfessionTrek ApostolNo ratings yet

- Law On Oblicon NotesDocument4 pagesLaw On Oblicon NotesaiswiftNo ratings yet

- Dalumpines Case 3Document9 pagesDalumpines Case 3Jessa Mae LabinghisaNo ratings yet

- 2020 T3 GSBS6410 Lecture Notes For Week 1 IntroductionDocument35 pages2020 T3 GSBS6410 Lecture Notes For Week 1 IntroductionRenu JhaNo ratings yet

- Board Resolution Sample FormatDocument2 pagesBoard Resolution Sample FormatShaswat JoshiNo ratings yet

- Audit QuestionsDocument2 pagesAudit QuestionsJoseph Bayo Basan0% (1)

- Ch. 1 4 - Audicisenv ReviewerDocument17 pagesCh. 1 4 - Audicisenv ReviewerKylne BcdNo ratings yet

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- Threat of Substitute and Bargaining Power of SuppliersDocument2 pagesThreat of Substitute and Bargaining Power of SuppliersgeorgeNo ratings yet

- Assn 2Document3 pagesAssn 2api-26315128100% (3)

- Activity 6 - Elasticity of Demand ApplicationDocument2 pagesActivity 6 - Elasticity of Demand ApplicationJelo DavidNo ratings yet

- Hw-Non LinearDocument2 pagesHw-Non LinearJenine YamsonNo ratings yet

- Earth RhythmDocument8 pagesEarth Rhythmpankhuri wasonNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- US Higher Education Exports: Competitive Advantage & Economic ImpactDocument31 pagesUS Higher Education Exports: Competitive Advantage & Economic ImpactAlyssa TordesillasNo ratings yet

- Eumy Membership Form 1Document4 pagesEumy Membership Form 1Alyssa TordesillasNo ratings yet

- Eumy Membership FormDocument4 pagesEumy Membership FormAlyssa TordesillasNo ratings yet

- ACT1207 Review of Audit ProcessDocument8 pagesACT1207 Review of Audit ProcessAlyssa TordesillasNo ratings yet

- Eumy Membership FormDocument4 pagesEumy Membership FormAlyssa TordesillasNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance Analysisboen jayme0% (1)

- Eumy Membership FormDocument4 pagesEumy Membership FormAlyssa TordesillasNo ratings yet

- Prelim Exam: Attempt HistoryDocument30 pagesPrelim Exam: Attempt HistoryAlyssa TordesillasNo ratings yet

- Entrep Financial FinalDocument54 pagesEntrep Financial FinalAlyssa TordesillasNo ratings yet

- 1JQS Poultry Farm Chapters 1 4Document41 pages1JQS Poultry Farm Chapters 1 4Alyssa TordesillasNo ratings yet

- FAR EASTERN UNIVERSITY-Institute of Accounts Business and Finance Law On Sales Assignment 5 Problems (5 Points Each)Document1 pageFAR EASTERN UNIVERSITY-Institute of Accounts Business and Finance Law On Sales Assignment 5 Problems (5 Points Each)ALIAHDAYNE POLIDARIONo ratings yet

- Chapter 18Document35 pagesChapter 18Mariechi Binuya100% (1)

- Lecture Notes: "In Business Insights"Document44 pagesLecture Notes: "In Business Insights"DIANE EDRANo ratings yet

- FEU-IABF Law on Sales Assignment 2 Problems (40 charactersDocument1 pageFEU-IABF Law on Sales Assignment 2 Problems (40 charactersAlyssa TordesillasNo ratings yet

- Flag Question: Question 2: Expensed Based On Estimate in Year of SaleDocument18 pagesFlag Question: Question 2: Expensed Based On Estimate in Year of SaleAlyssa TordesillasNo ratings yet

- Prelim Exam: Attempt HistoryDocument30 pagesPrelim Exam: Attempt HistoryAlyssa TordesillasNo ratings yet

- Beating The Market (Evolutionary Solver) : Range Name CellsDocument3 pagesBeating The Market (Evolutionary Solver) : Range Name CellsAlyssa TordesillasNo ratings yet

- FEU-IABF Law on Sales Assignment 2 Problems (40 charactersDocument1 pageFEU-IABF Law on Sales Assignment 2 Problems (40 charactersAlyssa TordesillasNo ratings yet

