Professional Documents

Culture Documents

Bmd-Fcpo-Daily-Report - 2021-04-20T103624.301

Uploaded by

Bruce KingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bmd-Fcpo-Daily-Report - 2021-04-20T103624.301

Uploaded by

Bruce KingCopyright:

Available Formats

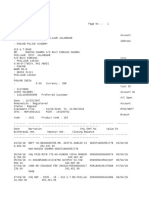

BMD FCPO FUTURES DAILY COMMENTARY 20th April 2021 (Tuesday)

32nd Floor, Menara TA One, 22 Jalan P. Ramlee, 50250 Kuala Lumpur, Malaysia.

For comments and enquiries, please contact us at Tel: +603-2072-4832

Fax: +603-2072-5001,Website : www.tafutures.com.my

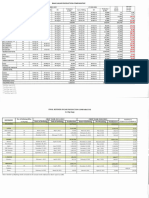

Settlement Open Interest

Month Open High Low Price Volume

Changes Lots Changes

(MYR)

May-21 4181 4185 4147 4180 -11 825 13271 -1596

Jun-21 3936 3936 3866 3909 -13 6188 38604 -2115

Jul-21 3726 3726 3666 3710 -6 16806 41945 2178

Aug-21 3588 3595 3550 3586 -3 4424 23579 -464

Sep-21 3494 3494 3453 3489 2 3405 23821 37

Oct-21 3418 3420 3382 3417 -1 2183 17607 310

Total 36,208 206,236

Price differential between CBOT

CBOT Soyoil July'21 (USD per pound) 54.50 54.55 53.68 53.87 -0.37 Soybean Oil and BMD Futures $287.57

NYMEX Crude Oil Jun'21 (USD per barrel) 63.01 63.69 62.67 63.43 0.24 CPO

DCE Palm Oil Sep'21 (RMB per tonne) 7100 7188 7044 7100 46

Malaysian Ringgit Spot (USD/MYR) 4.1250 4.1295 4.1210 4.1220 -0.0020

CBOT Soybean May'21 (US Cents per lb) 1430 1441 3/4 1423 2/4 1436 2/4 14

EU Palm Oil RBD dlrs tonne fob Apr'21 (USD per tonne fob) 1,057.50 -2.50

Source : Reuters

Apr '21 May '21 Jun '21 July '21

CPO Physical Price as per MPOB (Local Delivery)- 15 Apr 2021

4,163.00 4,113.00 NT NT

Source : MPOB

Estimated Ex port Volume

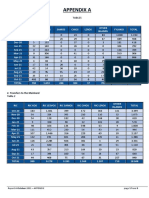

Amspec (Tonnes) SGS (Tonnes) ITS (Tonnes)

PERIODS Feb'21 Mar'21 Apr'21 Changes Feb'21 Mar'21 Apr'21 Changes Feb'21 Mar'21 Apr'21 Changes

1 to 10 399,529 311,198 343,356 10.30% 409,817 334,556 344,039 2.80% 400,375 309,898 345,010 11.30%

1 to 15 554,872 517,725 585,510 13.10% 542,709 549,273 583,875 6.30% 530,545 507,283 585,280 15.40%

1 to 20 697,794 745,260 734,622 733,668 698,380 734,463

1 to 25 921,929 1,017,730 967,845 1,014,162 919,765 1,011,433

Full month 1,000,854 1,277,255 1,052,779 1,245,567 1,001,440 1,270,058

Source : Reuters

MPO B (ton n e ) O ct'20 Nov'20 De c'20 Jan '21 Fe b'21 Mar'21 C h an ge s

P roduct ion 1,724,559 1,491,551 1,333,639 1,126,457 1,105,590 1,423,354 28.43%

Export 1,674,304 1,303,271 1,642,835 947,539 895,556 1,182,084 31.83%

End st ock 1,573,665 1,561,758 1,265,698 1,324,626 1,300,808 1,445,970 10.72%

Source : MPOB

Highlights:

