Professional Documents

Culture Documents

Internship Report Rezwan

Uploaded by

Hasnat nahid HimelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internship Report Rezwan

Uploaded by

Hasnat nahid HimelCopyright:

Available Formats

Internship Report

An Internship Report

On

Diversified Portfolio

&

SME Banking

of

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 1

Internship Report

Prepared for

Rubiat Begum

Lecturer in Finance

Faculty of Business Studies

Bangladesh University of Business & Technology (BUBT)

Prepared by

Md. Rezwan Kabir

ID no. 02033101015

BBA Program

1st Intake

Bangladesh University of Business & Technology (BUBT)

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 2

Internship Report

Date:___________

Date:___________

Mrs. Rubiat Begum

Lecturer in Finance

Faculty of Business Studies

Bangladesh University of Business & Technology (BUBT)

Mirpur

Dhaka-1216

Subject: Submission of Internship Report on “Diversified Portfolio & SME

Banking of Eastern Bank Limited”.

Dear Madam:

This is my pleasure to present my Internship Report on “Diversified Portfolio &

SME Banking of Eastern Bank Limited (EBL)" that you have asked me to

prepare as an internship report.

The report shows an analysis and overview of the subject. In preparing the report

I tried to gather information which was most complete and relevant.

I have great hope that the report will meet your expectation and aid you in

getting a clearer idea about the subject. I will take immense pleasure in

providing you with any queries you have regarding the study.

I gained some valuable knowledge and experience while working on this report

and I glad to have the opportunity to prepare this report for you.

Sincerely Yours’

______________

Md. Rezwan Kabir

ID no. 02033101015

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 3

Internship Report

BBA Program

1st Intake

Bangladesh University of Business & Technology (BUBT)

ACKNOWLEDGEMENT

Success is only possible where there is an engaged heart. In preparing this report,

it was evident that the engaged heart of mine alone was not enough. I needed the

support of significant others. It is therefore, difficult not to devote a page of this

text acknowledging the assistance we received from number of people.

First of all, I would like to express my deep gratitude to the almighty Allah for

fruitfully preparing this internship report.

And then it is important to give credit to my supervisors Mrs. Rubiat Begum,

Lecturer in Finance, faculty of business studies at BUBT. For her guidance,

constant supervision, constructive suggestions and moral support it is possible to

prepare this report.

I am very much thankful to all the persons of EBL who help me to complete my

internship in a meaningful way, without their help it was not possible for me to

complete my internship as well as the report.

The management of Sonargaon road SME had been extremely helpful in

providing necessary documents, annual report, statements, and brochure etc.

which have helped me lot for preparing this Internship report. I would like to

convey my appreciation and thanks for those who have guided me generously

with the right knowledge for this report. Shower of thanks to those entire

respondents who responded each and every time in collecting necessary data.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 4

Internship Report

“Table of Contents”

Topics Page

EXECUTIVE SUMMARY 07

Chapter- 1

Introduction

Origin of the Report

Statement of the report

Rational of the study 08-13

Objectives of the study

Scope of the study

Methodology

Sources and methods of data collection

Limitations of the study

Chapter- 2

An Overview Of Eastern Bank Limited (EBL)

Vision 14-17

Mission

Values

Job Level

Chapter- 3

Diversified Portfolio of EBL:

Consumer Banking 18-33

Corporate Banking

SME Banking

Chapter- 4

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 5

Internship Report

SME Banking:

The Case for the SMEs

Place of SMEs in the National Economy of Bangladesh 34-41

The importance of the SME sector

Current Scenario of SME financing in Bangladesh

SME Banking of EBL:

Products and Services (Mid Segments)

Products (Small Segments)

Chapter- 5 42-44

CREDIT RATING REPORT OF EASTERN BANK LTD.

Chapter- 6 45-52

FINANCIAL HIGHLIGHTS OF EBL

Chapter- 7 53-56

CONCLUSION

Chapter-8 57

Bibliography

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 6

Internship Report

EXECUTIVE SUMMARY

This is an internship report based on the internship program took place in

Eastern Bank Limited at Sonargaon Road in SME Banking. The main objective of

this report is to analysis the diversified portfolio and SME Banking of EBL.

I start my internship to the 16 th of August with an Office order issued by the HR

of EBL. Initially I started my internship at Principal Branch’s SME Banking then

I was shifted to the Sonargaon Road SME Banking.

In a word Sonargaon road SME Banking serves its customers through two

segments; Small Segments and Mid Segments.

I got only three months to gather practical knowledge from this branch, although

it was too difficult to gather maximum and proper knowledge within this short

range of time.

I tried my best to study the materials related with my topic and observed import

and export performed by EBL, SME and examine relevant official and others

published and unpublished data, annual reports of EBL, in order to prepare this

report.

I have equally faced co-

co-operation and many obstacles simultaneously. I hope this

report would be able to portray the real status of “Diversified Portfolio & SME

Banking of Eastern Bank LTD.” My effort will be meaningful if this report serves

the purpose effectively.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 7

Internship Report

I have faced new challenge in every steps of banking procedure. I also tried to

overcome in every case. I tried to present all the banking activities that I have

came across during my internship program.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 8

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 9

Internship Report

1.0 INTRODUCTION

This internship program was my on the job exposure and provided me with

learning experience and knowledge in several areas. During the first few weeks

of my internship period, I was able to get accustomed to the working environment

of the Bank. As the internship continued, I not only learned about the activities

and operations of correspondent Bank, but also gathered some knowledge about

the basic business of banking in first one month of my internship period.

EBL pursues centralized management policies and gives adequate work freedom

to the employees. This result in less pressure for the workers and acts as a

motivational tool for them, also gives them encouragement and inspiration to

move up the ladder of success. Overall, I have experienced a very friendly and

supporting environment at EBL, which gave me the pleasure and satisfaction to

be a part of them for a while.

While working in here found each and every employee is friendly to me to

cooperate. They have discussed in details about their respective tasks. I also

participated with their works. So I learnt the operations regarding their works.

1.1 Origin of the Report:

The report named “Diversified portfolio & SME Banking” of Eastern Bank Limited

was offered on August 16, 2007 as a requirement for the completion of the

Internship program as a student BBA program of Bangladesh University of

Business & Technology (BUBT).

The primary goal of the internship program is to provide the intern with the job

experience by orienting the intern with the organization and an opportunity for the

intern to relate the theoretical conceptions in the real business environment. The

program covers a period of three months of period. The duration of the internship

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 10

Internship Report

attachment with the organization was from August 16, 2007 to November 16,

2007.

1.2 Statement of the report:

Small and Medium Enterprises (SME) in Bangladesh contributed 25% of gross

domestic product (GDP) and 80% of the industrial jobs of the country in 2004.

According to ADB, the country's estimated 6 million SMEs and micro enterprises

firms of less than 100 employees have a significant role in generating growth and

jobs. This is a sector that has its own distinct needs and requires specialized

focus. Eastern Bank Ltd. (EBL) has launched SME Banking in early 2005 with

this view in mind. EBL Provides:

SMEs with easy access to financing.

Deliver products that ensure superior returns to our customers.

Orient customers with industry trends, regulatory issues etc, for their

success.

Value long-term relationship banking.

1.3 Rational of the study:

Bank is the heart of the economics and banking is the blood circulation of

country’s economic growth. Banks perform a significant role to serve the needs

of the society in different sectors, such as: capital formation, large scale of

production, industrialization, growth of trade and commerce etc. and banks are

contributing a lot of aspect.

EBL has already emerged as one of the world wide recognized banks due to its

foreign exchange and foreign trade trend according to their banking principles.

SME banking is a new diminution of banking where ‘Small & Medium businesses

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 11

Internship Report

are highly focused. So I tried to represent their performance and problems and

prospects.

1.4 Objectives of the study:

The objectives of this research paper are as below:

To acquire practical knowledge about the overall activities of SME

Banking of EBL.

