Professional Documents

Culture Documents

Grnxpts CBT

Grnxpts CBT

Uploaded by

Phương Nguyễn0 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

Grnxpts Cbt (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesGrnxpts CBT

Grnxpts CBT

Uploaded by

Phương NguyễnCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

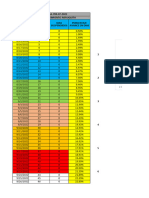

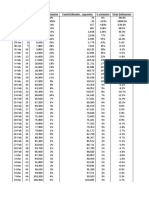

USDA Export Sales Report - Current and Recent History

Report Date: 9/2/2021

Weekly Sales Sales Needed

1000MT Per Week to Current Year 5 Year Average

Week Ending (Cotton 1000 RB) Meet USDA Est. % of USDA Est. % of USDA Est.

BEANS - 2021/2022 Marketing Year

26-Aug 2132.5 722.4 31.7% 27.5%

19-Aug 1750.0 748.6 27.9% 25.2%

12-Aug 2142.1 766.8 24.8% 22.8%

5-Aug 1120.3 791.4 21.0% 20.2%

29-Jul 424.8 797.2 19.0% 17.4%

BEAN MEAL - 2020/2021 Marketing Year

26-Aug 17.7 142.0 94.4% 98.2%

19-Aug 61.7 121.3 94.3% 97.7%

12-Aug 71.9 112.8 93.8% 97.3%

5-Aug 116.3 107.7 93.3% 96.3%

29-Jul 135.4 108.6 92.4% 95.2%

BEAN OIL - 2020/2021 Marketing Year

26-Aug 4.1 15.9 89.7% 101.3%

19-Aug 3.0 13.9 89.2% 101.2%

12-Aug 0.5 12.4 88.8% 100.4%

5-Aug 0.3 10.9 88.7% 99.9%

29-Jul 3.2 9.7 88.7% 99.2%

CORN - 2021/2022 Marketing Year

26-Aug 1159.5 766.6 33.5% 17.8%

19-Aug 684.0 773.8 31.6% 16.1%

12-Aug 510.0 772.2 30.5% 14.6%

5-Aug 601.8 767.5 29.7% 13.3%

29-Jul 830.2 764.6 28.7% 12.1%

WHEAT - 2021/2022 Marketing Year

26-Aug 295.3 272.2 39.6% 43.2%

19-Aug 116.0 272.6 38.3% 41.6%

12-Aug 306.7 269.8 37.8% 39.6%

5-Aug 293.1 270.4 36.6% 37.8%

29-Jul 308.3 270.8 35.3% 35.7%

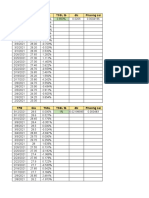

USDA Export Sales - Weekly Net Sales

Report Date: 9/2/2021

NET EXPORT SALES FOR THE WEEK ENDING 8/26/2021

In 1000 Metric Tonnes (Cotton is 1000 Running Bales)

CROP YEAR

Market Current Next Total

BEANS 68.2 2,132.5 2,200.8

BEAN MEAL 17.7 396.6 414.3

BEAN OIL 4.1 0.7 4.9

CORN -300.8 1,159.5 858.7

WHEAT 295.3 0.0 295.3

COTTON 105.2 23.8 129.0

NET EXPORT SALES FOR THE WEEK ENDING

8/26/2021

In Million Bushels

CROP YEAR

Market Current Next Total

BEANS 2.51 78.36 80.9

CORN -11.84 45.65 33.8

WHEAT 10.85 0.00 10.9

***This report includes information from sources believed to be reliable and accurate as of the date of this publication, but no independent

verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice.

This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or

commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully

consider the inherent risks of such an investment in light of their financial condition.

You might also like

- Goldman Sachs 7S NewDocument24 pagesGoldman Sachs 7S NewChetan Naik0% (1)

- 2308 Chile Fund Flows InsightsDocument9 pages2308 Chile Fund Flows InsightsGustavo MaturanaNo ratings yet

- Total: Equity Products Contracts Traded Ibex Products Contracts TradedDocument1 pageTotal: Equity Products Contracts Traded Ibex Products Contracts TradedKarren SVNo ratings yet

- 09ComInt 202210 ENDocument20 pages09ComInt 202210 ENRNo ratings yet

- Ramayana Sales Trend & Projection (Unaudited) : Projected Net Sales - 2017 Actual Net Sales - 2017Document9 pagesRamayana Sales Trend & Projection (Unaudited) : Projected Net Sales - 2017 Actual Net Sales - 2017Gilang RamadhanNo ratings yet

