Professional Documents

Culture Documents

Philippines Food Industry

Uploaded by

SAKefronOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippines Food Industry

Uploaded by

SAKefronCopyright:

Available Formats

Market Survey

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

PHILIPPINES FOOD INDUSTRY

2018-2019

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

FIT Manilla

Mrs Mia Santamaria Abela

Embassy of Belgium

Walloon & Brussels-Capital Export Agency

Multinational Bancorporation Centre 6805, Ayala Avenue 9th Floor

Salcedo Village 1227 Makati City - Metro Manila – Philippines

T: +63 88 43 69 82

manille@awex-wallonia.com

www.flandersinvestmentandtrade.com

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 2 van 14

SUMMARY

1. Introduction ......................................................................................................................................................................... 4

1.1 Fast Facts 4

2. Food Industry sub-sectors .......................................................................................................................................... 5

2.1 Philippine food retail sector - overview 5

2.1.1 Major Food Retailers in the Philippines 5

2.1.2 Convenience Stores 7

2.2 Philippine food service sector 8

2.3 Philippine food processing sector 9

3. Industry prospects – Products with strong potentials ......................................................................... 10

3.1 Food products with convenience - instant or “convenience” foods 10

3.2 Functional foods - healthy, natural & organic products 10

3.3 Gourmet products 10

3.4 Prepared food and beverage 10

3.5 “Double” products 10

3.6 Innovative ingredients and raw materials 10

4. Market Structure and Entry Strategy for Exporters ................................................................................ 11

5. Regulatory Systems and Import Requirements .......................................................................................... 11

5.1 Import regulations for agriculture and processed food products 11

5.2 New taxation on sweetened beverages 12

6. Sources :................................................................................................................................................................................ 14

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 3 van 14

1. INTRODUCTION

The Philippines is a robust, dynamic and growing market for imported food and beverages with total imports of

consumer oriented products exceeding US$ 1B annually. Consumption growth is underscored by the country’s

expanding economy that is expected to continue to grow at an average rate of 6-7 % in 2018-2022 and to remain

one of Asia’s top growth performers. The government’s commitment to intensify public investment and

infrastructure is expected to support this economic growth forecast and bolster job creation, poverty reduction and

further increase in consumption. The food and beverage sector of the Philippines, which accounts for 10% of the

GDP, is one of the top contributors to the country’s economic growth.

Factors that foster the growth of the food sector, covering retail, food service and food manunfacturing: population

growth, rising middle income earners, increasing number of dual-income families, higher disposable incomes, a young,

fast-growing, highly-urbanized population with increasingly sophisticated tastes and ever-growing access to

supermarkets and fast changing lifestyle, increasing frequency of “dining out”, higher awareness of food quality and

safety. Rising remittances from Philippine overseas workers and the burgeoning business process outsourcing (BPO)

sector likewise contribute to the growing disposable income among the middle class.

The capital city Manila represents a big share in the sales, although the growing economic activities in the regional

urban areas also contribute to the expansion of the sector.

E-commerce is also gaining grounds and contributes to the sales growth.

1.1 FAST FACTS

Population: 105.25M (July 2018 est.)1 ; annual growth rate = 1.6%

Urban population: 46.9% of total population; 13.48 million in the capital of Manila (2018)

Rate of urbanization: 1.99% annual rate of change (2015-20 est.)2

53% of the population is below 24 years old

High literacy: 96% of the 69 million Filipinos that are 15 years old and above can read and write

Potential customers: at least 20 million people3

Household expenditure on food and non-alcoholic beverage – 42% on an annual basis4

Food and drinks spending is expected to show a strong growth of 8 % annually

High awareness of and preference for imported products

Growing demand for “healthy,” organic, gourmet and convenience foods

Steady growth in retail, foodservice and food processing industries

1

CIA World Fact Book , https://www.cia.gov/library/publications/the-world-factbook/geos/rp.html

2 Ibid

3 US Agriculture Service GAIN Report RP 1903-Robust Opportunities in Philippine Food and Beverage Processing Industry, Maria Ramona C.

Singian, 12 March2019 https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Food%20Processing%20Ingredients_Manila_Philippines_3-12-

2019.pdf

4 Philippine Statistics Authority, Household Final Consumption Expenditure by Purpose http://psa.gov.ph/nap-press-

release/sector/Household%20Final%20Consumption

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 4 van 14

2. FOOD INDUSTRY SUB-SECTORS

2.1 Philippine food retail sector - overview

The Philippines’ robust economic performance of the past years continues to support the growth of the well-

established food retail industry. Sales from the domestic retail market increased by 5.4% to US$ 50 billion (from the

2017 record of US$ 47.4 billion5) and were driven by rising income and a growing young population.

While domestically produced items account for about 80% of the total food supply and the remaining 20% of the

supply is imported, food retailers remain very optimistic concerning the competitiveness of imported products6.

Though there is a strong campaign to buy local products, Filipinos have strong preference for imported products.

The growing sophistication among consumers, demand for gourmet and healthy foods, frozen foodstuff, ready-

to-cook food, processed grocery items, and other food ingredients for home meal replacement is increasing.

Expenditure on food and non-alcoholic beverages reached PhP 5.472 trillion in 2018 accounting for 42.5 % of the total

household expenditure representing a 12% growth rate7 from 2017. The sector’s rapid modernization and expansion

led to the increase of upscale supermarket chains throughout the country and improvement of cold chain and

distribution systems that allow better storage options for imported food that offers superior quality, variety and

reliability to the generally more upscale and demanding supermarket customers.

These retail chains provide lucrative opportunities for imported and high-value food items in the Philippines through

their fast product turnover, growth and wide market base. Retail is expected to account for 20 % of the Philippines’

GDP by 2025, as the BPO industry helps boost the local economic growth.

The market share of hypermarkets and superstores (which accounts for 30% of retail food sales) is likewise increasing.