To have a general idea about bank in terms of different functions and gain

experience on different functional departments.

To cover a comprehensive analysis of different Segments of EBL.

To study and understand the various services offered by this bank to its

clients.

To study how EBL has maintained growth in its banking business by

maintaining and enhancing its relationship with its clients.

To highlight the problems and necessary recommendations to overcome

the problems.

To know the performance of EBL in every aspects.

To understand the banking environment of private commercial bank in

Bangladesh.

By applying the theoretical knowledge in the bank to recommend on banks

operations and management.

1.5 Scope of the study:

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 12

Internship Report

The scope of the study includes problems and prospects Eastern Bank Limited.

Eastern Bank Limited has 25 branches at present. Being centralized bank all the

branches treaded as AD to perform foreign exchange and foreign trade activities.

The study on mentioned topic was conducted at Sonargaon road SME banking of

with a view to find out the problems and prospects of EBL.

1.6 Methodology

In this study, exploratory research was undertaken to gain insights and

understanding of the overall different SME banking system and also to determine

some of the attributes of service quality in Banks. After that a more

comprehensive conclusive research was undertaken to fulfill the main purpose of

the study.

1.6.1 Sources and methods of data collection:

Both primary and secondary sources have been utilized for collecting

necessary data to scrutinize EBL. Primary sources include face-to-face

interview with respective officials. Secondary sources consist of several

reading materials, such as journals, brochures, and annual reports.

1) Primary sources:

(A) Official record.

(B) Oral and informal interview of officials and employees in EBL.

2) Secondary Sources:

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 13

Internship Report

(A) Annual report of EBL.

(B) Printed forms and documentation supplied by EBL.

(C) Different bruisers of EBL.

(D) Relevant books, journals, booklets etc.

1.8 Limitations of the study:

One of the crucial limitations is time constraint. As I posted in the Sonargaon

road SME banking initially it was difficult for me to collect related documents and

necessary data. Finally, lack of previous experience in this area was another

limitation. Except these there are many points, those are given below:

SME banking is very busy as well as confidential regarding to some

important project, so getting adequate relevant information is difficult.

Unavailability of sufficient written documents as required making a

comprehensive study.

Lack of in depth understanding of banking activities that prevents me from

going into details.

Lack of enough information on head office since I am working in a branch.

Lack of time.

Lack of required data.

Lack of knowledge.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 14

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 15

Internship Report

2. AN OVERVIEW OF EASTERN BANK LIMITED (EBL)

VISION

To become the Bank of Choice by transforming the way we do

business and developing a truly unique financial institution that

delivers superior growth and financial performance and be that

most recognizable brand in the financial services industry in

Bangladesh.

MISSION

We will constantly challenge our systems, procedures and

training to maintain a cohesive and professional tem in

achieving service per excellence.

We will create an enabling environment and embrace a team

based culture where people will excel.

We will ensure to maximize shareholders’ value.

We will deliver service par excellence to all our customers,

both internal and external.

VALUES

Service Excellence

Openness

Trust

Commitment

Integrity

Responsible Corporate Citizen

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 16

Internship Report

Service Excellence

We passionately drive customer delight.

We use customer satisfaction to accelerate growth.

We believe in change to bring in timely solution.

Openness

We share the business plan

We encourage two way communications

We recognized achievements, celebrate results

Trust

We care for each other

We share learning/knowledge

We empower our people

Commitment

We know our road map

We believe in ‘continuous improvement’

We do not wait to be told

Integrity

We say what we believe in

We respect every relationship

We do not abuse ‘information power’

Responsible corporate Citizen

We are tax-abiding citizen

We conform to all law, norms, sentiments and values of the land

We promote protection of the environment for our children

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 17

Internship Report

Job Level

Deputy Managing Director (DMD)

Senior Executive Vice President (SEVP)

Executive Vice President (EVP)

Senior Vice President (SVP)

Vice President (VP)

Senior Assistant Vice President (SAVP)

First Assistant Vice President (FAVP)

Assistant Vice President (AVP)

Senior Principal Officer (SPO)

Principal Officer (PO)

Management Trainee Officer (MTO)

Senior Officer (SO)

Officer (O)

Supervisory Officer (SO)

Junior Officer (JO)

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 18

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 19

Internship Report

Diversified Portfolio of Eastern Bank Ltd.

Consumer Banking:

EBL Consumer Banking deals with the day to day financial wants of the

consumer clients. Our consumer banking products are designed keeping in

mind the financial necessities and affordability of the clients. The new IT

platform of EBL has enabled its Consumer Banking to offer world class and

comprehensive range of financial products and services. These have been

fashioned in a manner to fulfill our clients' banking needs with dedicated

Relationship Managers who are reaching out to the customers to make sure

that the job is done in a systematic manner within the clients time frame.

And with our EBL internet banking service, you can now access your EBL

accounts and EBL’s services at the click of your mouse

Products:

Current Account

Savings Account

Fixed deposit Account

Savings Insurance Account

High Performance Account

Monthly Income Plan

Monthly Deposit Plan

Fast Cash

Fast Loan

Executive Loan

Auto Loan

Current Account:

EBL Current Account is a non-interest bearing account suitable for both

corporate and consumer clients. It allows unlimited cash withdrawal facility

for customers from any of the 22 EBL branches across the country. There is a

minimum balance requirement of Tk. 1.000.00 for maintaining a current

account

Savings Account:

EBL Savings Account is suitably designed to meet the savings requirement of

the consumer customers willing to save from their hard earned income. It

pays interest at competitive rate matching the needs of the customers.

Savings Account is very easy to open and can be operated from any EBL

branch giving the customers the demographic flexibility. Minimum balance

requirement for a savings account is Tk. 15,000.00.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 20

Internship Report

Fixed Deposit:

EBL Fixed Deposits having flexible tenure ranging from one month to three

years allow the customers to get more out of their long term investment.

Keeping in mind the income requirement of the customers EBL offers high

interest rates. It is very simple to open a fixed deposit account from any EBL

branch.

High Performance Account:

You keep a minimum balance of Tk.20, 000.00 under this account. We offer

very competitive rates that are tiered into two slabs for deposits up to Tk. 10

lacs and above Tk. 10 lacs.

The interest on your account is calculated on a daily basis and added to your

deposit half yearly. If your deposit goes below the Tk. 20,000 limit on any

day then you lose interest for that day.

As the EBL High Performance Account is a hybrid account that conjoins the

security and growth of a Savings Account with the convenience of a Current

Account you get more out of your money while you enjoy the convenience of

unlimited cash withdrawal.

You get the highest interest rate on your deposit compared to other similar

accounts on offer in the market. EBL High Performance Account is available

at all the EBL branches in every major city

Monthly Income Plan (MIP):

EBL Monthly Income Plan is an income plan which helps you to earn a

monthly fixed amount on your fixed deposits kept with EBL for a period of 3

years.

All you need to do is keep TK 50,000/- or multiples of it for a period of 3

years. You will earn TK. 328/-(After deduction of Tax) per month on every

deposit of TK. 50,000/-, or TK. 525/-(After deduction of Tax) per month on

every deposit of TK. 100,000/- for a period of 3 years. You can open any

number of MIP of TK 50,000/- or multiples of TK 50,000/-

Monthly fixed interests will be automatically credited to your linked personal

Current /Savings/High Performance account on due date.

General information of Monthly Income Plan (MIP):

1. Easy procedure to open MIP

2. Customer must be a Bangladeshi citizen

3. Over 18 years of age

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 21

Internship Report

4. Must be an Account Holder of EBL

5. Customer must appoint a Nominee

6. Minimum balance of MIP is TK 50,000/-

7. Maximum balance any amount in multiples of TK 50,000/

8. A competitive interest rate of 7% per annum.

9. Minimum and maximum period of MIP is 3 years or 36 months

10. Auto renewal of MIP after three years unless advised otherwise

by you

11. Upto 90% Loan facility in the form of EBL FastCash/FastLoan

against MIP principal amount

12. Account access from any EBL branch

EBL Monthly Deposit Plan (MDP):

EBL Monthly Deposit Plan is a savings plan which helps you to turn your

small monthly savings into a large amount over a period of 5 years. It is a

convenient savings mode which helps your money to grow. To open a

Monthly Deposit Plan all you need to do is choose any of the six monthly

deposit amount options. You may choose more than one Monthly Deposit

Plan of different denomination.