- CCTs PerformancesDocument1 pageCCTs Performances888 BiliyardsNo ratings yet

- May 2020 Month End Report (Autosaved)Document21 pagesMay 2020 Month End Report (Autosaved)rsuertoNo ratings yet

- May 2023 RSI ReportDocument4 pagesMay 2023 RSI ReportBernewsAdminNo ratings yet

- U.S. Energy Information Administration, Short-Term Energy Outlook, December 2021Document4 pagesU.S. Energy Information Administration, Short-Term Energy Outlook, December 2021Alex ParedesNo ratings yet

- Fraser Valley Oct 08Document13 pagesFraser Valley Oct 08HudsonHomeTeamNo ratings yet

- Real Time Bond PricesDocument9 pagesReal Time Bond PricesManjishtaKainthNo ratings yet

- Industry CIADocument5 pagesIndustry CIANikitha MNo ratings yet

- TOTAL (Revenue and Non-Revenue) Change: Enplaned / Deplaned PassengersDocument8 pagesTOTAL (Revenue and Non-Revenue) Change: Enplaned / Deplaned PassengersNicholas FrancoNo ratings yet

- Finance For Business...Document8 pagesFinance For Business...Tahir IqbalNo ratings yet

- Life Insurance Update For November 2023Document6 pagesLife Insurance Update For November 2023rajautoprincNo ratings yet

- Precios QTDocument75 pagesPrecios QT2019 Act CONTRERAS SALCEDO VIVIAN ABIGAILNo ratings yet

- PortofolioDocument25 pagesPortofolioAmalia Ramadhani MentariNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalNo ratings yet

- India'S Macroeconomic Indicators: Oil Exports Non-Oil ExportsDocument1 pageIndia'S Macroeconomic Indicators: Oil Exports Non-Oil Exportsmsn_testNo ratings yet

- ITC Quarterly Result Presentation Q3 FY2021Document46 pagesITC Quarterly Result Presentation Q3 FY2021Vineet UttamNo ratings yet

- Iip J Aug 21Document6 pagesIip J Aug 21CuriousMan87No ratings yet

- Agriculture: Agriculture Performance During FY2020Document25 pagesAgriculture: Agriculture Performance During FY2020Muhammad WaqasNo ratings yet

- November Publication 2023 RSIDocument4 pagesNovember Publication 2023 RSIBernewsNo ratings yet

- Morning Breifing 04-10-2019Document18 pagesMorning Breifing 04-10-2019afnaniqbalNo ratings yet

- Press Release: SOCCSKSARGEN's Headline Inflation Continues To Rise at 7.1% in December 2022 Highest Since 2019Document6 pagesPress Release: SOCCSKSARGEN's Headline Inflation Continues To Rise at 7.1% in December 2022 Highest Since 2019Charmein TadoNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- GF0817new LogoDocument2 pagesGF0817new LogoDiawage SackoNo ratings yet

- Assignment Unit IVDocument35 pagesAssignment Unit IVHạnh NguyễnNo ratings yet

- Lavance en TiempoDocument6 pagesLavance en TiempoalexanderNo ratings yet

- E Xpor T Dis Patches Again S T Fys: Afghanistan Other (Sea) Afghanistan India Other (Sea)Document1 pageE Xpor T Dis Patches Again S T Fys: Afghanistan Other (Sea) Afghanistan India Other (Sea)hmaza shakeelNo ratings yet

- Export DataDocument1 pageExport Datahmaza shakeelNo ratings yet

- Tablas - Informes - Enero 2023Document109 pagesTablas - Informes - Enero 2023Luis IguaranNo ratings yet

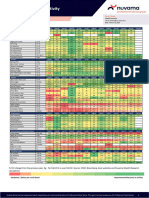

- Economic Spotlight - Nuvama ReportDocument8 pagesEconomic Spotlight - Nuvama Reportsonika.arora1417No ratings yet

- F3117 Domestic Price of Wheat Feed BED ReportDocument4 pagesF3117 Domestic Price of Wheat Feed BED ReportZhang YiNo ratings yet

- Beta CalculatorDocument19 pagesBeta CalculatorcakartikayNo ratings yet

- Portafolio de InversiónDocument27 pagesPortafolio de InversiónKaren Sofía MurNo ratings yet