Though the staple foods in the Philippines are rice, fish, seafood, fruits and vegetables, changes in the local market

trends result in an increasing presence of hypermarkets and superstores as well as a continuous growth in the food

service industry. Due to the rapid increase in sales of about 10 to 20% in a 10-year span for major players in the

retail food industry, operators have continuously expanded to urban and key provincial areas to widen their

consumer base and geographical reach. The food retail giants and chains dominate the food retail business wherein

competition has been minimized as new stores were opened and acquisitions of smaller local supermarket chains

were made.

Online grocery retailing is getting more popular in the Philippines. In 2018, the sector saw not only grocery retailers

starting to launch their own e-commerce, but also third party marketplaces introducing a dedicated platform for

online grocery sales. Efficient service, speedy delivery and a wide assortment of products will be necessary for the

continued growth of online grocery retailing over the coming years.

2.1.1 Major Food Retailers in the Philippines

SM Markets maintained its lead in the Philippine modern retailing amid the strong competition in the food retail

industry with a total of 310 stores.

o SM Supermarket or Super Value Inc. is the pioneer brand of the food retail group SM and primarily located inside

SM Malls.

5

Philippines food retail sector to hit $50 billion sales, Louise Maureen Simeon (The Philippine Star) - July 22, 2019

https://www.philstar.com/business/2019/07/22/1936651/philippines-food-retail-sector-hit-50-billion-sales#ruqoE3OFKumFBmjZ.99

6

2019 Food Retail Sectoral Report, Joycelyn Claridades Rubio,8 July 2019

https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Retail%20Foods_Manila_Philippines_7-8-2019.pdf

7

Own computation based on the Philippine Statistics Authority, Household Final Consumption Expenditure http://psa.gov.ph/nap-press-

release/sector/Household%20Final%20Consumption ; http://openstat.psa.gov.ph/

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 5 van 14

o The SM Hypermarket is the stand-alone large format destinations with 50/50 food/non-food mix offering more

than 150,000 brands of merchandise or SKUs with the aim to allow customers to satisfy all their routine shopping

needs in one trip.

o SM’s SaveMore is a stand-alone mid-sized format that is expanding nationwide.

o WalterMart - mid-sized format tenant – is one of the youngest and fastest-growing supermarket chains in the

Philippines with locations in Metro Manila, Central and South Luzon. Walter Mart Supermarket signed a joint

venture with SM Investment Corporation in 2013 and is the only member supermarket of International Grocers

Alliance (IGA) in the Philippines.

o Alfamart, a joint-venture with an Indonesian partner, has the mini-mart format providing supermarket goods

and prices in neighborhood locations

SM Supermarket: Footprint Expansion Opportunity8 nationwide

Stores # of Stores GSA (sqm) Average

SM Supermarket 57 360,250 6,320

SM Hypermarket 53 353,675 6,673

SaveMore 194 530,057 2,732

Waltermart 52 145,263 2,794

Alfamart 578 104,528 181

Robinsons Supermarket is the 2nd largest supermarket chain in the country with 252 stores and 499 convenience

stores as of end 2018, consisting of Robinsons Supermarket (mainstream), Robinsons Easymart (minimart), Robinsons

Selections (premium), Jaynith’s (cash & carry) and acquired stores from Rustan’s Supercenter Inc brands “Marketplace

by Rustan’s”, “Rustan’s Supermarket”, “Shopwise Hypermarket”, “Shopwise Express” and “Wellcome”.

Robinsons Retail Holdings, Inc. (RRHI) successfully acquired a 100 % stake in Rustan Supercenters, Inc. (RSCI) on

November 23, 2018.

Robinson’s Supermarket business segment9

Robinson’s Robinson’s Robinson’s Rustan’s Jaynith’s Convenience

Supermarket Selection Easymart Supercenter Inc Supermarket Store (Ministop)

136 3 22 88 3 499

Robinson’s Supermarket : Footprint Expansion Opportunity nationwide10 (1H 2019)

Stores Metro Manila Luzon Visayas Mindanao

Supermarket 114 87 38 16

Convenience Stores 339 156 23 -

Puregold Price Club Inc. (PPCI) is a chain of supermarkets established in 1998 and has grown into a giant retail chain

with 409 stores nationwide.

With 537,965 m² net selling area of stores11 Puregold Price Club Inc. also owns S&R Membership Shopping and S&R

Quick Service Restaurants - the first U.S.-based chain to enter the Philippines in 2001 after the passage of the 2000

Philippine Retail Trade Liberalization Law.

8

SM Investors Presentation , June2019 -

https://sminvestments.com/sites/default/files/investor_relations/3M2019%20Investor%20Presentation_06012019.pdf

9

Robinsons Retail Holdings Inc., 2018 Annual Report http://www.robinsonsretailholdings.com.ph/annualreport2018/view-pdf/

10

Robinsons Retail Holdings Inc., 1H2019 Unaudited Earnings Results 1 August 2019, http://www.robinsonsretailholdings.com.ph/investor-

relations/category-investor-presentations

11

Puregold Price Club Inc. Annual Report 2018- http://www.puregold.com.ph/index.php/annual-corporate-governance-report/

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 6 van 14

Puregold Stores12 Metro Manila Luzon Visayas Mindanao

Puregold Supermarket /Hypermart 125 194 25 10

S & R Membership Shopping 7 5 2 2

S & R QSR 25 9 4 1

* NE Bodega and Budgetlane Stores are converted to Puregold Stores in 2018

METRO Retail Stores Group Inc. (MRSGI) more known as Metro (Gaisano) is a family-owned business way back in 1949

and a premier homegrown retailer from Cebu which have steadily grown to become the market leader in the

Visayas region.

Through the years, it has expanded from Cebu to Manila and to rest of the country.