You do not have to turn up to the branch for monthly deposit payments.

Monthly deposit will be automatically debited from your linked

Current/Savings/High Performance account by standing instruction on due

dates.

General information of Monthly Deposit Plan (MDP):

1. Easy procedure to open MDP

2. Must be a Bangladeshi citizen

3. Over 18 years of age

4. Must be an Account Holder of EBL

5. Customer must appoint a Nominee

6. Minimum monthly deposit amount is TK 500/-

7. Maximum monthly deposit amount is TK 5,000/-

8. Other Monthly Deposit options are TK 1,000/-, TK 2,000/-, TK 3,000/-

& TK 4,000/-

9. Minimum and maximum period of MDP is 5 years or 60 months

10. A competitive interest @ 7.00% compounded monthly

11. Up to 80% Loan facility in the form of FastCash/FastLoan

against MDP Deposits after 2 years

12. Account access from any EBL Branch

EBL Fast Cash:

EBL Fast Cash is a revolving credit facility. FastCash allows the customer to

draw up to a predetermined amount of credit from their Current Account.

Customers will only be charged interest for the amount they draw. The

minimum limit for EBL FastCash is Tk. 50,000.00

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 22

Internship Report

General information of EBL FastCash:

1. Simple documentation to avail FastCash

2. You must be a Bangladeshi citizen

3. Over 18 years of age

4. You must be an Account Holder of EBL

5. Minimum overdraft limit is TK 50,000/-

6. Maximum overdraft limit is TK 5,000,000/-

7. EBL FDR interest rate + 2.75%: For others

securities 11.00% per annum

8. Interest is charged only on the withdrawn amount

9. Loan is sanctioned within 24 hours of application

10. Up to 90% loan facility of the offered security

11. Loan tenure is one year which is renewable

12. Account access from any EBL branch

Accepted Securities:

EBL Fixed Deposit Receipts (FDR)

ICB Unit Certificates

Wage Earners Development Bonds

EBL Executive Loan:

EBL Executive Loan is any purpose EMI (equated monthly installment) based

credit facility for salaried executives.

No Cash Security No Down payments No Price Quotation/ Invoice required

Amount: Maximum 6 times gross monthly salary

Tk. 50,000/- to 10,00,000/- for Salary A/C holders and lien of

Terminal Benefits

Tk. 50,000/- to 6,00,000/- for Salary A/C holders.

Tk. 50,000/- to 5,00,000/- for loan against Post-dated

cheques and 1 Personal Guarantee.

Interest rate:

13.25% for Salary A/C holders and lien of Terminal Benefits

14.5% for Salary A/C holders

15% for loan against Post-dated cheques and 1 Personal

Guarantee

Tenor: 12, 24 or 36 months

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 23

Internship Report

Eligibility:

Age: Between 25 to 52 years

Job experience: Minimum 4 years of which at least 1 year with current

employer.

Income: Minimum Tk. 15,000/-per month for private

organization and Tk. 10,000/- for government employees

Auto Loan:

EBL Auto Loan is here to help you purchase your dream car. It's easy and

flexible repayment schedule erase your worries about the burden of a loan.

Our Auto loan Scheme will allow you to avail credit up to 75% of the car

value. You need to be a Bangladeshi national between the age of 25-55,

working in a reputed multinational/ local firm or involved in a reputed

business.

The maximum repayment period for EBL Auto Loan is 4 years. You can

choose 12, 24, 36 or 48 equated monthly installments (EMI) to repay the

loan.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 24

Internship Report

Services of Consumer Banking:

Locker Services

EBL 5 to 9

Online Banking

EBL Visa Electron Card

Utility Services Bill Collection

Tuition Fees Collection

Student File

Locker services:

EBL offers three different types of lockers - small, medium and large. They

can be used for the safe keeping of personal belongings (jewelry, documents

etc.). However nothing illegal can be kept in the locker. The locker holder has

to have an account with EBL to get this service. The yearly rate of the lockers

range from the smallest one being TK 1000, the medium one being Tk 1500

and the Large one being TK 2500. This service is available at the following

branches of EBL.

1. Dhanmondi

2. Uttara

3. Shantinagar

4. Mirpur

5. Gulshan

6. Sonargaon Road

7. O.R.Nizam Road

8. Rajshahi

9. Bogra

10. Chouhatta (Sylhet)

EBL 5 to 9:

This is a service that gives the customer the option to deposit money in the

bank beyond banking hours. All the customer has to do is become a member

of the EBL 5 to 9 services by providing a nominal yearly fee. The customer

being a member will be given a bag and a lock.

He/she can put in money in the bag lock it and deposit the same in the EBL 5

to 9 safe deposit box kept in the branch any time during 24 hours time. The

bag upon deposit in the 5 to 9 deposit box will directly go to the bank's

secured vault. His/her deposit will be credited to the respective account the

following day and the deposit bag will be returned to the customer for further

deposits in the future.

This is a convenient 24 hour deposit service especially for small traders and

shop owners who feels unsafe keeping their money in the shop or carry it

home in the night.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 25

Internship Report

Online Banking:

Flexcube@ is the Internet banking solution that delivers the Corporate,

Consumer and Investment Banking products to bank's customers over the

Net. Our Internet Banking module is a secure, robust and extensible web

banking solution. It is anchored on a reusable component framework that

complies with industry standards. Conceived specifically to exploit the

potential of the web, our new banking platform delivers a modular solution

addressing Consumer, Corporate and Investment Banking. Customers will be

able to transfer funds, inquire balance, request for cheque book, pay utility

bills on-line etc.

Visa Electron online debit card:

First time ever in Bangladesh!

EBL Introduces the Visa Electron online debit card:

Unique Features:

1. With EBL Visa Electron you can now draw cash from the Q-cash ATM

network, 24 hours a day through out the year. No need to carry

excess cash in your wallet. Your card is electronically linked to your

EBL account.

2. EBL Visa Electron is also accepted at Visa merchants with Electronic

P.O.S Visa Symbol, where you can pay for merchandise and services.

3. Acceptance - Hassle free acceptance at network of Q-Cash ATMs

currently 10 and to be expanded up to 50 by July 2004 and

approximately 1000 POS deployed in major cities.

4. Photo card - Displays your photo & signature on front of your card for

enhanced security.

What else you can do:

1. Account balance checking from ATMs

2. PIN change facility

3. Cheque book request

4. Mini statement inquiry

5. Statement request

Additional EBL services:

1. Avail EBL Internet Banking facility

2. Card for joint account holders as well

3. Real time online transaction.

4. Services of well-trained relationship managers at any of our 22 real-

time branches.

ATM Location Details:

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 26

Internship Report

1. EBL, Principal Branch, 10 Dilkusha Dhaka

2. EBL, Mirpur Branch, Plot - 14, Main Road -3, Block-A, Sec -11, Mirpur

Dhaka

3. EBL, Uttara Branch, Plot- 1A, Road-4, Sector - 4, Uttara Model Town,

Dhaka

Eligibility:

Any EBL account holder can be issued the EBL Visa Electron. If you are an

EBL account holder, just drop by at any of our sales and service centers, fill

up an Application Form. We will courier your card within 7 working days. It is

that easy!

Your EBL Visa Electron is the first of its kind in Bangladesh, exactly what you

wanted. Become a proud member of EBL card family and discover the vast

array of added conveniences- a new dimension in banking!

