Professional Documents

Culture Documents

Profitability: TTM Vs 5 Year Average Margins

Uploaded by

Sariephine Grace Aras0 ratings0% found this document useful (0 votes)

21 views3 pagesOriginal Title

graph (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views3 pagesProfitability: TTM Vs 5 Year Average Margins

Uploaded by

Sariephine Grace ArasCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

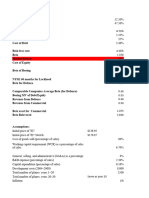

P/E Ratio TTM 9.61 36.

84

Price to Sales TTM 2.07 15.69

Price to Cash Flow MRQ 4.97 204.18

Price to Free Cash Flow TTM 4.71 4,344

Price to Book MRQ 0.49 5.37

Price to Tangible Book MRQ 0.49 6.25

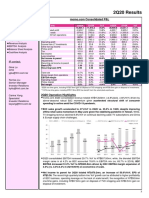

Profitability: TTM vs 5 Year Average Margins

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

Gross Margin Operating Margin Pretax Margin Net Profit Margin

TTM (%) Column1

Gross margin TTM 66.12% 35.81%

Gross Margin 5YA 63.82% 33.87%

Operating margin TTM 38.9% 23.54%

Operating margin 5YA 40.04% 26.39%

Pretax margin TTM 32.01% 32.58%

Pretax margin 5YA 35.42% 28.79%

Net Profit margin TTM 24.32% 24.43%

Net Profit margin 5YA 26.91% 23.34%

Revenue/Share TTM 1.37 147.42

Basic EPS ANN 0.3 17.56

Diluted EPS ANN 0.29 17.49

Book Value/Share MRQ 5.81 177.61

Tangible Book Value/Share MRQ 5.81 109.99

Cash/Share MRQ 1.26 69.95

Cash Flow/Share TTM 0.43 39.85

Revenue/Share TTM 1.37 147.42

Management Effectiveness: TTM vs 5 Year Average Margins

10.00%

9.00%

8.00%

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

Return on Equity Return on Assets Return on Investment

TTM (%) 5 Year Average

Return on Equity TTM 5.14% 12.84%

Return on Equity 5YA 8.7% 12.66%

Return on Assets TTM 2.92% 5.09%

Return on Assets 5YA 4.6% 5.86%

Return on Investment TTM 3.91% 8.31%

Return on Investment 5YA 5.99% 9.07%

EPS(MRQ) vs Qtr. 1 Yr. Ago MRQ -51.68% 18.57%

EPS(TTM) vs TTM 1 Yr. Ago TTM -46% 20.45%

5 Year EPS Growth 5YA -1.62% 17.82%

Sales (MRQ) vs Qtr. 1 Yr. Ago MRQ -47.6% 12.82%

Sales (TTM) vs TTM 1 Yr. Ago TTM -35.37% 8.96%

5 Year Sales Growth 5YA -0.59% 16.08%

5 Year Capital Spending Growth 5YA -37.64% 53.55%

EPS(MRQ) vs Qtr. 1 Yr. Ago MRQ -51.68% 18.57%

Asset Turnover TTM 0.12 0.22

Inventory Turnover TTM 0.13 1.86

Revenue/Employee TTM 43.20M 77.69M

Net Income/Employee TTM 10.50M 15.78M

Receivable Turnover TTM 0.98 1.65

Dividend Yield ANN 1.33% 0.99%

Dividend Yield 5 Year Avg. 5YA - 1.12%

Dividend Growth Rate ANN - 14.42%

Payout Ratio TTM 0% 8.36

You might also like

- GraphDocument2 pagesGraphSariephine Grace ArasNo ratings yet

- Advanced LNR RatiosDocument2 pagesAdvanced LNR RatiosJo MsManNo ratings yet

- Details: Art Technology Group IncDocument14 pagesDetails: Art Technology Group Incmer57rsNo ratings yet