Its supermarket business is operated under two brand names “Metro Supermarket” and “Metro Fresh N Easy,”

collectively referred as “Metro Supermarket.” The Metro Fresh N Easy brand name is used for smaller scale

supermarkets serving as neighborhood stores. While its hypermarket retail format is operated under the name

“Super Metro”, a hybrid between our supermarkets and department stores, providing a broad assortment of basic

everyday products at value prices and is supported by the same distribution centers as of its supermarkets and

department stores. As of end of end 2018, it operates 28 supermarkets and 13 hypermarkets with a total net selling

space of 47,940 m² for the supermarket and 45,326 m² for the hypermarkets13

Metro Gaisano stores14 Metro Manila Luzon Visayas Mindanao

Metro Gaisano Supermarket 7 4 17 0

Metro Hypermart 4 9 0

Landers Superstore, a new player on the modern food retail market, opened its first store in 2016. It is also a

membership shopping superstore similar to the S&R Membership Shopping that offers a wide variety of imported

products (food and non-food) that are usually not found in other major local supermarkets chains. Today, it has 5

branches : 4 in Metro Manila and 1 in Cebu.

2.1.2 Convenience Stores

Outside large-scale shopping centers, the growth of smaller retail outlets such as convenience stores and food and

beverage outlets is also expanding quickly.

The demand for convenience stores has been spurred by the ongoing proliferation of commercial areas, construction

of office and residential buildings, the bullish Business Process Outsourcing sector (BPO – call centers) and the hectic

lifestyle.

These convenience stores are mostly located in the business centers, BPO hubs and residential condominiums and

operate on a 24-hour basis. Aside from well-stocked shelves of ready-to-eat meals, packaged food, beverages and

other basic household necessities, convenience stores also offer other services such as bill payment and mobile phone

12

Ibid

13 http://www.metroretail.com.ph/images/pdf/0522018/MRSGI_SEC_Form_17_A_2018.pdf

14 Metro Retails Group Inc http://www.metroretail.com.ph/images/pdf/ANNUALREPORT_2015/MRSGI_2018_ANNUAL_REPORT.pdf

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 7 van 14

reloading transactions. Convenience Stores and Gas Marts, which are mainly location-oriented, are thus able to sell

products at a premium in exchange for convenience.

Among retail channels, convenience stores led the growth of modern grocery retailers. Competition has intensified

in the convenience store business with the entry of new brands that sought to challenge the two leading market

players 7-Eleven and Mini-Stop, run by Philippine Seven Corp. (PSC) and Robinsons Retail Holdings Inc. (RRHI)

respectively. Aside from Family Mart, the Puregold group also brought another foreign brand Lawson into the local

market while the SM group brought in the Indonesian brand Alfamart. Real estate magnate Manuel Villar has also

built his own convenience store network using his own brand “All Day.” 15 The Mercury Drug Corporation is primarily

the leading drugstore chain in the Philippines which has eventually evolved into a combination of drugstore and

convenience store that sells healthcare and personal care products, including medical devices and basic everyday

needs.

2.2 Philippine food service sector

The Philippine food service sector remains strong, brought about by the growing demand for convenience with the

growing urbanization across the country and increasing busy lifestyles pushed consumers to buy cooked foods or

simply dine out. The worsening traffic and transportation issues resulted to the growth of home delivery or

takeaway outlets. The steady growth of the sector has been spurred by the proliferation of shopping centers, the

robustly expanding horeca sector, the aggressive expansion of retail chain operators, the booming tourism industry,

the growing affluence of a “frequent snacking” culture, the liberalized retail trade landscape and to some extent the

reduction in import duties. All this created opportunties and increased food service sales.

In a 5 year period, restaurants and food service activities are continuously expanding. In 2018, the number of food

establishments increased to 86,812 while sales reached US$ 13 billion, registering an annual growth average of 8%.16

Of all the food service outlets in the country, chained operators still lead in value terms. “Chained operators

accounted for the majority value share in 2017 as they capitalized on consumer familiarity and brand loyalty. Chained

operators also benefit from Filipinos’ increasing interest in franchising,” 17 wherein the number of foreign brands

continues to grow in the Philippine food service industry. Among chain players, local operator Jollibee Foods

Corporation leads with its wide portfolio of leading fast food brands. Other important players include Golden Arches

Development Corp (with the McDonald’s brand), Yum! Brands, (Pizza Hut and KFC), Max’s Group, and Shakey’s.

Starbucks Corp. also joined the list of top companies in the food service industry. In recent years, there is also the

entry of international brands of the same format into the local dining scene.

The growing middle class results to bigger demand for a wider range of good food and high quality products. The

increasing average disposable income, coupled with the rise of value-oriented dining, helped to encourage customers

higher spending and eat out more often. Dining-out expenditure have increased dramatically in the past years and

accounts for 15 % of total family expenditure.

Upscale restaurants, malls, fast-food chains, cafes and Western-style dinners require high-quality F&B products such

as meat, poultry, seafood, dairy products, processed fruits and vegetables, fruit juices, dried fruits, nuts, wine and

craft beer. Restaurant operators are keen on introducing new and exciting menu offerings to attract customers.

Food service players focus on attracting millennials who comprised one third of the country’s population and are

recognized as the biggest spenders. Given this, this consumer group continues to inspire innovations within the food

service industry. More digital initiatives will be seen from the industry players to extend their reach, especially on

social media.

15 Philippine Daily Inquirer, “Ayala Land, SSI mull options on FamilyMart”, Doris Dumlao-Abadilla, http://business.inquirer.net/238290/ayala-land-

mulls-options-familymart#ixzz4yTha3BBT

16

US GAIN Report, Food Service - Hotel Restaurant Institutional, 2018 HRI Food Service, by Joycelyn Claridades Rubio, 11 October 2018

(https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Food%20Service%20-%20Hotel%20Restaurant%20Institutional_Manila_Philippines_10-17-2018.pdf

17

A taste of the country’s food service industry, Mark Louis F. Ferrolino, 25 May 2018 https://www.bworldonline.com/a-taste-of-the-countrys-

food-service-industry/

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 8 van 14

2.3 Philippine food processing sector

Food accounts for nearly half of the total output of the country’s manufacturing sector. With an average annual

growth rate of 8-10%, the food manufacturing industry has been identified by the Philippine government as a priority

sector for attracting foreign investment under special economic zones.