Utility Services Bill Collection:

1. WASA ( only Dhaka)

2. DESA ( Rajshahi, Bogra, Dhaka-Mirpur Branch)

3. PDB ( Chittagong, Rajshahi Jessore)

4. AKTEL

Internet Service Provider Bill

1. Proshikanet

2. Bdcom Online Ltd

3. ConnectBd Ltd

4. Access Telecom (BD) Ltd

5. In-touch Communication Ltd

6. Dhaka Broad Band Network (DBN)

7. Spark System Ltd

8. Agni Systems Ltd

9. Touch Tone Bd Ltd

Tuition Fees Collection:

Scholastica ( Pvt) Ltd

Scholastica Transport Service Ltd

South Breeze

Mirpur Bangla School

Aga Khan Education Service System

Shahid Smrity School

Student file:

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 27

Internship Report

EBL allows students who are going abroad to study to open an account in

order to transfer funds to wherever they are going. We take the step to take

the permission (if necessary) from Bangladesh Bank on behalf of the

customers. For this we need all the documents of the student's previous

completed education and his/her (s) acceptance letter from which ever

University he/she is going.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 28

Internship Report

Corporate Banking:

Corporate Banking is an integrated specialized area of the Bank which addresses the

diverse financial needs of Corporate Customers.

Local and Foreign Business Houses (Public and Private Limited Companies), NGO's ,

Associations , Not for profit Organizations , Sole Proprietorship Concerns and Various

Government Bodies/Corporations etc are considered to be our Corporate Customers .

Corporate Banking has been established in EBL to cope with the banks strategy to

transform into a Business Matrix from the existing Geographical Matrix Modules.

Corporate Banking Relationship Teams based in Dhaka and Chittagong are available to

understand your business and its requirements. They are specialists in developing high

quality financial solutions and to assist you in achieving your business objective. Services

provided by Corporate Banking are as follows:

Structuring of Facilities for Corporate Customers.

Develops understanding of customer businesses and advises Financial Solutions

Advisory Services/ Financial Consultancy

Arrange Loan Syndications

Developing Relationship between the Clients and the Bank

Processing credit facility requirements and arranging approvals for credit

facilities.

Handles pricing issues and Wallet Sizing Exercises to maximizes the earnings of

the Bank as well as of the Client

Coordinating service delivery of all EBL distribution channels viz.

Sales and Service centers, Trade Services, Treasury, Credit issues as required for

the customer.

Provides a one stop service for Credit facilities.

Ensures Corporate customers' complaints and Service issues are promptly

addressed.

Addresses Credit related issues.

Coordinates activities of support unit Credit Administration unit which prepares

security documentation, security registration, and CIB related issues.

Coordinates activities of operating departments in obtaining Central Bank

approvals where necessary.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 29

Internship Report

Services of Corporate Banking:

a. Structuring of Facilities for Corporate customers.

b. Providing Financial Solutions

c. Advisory Services

d. Arrange Loan Syndications

e. Developing Relationship between the Clients and the Bank

f. Processing credit and other approvals for credit and other facilities. Provides an

one stop service for Credit facilities.

g. Handles pricing issues and Wallet Sizing Exercises to maximizes the earnings

of the Bank as well as of the Client

h. Coordinating service delivery of all EBL distribution channels (Sales and

Service

centers, Trade Services, Treasury, Credit issues as required for the customer.

i. Ensures corporate customer's complaints are addressed.

j. Relationship Teams of EBL are available to serve you.

Corporate Banking Relationship teams structure:

This comprises of Teams of Relationship Managers.

There are 5 Asset Teams and 1 Cash Management Team in Dhaka

There are 3 Asset Teams in Chittagong

Both Dhaka and Chittagong Area have 1 Small Business Unit each to

handle requirements of small businesses (facilities below BDT 1.5 crores).

Corporate Banking Relationship Managers in each of the Outstation

Branches for ensuring smooth and uninterrupted services to the Corporate

Clients in Rajshahi , Jessore , Bogra , Khulna, Sylhet (Laldighir Par ,

Moulovibazar , Chouhatta ) .

The relation teams are composed of people specialized in dealing with the

needs of business entities and coordinating EBL's service delivery across

the EBL network.

Relationship Partners:

Corporate Banking believes in long term relationship. Corporate Banking is

managing a well diversified portfolio and the priority is in the following

sectors:-

Ceramics Tea

Construction. Jute

Garments Building materials

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 30

Internship Report

Textiles finance

Service Trades

Pharmaceuticals. Computer &

Health care Electronics

Food & Beverages Transportation

Poultry & Ship breaking

Hatchery Agro based

Steel Industry Batteries and

Power car oil and related

other industries

infrastructure Commodities

projects import

Mobile Telecom Steel products

Companies Chemical, plastic

Media & plastic

Cement products

Soap & Edible oil

detergents,cosme Clinics, Hospitals

tics and NGO's

Leather Educational

Paper and related Institutions

products Financial

Institutions

Shipping Airlines Shrimp Export

transport

II. Corporate Lending:

You will find an excellence inventory of products to match your business requirements.

Product development is a continuous endeavor of the Relationship Teams to optimize

the utility of Corporate Clients. The Product Inventory Shelve contains the following

products from which you can choose any one or any combination that fits best with the

requirements of your company. We tailor product to the requirements of each customers

as required.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 31

Internship Report

Product of Corporate Banking:

SOD Secured Overdraft

OD Overdraft

CC (HYPO) Cash Credit against Hypothecation

CC (PLEDGE) Cash Credit against Pledge

PC Packing Credit against Export L/C & Export Order

Demand Loan(Hypo) Demand Loan against Hypothecation

Demand Loan (Pledge) Demand Loan against Pledge

Time Loan Time Loan against Other Security/Collateral/Support

Term Loan Term Loan

SLC Sight Letter of Credit

ULC Usance Letter of Credit

BBLC Back to Back Letter of Credit

Import Loan (Hypo) Import Loan against Hypothecation

Import Loan (Pledge) Import Loan against Imported Merchandise Pledged

LTR Loan Against Trust Receipt

Acceptance Acceptance against ULC

LBPD Local Bill Purchased Documentary

FBPD Foreign Bill Purchased Documentary

LAFB (CLEAN) Loan Against Foreign Bill Clean

LAFBD Loan Against Foreign Bill Documentary

LG Letter of Guarantee -BB / PG / APG / RB / Pay. Gtee

BCP (Foreign) Bankers Cheque Purchase (Foreign)

BCP (Local) Bankers Cheque Purchase (Local)

Fwd FX Forward Contract

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 32

Internship Report

SME Banking:

Small and Medium Enterprises (SME) in Bangladesh contributed 25% of gross domestic

product (GDP) and 80% of the industrial jobs of the country in 2004. According to ADB,

the country's estimated 6 million SMEs and micro enterprises firms of less than 100

employees have a significant role in generating growth and jobs. This is a sector that

has its own distinct needs and requires specialized focus. Eastern Bank Ltd. (EBL) has

launched SME Banking in early 2005 with this view in mind.

" Provide SMEs with easy access to financing.

" Deliver products that ensure superior returns to our customers.

" Orient customers with industry trends, regulatory issues etc, for their success.

" Value long term relationship banking.

In short, we want to be the partner in your success.

Customer Qualification:

" Your business can fall within any of these categories:

(i) Manufacturing (ii) Trading (iii) Service

" You should have at least 2 years of business experience (with proven track record).

