Professional Documents

Culture Documents

Consolidated Group Financial Report - Jane CHP 12.2

Uploaded by

Ng GraceOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Group Financial Report - Jane CHP 12.2

Uploaded by

Ng GraceCopyright:

Available Formats

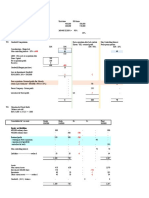

Preparing the Consolidated Statement of Financial Position Q 12.

W1 Group Structure

# Randy Bhd -(Parent) % of Paula Bhd (subsidiay)

# Date of acquisition

# Non-controlling interest (NCI)

Unit share RM share

Orignial share in unit in Paula

Investment share unit in Paula

Controlling = in unit/ 100% 280/400 = 70%

Non controlling interest 30%

W2 Goodwill Computation Post acquisition-after beli syarikat Non Controlling Interest

Haza - HQ - retained profit Daze punya portion

RM RM RM - 70% RM - 30%

Consideration - Harga beli 400

Non-controlling interest - 30% x 600 180 180

580

LESS : Net assets at acquisition date

Share Capital 500

previous profit Pre-acquisition profit 100

Reserves

600 -600

Goodwill/(Bargain purchase) -20 20

Loss on Impairment Goodwill

0 0

-20

-

Post acquisition- Retained profit dlm Subsidy -

profit semasa retain as per statement = RM200k (70% & 30%) - 140 60

less - released of fair value ( untung harga jualan) - 120-100 -14 -6

-

Parent Company - Retain profit ( 150+250) - 400 -

-

unrealised of Stock profit - w3 -10 -

-

-20 536 234

W3 Unrealised of Stock Profit

Balance not sold

RM 70,000-50,000 = 20,000 ( 1/2) only

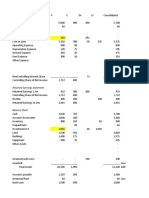

Consolidated of Account Randy Paula Dr Cr. Final

RM'000 RM'000 RM'000

Equity and liabilities

Ordinary share 900 500 -500 - 900

Retained profit - beginning - semasa acquired 150 100 -100 - 150

- -

- - -

Retained profit - current year 250 200 -60 - -

- working on fair value -20 - -

- impairment of goodwill - loss - bargin loss 0 20

- unrealised of stock -10 - 380

- - -

Non controlling interest - 240 240

- - -

Liabilities - - -

- - - - -

1,300 800 - - 1,670

- - - - -

Assets

Non current Assets 520 600 - -20 1,100 untung dlm asset

Investment 280,000 share 400 - - -400 -

Inventories 80 100 - -10 170

Other current assets 300 100 - - 400

- -

Goodwill - (10-2) - balance - - - - -

1,300 800 1,670

You might also like

- Consoliated Group Financial Report - Jane Lazar CHP 12.1Document1 pageConsoliated Group Financial Report - Jane Lazar CHP 12.1Ng GraceNo ratings yet

- Consolidated Group Financial Report - Test 2Document1 pageConsolidated Group Financial Report - Test 2Ng GraceNo ratings yet

- CitsitDocument12 pagesCitsitJulia Pratiwi ParhusipNo ratings yet

- Cash Flow Statement - HODocument7 pagesCash Flow Statement - HOAditi VermaNo ratings yet

- Exercise 3 - Group Accounts - SolutionDocument5 pagesExercise 3 - Group Accounts - SolutionAnh TramNo ratings yet

- T2 Ans. (PS & ITA)Document8 pagesT2 Ans. (PS & ITA)KY LawNo ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Sole TradershipDocument4 pagesSole Tradershipsreeroop ReddyNo ratings yet

- Eva Tree ModelDocument11 pagesEva Tree Modelwelcome2jungleNo ratings yet

- CFAP 1 Summer 2023Document7 pagesCFAP 1 Summer 2023Ali MohammadNo ratings yet

- WEEK 9 Solution To Questions On Statement of Cash FlowsDocument3 pagesWEEK 9 Solution To Questions On Statement of Cash Flowsvictoriaahmad95No ratings yet

- PG 227Document1 pagePG 227Ng WeiquanNo ratings yet

- FMDocument17 pagesFMRaghav Agarwal100% (3)

- Suggested Solution Q15.1Document4 pagesSuggested Solution Q15.1swordshoes100% (1)

- Preliminary Balance Sheet AssetsDocument3 pagesPreliminary Balance Sheet AssetsleuleuNo ratings yet

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Obaid RasheedNo ratings yet

- SBR Workbook Q & A PDFDocument293 pagesSBR Workbook Q & A PDFJony Saiful100% (1)

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- Cash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeDocument5 pagesCash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeTharani NagarajanNo ratings yet

- Cashflow QuestionDocument2 pagesCashflow QuestionMick MingleNo ratings yet

- FR Kit 333Document5 pagesFR Kit 333Khin Lapyae TunNo ratings yet

- Majeed SB - COMPUTATION and WEALTH STATEMENT 2022Document5 pagesMajeed SB - COMPUTATION and WEALTH STATEMENT 2022Muhammad SherazNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- RibbonsDocument52 pagesRibbonsKunal MehtaNo ratings yet