The growing consumption contributes to the rapid production expansion of processed foods and beverages which

presents excellent opportunities for raw materials and high-value ingredients. In 2018, the Philippine food and

beverage processing industry’s gross value-added output increased by 7.6% (at constant price) over the previous

year18 to $ 32.5 billion and grew with 31 % over the past five years (2014–2018).19

About 90% of the F&B processing industry’s output is consumed domestically, with excellent growth prospects

stemming from the country’s resilient economy and strong consumer base20. In addition, as quality and efficiency

continue to improve, the Philippines will be in a position to exploit export opportunities due to its strategic location

and association in various free trade agreements. While most of the roughly 500 F&B processors registered under

the Philippine Food and Drug Administration are micro to medium-sized businesses, food processors are also among

the largest corporations in the country21.

18 National Accounts of the Philippines, Philippine Statistics Authority. TABLE 32B. GROSS VALUE ADDED IN MANUFACTURING BY INDUSTRY

GROUP - https://psa.gov.ph/system/files/Q1%202019%20NAP_Publication.pdf

19

US Agriculture Service GAIN Report RP 1903-Robust Opportunities in Philippine Food and Beverage Processing Industry , Maria Ramona C.

Singian, 12 March2019 https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Food%20Processing%20Ingredients_Manila_Philippines_3-12-

2019.pdf

20EU-Philippines Business Network, Philippine Food & Beverage Webinar, 17 January 2017

US Agriculture Service GAIN Report -Prospects for U.S. Ingredients in Burgeoning Philippine Food Processing Industry; prepared by Maria

21

Ramona C. Singian, 11 October 2017

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 9 van 14

3. INDUSTRY PROSPECTS – PRODUCTS WITH STRONG

POTENTIALS

3.1 Food products with convenience - instant or “convenience” foods

Because of the country’s bullish Business Process Outsourcing industry (BPO) that operates around the clock

and the rise in the number of women joining the workforce, traders report strong demand in products that can

be classified as “convenient” including snack foods, meal-replacements and ready-to-drink beverages. The

Philippines is a large market for snack foods, consisting mainly of corn chips, chocolates, potato chips, sweet

biscuits, popcorn and confectionery.

3.2 Functional foods - healthy, natural & organic products

Retail stores have been increasing shelf-space to accommodate the growing number of new-to-market healthy,

natural and organic products because of the rise in disposable income and the strong consumer trend towards

health, wellness and beauty. Also referred to as nutraceuticals or para-pharmaceuticals, products targeting

beauty, slimming and or fat-inhibition have high potential.

3.3 Gourmet products

Most retailers maintain a gourmet section including products such as meat, seafood, fruits & vegetables,

specialty cheeses, sauces & condiments, herbs & spices, wines, craft beers and other beverages, dried fruits &

nuts, specialty biscuits, snack foods and chocolate & confectionery. There are several independent operators of

gourmet shops within high-end neighborhoods.

3.4 Prepared food and beverage

Traders report growth in sales of baking ingredients such as cocoa products, pre-mixes, jams and jellies and

flavorings due to the proliferation of small bakeshops that sell premium-quality artisanal baked goods.

3.5 “Double” products

Double products: dairy, meat and meat products, frozen and processed vegetables, frozen and processed fruits.

These products are in high demand as these have become standard menu offerings and ingredients in the food

service sector. In addition to being consumed directly, meat products as ingredients are used by the Philippines’

booming food processing industry*22. Frozen potatoes/French fries are highly in demand.

3.6 Innovative ingredients and raw materials

Ingredients and materials for further processing.

22

Note: Temporary ban on importation of pork meat due to African Swine Fever (AFS) per DA Memo Order # 31s.2018

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 10 van 14

4. MARKET STRUCTURE AND ENTRY STRATEGY FOR

EXPORTERS

Generally, as a common and preferred practice in the industry, retailers - especially the larger chain operators

- source from importers/distributor/trading firms. Although, these retailers also import directly for their own

retail outlets or have exclusivity of products e.g. in the membership shopping, private label arrangement.

Big food and beverage processors in the Philippines import full-container loads of agricultural raw materials

and ingredients directly, while smaller processors purchase from importers and distributors.

Horeca customers rarely import F&B products directly, except for a few fastfood chains. The importation is

done mostly by importers and a few retailers. Importers distribute directly to HRI customers or appoint sub-

distributors.

Exporters may also prefer to work with importers instead of setting up a local company in the country.

Most of the importers are based in Metro Manila and manage their own distribution, while others appoint

independent distributors to cover the country’s key provincial areas.

Importer/distributors are in direct contact with big supermarkets, hyper-marts and wholesale clubs. They

have their own distribution network and at times act as the distributor themselves. They are more

knowledgeable about the importation procedures and regulations.

Quite a number of importers distribute to the wet market. Wet markets carry lower value cuts of meat and

poultry products and other products such as frozen potatoes, fruits and vegetables, and other ingredients.

Exclusive distributorship agreements are preferred by Philippine importers. Although exporters can work with

one or several importers provided that the market coverage of each importer is properly identified.

Maintain close contact with your Philippine importers and support efforts to introducing the products to

foodservice customers by participating in technical seminars, product demonstrations, and local trade shows.

Regular market visits are also highly valued by Philippine importers and regarded as a show of support.

Releasing goods from Philippine Customs sometimes poses a challenge.

Expect higher volume of orders from September to December as importers stock-up for the Christmas season

(which is marked by higher consumer spending).