Malaysian palm oil futures eased on Monday on expectations for rising production and as a surge in COVID-19 cases in

top importer India and other countries ignited demand concerns

CBOT futures closed higher on Monday on technical buying, firm domestic cash markets and spill over strength

from corn, as the market continues to draw support from fears of a possible shortfall in U.S. soybean plantings

Oil prices edged higher on Monday, supported by a weaker U.S. dollar but gains were capped by concerns about

the impact on demand from rising coronavirus cases in India

The ringgit ended higher against the US dollar yesterday on a broad weakness of the greenback due to lower US

Treasury yields

European Union palm oil imports in the 2020/21 season that started last July stood at 4.23 million tonnes by April

18, down from 4.55mil tonnes a year ago, data published by the European Commission showed on Monday

Lockdowns, local restrictions and the rising fear of Covid-19 have impacted basmati rice and palm oil demand in

the past one and a half months with Basmati rice sales having dropped by 20% since the beginning of March and

demand for palm oil, the main cooking oil for hotels and restaurants, falling by 10%

Source: Reuters

Trading futures on margin carries a high level of risk and may not be suitable for many members of the public. Please read and understand the terms and conditions

applicable and the risks as well as charges involved before trading, investing or subscribing to the products and services offered. Please also consider your investment

objectives, level of experience and risk appetite prior to making any decision. This report is meant for reference material only, and it can change without prior notice. We

do not assume any liability for any direct or indirect losses arising from the use of this report.

BMD FCPO FUTURES DAILY COMMENTARY 20th April 2021 (Tuesday)

32nd Floor, Menara TA One, 22 Jalan P. Ramlee, 50250 Kuala Lumpur, Malaysia.

For comments and enquiries, please contact us at Tel: +603-2072-4832

Fax: +603-2072-5001,Website : www.tafutures.com.my

Source: Reuters

Trading futures on margin carries a high level of risk and may not be suitable for many members of the public. Please read and understand the terms and conditions

applicable and the risks as well as charges involved before trading, investing or subscribing to the products and services offered. Please also consider your investment

objectives, level of experience and risk appetite prior to making any decision. This report is meant for reference material only, and it can change without prior notice. We

do not assume any liability for any direct or indirect losses arising from the use of this report.

You might also like

- Energy Council (Nov.-2021)Document14 pagesEnergy Council (Nov.-2021)Arvind KumarNo ratings yet

- Presentation - MEE - Spray Dryer - Drum De-Contamination - Dahej - July 2021Document28 pagesPresentation - MEE - Spray Dryer - Drum De-Contamination - Dahej - July 2021sai muraliNo ratings yet

- 353 Units: Muhammad ShabbirDocument2 pages353 Units: Muhammad ShabbirWajahat KhanNo ratings yet

- PriceHour - 2021-10-24T163641.159Document1 pagePriceHour - 2021-10-24T163641.159Patiala SinghNo ratings yet

- Prod. & Usages 2020-21Document56 pagesProd. & Usages 2020-21TOR PUBG KILLERSNo ratings yet

- Attachment 1 Statistical Tables On Weekly Updates On Prices of Cereals Wk3Jan2021 NationalDocument1 pageAttachment 1 Statistical Tables On Weekly Updates On Prices of Cereals Wk3Jan2021 NationalJack DanielsNo ratings yet

- Corporate Performance AnalysisDocument217 pagesCorporate Performance Analysisroy_kohinoorNo ratings yet

- R-Revised Source: Weekly Cereals Price Monitoring, Philippine Statistics AuthorityDocument1 pageR-Revised Source: Weekly Cereals Price Monitoring, Philippine Statistics AuthorityLulu BritanniaNo ratings yet

- Solar Savings CorrectDocument22 pagesSolar Savings CorrectRudraksh ShivhareNo ratings yet