- Class Exercise 4B Changes in Shareholding Interest: Increase in ShareholdingDocument2 pagesClass Exercise 4B Changes in Shareholding Interest: Increase in ShareholdingMUHAMMAD HAMIZAN BIN ROSMAN MoeNo ratings yet

- Group 2Document8 pagesGroup 2Gaurav SinghNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- T3 Ans. (RA)Document6 pagesT3 Ans. (RA)KY LawNo ratings yet

- Solutions Ch09Document24 pagesSolutions Ch09KyleNo ratings yet

- No Items RM'000 Working (RM'000)Document4 pagesNo Items RM'000 Working (RM'000)Chushan TehNo ratings yet

- Solution Far410 Dec - 2019 - 1 - PDFDocument8 pagesSolution Far410 Dec - 2019 - 1 - PDF2022478048No ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- FAR610 Consolidated Cashflow Past Semester FinalexamDocument18 pagesFAR610 Consolidated Cashflow Past Semester FinalexamANIS SYAKIRAH ADHWA MAHDILLAHNo ratings yet

- T8 - CBS - BBFA1123 FA-2019 (Answer)Document8 pagesT8 - CBS - BBFA1123 FA-2019 (Answer)From PlutoNo ratings yet

- Tutorial 7 Answer Q1 2 3Document12 pagesTutorial 7 Answer Q1 2 3Chuah Chong AnnNo ratings yet

- Interactive Question 4: Acquisition of A Subsidiary: Non-Current AssetsDocument4 pagesInteractive Question 4: Acquisition of A Subsidiary: Non-Current AssetsRiad FaisalNo ratings yet

- Amity Global Business School Amity Global Business School: Valuation ConceptsDocument36 pagesAmity Global Business School Amity Global Business School: Valuation ConceptssachinremaNo ratings yet

- E TranspharmaDocument7 pagesE TranspharmaLucas Moraes Teixeira SalgadoNo ratings yet

- TEST1 ACC 106 Nov 2017 Solution Part ADocument4 pagesTEST1 ACC 106 Nov 2017 Solution Part AZulaikha JasniNo ratings yet

- Perniagaan Jared Akaun Perdagangan Dan Untung Rugi Bagi Tahun Berakhir 30 April 2016Document2 pagesPerniagaan Jared Akaun Perdagangan Dan Untung Rugi Bagi Tahun Berakhir 30 April 2016weiqiNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- Investments and Fair Value SolutionsDocument32 pagesInvestments and Fair Value Solutionssarah zahid100% (1)

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- Exercises P Class 1 2022Document5 pagesExercises P Class 1 2022Angel MéndezNo ratings yet

- 1Document7 pages1JessaNo ratings yet

- BAISAKHADocument2 pagesBAISAKHARashpreet PandiNo ratings yet

- ACC Individual AssignmentDocument6 pagesACC Individual AssignmentRuddyMartiniNo ratings yet

- Section-A Statement of Financial Position As at 31 Dec 2020 Non-Current AssetsDocument4 pagesSection-A Statement of Financial Position As at 31 Dec 2020 Non-Current AssetsFareeha RizwanNo ratings yet

- Cash Flow Session With ExamplesDocument9 pagesCash Flow Session With ExamplesPAVAN KUMAR GUDAVALLETINo ratings yet

- Himel LTD: Total AssetsDocument37 pagesHimel LTD: Total AssetsAbdulAhadNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Document68 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Mazikeen DeckerNo ratings yet

- Apr MRR 2019 - Santino's Farm VilleDocument2 pagesApr MRR 2019 - Santino's Farm VilleJun PaneloNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- Pyramid - Kaplan KitDocument2 pagesPyramid - Kaplan KitRida FatimaNo ratings yet

- IFRS - Worksheet For Students To Use - Fall 2022Document1 pageIFRS - Worksheet For Students To Use - Fall 2022Cao Thu HàNo ratings yet

- Chap 17 Intercompany Sales of InventoryDocument71 pagesChap 17 Intercompany Sales of InventoryPhrexilyn PajarilloNo ratings yet

- Statistic - Latihan 2Document2 pagesStatistic - Latihan 2Ng GraceNo ratings yet

- Examiner'S Report Mia Qe March 2018 Paper: TaxationDocument9 pagesExaminer'S Report Mia Qe March 2018 Paper: TaxationNg GraceNo ratings yet

- Taxation Solution 2018 MarchDocument11 pagesTaxation Solution 2018 MarchNg GraceNo ratings yet

- Taxation Question 2018 MarchDocument17 pagesTaxation Question 2018 MarchNg GraceNo ratings yet

- Business and Company Law Question 2018 MarchDocument6 pagesBusiness and Company Law Question 2018 MarchNg GraceNo ratings yet

- Examiner'S Report Mia Qe March 2018 Paper: Business and Company LawDocument8 pagesExaminer'S Report Mia Qe March 2018 Paper: Business and Company LawNg GraceNo ratings yet