5. REGULATORY SYSTEMS AND IMPORT REQUIREMENTS

All imported food and agricultural products are required to comply with the Philippines’ food health and

phytosanitary laws. In general, none of these products is allowed to enter the Philippines if it is deemed to pose a

danger to human life or well-being, either directly or indirectly.

All food and agricultural products, including plant products that enter the Philippines, are required to pass

through procedures designed to check that they are not contaminated with any pest and that they are fit for

their intended use.

Philippine food regulations are generally patterned after CODEX Alimentarius Commission guidelines as well as

regulations established by the FDA and respective government Departments.

The health and phytosanitary regulations and procedures applied on imported agriculture and food products are

broadly similar for all types of products. Under Philippine import laws, it is the responsibility of the exporter and

importer to ensure that any product entering the country’s customs territory is in full compliance with Philippine

health and phytosanitary regulations. The enforcing authorities will check for compliance by inspecting the goods

and relevant import/export documentation and decide on whether the goods may enter the Philippines.

5.1 Import regulations for agriculture and processed food products

It is important to highlight that all food and beverage products must be registered with the Philippine Food and Drug

Administration (FDA) prior to the sale and or distribution into market. Registration of imported products may only

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 11 van 14

be undertaken by a Philippine entity. Importation of products can only be done once FDA registration is completed

(a License to Operate (LTO) and a Certificate of Product Registration (CPR) have been issued to the importer).

Products have been divided into two categories with distinct sets of registration requirements and procedures.

Imported food products are as Category I and II with distinct sets of registration requirements and procedures.

Laws and Regulations pertaining to all regulated food can be accessed at the Food and Drug Administration (FDA)

website : http://www.fda.gov.ph/

The Department of Agriculture has jurisdiction over the importation of fresh and frozen meat and meat products,

fruits, vegetables and seafood products, while the Food and Drugs Authority has jurisdiction over importation of

processed meat and meat products like meat and meat products.

Laws and Regulations pertaining to the import of fresh fruits and vegetable products and other related agriculture

commodities can be accessed at the Department of Agriculture website : www.da.gov.ph.

As there are regular changes in the rules and regulations on the importation of food products, it is recommended

that the exporter contacts the Belgian Trade Office in Manila for further information or assistance.

5.2 New taxation on sweetened beverages 23

Republic Act (RA) 10963: Tax Reform for Acceleration and Inclusion (TRAIN) – Sweetened Beverages [Section 150B of

the Tax Code] imposes a tax per liter of volume capacity on sweetened beverages effective 01 January 2018.

Sweetened Beverages (SBs): refer to non-alcoholic beverages of any constitution (liquid, powder or concentrates),

that are pre-packaged and sealed in accordance with the Food and Drug Administration (FDA) standards, that

contain High Fructose Corn Syrup (HFCS) and other caloric and/or non-caloric sweeteners added by the

manufacturers.

Using purely caloric sweetener, purely non-caloric PHP 6.00/liter

sweetener or a mixture of both

Using purely high-fructose corn syrup or in PHP 12.00/liter

combination with any caloric or non-caloric

sweetener

Using purely coconut sap sugar /purely steviol exempt

glycosides

Subject to Excise Tax

Sweetened juice drinks;

Sweetened tea;

All carbonated beverages;

Flavored water;

Energy and sports drinks;

Other powdered drinks not classified as milk, juice, tea and coffee;

Cereal and grain beverages;

Other non-alcoholic beverages that contain added sugar

23

TRAIN Briefing on Sweetened Beverages conducted by the Bureau of Internal Revenues, 15th EPBN Food and Beverage Committee Meeting,

25 January 2018

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 12 van 14

The following products are not considered excisable products under this provision:

All milk products including infant & formula milk, soymilk, flavored milk, etc.

100% natural fruit juices without added sugar/caloric sweetener

100% natural vegetable juices without added sugar/caloric sweetener

Meal replacement and medically indicated beverages for oral nutritional therapy

Ground, instant soluble and pre-packaged powdered coffee products

Persons Liable

Manufacturer

Owner or possessor of untaxed products

Importer

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 13 van 14

6. SOURCES :

Organisations

Philippine Statistics Authority – www.psa.gov.ph | http://openstat.psa.gov.ph/

CIA World Fact Book, Philippines https://www.cia.gov/library/publications/the-world-

factbook/geos/rp.html

Food and Drug Authority – www.fda.gov.ph

Department of Agriculture – www.da.gov.ph

US DA Foreign Agricultural Services GAIN Reports :

o Robust Opportunities in Philippine Food and Beverage Processing Industry, Maria Ramona C.

Singian, 12 March2019

o 2019 Food Retail Sectoral Report, Joycelyn Claridades Rubio,8 July 2019

o 2018 HRI Food Service, Joycelyn Claridades Rubio, 11 October 2018

o U.S. Ingredients in Burgeoning Philippine Food Processing Industry, Maria Ramona C. Singian, 11

October 2017

Newspapers

The Philippine Star (www.philstar.com)

Philippines food retail sector to hit $50 billion sales, Louise Maureen Simeon, July 22, 2019

BusinessWorld Publishing – www.bworld.com.ph

A taste of the country’s food service industry, Mark Louis F. Ferrolino, 25 May 2018

Philippine Daily Inquirer – www.inquirer.net

Ayala Land, SSI mull options on FamilyMart, Doris Dumlao-Abadilla, October 09, 2017

Corporate Profiles and Presentations

SM Investment Corporation - 2018 Annual Report and Investors Presentation - June 2019

https://sminvestments.com/investor-relations/annual-reports

https://sminvestments.com/sites/default/files/investor_relations/3M2019%20Investor%20Presentation_0601201

9.pdf

Robinsons Retail Holdings Inc. - 2018 Annual Report and 1H2019 Unaudited Earnings Results 1 August 2019

http://www.robinsonsretailholdings.com.ph/annualreport2018/view-pdf/

http://www.robinsonsretailholdings.com.ph/investor-relations/category-investor-presentations

Puregold Price Club Inc. - Annual Report 2018

http://www.puregold.com.ph/index.php/annual-corporate-governance-report/

Metro Retail - Metro Retail Stores Group, Inc. - Annual report

http://www.metroretail.com.ph/index.php/disclosures/annual-reports

The information in this publication is provided for background information that should enable you to get a picture of the subject treated in this

document. It is collected with the greatest care based on all data and documentation available at the moment of publication. Thus this

publication was never intended to be the perfect and correct answer to your specific situation. Consequently it can never be considered a legal,

financial or other specialized advice. Flanders Investment & Trade (FIT) accepts no liability for any errors, omissions or incompleteness, and no

warranty is given or responsibility accepted as to the standing of any individual, firm, company or other organization mentioned.