- (Prices Per Kilogram) : R-Revised P-PreliminaryDocument2 pages(Prices Per Kilogram) : R-Revised P-PreliminaryHamizha Zhamyrra Santillana-MamaNo ratings yet

- Input Produksi Harian Inti Kebun Master SD TGL 2 AGUSTUSDocument597 pagesInput Produksi Harian Inti Kebun Master SD TGL 2 AGUSTUSfany fahrizalNo ratings yet

- DCA Lost RatioDocument12 pagesDCA Lost RatioMuhammad rafiq BayhaqiNo ratings yet

- 337 Units: Mansoor Ali DamaniDocument2 pages337 Units: Mansoor Ali DamaniSaadArshadNo ratings yet

- Beef Weekly Prices - enDocument13 pagesBeef Weekly Prices - enlyesNo ratings yet

- Feb - '23 UPPH Report For STB Updated - XLSBDocument21 pagesFeb - '23 UPPH Report For STB Updated - XLSBkesavanNo ratings yet

- Progress Summary: Piping Pre FabricationDocument9 pagesProgress Summary: Piping Pre FabricationWilson SombrioNo ratings yet

- Aicosia Daily Cottonseed Oilcake Report As On 01042022Document5 pagesAicosia Daily Cottonseed Oilcake Report As On 01042022mail.chhajedNo ratings yet

- Commodity Research Report 12 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 12 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Raw Data Laporan Bulanan Enviro (031221)Document17 pagesRaw Data Laporan Bulanan Enviro (031221)Bagus FelaniNo ratings yet

- 201 Units: M/S Saima PrideDocument2 pages201 Units: M/S Saima PridemunazzaNo ratings yet

- Sap PM DG Performance REPORTDocument11 pagesSap PM DG Performance REPORTkashinathNo ratings yet

- GM BookletDocument37 pagesGM BookletSSE/TRD APDJNo ratings yet

- SPM Morning Report 02-04-2022Document2 pagesSPM Morning Report 02-04-2022Skin Pass MillNo ratings yet

- Haj Ka TareeqaDocument2 pagesHaj Ka TareeqasallushanNo ratings yet

- SNBHGWDocument120 pagesSNBHGWayeeeeeeNo ratings yet

- 5 November 2022Document1 page5 November 2022Ega DarmawanNo ratings yet

- Batman V SupermanDocument2 pagesBatman V SupermanGaby CamposNo ratings yet

- 128 Units: Fawad IqbalDocument2 pages128 Units: Fawad IqbalSpring SuperbNo ratings yet

- Appendix ADocument9 pagesAppendix AHellenic Ministry of Migration and AsylumNo ratings yet

- Dispatch Plan 2021-22Document32 pagesDispatch Plan 2021-22Sohag PandyaNo ratings yet

- How To Read Utility BillsDocument2 pagesHow To Read Utility BillsSikander QaziNo ratings yet

- Weekly Farmgate, Wholesale and Retail Prices of Palay, Rice and Corn, August 2018 (Week 4)Document2 pagesWeekly Farmgate, Wholesale and Retail Prices of Palay, Rice and Corn, August 2018 (Week 4)zpmellaNo ratings yet

- Attachment 1 Statistical Tables On Weekly Updates On Prices of Cereals Wk2Jan2021 National 0Document1 pageAttachment 1 Statistical Tables On Weekly Updates On Prices of Cereals Wk2Jan2021 National 0Jack DanielsNo ratings yet

- Cobb Dsr2021Document111 pagesCobb Dsr2021Sagar CobbNo ratings yet

- Cement SU Dec22 05122022 Retail-06-December-2022-462370420Document9 pagesCement SU Dec22 05122022 Retail-06-December-2022-462370420NikhilKapoor29No ratings yet

- Water Unit Cost CalculationDocument20 pagesWater Unit Cost Calculationjasperzeus crisostomoNo ratings yet

- JBVN134 - SPL Feb 2021Document48 pagesJBVN134 - SPL Feb 2021Nguyen PhuongNo ratings yet

- Daftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsDocument14 pagesDaftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsGiyantoNo ratings yet

- VayuJal Water Production Table - Cities SpecificDocument2 pagesVayuJal Water Production Table - Cities SpecificRamesh SoniNo ratings yet

- Price HourDocument25 pagesPrice Hourumashankar.shuklaNo ratings yet

- PD Dimas M4 K2Document74 pagesPD Dimas M4 K2Muwaffaq ShiddiqNo ratings yet

- Dangote Cement (Ethiopia) PLC Royalty For Raw Materials As From March To May, 2020Document2 pagesDangote Cement (Ethiopia) PLC Royalty For Raw Materials As From March To May, 2020mickey mussieNo ratings yet

- Analisa Hidrologi-1Document35 pagesAnalisa Hidrologi-1Muhammad FharabiNo ratings yet

- Week To Week Comparative WE 08-31-22Document5 pagesWeek To Week Comparative WE 08-31-22That Duck GodNo ratings yet

- Inventroy 2022Document2 pagesInventroy 2022Septian Yudha AgungNo ratings yet

- QrisDocument10 pagesQrisFebria Nur VitasariNo ratings yet

- Navotas City Health Department: Background and OverviewDocument45 pagesNavotas City Health Department: Background and OverviewKeanu Win CatipayNo ratings yet

- Production Analysis April 22 To March 23Document3 pagesProduction Analysis April 22 To March 23Rishabh SharmaNo ratings yet

- Datasheet hk70Document5 pagesDatasheet hk70Abdallah GomaaNo ratings yet

- Length Power Dynamic Viscosity Heat FluxDocument5 pagesLength Power Dynamic Viscosity Heat FluxAnanthan IndukaladharanNo ratings yet

- BillingParameters X1261999Document3 pagesBillingParameters X1261999SandeepNo ratings yet

- Quarterly Business Reveiw MeetingDocument13 pagesQuarterly Business Reveiw MeetingMahmuda MituNo ratings yet

- CCFG - July Spandex Feedstock & Fiber Market ReportDocument13 pagesCCFG - July Spandex Feedstock & Fiber Market ReportNISHSHANKANo ratings yet

- Option Nifty - BankDocument41 pagesOption Nifty - Banksawsac9No ratings yet

- Commodity Research Report 29 May 2018 Ways2CapitalDocument13 pagesCommodity Research Report 29 May 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 19 February 2018 Ways2CapitalDocument14 pagesCommodity Research Report 19 February 2018 Ways2CapitalWays2CapitalNo ratings yet

- Orwe Oe 2022-07-17Document6 pagesOrwe Oe 2022-07-17BalbaaAmrNo ratings yet

- Source: Weekly Cereals Price Monitoring, Philippine Statistics AuthorityDocument1 pageSource: Weekly Cereals Price Monitoring, Philippine Statistics AuthorityTajNo ratings yet

- Etizola Brand PlanDocument23 pagesEtizola Brand PlanMuhammad Ali JehangirNo ratings yet

- Ladokhin Borovkova EESubmissionDocument42 pagesLadokhin Borovkova EESubmissionBruce KingNo ratings yet

- FFB Yield January-June 2019Document1 pageFFB Yield January-June 2019Bruce KingNo ratings yet

- Sustainability: Using Nighttime Satellite Imagery As A Proxy Measure of Human Well-BeingDocument32 pagesSustainability: Using Nighttime Satellite Imagery As A Proxy Measure of Human Well-BeingBruce KingNo ratings yet

- Vortex Paper Final Before ProofsDocument17 pagesVortex Paper Final Before ProofsBruce KingNo ratings yet

- FFB Yield July-December 2019Document1 pageFFB Yield July-December 2019Bruce KingNo ratings yet

- Mooncake Catalog 2021 - OGORDocument2 pagesMooncake Catalog 2021 - OGORBruce KingNo ratings yet