" The most important securities we look at are:

(i) Business performance (ii) Industry reputation (iii) Experience

Our existing and prospective customers generally are in the following businesses:

(i) Manufacturing:

" Packaging

" Flour Mills

" Suppliers to MNC / LLC

" Printing & publishing

" Garments accessories

" Furniture Pharmaceuticals

(ii) Trading:

" Distributors of Multinational Company (MNC) / Large

local Corporate (LLC), Supplier of MNC / LLC

" Importer of food & grain, dyes & chemicals, milk

powder, motor parts, bicycle parts, motor car, electrical

and electronic goods, hardware & machinery, poultry

feed, garments accessories, construction materials, water

pump and generator, cotton yarn, seed distributor, steel

sheet, jewellery, edible oil and crude oil

" Retailer of readymade garments and boutiques

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 33

Internship Report

" Restaurant & fast food

" Super market

" Stationary items

" Furniture & wood seller

" Drug & medicine seller

(iii) Services:

" Educational institute

" Travel agency

" Advertisement firm

" Shipping agents

" Transport / container mover

" Clearing & forwarding agent

" Gas stations

" Real estate companies

" Contractors

" Non profit organization

" Clubs

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 34

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 35

Internship Report

The Case for the SMEs

The SMEs worldwide are recognized as engines of economic growth. The

commonly perceived merits often emphasized for their promotion especially in

the developing countries like Bangladesh include their relatively high labor

intensity, dependence on indigenous skills and technology, contributions to

entrepreneurship development and innovativeness and growth of industrial

linkages.

The case for fostering SME growth in Bangladesh is irrefutable as these

industries offer bright prospects for creating large-scale employment and income

earning opportunities at relatively low cost for the un-and unemployed especially

in the rural areas strengthening the efforts towards achieving high and sustained

economic growth which are critically important prerequisites for triggering an exit

from endemic poverty and socio-economic deprivation.

These promotional arguments for the SMEs, while universally emphasized are

often put forward by their ardent advocates in a small versus large context and

thus arouse serious debates concerning their economic viability. Much of such

controversies may, however breakdown if the intrinsic virtues specific to SMEs

and unavailable to large-scale industries are correctly identified and carefully

exploited.

A combined interaction of the forces of product-mix, locational factors,

technological advantages and market advantages create opportunities for SMEs

to grow and prosper at all levels of development which are often ignored by the

traditional approach to their economic strengths and development potentials.

The growing economic significance of the SMEs as sources of new business

creation and employment generation in the developed, OECD countries especially

since 1970s is now widely recognized in an increasingly growing volume of

literature (OECD1997).

The recent structural shifts in industrial production from the Florist approach of

mass production to more flexible and adaptable production regime in response to

constantly changing market opportunities have led to a notable resurgence of

these industries in the West. The re-emergence of the SMEs in the developed

world makes economic case for fostering development of these industries

stronger than ever before.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 36

Internship Report

Place of SMEs in the National Economy of Bangladesh

Any precise quantitative estimate of the importance of SMEs in Bangladesh economy is

precluded by non-availability of comprehensive statistical information

about these industries at the national level.

The latest BSCIC estimates suggest that there are currently 55,916 small industries and

511,612 cottage industries excluding handlooms. Including handlooms, the number of

cottage units shoots upto 600,000 units indicating numerical superabundance of the

SCIs in Bangladesh.

Quoting informal Planning Commission estimates, the SMDF puts the number of medium

enterprises (undefined) to be around 20,000 and that of SCIs to be between 100,000 to

150,000.

This wide variation in the BSCIC and Planning Commission estimates of the numerical,

size of the SMEs might be due to at least two reasons: (a) different set of definitions of

the SMEs and (b) different coverage of SME families.

This strongly suggests the need for adopting and using an uniform set of definitions for

SMEs by all Government agencies to help formulation of pro-active SME promotion

policies. Whatever the correct magnitude, the SMEs are undoubtedly quite predominant

in the industrial structure of Bangladesh comprising over 90% of all industrial units. This

numerical predominance of the SMEs in Bangladesh’s industrial sector becomes visible in

all available sources of statistics on them (Ahmed, M.U 2001).

Together, the various categories of SMEs are reported to contribute between 80 to 85

per cent of industrial employment and 23 per cent of total civilian employment (SEDF,

2003)2. However, serious controversies surround their relative contribution to

Bangladesh’s industrial output due to paucity of reliable information and different

methods used to estimate the magnitude. The most commonly quoted figure by

different sources (ADB, World Bank, Planning Commission and BIDS) relating to value

added contributions of the SMEs is seen to vary between 45 to 50 per cent of the total

manufacturing value added. While the SMEs are characteristically highly diverse and

heterogeneous, their traditional dominance is in a few industrial sub-sectors such as

food, textiles and light engineering and wood, care and bamboo products.

According to SEDF sources quoted from ADB (2003), food and textile units including

garments account for over 60% of the registered SMEs. However, as identified by

various recent studies, (Ahme, M.U. 2001, ADB 2001, US-AID 2001) the SMEs have

undergone significant structural changes in terms of product composition, degree of

capitalization and market perpetration in order to adjust to changes in technology,

market demand and market access brought by globalization and market liberalization.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 37

Internship Report

The importance of the SME sector

• Employment of medium to low skilled workers.

• Increased cash flow in Rural/Semi-Urban Areas.

• Reduction of Poverty.

• Reduce Urban Migration.

• Development/Formation of Linkages .

• Enhance living standards and consumption.

• Economic Growth (GDP growth).

• Creation of a semi-urban entrepreneur class.

Current Scenario of SME financing in Bangladesh

• Commercial Banks and Financial Institutions have incorporated SME

banking.

• This done by only re-designing and scaling down their current financial

products for the SME customer.

• Therefore expected value addition not created in SME financing, since it

continues to be traditional financing.

• Micro finance institutions (MFI’s) haven’t yet entered the Small business

market.

Employment

Economic Reduce

Growth Poverty

SME

Creation of Enhance

Entrepreneur Living

s Standards

Formation of

Linkages

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 38

Internship Report

SME Banking of EBL:

Small and Medium Enterprises (SME) in Bangladesh contributed 25% of gross

domestic product (GDP) and 80% of the industrial jobs of the country in 2004.

According to ADB, the country's estimated 6 million SMEs and micro enterprises

firms of less than 100 employees have a significant role in generating growth

and jobs. This is a sector that has its own distinct needs and requires specialized

focus. Eastern Bank Ltd. (EBL) has launched SME Banking in early 2005 with this

view in mind.

Provide SMEs with easy access to financing.

Deliver products that ensure superior returns to our customers.

Orient customers with industry trends, regulatory issues etc, for their

success.

Value long term relationship banking.

Customer Qualification:

Business can fall within any of these categories:

Manufacturing

Trading

Service

One should have at least 2 years of business experience (with proven track

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 39

Internship Report

record).

The most important securities we look at are:

Business performance

Industry reputation

Experience

Products and Services (Mid Segments):

Financing Amount:

Facilities range upto Tk. 5 crore for one or multiple product(s); products are

suited for all types of business needs in every stage of your business, which falls

in cash management, lending, and trade services categories. The products are:

Cash Management:

Current Account Transactional account with cheque book and debit card

facilities, along with online and internet banking.

Short Term Interest bearing account that can be linked to the current

Deposit (STD) account to combine the facilities of both accounts.

Account

Fixed Deposit High interest bearing time deposit that has to be kept with

(FD) the bank for a time period to earn the interest.

Lending:

Overdraft/Cash Fully secured line of credit with a tenor of 12 months and can

Credit be renewed on maturity.

Demand Loan Loan for financing inventory procured locally or financing

duty/tax against hypothecation of inventory and book debts.

Time Loan (Work Loan for short term need against work order from reliable

Order Financing) benefactor.

Term Loan Long term loan to finance fixed asset against hypothecation

of the fixed asset.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 40

Internship Report

Trade Services:

Letter of Credit Financing of import of goods against title of the documents

or sales.

Import Loan Financing of imported merchandise against hypothecation or

pledge of inventory or book debts.

Guarantee Bid bond, performance guarantee, and payment guarantee

for contractual obligation.

Local Bill Purchase or discount of local usance L/C with upfront

Purchase realization of interest.

Foreign Bill Cash against documents or negotiation of export document

Purchase against sight or usance export L/C.

Products (Small Segments):

EBL ASA

Any business purpose loan from Tk. 200,000.00 to Tk.