- Assignment 1Document1 pageAssignment 1Maryrose SumulongNo ratings yet

- BL (1-2 W Answers)Document9 pagesBL (1-2 W Answers)Melissa Kayla ManiulitNo ratings yet

- Activity On Module 6: Far Eastern UniversityDocument1 pageActivity On Module 6: Far Eastern UniversityShiela RengelNo ratings yet

- Students' Feedback About The Learning Outcomes - CanvasDocument1 pageStudents' Feedback About The Learning Outcomes - CanvasAlyssa TordesillasNo ratings yet

- Flag Question: Question 2: Expensed Based On Estimate in Year of SaleDocument18 pagesFlag Question: Question 2: Expensed Based On Estimate in Year of SaleAlyssa TordesillasNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationTyra Joyce Revadavia100% (1)

- Automated Guided VehicleDocument17 pagesAutomated Guided VehicleTedy ThomasNo ratings yet

- JVL MacComm OCX FileDocument2 pagesJVL MacComm OCX FileElectromateNo ratings yet

- RESUME TITLEDocument2 pagesRESUME TITLEYogesh ChaudhariNo ratings yet

- Artificial Intelligence CSCI/PHIL-4550/6550Document26 pagesArtificial Intelligence CSCI/PHIL-4550/6550Alan StandingNo ratings yet

- Bias Point Analysis by Hand and in SPICE DescriptionDocument6 pagesBias Point Analysis by Hand and in SPICE DescriptionMit MA0% (1)

- Lavadora LAVAMAT 72950 M3 LAVAMAT 74950 M3Document80 pagesLavadora LAVAMAT 72950 M3 LAVAMAT 74950 M3MarcosNo ratings yet

- PCC1300 O&M ManualDocument54 pagesPCC1300 O&M ManualThein Htoon lwinNo ratings yet

- Green Arch PDFDocument19 pagesGreen Arch PDFKishore RajaramNo ratings yet

- Technical specifications of 12 kW heat pump water heating system and 10000 LPD solar water heating collectorsDocument2 pagesTechnical specifications of 12 kW heat pump water heating system and 10000 LPD solar water heating collectorsM Balaji Shrinivas 16BEE0326No ratings yet

- Using Ti's Dlms Cosem LibraryDocument10 pagesUsing Ti's Dlms Cosem LibraryhanspktNo ratings yet

- Android Screen Lock-Unlock IntentsDocument3 pagesAndroid Screen Lock-Unlock IntentsChandan AdigaNo ratings yet

- Range UO - BD 049 Bulbs - 2017-08-26Document4 pagesRange UO - BD 049 Bulbs - 2017-08-26johnNo ratings yet

- 615 Series Quick Start Guide 757435 ENa. Relay ABBDocument4 pages615 Series Quick Start Guide 757435 ENa. Relay ABBTung NguyenNo ratings yet

- Math 1151 Sample Questions For MID Exam Summer 2023Document8 pagesMath 1151 Sample Questions For MID Exam Summer 2023Shurav DasNo ratings yet

- C.B.S.E Study Material 2 (Unit-1)Document71 pagesC.B.S.E Study Material 2 (Unit-1)vikramkhatri4100% (2)

- Production of Acrylonitrile (ANKB40303Document75 pagesProduction of Acrylonitrile (ANKB40303NUR AKMAL HISHAMNo ratings yet

- 231C Air Impact Wrench - Exploded View: (Dwg. TPA567-11)Document2 pages231C Air Impact Wrench - Exploded View: (Dwg. TPA567-11)julio bolivarNo ratings yet

- BHA PROPOSAL FOR SERD-N2 ST WELLDocument1 pageBHA PROPOSAL FOR SERD-N2 ST WELLPinggir KaliNo ratings yet

- Unlock The Rest of Learning Java, 4th Videos: Edition and 30,000 Other Books andDocument8 pagesUnlock The Rest of Learning Java, 4th Videos: Edition and 30,000 Other Books andRennyDortaNo ratings yet

- C LanguageDocument135 pagesC LanguageSandeep SandyNo ratings yet

- Lecture 5: Model-Free Control: David SilverDocument43 pagesLecture 5: Model-Free Control: David SilverFawaz PartoNo ratings yet

- G-Series Pneumatic and Hydraulic Actuators: The Latest Generation in Valve Automation SolutionsDocument6 pagesG-Series Pneumatic and Hydraulic Actuators: The Latest Generation in Valve Automation SolutionsThang Tran QuangNo ratings yet