Date of publication: 11/2019

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25.11.2019 Philippines Food Industry pagina 14 van 14

You might also like

- Business Startup Practical Plan PDFDocument70 pagesBusiness Startup Practical Plan PDFShaji Viswanathan. Mcom, MBA (U.K)No ratings yet

- Gas Grill Cookbook The Gas Grill Bible For Successful Grilling For Beginners and Advanced Users With 107 RecipesDocument162 pagesGas Grill Cookbook The Gas Grill Bible For Successful Grilling For Beginners and Advanced Users With 107 Recipesaleksandra100% (1)

- Business Plan For A Commercial Teff Farm in Ethiopia PDFDocument81 pagesBusiness Plan For A Commercial Teff Farm in Ethiopia PDFbefekadu tsegaye100% (1)

- 2 1174 Original Famous People in Computer History 1deb09Document1 page2 1174 Original Famous People in Computer History 1deb09Sariephine Grace ArasNo ratings yet

- The Philippine Bamboo Industry Development RoadmapDocument58 pagesThe Philippine Bamboo Industry Development Roadmapjuvethjane100% (2)

- How A Realist Hero Rebuilt The Kingdom - Volume 1Document231 pagesHow A Realist Hero Rebuilt The Kingdom - Volume 1Stevano Suoth100% (2)

- Code of Good Animal Husbandry Practices For Poultry PDFDocument23 pagesCode of Good Animal Husbandry Practices For Poultry PDFAngelito Dela CruzNo ratings yet

- Project Proposal Almunium Profile Manufacturing Plant: Project To Be Implemented in Galan Town, Oromia Region StateDocument37 pagesProject Proposal Almunium Profile Manufacturing Plant: Project To Be Implemented in Galan Town, Oromia Region StateTesfaye Degefa50% (2)

- Organized Agri Food Retailing India 2011Document141 pagesOrganized Agri Food Retailing India 2011novateurNo ratings yet

- Mangaon Ta!: Biliran Province State UniversityDocument11 pagesMangaon Ta!: Biliran Province State UniversityDanjever Buen LumbreNo ratings yet

- Food & Beverage MyanmarDocument43 pagesFood & Beverage MyanmarMyo Pa Pa Nyein0% (1)

- Ethiopian Meat and Dairy Industry Development Institute - Feasibility Study For The Establishment of Animal Feed Processing PDFDocument21 pagesEthiopian Meat and Dairy Industry Development Institute - Feasibility Study For The Establishment of Animal Feed Processing PDFTSEDEKE100% (7)

- Small - Scale - Cashew - Processing - Sample Project ReportDocument22 pagesSmall - Scale - Cashew - Processing - Sample Project ReportIshaan nautiyalNo ratings yet

- Business Plan... Org.Document16 pagesBusiness Plan... Org.georgesways247No ratings yet

- Vegitable and FruitDocument38 pagesVegitable and FruitRedwan100% (4)

- Project Proposal On The Establishment of Animal Feed Producing Plant in Gondar Zuriya Woreda Maksegnit TownDocument44 pagesProject Proposal On The Establishment of Animal Feed Producing Plant in Gondar Zuriya Woreda Maksegnit TownTesfaye Degefa100% (3)

- Final Report of Goat FarmingDocument28 pagesFinal Report of Goat FarmingUsman Tariq100% (2)

- C1 Advanced Reading Worksheet - 6 - PlusDocument7 pagesC1 Advanced Reading Worksheet - 6 - Plusmixtapemade.llcNo ratings yet

- NESTLÉ PHILIPPINES, INC. - Group 4Document31 pagesNESTLÉ PHILIPPINES, INC. - Group 4Abby VillagraciaNo ratings yet

- W530 Megaworld CorporationDocument38 pagesW530 Megaworld CorporationSariephine Grace Aras100% (1)

- Doing Aquaculture as a Business for Small- and Medium-Scale Farmers. Practical Training Manual. Module 2: The Economic Dimension of Commercial AquacultureFrom EverandDoing Aquaculture as a Business for Small- and Medium-Scale Farmers. Practical Training Manual. Module 2: The Economic Dimension of Commercial AquacultureNo ratings yet

- A Research Paper On Megaworld, IncDocument33 pagesA Research Paper On Megaworld, IncSariephine Grace Aras100% (1)

- Marketing Plan of A Dairy CompanyDocument45 pagesMarketing Plan of A Dairy CompanyAgesh Eileen Palmer69% (32)

- 2019 - Animal Nutrition Market in PeruDocument15 pages2019 - Animal Nutrition Market in PeruMarkus_MardenNo ratings yet

- PCC Issues Paper 2021 03 Issues Paper On The Philippine Milk Products IndustryDocument38 pagesPCC Issues Paper 2021 03 Issues Paper On The Philippine Milk Products Industryalexander tabacNo ratings yet

- Arsi University College of Business and Economics Department of Accounting and FinanceDocument13 pagesArsi University College of Business and Economics Department of Accounting and FinanceTilahunNigusieNo ratings yet

- Seaweed in NTB West PapuaDocument17 pagesSeaweed in NTB West PapuaSlamet AbdullahNo ratings yet