- Comparative Analysis With Key Retail Sector OrganizationsDocument3 pagesComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Date of Analysis 8/29/2020: Dicount Rate 10y Fed Note %Document61 pagesDate of Analysis 8/29/2020: Dicount Rate 10y Fed Note %bysqqqdxNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- Portfolio Overview JUN 20th, 2020 Report DateDocument2 pagesPortfolio Overview JUN 20th, 2020 Report DateEstéfano ZárateNo ratings yet

- Aapl +0 08 $195 99Document1 pageAapl +0 08 $195 99Gisnelly LucianoNo ratings yet

- American Airline Case StudyDocument10 pagesAmerican Airline Case StudyFathi Salem Mohammed Abdullah100% (5)

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- Quarterly Results Q3FY 2011Document41 pagesQuarterly Results Q3FY 2011tamirisaarNo ratings yet

- Sarawak Plantation 100827 RN2Q10Document2 pagesSarawak Plantation 100827 RN2Q10limml63No ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- TH TH TH TH ST TH TH TH TH ST TH TH TH TH STDocument1 pageTH TH TH TH ST TH TH TH TH ST TH TH TH TH STNiraj DugarNo ratings yet

- Investor PPT March 2023Document42 pagesInvestor PPT March 2023Sumiran BansalNo ratings yet

- Hoàng Lê Hải Yến-Internal AuditDocument3 pagesHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnNo ratings yet

- Investor Update For December 31, 2016 (Company Update)Document17 pagesInvestor Update For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Trent LTD: Financials at A GlanceDocument1 pageTrent LTD: Financials at A GlanceAnnu AggarwalNo ratings yet

- Earth RhythmDocument8 pagesEarth Rhythmpankhuri wasonNo ratings yet

- Maruti Suzuki Q1FY19 Investor PresentationDocument14 pagesMaruti Suzuki Q1FY19 Investor PresentationRAHUL GUPTANo ratings yet

- Comparison ResultDocument3 pagesComparison ResultSanjhi ParasharNo ratings yet

- BCTA-RR (3QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (3QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Microsoft MSFT Stock Valuation Calculator SpreadsheetDocument15 pagesMicrosoft MSFT Stock Valuation Calculator SpreadsheetOld School Value100% (1)

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Hing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDDocument4 pagesHing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDlimml63No ratings yet

- Consensus Estimates AnalysisDocument12 pagesConsensus Estimates Analysisdc batallaNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Course Work M.A. Tullow Oil Vs BGDocument31 pagesCourse Work M.A. Tullow Oil Vs BGltfy1122No ratings yet

- Bharat Petroleum Corporation Ltd. Performance Analysis: BY: Souravsipani 3 2 2 5Document16 pagesBharat Petroleum Corporation Ltd. Performance Analysis: BY: Souravsipani 3 2 2 5Rajan BaaNo ratings yet

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- 040821-SBI Press Release Q1FY22Document2 pages040821-SBI Press Release Q1FY22Prateek WadhwaniNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Likhitha InfraDocument26 pagesLikhitha InfraMoulyaNo ratings yet

- THP 2Q10Document3 pagesTHP 2Q10limml63No ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Wacc Calculation: All Fig. in Crore (RS) 2006 2007 PAT DEP NWC Inwc CapexDocument65 pagesWacc Calculation: All Fig. in Crore (RS) 2006 2007 PAT DEP NWC Inwc CapexNeeraj BhardwajNo ratings yet

- Current Price (BDT) : BDT 1,010.0Document6 pagesCurrent Price (BDT) : BDT 1,010.0Uzzal AhmedNo ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- Momo Operating Report 2022 Q4Document5 pagesMomo Operating Report 2022 Q4Harris ChengNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Please Click On The Link For The Report:: cm09MjgDocument2 pagesPlease Click On The Link For The Report:: cm09Mjgneil5mNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- Key Financial Ratios of GAIL India - in Rs. Cr.Document2 pagesKey Financial Ratios of GAIL India - in Rs. Cr.Anonymous N7yzbYbHNo ratings yet

- D P WiresDocument93 pagesD P WiresKartik KandangkelNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Tax Transfer Pricing: Under the Arm’s Length and the Sale Country PrinciplesFrom EverandTax Transfer Pricing: Under the Arm’s Length and the Sale Country PrinciplesNo ratings yet

- Achieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalFrom EverandAchieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalNo ratings yet

- Activity#2 Mosaic On My Self-PortraitDocument2 pagesActivity#2 Mosaic On My Self-PortraitSariephine Grace ArasNo ratings yet

- Ensure That The Results of The Board Evaluation ArDocument1 pageEnsure That The Results of The Board Evaluation ArSariephine Grace ArasNo ratings yet

- Material ExposuresDocument1 pageMaterial ExposuresSariephine Grace ArasNo ratings yet

- Assist The Board in Ensuring That There Is An EffeDocument1 pageAssist The Board in Ensuring That There Is An EffeSariephine Grace ArasNo ratings yet

- Facing Profitability ProblemsDocument1 pageFacing Profitability ProblemsSariephine Grace ArasNo ratings yet

- The Stock Price of Jollibee Foods Corporation at TDocument1 pageThe Stock Price of Jollibee Foods Corporation at TSariephine Grace ArasNo ratings yet

- Class Schedule He 1 1st Sem 22-23Document2 pagesClass Schedule He 1 1st Sem 22-23Sariephine Grace ArasNo ratings yet

- Evaluate and Determine The NonDocument1 pageEvaluate and Determine The NonSariephine Grace ArasNo ratings yet

- Sariephine Grace Aras - Exercise 2 (D)Document4 pagesSariephine Grace Aras - Exercise 2 (D)Sariephine Grace ArasNo ratings yet

- Research Question Independent Variable(s) Dependent Variable(s)Document1 pageResearch Question Independent Variable(s) Dependent Variable(s)Sariephine Grace ArasNo ratings yet

- Perform Oversight Functions Over The CompanyDocument1 pagePerform Oversight Functions Over The CompanySariephine Grace ArasNo ratings yet

- 2 1174 Original Famous People in Computer History 1deb09Document1 page2 1174 Original Famous People in Computer History 1deb09Sariephine Grace ArasNo ratings yet

- Sariephine Grace Aras - Exercise 1Document3 pagesSariephine Grace Aras - Exercise 1Sariephine Grace ArasNo ratings yet

- Case StudyDocument2 pagesCase StudySariephine Grace ArasNo ratings yet

- Bismillah Revisi-3 FixDocument110 pagesBismillah Revisi-3 FixSariephine Grace ArasNo ratings yet

- Sariephine Grace Aras-Learning LogDocument1 pageSariephine Grace Aras-Learning LogSariephine Grace ArasNo ratings yet

- 10 Comprehensive IncomeDocument1 page10 Comprehensive IncomeSariephine Grace ArasNo ratings yet

- 2019Document1 page2019Sariephine Grace ArasNo ratings yet

- W530 Megaworld CorporationDocument38 pagesW530 Megaworld CorporationSariephine Grace Aras100% (1)

- Sariephine Grace Aras-Learning LogDocument1 pageSariephine Grace Aras-Learning LogSariephine Grace ArasNo ratings yet

- Sariephine Grace Aras-First ActivityDocument3 pagesSariephine Grace Aras-First ActivitySariephine Grace ArasNo ratings yet

- This Pandemic, What Do You Think Is The Role of The Statement of The Financial Position To Management?Document1 pageThis Pandemic, What Do You Think Is The Role of The Statement of The Financial Position To Management?Sariephine Grace ArasNo ratings yet

- 2019Document1 page2019Sariephine Grace ArasNo ratings yet

- Balance Sheet: RD THDocument1 pageBalance Sheet: RD THSariephine Grace ArasNo ratings yet

- A Research Paper On Megaworld, IncDocument33 pagesA Research Paper On Megaworld, IncSariephine Grace Aras100% (1)

- Update and BenefitsDocument3 pagesUpdate and BenefitsSariephine Grace ArasNo ratings yet

- Philippines Food IndustryDocument14 pagesPhilippines Food IndustrySariephine Grace ArasNo ratings yet