- DePrado - Three Quant Lessons From COVID-19 (Presentation Slides)Document18 pagesDePrado - Three Quant Lessons From COVID-19 (Presentation Slides)Bruce KingNo ratings yet

- DESCO Market Insights Vol 2 No 3 September2010Document6 pagesDESCO Market Insights Vol 2 No 3 September2010Bruce KingNo ratings yet

- IOI Edible Oils Sandakan Full Mill ListDocument1 pageIOI Edible Oils Sandakan Full Mill ListBruce KingNo ratings yet

- Palm Oil Mill List From Unilever Suppliers - tcm244 530097 - enDocument22 pagesPalm Oil Mill List From Unilever Suppliers - tcm244 530097 - enBruce KingNo ratings yet

- THFJ Tomorrow S Titans SurveyDocument10 pagesTHFJ Tomorrow S Titans SurveymattybearsNo ratings yet

- Palm Oil Mill ListDocument68 pagesPalm Oil Mill ListBruce KingNo ratings yet

- Association Between Markov Regime-Switching Market Volatility and Beta Risk Evidence From Dow Jones Industrial SecuritiesDocument28 pagesAssociation Between Markov Regime-Switching Market Volatility and Beta Risk Evidence From Dow Jones Industrial SecuritiesBruce KingNo ratings yet

- BURSA OCPO Contract SpecDocument2 pagesBURSA OCPO Contract SpecBruce KingNo ratings yet

- Edf Man - Annual Report 2017Document39 pagesEdf Man - Annual Report 2017Marc AseanNo ratings yet

- Bmd-Fcpo-Daily-Report - 2021-04-20T103624.301Document2 pagesBmd-Fcpo-Daily-Report - 2021-04-20T103624.301Bruce KingNo ratings yet

- Average Crude Palm Oil (Cpo) Yield of Oil Palm Estates JAN-JUNE 2021 & 2020 (TONNES/HECTARE)Document2 pagesAverage Crude Palm Oil (Cpo) Yield of Oil Palm Estates JAN-JUNE 2021 & 2020 (TONNES/HECTARE)Bruce KingNo ratings yet

- A Selection of Research On ESG BridgewaterDocument105 pagesA Selection of Research On ESG BridgewaterBruce KingNo ratings yet

- Your Trader Personality Type: AwareDocument6 pagesYour Trader Personality Type: AwareBruce KingNo ratings yet

- Average FFB Yield of Oil Palm Estates JAN-JUNE 2021 & 2020 (TONNES/HECTARE)Document2 pagesAverage FFB Yield of Oil Palm Estates JAN-JUNE 2021 & 2020 (TONNES/HECTARE)Bruce KingNo ratings yet

- Agricultural Crop YieldDocument7 pagesAgricultural Crop YieldBruce KingNo ratings yet

- A Conversation With Flavia Cymbalista: Including A Case Study: A Real World HRIS DilemmaDocument8 pagesA Conversation With Flavia Cymbalista: Including A Case Study: A Real World HRIS DilemmaBruce KingNo ratings yet

- Prediction of Crop Yield Using Regression AnalysisDocument5 pagesPrediction of Crop Yield Using Regression AnalysisPriya NarayananNo ratings yet

- Your Trader Personality Type: AwareDocument6 pagesYour Trader Personality Type: AwareBruce KingNo ratings yet

- BMD Fkli Daily ReportDocument2 pagesBMD Fkli Daily ReportBruce KingNo ratings yet

- Arthur's A La Carte-1-9-18Document2 pagesArthur's A La Carte-1-9-18Bruce KingNo ratings yet

- BMD Fkli Daily ReportDocument2 pagesBMD Fkli Daily ReportBruce KingNo ratings yet

- Is Trend Following DeadDocument7 pagesIs Trend Following DeadBruce KingNo ratings yet

- ADM Feed Ingredients Catalog PDFDocument36 pagesADM Feed Ingredients Catalog PDFAlmosuNo ratings yet