- Dimalupig & Gabrielle: Marketing PlanDocument24 pagesDimalupig & Gabrielle: Marketing PlanErika May RamirezNo ratings yet

- 10 .Kelemwork Addis .05382/09: Dugna AnleyDocument24 pages10 .Kelemwork Addis .05382/09: Dugna AnleyGetie TigetNo ratings yet

- SWOT Analysis of Food Industry in Nepal PDFDocument19 pagesSWOT Analysis of Food Industry in Nepal PDFPankaj DahalNo ratings yet

- SWOT Analysis of Food Industry in Nepal 1Document20 pagesSWOT Analysis of Food Industry in Nepal 1Pankaj DahalNo ratings yet

- Processed Mango Pearl State of The Sector Report 2004Document104 pagesProcessed Mango Pearl State of The Sector Report 2004Neil Jonathan NaduaNo ratings yet

- The Food and Beverage Market in Hong KongDocument30 pagesThe Food and Beverage Market in Hong KongSam McNallyNo ratings yet

- Frijoles EnlatadosDocument66 pagesFrijoles EnlatadosAnonymous Pbd6gdPszNo ratings yet

- 2017 EIBN Sector Report Food and BeverageDocument47 pages2017 EIBN Sector Report Food and BeverageRizky PriantamaNo ratings yet

- Learn More About African Organic Agriculture 294094f7 001 L0C0Document27 pagesLearn More About African Organic Agriculture 294094f7 001 L0C0Fatimah BerlianaNo ratings yet

- ESW0 P1200 Ussen 000 June 02102011Document131 pagesESW0 P1200 Ussen 000 June 02102011Michael LangatNo ratings yet

- Group1 Topic7 Principle of mkt đã chuyển đổiDocument12 pagesGroup1 Topic7 Principle of mkt đã chuyển đổiTạ Trần Yến NhiNo ratings yet

- Group1 Topic7 Principle of mkt đã chuyển đổiDocument12 pagesGroup1 Topic7 Principle of mkt đã chuyển đổiTạ Trần Yến NhiNo ratings yet

- Review of The Dairy Industry in MauritiusDocument81 pagesReview of The Dairy Industry in MauritiusStephane RacineNo ratings yet

- The Beer Market in Peru 2018 PDFDocument43 pagesThe Beer Market in Peru 2018 PDFjadriazolaNo ratings yet

- Business Plan Savoury SnackDocument21 pagesBusiness Plan Savoury SnackKenneth MontoyaNo ratings yet

- 26-Final Fruit and Forest Plant Nursery Revised 17 FebDocument18 pages26-Final Fruit and Forest Plant Nursery Revised 17 FebMuaqeel NisarNo ratings yet

- Fruits Vegetables-Cannedfruits VegetablesDocument30 pagesFruits Vegetables-Cannedfruits VegetablesSarthak KarandeNo ratings yet

- Pre - Feasibility Study: Mushroom Production and ProcessingDocument13 pagesPre - Feasibility Study: Mushroom Production and ProcessingMuhammad RukhamNo ratings yet

- Major Project - Ics, Orion Food IndustryDocument105 pagesMajor Project - Ics, Orion Food IndustrySooraj GanapathyNo ratings yet

- Conservera EngDocument223 pagesConservera EngManuel TorresNo ratings yet

- Abbaa Karam NigaatuDocument27 pagesAbbaa Karam NigaatuMahamedsafaa Jihaad IbraahimNo ratings yet

- Market Survey Edited Final For Print 2607Document30 pagesMarket Survey Edited Final For Print 2607wanttobeanmacccNo ratings yet

- Deciphering The Impact of COVID-19 Pandemic On Food Security, Agriculture, and Livelihoods: A Review of The Evidence From Developing CountriesDocument6 pagesDeciphering The Impact of COVID-19 Pandemic On Food Security, Agriculture, and Livelihoods: A Review of The Evidence From Developing CountriesEndashawNo ratings yet

- Import Export Management ReportDocument32 pagesImport Export Management ReportChau AnhNo ratings yet

- FNP Strategy Dec 2019Document193 pagesFNP Strategy Dec 2019Abdiwak DiribaNo ratings yet

- Cats and DodsDocument42 pagesCats and DodsCA's HobbyNo ratings yet

- V.rmh.0091 Final ReportDocument36 pagesV.rmh.0091 Final ReportMwenjie TanNo ratings yet

- Hailu Ginchi FarmDocument54 pagesHailu Ginchi FarmRamon ColonNo ratings yet

- Business DevelopmentDocument12 pagesBusiness DevelopmentRobert Fagans SrNo ratings yet

- Business Planne NebretDocument20 pagesBusiness Planne Nebretmulieman100% (1)

- 5.horticulture Value Chain Assessment Jan 31 2013Document118 pages5.horticulture Value Chain Assessment Jan 31 2013Muhemmed AhmedNo ratings yet

- 15 Punjabi Potato Contract Farming For Pepsi India FormattedDocument17 pages15 Punjabi Potato Contract Farming For Pepsi India FormattedVineet SinghNo ratings yet

- Field Manual:poultry ProductionDocument26 pagesField Manual:poultry ProductionyididyaNo ratings yet

- Pectin Value ChainDocument32 pagesPectin Value Chainlabemanza03No ratings yet

- Business Economics and Analysis - VirangaDocument15 pagesBusiness Economics and Analysis - VirangadrakipdNo ratings yet

- Oduol Et Al. 2017.value Chain Development Strategies ReportDocument138 pagesOduol Et Al. 2017.value Chain Development Strategies ReportJudith Beatrice OduolNo ratings yet

- Packaged Food in MexicoDocument37 pagesPackaged Food in MexicoMarina VargasNo ratings yet

- Ey Report On The Takeaway Industry in IrelandDocument68 pagesEy Report On The Takeaway Industry in IrelandNi ShaNo ratings yet