- Current StateDocument3 pagesCurrent StateSariephine Grace ArasNo ratings yet

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- InTech-Molar Incisor Hypomineralization Morphological Aetiological Epidemiological and Clinical ConsiderationsDocument25 pagesInTech-Molar Incisor Hypomineralization Morphological Aetiological Epidemiological and Clinical ConsiderationsNeagu EmaNo ratings yet

- YCT 4 Vocabulary ListDocument14 pagesYCT 4 Vocabulary Listhauulty100% (1)

- Supplementary: Materials inDocument5 pagesSupplementary: Materials inEvan Siano BautistaNo ratings yet

- Module 6:market Segmentation, Market Targeting, and Product PositioningDocument16 pagesModule 6:market Segmentation, Market Targeting, and Product Positioningjanel anne yvette sorianoNo ratings yet

- STO Trade Qualifier Application GuideDocument15 pagesSTO Trade Qualifier Application Guidechrisandersen1111No ratings yet

- Periyava Times Apr 2017 2 PDFDocument4 pagesPeriyava Times Apr 2017 2 PDFAnand SNo ratings yet

- Present PerfectDocument1 pagePresent PerfectFrancs Fuentes100% (1)

- PAL v. CIR (GR 198759)Document2 pagesPAL v. CIR (GR 198759)Erica Gana100% (1)

- Can Amitriptyline Makes You Feel More Awake Instead of DrowsyDocument3 pagesCan Amitriptyline Makes You Feel More Awake Instead of Drowsyteddypol100% (1)

- McDonald's RecipeDocument18 pagesMcDonald's RecipeoxyvilleNo ratings yet

- Plotting A Mystery NovelDocument4 pagesPlotting A Mystery NovelScott SherrellNo ratings yet

- Yoni TantraDocument28 pagesYoni Tantradrept555100% (10)

- PUP College of Law - FAQsDocument15 pagesPUP College of Law - FAQsAlvin ClaridadesNo ratings yet

- TV Ads/Commercials Thread (October-December 2010)Document55 pagesTV Ads/Commercials Thread (October-December 2010)Pcnhs Sal100% (1)

- The People Lie, But Numbers Don't Approach To HR AnalyticsDocument8 pagesThe People Lie, But Numbers Don't Approach To HR AnalyticsYour HR BuddyNo ratings yet

- NewsWriting HizonDocument18 pagesNewsWriting HizonCrisvelle AlajeñoNo ratings yet

- Kaulachara (Written by Guruji and Posted 11/3/10)Document4 pagesKaulachara (Written by Guruji and Posted 11/3/10)Matt Huish100% (1)

- Polaris Ranger 500 ManualDocument105 pagesPolaris Ranger 500 ManualDennis aNo ratings yet

- Group BehaviourDocument13 pagesGroup Behaviourtasnim taherNo ratings yet

- Steve Allen - The Public HatingDocument8 pagesSteve Allen - The Public HatingDavid SalvatierraNo ratings yet

- IPCC - Fast Track Accounting - 35e PDFDocument37 pagesIPCC - Fast Track Accounting - 35e PDFRam IyerNo ratings yet

- Sustainable Development - Wikipedia, The Free EncyclopediaDocument22 pagesSustainable Development - Wikipedia, The Free EncyclopediaŚáńtőśh Mőkáśhí100% (1)

- Supplementary Cause List - 16.10.2023Document7 pagesSupplementary Cause List - 16.10.2023Aamir BhatNo ratings yet

- Madeleine Leininger Transcultural NursingDocument5 pagesMadeleine Leininger Transcultural Nursingteabagman100% (1)

- Dental EthicsDocument50 pagesDental EthicsMukhtar Andrabi100% (1)

- 2021 06 WJU Circus Fanfare NOV DECDocument28 pages2021 06 WJU Circus Fanfare NOV DECDwarven SniperNo ratings yet

- BankingDocument50 pagesBankingKishore MallarapuNo ratings yet

- Willis, D. - Visualizing Political StruggleDocument11 pagesWillis, D. - Visualizing Political StruggleAndreea Mitreanu100% (3)

- Week - 14, Methods To Control Trade CycleDocument15 pagesWeek - 14, Methods To Control Trade CycleMuhammad TayyabNo ratings yet