- March 2023 RSI ReportDocument4 pagesMarch 2023 RSI ReportBernewsAdminNo ratings yet

- 24.1growth Performance of Manufacturing Sector: Industrial Sector in India and Economic LiberalizationDocument5 pages24.1growth Performance of Manufacturing Sector: Industrial Sector in India and Economic LiberalizationAadhityaNo ratings yet

- P0141 March 2023Document12 pagesP0141 March 2023Luyolo MagwebuNo ratings yet

- Inventory Still Low As Buyers Struggle To Find Properties in AlabamaDocument14 pagesInventory Still Low As Buyers Struggle To Find Properties in AlabamaJeff WyattNo ratings yet

- Press Release: S, R S, F C U, I DDocument4 pagesPress Release: S, R S, F C U, I DElectra EVNo ratings yet

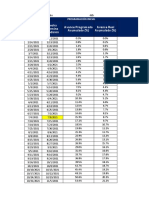

- TPB Gía TSSL TSSL TB ĐLC Phương SaiDocument5 pagesTPB Gía TSSL TSSL TB ĐLC Phương SaiNguyễn Thị Minh ThưNo ratings yet

- ZxweDocument8 pagesZxweFeri Febrianas FeriNo ratings yet

- Comparación de ProgramacionesDocument159 pagesComparación de ProgramacionesDario Cerda ArNo ratings yet

- Ejercicio 12Document28 pagesEjercicio 12Valeria SandovalNo ratings yet

- December 2023 RSI ReportDocument4 pagesDecember 2023 RSI ReportBernewsNo ratings yet

- 55 Casas Terrazas de Landa Curva de Avance General: FechasDocument12 pages55 Casas Terrazas de Landa Curva de Avance General: Fechasmarcelo garridoNo ratings yet

- 2017 09 September Stats PackageDocument9 pages2017 09 September Stats PackageVancouver Real Estate PodcastNo ratings yet

- KHS New Daily Progres UpdateDocument3,256 pagesKHS New Daily Progres UpdateRifaldyo TrinandaNo ratings yet

- Perhitungan Curah Hujan RencanaDocument79 pagesPerhitungan Curah Hujan RencanaMuhammad Adli FikriNo ratings yet

- SK 121201Document29 pagesSK 121201BoomdayNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- LA Economic Vitals Dec Jan 2021Document5 pagesLA Economic Vitals Dec Jan 2021ChrisMNo ratings yet

- 24 M Retail GroundDocument9 pages24 M Retail GroundOsa MaNo ratings yet

- IIP Growth Rate (Month - Wise) : Highlights of Index of Industrial Production (IIP) May, 2021 (Base: 2011-12 100)Document4 pagesIIP Growth Rate (Month - Wise) : Highlights of Index of Industrial Production (IIP) May, 2021 (Base: 2011-12 100)sanjay josephNo ratings yet

- May 2022 RSI ReportDocument4 pagesMay 2022 RSI ReportBernewsAdminNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument14 pagesNuevo Hoja de Cálculo de Microsoft ExcelMarcelo SalasNo ratings yet

- Nielsen Piata Mezeluri Ian Aug 2014Document15 pagesNielsen Piata Mezeluri Ian Aug 2014Alexandra CioriiaNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Deliverable Commodities Under RegistrationDocument6 pagesDeliverable Commodities Under RegistrationPhương NguyễnNo ratings yet

- Spring Wheat Crop ConditionsDocument2 pagesSpring Wheat Crop ConditionsPhương NguyễnNo ratings yet

- Winter Wheat Crop ConditionsDocument2 pagesWinter Wheat Crop ConditionsPhương NguyễnNo ratings yet

- Soybean Crop ConditionsDocument2 pagesSoybean Crop ConditionsPhương NguyễnNo ratings yet

- SND CBTDocument4 pagesSND CBTPhương NguyễnNo ratings yet

- Crncondit CBTDocument2 pagesCrncondit CBTPhương NguyễnNo ratings yet

- LH Piginvntry CBTDocument2 pagesLH Piginvntry CBTPhương NguyễnNo ratings yet

- LC Onfeed CBTDocument1 pageLC Onfeed CBTPhương NguyễnNo ratings yet

- Adb Asia Sme Monitor 2020 Tables MyaDocument19 pagesAdb Asia Sme Monitor 2020 Tables MyaMeno Jetty Tu TaNo ratings yet