1,000,000.00.

To be repaid within maximum 24 months (next loan is payable

within 60 months).

No requirement for collateral security.

Loan repayable in equal monthly installment.

EBL PUJI

Any business purpose loan from Tk. 1,000,000.00 to Tk.

5,000,000.00.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 41

Internship Report

To be repaid within maximum 36 months (next loan is payable

within 60 months).

Collateral security required along with charge on business assets.

Loan repayable in equal monthly installment.

EBL UDDOG

Any business purpose loan from Tk. 600,000.00 to Tk.

5,000,000.00.

Without land/building mortgage.

To be repaid within 60 months.

Loan repayable in equal monthly installment.

50% of the loan amount in the form of fixed deposit is needed.

EBL AGRIM

Any business purpose loan from Tk. 200,000.00 to Tk.

950,000.00.

No collateral security required.

Lone tenure 1 month to 6 months.

Single shot payment at maturity but interest will be realized on

monthly basis

Partial payment and early payment allowed no additional fee

required.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 42

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 43

Internship Report

Credit Rating of Eastern Bank Limited

RATIONALE

CRISL reaffirms “A” rating to Eastern Bank Limited in long term and St-3 rating

for short term. It has been done on the basis of good fundamentals such as

satisfactory capital adequacy, good asset quality, diversified product lines,

significant non funded business, experienced top management etc. However the

above factors are moderated to some extent by limited market share,

dependency on term deposit, high loan to deposit ratio etc. Financial Institutions

rated in this category are adjudged to offer adequate safety for timely

repayment of financial obligations. This level of rating indicates a corporate

entity with an adequate credit profile. Risk factors are more variable and greater

in periods of economic stress than those rated in the higher categories. The

short term rating indicates good certainty of timely payment. Liquidity factors

and company fundamentals are sound. Although ongoing funding needs may

enlarge total financing requirements, access to capital markets is good. Risk

factors are small.

PREVIOUS RATING

CRISL earlier assigned “A” rating in the long term and ST -3 rating in the short

term to Eastern Bank Limited on the basis of its strong fundamentals such as

satisfactory capital base, strong non funded income base, diversified product

line, satisfactory asset quality and prudent investment policy. However, the

above ratings are constrained to some extent by the limited market share,

marginal liquidity position, dependency on term deposits etc. These ratings were

assigned on the basis of financials up to 30th June 2006. Financial Institutions

rated in this category are adjudged to offer adequate safety for timely

repayment of financial obligations. This level of rating indicates a corporate

entity with an adequate credit profile. The short-term rating also indicated the

high certainty with regard to the obligor’s capacity to meet its financial

commitments.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 44

Internship Report

Credit Rating of EBL

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 45

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 46

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 47

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 48

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 49

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 50

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 51

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 52

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 53

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 54

Internship Report

EBL started its journey from a meager information technology platform. The branches

were operating in a standalone/decentralized environment using a local software where

limitations were in abundance. It was limited from the delivery channels perspective for

providing the customers with maximum benefits in terms of banking products and

services. The most private banks in Bangladesh generally have been less competitive

with their MNC bank counter parts. The sense of customer support and service at these

private banks, literally, were not up to the par with what the customers came to expect

from these MNC banks. So, for obvious reasons privates started loosing businesses to

these MNC banks.

Eastern Bank Limited Provides Online banking services, E-commerce Banking, EBPP

Services, E-Banking Facility, E commerce Transaction, E-commerce Banking could be

provided effectively. All the branches of Eastern Bank Ltd will come under one online

Banking network so that clients will enjoy the Online banking services in Bangladesh.

Eastern bank Ltd will help to enjoy Online banking service in Bangladesh. Electronic

Banking service in Bangladesh is provides a new step of Electronic Banking in

Bangladesh. Eastern bank ltd also helps for real time banking in Bangladesh.

EBL management consisting of dynamic bankers from foreign banks working

environment could assess the benefits out of Information Technology [IT] in utilizing it

to the maximum through their experience. Their guideline and streamlined decision

making has played a pivotal role in the implementation process of Flexcube software in

the branches.

EBL is the pioneer Bank in laying foundation to the world class banking software in

Bangladesh. No other private Banks in Bangladesh could implement foreign banking

software with success in the past.

The concerned IT resources worked relentlessly over the months played a significant

role behind the successful implementation of Flexcube banking software in EBL

branches.

Essentially, EBL was not in a well connected situation. Data Communication was limited

to secluded offices in a very limited fashion. EBL now is a different scenario. EBL HO is

now connected with the branches all around Bangladesh. Here is a breakdown of what

the data communication infrastructure looks like today:

• High Speed DDN and Radio Link connectivity between Branches and the Head Office.

• Local Area Network (LAN) - providing data network connectivity at the Head Office and

the Branches.

• Metropolitan Area Network (MAN) - connecting the DHK branches with HO, CTG

branches with Agrabad and SYL branches with Chouhatta.

• Wide Area Network (WAN) - enabling the data network circle between Head Office and

the Branches.

• Solid foundation over data and network security implementation.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 55

Internship Report

EBL wanted to stand up in the crowd. For moving out of the ramshackle, EBL

management under the dynamic leadership of the honorable Directors of the Board

switched over to a centralized platform using a world renowned banking software which

was the #1 most popular software in the world for the year 2003. The result has been

incredible. We list a few of the benefits of centralization here.

At a glance - Benefits from Changes

Standalone systems = > Centralized system

Branch Banking = > Anywhere Banking

Anywhere Banking = > EOD at Data Centre

Telegraphic Transfers = > Online Inter-branch transfer

Hold accounts = > Online Inter-branch transfer

Produce MIS at Branch = > Centralized MIS

Poor ‘Control’ reports = > Improved ‘Control’ reports

Audit needs branch visit = > MIS available at Head Office

Information on paper = > Information in CIF

On Card Signature/Pix = > Digital Signature/Pix

No Funds Management = > Automatic Sweep-in/Out

EBL Banking Benefits:

Flexcube banking software automated in all branches of EBL has the adaptability for

incorporating the delivery channels like, Internet Banking, Tele-Banking, ATM/POS,

Home Banking, Wireless Access Protocol, Call Centre are all superb services which a

customer can avail in due course.

EBL’s repertoire of hardware is highly sophisticated as no other banks in Bangladesh has

availed this in recent times. The combination of hardware will help consolidate the

backbone for the plethora of services provided to the customers by the Bank for the

years to come. Moreover, EBL, country wise bade farewell to the lackluster range of

hardware which were in use over the years.

Anywhere 24 hours X 7 days banking

Internet banking, Tele banking and ATM/POS

One Stop Shop for all your banking need

Significantly reduced time in banking transactions

Sophisticated Customer Information at the fingertips and can be provided

anytime

Online Inter-branch Transfer

Any Branch Pay Order System

Digital Signature/Photo image while transacting

Display Customers Balance, Transactions, Statements online

Automatic Sweep in & out

Locker Service Availability

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 56

Internship Report

EBL 5 to 9 Extended Service

Bill payment

o Utility Services Bill

o Tuition Fees

o Mobile Phone Bills

Versatile Products availability

Fast Cash

Fast Loan

Auto Loan

Consumer Loans

High Performance Account

Savings Insurance Account

Monthly Income Plan

Monthly Deposit Plan

EBL Internet banking application addresses the needs of small, individual and corporate

account holders of the bank. This application provides a comprehensive range of

banking services that enable the customer to meet most of their banking requirements

over the Net.