- Sample BPDocument30 pagesSample BPABU YEROMENo ratings yet

- Class Schedule He 1 1st Sem 22-23Document2 pagesClass Schedule He 1 1st Sem 22-23Sariephine Grace ArasNo ratings yet

- Activity#2 Mosaic On My Self-PortraitDocument2 pagesActivity#2 Mosaic On My Self-PortraitSariephine Grace ArasNo ratings yet

- Bismillah Revisi-3 FixDocument110 pagesBismillah Revisi-3 FixSariephine Grace ArasNo ratings yet

- Profitability: TTM Vs 5 Year Average MarginsDocument3 pagesProfitability: TTM Vs 5 Year Average MarginsSariephine Grace ArasNo ratings yet

- GraphDocument2 pagesGraphSariephine Grace ArasNo ratings yet

- Competition and Market Structure in The Plastics CDocument42 pagesCompetition and Market Structure in The Plastics CSariephine Grace ArasNo ratings yet

- Sales and Marketing Plan: Min-Aesthetic PhcoDocument4 pagesSales and Marketing Plan: Min-Aesthetic PhcoSariephine Grace ArasNo ratings yet

- Group 2 Cardiovascular and Respiratory System of GymnastDocument19 pagesGroup 2 Cardiovascular and Respiratory System of GymnastSariephine Grace ArasNo ratings yet

- SARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxDocument8 pagesSARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxSariephine Grace ArasNo ratings yet

- Intermediate Accounting FormulasDocument2 pagesIntermediate Accounting FormulasSariephine Grace ArasNo ratings yet

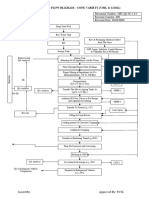

- Process Flow Diagram (Update)Document4 pagesProcess Flow Diagram (Update)sumon.dey.1494No ratings yet

- Lesson 05 A Letter To A PenfriendDocument2 pagesLesson 05 A Letter To A PenfriendMauricio Alejandro Rodriguez OlguinNo ratings yet

- Traditional Catalogue - 2019 - Lowres PDFDocument60 pagesTraditional Catalogue - 2019 - Lowres PDFFarshan SulaimanNo ratings yet

- Garlic Herb Pull-Apart Bread (Vegan) - Sarah's Vegan KitchenDocument3 pagesGarlic Herb Pull-Apart Bread (Vegan) - Sarah's Vegan Kitchenwv6bgjcz46No ratings yet

- Brief 2 AD Convention Center 2022Document6 pagesBrief 2 AD Convention Center 2022Utkarsh ShahNo ratings yet

- LG TMF Refrigerator (ENG)_240507_110934Document39 pagesLG TMF Refrigerator (ENG)_240507_110934cch5351No ratings yet

- 1st Summative Test Eng.6Document2 pages1st Summative Test Eng.6Lyneina Morales EmbalsadoNo ratings yet

- Multi Grade Lesson Plan in EnglishDocument16 pagesMulti Grade Lesson Plan in EnglishJulhan Gubat100% (1)

- 1588155056unit IV Heat Exchange EquipmentsDocument8 pages1588155056unit IV Heat Exchange EquipmentsPNo ratings yet

- Letter U5. T1. Act. 1Document3 pagesLetter U5. T1. Act. 1SANDRA BADILLO LUCERONo ratings yet

- Aiba Company PresentationDocument20 pagesAiba Company PresentationsuelaNo ratings yet

- Q1 Module 1 For Food and Beverage Services 10 Final MwcisDocument24 pagesQ1 Module 1 For Food and Beverage Services 10 Final MwcisJames Adrian MiloNo ratings yet

- Scottish DictionaryDocument713 pagesScottish Dictionarysmiruthi77No ratings yet

- Tourte de Seigle (100% Rye Bread)Document2 pagesTourte de Seigle (100% Rye Bread)alex moliniNo ratings yet

- Sticker Barang DapurDocument6 pagesSticker Barang DapurUmmi MuhammadNo ratings yet

- (Đề thi gồm 11 trang) : Thời gian làm bài: 180 phút (Không kể thời gian giao đề)Document11 pages(Đề thi gồm 11 trang) : Thời gian làm bài: 180 phút (Không kể thời gian giao đề)Productive MarsNo ratings yet

- Irregular Verbs Practice Fun Activities Games Grammar Drills 36574Document2 pagesIrregular Verbs Practice Fun Activities Games Grammar Drills 36574Olteanu NicoletaNo ratings yet

- TLE Group Sandwich Making Scoresheet (Rubrics)Document3 pagesTLE Group Sandwich Making Scoresheet (Rubrics)Elith Beatriz RomeroNo ratings yet

- CH 01Document28 pagesCH 01Brenda GutierrezNo ratings yet

- Mne CV 2014 OpDocument5 pagesMne CV 2014 OpGBG PogiNo ratings yet

- Comparative and SuperlativeDocument6 pagesComparative and SuperlativePiqa WeirdestNo ratings yet

- Found SITXFSA001 Student Assessment Tasks 07-07-20Document23 pagesFound SITXFSA001 Student Assessment Tasks 07-07-20Ramesh AdhikariNo ratings yet

- 1-Salient Features and List of Users of DietCalDocument5 pages1-Salient Features and List of Users of DietCalRahmathul BariNo ratings yet

- Syllogism Questions and AnswersDocument12 pagesSyllogism Questions and AnswersVivekananda SubramaniNo ratings yet

- Drug Study FinalDocument6 pagesDrug Study FinalJade HemmingsNo ratings yet

- Basics Command SkyrimDocument29 pagesBasics Command Skyrimkusuemon77No ratings yet

- Celavive & OralCare Presentation - CPT 2020 Slides - OptimizedDocument78 pagesCelavive & OralCare Presentation - CPT 2020 Slides - OptimizedDD CCNo ratings yet