- IBPS PO Prelims Memory Based Paper Held On 23 Sept 2023 Shift 1Document30 pagesIBPS PO Prelims Memory Based Paper Held On 23 Sept 2023 Shift 1VarunNo ratings yet

- Survey Questionnaire ThesisDocument2 pagesSurvey Questionnaire Thesisstein dignadiceNo ratings yet

- Mediterranean Sea TradeDocument14 pagesMediterranean Sea TradeL.No ratings yet

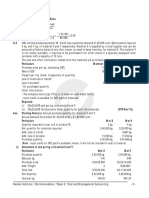

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- Brealey Principles 14e BYP Ch02C Using Excel To Solve Spreadsheet QuestionsDocument36 pagesBrealey Principles 14e BYP Ch02C Using Excel To Solve Spreadsheet Questionsnga ngaNo ratings yet

- Unit 4Document39 pagesUnit 4Cuti PandaNo ratings yet

- CAHOCON 23 - SponsorshipBrochure PDFDocument11 pagesCAHOCON 23 - SponsorshipBrochure PDFsubhraj7027No ratings yet

- Farmer Protests Could Take A Toll On The EconomyDocument4 pagesFarmer Protests Could Take A Toll On The EconomySimhbNo ratings yet

- Lecture 2 - Business Application of FintechDocument19 pagesLecture 2 - Business Application of Fintechanon_888020909No ratings yet

- Running Account Bill - C: Assam Schedule III (Sec. II) Form No 25 F.R.Form No 29Document3 pagesRunning Account Bill - C: Assam Schedule III (Sec. II) Form No 25 F.R.Form No 29debb-bflat100% (2)

- ING Think Ceemea FX Outlook 2022 Treating Inflation With RespectDocument12 pagesING Think Ceemea FX Outlook 2022 Treating Inflation With RespectOwm Close CorporationNo ratings yet

- Residual Demand Curve: Monopoly Market StructureDocument5 pagesResidual Demand Curve: Monopoly Market StructureM.Azeem SarwarNo ratings yet

- BUSS 207 Quiz 4 - SolutionDocument4 pagesBUSS 207 Quiz 4 - Solutiontom dussekNo ratings yet

- Navkar Institute - CA Intermediate - Paper 2: Cost and Management Accounting - 9Document1 pageNavkar Institute - CA Intermediate - Paper 2: Cost and Management Accounting - 9Amrit SarkarNo ratings yet

- LETOP Basin Catalogue 2022Document48 pagesLETOP Basin Catalogue 2022ankushagarwallNo ratings yet

- JPM Equity Strategy 2021-03-15 - 3677865Document31 pagesJPM Equity Strategy 2021-03-15 - 3677865gustavomorgadoNo ratings yet

- Principles of Economics (Microeconomics) Homework With AnswersDocument3 pagesPrinciples of Economics (Microeconomics) Homework With AnswersAndriyNo ratings yet

- Impact of Human Capital Development On The Performance of Ethiopian Road ContractorsDocument31 pagesImpact of Human Capital Development On The Performance of Ethiopian Road ContractorsTigist AyeleNo ratings yet

- 2.4.5 TestDocument4 pages2.4.5 TestDios TE AmaNo ratings yet

- TEXTDocument3 pagesTEXTahmad zackNo ratings yet

- Meaning of International BusinessDocument13 pagesMeaning of International Businesssanju2k9bitNo ratings yet

- TNC Coin: WhitepaperDocument30 pagesTNC Coin: WhitepaperyujhyNo ratings yet

- Unit 5. Supply - Lecture 1 (SL)Document27 pagesUnit 5. Supply - Lecture 1 (SL)IrinaNo ratings yet

- 5.2.1 JM21 Annuities VFAZ - 82777235Document2 pages5.2.1 JM21 Annuities VFAZ - 82777235Jorge Eduardo Caro OrtizNo ratings yet

- Final Exam GNED 07 (Signed)Document8 pagesFinal Exam GNED 07 (Signed)NEBRIAGA, MARY S. 3-2No ratings yet

- New Centres of Power PART IV BRICS (Brazil, Russia, India, China, South Africa)Document11 pagesNew Centres of Power PART IV BRICS (Brazil, Russia, India, China, South Africa)Muskan DhankherNo ratings yet

- CHAPTER 8 - Regional Economic IntegrationDocument44 pagesCHAPTER 8 - Regional Economic Integration719d0011No ratings yet