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 57

Internship Report

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 58

Internship Report

BIBLIOGRAPHY

1. “Financial Management” by P K Jain

2. “Financial Management” by Van Horn

3. “Basics in Report Writing” by Leisikar

4. www.ebl.com.bd

5. Annual Report- Eastern Bank Limited, 2004

6. Annual Report- Eastern Bank Limited, 2005

7. Annual Report- Eastern Bank Limited, 2006

8. Hemple & Johansson, “Bank Management”, fifth edition

“Diversified Portfolio & SME Banking of Eastern Bank Limited” 59

You might also like

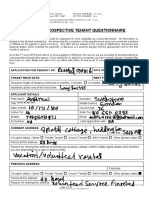

- PROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Document10 pagesPROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Duke Jno100% (1)

- Corporate GiftingDocument24 pagesCorporate GiftingPrinceCharmIngMuthilyNo ratings yet

- AB Bank ReportDocument52 pagesAB Bank ReportMd Maruf HasanNo ratings yet

- Prefabricated StructureDocument129 pagesPrefabricated Structureemraan Khan100% (1)

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDocument4 pagesUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Bidder Invoice 1098458 01-06-2023 04-03-05Document2 pagesBidder Invoice 1098458 01-06-2023 04-03-05appp2711No ratings yet

- Lecturer Computer Science Past Papers Solved Mcqs Download Click HereDocument88 pagesLecturer Computer Science Past Papers Solved Mcqs Download Click Herefozia48% (29)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- BANK of PUNJAB Internship ReportDocument74 pagesBANK of PUNJAB Internship Reportbbaahmad8960% (5)

- Harpreet Singh Project Report On NPADocument85 pagesHarpreet Singh Project Report On NPAHarpreet SinghNo ratings yet

- Customer RetentionDocument54 pagesCustomer RetentionRafizAhmedTanveerNo ratings yet

- Tugas 4 AKM - Kelompok 5 - 142200278Document13 pagesTugas 4 AKM - Kelompok 5 - 142200278muhammad alfariziNo ratings yet

- Sample of Project Charter For Solar PanelDocument10 pagesSample of Project Charter For Solar PanelAZLAN AIYUBNo ratings yet

- Analysis of Marketing Strategy of Eastern Bank LimitedDocument55 pagesAnalysis of Marketing Strategy of Eastern Bank LimitedSharifMahmud100% (6)

- Financial Calculation of EBLDocument38 pagesFinancial Calculation of EBLAbdullah Al-RafiNo ratings yet

- Internship Report AB BankDocument85 pagesInternship Report AB BankDhoni KhanNo ratings yet

- Intern 179Document58 pagesIntern 179Md.Mahbub MorshedNo ratings yet

- Foreign Exchange Activities of Exim Bank of Bangladesh LTDDocument40 pagesForeign Exchange Activities of Exim Bank of Bangladesh LTDNeamul Nis100% (1)

- Internship Report NBL Report BDDocument37 pagesInternship Report NBL Report BDMrinal Kanti DasNo ratings yet

- Financial Statement of Uttara BankDocument30 pagesFinancial Statement of Uttara BankRaqibul IslamNo ratings yet

- Standard Chartered Bank Internship Report on ProductsDocument31 pagesStandard Chartered Bank Internship Report on ProductsSumon AkhtarNo ratings yet

- Internship Report On UCBLDocument47 pagesInternship Report On UCBLIftakher HossainNo ratings yet

- Banking Activities of Jamuna BankDocument6 pagesBanking Activities of Jamuna BankTanjum AkhiNo ratings yet

- NCC Bank ReportDocument54 pagesNCC Bank ReportSumon Shopnil100% (1)

- Internship Report Bank of Punjab: Submitted byDocument28 pagesInternship Report Bank of Punjab: Submitted byLucifer Morning starNo ratings yet

- Credit Management System of IFIC Bank LTDDocument73 pagesCredit Management System of IFIC Bank LTDHasib SimantoNo ratings yet

- Internship Report AB BankDocument70 pagesInternship Report AB BankS M Mazharul KarimNo ratings yet

- Internship RDocument62 pagesInternship RjumaNo ratings yet

- Final TopicDocument123 pagesFinal TopicSonet IslamNo ratings yet

- Financial: Performance Analysis of National Credit and Commerce Bank Limited" Anderkilla Branch, ChittagongDocument53 pagesFinancial: Performance Analysis of National Credit and Commerce Bank Limited" Anderkilla Branch, ChittagongFahimNo ratings yet

- Internship Report On Foreign Exchange Operation at Standard Bank LimitedDocument53 pagesInternship Report On Foreign Exchange Operation at Standard Bank LimitedArifulIslamArifNo ratings yet

- Assignment For HR (Modified) Prime Bank Ltd.Document54 pagesAssignment For HR (Modified) Prime Bank Ltd.death_heavenNo ratings yet

- Investment Mechanism of Islami Bank BangladeshDocument67 pagesInvestment Mechanism of Islami Bank BangladeshImranAhamedShakhor50% (2)

- Banking System Analysis of IFIC Bank LimitedDocument28 pagesBanking System Analysis of IFIC Bank LimitedMd Omar FaruqNo ratings yet

- Final OCP ReportDocument42 pagesFinal OCP ReportsaifulrizviNo ratings yet

- Final Re (Port On Sme Banking (1) 235Document44 pagesFinal Re (Port On Sme Banking (1) 235Mohiuddin Al FarukNo ratings yet

- Internship Report of Sjibl-GbDocument45 pagesInternship Report of Sjibl-GbsaminbdNo ratings yet

- Job Satisfaction of The Employees of Mercantile Bank LimitedDocument51 pagesJob Satisfaction of The Employees of Mercantile Bank Limitednasima khatun100% (1)

- Financial Performance Analysis of Al Arafa Bank Ltd.Document78 pagesFinancial Performance Analysis of Al Arafa Bank Ltd.Munsi Araf60% (5)

- Demo 1Document70 pagesDemo 1Rifatul Islam SiamNo ratings yet

- ABL Toseef Word 2003Document94 pagesABL Toseef Word 2003Ahsan LaghariNo ratings yet

- General Banking Activities at Prime BankDocument41 pagesGeneral Banking Activities at Prime BankMekonen DestaNo ratings yet

- Report of Sme On SeblDocument88 pagesReport of Sme On SeblArman HossainNo ratings yet

- Asa University Bangladesh: Thesis Report On "Procedure of Foreign Trade Finance in AB Bank Limited"Document115 pagesAsa University Bangladesh: Thesis Report On "Procedure of Foreign Trade Finance in AB Bank Limited"Abdullah Al MahmudNo ratings yet

- NCC Bank's Overall Banking SystemDocument39 pagesNCC Bank's Overall Banking Systemashrafulkabir100% (1)

- Job Satisfaction of Shahjalal Islami Bank LimitedDocument63 pagesJob Satisfaction of Shahjalal Islami Bank LimitedRedwan Ferdous50% (2)

- Credit Risk Management Techniques at National BankDocument48 pagesCredit Risk Management Techniques at National Bankms694200% (1)

- Foreign Remittance Activities of EXIM Bank LimitedDocument58 pagesForeign Remittance Activities of EXIM Bank LimitedMd Khaled NoorNo ratings yet

- Jamuna Bank Recruitment ProcessDocument99 pagesJamuna Bank Recruitment ProcessTanvir80% (5)

- Introduction to Investment Modes of Pubali BankDocument4 pagesIntroduction to Investment Modes of Pubali BankSazedul Ekab0% (1)

- Intership ReportDocument24 pagesIntership ReportKawser islamNo ratings yet

- An Internship Report On: Supervised byDocument8 pagesAn Internship Report On: Supervised byarshed_69No ratings yet

- Jamuna Bank Final DraftDocument55 pagesJamuna Bank Final DraftImam Hossain MishorNo ratings yet

- AcknowledgementDocument28 pagesAcknowledgementMd. MizanNo ratings yet

- Job Satisfaction at SJIBLDocument60 pagesJob Satisfaction at SJIBLZordan Ri Z VyNo ratings yet

- American International University-Bangladesh (AIUB) Internship Affiliation Report On "General Banking Activities of National Bank Limited"Document48 pagesAmerican International University-Bangladesh (AIUB) Internship Affiliation Report On "General Banking Activities of National Bank Limited"Miraz RahmanNo ratings yet