- Information Activity and RubricDocument2 pagesInformation Activity and RubricGlaiza FloresNo ratings yet

- Code of Business Ethics and ConductDocument7 pagesCode of Business Ethics and ConductShane NaidooNo ratings yet

- Somaliland Food and Water Security StrategyDocument58 pagesSomaliland Food and Water Security StrategyMohamed AliNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Audrey Janae SorianoNo ratings yet

- MACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)Document514 pagesMACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)the.lord.of.twitter101No ratings yet

- Chap 006Document32 pagesChap 006eaktaNo ratings yet

- Shimoga TourDocument180 pagesShimoga Tourb_csr100% (1)

- UPS Marketing PlanDocument8 pagesUPS Marketing PlanmaverickgmatNo ratings yet

- PDCS Minor Project BBA III Sem Morning Evening Final 1Document38 pagesPDCS Minor Project BBA III Sem Morning Evening Final 1ANKIT MAANNo ratings yet

- CH 15Document56 pagesCH 15Quỳnh Anh Bùi ThịNo ratings yet

- Three Models of Corporate Governance January 2009Document4 pagesThree Models of Corporate Governance January 2009Shubham AgarwalNo ratings yet

- Supply Chain Management in Brief: Medhi CahyonoDocument7 pagesSupply Chain Management in Brief: Medhi CahyonoSetio TanoeNo ratings yet

- 165-Article Text-980-1-10-20220214Document16 pages165-Article Text-980-1-10-20220214Jebat FatahillahNo ratings yet

- On The Role of Human Resource Intermediaries - Basic Concepts and Research PDFDocument2 pagesOn The Role of Human Resource Intermediaries - Basic Concepts and Research PDFFredrik MarkgrenNo ratings yet

- 1538139921616Document6 pages1538139921616Hena SharmaNo ratings yet

- Chapter 15 Sales Type LeaseDocument3 pagesChapter 15 Sales Type LeaseNikki WanoNo ratings yet

- Green HRM - Issues & Challenges: Mrs. Pallavi KumariDocument21 pagesGreen HRM - Issues & Challenges: Mrs. Pallavi KumariAbida SultanaNo ratings yet

- 5-Vendors Are The King MakerDocument2 pages5-Vendors Are The King Makersukumaran3210% (1)

- Call For Papers: 11 International Scientific Conference of Business FacultyDocument6 pagesCall For Papers: 11 International Scientific Conference of Business FacultyИванов ХристоNo ratings yet

- L01B Topic 2Document39 pagesL01B Topic 2Emjes GianoNo ratings yet

- Production Planning & ControlDocument23 pagesProduction Planning & Controlrupa royNo ratings yet

- The Inland Water Transport of Bangladesh and I2Document3 pagesThe Inland Water Transport of Bangladesh and I2Syed Mubashir Ali H ShahNo ratings yet

- Activity - Cultural Differences and HRMDocument3 pagesActivity - Cultural Differences and HRMSaraKovačićNo ratings yet

- Canara BankDocument18 pagesCanara Bankmithun mohanNo ratings yet

- FTU Exchange Student GuidelinesDocument14 pagesFTU Exchange Student GuidelinesAnonymous hXUhpe7SNo ratings yet

- Foreign Exchange RiskDocument16 pagesForeign Exchange RiskPraneela100% (1)

- CRM DimensionsDocument12 pagesCRM DimensionsetdboubidiNo ratings yet

- Intangible Asset Accounting and Accounting Policy Selection in The Football IndustryDocument347 pagesIntangible Asset Accounting and Accounting Policy Selection in The Football IndustryJuan Ruiz-UrquijoNo ratings yet

- Compensation Survey 2021Document14 pagesCompensation Survey 2021Oussama NasriNo ratings yet

- Strategies To Reduce Supply Chain Disruptions in GhanaDocument126 pagesStrategies To Reduce Supply Chain Disruptions in GhanaAlbert HammondNo ratings yet