- Auditing & Assurance Services Solution 2018 MarchDocument10 pagesAuditing & Assurance Services Solution 2018 MarchNg GraceNo ratings yet

- Afar Mia Qe March 2018 Suggested SolutionDocument7 pagesAfar Mia Qe March 2018 Suggested SolutionNg GraceNo ratings yet

- Advanced Financial Accounting and Reporting: Qualifying ExaminationDocument8 pagesAdvanced Financial Accounting and Reporting: Qualifying ExaminationNg GraceNo ratings yet

- F6mys 2018 Marjun ADocument7 pagesF6mys 2018 Marjun ANg GraceNo ratings yet

- Examiner'S Report Mia Qe March 2018 Paper: Advanced Financial Accounting and ReportingDocument5 pagesExaminer'S Report Mia Qe March 2018 Paper: Advanced Financial Accounting and ReportingNg GraceNo ratings yet

- Characteristics of Floating ChargeDocument4 pagesCharacteristics of Floating ChargeNg GraceNo ratings yet

- Battle Ship LabDocument1 pageBattle Ship Labapi-276688928No ratings yet

- Management Accounting (Tilburg University) Management Accounting (Tilburg University)Document20 pagesManagement Accounting (Tilburg University) Management Accounting (Tilburg University)Afriliani100% (1)

- Schengen VisaDocument4 pagesSchengen Visajannuchary1637No ratings yet

- Research Paper On N Queen ProblemDocument7 pagesResearch Paper On N Queen Problemxvrdskrif100% (1)

- Networking Straight-Through and Cross OverDocument25 pagesNetworking Straight-Through and Cross OverJan GolimanNo ratings yet

- 14 WartsprotocolDocument9 pages14 WartsprotocolLakshmi Deepak INo ratings yet

- Solved - The Data in WAGE2.RAW On Working Men Was Used To Estima...Document1 pageSolved - The Data in WAGE2.RAW On Working Men Was Used To Estima...kharismapb0% (1)

- Deed of Road Right of WayDocument6 pagesDeed of Road Right of WayPlaridel Madrigal75% (4)

- Dolfin User ManualDocument118 pagesDolfin User ManualWarstilide49No ratings yet

- Fiat Ducato 1st - x250 - Training ManualDocument187 pagesFiat Ducato 1st - x250 - Training Manualfragma84100% (1)

- Airline Cabin Crew ETextbook 3rded-2017 TALG-51Document455 pagesAirline Cabin Crew ETextbook 3rded-2017 TALG-51Abdul Nasar100% (9)

- 01ci0811 - Design of FormworkDocument2 pages01ci0811 - Design of FormworkpatilshabbuNo ratings yet

- 3UG46161CR20 Datasheet enDocument6 pages3UG46161CR20 Datasheet envoNo ratings yet

- 01-2Document29 pages01-2HamzaKadNo ratings yet

- Iqta'Document3 pagesIqta'ZABED AKHTARNo ratings yet

- HTML BackgroundsDocument5 pagesHTML Backgroundsrc.david.florendoNo ratings yet

- Tadano Rough Terrain Crane GR-800EX - S - G PDFDocument16 pagesTadano Rough Terrain Crane GR-800EX - S - G PDFlesantiago100% (1)

- Graduate School: Cebu Technological UniversityDocument2 pagesGraduate School: Cebu Technological UniversityRitchfildjay MariscalNo ratings yet

- Sem3 MCQ HRMDocument8 pagesSem3 MCQ HRMvenkat annabhimoju50% (2)

- Impact of COVID-19 On FMCG Sector: Shanlax International Journal of Management April 2021Document7 pagesImpact of COVID-19 On FMCG Sector: Shanlax International Journal of Management April 2021Geet ShuklaNo ratings yet

- Atul Anand. Appointment LetterDocument2 pagesAtul Anand. Appointment Letteramritam yadavNo ratings yet

- Torque Follower Setup Rev 1Document7 pagesTorque Follower Setup Rev 1NelsonNo ratings yet

- LANDocument38 pagesLANDenise NelsonNo ratings yet

- Audi Qrs A4-2009 PDFDocument98 pagesAudi Qrs A4-2009 PDFJOHNNY5377No ratings yet

- IC A25 Basic ManualDocument24 pagesIC A25 Basic ManualMiguel López AguayoNo ratings yet

- Memory Sports RTVDocument13 pagesMemory Sports RTVAgit PermanaNo ratings yet

- Datasheet Hitachi Content Software For FileDocument4 pagesDatasheet Hitachi Content Software For FileHung Do MinhNo ratings yet

- Bag Filters: Amerseal Cube Filters Dripak Dripak 2000Document4 pagesBag Filters: Amerseal Cube Filters Dripak Dripak 2000Bayu SamudraNo ratings yet

- Economía EnergéticaDocument8 pagesEconomía EnergéticaSERGIO MANZO ANDRADENo ratings yet

- Injection Wafer DatashtDocument2 pagesInjection Wafer DatashtMisael RamírezNo ratings yet