- Asad CH 1 2Document12 pagesAsad CH 1 2Abrar Alam ChowdhuryNo ratings yet

- Letter of Endorsement InsightsDocument75 pagesLetter of Endorsement InsightsAshikur Rahman33% (3)

- HBL Bank Internship Final ReportDocument85 pagesHBL Bank Internship Final ReportMubeen MalikNo ratings yet

- Internship Report on Consumer Banking at EBL and Employee RetentionDocument58 pagesInternship Report on Consumer Banking at EBL and Employee RetentionMehedi HasanNo ratings yet

- Project Paper On HR Practices in AB Bank LTDDocument97 pagesProject Paper On HR Practices in AB Bank LTDAshik Khan67% (3)

- Internship SadmanDocument42 pagesInternship SadmanSadmanNo ratings yet

- Customer Satifaction ReportDocument44 pagesCustomer Satifaction ReportSaif HassanNo ratings yet

- Proposal BinodDocument16 pagesProposal BinodbinuNo ratings yet

- Course Code: MKT 603 Course Title: Consumer Behavior Time: 1.30 Hour Mark: 40 PointsDocument2 pagesCourse Code: MKT 603 Course Title: Consumer Behavior Time: 1.30 Hour Mark: 40 PointsHasnat nahid HimelNo ratings yet

- Identifying Market Segments & TargetsDocument16 pagesIdentifying Market Segments & TargetsHasnat nahid HimelNo ratings yet

- BUS501 Chapter 2 AssignmentDocument1 pageBUS501 Chapter 2 AssignmentHasnat nahid HimelNo ratings yet

- Marketing Communication: Media Planning & StrategyDocument10 pagesMarketing Communication: Media Planning & StrategyHasnat nahid HimelNo ratings yet

- Marketing Communication: Perspectives On Consumer BehaviorDocument10 pagesMarketing Communication: Perspectives On Consumer BehaviorHasnat nahid HimelNo ratings yet

- Crafting a Competitive Brand Positioning StrategyDocument12 pagesCrafting a Competitive Brand Positioning StrategyHasnat nahid HimelNo ratings yet

- MKT 501 - CH 17 (F03)Document15 pagesMKT 501 - CH 17 (F03)Hasnat nahid HimelNo ratings yet

- Hasnat Nahid Himel (2025407507)Document57 pagesHasnat Nahid Himel (2025407507)Hasnat nahid HimelNo ratings yet

- Internship Report RezwanDocument59 pagesInternship Report RezwanHasnat nahid HimelNo ratings yet

- Crafting a Competitive Brand Positioning StrategyDocument12 pagesCrafting a Competitive Brand Positioning StrategyHasnat nahid HimelNo ratings yet

- Resignation LetterDocument1 pageResignation LetterHasnat nahid HimelNo ratings yet

- Crafting a Competitive Brand Positioning StrategyDocument12 pagesCrafting a Competitive Brand Positioning StrategyHasnat nahid HimelNo ratings yet

- New Line Statement: Sr. N Date User Name Client Name Phone No. AddressDocument9 pagesNew Line Statement: Sr. N Date User Name Client Name Phone No. AddressHasnat nahid HimelNo ratings yet

- Company profile highlights ISP's strengths and servicesDocument10 pagesCompany profile highlights ISP's strengths and servicesHasnat nahid HimelNo ratings yet

- Resignation LetterDocument1 pageResignation LetterHasnat nahid HimelNo ratings yet

- Identifying Market Segments & TargetsDocument16 pagesIdentifying Market Segments & TargetsHasnat nahid HimelNo ratings yet

- Internship Report of Liza - Copy 1Document34 pagesInternship Report of Liza - Copy 1Hasnat nahid HimelNo ratings yet

- Hasnat Nahid Himel (2025407507)Document57 pagesHasnat Nahid Himel (2025407507)Hasnat nahid HimelNo ratings yet

- Company profile highlights ISP's strengths and servicesDocument10 pagesCompany profile highlights ISP's strengths and servicesHasnat nahid HimelNo ratings yet

- Internship Report RezwanDocument59 pagesInternship Report RezwanHasnat nahid HimelNo ratings yet

- Chapter#3: Effective Job of The Most Common Analysis... : Linking Organisational Strategy To Human Resource PlanningDocument3 pagesChapter#3: Effective Job of The Most Common Analysis... : Linking Organisational Strategy To Human Resource PlanningHasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- BUS501 Chapter 2 AssignmentDocument1 pageBUS501 Chapter 2 AssignmentHasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Monday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Document2 pagesMonday, April 05, 2021 Monday, April 05, 2021 Monday, April 05, 2021Hasnat nahid HimelNo ratings yet

- Violations of Rational Choice Principles in Pricing DecisionsDocument10 pagesViolations of Rational Choice Principles in Pricing DecisionsEliana Salazar JaramilloNo ratings yet

- ESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and AsiaDocument4 pagesESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and Asiaish ishokNo ratings yet

- AsteriskNow 3.0.0 x86 - 64 VirtualBox VDI Virtual Appliance - VirtualBoxImagesDocument2 pagesAsteriskNow 3.0.0 x86 - 64 VirtualBox VDI Virtual Appliance - VirtualBoxImagesjnhugNo ratings yet

- Report On Riverside County Coroner's OfficeDocument15 pagesReport On Riverside County Coroner's OfficeThe Press-Enterprise / pressenterprise.comNo ratings yet

- Grant-Thorton Circle Usdc Reserves 07162021Document8 pagesGrant-Thorton Circle Usdc Reserves 07162021ForkLogNo ratings yet

- Lean Information Management Toolkit TOCDocument12 pagesLean Information Management Toolkit TOCArk GroupNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- 14th WIEF Sponsorship BenefitsDocument2 pages14th WIEF Sponsorship BenefitsLatifiNo ratings yet

- Is Globalization OverDocument188 pagesIs Globalization OverDiego A. Odchimar IIINo ratings yet

- Summative Test 3rd QDocument3 pagesSummative Test 3rd QDah RylNo ratings yet

- SAP FICO Training Videos - Materials Folder Screenshots PDFDocument8 pagesSAP FICO Training Videos - Materials Folder Screenshots PDFSajanAndyNo ratings yet

- The e Commerce Revolution American English Student BWDocument4 pagesThe e Commerce Revolution American English Student BWmaomaoNo ratings yet

- Investigación Tik Tok InglesDocument5 pagesInvestigación Tik Tok InglesZEUS POSEIDONNo ratings yet

- Accounting Revision Notes and Assessment TasksDocument148 pagesAccounting Revision Notes and Assessment TasksArnoldNo ratings yet

- Ielts General Test 1Document6 pagesIelts General Test 1Jen MattNo ratings yet

- 4B - Qian Hu Corporation Limited - GM 9 - Knowledge ManagementDocument17 pages4B - Qian Hu Corporation Limited - GM 9 - Knowledge Managementezra natanaelNo ratings yet

- AiNEX 2015 Brochure - Form - RulesDocument3 pagesAiNEX 2015 Brochure - Form - Ruleskabuto riderNo ratings yet

- Entrepreneurship Style - MagicianDocument1 pageEntrepreneurship Style - MagicianhemanthreddyNo ratings yet

- Successful Career DevelopmentDocument7 pagesSuccessful Career DevelopmentAynurNo ratings yet

- bcc950 Quickstart Guide PDFDocument8 pagesbcc950 Quickstart Guide PDFOka GianNo ratings yet

- 17-Line Cost Analysis 3 - Admin Office BLDGDocument1 page17-Line Cost Analysis 3 - Admin Office BLDGJohn EstremeraNo ratings yet

- DSWD-QMS-GF-005 - REV 05 - CSM Questionnaire English VersionDocument1 pageDSWD-QMS-GF-005 - REV 05 - CSM Questionnaire English VersionChrisAlmerRamosNo ratings yet